Scrapping the beer duty escalator

advertisement

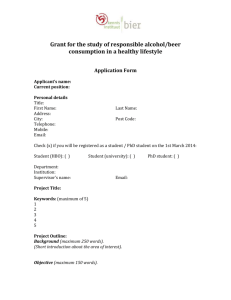

Scrapping the beer duty escalator - benefits to consumers, pubs and brewers A report for the Campaign for Real Ale February 2015 2 Disclaimer Whilst every effort has been made to ensure the accuracy of the material in this document, neither Centre for Economics and Business Research Ltd nor the report’s authors will be liable for any loss or damages incurred through the use of the report. Authorship and acknowledgements This report has been produced by Cebr, an independent economics and business research consultancy established in 1993, providing forecasts and advice to City institutions, Government departments, local authorities and numerous blue chip companies throughout Europe. London, February 2015 © Centre for Economics and Business Research 3 Contents Executive Summary 4 Introduction 5 Recent history of excise duties on alcohol 8 The decline of the beer industry 10 Impact on beer consumption and production 13 Impact on investment in brewing and pubs 18 Impact on employment 23 Conclusion 26 Appendix 28 © Centre for Economics and Business Research 4 Executive Summary This report aims to quantify the impact of scrapping the beer duty escalator and the two successive penny cuts in duty which were introduced in the Budgets of 2013 and 2014. The changes introduced were widely welcomed as measures that would boost both the beer and pub sectors as well as saving consumers money. The effects of these measures are considered across this range of stakeholders, analysing the impact on, for example, consumer prices, the number of pubs, investment and employment. The report’s main findings are: 1 The consecutive cuts in beer duty saved consumers around 16p on a pint of beer - The average pint of beer, which currently stands at £3.04, would have cost £3.20 if not for 1 these measures . An additional 750 million pints of beer will be purchased in the UK this financial year as a result of the budget changes - We estimate that, by the end of this financial year, sales volumes would have fallen a further 2.8 million hectolitres from their level in 2012 if beer remained on the duty escalator. This would equate to a fall of over 595 million pints. In 2014 alone, we expect investment in the brewing industry stood £61 million higher than it would have if the beer duty escalator had been maintained - Over 71% of respondents of CAMRA’s survey of pubs and brewers reported increasing investment expenditure this year. Almost four times as many businesses increased expenditure by over 50% than those businesses that cut investment. We estimate that an additional 1,047 pubs would have closed by the end of 2014 if the Beer Duty Escalator had remained in place instead of beer duty being cut by 2p over the last two years. Compared with the level in 2012, the policy measures of the 2013 and 2014 Budgets contributed to a total of 26,000 additional jobs in 2015 that would not have been created if the alcohol duty escalator remained in place - around 24,000 jobs were created in pubs and bars thanks to the boost to beer sales and a further 500 jobs were created in the manufacture of beer. An extra 33,000 jobs could be created by 2020 if the government opts to freeze beer duty over the course of the next parliament - 89,000 jobs could be created if the government froze beer duty until 2020. The current policy of up-rating alcohol duty by RPI inflation would create a total of 56,000 additional jobs. Source: HMRC, ONS, Cebr analysis © Centre for Economics and Business Research 5 Introduction Cebr was commissioned by the Campaign for Real Ale (CAMRA) to quantify the economic benefits of scrapping the beer duty escalator, a policy which up-rated the excise duty placed on beer by 2 percentage points above inflation each financial year between 2008 and 2013. The Budget of 2013 saw the planned 5.2% rise in beer duty scrapped and instead replaced by a 2% cut, reducing the duty placed on a pint of beer by 1p. A further 2% cut was then introduced by the Chancellor in the following year. This report presents Cebr’s analysis of the impact of the beer duty changes introduced as part of the 2013 and 2014 Budgets, namely the scrapping of the beer duty escalator and two successive 1p cuts in beer duty. The analysis has a particular focus on the benefits realised by UK consumers, brewers and pubs across the country and quantifies the impact of beer duty changes on a number of key areas over the next parliament. The key areas include: Changes in consumer prices The consumption of beer The number of pubs in the UK UK beer production Employment Investment in pubs and brewing A variety of sources have been engaged as part of this research including an industry survey of both brewers and pub-owning companies and a series of interviews with trade associations, brewers and pub owning companies. Using data from HM Revenues and Customs (HMRC), the Office for National Statistics (ONS), the British Beer and Pub Association (BBPA) and Cebr’s forecasts for key macroeconomic indicators, we utilise econometric analysis of how alcohol consumption across the various product categories changes in response to relative price changes to the model the impact of a continuation of the current beer