optional assignment characteristics table

advertisement

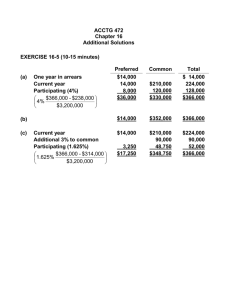

CHAPTER 15 Stockholders’ Equity OPTIONAL ASSIGNMENT CHARACTERISTICS TABLE Item Description BE15-4 BE15-6 BE15-7 BE15-13 BE15-14 Lump-sum sales of stock with preferred stock. Issuance of stock with payment of stock issue costs. Treasury stock transactions. Small stock dividend. Large stock dividend. E15-2 E15-5 E15-10 E15-11 E15-12 E15-13 E15-15 E15-17 E15-18 E15-21 Recording the issuance of common and preferred stock. Lump-sum sales of stock with preferred stock. Analysis of equity data and equity section preparation. Analysis of equity transactions on the balance sheet. Cash dividend and liquidating dividend. Stock split and stock dividend (a. & b. only). Dividend entries. Stockholders’ equity section. Dividends and stockholders’ equity section. Preferred dividends (a. & b. only) P15-1 P15-2 P15-6 P15-8 P15-11 Equity transactions and statement preparation (Req. a. only) Treasury stock transactions and presentation (Req. a. only) Treasury stock—cost method (Req. a. only) Dividends and splits. Stock and cash dividends (a. & b. only). CH 15 Optional Homework, P ag e |1 BRIEF EXERCISE 15-4 Cash ......................................................................................................................... Preferred Stock (100 X $50) ............................................................................ Paid-in Capital in Excess of Par—Preferred ($8,100 − $5,000) ..................... Common Stock (300 X $10) ............................................................................ Paid-in Capital in Excess of Par—Common ($5,400 − $3,000) ...................... 13,500 5,000 3,100 3,000 2,400 [(FV of common (300 X $20) = $6,000) + (FV of preferred (100 X $90) = $9,000) = total FV $15,000] Allocated to: preferred $13,500 x ($9,000/$15,000) = $8,100; common: $13,500 x ($6,000/$15,000) = $5,400 BRIEF EXERCISE 15-6 Cash ($60,000 – $1,500)............................................................................................ Common Stock (2,000 X $10) ......................................................................... Paid-in Capital in Excess of Par—Common ($60,000 – $20,000 −$1,500) .... 58,500 20,000 38,500 BRIEF EXERCISE 15-7 7/1/12 9/1/12 11/1/12 Treasury Stock (100 X $87) ............................................................... Cash ........................................................................................ 8,700 Cash (60 X $90) ................................................................................. Treasury Stock (60 X $87) ....................................................... Paid-in Capital--Treasury Stock............................................... 5,400 Cash (40 X $83) ................................................................................. Paid-in Capital--Treasury Stock ......................................................... Treasury Stock (40 X $87) ....................................................... 3,320 160 8,700 5,220 180 3,480 BRIEF EXERCISE 15-13 Declaration Date. Retained Earnings [(400,000 x 5%) = 20,000 x $65] ............................................... Common Stock Dividend Distributable (20,000 x $10) .............................. Paid-in Capital in Excess of Par—Common................................................ Distribution Date. Common Stock Dividend Distributable ..................................................................... Common Stock ............................................................................................ 1,300,000 200,000 1,100,000 200,000 200,000 BRIEF EXERCISE 15-14 Declaration Date. Retained Earnings .................................................................................................... Common Stock Dividend Distributable (400,000 X $10) ............................. 4,000,000 Distribution Date. Common Stock Dividend Distributable ..................................................................... Common Stock ............................................................................................ 4,000,000 4,000,000 4,000,000 CH 15 Optional Homework, P ag e |2 EXERCISE 15-2 Jan. Mar. April May Aug. Sept. Nov. 10 1 1 1 1 1 1 Cash (80,000 X $5) ....................................................................... Common Stock (80,000 X $2) .............................................. Paid-in Capital in Excess of Stated Value—Common ........ 400,000 Cash (5,000 X $108) ..................................................................... Preferred Stock (5,000 X $50) ............................................. Paid-in Capital in Excess of Par Value—Preferred .............. 540,000 Land .............................................................................................. Common Stock (24,000 X $2) .............................................. Paid-in Capital in Excess of Stated Value—Common ......... 80,000 Cash (80,000 X $7) ....................................................................... Common Stock (80,000 X $2) .............................................. Paid-in Capital in Excess of Stated Value—Common ......... 560,000 Organization Expense ................................................................... Common Stock (10,000 X $2) .............................................. Paid-in Capital in Excess of Stated Value—Common ......... 50,000 Cash (10,000 X $9) ....................................................................... Common Stock (10,000 X $2) .............................................. Paid-in Capital in Excess of Stated Value—Common ......... 