Exxon/Mobil (Fall 2015)

advertisement

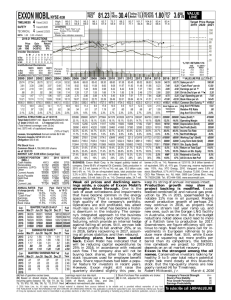

Analysts: Michael Piri (Michael.piri12@stjohns.edu) Todd Hinson (Todd.Hinson14@stjohns.edu) Danni Sun (Danni.Sun14@stjohns.edu) Fangxia Peng (Fangxia.Peng14@stjohns.edu) Share Data (as of 12/18/15): Fundamentals (as of 12/18/15): Price: $77.28 Shares Outstanding: 4.163M Market Cap: $309.47 B 52 Week High: $95.18 52 Week Low: $66.55 LTM P/E: 16.3 GAAP EPS[2014]: $7.60 E[EPS 2015]: 3.90 ROA LTM Sept 2015: 5.75% ROE LTM Sept 2015: 11.35% 1 Table of Contents: Executive Summary 4 Company Overview 5 Management and Segment Breakdown 5 Strategic Direction 6 Oil and Gas Reserves Industry Risk Factors 6 7 Supply 7 Demand 8 Economic Conditions 9 Governmental and Political Factors 9 Management Effectiveness 9 Fundamental Analysis 10 Summary 10 Custom Industry 10 Growth 12 Sales 12 Net Income 13 Cash Flow From Operating Activity 14 EBIT 15 Profitability 16 Gross Margin 16 EBIT Margin 16 Net Profit Margin 17 SG&A Margin 17 ROE 18 ROA 18 Liquidity 19 Current Ratio 19 Quick Ratio 19 Efficiency 20 Receivables Turnover 20 Asset Turnover 20 2 Inventory Turnover Long Term Solvency 21 22 Long-term debt/Equity 22 Times Interest Earned (TIE) 22 Financial Leverage Ratio 23 Income Statement Forecast 24 Relative Valuation 26 Absolute Valuation 27 Conclusion 31 Citations 32 3 Executive Summary: The MBA SMIF team of Fall 2015 hereby makes an add recommendation in the amount of 200 shares to the MBA SMIF’s current holdings of Exxon Mobil. We came to this conclusion after a comprehensive analysis of the current status of the company, evaluation of the macroeconomic factors effecting the industry, ratio analysis, relative valuation of Exxon Mobil using comparable companies, and an absolute valuation analysis. Crude Oil closed at $34.95 on December 18, 2015 (Oil-Price, 2015). These prices represent the lowest the commodity has been priced in the last seven years. Exxon Mobil and other oil and gas companies’ prices for its products are heavily reliant on the prices of commodities in the market. Therefore, the entire oil and gas sector has been exposed to the downward pressures of Crude Oil over the mediumterm. However, after a current, and historical, ratio analysis of Exxon Mobil, we feel that the company is well positioned, relative to many of its peers, to outlast the recent collapse in prices. In addition, while some smaller companies in the industry are slashing dividends paid to shareholders, Exxon Mobil has grown its dividend in each of the last 32 years (Dividend, 2015). In addition, our relative valuation model suggests that the current estimate of Exxon Mobil’s price is $94.13. The model examined the P/E to P/E relationships of Exxon Mobil and our selected peers over the last ten years by applying an appropriate adjustment factor to each company and our E (EPS 2016). Given this information, we feel that Exxon Mobil is undervalued in the market, supporting our add recommendation. Furthermore, our absolute value analysis also upheld our recommendation. For instance, we calculated various different costs of capital using data from Bloomberg to use the CAPM and Fama French methods. We then calculated the intrinsic value of the future expected cash flows and found a growth rate that equaled our intrinsic value. We predict that in the years after 2021, Exxon Mobil’s actual growth rate will increase as commodity prices begin to stabilize. Overall, our research, assumptions, calculations, ratio analysis, valuation models, and expectations for the future, support our add recommendation for Exxon Mobil. 4 Company Overview: Management and Segment Breakdown Exxon Mobil was founded in 1882 by John D. Rockefeller and is currently headquartered in Irving, Texas. Exxon Mobil is currently the largest publicly traded oil and gas company in the world. Exxon Mobil’s key management figures include; Rex W. Tillerson (Chairman & Chief Executive Officer), Andrew P. Swinger (Chief Financial Officer & Senior Vice President), and Mark W. Albers (Senior Vice President). 