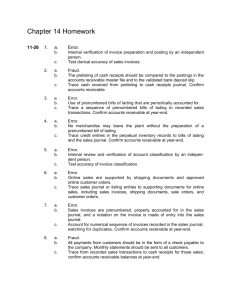

Accounts Receivable Overview

Document

for Sage 100 ERP

©2012 Sage Software, Inc. All rights reserved. Sage Software, Sage Software logos, and the Sage

Software product and service names mentioned herein are registered trademarks or trademarks of Sage

Software, Inc., or its affiliated entities. All other trademarks are the property of their respective owners.

Table of Contents

Introduction .......................................................................................................................................... 1

Main Menu ........................................................................................................................................... 2

Customer Maintenance/Customer Inquiry ......................................................................................... 2

Invoice History Inquiry ...................................................................................................................... 4

Repetitive Invoice Entry .................................................................................................................... 5

Repetitive Invoice Selection .............................................................................................................. 6

Invoice Data Entry ............................................................................................................................ 7

Invoice Printing ................................................................................................................................. 8

Cash Receipts Entry ......................................................................................................................... 9

Cash Receipts Journal.................................................................................................................... 10

Reports Menu .................................................................................................................................... 11

Customer Listing............................................................................................................................. 11

Customer Listing with Balances ...................................................................................................... 12

Customer Mailing Labels ................................................................................................................ 13

Customer Memo Printing ................................................................................................................ 14

Accounts Receivable Aged Invoice Report ...................................................................................... 15

Accounts Receivable Trial Balance ................................................................................................. 16

Cash Expectation Report ................................................................................................................ 17

Customer Sales Analysis ................................................................................................................ 18

Customer Sales History by Period .................................................................................................. 19

Salesperson Sales History by Period .............................................................................................. 20

Sales Analysis by Salesperson ....................................................................................................... 21

Salesperson Commission Report .................................................................................................... 22

Accounts Receivable Sales Tax Report .......................................................................................... 23

Monthly Sales Report ..................................................................................................................... 24

Cash Receipts Report..................................................................................................................... 25

Accounts Receivable Invoice History Report ................................................................................... 26

Accounts Receivable Analysis ........................................................................................................ 27

Accounts Receivable Analysis Report ............................................................................................. 28

Invoice History Printing ................................................................................................................... 29

Customer Audit Report ................................................................................................................... 30

Deposit Transaction Report ............................................................................................................ 31

Credit Card Settlement Report ........................................................................................................ 32

Customer Pricing Report................................................................................................................. 33

Period End Menu ............................................................................................................................... 34

Finance Charge Calculation ............................................................................................................ 34

Finance Charge Entry ..................................................................................................................... 35

Finance Charge Journal.................................................................................................................. 36

Statement Printing .......................................................................................................................... 37

Commission Edit Maintenance........................................................................................................ 38

Commission Edit Register............................................................................................................... 39

Match Credits to Open Invoices ...................................................................................................... 40

Period End Processing ................................................................................................................... 41

Setup Menu ....................................................................................................................................... 42

Accounts Receivable Options ......................................................................................................... 42

Division Maintenance...................................................................................................................... 43

Terms Code Maintenance............................................................................................................... 44

Salesperson Maintenance .............................................................................................................. 45

Payment Type Maintenance ........................................................................................................... 46

Bill To Customer Maintenance ........................................................................................................ 47

Price Level by Customer Maintenance ............................................................................................ 48

Price Level By Customer Copy ....................................................................................................... 49

Utilities Menu ..................................................................................................................................... 50

i

Accounts Receivable Overview

Delete and Change Customers ....................................................................................................... 50

Global Customer Field Change ....................................................................................................... 52

Remove Temporary Customers ...................................................................................................... 53

Remove Zero Balance Invoices ...................................................................................................... 54

Recalculate Customer High Balances ............................................................................................. 55

Salesperson Commission Purge ..................................................................................................... 56

Purge Accounts Receivable History ................................................................................................ 57

Purge Sales Tax History ................................................................................................................. 58

Sales Tax Calculation ..................................................................................................................... 59

Internet Customers Enable/Purge ................................................................................................... 60

Clear Credit Card Information ......................................................................................................... 61

Recalculate Open Order Amounts .................................................................................................. 62

Remove Inactive Customers ........................................................................................................... 63

ii

Introduction

This document includes overview information about each task in the Accounts Receivable module that is

accessible from the menus. You can print this document to use as an offline reference.

The information in this document is also available in the Help system in the overview Help topics.

For additional information about the software, refer to the Help system, which also includes the following:

•

•

•

•

•

•

Overview information for windows that cannot be accessed directly from menus

Procedures that guide you step-by-step through common activities

Explanations of important concepts

Field descriptions

Flowcharts

FAQs

1

Accounts Receivable Overview

Main Menu

Customer Maintenance/Customer Inquiry

Navigation

To access Customer Maintenance, select Accounts Receivable Main menu > Customer Maintenance.

To access Customer Inquiry, select Accounts Receivable Main menu > Customer Inquiry.

Customer Inquiry fields can only be viewed.

NOTE When this task is accessed from Sage CRM, the system date is automatically used as the

accounting date.

Overview

Use Customer Maintenance to create and maintain detailed records for each of your customers. This task

provides several major functions that allow you to set up, maintain, and inquire about customers,

including:

•

Viewing sales history for the selected customer by period by year

•

Creating and maintaining multiple contacts for customers and ship-to addresses

•

Defining electronic delivery options for invoices, statements, sales orders, and RMAs

•

Assigning a new customer number to any current customer

•

Displaying additional customer information, such as sales tax and credit card information

•

Setting up tax schedules and exemptions for each ship-to address

•

Selecting a primary credit card for the customer

•

Viewing customer sales and payment history information

•

Viewing open invoices by customer, along with a breakdown by aging category of total invoiced

amounts due

•

Defining customers as bill-to and/or sold-to customers

•

Viewing open orders for a specific customer

If the Customer Relationship Management module is set up, you can create and maintain relationships

between customers and Sage CRM companies. You can also maintain the Sage CRM Prospects

customer, which is a single shared customer record in Accounts Receivable that allows you to define

default information for all Sage CRM prospect companies that are not related to Accounts Receivable

customers. The Sage CRM Prospects information is then defaulted into all prospect quotes.

The Sage CRM Prospects customer record in Sage 100 ERP represents multiple prospect companies in

the Sage CRM system; therefore, do not enter specific information for this customer record unless it can

be used for all prospect quotes.

If a relationship is created between a customer and Sage CRM company, relationships for customer

contacts and ship-to addresses can be created separately in Customer Contact Maintenance and

Customer Ship-To Address Maintenance. Deleting a relationship between a customer and Sage CRM

company automatically deletes the customer contact and ship-to address relationships for that customer

and company.