90,000 Cash (1,000 X $112) ..................................................................... Preferred Stock (1,000 X $50) ............................................. Paid-in Capital in Excess of Par Value—Preferred .............. 112,000 160,000 240,000 250,000 290,000 48,000 32,000 160,000 400,000 20,000 30,000 20,000 70,000 50,000 62,000 EXERCISE 15-5 (a) Fair value of Common (500 X $168) .............................................................................. Fair value of Preferred (100 X $210) .............................................................................. $ 84,000 21,000 $105,000 Allocated to Common: $84,000/$105,000 X $100,000 = $ 80,000 Allocated to Preferred: $21,000/$105,000 X $100,000 = $ 20,000 Cash ............................................................................................................ Common Stock (500 X $10) ............................................................... Paid-in Capital in Excess of Par—Common ($80,000 – $5,000) ....... Preferred Stock (100 X $100) ............................................................. Paid-in Capital in Excess of Par—Preferred ($20,000 – $10,000) ..... (b) 100,000 5,000 75,000 10,000 10,000 Lump-sum receipt Allocated to common (500 X $170) Balance allocated to preferred Cash ............................................................................................................ Common Stock ................................................................................... Paid-in Capital in Excess of Par—Common ($85,000 – $5,000) ....... Preferred Stock ................................................................................... Paid-in Capital in Excess of Par—Preferred ($15,000 – $10,000) ..... $100,000 85,000 $ 15,000 100,000 5,000 80,000 10,000 5,000 CH 15 Optional Homework, P ag e |3 EXERCISE 15-10 (a) (1) The par value is $2.50 ($545 / 218) or ($540 / 216). (2) The cost per share of treasury stock at December 31, 2013 was $42 per share ($1,428 / 34) compared to the cost at December 31, 2012 of $34 per share ($918 / 27). Stockholders’ equity (in millions of dollars and shares) Paid-in capital: Common stock, $2.50 par value, 500 shares authorized, 218 shares issued, and 184 shares outstanding Additional paid-in capital ..................................................................................... Total paid-in capital .................................................................................. Retained earnings.......................................................................................................... Treasury stock (at cost; 34 shares) ............................................................................... Total stockholders’ equity ........................................................................ (b) $ 545 891 1,436 7,167 (1,428) $ 7,175 EXERCISE 15-11 Item 1. 2. 3. 4. 5. 6. 7. 8. 9. Assets I NE NE NE D D NE NE NE Liabilities NE NE I NE NE D I NE NE Stockholders’ Equity I NE D NE D NE D NE NE Paid-in Capital NE NE NE NE NE NE NE I NE Retained Earnings I NE D NE D NE D D NE Net Income I NE NE NE D NE D NE NE EXERCISE 15-12 (a) (b) 6/1 Retained Earnings (10,000,000 x $.60) .................................................................. 6,000,000 Cash Dividends Payable ............................................................................. 6/14 No entry on date of record. 6/30 Cash Dividends Payable ......................................................................................... 6,000,000 Cash ............................................................................................................ 6,000,000 6,000,000 If this were a liquidating dividend, the debit entry on the date of declaration would be to Additional Paid-in Capital rather than Retained Earnings. EXERCISE 15-13 (a & b only) (a) Memo entry: The Board of Directors declared a 2-for-1 common stock split, resulting in 10 million common shares issued and outstanding (5 million x 2) with a par value of $5 per share ($10 / 2). (b) Retained Earnings [(5,000,000 x 100%) x $10 par] ................................................. 50,000,000 Common Stock Dividend Distributable ............................................................. 50,000,000 Common Stock Dividend Distributable .................................................................... 50,000,000 Common Stock ................................................................................................. 50,000,000 CH 15 Optional Homework, P ag e |4 EXERCISE 15-15 (a) Declaration Date. Retained Earnings (60,000* shares X 5% = 3,000 X $39) ...................................... 117,000 Common Stock Dividend Distributable (3,000 x $10) ................................ Paid-in Capital in Excess of Par—Common ............................................... * ($600,000 / $10 = 60,000 shares outstanding) Distribution Date. Common Stock Dividend Distributable .................................................................... 30,000 Common Stock ........................................................................................... 30,000 87,000 30,000 (b) Memo entry: 5-for-1 common stock split, resulting in 300,000 shares outstanding (60,000 X 5) with a par value of $2 per share ($10 / 5). (c) January 5, 2013 Debt Investments ($125,000 − $90,000) ................................................................. 35,000 Unrealized Holding Gain - Income .............................................................. 35,000 Retained Earnings ................................................................................................... 125,000 Property Dividends Payable........................................................................ 125,000 January 25, 2013 Property Dividends Payable .................................................................................... 