1 For over 125 years Exxon Mobil has been exploring, developing, and distributing crude oil and natural gas to various businesses and individuals around the world. In addition to the exploration and production of crude oil and gas, Exxon Mobil also produces commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics and a variety of specialty products 2. The company conducts its business operations under three main segments; Downstream, Chemical, and Upstream (Figure 1). Figure 1 Revenue by Segment (Billions) 37.2 38.2 Downstream Chemical Upstream 318.17 The Downstream segment refers to the manufacturing and selling of petroleum products. The refining and supply operations within the Downstream segment encompass a global network of manufacturing plants, transportation systems, and distribution centers3. Downstream operations, the largest segment of 5 Exxon Mobil’s operations, accounts for approximately 81% of Exxon Mobil’s total revenue. In contrast, the Upstream and Chemical segments of Exxon Mobil’s Operations combine for approximately 19% of Exxon Mobil’s total revenue. The Upstream segment primarily is tasked with the exploration and production of crude oil and natural gas. The Chemical segment of Exxon Mobil’s operations manufactures and sells the aforementioned commodity petrochemicals to a wide number of consumers and businesses. In addition, Exxon Mobil categorizes the regions in which it conducts business operations into United States, Non-United States, Canada, and Other (Figure 2). Figure 2 Revenue by Region (Billions) 119 148.7 United States Non-United States Canada Other 36.1 90.3 Strategic Direction: Oil and Gas Reserves Exxon Mobil’s overall volume capacity outlook for the subsequent years is expected to increase. Exxon Mobil ascertains the expected volume related figures in its 10-K report through “advanced reporting technology such as wellbores, well logs, reservoir core samples, fluid samples, static and dynamic pressure barometers, and surveillance information.” (Exxon, 2014). Despite the accuracy of the copious reporting tools at Exxon Mobil’s disposal, the company recognizes that the actual 6 reported figures, and the time in which they are reported, may vary from estimates due to the various detailed risk factors that will be discussed later in this report. Exxon Mobil has decreased its exploratory and development activities in the United States, and the other regions in which it operates, in 2014 compared to 2013. These specific activities include Syncrude Operations and the Kearl Project. Syncrude is a joint venture established to recover shallow deposits of oil sands using open-pit mining methods to extract the crude bitumen, and then upgrade it to produce a highquality, light, sweet, synthetic crude oil4. The Kearl Project is another joint venture, similar to the Syncrude Operations, located approximately 40 miles north of Fort McMurray in Alberta, Canada. In the 2014 10-K report, Exxon Mobil mentions that the “Kearl Expansion Project was essentially complete by the end of 2014…”, thus explaining the decline in activities (Exxon, 2014). In addition to exploration and extraction activities, wet and dry well drilling were also down in fiscal year 2014 compared to the previous year. Although Exxon Mobil has operations in all of the contiguous 48 states in the United States, it primarily focuses its operations in “Permian Basin of West Texas and New Mexico, the Bakken oil play in North Dakota and Montana, and the Woodford and Caney Shales in the Ardmore and Marietta basins of Oklahoma”5 (Exxon Mobil, 2014). On December 18, 2015, Congress officially lifted the “40-year ban on U.S. Crude Oil Exports.” (BBC News, 2015). The passage of this bill into law means that Exxon Mobil can now sell their oil products in certain areas of the global market that they previously were not allowed to. Immediately following the release of this news, oil prices began to marginally climb from their recent seven-year lows. We affirm that this news will allow Exxon Mobil to diversify its business segmentation and reach new markets in the medium-to-long term. Industry Overview: Risk Factors: Supply The oil, gas, and petrochemical businesses (the three major segments of Exxon Mobil’s operation strategies) are fundamentally commodity businesses. Given the nature of these businesses, operations and earnings are significantly influenced by fluctuation in commodity prices. In fact, perhaps the biggest challenge facing Exxon Mobil right now is the continued downward pressure in commodity oil prices. On 7 December 4, 2015, the Organization of the Petroleum Exporting Countries (OPEC) announced that the supply of oil in 2016 is to remain unchanged from current levels of production. OPEC produces approximately 81% of the world’s oil on a yearly basis (OPEC, 2015). The immense presence of OPEC in the global economy allows the Organization to manipulate the prices of certain commodities through its levels of production. For