duty policy. This allowed us to contrast these base results with counterfactual results that are reflective of the continuation of the beer duty escalator through 2013-2020. The results of our analysis show that these measures have clearly helped to slow the decline in sales of beer across the industry but still suggest that more could be done to support this key and historic part of the UK economy. © Centre for Economics and Business Research 6 Economic contribution of the beer industry to the UK economy: The beer industry is a considerable contributor to both the UK economy and government tax revenues. Beer and pubs contributed £22bn to the UK economy in 2014 and beer itself 2 generated £13bn in tax revenue from duty and VAT alone . The beer industry is an important source of employment across the UK, both in the brewing of beer and through supporting jobs in pubs and clubs. As Figure 1 shows, over 15,000 people were employed in the production of beer and malt in 2013 – 87% more than were employed in the production spirits and more than seven times the number of people with jobs in the cider industry. Figure 1: Employment in the production of the main alcohol product categories in Great Britain, 2013 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 Wine Cider and other fruit wines Spirits Beer and malt Source: British Beer and Pub Association 3 This employment was spread over 1,400 breweries located across every region of the United 4 Kingdom and generated almost £500m in wages. Pubs and bars provided over 400,000 jobs across Great Britain in 2014. However, employment in this sector has fallen sharply since 2006, reflecting the impact of the economic downturn and 2 The Beer Story: Facts on Tap 3 Source: British Beer and Pub Association 4 Source: ONS, Cebr analysis © Centre for Economics and Business Research 7 the persistent squeeze on household spending power. A combination of higher rates of unemployment and a fall in real wages put pressure on households’ disposable incomes in the years following the financial crisis. As a result, consumers became increasingly unwilling or unable to spend on luxuries such as a pint of beer in the local pub, particularly as the price of each pint increased significantly more quickly than the general rate of price increases. As Figure 2 shows, employment in pubs and bars fell by 19.3% between 2006 and the three months to March 2014. Despite this, the 446,000 jobs in pubs and bars in 2014 supported a further 235,000 jobs through indirect and induced spending. Thanks to the relative volume of beer sales in these premises (seven in every 10 drinks sold in British pubs are beer) these jobs are all heavily reliant on the health of the beer industry. Figure 2: Employment in public houses and bars in Great Britain 580,000 560,000 540,000 520,000 500,000 480,000 460,000 440,000 420,000 400,000 2006 2007 2008 Source: British Beer and Pub Association © Centre for Economics and Business Research 2009 2010 2011 2012 2013 2014 8 1 Recent history of excise duties on alcohol Until the 2013 Budget, the Government’s alcohol policies have favoured the spirits markets over those for beer. Duty on spirits over the decade to 2007 was frozen while, during the same period, duty on beer increased broadly in line with the rate of inflation, as measured by RPI. This allowed the price of spirits to fall relative to beer. The introduction of the alcohol duty ‘escalator’ in the 2008 budget meant that the cost of all categories of alcoholic beverage (beer, cider, spirits, wine) increased significantly faster than the general rate of price increases across the economy. This was because duty increased by RPI inflation plus 2 percentage points each year. The price of a pint of draught bitter in 2008 was on average £2.41. This increased 16.2% in the four years the duty escalator was in place to £2.80 in 2012. This contrasts to prices in general (as measured by the RPI), which have increased by 13% over the same period. If beer duty had continued to increase at the rate of inflation only, the duty on a pint of beer would have been 8p lower in 2012 and 13p lower if the rate had remained frozen at its 2007 level. After a well-reasoned campaign from the beer industry, the government not only officially scrapped the duty escalator on beer in the 2013 Budget but went further, announcing a cut of 1p in the duty placed on a pint of beer (a cut of 2%). The government appeared to recognise the need to support the brewing and pub industries and moved further in that direction in the Budget of 2014. In addition to removing the duty escalator for two more alcohol categories, cider and spirits, the government announced an additional 1p cut in beer duty, helping to reverse some of the relative increase the duty on beer has experienced since 1997 compared to spirits and cider. Figure 3: Percentage increases in United Kingdom alcohol excise duty since 1997 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Wine Source: HM Revenue & Customs © Centre for Economics and Business Research Spirits Beer Cider 9 The impact on excise duty across the four main categories since 1997 can be seen in Figure 3. Clearly, duty on all alcoholic drinks has increased markedly since 2007, but as the duty payable on beer and wine rose to a greater