TABLE OF CONTENT

EXECUTIVE SUMMARY

COMPANY DESCRIPTION

STRATEGIC FOCUS AND PLAN

MISSION/VISION & GOALS

CORE COMPETENCY

SUSTAINABLE COMPETITIVE ADVANTAGE

ORGANIZATIONAL STRUCTURE

SITUATION ANALYSIS

S.W.O.T. ANALYSIS

INDUSTRY ANALYSIS

COMPETITOR ANALYSIS

CUSTOMER ANALYSIS

MARKET-PRODUCT FOCUS

MARKETING AND PRODUCT OBJECTIVES

TARGET MARKETS

POINTS OF DIFFERENCE

POSITIONING

MARKETING PROGRAM

PRODUCT STRATEGY

PRICE STRATEGY

PROMOTION STRATEGY

PLACE (DISTRIBUTION) STRATEGY

WORKS CITED

APPENDIX

EXHIBIT 1 – EMAIL CORRESPONDENCE

EXHIBIT 2 – NIKON CORPORATE STRUCTURE

EXHIBIT 3 – NIKON S.W.O.T.

EXHIBIT 4 – PENTAX S.W.O.T.

EXHIBIT 5 – CANON S.W.O.T.

EXHIBIT 6 – SONY S.W.O.T.

EXHIBIT 7 – TARGET TABLE 1

EXHIBIT 8 – US DEMOGRAPHY

EXHIBIT 9 – MEDIA FLOW CHART

EXHIBIT 10 – HOUSTON SYMPHONY RATES

EXHIBIT 11 – DIGITAL PHOTO PRO COVER

EXHIBIT 12 – DIGITAL PHOTO PRO RATES

EXHIBIT 13 – PC PHOTO COVER

EXHIBIT 14 – PC PHOTO RATES

EXHIBIT 15 – OUTDOOR PHOTOGRAPHER

WEB SITE AND E-NEWSLETTER RATES

EXHIBIT 16 – DISTRIBUTION FLOW CHART

EXHIBIT 17 – UPS SUPPLY CHAIN SOLUTIONS

1

3

3

3

4

4

5

5

5

6

6

8

9

9

10

12

12

12

12

15

18

21

22

24

26

28

29

30

32

33

34

35

36

37

38

39

40

41

42

43

44

EXECUTIVE SUMMERY

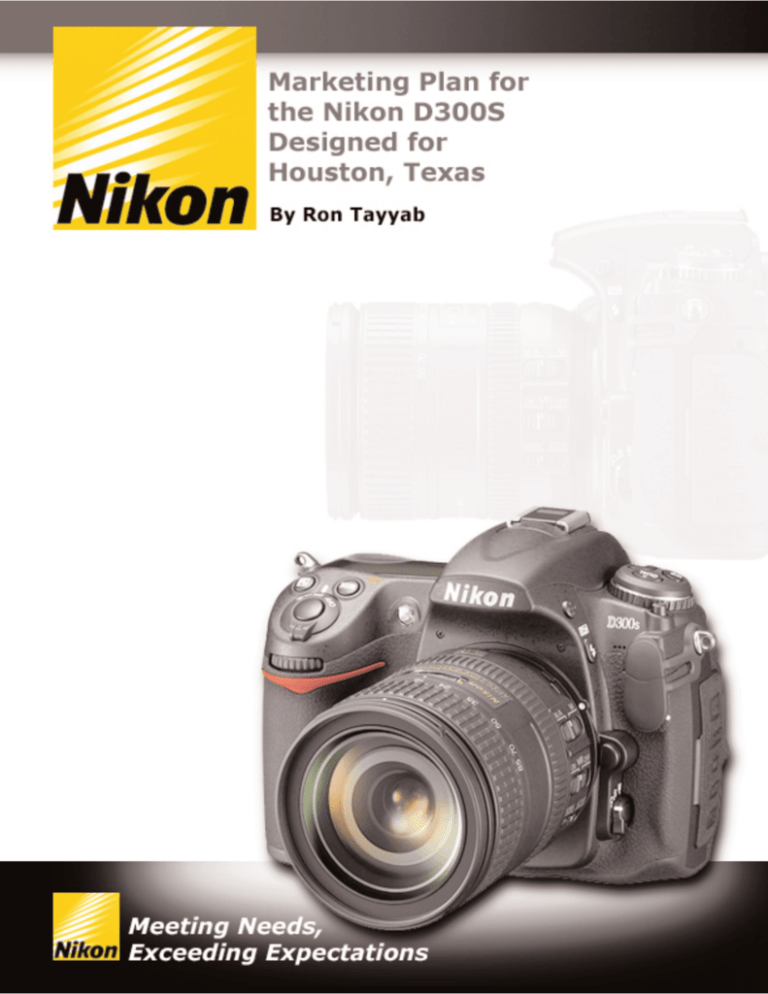

The purpose of this marketing plan is to increase awareness of the new Nikon

D300S, with the goal to distribute and increase sales in the Houston, Texas

area within 2010. To reach this objective, G.R.C. Marketing Group proposes

the following strategy.

The marketing plan is divided into the following sections, and will be discussed

in detail in each corresponding section.

•

•

•

•

Company Overview - includes Mission, Vision and Goals,

Core Competencies and Competitive Advantage.

Situation Analysis – includes SWOT and PEST analysis.

Market-Product Focus – includes Industry, Competitor,

and Customer Analysis.

Marketing Program – includes product description, promotion, price

strategy, distribution methods and media buy strategies.

The Nikon Corporation is a well-established Japanese company founded in

1917 and has its core competency in precision optic manufacturing. Other

products produced by the firm medical devices and optics, semi-conductor and

wafer technology, survey and measuring equipment, photographic lens and

camera products. Nikon is a global company with subsidiaries across, Asia, the

Americas, Europe and Australia.

When it comes to photographic equipment, Nikon’s goals are to:

•

•

•

•

•

Increase satisfaction and trust from their customers

Provide products and services that have superior levels of

quality and safety

Enhance and enrich the enjoyment of photographs

Minimize impacts on the environment from production of

products and services

Build products that conform to international safety standards.

“Safety Design Principle” (Nikon | Corporate Info)

The company’s sustainable competitive advantage and strengths encompass

its roots in optical design expertise and corporate culture, long-term development

of optical and camera technology, continuous collection of data and research,

superior customer service with its techniques to discover customer needs and

rapid customer response system.

1

Competitors such as Pentax, Canon, and Sony have comparable products, but

because of a robust pricing structure, coupled with Nikon’s established brand and

distribution channels, these firms do not pose any serious competitive advantage.

The new Nikon D300S has an outstanding list of features ranging from its

electronics and sensor systems to high-quality HD video capability; it also

includes a unique dual-slot memory card set up to separate pictures from

video capture. Its affordable and competitive price makes this camera a highly

attractive product for individuals who either want to seriously enter the world

of digital photography or are professionals who want to upgrade from their

present equipment.

Based on our customer analysis and research, we recommend the following

promotional strategy and targeted media campaign, exclusively for Houston,

Texas, in conjunction with the FotoFest event in April and May of 2010. The

overall goal with this campaign is to raise sales by 2% for 2010 in the Houston

market.

To reach the market we crafted two major campaigns for print and online

media. The first is a continuous campaign, starting in January and running

until December. The second is a shorter campaign starting in January continuing

until the end of the FotoFest event in May.

Both campaigns are designed to utilize local print publications, online banner

ads and search engine marketing tactics, with FotoFest being targeted on a

national level to reach potential customers who plan to travel to Houston for

the event. The second campaign would be a Nikon sponsored campaign in

conjunction with participating local retailers.

In addition to the print and online campaigns we propose several bundled

and/or rebate offers to attract customers. These offers range from camera and

selected lens bundles to upgrades of memory cards at purchase.

We recommend that Nikon continue its relationship with UPS as a cost effective

distribution channel for the new D300S and that the firm count on this firm to

maintain positive relationship with Nikon’s established specialty retailers.

To achieve these goals, Nikon budgets $500,000 for all marketing initiatives.

They include printed advertising in the Houston local publications, several

nationally distributed trade magazines, online banner campaigns on Google,

Yahoo!, publication web site, and a direct mail campaign and targeted email

blasts to customers on local retailers’ mailing lists.

2

COMPANY DESCRIPTION

Nikon began in 1917 when three of Japan’s leading optical equipment

manufacturers merged to form Nippon Kogaku (Japan Optics), offering a full

range of optical products. The company’s core competency was research and

production of optical glass. Their product line included cameras, microscopes,

binoculars, surveying and measuring instruments, and ophthalmic lenses. In

1946, they named their first cameras Nikon. In 1952 they established the

Nikkor Club with its mission to promote a photography culture (Nikon-AboutHistory). Nikon’s first single lens reflex camera (SLR), the Nikon F, was first

introduced in 1959.