Customer records can be deleted only if there is no outstanding activity for that customer. If there is

activity, such as pending orders or e-mails for the customer, you must wait until all open invoices for the

2

Accounts Receivable Overview

customer are paid and purged before you proceed with the record deletion, or use the Delete and Change

Customers utility.

NOTE If a customer with a Sage CRM relationship is deleted, the relationship with the Sage CRM

company is deleted, but the Sage CRM company record itself is not deleted from the Sage CRM system.

The Sage CRM Prospects customer in Sage 100 ERP cannot be deleted, copied, or renumbered in

Customer Maintenance.

3

Accounts Receivable Overview

Invoice History Inquiry

Navigation

Select Accounts Receivable Main menu > Customer Maintenance. At the drop-down button, select

Invoices Inquiry.

Overview

Use Invoice History Inquiry to view invoice information for the selected customer.

This task is available only if Yes or Summary is selected in the Retain in Detail field in Accounts

Receivable Options.

4

Accounts Receivable Overview

Repetitive Invoice Entry

Navigation

Select Accounts Receivable Main menu > Repetitive Invoice Entry.

Overview

Use Repetitive Invoice Entry to create and maintain repetitive invoices for receivable items such as rent or

service contracts. After the items are set up, they can be selected as necessary and transferred to Invoice

Data Entry automatically for processing. Each time a repetitive invoice is processed, the last billed date

on file for the invoice is updated.

When entering a new repetitive invoice, you can copy information from an existing customer's repetitive

invoice to the new one.

•

If the Allow Credit Cards check box is selected in Accounts Receivable Options, the Credit Card

tab appears allowing you to enter information pertaining to the credit card record, including billing

information, corporate card information, and transaction information. You can also clear credit

card information that defaults from the customer for the current transaction. Additionally, you can

access Sage Exchange to enter and store sensitive credit card information.

•

If the Job Cost module is integrated with Accounts Receivable, use Repetitive Invoice Entry to

create and maintain a file of recurring invoices for job-related receivable items such as rent or

service contracts. Also, do monthly and quarterly service-type billing, which must be done to track

profit for service-type jobs. Repetitive invoicing for jobs does not allow for retention entries.

Customer numbers are assigned to a job in Job Masterfile Maintenance.

5

Accounts Receivable Overview

Repetitive Invoice Selection

Navigation

Select Accounts Receivable Main menu > Repetitive Invoice Selection.

Overview

Use Repetitive Invoice Selection to select recurring invoices when you are ready to invoice customers.

You can select a customer number range, reference code range, and/or select cycles. You can also enter

a starting invoice number which is used by the system to automatically assign invoice numbers to the

selected repetitive invoices.

The invoices selected are transferred automatically from Repetitive Invoice Entry to Invoice Data Entry. If

you have no changes to make to any of the repetitive invoices selected, print the invoices after the

selection process is completed, print the Sales Journal, and update the permanent files.

Repetitive invoices can be selected and processed along with a batch of regular invoices, or they can be

processed separately. You must print the Sales Journal and perform the subsequent update in order to

transfer the repetitive invoice data to the permanent files.

To modify repetitive invoice information before printing invoices (for example, to add a last-minute freight

charge, make a change in the salesperson commission rate, or enter the CVV number for credit card

transactions), use Invoice Data Entry. Taxes will be recalculated for selected invoices.

NOTE If the CVV number for credit card transactions is not submitted to Sage Exchange in Invoice Data

Entry, the credit card company may charge a higher transaction fee.

Only invoices for which the Print Invoice check box is selected in Repetitive Invoice Entry can be printed.

If the Job Cost module is integrated with Accounts Receivable, Repetitive Invoice Selection can be used

to select recurring invoices for job-related receivable items. When allowed job statuses are defined in Job

Status Maintenance, the system checks for allowed job statuses only when a job number is first entered

in a data entry window. Changing a job status from allowed to not allowed does not affect existing

records. The system will not check for allowed job statuses when selecting transactions for Repetitive

Invoice Selection.

6

Accounts Receivable Overview

Invoice Data Entry

Navigation

Select Accounts Receivable Main menu > Invoice Data Entry.

Overview

Use Invoice Data Entry to enter information necessary for preparing customer invoices and provide a first

step toward evaluating and processing your receivables. All invoices, debit memos, credit memos, and

adjustments to previously recorded invoices must first be entered here.

•

If your business handles over-the-counter sales, use Invoice Data Entry to record the sale and

produce an invoice. Invoices that are entered but not yet updated can be maintained when

necessary. Check your invoice entries for accuracy by reviewing the Sales Journal prior to

completing the update.

•

If the Job Cost module is integrated with Accounts Receivable, you can enter the job number and

retention that will print on the invoice and sales journal. For normal job-related billing, Job Billing

Data Entry should be used. You can use Invoice Data Entry to enter invoices that are not related,

that are not work-in-process billings, or to make adjustments to job-related invoices. This task

does not relieve work-in-process accounts for job-related invoices.

•

If you are currently using a manual Accounts Receivable system or a different computerized

system, you must perform certain preliminary data entry procedures to ensure that your

accounting records are in balance.

•

If the Allow Credit Cards check box is selected in Accounts Receivable Options, the Credit Card

tab appears allowing you to enter information pertaining to the credit card record, including billing

information, corporate card information, and transaction information. You can also clear credit

card information that defaults from the customer for the current transaction. Additionally, you can

access Sage Exchange to enter and store sensitive credit card information.

Adjustments print on a customer’s invoice and/or statement. Internally, the adjustments print on the Sales

Journal and the Daily Transaction Register. If a debit memo or credit memo is applied to a specific

invoice, the appropriate invoice number is also shown on these reports. You can also use the Match

Credits to Open Invoices task.

Debit memos are generally issued to an account for billing errors, freight not billed, or other

miscellaneous, charges; credit memos are typically used to credit an account for returned goods. Enter

the debit or credit memo as a positive amount. The system recognizes the -DM or -CM invoice type and

automatically reverses the amount signs, when necessary, before applying the amount to the proper

account.

7

Accounts Receivable Overview

Invoice Printing

Navigation

Select Accounts Receivable Main menu > Invoice Printing.

Overview

Use Invoice Printing to print invoices entered in A/R Invoice Data Entry for your customers. Recurring

invoices selected in Repetitive Invoice Selection can also be printed from this window.

•

If the Allow Batch Entry for Invoicing check box is selected in Accounts Receivable Options,

invoices entered by batch can also be printed.

•

If the Job Cost module is integrated with Accounts Receivable, invoices relating to a job can print

job number and retention amount information.

•

If the Allow Credit Cards check box is selected in Accounts Receivable Options and you have

invoices with credit card transactions, the credit card payment amount appears on the invoice and

is reflected in the invoice balance.

After you have printed invoices, you can print the Sales Journal and the Gross Profit Journal (optional),

which contain cost of goods sold, commission, and tax information. You can then update the invoices to

the general ledger to post the receivables amounts.