example, since this announcement Crude Oil has plummeted to sixyear lows, closing at $37.23 on December 9, 20156. The decision by OPEC has caused losses of approximately $240 billion in market value across the entire oil and gas industry since its announcement. According to Bloomberg, “…companies producing, refining, piping, and exploring for oil, along with those that provide them with services, had a market value of about $3.72 trillion as of Friday, December 10, 2015 compared with $3.96 trillion on December 3, 2015, the day before OPEC’s meeting in Vienna.” (See Figure 3)7 . Exxon Mobil is not the only oil and gas company suffering from lower commodity prices. For example, the second largest oil and gas company in the nation, Chevron, has announced that it plans to cut its budgetary spending for 2016 by an immense 24% from its 2015 plan8. OPEC has declared that “the global oil surplus will persist at least until late 2016 as demand growth slows and OPEC shows ‘renewed determination’ to maximize output.”9 Figure 3 Demand Demand for Exxon Mobil’s resources can also be influenced by improvements in alternative energy sources. There has been a growing sentiment in many parts of the world to become more efficient in energy consumption due to the effects it may have 8 on the environment. One instance in which this particular phenomenon can be seen is the trend in fuel-efficient cars. Many consumers are opting for hybrid and electric vehicles in efforts to preserve the environment. Furthermore, demand for oil and gas products is influenced by seasonality in weather patterns. For instance, extended periods of cold weather will require businesses, municipalities, and residential homes to consume more oil in order to keep areas at appropriate temperatures. Economic Conditions Like several different businesses, Exxon Mobil is not immune to the ever-changing economic conditions in the countries in which it operates. In particular, the demand for the commodities that Exxon Mobil produces, manufactures, distributes, and sells, is heavily influenced by growth rates in the economy. The aggregate annual GDP growth rate in the world has increased from 2.2% in 2012 to 2.5% in 2014 10. Exxon Mobil, along with other oil and gas companies must be cognizant of the recent, marginal growth rates in the aggregate economy. Governmental and Political Factors Exxon Mobil faces risk in access limitations that could be mandated, at any time, by the countries they conduct business in. Regulatory and litigation risks are also prominent in the oil and gas industry. The United States, and other areas that are known to impose large punitive damages for violations of environmental regulations, represent a huge risk for Exxon Mobil and its affiliate companies considering the large portion of revenue it generates in these locations. Exxon Mobil is forced to comply with the regulations and restrictions in any given country it chooses to conduct operations in. Specifically, these risk factors can include, increase in local tax rates, governmental royalties, price manipulation, changes in environmental regulations, fluctuation in cost of compliance, adoption of regulations mandating the use of alternative fuel sources, and by the change in currency rates. Management Effectiveness Although many of the previously stated risk factors are seemingly out of Exxon Mobil’s direct control, there are aspects of risk that can be effectively controlled by the company. These factors can include, but are not limited to, exploration and development programs, project management, ability to negotiate with outside forces, operational efficiency, research and development, safety measures, and preparedness for unforeseen natural occurrences. 9 Fundamental Analysis SUMMARY: The team analyzed growth rates, profitability, solvency, and operating efficiency from 2005 to 2015: year-to-date + Q4 2015 estimates to complete calendar 2015 for growth rates, last twelve months (LTM) Sept 2015 for ratios. Two prominent macroeconomic factors were prevalent in every graph – the financial crisis of 2008 and the current overabundance of oil in the market beginning approximately in 2013, which caused barrel prices to drop. For these reasons, and although our figures date back to 2005 for reference, we will only focus on the time period from 2010, when the market began to rebound, to present. Additionally, we also believe the current drop in the price of oil to be a significant factor in the overall downward trend in the industry