125,000 Debt Investments ........................................................................................ 125,000 EXERCISE 15-17 Teller Corporation Balance Sheet (partial) December 31, 2012 STOCKHOLDERS’ EQUITY Paid-in Capital: Capital stock: Preferred stock, $4 cumulative, $50 par value; 60,000 shares authorized; 10,000 shares issued and outstanding .............................. Common stock, $1 par value; 600,000 shares authorized; 200,000 shares issued, and 190,000 shares outstanding .................... Additional paid-in capital: Paid-in capital in excess of par value--common....................................... Paid-in capital, treasury stock .................................................................. Total paid-in capital ..................................................................... Retained earnings ................................................................................................... Treasury stock (at cost; 10,000 common shares) .................................................. Total stockholders’ equity ......................................................................... $ 500,000 200,000 1,000,000 160,000 1,860,000 201,000 (170,000) $1,891,000 EXERCISE 15-18 (a) 1. 2. 3. Cash Dividends Payable [(2,000 X $8) + (20,000 x $2)] .............................................. 56,000 Cash ............................................................................................................ 56,000 Treasury Stock (2,700 X $40) ................................................................................ 108,000 Cash ............................................................................................................ 108,000 Land......................................................................................................................... 30,000 Treasury Stock (700 X $40) ........................................................................ Paid-in Capital--Treasury Stock .................................................................. 28,000 2,000 CH 15 Optional Homework, P ag e |5 EXERCISE 15-18 continued 4. 5. 6. 7. (b) Cash (500 X $105) .................................................................................................. 52,500 Preferred Stock (500 X $100) ..................................................................... Paid-in Capital in Excess of Par—Preferred ............................................... Retained Earnings (1,800* X $45) .......................................................................... 81,000 Common Stock Dividend Distributable (1,800 X $5) ................................. Paid-in Capital in Excess of Par—Common ............................................... *[20,000 shares issued – 2,000 shares T/S (2,700 – 700) = 18,000 shares outstanding X 10%] Common Stock Dividend Distributable.................................................................... 9,000 Common Stock ........................................................................................... Retained Earnings (P/S $20,000 + C/S $39,600) ................................................... 59,600 Cash Dividends Payable ............................................................................. [(P/S = 2,500 x $8); (C/S = [(18,000 + 1,800) x $2)] 50,000 2,500 9,000 72,000 9,000 59,600 ELIZABETH COMPANY Balance Sheet (partial) December 31, 2012 STOCKHOLDERS’ EQUITY Paid-in Capital: Capital stock: Preferred stock, 8%, $100 par, 10,000 shares authorized, 2,500 shares issued and outstanding ...................................................... Common stock, $5 par, 100,000 shares authorized, 21,800 shares issued, 19,800 shares outstanding .................................. Additional paid-in capital: Paid-in capital in excess of par .................................................................. Paid-in capital, treasury stock .................................................................... Total paid-in capital ............................................................................................ Retained earnings ...................................................................................................... Less: Treasury stock (at cost; 2,000 common shares) ..................................................... Total stockholders’ equity ............................................................................................. $250,000 109,000 199,500 2,000 560,500 639,400 (80,000) $1,119,900 Computations: Preferred stock: $200,000 + $50,000 = $250,000 Common stock: $100,000 + $ 9,000 = $109,000 Paid-in capital in excess of par (can’t split between P/S & C/S): $125,000 + $2,500 + $72,000 = $199,500 Paid-in capital, treasury stock: $2,000 Retained earnings: $450,000 – $81,000 – $59,600 + $330,000 = $639,400 Treasury stock: $108,000 – $28,000 = $80,000 EXERCISE 15-21 (a. and b. only) (a) Preferred stock is noncumulative, nonparticipating: Preferred = [($100 X 6% = $6 x 2,000] = $12,000 Common = ($70,000 – $12,000) = $58,000 (b) Preferred stock is cumulative, nonparticipating: Preferred = ($12,000 x 3 years) = $36,000 Common = ($70,000 – $36,000) = $34,000 CH 15 Optional Homework, P ag e |6 PROBLEM 15-1 (Req. a. only) Jan. 11 Feb. 1 Jul. 29 Cash (20,000 X $16) ................................................................................ Common Stock (20,000 X $10) ......................................................... Paid-in Capital in Excess of Par—Common ....................................... 