The Nikon Optical Co. was the first subsidiary to open in the United States in

1953. In the following decades, their lines of products would expand drastically.

Some of these products included: in the 1960s the all weather camera, in the

1970s sunglasses, the 1980s introduced the first auto-focus compact camera

and color printers, and in the 1990s the first underwater SLR camera and

electrochromic sunglasses (they had the ability to change color depending on

the surroundings brightness). Subsidiaries would also open all over the world

in countries such as the Netherlands, Switzerland, the U.K., Germany, Canada,

Hong Kong, France, Taiwan, Sweden, China, Thailand and Hungary.

In 2007, Nikon’s aspirations were defined: Meeting Needs, Exceeding

Expectations (Media Information). Nikon’s innovative company continues to

develop and introduce new cutting-edge consumer-based products to the

world today.

STRATEGIC FOCUS AND PLAN

MISSION, VISION AND GOALS

“…Our determination and goal: Transforming imagination into creativity”

(Nikon).

Nikon’s philosophy of “Trustworthiness and Creativity” defines the company’s

focus on meeting the needs and expectations of their consumers.

Nikon’s mission is based on the company’s responsibility to positively serve

their customers and the global environment. Nikon’s overarching goal is to

achieve loyal customer satisfaction by producing efficient high quality products.

Nikon takes its role as stewards of the environment seriously as evidenced by

their very own “Safety Design Principle” (Nikon | Corporate Info).

3

Nikon’s overall corporate goals can be summarized in the following:

•

•

•

•

•

Increase satisfaction and trust from their customers

Provide products and services that have superior levels

of quality and safety

Enhance and enrich the enjoyment of photographs

Minimize impacts on the environment from production

of products and services

Build products that conform to international safety standards

as guided by “Safety Design Principle”

NIKON CORE COMPETENCY

The Nikon Corporation is a complex organization with a multitude of

subsidiaries, products and service offerings. Hence, their core competencies

exist on many layers. However, there is one basic core competency that spans

across all products and services — Nikon glass — from which all precision optical

lenses are crafted. From the raw silicon to the final coating, Nikon glass

production is considered both a science and an art form (Media Information).

NIKON SUSTAINABLE COMPETITIVE ADVANTAGE

The Nikon Corporation’s competitive advantage can be broken into several key

components:

•

•

•

•

•

•

Its roots in optical design expertise, corporate culture, and vast

knowledge of and deep respect for all things photographic

Long-term research and development of optical technology, camera

development, processing technology forged by history and preserved

tradition

Continuous collection of data and responses, plus research and

development at its Core Technology Center

Customer service, customer satisfaction, and customer retention —

all of which are vital to the success of the firm and at which the

company excels

Integrated solutions to discover customer needs and concerns,

in order to address them as quickly as possible

A rapid-response system that was implemented in 2006 that allows

Nikon to respond to customer inquiries within 5 hours — a time 600%

faster than prior to implementation of this customer service strategy

(Nikon’s competitive edge) (See exhibit 1 – Email correspondence)

4

NIKON ORGANIZATIONAL STRUCTURE

The Nikon Corporation is a global organization with a multitude of subsidiaries

and product divisions across Asia, the Americas, Australia and Europe (Nikon,

Fact Book). (See exhibit 2 – Corporate Structure)

SITUATION ANALYSIS

NIKON S.W.O.T. ANALYSIS

The Nikon Corporation’s primary strength lies in its roots in optical device

manufacturing and optical lens development. Its network of subsidiaries

enables Nikon to penetrate many markets to help maintain its position as the

leader in photographic equipment manufacturing and in the field of semi-conductor

technology. The implementation of processes to enhance internal communication

and consumer relations aided Nikon in establishing a corporate culture that

fosters motivation and customer satisfaction. Also, the integration of an

advanced CRM (Customer Relationship Management) system helps Nikon to

effectively collect, evaluate and manage information to benefit business operations.

Potential weaknesses that could be improved upon are its pricing structure,

exploring opportunities to produce high quality but less expensive products,

and the firm’s need to raise awareness of areas of expertise other than the

development of precision optics and cameras.

Areas of opportunity include the expansion and positioning of Nikon in the

semi-conductor technology manufacturing space; embrace Web 2.0 technology

and utilize the social media trends and the promotion of My Picturetown®, an

online photo sharing and distribution application.

Serious threats exist due to fierce competition by the alliance of ASML and

Zeiss Company. Less serious threats are in the area of camera equipment

production, as Nikon also faces continuous competition with the development

of cheaper and comparable products, for example: Canon and Pentax digital

SRLs with video capability for the consumer market. Additionally, the recent

less favorable economic climate contributes to lower consumer spending and

awareness to price conscious end users. (See exhibit 3 – S.W.O.T. Chart)

5

INDUSTRY ANALYSIS

PEST ANALYSIS

•

•

•

•

•

Political factors include government regulations and legal issues. In the

case of Nikon Digital SLR cameras, the only restriction we could

encounter, are tax policies and trade restrictions and tariffs. Nikon is

staying ahead by implementing eco-friendly regulations in their

companies before legislation requires.

Economic factors that could affect a successful marketing initiative are

the current economic down turn, difficulty in qualifying for a loan,

potentially high interest rates. In a depressed economy, consumers are

more cost conscious and may not want to invest in new cameras or

accessories or replace older equipment until absolutely necessary. At

the same time, potential expansion of the secondary market in today’s

society demands for higher quality images and with Nikon’s expertise in

that area, the firm could experience increased marketability.

There are no real Social factors that would negatively impact the

company. Nikon’s “Vision Nikon 21” and “Safety Design Principle” provide

the company a solid image in the social responsibility and environmental

conscious platforms.

Socially, consumers perceive that an individual wielding a Nikon camera

is a serious photographer and knows what he/she is doing.

Technological factors in respect to Nikon Digital SLR marketing such as

R&D activities, automation, technological incentives and the rate of

technological change will not be a problem because of continuous

research and innovation to stay ahead of the competition. Pending

Patents is being assigned continuously with Nikon keeping them on the

edge of technology.

COMPETITOR ANALYSIS

PENTAX S.W.O.T. ANALYSIS

Similar to Nikon, the Pentax Corporation has its roots in the optical device

research and manufacturing sector. Only two years after the foundation of

Nikon in 1919, Pentax started developing high-quality lenses and began building

its core competency in lens polishing technology.

6

Historically, Pentax developed and continues to develop cameras and lens

systems at a very fast rate. Pentax also is exploring other industries, such

as the development of digital scopes and precision surgical optics. Pentax also

recognized the potentials of the Internet and the influence of social media

and customer behavior, and the company launched two web sites:

pentaxian.com and pentaxphotogallery.com, both intended for sharing and

distributing imagery.

Pentax’s major (current) weakness, however, is its fragile corporate and

management structure caused by the merger with the HOYA Corporation in

2006. Consequently, the firm continues to struggle in stabilizing its business

infrastructure. (See exhibit 4 – S.W.O.T. Chart)

CANON S.W.O.T. ANALYSIS

The Canon Corporation has been an established company for nearly threequarters of a century. When it comes to cameras, they are a household name.

The firm began in the 1930s with their focus on developing quality cameras.

Only one other company is at their level of notoriety: Nikon.

Today’s society has become a very “Green” conscience world, and Canon has

joined that following. Factor 2’s goal is make lighter, smaller, more energy

efficient products with the goal of reducing greenhouse gases (Canon:

Corporate Info). Canon‘s focus on environmental concerns makes them very

desirable to the earth-conscience society we live in today. That strong focus,

though environmentally friendly, may not be so consumer friendly. Focus on

customer service should be a priority as well. Canon’s price point remains

competitive with its top competition, Nikon.

Though, to keep up with Nikon in the market place, further expansion globally

could be useful. Also, in today’s declining economy, expansion could increase

buyers. Digital SLR’s are not an inexpensive product and cannot be afforded

by all. (See exhibit 5 – S.W.O.T. Chart)

SONY S.W.O.T. ANALYSIS

SONY’s strengths lie in the social platform arena and the company’s contribution

to society at large. Corporate entities such as the Sony Life Insurance Co., Ltd,

Sony Institute of Higher Education Shohku College, Sony Corp of America, and

Sony de Mexico S.A de C.V. create a solid foundation and structure for Sony

that could be expanded on within Japan and other countries.