NOTE You can save settings in this window by creating a new form code. Changes to settings for the

STANDARD form code are not saved when you close the window.

8

Accounts Receivable Overview

Cash Receipts Entry

Navigation

Select Accounts Receivable Main menu > Cash Receipts Entry.

Overview

Use Cash Receipts Entry to record cash and/or credit card payments against outstanding customer

balances. You can enter both cash and credit card deposit amounts for a single deposit. You can search

for records by customer number or invoice number.

•

On the Lines tab, you can distribute (or redistribute) the amount received to the appropriate

invoices or general ledger accounts. Each line item represents payment distribution to an invoice

or miscellaneous general ledger accounts. Comments can be added to each distribution and are

posted to the Cash Receipts History file.

•

On the Credit Card tab, you can enter information pertaining to the credit card record, including

billing information, corporate card information, and transaction information. You can also clear

credit card information that defaults from the customer for the current transaction. Additionally,

you can access Sage Exchange to enter and store sensitive credit card information. This tab

appears only if the Allow Credit Cards check box is selected in Accounts Receivable Options.

•

For open item customers, you can apply the cash and/or credit card payments against specific

open invoices, or you can record a cash and/or credit card payment for an invoice not contained

in the Open Invoice file. Use Cash Receipts Entry to control the entry of each cash deposit by

deposit number.

•

For balance forward customers, cash or credit card payments are applied against aged balances.

For miscellaneous cash receipts or adjustments to customer balances, you can apply cash or

credit card payments directly to the appropriate general ledger accounts. You can use Cash

Receipts Entry to apply cash or credit card payments to debit memos and to apply credit memos

against open invoices.

•

If the Enable Bill To Customer Reporting check box is selected in Accounts Receivable Options,

you can record cash and/or credit card payments against outstanding bill-to customer balances

for their sold-to customers.

•

If the Job Cost module is integrated with Accounts Receivable, payments are not applied

automatically to the retention balance of an invoice; however, you can manually specify that a

payment be applied against the retention balance.

Transactions recorded using Cash Receipts Entry are printed on a journal, checked for accuracy, and

updated.

9

Accounts Receivable Overview

Cash Receipts Journal

Navigation

Access this window using one of the following methods:

•

Select Accounts Receivable Main menu > Cash Receipts Journal.

•

Select Accounts Receivable Main menu > Cash Receipts Entry. In Cash Receipts Entry, click the

Print button.

Overview

Use Cash Receipts Journal as an audit trail to check the accuracy of the data entered using Cash

Receipts Entry. The entries reflected may include receipts against invoices, debit memos, and finance

charges. Credit memos, prepayments, out-of-balance entries, and general ledger adjustments are also

shown.

For cash receipts, information on the journal includes the bank code, posting date, deposit amount,

customer number and name, check number and amount, discount amount, and the invoice numbers to

which the credit card receipts are applied. The amount posted to each invoice is shown along with any

outstanding balance.

If the Job Cost module is integrated with Accounts Receivable, the job-related entries reflected on the

journal include the job number and retention applied, if any. During the update process, the cash receipts

information for job-related invoices is updated to the Job file and the Job Billing History file. If the deposit

date is in a future Job Cost period, the payment received information is updated to the future period.

Cash and credit card transactions that were entered in a single deposit in Cash Receipts Entry are

processed in a single deposit during the update.

Review the Cash Receipts Journal to verify your entries; prepare an adding machine tape of the checks

and credit card payments posted, and check the total against the total on the journal. These totals should

match.

If the deposit balance for any of the deposit dates does not balance, the out-of-balance amount prints on

the report. You must correct your entries in Cash Receipts Entry before continuing with the update.

If the Enable Credit Card Processing check box is selected in Company Maintenance and entries with

credit card transaction information without an authorization exists, you are prompted to process your

credit card transactions. After processing credit card transactions, proceed with the Cash Receipts

Journal update. The last four digits of the customer's credit card, the payment type, and authorization

number are included on the report.

WARNING Do not under any circumstances, interrupt the update process.

10

Accounts Receivable Overview

Reports Menu

Customer Listing

Navigation

Access this window using one of the following methods:

•

Select Accounts Receivable Reports menu > Customer Listing.

•

Select Accounts Receivable Main menu > Customer Maintenance. In Customer Maintenance,

click the Print button.

Overview

Use Customer Listing to print a list of customer-related information. You can select to print only active,

only temporary, only on credit hold, only inactive, or all customers in the customer number range

selected. If the eBusiness Manager module is installed, you can also select to print Internet customers

only.

You can print tax exemption numbers, ship-to address information, credit card information, price level

information, bill-to and sold-to information, split commission information, customer memos, and customer

contacts for the selected range of customers.

You can enter a selection of customer numbers and names, salespersons, customer types, sort fields,

states, ZIP Codes, tax schedules, and user-defined fields (UDFs) to print.

NOTE To print a customer listing with balances, use the Customer Listing with Balances report.

11

Accounts Receivable Overview

Customer Listing with Balances

Navigation

Accounts Receivable Reports menu > Customer Listing with Balances.

Overview

Use Customer Listing with Balances to print a list of customer-related information, similar to the Customer

Listing, as well as customer sales history data such as period-to-date, year-to-date, and prior-year sales.

This report also allows you to print the customer data by any defined fiscal year or period.

You can enter a selection of customer numbers and names, salespersons, customer types, sort fields,

states, ZIP Codes, tax schedules, and user-defined fields (UDFs) to print.

NOTE If the Enable Bill To Customer Reporting check box is selected and Bill To and Sold To Customers

is selected in the Track Customer Sales History in Accounts Receivable By field in Accounts Receivable

Options, a message appears stating that the sales information will be overstated when printing the report

for both the bill-to and sold-to customers.

12

Accounts Receivable Overview

Customer Mailing Labels

Navigation

Select Accounts Receivable Reports menu > Customer Mailing Labels.

Overview

Use Customer Mailing Labels to print customer names and addresses, as well as tax schedule and

exemption numbers from the Exemption file onto labels. Options are available for aligning the data to fit

the size of your labels and the format of your label sheets. You can select to print active only, inactive

only, temporary only, or all customers in the selected range. You can also print multiple labels for each

customer. Ship-to-address information can be printed instead of the customers' regular address.

The standard, default format for customer mailing labels is contained in the Forms file. This format can be

modified, or you can customize new formats to print customer information on a variety of forms.

You can print one type of label for correspondence and a different type of label to use on file folders or

other internal records. You can also create formats to accommodate Rolo-Dex cards, continuous form

envelopes, or even personalized business letterhead. In addition to names and addresses, you can print

any information contained in the Customer file, including phone numbers, contacts, reference numbers,

and receivable balances.

®

NOTE Customer Mailing Labels supports the use of Avery Labels.

NOTE You can save settings in this window by creating a new form code. Changes to settings for the

STANDARD form code are not saved when you close the window.

13

Accounts Receivable Overview

Customer Memo Printing

Navigation

Accounts Receivable Reports menu > Customer Memo Printing.