extent than spirits and cider over the 1997-2013 period. Even after two consecutive cuts of 2%, beer duty is still 73.2% higher now than it was in 1997. The excise duty placed on spirits on the other hand increased by 48.6% over the same period. Figure 4: Real changes in United Kingdom alcohol excise duty since 1997 40% 30% 20% 10% 0% -10% -20% -30% Wine Spirits Beer Dec-14 Dec-13 Dec-12 Dec-11 Dec-10 Dec-09 Dec-08 Dec-07 Dec-06 Dec-05 Dec-04 Dec-03 Dec-02 Dec-01 Dec-00 Dec-99 Dec-98 -40% Cider Source: HM Revenue & Customs Changes in government policy in the 2013 Budget have provided some relief on beer duties, reducing the rate payable in both 2013 and 2014 and limiting the extent of future duty rises to RPI inflation. However, as shown in Figure 4, beer duty remains around 6% higher in real terms in December 2014 compared with 1997. Meanwhile duty on spirits has fallen by 18% in real terms and cider duty is almost at the same level in real terms. © Centre for Economics and Business Research 10 2 The decline of the beer industry The UK beer industry has been in structural decline since the 1980s. Over the three decades to 2013, overall consumption of beer in the UK fell by nearly a third (32.3%). In particular, there has been a significant contraction in the volume of beer consumed through the “on-trade” – which includes restaurants, hotels and pubs. The amount of beer purchased through this channel has plummeted by 60% over the three decades to 2014, mirroring the decline of Britain’s industrial, manufacturing and primary industries since the 1970s. Having risen from around 14% in 1983, the share of all beer sales made through shops and supermarkets represented more than half of the market for the first time in 2014. Figure 5: Beer quantity released for UK consumption, million barrels 40 35 30 25 20 15 10 5 On trade 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 0 Off trade Source: British Beer and Pub Association However, it is encouraging to see that, following the two successive duty cuts, 2014 ended a decade-long decline in UK beer sales, with overall sales rising by 1.3% as shown in Figure 6. © Centre for Economics and Business Research 11 Figure 6: UK Beer Sales (both on-trade and off-trade), thousands hectolitres 70000 65000 60000 55000 50000 45000 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 40000 Source: British Beer and Pub Association In contrast to beer, sales of imported spirits, wine and cider were all higher in 2013/14 than in the 1980s, as analysis of alcohol clearance data from HM Revenue & Customs in Figure 7 illustrates. Figure 7: Pure alcohol clearances by type, million hectolitres of pure alcohol 3.0 2.5 2.0 1.5 1.0 0.5 1986/1987 1987/1988 1988/1989 1989/1990 1990/1991 1991/1992 1992/1993 1993/1994 1994/1995 1995/1996 1996/1997 1997/1998 1998/1999 1999/2000 2000/2001 2001/2002 2002/2003 2003/2004 2004/2005 2005/2006 2006/2007 2007/2008 2008/2009 2009/2010 2010/2011 2011/2012 2012/2013 2013/2014 0.0 Wine Beer Source: HM Revenue & Customs © Centre for Economics and Business Research Cider Home produced whisky Imported and other spirits 12 Pure alcohol clearances from beer fell by 29% between 1986/87 and 2013/14. By contrast, pure alcohol clearances from spirits are now 13% higher than in 1986/87, while clearances from wine and cider have both more than doubled, rising by 134% and 145% respectively. This is illustrated in Figure 8 below. Figure 8: Pure alcohol clearances by type, % change between 1986/87 and 2013/14 150% 145% 134% 100% 57% 50% 0% -29% -50% -43% -100% Cider Wine Imported and other spirits Beer Home produced whisky Source: HM Revenue & Customs Notably, for spirits, there is a stark contrast in trends for domestically produced whisky compared with imported and other spirits, such as vodka. Between 1986/87 and 2013/14, pure alcohol clearances of home produced whisky fell by over 40%, while clearances of imported and other spirits increased by 57%. This casts doubt on the notion that the Scotch whisky industry was the main beneficiary of the differential treatment that spirits duty received in recent decades. Excise duty policies for much of the last two decades have reinforced the structural decline of the beer industry, and are unlikely to have been the best way to raise tax revenues or protect the significant number of jobs supported by the sector. Although the Government’s decision to give more preferential treatment to beer in 2013 and 2014 is a step in the right direction, in this respect, this report shows that more could be done to protect the beer industry, given the substantial contribution it makes to the UK economy. © Centre for Economics and Business Research 13 3 Impact on beer consumption and production The average selling price of a pub pint of bitter (3.9% abv) in 2007 was £2.28, a pub pint of lager (4.1% abv) £2.48 and a four can pack of lager (4.1% abv) £2.83. In the same year, 49,900 hectolitres of beer were sold in the UK market, with 56.5% (28,200 hectolitres) of sales within the on-trade. Since the introduction of the beer duty escalator in the Budget of 2008 the price of these products has increased considerably and sales of beer have declined sharply, particularly within the on trade. However, the fall in sales can’t be attributed solely to