metrics rather than firm specific risk factors. For this reason, we have focused on Exxon’s position in the market relative to its peers, despite the industry-wide drop. We found the following trends in our analysis regarding Exxon: a. Growth rates – Industry leader b. Profitability – Top 3 most profitable in the industry c. Short-term solvency – Top 4 d. Long-term solvency – Top 4 and stable, relative to volatility of industry. e. Operating Efficiency – Industry leader in operating efficiency CUSTOM INDUSTRY: We analyzed Exxon compared to its 3 largest competitors by market share and industry performance - Chevron (CVX), BP (BP-US), and Shell (RDS.B) as well as a custom industry comprised of 16 companies in the oil & gas sector. The custom industry is as follows: 10 Ticker XOM CVX OXY 857.HK RDS.B CHK COG COP DVN MPC VLO EOG HES PSX NBL BP Market Market Cap Share Company ExxonMobil $ 309.47 7.80% Chevron $ 162.68 4.03% Occidental Petroleum $ 59.42 0.42% PetroChina ADR $ 32.51 8.03% Royal Dutch Shell ADR $ 9.71 8.13% Chesapeake Energy $ 14.43 0.35% Cabot Oil & Gas $ 222.02 0.05% ConocoPhillips $ 13.98 1.01% Devon Energy $ 44.16 0.45% Marathon Petroleum $ 6.66 2.23% Valero Energy $ 94.19 2.86% EOG Resources $ 141.38 0.30% Hess $ 41.17 0.18% Phillips 66 $ 13.79 2.89% Noble Energy $ 2.77 0.11% BP ADR $ 50.43 6.64% 11 GROWTH (Year-to-Year) Sales The financial crisis of 2008 and the current overabundance of oil in the market have both contributed to drastic decreases in sales for the industry as a whole. The financial crisis drastically impacted sales as shown by the dip in sales during the back end of 2008. Notably, as sales began to rebound in 2009 to their pre-crisis levels, Exxon was able to maintain its market position and has continued to maintain that position despite the oversaturation of oil in the market, causing prices to drop to their lowest levels in years. 12 Net income Exxon’s net income has been consistently higher than its competitors since at least 2010. The financial crisis and overabundance of oil in the industry have drastically impacted sales and since operating costs have remained relatively stable over the same period, net income has also suffered. Despite this, Exxon has managed to maintain higher net income relative to its competitors. 13 Cash flow from Operations The company’s cash flow from operations steadily increased from 2005 to 2008, and although it has not been able to reach pre-crisis momentum, was and remains higher than its competitors to date. YTD 2015 actual cash flow from operations + the Q4 projection is higher than its competitors at $33.91B, followed by Shell with $30.42B. Exxon vs. Competitors - CF from Ops (including industry line) 450.00 400.00 350.00 300.00 250.00 200.00 150.00 100.00 50.00 0.00 2005 2006 Series1 2007 2008 Series2 2009 2010 Series3 2011 2012 Series4 2013 2014 YTD Series5 14 EBIT Exxon’s EBIT consistently grew from 2005 up until the financial crisis of 2008. Post-crisis, Exxon’s EBIT has remained higher than its competitors, even after 2012 when the price of oil began to drop. 15 PROFITABILITY Gross Margin Briefly in 2010, Exxon’s gross margin trailed behind that of Chevron. Post2010, Exxon has had one of the highest gross margins in the industry. Gross profit margin has remained relatively stable year-to-year, however, a larger downward trend can be seen. EBIT Margin Exxon has been top 3 in the industry in terms of its EBIT margin. EBIT margin has remained relatively stable compared to EBIT margins of its competitors. Post financial crisis to present, Exxon’s EBIT margin trailed behind Chevron’s. 16 Net Profit Margin Exxon’s net profit margin has remained relatively stable since 2010 as well, again despite volatility among its peers. SG&A Margin Exxon’s SG&A margin has remained on par with that of the industry since at least 2005 to present. 17 ROE ROE has been consistently higher than its competitors and the industry average over the entire time period 2005 to LTM Sept 2015 shown in the chart. ROA ROA for Exxon/Mobil and Chevron have been similar, with Exxon/Mobil usually the industry leader. 