7

With their brand widely known within several retail areas, SONY proves to be

proficient within their marketing capabilities. Their low price point of their

products seem to be sufficient to customers’ needs, making Sony one of the

most affordable brands among the competition from Nikon and Canon. SONY

has the ability to enhance their brand through careful planning of low material

cost and high operational efficiency.

Company weaknesses are in customer service and sales service satisfaction,

which has the potential to drive away long-term customers and convert brand

loyalists.

An area of opportunity that can be improved is in environmental responsibility.

Marketing their products globally, with the emphasis on product safety as well

environmental philosophy could bring SONY closer in competition with Nikon’s

“Safety Design Principle.”

Major threats to SONY come from Nikon’s “Vision Nikon 21” customer service

strategy, and Nikon’s “Safety Design Principle.” Both programs are extremely

important to Nikon’s success and retention of customers and to create brand

loyalty. (See exhibit 6 – S.W.O.T. Chart)

NAICS CODES

•

•

•

Primary SIC Code: 3861 - Photographic equipment and supplies

Primary UK SIC Code: 33.403 - Manufacture of photographic and

cinematographic equipment

Primary NAICS Code: 333315 - Photographic and Photocopying

Equipment Manufacturing

The Nikon Corporation specializes on a variety of products and services that

span different industries. The above NAICS codes reflect all photographic

equipment in which Nikon is involved.

CUSTOMER ANALYSIS

MARKET SEGMENTS INTRODUCTION

G.R.C. Marketing Group identified two sectors of the digital SLR camera space,

the consumers and the professionals. We segmented the consumers into

students, teachers, individuals, and amateur/hobby photographers, with

students being the target group for lower mega-pixels and lower cost digital

SRLs. Teachers, individuals and hobby photographers are the targets for the

8

10 to 12 megapixels and higher cost range. Cameras are purchased either

online or at retail stores. Cost is a significant factor for these consumer segments.

Cameras are purchased throughout the year with possible spikes before and

after the summer period. Special sales programs could be before summer

vacation and before start of school and at the year-end start of holiday season.

Other considerations are competitor activities. The primary target markets is the U.S.

The professional sector is divided into educational organizations, photo studios,

advertising agencies, researchers, and government or military, with focus

on the 12 and 24 megapixels cameras, because of the higher cost of the

purchase and need of use. No special timeframe is designated for these

segments. Purchase will happen according to need any given time of the year.

A possible spike in purchase of high-end models could be 4th quarter, as budgets

are either planned or need to be spent.

For the consumer sectors, cost is major factor in purchase decision, whereas

the professional sector is driven by need. Other significant reasons for

purchase in both sectors could account for the prior purchase and availability

of interchangeable Nikkor lenses and accessories for older 35mm Nikon cameras

by brand loyalists who are switching to digital photography.

Based on the assumptions in Table 1, we will focus marketing efforts towards

the 10 and 12 mega-pixels range digital SLRs, for both the consumer and

professional sectors. Targeted advertising campaigns will be deployed in late

spring and early fall, for both print and online media, including coupon offers

and / or special bundled items for added value depending on geography.

(See exhibit 7 – Market Segments - Table 1)

MARKET-PRODUCT FOCUS

MARKETING AND PRODUCT OBJECTIVES

Nikon’s main focus is marketing to professional photographers by having the

highest quality and most technically advanced photography equipment on the

market. The current D series SLR cameras offer features such as EXPEED

motion cancellation, high megapixel format, and low noise ISO sensitivity. The

quality of a final image is what the photographer is most concerned with, and

Nikon gives them the tools they need to capture any photo, in any condition.

Nikon also extends their products to the more avid consumer interested in

photography as a side hobby or future career interest. Long battery life,

9

in-camera image editing, more advanced help menu features and a reasonable

price tag are things this market is interested in, and Nikon meets their needs

with models such as the D300S.

Because of the ever-growing technological advancements in the industry,

Nikon keeps their products as up to date as possible. New models are released

regularly introducing features and additions being demanded by customers,

and less frequently an entire new product with an entirely new feature will

be released.

TARGET MARKET

PRIMARY MARKET

PROFESSIONAL PHOTOGRAPHER

Age 18-50

College educated

Caucasian, Asian, and other ethnicities

Male

No children 0-17

Income $100,000+ annually

Geographic location: United States

Employed

The primary purchaser of a Nikon D-SLR camera is a professional photographer.

He is male, between the ages of 18 and 50, and a college graduate. He lives

in the United States, has no children, and makes upwards of $100,000

annually, placing him in the Upper class.

SECONDARY MARKET

CONSUMER PHOTOGRAPHER

Age: 18+

Sex: Male/Female

Income: $30 – $100k

Education: Some college/college graduate

Race: All

Social Class: Middle/ upper class

Family Size: No children 0-17

Geographical: United States

Lifestyle: Two income, single parent incomes, student

10

Nikon’s secondary market targets both males and females 18 years of age and

older. This group would usually consist of people with a college background

who consider photography as a hobby and/or may be studying the field of

photography for a potential career opportunity. All races are included. The

secondary group has an income average of $30-$100k, establishing themselves

as the middle/upper class group.

According to the Nikon Quantcast Audience Profile for Nikon, “No Kids In High

School” best describes the family size. It is also reported that this particular

group has a high interest in Consumer Electronics, Technology, Sports/Outdoors,

and Consumer Goods. The above characteristics were partially determined using

graphs showing web traffic. (See exhibit 8 – U.S. Demographics)

TRADE ASSOCIATIONS – NIKON

CONSUMER ELECTRONICS ASSOCIATION- CEA

(HTTP://WWW.CE.ORG/)

The CEA mission statement: “CEA's mission is to grow the consumer electronics

industry” (About CEA) Their members receive access to market research,

networking opportunities, educational programs, regulatory and legislative

news and exposure in promotional programs. Over 2000 companies have been

united by CEA to achieve this. They have online forums, meetings and conferences

to help members stay in touch with such people as government representatives,

buyers, industry leaders and the media. For 75 years they have been providing

objective market research, and are accredited by the American National

Standards Institute.

‘The voice of the U.S. standards and conformity assessment system’ (About

ANSI) Their Technology and Standards program consists of about 1900

participants and 30 working groups, committees and subcommittees. The

world’s largest consumer technology tradeshow is produced by the CEA: the

International CES. United at this conference are press from over 140 countries

and over 100,000 distributors, manufacturers, importers, exporters, retail

buyers and market analysts. If a member were to have an exhibit at the show

they would receive benefits and discounts.

11

POINTS OF DIFFERENCE – NIKON D300S

Nikon has many qualities within their operations that allow them to outshine

the competition

•

•

•

•

•

•

Nikon announces a new product one to two months before releasing it,

allowing consumers the option to wait for the new and improved model

This never leaves their customer in the position of feeling their purchase

was obsolete.

D-Movie Mode with sound: Record 720p HD movie clips enhanced by

NIKKOR interchangeable lens quality and versatility. Offers the most

cutting edge optical products in both the commercial and consumer

market.

Vari-angle color LCD monitor: Position the 3 -inch monitor freely for

fresh shooting perspectives. Screen flips inward for safe keeping.

GPS Geo-tagging: GP-1 GPS unit (optional) automatically identifies and

records every image’s latitude, longitude and altitude, with satellite

time-of-day.

Built-in Flash unit: up to 17 feet range.

Affordable and competitive pricing. (Nikon D300S Points of Difference)

POSITIONING

Nikon’s new D300S is the DSLR camera that delivers patented EXPEED

processing technology and dual memory card slots only because Nikon is the

leader in quality and performance.

MARKETING PROGRAM

PRODUCT STRATEGY

The Nikon D300s has a remarkable number of features that will draw the

buyer in. These features are what make this camera unique and a “must have”

for any photographer.

•

12.3 megapixel, high resolution, and low-noise image, creating sensor

This is a sensor that offers 1,005-Pixel 3D Color Matrix Metering II, the

only system that meters the colors in your shot to make exposures

more brilliantly accurate.

12

•

•

•

•

•

•

•

•

The ISO range is 200 to 3200, and also offers a Lo-1 and Hi-1 option

which are equal to having a 100 and 6400 ISO allowing for a high range

of lighting variations and still create incredible images.

The 920,000-dot, 100% accurate, LCD Monitor is a full 3 inches and

capable of One-Button Live View help for challenging shoots and

reviewing them afterward.

When taking pictures of people it is important to make sure that they

are in focus, so Nikon has implemented its Face Detection System. This

works during playback, and it zooms in directly onto the face in the

image so you can check for its sharpness.