the duty policies adopted between 2008 and the present day. Other factors, such as the financial crisis and recession that followed, have played an important role in the path that the sales of both beer and other alcohol products have followed since the introduction of the duty escalator. As part of the research, we conducted a survey of brewers and pub owning companies in order to gauge the impact that recent policy decisions have had on trading conditions. The results were generally positive with almost 40% of the companies surveyed suggesting that trading conditions had improved in the last 12 months and over 82% suggesting that conditions had not deteriorated. When questioned further as to the impact of the government’s decision to cut beer duty in the 2013 and 2014 Budgets on domestic sales/profitability, over 56% of businesses said that it had led to an increase in their company’s domestic sales/profitability. However, only around 8% suggested that it had led to a significant increase in these performance indicators. In order to empirically analyse the impact of the beer duty escalator and assess the subsequent benefits of the decision to scrap it in the 2013 Budget, we have developed a model of the alcohol industry. The model takes into account a wide range of factors that influence the sales volumes of different alcohol products such as household’s disposable incomes and price changes; which includes both changes in the base price of each product and the impact of tax changes. Using this we are able to model an alternative policy scenario in which the alcohol products remain on the duty escalator through until 2015. Gary Walters, Ludlow Brewing Company The further penny off a pint in 2014 has helped the brewery to continue to limit price increases to their customers. Owner Gary Walters reported that the brewery, by the end of 2014, was approximately 15% up on last year’s sales. © Centre for Economics and Business Research 14 Policy Scenarios: Base Scenario: The base scenario reflects the actual changes in beer duty that have taken place since 2008. Scenario 1: Alcohol duty escalator remains in place through 2014/15. The alternative scenario represents the policy plans initially set out when the alcohol duty escalator was introduced in 2008. Following the VAT cut in the 2008 pre-budget report, duty on all alcohol products was increased by 6% above the rate of inflation to compensate for lost revenues in 2008. Following this, duty was then up-rated by RPI plus 2 percentage points each year for the next four years (later extended to 5 years). As a result, between 2008–14 duty on all alcohol products has increased by around 56%. Figure 9 shows the effect of the continuation of the escalator on the duty rates of a pint of beer (5.0% abv) compared to the two consecutive cuts in 2013 and 2014. Figure 9- Duty rates on a pint of beer in the on-trade £0.65 £0.60 £0.55 £0.50 £0.45 £0.40 2008 2009 2010 Beer (5.0% abv) 2011 2012 2013 2014 Continuation of Beer Duty Escalator Source: HM Revenue & Customs, Cebr analysis The continuation of the beer duty escalator through 2013 and 2014 would have raised the duty payable on a pint of beer by a further 5p.In contrast, after two consecutive cuts introduced by the Chancellor in those years, beer duty actually fell 2p. With VAT levied on the post duty price, the continuation of the beer duty escalator would have further increased the tax due on the © Centre for Economics and Business Research 15 average pint. VAT on a pint of beer would have been over 4p higher in 2014 if the beer duty escalator had remained in place. Thanks to a higher rate of pass through (i.e. the amount the final selling price changes in response to changes in costs) in the on-trade; the selling price for a pint of beer has increased by more than the changes in tax. The average pint of beer (5.0% abv), which currently stands at £3.04, would have cost £3.20 if the beer duty escalator had not been scrapped and replaced by two consecutive 1p cuts in 2013 and 2014. Figure 10 shows estimates of beer volumes for the period under the base scenario and scenario 1. The divergence in sales volumes is testament to the positive impact that cutting beer duty over the past two years has had versus the continuation of the beer duty escalator. In the year following the introduction of the first 1p cut in beer duty, sales volumes increased by some 676 thousand hectolitres or over 142 million additional pints. We estimate that the additional cut of 1p this year should further support sales, which we project to grow slightly over 2014/15. This compares with further declines in volumes if the beer duty escalator was retained. We estimate that sales volumes would have fallen a further 2,816 thousand hectolitres, over 595 million pints, by the end of the 2014/15 financial year. Figure 10- Domestic beer clearances 2007/08 – 2014/15, thousands hectolitres 50,000 Thousand Hectolitres 45,000 40,000 35,000 2007/08 2008/09 2009/10 2010/11 Base 2011/12 2012/13 2013/14 2014/15 Scenario 1 Source: Cebr analysis Despite the recovery of the UK economy over the past 24 months, household finances have remained strained as stubbornly weak wage growth has persisted. A continuation of the alcohol duty escalator on all products would have placed