Overview

Use Customer Memo Printing to print a listing of memos containing information pertinent to specific

customers. This report can contain recaps of customer correspondence, specific instructions regarding

the maintenance of individual accounts, and overridden auto-display settings.

You can enter a selection of customer numbers, memo codes, memo descriptions, memo dates,

expiration dates, and starting and ending reminder dates to print.

14

Accounts Receivable Overview

Accounts Receivable Aged Invoice Report

Navigation

Select Accounts Receivable Reports menu > Accounts Receivable Aged Invoice Report.

Overview

Use the Aged Invoice Report to provide a detailed list of invoices by customer number and by aging

categories for all or for a selected range of customers. This report provides a concise overview of

outstanding receivables balances and is useful for managing collections and achieving an efficient

receivables turnaround. You can include open invoices only, paid invoices only, or all invoices.

If the Enable Bill To Customer Reporting check box is selected in Accounts Receivable Options, the soldto customer information can be included for the bill-to customer.

If the Job Cost module is integrated with Accounts Receivable, the job number and retention balance are

also printed for job-related invoices.

You can specify complete invoice item detail, invoice information without item detail, or summary total

information by customer. You can also include, and age, any credit memos issued during the selected

period.

You can enter a selection of customer numbers and names, salespersons, customer types, states, ZIP

Codes, phone numbers, sort fields, customer purchase orders, and user-defined fields (UDFs) to print.

NOTE Information is provided for any specific date as long as the date does not represent a period that is

already closed, or the invoice date and the accounting date are not in the same accounting period.

The report can include any one or all of the four aging categories specified in Accounts Receivable

Options. For each invoice, the report shows the invoice number, invoice date, amount, due date, and

discount due date (if applicable). Totals are printed by customer number and by division, with a grand

total of all invoices shown as the report total.

If the Track Job Cost Retention Receivables check box is selected in Accounts Receivable Options, the

Aged Invoice Report prints only three aging categories, instead of the standard four. The last column is

used to print the retention balance. The aged invoice balance does not include the retention balance.

Invoices purged from the Accounts Receivable Open Invoices files do not display on the Accounts

Receivable Aged Invoice Report, even when it is printed as of the last date. Records for paid invoices are

purged by using the Remove Zero Balance Invoices utility. Paid invoice records are also removed during

period-end and year-end processing based on the setting in the Days to Retain Paid Invoices field in

Accounts Receivable Options.

15

Accounts Receivable Overview

Accounts Receivable Trial Balance

Navigation

Select Accounts Receivable Reports menu > Accounts Receivable Trial Balance

Overview

Use the Trial Balance report to provide a complete recap of the Accounts Receivable invoices, detailing

all receipts, adjustments, or other activities that affect the Accounts Receivable balances during a

specified period. You can also use the Trial Balance report to reconcile the general ledger accounts

receivable accounts. Information is organized by general ledger posting date (or transaction date).

NOTE You can use this report to reconcile your general ledger to the balance of the Accounts Receivable

account.

The Aged Invoice Report uses the invoice date or due date specified in Accounts Receivable Options.

The Trial Balance Report uses the transaction date (accounting date). If the Aged Invoice Report and the

Trial Balance Report do not balance to each other, one or more invoices may have an invoice date and a

transaction date that are not in the same period.

When transaction detail prints, the payment type for credit card and other payment type transactions

generated through the Sales Order module are added to the report.

NOTE Information is provided for any specific date as long as the date does not represent a period that is

already closed, or the invoice date and the accounting date are not in the same period.

You can select a range of customer numbers to include in the report. In addition, you can include all

invoices on file, or select either open or paid invoices. You can print the transaction information in detail

form, or summarized it by invoice. Print this report before performing period-end processing.

16

Accounts Receivable Overview

Cash Expectation Report

Navigation

Select Accounts Receivable Reports menu > Cash Expectation Report.

Overview

Use the Cash Expectation Report to provide a summary of outstanding customer invoices due for up to

four consecutive periods and one "future" period. This report provides a comprehensive picture of the

cash you expect to receive within a given time frame. The "future" period will contain all cash expectations

beyond the four periods.

NOTE Information is provided for any specific date as long as the date does not represent a period that is

already closed, or the invoice date and the accounting date are not in the same accounting period.

Entries made in the Ending Date fields must be prior to Ending Date 4.

Information on the report includes the customer number and name, invoice number and due date,

available discount and due date, invoice balance, and aged payments due. Due dates can also be

calculated using the average days to pay information for each customer. Totals are provided by customer

and division, with a total of all payments due within the period-ending dates specified.

If the Job Cost module is integrated with Accounts Receivable, the job number and retention balance are

printed for job-related invoices. If the Track Job Cost Retention Receivables check box is selected in the

Accounts Receivable Options window, only three accounting periods can be printed. To replace the fourth

accounting period, the retention balances for job invoices are printed on this report in a separate column.

The retention amounts are not included in the cash expectation balances.

17

Accounts Receivable Overview

Customer Sales Analysis

Navigation

Select Accounts Receivable Reports menu > Customer Sales Analysis.

Overview

Use Customer Sales Analysis to obtain a comprehensive recap of total sales, cost of goods sold, profit

percentages, cash received, and finance charges. The total number of invoices and finance charges

issued to each customer is also itemized. Use information detailed in this report to compare sales activity

by customer for any fiscal year and period defined, as well as by period-to-date, year-to-date, and prioryear data. Sales amount percent-of-total figures are printed only if the report is being ranked by period-todate, year-to-date, or prior-year sales. The percentage shown represents the percentage of the total

receivables each customer's sales represents. If you have created divisions, divisional totals are also

provided.

Printing the Customer Sales Analysis report by salesperson reflects the customer sales, sorted by the

default salesperson for each customer. The Sales Analysis by Salesperson report provides accurate

information by the actual salesperson assigned to each invoice.

You can enter a selection of customer numbers and names, salespersons, customer types, states, ZIP

Codes, sort fields, period-to-date sales, year-to-date sales, prior-year sales, and user-defined fields

(UDFs) to print.

NOTE If the Enable Bill To Customer Reporting check box is selected and Bill To and Sold To Customers

is selected in the Track Customer Sales History in Accounts Receivable By field in Accounts Receivable

Options, a message appears stating that the sales information will be overstated when printing the report

for both the bill-to and sold-to customers.

18

Accounts Receivable Overview

Customer Sales History by Period

Navigation

Select Accounts Receivable Reports menu > Customer Sales History by Period.

Overview

Use Customer Sales History by Period to print customer sales history information by period for a specified

fiscal year. You can sort the report by customer number, total dollars sold, total gross profit amount, and

total gross profit percent. A total column, which reflects the total of all periods, prints after the last period

for each item selected to print.

A total for each division along with a report total prints except when sorting by total dollars sold, total

gross profit amount, and total gross profit percent.