Nikon has a 51-point Auto-focus system and utilizes 3D Focus Tracking,

which is a system designed specifically for moving subjects. This system

follows the subject while the shutter is pressed half way down, then

when the lapse between the shutter being pushed and the picture is

taken. The camera predicts where the object will move to ensure a

clear image.

Nikon’s patented EXPEED processing technology produces your images

with amazing precision at fast speeds and while also using less power.

In continuous shoot mode, 7 frames can be shot per second and with

the included EN-EL3e battery fully charged; up to 950 pictures can

be taken.

This camera not only shoots HD video, but it shoots at a cinematic 24

frames per second rate. When you are done shooting a video, Picture

Controls allows you to trim the video or modify its tone and color. These

same controls are used for still images allowing adjustments of

Sharpening, Contrast, Brightness, Saturation and Hue, as well as

customizing 9 capture preferences in addition to the 4 already

available: Standard, Neutral, Vivid and Monochrome.

High contrast situations are a challenge for professional photographers,

usually something that must be remedied in post processing software

that leads to degradation of images, Nikon’s Active D-Lighting in the

D300S takes care of this problem by bringing back the highlight and

shadow details by centralizing tonal control. Wedding photographers

who photograph white dresses and black tuxedos will truly appreciate

this aspect of this product.

13

•

•

Another feature regarding lighting with the D300S is its built-in flash

that is compatible with Nikon’s Creative Lighting System. This system

makes it possible to control remote flash units for wireless lighting. This

particular camera can control up to two units. The built-in flash also has

a wider coverage than most cameras with coverage for a 16mm

wide-angle lens.

The D300S includes a Virtual Horizon Graphic Indicator which eliminates

the purchase of a separate hot shoe level for those times you need to

make sure you are trying to get that perfect landscape shot, it can be

leveled through either the viewfinder or the LCD monitor. (Nikon D300S

Features and specifications)

The Unique Selling Proposition of the Nikon D300S is its dual memory card

slot. One slot is for Compact Flash mass storage card (CF cards) and the other

is for a Secure Digital non-volatile memory card (SD cards). These two-memory

card slots help organize images while shooting. If you are shooting video and

pictures, you can separate the two by putting the videos on one and the still

images on the other. Also, if you are shooting JPEGs and raw files, they

can also be separated by memory card. Images or videos can be copied

and pasted between cards. If you are shooting a video, the card with the

most memory left on it can be calculated to make sure that video is placed

on that card.

Since it is the features that sell the camera, and when a purchaser is making

their decision they are looking at the camera itself and not the box, the

packaging will be kept simple to keep costs down. A simple box with the label

of the type of camera in the box is all that is necessary.

Nikon offers a standard 1-year parts and labor Limited Warranty as well as a

toll-free number that can be called for additional support. When in-person

support is necessary, Nikon has local retailers and distributors that it partners

with for help that can be easily contacted.

14

PRICE STRATEGY

Unit Cost and profit per unit for Nikon D300S

Cost Break up per unit (Unit price $500)

Materials

Fixed Cost (Salary)

Misc. Fees (Legal)

Total Cost per unit

$

$

$

$

250

125

50

425

The D300S will be sold for $500 to the wholesalers. Based on this model,

profit per unit will be $75.

BREAK-EVEN ANALYSIS

The following calculations are based on estimated fixed and variable costs,

for 1 Million D300S cameras to be sold.

Cost Breakdown (Fixed Cost)

Marketing/Advertising/Graphics

Facility (12 months) - $20,000 monthly

(Lease, Rent, Property Tax)

Overhead (Utilities, Phone, Water, etc.)

12 months - $5.000 monthly

Salaries & Benefits (related to D300S personnel)

Patent & Legal Fees

Subtotal

Fixed cost per unit: $ 1,900,000 / $ 1,000,000 = $ 1.9

Cost Breakdown (Variable Cost) for 1 Million Units

R&D

Materials — $250 per unit

Transport Fees — $5 per unit in bulk

Tax & Tariffs — based on assumed 20% for each unit

Subtotal

$

500,000

$

240,000

$

$

$

$

60,000

1,000,000

100,000

1,900,000

1,000,000

$

$ 250,000,000

$

5,000,000

$ 50,000,000

$306,000,000

Variable cost per unit: $ 306,000,000 / $ 1,000,000 = $ 306

To break even, Nikon needs to sell 9,793 units of the D300S camera.

1,900,000 / (500 [unit price] – 306 [variable cost]) = 9,793 units

15

SUGGESTED RETAIL PRICE STRUCTURE FOR THE NIKON D300S

Cost Breakdown

Materials

Fixed Cost (Salary)

Misc. Fees (Legal)

Total Cost per unit

$ 250

$ 125

$

50

$ 425

Tax & Tariffs (based on 20% of $500)

Transport (bulk shipment per unit)

Sub total ($500 +$100 + $5)

$

$

$

Total Unit Cost (Suggested retail price)

$1,815

Profit based on $500 sold per unit ($75)

Wholesaler Mark up (estimated)

Retailer Mark up (estimated)

$

$

100

5

605

605

605

PROMOTION STRATEGY

CREATIVE PRICING STRATEGY AND TACTICS

•

Odd-even Pricing—retail price of 1799.95

•

Offer trade-in discounts: up to so much off ($300) of your D300S

with the trade-in of your used D-SLR

•

•

•

•

•

Quantity Discount Pricing—For schools or photography businesses

offer a discount when purchasing more than one camera.

Seasonal Discount—Christmas and Thanksgiving offer an additional

percentage off

Offer Package deals that could possibly include: one or more lenses,

carrying case, tripod, extra battery, memory card(s), a flash, or a

lens cleaning kit.

Offer Instant Rebates ($150) on other Nikon products with the

purchase of a Nikon D300S

Student Discounts—with student ID receive 30% off

16

CONTROL PLAN

In the event that Nikon does not reach its financial goals for the year due to

possible deviations, Nikon has already created possible solutions.

POSSIBLE DEVIATION

•

Sales suffer a great decrease due to the suffering economy.

•

Sales decline due to the lack of advertising of the product.

•

There is a sudden increase of product substitution from competitors.

POSSIBLE SOLUTIONS

•

•

•

Due to the suffering economy, Nikon sales can potentially drop. If this

scenario should arise, Nikon will then search within a field for potential

future growth where their distribution network can be used. They will

make necessary means to expand worldwide by identifying potential

regions where a promising increase of sales numbers can be expected.

If there is an increase of product substitutes by competitors, Nikon

will search different approaches to make their product more efficient.

Nikon will search opportunities in the high-tech industry and visual

imaging field to capitalize on their product.

Product sales that may decline due to a lack of advertising, Nikon will

have the opportunity to embark on several business promotions outside

the Nikon Group. Nikon will search for elements outside the company

to expand promotion with promoting tie-ups, alliances, mergers, and

several acquirement.

PLACE STRATEGY

Nikon has several affiliates, but our product is mainly seen in specialty stores

such as Houston Camera Exchange and Wolf Camera. To reach potential

consumers and maximize the distribution channels, we recommend that Nikon

do a co-op promotion with the specialty stores in order to help maximize their

budgets as well as get them to feature this camera in their promotions.

17

PROMOTIONAL STRATEGY

As part of the promotional strategy for the Nikon D300S, G.R.C. proposes two

major marketing campaigns for print, online and mass media. The first is

directed towards families and individuals planning for their summer vacation

who want to capture their memorable moments, as well a special campaign

for the Houston FotoFest, starting in April 2010. This group of consumers

could be first-time purchasers of a digital SLR, or hobby photographers who

want to make the switch from traditional 35 mm film cameras to digital

cameras, or for photographers who plan on upgrading their current

D-SLR camera.

The second campaign would be initiated in mid-to-late fall and would be

directed towards professional photographers, businesses and organizations

that plan on purchasing new equipment to take advantage of the fourth quarter

corporate spending as well as the following year’s tax incentives. A tertiary

target group is present for the fall campaign – students, especially those in

the field of photography, who choose to purchase their own equipment.

This could be combined with a targeted campaign towards educational

organizations only.

There are two key strategies for each campaign, which could be potentially

combined:

•

•

A special offer of bundled components, such as the D300S and an

18-to-135 mm lens.

A coupon reimbursement offer that would allow capturing consumer

behavior data for future targeted online marketing.

(See exhibit 9 – Promotion Details)

G.R.C. Marketing Group proposes a media and advertising campaign for the

Nikon D300S camera, which will be focusing on the Houston, Texas, area.

Media channels include print advertising in local newspapers and magazines,

with a special national ad campaign sponsored by Nikon, in several trade

magazines such as Digital Photo, PC Photo, and Outdoor Photographer. This

special campaign will be targeted towards the FotoFest event in March 2010

in Houston, and is part of an integrated marketing strategy that will utilize

online banner space to increase awareness nationwide prior to the arrival of

visitors and participants. Our secondary goal is to set a foundation for other

cities to join for similar events across the U.S.