18 LIQUIDITY Current Ratio Exxon’s current ratio has been consistently less than that industry since 2009. Keep in mind that current ratio does not take into consideration the quality of the assets – which can be used to generate more income relative to lower quality assets. Quick Ratio 2009. Exxon’s quick ratio has also been consistently less than that industry since 19 EFFICIENCY Receivables turnover Exxon has been particularly efficient and quick in collecting on its receivables. Since roughly 2006, Exxon’s receivables turnover has remained stable and has been higher than the industry. Asset turnover Exxon’s asset turnover was on an upward trajectory up until the financial crisis, where aggregate industry asset turnover fell steeply. The industry has not been able to reach pre-crisis levels, and is gradually declining since 2011. 20 Inventory turnover Inventory turnover has been somewhat volatile since at least 2005. Relative to the industry, Exxon’s inventory turnover has been less, but has followed the same trajectory – sharp fall experienced during the crisis followed by a rebound period post-crisis in 2009 to about 2011 where turnover slowly and steadily has been declining. 21 LONG-TERM SOLVENCY Long-term debt/Equity Exxon has used the least amount of debt financing. This suggests that Exxon may not be using enough debt, which is the cheaper source of financing. However, it has recently increased its increased its debt load, which could be to finance value adding projects. Exxon vs. Competitors - LT Debt to Equity 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 2005 2006 2007 2008 Exxon 2009 2010 Chevron 2011 BP 2012 2013 2014 LTM Shell Time Interest Earned (TIE) Owing to its low debt levels and income generation, Exxon/Mobil has one of the higher interest coverage ratios in the industry. 22 Financial Leverage Exxon/Mobil exhibits a stable and consistent financial leverage ratio, in line with most of its peers. 23 Income Statement Forecast: Total Revenue: In order to forecast Exxon Mobil’s total revenue for FY 2016, we first considered the companies within our “Custom Industry” located earlier in this report. We then added the FactSet revenue estimates for these companies in FY 2016 to help us derive our FY 2016 estimate. Specifically, we considered Exxon Mobil’s five and ten year market share percentages to come up with an estimate of 17% for FY 2016 based upon Exxon Mobil’s peers’ estimates. By coming to this conclusion, we were able to estimate our FY 2016 revenue as 267 billion. Cost of Goods Sold (Excl. D&A): To estimate our COGS for FY 2016, we first took the five and ten year averages for COGS as a percentage of sales, to analyze the historical relationship between the two line items. We found that the latest fiveyear average was the was an appropriate adjustment factor to use as a basis for estimating the subsequent year due to its consistency. Therefore, we decided to estimate COGS for FY 2016 as 72% of sales. Depreciation and Amortization: On Exxon Mobil’s 10-K report, they refer to this cost as “Depreciation and Depletion” (Exxon, 2014). In order to forecast depreciation and depletion expense for FY 2016, we calculated the depreciation expense as a percentage of the prior year’s gross and net Property Plant and Equipment. We came to the conclusion that gross was a more consistent indicator of the following year’s reported PP&E. However, we found that the 10-year average was a better indicator than the five-year average because the previous couple of fiscal years were closer to 4% (the 10-year average) than they were to 8% (the fiveyear average). Finally, we came to our estimate of 18.00 billion by multiplying the prior year’s Gross Property Plant and Equipment (450; as reported on FactSet’s restated 2014 Balance Sheet) by 4%. SG&A Expense: We estimated FY 2016 SG&A expense to be higher than it has been in any year since 2011. We saw that the 2015 SG&A Expense as a percentage of sales is tracking higher in 2015 YTD than it has been in the previous couple of fiscal years. Upon further investigation, we found that in the most recent 10-Q, management indicated that “higher maintenance” related costs were the cause for this phenomenon (Exxon, 2014). The report did not go into copious detail on this new cost to the firm. However, because they gave no indication as to the duration of these new costs, we incorporated the higher expected costs into our estimates for 2016. Specifically, we determined that simply evaluating the SG&A Expense as a percentage of sales was not an appropriate assumption for 2016. Therefore, we 24 came up with an adjustment factor of 5%, which is higher than the historic averages and close to the current rate for the in-progress fiscal year. We applied that 5% to our revenue estimate of $267b to estimate SG&A expense for 2016. Other Operating Expense: Similarly, “Other Operating Expense” as a percentage of sales was