You can enter a selection of customer numbers, total dollars sold, total gross profit amounts, and total

gross profit percentages to print.

NOTE If the Enable Bill To Customer Reporting check box is selected and Bill To and Sold To Customers

is selected in the Track Customer Sales History in Accounts Receivable By field in Accounts Receivable

Options, a message appears stating that the sales information will be overstated when printing the report

for both the bill-to and sold-to customers.

19

Accounts Receivable Overview

Salesperson Sales History by Period

Navigation

Select Accounts Receivable Reports menu > Salesperson Sales History by Period.

Overview

Use Salesperson Sales History by Period to print salesperson sales history by period for a specified fiscal

year. You can sort the report by salesperson, total dollars sold, total gross profit amount, and total gross

profit percent. A total column, which is the total of all periods, prints after the last period for each item

selected to print. If the Include Sales Tax and Freight in Sales History check box is selected in the

Accounts Receivable Options window, the report prints the sales tax and freight.

You can enter a selection of salespersons, total dollars sold, total gross profit amounts, total gross profit

percentages, and customer numbers to print.

NOTE A total for each division along with a report total prints except when sorting by total dollars sold,

total gross profit amount, and total gross profit percent. When printing the customer information, a

subtotal is printed for each salesperson. The sales on the Salesperson Sales History by Period report

reflect what was sold to the customer by the primary salesperson.

20

Accounts Receivable Overview

Sales Analysis by Salesperson

Navigation

Select Accounts Receivable Reports menu > Sales Analysis by Salesperson.

Overview

Use Sales Analysis by Salesperson to obtain a recap of sales analysis information that can be sorted by

salesperson, customer number, period-to-date sales, year-to-date sales, and prior-year sales for any

fiscal year and period defined. Use this report to accurately reflect salesperson sales based on the

salesperson assigned to each invoice. You can include period-to-date, year-to-date, or prior-year

information, or you can incorporate all three periods.

You can enter a selection of salespersons, customer numbers, period-to-date sales, year-to-date sales,

prior-year sales, and user-defined fields (UDFs) to print.

The information detailed in this report allows you to compare receivables activity by salesperson and

customer for any of the three periods selected. If you have created divisions, divisional totals are also

provided.

NOTE The sales on the Sales Analysis by Salesperson report reflect what was sold to the customer by the

primary salesperson. This report also contains sales tax and freight depending on the settings in the

Include Sales Tax and Freight in Sales History fields in Accounts Receivable Options.

21

Accounts Receivable Overview

Salesperson Commission Report

Navigation

Select Accounts Receivable Reports menu > Salesperson Commission Report.

Overview

Use the Salesperson Commission Report to list details of commissions updated in the current period.

Commission information for each salesperson includes the invoice number, the invoice date, and the

total, as well as the cost, gross profit, and percent-of-profit earned. Totals are provided by customer and

salesperson, followed by a total of all commissions reported. If you have divisionalized your Accounts

Receivable, divisional totals are also provided.

The report shows the invoice amount paid and the commission payable amount for invoices fully paid if

the Commissions Paid on Paid Invoices Only check box is selected in the Accounts Receivable Options

window.

NOTE This report is available only if the Salesperson Commission Reporting check box is selected in the

Accounts Receivable Options window.

22

Accounts Receivable Overview

Accounts Receivable Sales Tax Report

Navigation

Select Accounts Receivable Reports menu > Accounts Receivable Sales Tax Report.

This task is available only if the Sales Tax Reporting check box is selected in the Accounts Receivable

Options window.

Overview

Use Accounts Receivable Sales Tax Report to provide a recap of all sales tax information by tax code.

This report can be printed in summary or detail format and includes taxable sales, nontaxable sales,

taxable freight, nontaxable freight, taxable tax, exempt amount, and sales tax amount for each tax code.

The accumulated sales tax collected is printed for each tax code and primary tax code.

•

Cleared information appears on the report with zero amounts for the taxable and nontaxable

columns. Clear records are the result of using the AP from AR Clearing utility to pay off Accounts

Receivable invoices that contain sales tax.

•

Recap information appears on the report with the sales tax collected amount for the day. Recap

records are the result of using the Cash Receipts Journal, Accounts Receivable Sales Journal,

and Sales Order Sales Journal for invoices paid in full that contain sales tax.

The report reflects all sales tax from all invoices recorded since the last time the report was printed and

the file was cleared. This report should be printed and the file be cleared before processing any invoices

for the next tax reporting period. To purge sales tax detail, use the Purge Sales Tax History option in

Period End Processing.

The Accounts Receivable Sales Tax Report offers multiple print options. When the Print by Primary Tax

Code check box is selected and your state is defined as the first tax code within the tax schedules, the

report provides subtotals by all primary tax codes, as defined in Library Master Sales Tax Schedule

Maintenance. If your state is defined as the first tax code within the tax schedules, the report also prints

by state.

23

Accounts Receivable Overview

Monthly Sales Report

Navigation

Select Accounts Receivable Reports menu > Monthly Sales Report.

Overview

Use the Monthly Sales Report to provide a recap of all sales activities for the period recorded in the

Accounts Receivable module. All invoices recorded using Invoice Data Entry, Cash Receipts Entry, and

the Sales Order module are included on this report.

If you have created divisions, this report is sorted by division. Invoices within each division are sorted by

customer number and sorted further by invoice number. The invoice information detailed by this report

includes the invoice date, due date, and discount date. The transaction information included specifies the

transaction type, date, and amount. Any prepayments applied to each invoice are also specified. Invoices

are subtotaled by customer number and totaled by division. Report totals are also provided.

You can enter a selection of customer numbers, invoice numbers, and user-defined fields (UDFs) to print.

If the Enable Bill To Customer Reporting check box is selected in Accounts Receivable Options, the soldto customer information can be included on the report.

NOTE This report is cleared during period-end processing.

24

Accounts Receivable Overview

Cash Receipts Report

Navigation

Select Accounts Receivable Reports menu > Cash Receipts Report.

Overview

Use Cash Receipts Report to provide a recap of all cash receipts processed for a specified date using

Cash Receipts Entry. The information for each deposit includes the deposit date and number, as well as

the customer name and number.

All checks deposited and all invoices (or miscellaneous general ledger distribution) to which they are

applied are detailed along with the cash amounts applied, discounts applied, and invoice balance

information. Totals are provided by deposit number, deposit date, and bank code.

NOTE The Monthly Cash Receipts Report does not reflect credit card transactions. The Deposit

Transaction Report includes sales order deposits (paid by cash or credit card) entered and updated in the

Sales Order module, as well as credit card receipts entered in Cash Receipts Entry.

You can enter a selection of customer numbers, bank codes, deposit dates, check numbers, and userdefined fields (UDFs) to print.

If the Enable Bill To Customer Reporting check box is selected in Accounts Receivable Options, the soldto customer information can be included on the report.