18

MEDIA PLAN

Magazine

•

•

•

Houston Symphony – Monthly advertising in several different spots

and sizes. They include 12 Back cover, Inside Front cover, 1/2-page,

and Center spread in color, and 1/3-page in black & white ads.

Digital Photo Pro – 3 monthly issues – February, March and April of

2010. Ads will start running one month prior the Photo Fest event

start in Houston, Texas, and will end when the event ends on April 25,

2010. Ads include 3 Full page, Cover 2, 1/2-page in color, and 3 1/3

page in black & white.

PC Photo – 3 monthly issues – February, March and April 2010. Ads

will start running one month prior the FotoFest event in Houston,

Texas, and will end, when event ends on April 25, 2010. Ads include 3

Full page, Cover 2, 1/2-page in color, and 3 1/3 page in black & white.

Newspaper

•

•

Houston Symphony – Monthly advertising in several different spots

and sizes. They include 12 Back cover, Inside Front cover, 1/2-page,

and Center spread in color, and 1/3-page in black & white ads.

Houston Press – Weekly (52) Jr. Premium print advertisements for

12 months.

Email Blast and Direct Mail

Both email and direct mail strategies will be a combined deployment of local

retailers with co-op support from Nikon. Combined US mailings and email

blasts will contain special incentives for potential customers: for example, buy

the camera and get an upgraded memory card. Direct mail postcard will be

sent in February, and the e-mail blast will be sent in September.

Online Banner Campaigns

We allocated $60,000 for Google (Ad Words) and Yahoo! ad placements and

will monitor and control deployment at various times of the day and week,

as well as the number of clicks. The banners for Google and Yahoo! will be

running the entire year for constant exposure.

A more focused banner campaigns will be deployed before the Houston

FotoFest. Banners include Leaderboards at 728x90 pixels, for 4 issues of

19

e-newsletters of each. Outdoor Photographer, PC Photo, and Digital Photo Pro

(Werner Publishing) magazines, and their corresponding home pages,

measured at 200,000 (CPM – Cost per thousand). They will be deployed starting

in January, and will run until the end of April. Cost for each e-publication is

$2,395. The budget for each of the three publication web sites is allocated

at $18,000.

The following is a detailed break down of the various print and online

advertising components:

Line Item Budget

Magazine & Newspaper Print Advertising

Digital Photo Pro (3x – various sizes and cover)

Nikon co-op sponsored

PC Photo (3x – various sizes and cover)

Nikon co-op sponsored

Houston Symphony (12x – Full Page Back

cover & Inside)

Houston Press (Junior Premium 52 Weeks)

Direct Mail (Co-Op with

local retailers)

Postcards (estimated)

$

65,455

$

43,365

$

16,530

$

91,468

$

$

30,000

50,000

$

80,000

$

30,000

$

30,000

$

7,185

Online Email Blasts (Co-Op with local retailers)

Campaign Monitor bulk mailing (100,000 recipients

@ 0.8 cents)

Online Banner Advertising

Yahoo! (Depending on imprints and clicks) – sponsored

Google Ad Words (Depending on imprints and clicks)

Nikon co-op sponsored

Werner Publishing (4 x Banner Ads for newsletter)

Nikon co-op sponsored

Werner Publishing (Banner Ads on home pages)

Nikon co-op sponsored

Total Advertising Cost

(See exhibit 9 – Media Buy Flow Chart)

(See exhibit 10 to 15 – 2009 Advertising Rates & Samples)

$ 54,000

$498,003

20

PLACE (DISTRIBUTION) STRATEGY

Nikon partners with UPS Supply Chain Solutions to provide a solid distribution

network. The network includes; supply chains, logistics, transportation, and

freight & customs brokerage services. Nikon is responsible for keeping skilled

customer service primary, and keeping distributors and retailers updated on

product availability. With UPS Supply Chain Solutions, Nikon will reach its sales

goals of $5 million by distributing in areas within the United States, Latin

America, and the Caribbean.

Nikon's merchandise starts at manufacturing centers in Korea, Japan, and

Indonesia. Air and ocean freight, and customs brokerage are managed by UPS

Supply Chain Solutions which are all forwarded to UPS's global operations and

logistics center main campus in Louisville Kentucky. Here, Nikon's products are

"kitted" with batteries, chargers, and with any type of needed accessory. The

products is then repackaged to meet the requirements of Nikon's in-store

display arrangements and are shipped for export within the United States, to

Latin American and Caribbean retail outlets and distributors for customers

purchase.

To keep track of their products, UPS Supply Chain Solutions provides

“SKU-Level” visibility and provides Nikon with advance shipment notifications

throughout the U.S, Caribbean & Latin American markets. This method gives

Nikon a glance of the supply chain that rivals their performance. (See Exhibit

16 – Distribution Flow Chart)(See Exhibit 17 – UPS Supply Chain Solution)

21

WORKS CITED

(2009). About Us/Overview. Retrieved August 17, 2009, from American City

Business Journal

Nikon | About Nikon | Responsibility / Safety Design Principle. Retrieved

July 14, 2009, from http://www.nikon.com/about/csr/customers/productsafety/index.htm

Nikon’s competitive edge. Email correspondence. Retrieved July 16 2009.

Exhibit 1a and 1b

Peppers & Rogers Group, "Turning Customer Experiences Into Competitive

Edge:Nikon's Journey to Leadership." (2006): 5. Print.

"Nikon|Corporate Info|Nikons Philosophy." Nikon. 2008. Nikon Group.

16 Aug 2009 <http://www.nikon.com/about/info/philosophy/index.htm>.

Nikon | Corporate Info | Products History (Corporate / Cameras / Movie and

Digital Imaging Equipment and Others). (n.d.). Retrieved July 14, 2009,

from http://www.nikon.com/about/info/history/products/index.htm

Nikon, Fact Book 2008 English Edition 16. Print. Exhibit 2

Nikon Instruments Inc. | News | US News | Company Backgrounder. (n.d.).

Retrieved July 17, 2009, from http://www.nikoninstruments.com/News/USNews/Company-Backgrounder

Nikon | Responsibility | Production of Safe Products. (n.d.). Retrieved

July 16, 2009

http://www.nikon.com/about/csr/customers/product-safety/index.htm

Nikon | Responsibility | Quality Control. (n.d.). Retrieved July 15, 2009,

from http://www.nikon.com/about/csr/customers/quality-control/index.htm

Nikon | Responsibility | Relationship with Customers. (n.d.). Retrieved

July 15, 2009, from http://www.nikon.com/about/csr/customers/index.htm

Nikon | Responsibility | Role in Society. (n.d.). Retrieved July 15, 2009, from

http://www.nikon.com/about/csr/society/index.htm

About PENTAX - Company History and Timeline. (n.d.). Retrieved July 25,

2009, from http://www.pentaximaging.com/about/history

AnnualReports.com. (n.d.). Retrieved August 8, 2009, from

http://www.annualreports.com/About

22

CEA: About CEA - About CEA. (n.d.). Retrieved August 8, 2009, from

http://www.ce.org/AboutCEA/default.asp

Canon : Corporate Info. (n.d.). Retrieved July 24, 2009, from

http://www.canon.com/corp

Canon | Environmental Activities | Vision for 2010 : Factor 2. (n.d.).

Retrieved July 24, 2009, from

http://www.canon.com/environment/vision/factor2.html,

http://www.canon.com/environment/vision/vision.html

Census Bureau Home Page. (n.d.). Retrieved July 29, 2009, from

http://www.census.gov

Canon | Environmental Activities. (n.d.). Retrieved July 24, 2009, from

http://www.canon.com/environment

Feldman, D. S. (n.d.). Business Activity Code, NAICS Code, SIC Code &

Industry Search. Retrieved July 29, 2009, from http://www.naicscode.com

"Examples Of Positioning Statements." Business Plans to Start and Grow

your Business.. 15

Aug. 2009 <http://www.growthconnection.com/Examples-OfPositioningStatements.htm>

IR Solutions. (n.d.). Retrieved August 8, 2009, from

http://www.irsolutions.com/irSolutions-productsservices.html NAICS & SIC

Updates, Manuals, Reference Files & Database

Enhancements. (n.d.). Retrieved July 29, 2009, from http://www.naics.com

Nikon Competition . (n.d.). Retrieved July 25, 2009, from

corptv.datiq.net/asml/Q22009/index.html nikon.com - Quantcast Audience

Profile. (n.d.).Retrieved July 31, 2009, from

http://www.quantcast.com/nikon.com#demographics

Nikon’s competitive edge. Email correspondence. Retrieved July 16 2009.