tracking higher for YTD 2015 than it has been in any year since 2010. While the report gave no specific mention as to the phenomenon that is causing this increased rate, we decided to use an adjustment factor of 10%, which is slightly higher than the most recent five-year average of 9.3% of sales. Other Income Expense: In order to come up with this estimate, we simply compared the five and 10-year averages (4.49 and 4.57, respectively). Since these numbers were very consistent, we chose to use an estimate of 4.5 for 2016. Interest Expense: In order to derive the interest expense estimate for 2016, we closely examined the debt structure for the firm over the past few years. For instance, we first looked at 2012’s debt structure in order to come up with a forecast for 2013, to compare to the income statement actual. We multiplied the amount of debt outstanding by the given coupon rate, located either in FactSet or the 10-K, and summed up the totals to forecast net interest for the next year. After a few iterations of this process (2012 for 2013, 2013 for 2014, and 2014 for 2015), we felt confident in our ability to accurately predict our estimate of .479 for our interest expense for 2016. Income Taxes: In order to calculate estimated income taxes, we first calculated the effective tax rates for the previous 10 years by simply dividing each year’s income tax by it’s pre-tax income. We saw that the effective tax rate in 2014 was significantly lower than it has been in the prior years (.3489 compared to .4202 in 2013). Upon further investigation, the 10-K demonstrated that this was because of “favorable tax legislation” in the previous year (Exxon, 2014). Furthermore, YTD 2015 is tracking to ultimately be at or around the .3489 rate used in 2014. Therefore, we have decided to use an adjustment factor of .35 as our income tax estimate for 2016. Minority Interest: Minority Interest was estimated by calculating historic averages as a percentage of pre-tax income. We found that there was more volatility in this rate in the past five years as compared to the whole 10-year sample we considered. Therefore, we felt more comfortable using an adjustment factor of 2.17% (the fiveyear average) to forecast minority interest because it was greater than the 10-year sample (1.82%). 25 Earnings Per Share: Finally, we have forecasted earnings per share figure of $4.76 for FY 2016. This number was derived from our net income divided by the estimated weighted average of diluted shares outstanding in 2016. In order to accurately predict this number, we found some helpful information in the 10-Q. We found that Exxon Mobil does not currently employ a ‘formal’ annual sharerepurchasing program. However, in each of the past four fiscal years, the firm has been systematically buying back an average of 3.6% (found by examining the yearly growth rate in reported shares in the 10-K) of its outstanding common shares to compensate for the shares administered as compensation. Relative Valuation Relative Valuation is a method to determine the value of an asset. Specifically, this valuation method can be used to determine how the asset is valued relative to its peers. In order to calculate Exxon Mobil’s relative valuation, we used the following formula: Estimate of Current Price = E [EPS1] * P/E (EPS1) * Adjustment Factor This formula encompasses our forecasted earnings per share for 2016 ($4.76), the forward P/E of a given comparable asset, and an adjustment factor based upon the P/E to P/E relationship of Exxon Mobil to that specific peer. Our findings derived from this calculation are featured below: We prudently calculated two separate averages from our relative valuation table. The first average is simply the average of all 7-price estimates. However, we realized that this is not the best way to estimate Exxon Mobil’s current price because there were two significant outliers present in the sample. Therefore, we 26 calculated an average excluding both Occidental Petroleum and Conoco Phillips due to their extremely high estimates. Essentially, our average price, without the presence of outliers, of $94.13 demonstrated that Exxon Mobil is undervalued relative to the selected comparable companies and energy sector. Absolute Valuation The absolute valuation model is used to determine a company’s intrinsic worth based on its projected cash flows. The business valuation model uses discounted cash flow analysis to determine a company’s financial worth. By comparing what a company's share price should