25

Accounts Receivable Overview

Accounts Receivable Invoice History Report

Navigation

Select Accounts Receivable Reports menu > Invoice History Report.

This task is available only if Yes or Summary is selected in the Retain in Detail field in Accounts

Receivable Options.

Overview

Use Invoice History Report to obtain a detailed listing of invoice information recorded using Invoice Data

Entry. If the Sales Order or Job Cost module is integrated with Accounts Receivable, you can also access

invoice history information for invoices entered through those modules.

You can enter a selection of invoice numbers, customer numbers and names, salespersons, ship-to

states, bill-to states, customer purchase orders, sales order numbers, invoice dates to print, and userdefined fields (UDFs) to print. The customer number and name, billing address, ship-to address, and

invoice total appear for each invoice. Line item detail information can also be provided for each invoice.

If the Enable Bill To Customer Reporting check box is selected in Accounts Receivable Options, the bill-to

customer information can be included on the report.

If the Purchase Order module is set up, the purchase order number and purchase order required date can

be included on the report.

If the Job Cost module is integrated with Accounts Receivable, you can print job number and retention

balance information for job-related invoices. If the Job Cost module is integrated with Sales Order, you

can print the job number, retention amount, cost code, and cost type for invoices updated from the Sales

Order module.

Line item detail information for time and material invoices processed through the Job Cost module is

summarized as a single line on this report.

If the Customer Relationship Management module is set up, the Sage CRM user, company, opportunity,

and person information prints for invoices created from Sage CRM orders if the fields are added to the

form using the Crystal Reports software.

26

Accounts Receivable Overview

Accounts Receivable Analysis

Navigation

Select Accounts Receivable Reports menu > Accounts Receivable Analysis.

Overview

Accounts Receivable Analysis produces a management report consisting of a statistical summary of

receivables activity and an aging recap for up to six consecutive closed periods within the current year.

NOTE Reporting is based on the current module date and includes previously closed periods (processed

through period-end processing).

Information reported includes total Accounts Receivable dollars, the percentage of change over the prior

period(s), the total number of invoices, and a breakdown by period of invoices overdue.

The aging recap portion of the report includes data for up to six previously closed periods. For example, if

you set up your system in January, and run this report in March, periods 1 and 2 (January and February)

are the only previous closed periods reflected.

27

Accounts Receivable Overview

Accounts Receivable Analysis Report

Navigation

Select Accounts Receivable Reports menu > Accounts Receivable Analysis Report.

Overview

The Accounts Receivable Analysis Report is an in-depth management report consisting of an aging recap

and statistical summary of receivables activity for up to six consecutive closed periods within the current

year. The statistical summary indicates whether Accounts Receivable activity is increasing or decreasing

in comparison to prior periods and what proportion of the receivables is not current.

NOTE Reporting is based on the current module date and includes previously closed periods (processed

through period-end processing).

Information is accumulated from the Open Invoices file and includes, total Accounts Receivable dollars,

the percentage of change over the prior periods, the total number of invoices, and a breakdown by period

of overdue invoices. The aging of invoices is based on the Aging Categories field in the Accounts

Receivable Options window.

Statistical data includes percentage comparisons of Accounts Receivable dollars as of the current module

date and aged over the previous period and the remaining period average.

The aging recap portion of the report includes data for up to six previously closed periods. For example, if

you set up your system in January, and run this report in March, periods 1 and 2 (January and February)

are the only previous periods reflected.

28

Accounts Receivable Overview

Invoice History Printing

Navigation

Select Accounts Receivable Reports menu > Invoice History Printing.

Overview

Use Invoice History Printing to print history invoices for a range of customer numbers, invoice numbers,

and invoice dates. You must print the different types of invoices separately. You can print only unpaid

invoices for open item customers, which shows past due invoices for collection purposes.

•

If the Enable Bill To Customer Reporting check box is selected in Accounts Receivable Options,

the bill-to customer number and name can be included.

•

If the Allow Credit Cards check box is selected in Accounts Receivable Options and you have

invoices with credit card transactions, the credit card payment amount appears on the invoice and

is reflected in the invoice balance.

•

If the Customer Relationship Management module is set up, the Sage CRM user, company,

opportunity, and person information prints for invoices created from Sage CRM orders if the fields

are added to the form in the Crystal Reports software.

•

If the Job Cost module is integrated with Accounts Receivable, you can print job number and

retention balance information for job-related invoices. If the Job Cost module is integrated with

Sales Order, you can print the job number, retention amount, cost code, and cost type for

invoices updated from the Sales Order module. The retention amount appears only if the Track

Job Cost Retention Receivables check box is selected in Accounts Receivable Options.

29

Accounts Receivable Overview

Customer Audit Report

Navigation

Select Accounts Receivable Reports menu > Customer Audit Report.

Overview

Use the Customer Audit Report to track changes, deletions, and additions to customer information. This

report prints changes made to data fields, including changes created "on the fly," and notes the date and

user code or workstation ID. You can enter a selection of user logons or workstation names, and

transaction dates. By entering these selections, you can obtain a report that allows you to identify

pertinent information.

If you do not purge the Customer Audit file after printing the Customer Audit Report, the transaction

information remains in the file and is available for future reporting needs.

NOTE This report is not available if No is selected in the Track Customer Changes field in the Accounts

Receivable Options window.

30

Accounts Receivable Overview

Deposit Transaction Report

Navigation

Select Accounts Receivable Reports > Deposit Transaction Report.

This task is available only if an option other than None is selected in the Retain Deposit Transaction

History field in Accounts Receivable Options.

Overview

Use Deposit Transaction Report to provide a history of deposit payment transactions processed by the

system. The report prints in payment type/invoice number order. When the report prints, you can then

purge the printed transactions. All transactions within the printed range are deleted.

NOTE The Deposit Transaction Report includes sales order deposits (paid by cash or credit card) entered

and updated in the Sales Order module, and credit card deposits recorded in Cash Receipts Entry.

31

Accounts Receivable Overview

Credit Card Settlement Report

Navigation

Select Accounts Receivable Reports menu > Credit Card Settlement Report.

Overview

Use Credit Card Settlement Report to print credit card transactions settled by Sage Exchange. You can

print the report in summary or in detail, and you can enter a range of settlement dates or print all

settlement dates.

NOTE This report is available only if the Credit Card Processing module is registered.

32

Accounts Receivable Overview

Customer Pricing Report

Navigation

Select Accounts Receivable Reports menu > Customer Pricing Report.

Overview

Use Customer Pricing Report to produce a list of customer's special pricing and discounts, including

customers that have been set up with product line/price level records. You can enter a selection of

customers, item codes, product lines, price codes, price levels, and item categories (if descriptions have

been entered in Inventory Management Options). You can also print or suppress product line information,

weight, item categories, bill-to customer numbers (if the Enable Bill To Customer Reporting check box is

selected in Accounts Receivable Options), and/or customer pricing information such as the price code,

price level, and price source.