further pressure on household budgets and sales volumes for most alcohol categories would have fallen between 2012-14 as consumers © Centre for Economics and Business Research 16 were forced to cut back. Sales volumes of beer in the last two years have not just been supported by the more moderate inflation on the price of beer itself. The fall in the relative price of beer reverses the long-running trend which has seen alcohol duty on beer raised proportionally by more than that for cider and spirits and appears to have encouraged some substitution back towards the consumption of beer. Lawrence Washington, Purple Moose Brewery “Our sales increased by 27% in 2013 on the previous year, but clearly some of this will be down to us installing extra capacity. Having said that, sales in 2014 are a further 12% up on 2013. We are now looking to install further fermenting vessels and we have taken on a new member of staff in production in the past year.” Future Impact: The analysis above makes it clear that the decision to scrap the beer duty escalator in favour of the policies of the Budgets of 2013 and 2014 is already having a noticeable effect on the UK beer industry, supporting sales growth as opposed to compounding the decline of the sector. However, the change in policy direction could also have a much longer term impact on beer consumption. Considering a number of different policy paths over the course of the next parliament, we use our economic model to compare the impact that different duty policies could have on beer consumption through to the end of the next parliamentary term in 2020. Future Policy Scenarios: Base: Duty on all alcohol products up-rated by RPI inflation from 2015/16 – 2019/20. Scenario 1: Alcohol duty escalator retained through 2013/14 – 2019/20. Scenario 2: As with the base scenario but duty on beer frozen for next 5 years. © Centre for Economics and Business Research 17 Figure 10- Domestic beer clearances 2010/11 - 2019/20, thousands hectolitres Thousands Hectolitres 45,000 40,000 35,000 30,000 2010/11 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 Base Scenario 1 Scenario 2 Source: Cebr analysis As Figure 10 shows, beer sales are projected to fall over the forecast horizon in each of the policy scenarios modelled. However, there is a stark contrast between the performances of sales volumes across the scenarios. The continuation of the beer duty escalator in Scenario 1 suggests that beer consumption could have fallen by nearly 2 billion pints per year between 2012/13 and 2019/20, an additional 1.2 billion pints compared with the current policy path (Base Scenario). However, the analysis suggests that whilst the change in policy in recent years has helped to support the performance of the UK beer industry, more may need to be done over the course of the next parliament to truly reverse the decline of the sector. Compared with a fall of 800 million pints per year, Scenario 2 suggests that beer consumption would fall by just 250 million pints per year by 2020 if beer duty was frozen at its current level during the course of the next parliament. © Centre for Economics and Business Research 18 4 Impact on investment in brewing and pubs The ability to invest has been a substantial issue for both brewers and pubs in recent years. Arguments have been made that under-investment has been a key part of the decline of these industries for some time. Domestic brewers have lacked the confidence in the strength of the market to invest in new products and, with beer volumes falling, have had little need to invest in extra production capacity. Additionally, the weakness in the UK beer market has discouraged global brewing companies from investing in their UK facilities as operations in other parts of the world have presented more attractive investment opportunities. Analysis in section 3 has already shown that the policy decisions made in the 2013 and 2014 Budgets have helped to support domestic sales of beer, which will continue to remain around their current levels through 2016. This upturn in demand and the signal of increased support for the industry that the two duty cuts provided have boosted confidence in the British beer industry which should have a positive impact on investment in brewing and pubs. If this proves to be the case, the duty changes could have an even more substantial impact on the long-term health of the beer industry. Figure 11- Net capital investment by sector, £ millions £400 £14,000 £350 £12,000 £300 £10,000 £250 £8,000 £200 £6,000 £150 £4,000 £100 £2,000 £50 £0 £0 2008 2009 2010 Manufacture of Beer (LH axis) 2011 2012 2013 Manufacturing Sector (RH axis) Source: ONS Annual Business Survey Figure 11 shows how capital investment in the brewing industry fell more sharply following the financial crisis compared with investment in the manufacturing sector as a whole. Net capital investment in the manufacture of beer fell from £336 million in 2008 to just £100 million in 2011, a fall of over 70%. In the manufacturing sector as a whole, net capital investment had © Centre for Economics and Business Research 19 already begun to pick up after bottoming out in 2009. Despite the Budget measures introduced in April 2013, investment in the brewing industry fell by over 8% from the 2012 