Exhibit 1a and 1b

Peppers & Rogers Group, "Turning Customer Experiences Into Competitive

Edge:Nikon's Journey to Leadership." (2006): 5. Print.

"Nikon|Corporate Info|Nikons Philosophy." Nikon. 2008. Nikon Group. 16

Aug 2009 <http://www.nikon.com/about/info/philosophy/index.htm>.

23

Nikon | Corporate Info | Products History (Corporate / Cameras / Movie and

Digital Imaging Equipment and Others). (n.d.). Retrieved July 14, 2009,

from http://www.nikon.com/about/info/history/products/index.htm

Nikon, Fact Book 2008 English Edition 16. Print. Exhibit 2

Nikon Instruments Inc. | News | US News | Company Backgrounder. (n.d.).

Retrieved July 17, 2009, from http://www.nikoninstruments.com/News/USNews/Company-Backgrounder

Nikon | Investor Relations. (n.d.). Retrieved July 15, 2009, from

http://www.nikon.com/about/ir/index.htm

Overview. (n.d.). Retrieved August 8, 2009, from

http://www.ansi.org/about_ansi/overview/overview.aspx?menuid=1

Nikon | Responsibility | Production of Safe Products. (n.d.). Retrieved July

16, 2009, from http://www.nikon.com/about/csr/customers/productsafety/index.htm

Nikon | Responsibility | Quality Control. (n.d.). Retrieved July 15, 2009,

from http://www.nikon.com/about/csr/customers/quality-control/index.htm

Nikon | Responsibility | Relationship with Customers. (n.d.). Retrieved

July 15, 2009, from http://www.nikon.com/about/csr/customers/index.htm

Nikon | Responsibility | Role in Society. (n.d.). Retrieved July 15, 2009, from

http://www.nikon.com/about/csr/society/index.htm

PENTAX Photo Gallery. (n.d.). Retrieved July 24, 2009, from

http://www.pentaxphotogallery.com/home

Pentax - Wikipedia, the free encyclopedia. (n.d.). Retrieved July 25, 2009,

from http://en.wikipedia.org/wiki/Pentax

"PEST Analysis." Strategic Management. 2007. 17 Aug 2009

<http://www.quickmba.com/strategy/pest/>.

Sony Complaints. (n.d.). Retrieved July 23, 2009, from http://www.complaintsboard.com/bycompany/sony-a12607.html

Sony Global - Affiliated Companies(Japan). (n.d.). Retrieved July 27, 2009,

from http://www.sony.net/SonyInfo/CorporateInfo/Subsidiaries/index.html

Sony Global - Procurement and Purchasing. (n.d.). Retrieved July 23, 2009,

from http://www.sony.net/SonyInfo/procurementinfo/index.html

24

"PEST Analysis." QuickMBA: Accounting, Business Law, Economics,

Entrepreneurship, Finance, Management, Marketing, Operations, Statistics,

Strategy. 2 Sep. 2009

<http://www.quickmba.com/strategy/pest/>.

(2008). Nikon | News | Vision Nikon 21. Retrieved August 31, 2009, from

Nikon Web site:

http://www.nikon.com/about/news/2000/principal.htm

Nikon D300S Points of Difference. Retrieved September 24, 2009, from

http://photo.net/equipment/nikon/D300s/preview/,

Product brochure (PDF )

Nikon D300S Features and specifications. Retrieved September 24, 2009, from

http://imaging.nikon.com/products/imaging/lineup/digitalcamera/slr/d300s/

"UPS Supply Chain Solutions - Nikon Consumer Goods." 2005. UPS/NIKON.

7 Sep 2009

Yahoo! Online advertising - http://adspecs.yahoo.com/index.php

Email Blast - http://www.campaignmonitor.com/pricing/

25

APPENDIX

26

EXHIBITS

Exhibit 1 - Email Correspondence

Gmail - Nikon's competitive edge

http://mail.google.com/mail/?ui=2&ik=329c5a3db3&view=pt&ca...

Ron Tayyab <rontayyab@gmail.com>

Nikon's competitive edge

Fasano Edward R. <efasano@nikon.net>

To: Ron Tayyab <ron.tayyab@gmail.com>

Thu, Jul 16, 2009 at 12:10 PM

Ron,

I'm afraid that time is an extremely valuable commodity that collides with a surprising number of requests

such as yours. Still, we are flattered that our brand is occasionally viewed as a model for study. In any case, I

offer the following, albeit brief and less than ideally ordered responses to your question.

Nikon Inc., a wholly-owned subsidiary of Nikon Corporation in Tokyo. We are one of Nikon

Corporation's major marketing centers (a Kyoten), with sales, marketing and service responsibilities for

North and South America and the Caribbean.

As the historical information on various Nikon websites indicates, the company's roots, and arguably

one of its core competencies is considerable expertise in optical engineering, combined with the

essential resources and infrastructure to execute against that expertise.

However, optical design expertise does not, by itself, necessarily provide an ideal foundation for the

design, manufacture and marketing of photographic products. This is where another layer of core

competency comes into play. As obvious as it may sound, Nikon (unlike many competing consumer

electronics companies, and even some competing photographic manufacturers), has a vast knowledge

of, and deep respect for, things photographic. And because optical design, as it relates to the

development of interchangeable lenses, is sometimes as much art as it is science, this combination of

competencies, mixed with protected values contributes to perhaps our most important unique selling

proposition—NIKKOR interchangeable lenses. This USP, stemming from core competencies, yields a

special (if not unique) sustainable competitive advantage.

Certainly though, Nikon's expertise is not limited to optics. SLR cameras (once film and now

overwhelmingly digital), Speedlights and system accessories, together with NIKKOR lenses contribute

to the strength of the photographic brand that is Nikon. Nikon is, by no means, a small company. But,

we are smaller than our nearest competitor. Some would say (and I have) that our brand is bigger than

we are. We work very hard, and often make some challenging decisions, to sustain that.

The Nikon brand, for what it represents; combined with the Nikon photographic system for its

capabilities, come together to create something against which, competing in a meaningful way, is no

easy task. At the same time, it is no easy task (for those of us at Nikon) to remain intensely focused on,

and to aggressively protect the fundamental values that helped get us to where we are. But, the

potential (and historically-proven) reward for doing so is the ability to remain a brand against which

competing is difficult.

Much of the above substantiates a fascinating business culture, within which both the brand and

photography itself are held in exceptionally high regard. Nikon's core beliefs go beyond mission

statements on a plaque or platitudes in company newsletters. When a majority of employees share a

similar mindset as a matter of course, it has a natural and positive effect on decision-making at virtually

every level. More times than not, this decision-making effect leads to decisions that are (1) correct and

(2) serve to protect the brand and the corporation’s values.

Clearly, Nikon has meaningful competition. That competition makes us a better company. And I would

1 of 3

7/17/09 6:18 PM

27

Exhibit 1 - Email Correspondence

Gmail - Nikon's competitive edge

http://mail.google.com/mail/?ui=2&ik=329c5a3db3&view=pt&ca...

submit that they would admit that we also make them better company. An important result of this is

better value and higher performance for discriminating photographers and casual picture takers alike.

When occasionally asked, from a marketing perspective, what is the single most important thing a

marketing manager can and should do; my response is always the same. Before all else, protect your

brand.

One important way in which we protect the brand is our deep appreciation for the images that our

products are capable of generating.

Another and much more tedious way in which we protect the brand is linked to truthfulness. A

surprising number of photographic images used in the advertising of photographic merchandise

(visually suggesting or plainly stating the capabilities of the hero product) weren't captured with that

hero product. In many instances, stock images are selected and licensed with little, if any regard for

what equipment was used for their capture. And in other instances, a manufacturer may use

professional-grade equipment to produce images that will ultimately be used to demonstrate the

capabilities of much lesser products. Nikon end-result images that appear in advertising, on packaging,

point of purchase materials, websites and more, must first meet the stringent requirement of having

been captured with the product to which they are being associated. Candidly, we get little credit for this.

Still, it is something that we feel is (1) right and (2) is one of those elements that protects the brand. In

the end, it also helps us sleep better at night.

I'm going to guess that this series of scattered responses may not be what you expected, but I hope that they

offer you some insight that will allow you and your team to refine your own conclusions.

Good luck with your studies and your business future.

Edward R Fasano

General Manager, Marketing, SLR System Products

Nikon Inc.