In addition, you can select to print only items with sales history.

33

Accounts Receivable Overview

Period End Menu

Finance Charge Calculation

Navigation

Select the Accounts Receivable Period End menu > Finance Charge Calculation.

Overview

Charge Calculation to calculate finance charges on overdue amounts before printing customer

statements. You can specify a customer number range, aging date, statement cycle (monthly, bimonthly,

etc.), and minimum balance to use in the calculation. Finance charges are calculated for all customers

and all statement cycles, as of the current date, and are based on the minimum overdue balance for

applying a finance charge established in Accounts Receivable Options. When the calculations are

completed, you can calculate the finance charge for another range of customers, or print the Finance

Charge Journal.

If you click Clear after a calculation is performed, but before the Finance Charge Journal is updated, the

calculated finance charges are deleted and are not applied against the customer's unpaid balance.

NOTE If invoices must be printed for finance charges, you can create finance charge invoices from the

Invoice Data Entry window by typing an –FC in the Invoice No. field.

If applying finance charges is an exception rather than a common practice in your business, you may

want to skip the Finance Charge Calculation task and enter the finance charges individually in Finance

Charge Entry.

NOTE If None is selected in the Computation Method field in the Accounts Receivable Options window,

Finance Charge Calculation is not available.

34

Accounts Receivable Overview

Finance Charge Entry

Navigation

Select Accounts Receivable Period End menu > Finance Charge Entry.

This task is available only if Fixed or Percent is selected in the Computation Method field in the Accounts

Receivable Options window.

Overview

Use Finance Charge Entry to manually apply finance charges to individual customers or to adjust

calculated finance charges automatically. If applying finance charges is an exception rather than a rule,

you may want to skip Finance Charge Calculation and enter the charges using this task. At the

completion of Finance Charge Entry, you can print the Finance Charge Journal to review your entries for

accuracy. The information can then be updated, and the finance charges are reflected on the customers'

next statements.

NOTE Cash customers cannot be entered in Finance Charge Entry.

NOTE If invoices must be printed for finance charges, you can create finance charge invoices from the

Invoice Data Entry window by typing an –FC in the Invoice No. field.

The aging categories displayed are Days or Months, depending on whether Days or Months is selected in

the Aging Categories to Be Used field in the Accounts Receivable Options window. If you use the Fixed

method for calculating finance charges, the fixed amount entered in Accounts Receivable Options is

added to the customer balance automatically unless a different amount was entered for specific

customers in the Customer file. If a blank percentage (or amount) is on file for any customers in the range

selected, no finance charge is calculated. If you use the Percentage method for calculating finance

charges, the percentage entered in Accounts Receivable Options is used to perform the calculation. If a

different percentage is on file for individual customers in the Customer file, that percentage is used

instead. If the calculated finance charge is not greater than the minimum finance charge amount entered

in Accounts Receivable Options, the minimum finance charge amount is used instead.

35

Accounts Receivable Overview

Finance Charge Journal

Select Accounts Receivable Period End menu > Finance Charge Journal.

Use the Finance Charge Journal to list all finance charges that are calculated using Finance

Charge Calculation or entered using Finance Charge Entry. Information includes the customer

number and name, the receivables balance, any past due amount, and the finance charge

amount. If you have divisionalized your Accounts Receivable module, divisional totals are also

provided. This journal can be used to review finance charges before updating the information and

printing customer statements.

After printing the Finance Charge Journal, review it for accuracy. If there are errors, return to

Finance Charge Entry, make the necessary changes, print the Finance Charge Journal, and

proceed with the update.

WARNING Do NOT, under any circumstances, interrupt the update process!

During the update process, the following occurs:

•

The finance charge amounts are updated to the Open Invoice file for printing on customer

statements and to the Finance Charges Period to Date, Year to Date, and Last Year

fields in the Customer Maintenance and Customer Inquiry windows.

•

The General Ledger Daily Transaction file is updated for future printing of the Daily

Transaction Register and subsequent update to the general ledger.

After the update is completed, you can print the Daily Transaction Register and update the

general ledger entries posted from the Finance Charge Journal.

NOTE This task is available only if Fixed or Percent is selected in the Computation Method field in

the Accounts Receivable Options window.

36

Accounts Receivable Overview

Statement Printing

Navigation

Select Accounts Receivable Period End Processing menu > Statement Printing.

Overview

Use Statement Printing to print statements for selected customers on preprinted statement forms or plain

paper. Statements can also be e-mailed in PDF format to selected customers, if the E-mail Statements

check box is selected in Accounts Receivable Options.

Statements are printed using the information entered in Invoice Data Entry, Repetitive Invoice Entry,

Cash Receipts Entry, Finance Charge Calculation, or Finance Charge Entry. Name and address

information, and invoice and payment detail information can be printed. You can print statements for a

range of customer numbers, a group of statement cycles and/or customers with a certain minimum

balance, or by the aging category of the customer's oldest balance. You can also print a separate bill-to

statement for each sold-to customer, and you can include bill-to invoices on a sold-to customer

statement. If the Print Sold To Customer Number on Bill To Statements check box is selected in Accounts

Receivable Options, the sold-to customer number is printed under the invoice number for those invoices

that have a sold-to customer number.

NOTE You can print customer statements only if the Print Customer Statements check box is selected in

Accounts Receivable Options.

Statements that have been set up as fax enabled can be batch faxed.

If the Job Cost module is integrated with Accounts Receivable, the invoice retention can be printed for

job-related invoices.

NOTE You can save settings in this window by creating a new form code. Changes to settings for the

STANDARD form code are not saved when you close the window.

37

Accounts Receivable Overview

Commission Edit Maintenance

Navigation

Select Accounts Receivable Period End menu > Commission Edit Maintenance.

This task is available only if the Salesperson Commission Reporting check box is selected in the

Accounts Receivable Options window.

Overview

Use Commission Edit Maintenance to edit any individual record in the Salesperson Commission file.

Edited records are marked on the window display and the Commission Edit Register. Print the

Salesperson Commission Report before making entries in Commission Edit Maintenance to review the

commissions currently earned or due for payment.

You can also use Commission Edit Maintenance with the Commission Edit Register to update the

invoices for a specific salesperson to other modules.

When adding commissions using Commission Edit Maintenance, amounts are written to the Salesperson

Commission file, but not to the Salesperson file. The period-to-date and year-to-date values are not

updated in the Salesperson file when commissions are manually entered or corrected using Commission

Edit Maintenance. Totals need to be entered manually in Salesperson Maintenance.

The Salesperson Commission Report should be printed after using Commission Edit Maintenance to

verify changes.

If you are not using linkages, use Commission Edit Maintenance to change, add, or delete a record in the

Salesperson Commission file, and then print the Salesperson Commission Report to verify changes. If

you are using linkages, use Commission Edit Maintenance to change, add, or delete a record in the

Salesperson Commission file, and then print the Salesperson Commission Report and Commission Edit

Register. Update to the respective modules and clear the Commission Edit Register.