be given its intrinsic value to the price at which the stock is actually trading, investors can determine if a stock is currently under or overvalued. We used the CAPM model to calculate the cost of capital “k’s”. And we used the Fama-French Three-Factor Model as reference to verify that our k’s assumptions were reasonable. We used the Dividend Discount Model to estimate the intrinsic value of the company’s stock price. The Dividend Discount Model discounts predicted dividends in an attempt to value a stock, the justification being that dividends represent the actual cash flows going to the shareholder, thus valuing the present value of these cash flows should give us a value for how much the shares should be worth. The companies that pay stable and predictable dividends are typically mature bluechip companies in well-developed industries. And Exxon is one of these types of companies that are often best suited for DDM valuation method. Cost of Capital (K) As cost of capital can be calculated based on multiple assumptions and multiple rates, we decided to calculate four different k’s to get a better idea of cost of capital. The formula for CAPM is as follows: E[Rasset] = rf + βasset*[E(rmkt – rf)] Where, E[Rasset] = Expected Return of the company rf = Risk Free Interest Rate βasset = Beta of company vs S&P500 (rmkt – rf)= Market Risk Premium 27 The following table shows the costs of capital based on different input assumptions: (As of Treasury 12/02/1 Source: Bloomberg Rates 5) Premium 7.1440 10 Year 2.1780% = % 6.4154 30 Year 2.9066% % U.S. Country Risk Premium 9.3220% Beta 5 Year 10 Year WACC from Bloomber g Calculate k or multiple k's Source: Bloomberg 10/29/10-10/30/15 10/31/05-10/30/15 0.926 0.616 (As of 12/02/15) Source: Bloomberg 9.2401% Excess Return=8.40% from Table 5.2 in Portfolio Theory, and we assume beta=0.9 from above. k 1)= 0.02178+0.9*(0.09322-0.02178) = k 2)= 0.02907+0.9*(0.09322-0.02907) = 0.02178+0.9*(0.0840) k 3)= = 0.02907+0.9*(0.0840) k 4)= = 8.61% 8.68% ----->k1 8.70% 9.74% 10.47% ----->k2 10% We used both the 10-year and 30-year treasury rate as our risk free rate, and Exxon’s 5-year beta of 0.90 in the CAPM equation, with both market risk premiums from Bloomberg Terminal as 7.1440% and 6.4154%, and the historical excess return of the S&P500 over a treasury rate as 8.40%. Based on the four combinations of CAPM calculations above, we got four different k’s from CAPM, which we decided to amend as two costs of capital. 28 As a reference, we used the Fama-French method to calculate the 5-year, 10year, and 20-year Exxon beta coefficients on the market premium, SMB and HML factors, which gave us 3 k’s in the range of 5.85%-13.06%. Our calculations excluded coefficients which were not significantly different from zero. These k’s would be unrealistic if we had chosen to use one of them to substitute our CAPM k’s, but these brought us to the k’s we reached from CAPM. Dividend Discount Model The chart below contains the annual earnings per share, dividends per share, dividend yield and payout ratio data used in our analysis: 2015 2014 Q1+Q2+Q3 actuals + Q4 qtrly forecasts EPS (Diluted) Dividends Per Share Stock price as of 12/31 Dividend Yield Dividend payout ratio Year-overyear growth 2013 2012 2011 2010 2009 2008 2007 2006 2005 3.93 7.60 7.37 9.70 8.42 6.22 3.98 8.69 7.28 6.62 5.71 2.88 2.70 2.46 2.18 1.85 1.74 1.66 1.55 1.37 1.28 1.14 74.35 92.45 101.2 86.55 84.76 73.12 68.19 79.83 $93.69 76.63 56.17 3.87% 2.92% 2.43% 2.52% 2.18% 2.38% 2.43% 1.94% 1.46% 1.67% 2.03% 73.28% 35.53% 33.38% 22.47 % 21.97 % 27.97 % 41.71 % 17.84 % 18.82 % 19.34% 19.96% 6.67% 9.76% 12.84% 17.84 % 6.32% 4.82% 7.10% 13.14 % 7.03% 12.28% 7.55% Using these data, the geometric average annual growth rate of the DPS was calculated over 3, 5, 7, and 10-year time periods. DPS Average Annual Growth Rate 10yr 7yr 5yr 3yr 2005-2015 2008-2015 2010-2015 2012-2015 0.09711 0.09254 0.10603 0.09727 From our relative valuation and pro-forma income statement, we forecasted expected EPS in 2016 as $4.76. The payout ratio in 2015 is higher than in any other year shown at a staggering 73.28%, because of the sharp decline in the EPS, which, as we decided, was not appropriate to base on to forecast our future dividends. Also 29 it would not make our estimated DPS growth rate comparable with the year average growth rate. So instead of using payout ratio, we took the recent five-year average of Exxon’s ROE at 20.90%, and multiplied it with the retention ratio at 35% in a conservative estimate. This gave us a dividend growth rate of 6.90% constantly six years in the future. From here, the predicted constant growth rate and cost of capital (k2) brought us the expected dividend per share from 2016 to 2021and their present value as of 2015. 