level. However, the fall was less sharp than the general decline in investment seen across the manufacturing sector in 2013. To assess the impact of the duty changes of 2013 and 2014 on investment we once again utilise the model of the alcohol industry, relating the projections of total beer sales to the value of the industry’s output and using this to forecast capital expenditure. Policy Scenarios: Base Scenario: The base scenario reflects the actual changes in beer duty that have taken place since 2008 and duty on all alcohol products up-rated by RPI in the future. Scenario 1: Alcohol duty escalator retained through 2013/14 – 2019/20. Scenario 2: As with base scenario but duty on beer frozen for next 5 years. Figure 12- Net capital investment in the brewing industry, £ millions £400 £350 £300 £250 £200 £150 £100 £50 £0 2008 2009 2010 2011 2012 Base 2013 2014 Scenario 1 2015 2016 2017 2018 2019 2020 Scenario 2 Source: Cebr analysis The results in Figure 12 show that the policies of recent years should provide a boost to the level of investment brewers are currently making and this recovery should be sustained through the rest of the decade. In 2014 alone, we expect investment stood £61 million higher than it would have if the beer duty escalator had been maintained up to and including the budget of 2014. If © Centre for Economics and Business Research 20 the duty escalator was maintained over the course of the next parliament, as opposed to uprating duty by RPI inflation only, investment in 2020 would likely be around £96 million lower. Ant Stevens, Ledbury Real Ales “The removal of the beer duty escalator and the reduction in the rate of beer duty by two 1p reductions has given our business the confidence to invest in the future. Over the past two years we have invested in new equipment (made in the UK), made a significant investment in new casks (made locally in Hereford) and invested in the infrastructure of our brewery itself with a new cool room and dry store.” The survey of brewers and pub owning companies undertaken as part of this research was also used to ascertain how investment had changed over the last 12 months and asked respondents to project changes in expenditure levels over the coming year. The results suggested there had been a strong pick up in investment over the last 12 months. Over 71% of respondents reported increasing expenditure on, for example, purchasing new equipment, new premises, R&D and marketing this year. In addition, almost four times as many businesses increased expenditure by over 50% as those businesses that cut investment. Projections for the next 12 months are even stronger with over 83% of companies projecting increases in this form of spending and only 3% looking to reduce investment expenditure. When asked about the main reasons for increasing investment, one of the most popular answers given were the Chancellor’s decision to scrap the alcohol duty escalators combined with cuts in beer duty in 2013 and 2014. The other most popular answer was an increase in domestic sales, which the Budget decisions have played an important role in as shown in section 3. The decline in beer sales in the on trade shown in section 2 has had a knock on effect on the health of the pub industry. The number of pubs in the UK has fallen for over three decades, as shown in Figure 13. The number of public houses in 1980 stood at 69,000 but has declined over 30% over the last 33 years to just over 48,000 in 2013. © Centre for Economics and Business Research 21 Figure 13- Number of Public Houses in the UK 70,000 65,000 60,000 55,000 50,000 45,000 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 Source: British Beer and Pub Association Clearly the decline in the British pub industry supersedes the introduction of the alcohol duty escalator which suggests that there are a number of other factors that have weighed on the prospects of the sector. However, the rate of decline has accelerated since 2007. For example 5 more than 29 pubs a week closed in the six months to December 2014 compared with just 6 under 8 a week just a decade earlier .Whilst the recession is likely to have played a key role in this, the introduction of the alcohol duty escalator is likely to have accelerated the decline. Utilising the historical relationship between on-trade beer sales and the number of public houses, we use our model to estimate the number of pubs in each year under the different policy scenarios highlighted earlier in this section. Dave Sweeney, Bank Top Brewery "The back to back cuts in beer duty and the welcomed scrapping of the escalator system have enabled Bank Top Brewery to increase our staffing by three people. In addition Bank Top Brewery Estates is flourishing with two public houses having been purchased within the last 5 years, both have been fully refurbished to a high standard and with a third public house purchase on the horizon we can only be moving from strength to strength.” 