When the Commission Edit Register prints, the system validates that all salespersons with established

links actually connect to a valid vendor, employee, or general ledger account. You are prompted to

update to each module.

38

Accounts Receivable Overview

Commission Edit Register

Navigation

Select Accounts Receivable Period End menu > Commission Edit Register. In Commission Edit Register,

click the Print button.

WARNING Before printing the Commission Edit Register, print the Salesperson Commission Report to

validate the data on the Commission Edit Register.

This task is available only if the Salesperson Commission Reporting check box is selected in Accounts

Receivable Options.

Overview

Use Commission Edit Register to check the accuracy of salesperson commission changes entered in

Commission Edit Maintenance. The system writes the changes directly to the Salesperson Commission

file, so you do not need to print the register to update the changes; however, you can print the register

and update the invoices to the Accounts Payable, General Ledger, and Payroll modules.

You can select invoices by date range for a specific salesperson; because it is not possible to select a

specific invoice for an update, you must perform the update for all invoices at one time.

The Commission Edit Register provides the invoice number, invoice date, and total, as well as the sales

and cost subject to commission, gross profit, percent-of-profit earned, and commission amount. Totals are

provided by customer and salesperson, with a grand total of all commissions reported. If you use

divisions in your Accounts Receivable module, division totals are also provided.

If the Commissions Paid on Paid Invoices Only check box is selected in Accounts Receivable Options,

the commission record does not update to another module or clear from the Salesperson Commission file

until the invoice has been paid in full. If the check box is cleared, the commissions update and are cleared

after running the Commission Edit Register.

The Commission Edit Register allows you to choose whether to update the register after printing.

Additionally, you are not prompted to purge files after completing the Commission Edit Register. To purge

files, use the Salesperson Commission Purge utility.

39

Accounts Receivable Overview

Match Credits to Open Invoices

Navigation

Accounts Receivable Period End menu > Match Credit to Open Invoices.

Overview

Use the Match Credits to Open Invoices task to match credits automatically, such as prepayments, credit

memos, and negative invoices, against open invoices in the Open Invoice file. You can perform global or

selective matching of credits to outstanding invoices by invoice date or invoice number. There is no

requirement that the invoice numbers and credit numbers must match.

The Match Credits to Open Invoices Report shows all invoices for which the task automatically applies the

credits. After printing and reviewing the report, you can update credit matches to the Accounts Receivable

Open Invoice file and the Transaction/Payment History file.

Review the Match Credits to Open Invoices report for accuracy before updating the Accounts Receivable

files.

WARNING Do NOT, under any circumstances, interrupt the update process!

Credit memos are created with a transaction type payment of CREDIT-X, with the transaction date and an

offset amount to the open invoices selected for matching.

40

Accounts Receivable Overview

Period End Processing

Navigation

Select Accounts Receivable Period End menu > Period End Processing.

Overview

Use Period End Processing to automatically perform either period-end or year-end processing based on

the period entered at the Current Period field in Accounts Receivable Options.

Period End Processing allows you to close the current period and increment the accounting period

forward to the next period. Period-end processing is usually performed at the end of each accounting

period. Year-end processing takes place automatically when period-end processing is performed for the

last period of the fiscal year.

NOTE Fields in Accounts Receivable Options are used to determine the current accounting period and

number of years to retain customer sales history, salesperson history, and cash receipts history after

year-end processing.

The following occurs during period-end or year-end:

•

Temporary customers with zero balances are automatically purged during period- and year-end

processing unless you selected the Retain Temporary Customers Paid Invoices check box in

Accounts Receivable Options.

•

Monthly cash receipts history, customer sales history, and salesperson sales history is purged

only during period year-end processing based on the selections made in the Years to Retain

Cash Receipts History, Years to Retain Customer History, and Years to Retain Salesperson

History fields in Accounts Receivable Options. For example, if the number of years to retain cash

receipts history, customer sales history, and salesperson history is set to three years, sales and

cash receipts history for the year 2010 will be purged when year-end processing is performed for

the year 2012.

•

Open invoices with zero balances are removed during period- and year-end processing based on

the number of days entered in the Days to Retain Paid Invoices field in Accounts Receivable

Options.

If you have not already printed period-end reports, you can do so during period-end processing.

Alternately, you can select and print period-end reports without accessing Period End Processing by

using Period End Report Selection.

WARNING Backing up your data is an important part of your daily and monthly procedures. Back up all

Accounts Receivable data before proceeding.

41

Accounts Receivable Overview

Setup Menu

Accounts Receivable Options

Navigation

Select Accounts Receivable Setup menu > Accounts Receivable Options.

For new companies, you can access Accounts Receivable Options only after completing the Accounts

Receivable Setup Wizard.

Overview

Accounts Receivable Options presents a series of options allowing you to maintain features most

appropriate for your business. Some of these options are defined during new company setup using the

Accounts Receivable Setup Wizard, but they can be further maintained in this window.

42

Accounts Receivable Overview

Division Maintenance

Navigation

Select Accounts Receivable Setup menu > Division Maintenance.

Overview

Use Division Maintenance to organize your customer and invoice information by divisions. You can define

up to 100 divisions by department, branch, or profit center. Additionally, each division can maintain its

own Accounts Receivable and Discounts Allowed account numbers for posting to the general ledger.

Amounts posted to each account reflect the activities for only that division. If you integrate the General

Ledger module with Accounts Receivable, you can print the accounts receivable ending balance amounts

for each profit center on your financial statements and other General Ledger reports.

Divisions affect the numbering of your customers. The division number precedes the customer number

entered in Customer Maintenance and determines which general ledger accounts are posted to when an

invoice or cash receipt is processed. Additionally, all reports containing customer invoice and payment

information provide subtotals by division. The accounts posted to are based on the accounts specified in

Division Maintenance.

If the Accounts Receivable Divisions check box is selected in the Accounts Receivable Options window,

use Division Maintenance to assign a two-digit number and description to each division of your company.

You also record the general ledger account numbers transactions to post when invoices or cash receipts

are processed for a customer within a specific division.

If the Accounts Receivable Divisions check box is cleared in the Accounts Receivable Options window,

enter information for division 00 only. Division 00 cannot be deleted. You cannot post invoices, cash

receipts, or finance charges if any general ledger account numbers are blank.

NOTE When an invoice with retention is first entered, the net invoice amount (invoice balance minus

retention) is debited to the Accounts Receivable account, and the retention amount is debited to the

Retention Receivable account. You must specify the Retention Receivable account to use in Division

Maintenance. If you do not want to post retention separately, use the same general ledger account for

both the Accounts Receivable and Retention Receivable accounts.

When a payment for an invoice is received, it is assumed that the Accounts Receivable balance is applied

before any payment is applied to the retention balance. This means that any partial payment that does

not fully pay the invoice is first applied against the Accounts Receivable account until the invoice balance