1300 Walt Whitman Road

Melville NY 11747-3064

Office: 631-547-4003

Fax: 631-547-0309

efasano@nikon.net

www.nikonusa.com

From: rontayyab@gmail.com [mailto:rontayyab@gmail.com] On Behalf Of Ron Tayyab

Sent: Wednesday, July 15, 2009 12:23 PM

To: Fasano Edward R.

Subject: Nikon's competitive edge

[Quoted text hidden]

2 of 3

7/17/09 6:18 PM

28

Exhibit 2 - Nikon Corporate Structure

Structure of Nikon Group

As of July 1, 2008

General Shareholders’ Meeting

Board of Directors

Representative Director, President, CEO & COO

Corporate Auditors/Board of Corporate Auditors

Executive Committee

Internal Audit Department

Corporate Planning Department

Financing & Accounting Department

Corporate Communications & IR Department

Affiliates Administration Department

Business Development Headquarters

Information System Headquarters

Hikari Glass Co., Ltd.

Nikon Optical Shop Co., Ltd.

Nikon Vision Co., Ltd.

Nikon Engineering Co., Ltd.

Nikon Americas Inc.

Nikon Holdings Europe B.V.

Nikon-Essilor Co., Ltd.

Nikon-Trimble Co., Ltd.

Nikon Systems Inc.

Intellectual Property Headquarters

Business Administration Center

Nikon Business Service Co., Ltd.

Nikon Tsubasa Inc.

Core Technology Center

Research & Development Headquarters

Production Technology Headquarters

Precision Equipment Company

Sales Headquarters

Development Headquarters

Production Headquarters

Mito Nikon Precision Corporation

Zao Nikon Co., Ltd.

Tochigi Nikon Precision Co., Ltd.

Sendai Nikon Precision Corporation

Nikon Tec Corporation

Nikon Precision Inc.

Nikon Research Corporation of America

Nikon Precision Europe GmbH

Nikon Precision Korea Ltd.

Nikon Precision Taiwan Ltd.

Nikon Precision Singapore Pte Ltd

Nikon Precision Shanghai Co., Ltd.

LCD Equipment Division

Imaging Company

Marketing Headquarters

Development Headquarters

Production Headquarters

Instruments Company

Customized Products Division

Tochigi Nikon Corporation

Sendai Nikon Corporation

Nikon Imaging japan Inc.

Nikon Inc.

Nikon Canada Inc.

Nikon Europe B.V.

Nikon AG

Nikon GmbH

Nikon U.K. Ltd.

Nikon France S.A.S.

Nikon Nordic AB

Nikon Kft.

Nikon s.r.o.

Nikon Polska Sp.z o.o.

Nikon Hong Kong Ltd.

Nikon Singapore Pte Ltd

Nikon (Malaysia) Sdn. Bhd.

Nikon Imaging (China) Sales Co., Ltd.

Nikon Australia Pty Ltd

Nikon India Private Limited

Nikon Imaging Korea Co., Ltd.

Nikon (Thailand) Co., Ltd.

Nikon Imaging (China) Co., Ltd.

Nikon International Trading (Shenzhen) Co., Ltd.

Guang Dong Nikon Camera Co., Ltd.

Hang Zhou Nikon Camera Co., Ltd.

Kurobane Nikon Co., Ltd.

Nikon Instech Co., Ltd.

Nikon Instruments Inc.

Nikon Instruments Europe B.V.

Nikon Instruments S.p.A.

Nikon Instruments (Shanghai) Co., Ltd.

Nikon Instruments Korea Co., Ltd.

Nanjing Nikon Jiangnan Optical Instrument Co., Ltd.

Glass Division

16

29

Exhibit 3 - Nikon S.W.O.T. Analysis

v

v

v

v

v

v

v

Strengths

Core competency: Manufacturing of

precision optics and high-quality

lenses (NIKKOR).

Expertise: Long-term research and

development in optical technology,

camera development, processing

technology and other technological

innovations forged by history and

preserved tradition. Continuous

collection of data and responses,

research and development at its Core

Technology Center.

Market share: Global market

penetration with subsidiaries in Asia,

the Americas, Europe and Australia.

Quality: Almost 100 years of

reputable brand building.

Client relationship: Vision Nikon 21 superior customer service strategy by

listening to the needs of customers and

improved response rate.

Corporate culture: Motivating

corporate culture radiation outwards

and environmental-friendly

manufacturing process.

Business operation: Rapid

management response system to

quickly adapting to frequently

changing business climate.

v

v

Weaknesses

Pricing structure: Nikon

photographic products are relatively

expensive to the average consumer.

Often competitors such as Canon

and Pentax develop comparable

products that are packed with more

advanced features.

Product awareness: Nikon is

known for its development of

photographic equipments. However

Nikon is a competent player in many

other areas, especially in the

development of semi-conductor

technology, and / or in areas of

Electron Projection Lithography.

30

Exhibit 3 - Nikon S.W.O.T. Analysis

v

v

v

v

v

Opportunities

Niche market development: Semiconductor wafer technology.

Web 2.0 integration:

my Picturetown® – online image

storage, viewing and distribution

application, enabled through Wi-Fi

technology.

Growing emerging markets:

Affordable consumer products in the

field of photography for both the

casual and professional user and

shortening the product replacement

cycle.

Broader features and advanced

technology: Shift from digital picture

taking to HD video capabilities,

broadened field for development to

post-photography image processing

and viewing.

Sales regions: Will widen

considerably with growth in markets

following economic development in

emerging markets.

Threats

Serious Threats

v Semi-conductor technology:

Long-term continuing shrinkage.

v Fierce competition: ASML/Zeiss

Alliance in optical technology in the

semi-conductor sector; CANON and

PENTAX camera development of

affordable HD video able D-SLRs.

Probable Threats

v Pricing structure: Nikon

photographic products are relatively

expensive to the average consumer.

Often competitors such as Canon

and Pentax develop comparable

products that are packed with more

advanced features.

v Economy: Global economic

downturn, hence less consumer

spending.

31

Exhibit 4 - Pentax S.W.O.T. Analysis

v

v

v

v

v

v

v

v

v

v

Strengths

Core competency: Manufacturing of

precision optics, superb lens polishing

technology and cameras.

Expertise: Long-term research and

development in optical technology and

camera development. Branching off

into medical and surgical optical

device development and scopes for

recreational use.

Market share: Global market

penetration with strong foothold the

U.S., Asia and Europe.

Quality: Almost 100 years of

reputable brand building (like Nikon).

Business operation:

Rapid development of products and

ability to adapt to the fast changing

business environment.

Pricing structure: Affordable highquality equipment.

Opportunities

Niche market development:

Medical and surgical product

expansion. Riflescopes and digital

binocular manufacturing.

Web 2.0 integration: pentaxian.com

and pentaxphotogallery.com –

viewing, sharing and distribution

application.

Growing emerging markets:

Affordable consumer products for

photographic cameras, for both the

casual and professional user. Digital

compact camera market expansion.

Technology: Broader features and

advanced technology. Shift from

digital picture taking to HD video

capabilities.

v

v

v

v

v

Weaknesses

Business operation: Internal

turmoil caused by recent mergers

and management turnover.

Availability of lenses: a) high

demand and not being able to

produce, and b) range of lens

products.

Threats

Competition: Nikon and Canon

camera development of HD video

able D-SLRs.

Economy: Global economic

downturn, hence less consumer

spending.

Business Operation: Shareholder

input and pressure.

32

Exhibit 5 - Canon S.W.O.T. Analysis

v

v

v

v

v

v

v

v

v

v

v

Strengths

Experience: 72 yrs.

Striving to improve on safety of

people who produce our products and

improving on the products themselves.

The Global Environment Strategic

Expert Committee: goal to strengthen

environmental management.

Expansion: people connected to the

company and the regions Canon

resides in increases daily.

Energy Conservation: Factor 2

introduction-energy saving equipment

brought into production facilities as

well as products being produced that

are more efficient, smaller and lighter.

Competitive pricing

Main Product Focus: from

inception; cameras.

Corporate Culture: San-ji which

means Three Selves: self-motivation,

self-management, and self-awareness

Opportunities

Possible merger with competing

companies to reduce competition.

Acquiring experts with knowledge to

help improve products more efficiently

and quickly.

Expansion of advertising to create

knowledge to potential customers.

v

v

v

v

v

v

v

v

Weaknesses

Pricing: D-SLR’s are a higher-end,

more expensive product, not

affordable by all.

Technology Based Corporation:

Ever changing technology, must

always keep up.

Global: not as Global as main

competitor, Nikon

Customer relationship: stronger

focus on environment and employee

concerns.

Threats

Potential decline in demand.

