The Impact of Hedge Fund Activism: Evidence and

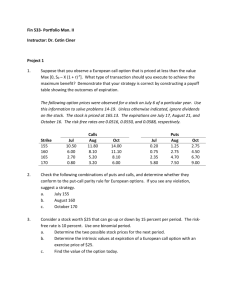

advertisement