2016 6.90% E[DPS 2016] $ 2017 2018 2019 2020 3.08 $ 3.29 $ 3.52 $ 3.76 $ 4.02 E[DPS 2021] back to 2015, k = k2 = 10% when k = k1 = 8.70% PV of E[DPS] 2021 $ 2.80 $ 2.72 $ 2.83 $ 3.03 $ 2.64 $ 3.24 $ 2.57 $ 3.46 $ 2.50 $ 3.70 $ 4.30 $ 2.43 $ 3.95 The next step involved estimating Exxon’s present value at 2020 of all post 2020 dividend cash flows, and its intrinsic value at 2015, which were achieved by the scenario test, growing the estimated 2021DPS value by nine different growth rates ranging from 1% to 9%. The charts below illustrate these methods using our two different “k’s”. k1 8.70% k2 10.00% Current Price TERMINAL VALUES k1 Terminal at FY value 2020 PV (back to 2015) Intrinsic Value k2 Terminal value PV (back to 2015) Intrinsic Value Present value of FCF back to 2015, as k2 as of 12/16/15 $ 4.30 at FY 2015 at FY 2020 at FY 2015 $ 4.30 2016 $ 2.90 2017 $ 2.83 2018 $ 2.76 2019 $ 2.69 2020 $ 2.63 4% $ 91.43 $ 60.25 4.35% $ 98.79 $ 65.10 6% $ 159.16 $ 104.88 7% $ 252.78 $ 166.57 8% $ 613.89 $ 404.52 $ 118.57 $ 180.27 $ 418.22 2021 $ 2.56 $78.77 1% $ 55.81 $ 36.77 2% $ 64.14 $ 42.26 3% $ 75.39 $ 49.68 $ 50.47 $ 55.96 $ 63.38 $ 73.95 $ 78.79 1% $ 47.75 $ 29.65 2% $ 53.72 $ 33.35 3% $ 61.39 $ 38.12 4% $ 71.62 $ 44.47 5% $ 85.94 $ 53.36 5.93% $ 105.58 $ 65.56 7% $ 143.24 $ 88.94 8% $ 214.86 $ 133.41 $ 42.87 $ 46.58 $ 51.34 $ 57.70 $ 66.59 $ 78.78 $ 102.17 $ 146.64 9% $ (1432.40) $ (943.88) $ (930.18) 9% $ 429.72 $ 266.82 $ 280.05 30 Summary We found that using k1 = 8.7%, the post-2021 growth rate that makes the stock fairly valued now (its price is $78.77 on 12/16/15) is 4.35%; with k2 = 10%, the fair value growth rate is 5.93%. This means that if our model assumptions are correct, the market is assigning a growth rate in perpetuity between 4.35% to 5.93% beyond 2021. With our 5-year dividend growth rate projection of 6.90% and our expectation that the oil price will soon recover, we should buy more XOM shares. Since our k2 is higher than k1, we used the higher cost of capital (k2) to finish our calculation based on the conservative perspective, which implies the scenario under k1 will definitely bring us a better performance beyond expectation. And if the earnings would go back to where it should be as previous years’ trend in the future, our expectation on the growth of the stock performance could be greater. Conclusion Exxon has shown consistent growth with no signs of letting up. Fundamental analysis puts Exxon in a strong position relative to its peers; the company holds first place, if not in the top three in the industry in terms of growth, profitability, and efficiency. The company has a solid management team that has continued to make value-adding decisions. Additionally, the company has consistently paid dividends and there is no indication of that stopping. We have decided to add 200 shares of Exxon doubling our current position of 200. 31 Citations Coy, Peter. "Shale Doesn't Swing Oil Prices-OPEC Does." Bloomberg.com. Bloomberg, 9 Dec. 2015. Web. 16 Dec. 2015. "Crude Oil Price, Oil, Energy, Petroleum, Oil Price, WTI & Brent Oil, Oil Price Charts and Oil Price Forecast." OilPricenet RSS. N.p., n.d. Web. 16 Dec. 2015. "GDP Growth (annual %)." GDP Growth (annual %). N.p., n.d. Web. 16 Dec. 2015. Katakey, Rakteem. "Oil Investors Are $240 Billion Poorer a Week After OPEC Call." Bloomberg.com. Bloomberg, 11 Dec. 2015. Web. 16 Dec. 2015 "OPEC Share of World Crude Oil Reserves." OPEC :. N.p., n.d. Web. 15 Dec. 2015. "US Spending Bill Lifts 40-year Ban on Crude Oil Exports - BBC News." BBC News. N.p., n.d. Web. 16 Dec. 2015. "XOM: Dividend Date & History for Exxon Mobil - Dividend.com." XOM: Dividend Date & History for Exxon Mobil - Dividend.com. N.p., n.d. Web. 16 Dec. 2015. FactSet: Exxon Mobil Corporate Information FactSet: Exxon Mobil Business Description 3 FactSet: Exxon Mobil Business Description 4 XOM 10K page 13 5 XOM 10K page 13 6 Bloomberg Business: “Shale Doesn’t Swing Oil Prices – OPEC Does” 7 Bloomberg Business: “Oil Investors are $240 Billion Poorer a Week After OPEC Call” 8 Bloomberg Business: “Oil Investors are $240 Billion Poorer a Week After OPEC Call” 9 Bloomberg Business: “Oil Investors are $240 Billion Poorer a Week After OPEC Call” 10 The World Bank: Annual Aggregate GDP Growth 1 2 32