Nikon is extremely strong

competition-technology expansion

similarly paced.

Construction delays for

prospective expansion.

Unforeseen lawsuits

33

Exhibit 6 - Sony S.W.O.T. Analysis

v

v

v

v

v

v

Strengths

Affiliates: expansion with several

companies within and outside of

Japan. Ex: Sony Life Insurance Co.,

Ltd, Sony Institute of Higher

Education Shohku College, Sony Corp

of America, and Sony de Mexico S.A

de C.V.

Customer and Supplier Loyalty:

High level of expectation with

customers and suppliers from all

backgrounds.

Prices: Lower product prices vs.

Nikon and Canon product prices.

Procurement Activities: Enhancing

Sony Brand Equity, Competitive

Products, and Strengthening Profits

with lower material cost and great

operational output

Opportunities

Corporations: Offer marketable

corporations such as banking

opportunities or higher education

learning worldwide.

Environmental: Market their

approach globally of environmental

research and safe production

v

v

v

v

Weaknesses

Customer Service: Lack of

customer service / sale service

satisfaction. This important factor

can drive away long-term

customers.

Environmental: Lack of an

established environmental safety

plan for production of their products

Threats

Production Safety: Nikon's

customer satisfaction and

environmental approach for their

products. (Nikon's 'Safety Design

Principle').

Customer Service: Nikon's 'Vision

Nikon 21'. SONY's lack in customer

service satisfaction can damage

customer loyalty

34

Exhibit 7 - Market Segments - Table 1

MARKETS

SECTOR

SEGMENT

PRODUCTS

< 10 MP*

10 MP

12 MP

24 MP

Students

Consumer

Teachers

Individuals

Amateur

Education

Studios

Professonal

Agencies

Research

Gov./Military

Table 1

*Megapixels

35

Exhibit 8 - U.S. Demographics

36

Exhibit 9 - Media Buy Flow Chart

37

Exhibit 10 - Houston Symphony Rates

THE HOUSTON SYMPHONY – WHERE YOUR

MESSAGE MEETS MILLIONAIRES…AND MORE!

OFFICIAL PROGRAM GUIDE OF THE HOUSTON SYMPHONY

Read by elite, luxury consumers of high-end goods and services

Hand-delivered at every Houston Symphony performance – more

than 100 annually

0% newsstand waste

Pass-along readership 625,000

Attract business owners and executives, loyal arts patrons,

high-wealth Houstonians

Year-round distribution at prestigious Jones Hall

DEMOGRAPHICS

• 1 in 6 patrons are millionaires. Average income: $180K

• 70%+ CEOs, business owners, executives, decision-makers

• 88% own stocks and bonds

• 21% own second homes

• 81% visit galleries and museums

• 61% dine out frequently each week

FOUR COLOR

2X

4X

6X

12X

4,620

ADVERTISING

RATES

BACK COVER

5,890

5,595

5,305

INSIDE FRONT COVER

4,855

4,615

4,370

3,810

INSIDE BACK COVER

4,450

4,230

4,005

3,490

Circulation: 250,000

Pass-along: 625,000

FULL PAGE

3,600

3,420

3,240

2,825

Frequency: Monthly

2/3 PAGE

2,680

2,545

2,410

2,100

1/2 PAGE

2,120

2,015

1,905

1,665

1/3 PAGE

1,505

1,430

1,355

1,180

1/6 PAGE

1,155

1,045

990

860

CENTER SPREAD

7,725

7,335

6,600

5,605

BLACK AND WHITE

2X

4X

6X

12X

FULL PAGE

2,585

2,450

2,325

2,020

2/3 PAGE

1,890

1,760

1,670

1,455

1/2 PAGE

1,525

1,405

1,340

1,165

1/3 PAGE

1,080

1,010

955

830

1/6 PAGE

725

670

640

555

PRICING FOR PREFERRED POSITIONS AVAILABLE UPON REQUEST

38

Exhibit 11 - Digital Photo Pro Cover

39

Exhibit 12 - Digital Photo Pro Rates

®

Rate Card #8

Effective January 2009

GENERAL ADVERTISING RATES

BLACK & WHITE

1 time

3 times

6 times

Full Page $11,175 $10,740 $10,320

9 times 12 times 18 times

$9,910

$9,505

$9,125

2/3 Page

8,515

8,170

7,835

7,525

7,240

6,965

1/2 Page

6,485

6,210

5,970

5,730

5,495

5,295

1/3 Page

4,940

4,740

4,540

4,360

4,185

4,025

1/4 Page

3,760

3,585

3,450

3,330

3,185

3,065

1/6 Page

2,855

2,730

2,635

2,515

2,435

2,330

1/12 Page

2,195

2,090

2,020

1,915

1,855

1,775

1-inch

1,120

1,065

1,015

965

950

895

BLACK & 1 PROCESS COLOR

1 time

3 times

6 times

9 times 12 times 18 times

Full Page $12,725 $12,225 $11,750 $11,275 $10,820 $10,385

2/3 Page

9,705

9,290

8,935

8,575

8,240

7,915

1/2 Page

7,360

7,085

6,785

6,530

6,265

6,030

1/3 Page

5,600

5,380

5,175

4,975

4,760

4,580

1/4 Page

4,260

4,105

3,925

3,780

3,640

3,475

FOUR-COLOR

1 time

3 times

6 times

9 times 12 times 18 times

2009

RATES

SPECIAL CLASSIFICATION

BLACK & WHITE

1 time

Full Page $7,765

2/3 Page

5,905

1/2 Page

4,495

1/3 Page

3,425

1/4 Page

2,610

1/6 Page

2,000

1/12 Page 1,520

1-inch

780

3 times

$7,460

5,695

4,345

3,285

2,515

1,915

1,480

765

6 times 9 times 12 times 18 times

$7,165 $6,885 $6,625 $6,335

5,450 5,240

5,015

4,830

4,165 4,005

3,825

3,690

3,165 3,040

2,925

2,805

2,395 2,310

2,235

2,135

1,840 1,755

1,675

1,640

1,400 1,355

1,305

1,255

705

680

660

645

BLACK & 1 PROCESS COLOR

1 time 3 times 6 times 9 times 12 times 18 times

Full Page $9,005 $8,650 $8,320 $7,980 $7,680 $7,360

2/3 Page

6,865

6,605

6,335

6,070

5,835

5,600

1/2 Page

5,210

5,015

4,815

4,615

4,425

4,260

1/3 Page

3,985

3,810

3,665

3,520

3,385

3,230

1/4 Page

3,025

2,910

2,790

2,685

2,570

2,470

FOUR-COLOR

1 time 3 times

Full Page $10,555 $10,150

2/3 Page

8,035

7,715

1/2 Page

6,125

5,890

1/3 Page

4,665

4,475

1/4 Page

3,545

3,400

6 times

$9,745

7,405

5,650

4,280

3,270

9 times 12 times 18 times

$9,365 $8,990 $8,630

7,120

6,845

6,550

5,410

5,190

4,995

4,120

3,945

3,810

3,145

3,025

2,910

Full Page $14,895 $14,315 $13,765 $13,205 $12,650 $12,150

2/3 Page

11,335

10,895

10,465

10,025

9,625

9,250

1/2 Page

8,630

8,285

7,955

7,625

7,335

7,020

1/3 Page

6,550

6,285

6,050

5,815

5,575

5,360

1/4 Page

4,995

4,775

4,595

4,425

4,240

4,060

3 times

6 times

COVERS

1 time

Cover 2

9 times 12 times 18 times

$16,680 $16,025 $15,395 $14,775 $14,180 $13,600

Cover 3

15,805

15,160

14,555

14,000

13,420

12,885

Cover 4

17,880

17,165

16,505

15,825

15,190

14,590

MARKETPLACE

4.75-inch

3-inch

2-inch

1-inch

1 time

$1,610

1,360

1,000

640

3 times

$1,545

1,310

965

610

6 times

$1,490

1,1250

920

590

CLASSIFIEDS

Words

Red Words

Borders

$35

50

65

each

each

Bleed covers and body units are an additional 10%. No charge for gutter bleed only. Oversized material that requires bleed handling will be charged the bleed premium.

WERNER PUBLISHING CORPORATION • 12121 WILSHIRE BOULEVARD, SUITE 1200, LOS ANGELES, CA 90025

PHONE: (310) 820-1500 • FAX: (310) 826-5008 • WWW.DIGITALPHOTOPRO.COM

40

Exhibit 13 - PC Photo Cover

41

Exhibit 14 - PC Photo Rates

®

Rate Card #14

Effective January 2009

GENERAL ADVERTISING RATES

BLACK & WHITE

1 time