320,000 Equipment ................................................................................................. Buildings .................................................................................................... Land ........................................................................................................... Preferred Stock (4,000 X $100) .......................................................... Paid-in Capital in Excess of Par—Preferred ...................................... 50,000 160,000 270,000 Treasury Stock (1,800 X $17) ................................................................... Cash ................................................................................................... 30,600 Aug. 10 Cash (1,800 X $14) ................................................................................... Retained Earnings ................................................................................... Treasury Stock (1,800 X $17) ............................................................. 200,000 120,000 400,000 80,000 30,600 25,200 5,400* 30,600 *(The debit is made to Retained Earnings because no Paid-in Capital from Treasury Stock exists.) Dec. 31 Retained Earnings ($5,000 + $32,000) .................................................... Cash Dividends Payable .................................................................... 37,000* 37,000 * Common dividend = (20,000 X $.25) = $5,000; Preferred dividend = (4,000 X $100 X 8%) = $32,000 Dec. 31 Income Summary .................................................................................... Retained Earnings .............................................................................. 175,700 175,700 PROBLEM 15-2 (Req. a. only) (a) Feb. Mar. 1 1 Mar. 18 Apr. 22 Treasury Stock (2,000 x $19) .............................................. Cash ....................................................................... 38,000 Cash (800 x $17) ................................................................. Retained Earnings (800 x $2) ............................................. Treasury Stock (800 x $19) .................................... 13,600 1,600 Cash (500 x $14) ................................................................. Retained Earnings (500 x $5) ............................................. Treasury Stock (500 x $19) .................................... 7,000 2,500 Cash (600 x $20) ................................................................. Treasury Stock (600 x $19) .................................... Paid-in Capital, Treasury Stock.............................. 12,000 38,000 15,200 9,500 11,400 600 CH 15 Optional Homework, P ag e |7 PROBLEM 15-6 (Req. a. only) 1. 2. 3. 4. 5. 6. Treasury Stock (280 X $97) ............................................................................... Cash ......................................................................................................... 27,160 Retained Earnings ............................................................................................. Cash Dividends Payable [(4,800 – 280) X $20] ....................................... 90,400 Cash Dividends Payable .................................................................................... Cash ........................................................................................................ 90,400 Cash (280 X $102) ............................................................................................. Treasury Stock (280 X $97) ..................................................................... Paid-in Capital, Treasury Stock (280 X $5) ......................................... ...... 28,560 Treasury Stock (500 X $105) ............................................................................. Cash ........................................................................................................ 52,500 Cash (350 X $96) ............................................................................................... Paid-in Capital, Treasury Stock .......................................................................... Retained Earnings .............................................................................................. Treasury Stock (350 X $105) ................................................................... 33,600 1,400 1,750 27,160 90,400 90,400 27,160 1,400 52,500 36,750 PROBLEM 15-8 Note: # shares issued (& outstanding since there is no treasury stock) = $20,000 / 5 = 4,000 NE = no effect (a) (b) (c) (d) (e) (1) (2) (3) (4) (5) (6) Total Assets − $2,000 (1) NE NE − $12,000 (6) NE Common stock NE + $2,000 (2) + $6,000 (5) NE NE PIC in Excess of Par NE + $3,600 (3) NE NE NE Retained Earnings − $2,000 (1) − $5,600 (4) − $6,000 (5) − $12,000 (6) NE Total Stkhldrs’ Equity − $2,000 (1) NE NE − $12,000 (6) NE (4,000 X $.50) [(4,000 X 10%) = 400 X $5] [(400 X $14) – $2,000] (400 x $14)) [(4,000 X 30%) = 1,200 X $5] [(4,000 / 2 = 2,000 X $6)]; or + from $8,000 gain (2,000 x $4) − $20,000 dividend (2,000 x $10) PROBLEM 15-11 (a & b only) (a) May 5 Retained Earnings (3,000,000 x $.60) ........................................... Cash Dividends Payable ........................................................ 1,800,000 Jun. 30 Cash Dividends Payable ............................................................... Cash ....................................................................................... 1,800,000 (b) Nov. 30 Retained Earnings [(3,000,000 x 6%) = 180,000 x $34] .............. Common Stock Dividend Distributable (180,000 x $10) ....... Paid-in Capital in Excess of Par--Common .......................... 6,120,000 Dec. 31 Common Stock Dividend Distributable ........................................ Common Stock ..................................................................... 1,800,000 1,800,000 1,800,000 1,800,000 4,320,000 1,800,000