5 CGA-CAMRA Pub Tracker, June- December 2014 6 Source British Beer and Pub Association 2004-05 © Centre for Economics and Business Research 22 Figure 14- Forecasts for the number of Public Houses in the UK 58,000 56,000 54,000 52,000 50,000 48,000 46,000 44,000 42,000 2006 2007 2008 2009 2010 Base 2011 2012 2013 Scenario 1 2014 2015 2016 Scenario 2 2017 2018 2019 Source: Cebr analysis As Figure 14 shows the Budget changes have not stopped the number of registered public houses continuing on the downward trend of the last three decades but they have helped stem the flow slightly. By the end of 2014, we estimate that an additional 1,047 pubs would have closed if beer duty had continued to be up-rated by RPI+2% in 2013 and 2014. If the beer duty escalator continued through the next parliament there would be over 2,100 fewer pubs in the UK compared with a continuation of the current plans set out for 2015/16. © Centre for Economics and Business Research 23 5 Impact on employment The beer and pub industry is an important source of employment across the UK. However, falling beer consumption in recent times has led to a decline in the level of employment that these industries have supported, both directly and indirectly. For instance, direct employment in brewing has fallen by 40% since the beginning of the Millennium and employment in pubs and bars declined by around 18% over the same period. Section 4 showed how the scrapping of the beer duty escalator and two consecutive 1p cuts have helped to support a significant increase in beer consumption when compared with the level that may have been experienced if the beer duty escalator was still in place. This in turn should support jobs directly, in the manufacture of beer and industries such as pubs and clubs, and indirectly through its positive impact on the supply chains associated with these industries. Based on the historic relationships between beer sales, domestic beer production and employment, we can utilise our economic model to assess the impact of the Budget decisions of 2013 and 2014. The scenarios used are retained from the previous section. Figure 15- Forecasts of the number of people directly employed in the manufacture of beer 16 Thousands 15 14 13 12 11 2012 2013 2014 Base Source: Cebr analysis © Centre for Economics and Business Research 2015 2016 Scenario 1 2017 2018 Scenario 2 2019 2020 24 Despite a rise in the number of breweries in the UK, which is primarily attributable to a sizeable influx of smaller breweries, employment in brewing has been in decline for more than a decade. As shown in Figure 15, a decision to maintain the beer duty escalator through 2013-2014 and over the course of the next parliament would have caused employment in the manufacture of beer to continue to decline at a considerable pace, with a further 1,000 job losses in the sector between 2012 and 2014. By 2020 the UK brewing industry would have lost around 3,300 jobs compared with the level of employment observed prior to the 2013 Budget. In contrast, we estimate that, thanks to the cuts in beer duty in 2013 and 2014, employment in brewing has risen by nearly 500 jobs, since 2012. Whilst we forecast that employment will continue to fall slightly over the course of the next parliament if the planned duty path of RPI up-rating continues, we forecast that employment in 2020 will stand at a similar level to 2012 if beer duty is frozen at its current level. Figure 16 – Forecasts for employment in public houses and bars in Great Britain 520 510 500 Thousands 490 480 470 460 450 440 430 420 2010 2011 2012 2013 Base 2014 2015 Scenario 1 2016 2017 2018 2019 2020 Scenario 2 Source: Cebr analysis While the number of pubs continues to decline, employment in pubs and bars picked up in 2013. The number slipped slightly in 2014, but our analysis in Figure 16 shows that the duty changes of 2013 and 2014 are having a positive impact on employment, which we forecast will stand around 12,000 higher in the first three months of 2015 compared to the level in Scenario 1, where the escalator is retained. By the start of 2020 employment will stand around 33,000 people higher if duty continues to be up-rated by RPI compared with a situation where the alcohol duty escalator remained in place between 2013-2020. © Centre for Economics and Business Research 25 Table 1 shows the wider impact on employment that the policies of 2013 and 2014 had. The policies not only have a direct impact on employment, as already reviewed, but also have an influence on employment through the impact on supply chains (indirect employment). Furthermore the expenditure of these additional employees helps to induce an even greater increase in employment across the economy (induced employment). Compared with the level in 2012, we forecast the policy measures of the 2013 and 2014 Budgets contributed to a total of 26,000 additional jobs in 2015 that would not have been created if the alcohol duty escalator remained in place. Table 1- Total change in employment between 2012 and year given, thousands Base Direct Scenario 1 Scenario 2 Indirect Induced Total Direct Indirect Induced Total Direct Indirect Induced Total 2015 +24 +8 +6 +38 +10 +1 +1 +12 +24 +8 +6 +38 2020 +39 +8 +8 +56 +3 -6 -3 -6 +58 +16 +15 +89 The current policy of up-rating alcohol duty by RPI inflation would create a further 18,000 jobs by the end of the next parliament, a total of 56,000 additional jobs. However, there is the potential for the government to create an extra 33,000 jobs on top of this by freezing beer duty over the course of the next parliament. Gary Walters, Ludlow Brewing Company “The cut in beer duty has given us the confidence to put a young brewer through an apprenticeship. The business is looking to employ two more full time staff within the coming months and is soon to invest in another 3000 litre fermentation vessel”. © Centre for Economics and Business Research 26 Conclusion The beer and pub industries are both historic parts of the UK economy and key components of local economies and communities. However, the two have been under considerable pressure for some time with beer sales falling, pubs closing and jobs being lost. Fortunately, the government has begun to recognise the importance of the excise duty system and the role it can play in supporting these industries. The duty escalator that up-rated beer duty by RPI+2% was scrapped in the 2013 Budget and duty was instead cut by 2% for two consecutive years. Our analysis suggests that this reversal in the direction of duty policy is already having a positive and sizeable impact on the health of the UK beer industry and the public houses that the sale of beer supports. Domestic beer sales are considerably higher than they would likely have been if duty had remained on the escalator, helping to boost investment in the brewing industry and stem the decline in the level of employment associated with the manufacture of beer. There are also signs that the improvement in beer clearances isn’t solely driven by an increase in sales in supermarkets and other off-licence premises as declining sales in the on trade, which includes pubs and bars, are beginning to steady. This has helped to slow the rate of pub closures, particularly when compared with the scenario where the beer duty escalator remained in place in the last two years. However, our analysis also reveals that whilst the Budget decisions have provided a welcome boost to the beer and pub industries, it far from solves the pressures that these industries will face going forward. Our scenarios show that a freeze on beer duty over the course of the next parliament would further support consumers, brewers and pubs compared with the current plans. The current system would see duty on all alcohol products up-rated by RPI inflation and the return of undifferentiated duty policy despite the relative importance of the beer industry, which in manufacturing alone employs 87% more than the spirits industry and more than seven times that of the cider industry. When asked to rate future policy announcements in terms of the extent to which they would support brewers and pub companies, companies rated three policy announcements above 4.0 (where 5 represented an announcement that would have a very important impact on their business). Of these three, two of the answers referred specifically to excise duty policy; a further cut in duty and an announcement that duty would be frozen over the course of the next parliament. This highlights the importance of this section of Ant Stevens, Ledbury Real Ales “We have seen recent increases in our raw material costs with hops seeing double digit percentage increases. The reduction in fuel prices will help our business a lot as that is a big day to day expense for us, but I still expect my overall margin to be put under pressure due to supplier price increases in 2015. We have a growth plan to meet in 2015 and this will include a further investment in equipment, any duty cut or reduction in our overall expenses will assist in allowing us to part fund this investment in UK made equipment.” © Centre for Economics and Business Research 27 the tax system to the confidence and health of businesses in the beer and pub industries. The government cannot rely on the economic recovery to truly reverse the fortunes of the beer and pub industries and the measures of 2013 and 2014 appear to recognise the need to support these sectors. Yet there is still more that can be done in terms of the level of duty on beer compared to other alcohol products. The government has yet to fully reverse the impact of the 1997-2007 period when beer duty was raised but duty on spirits and cider remained broadly flat. This is something that a duty policy that truly differentiates beer in the coming years can work towards and, as shown in our analysis, such a policy would, at the same time, boost beer sales, help to stem the decline in the number of pubs in the UK and increase employment. Dave Sweeney, Bank Top Brewery I look forward and welcome any further reductions in beer duty and/or any further assistance the Government may choose to offer the industry. Part of the history behind Public Houses is that they are a great tourist attraction, welcoming guests from far and wide to meet and chat, this environment simply cannot be recreated within the confines of a living room with supermarket purchased beverages. In my view cask ale is the National drink!" © Centre for Economics and Business Research 28 Appendix Survey Note Survey results are based off of a survey of breweries and pub owning companies commissioned by CAMRA and conducted by the Centre for Economics and Business Research. The survey was conducted between 27th August 2014 and 22nd October 2014. The results are based on a survey of 13 questions and a sample of 68 breweries and pub owning companies. Modelling assumptions For the purposes of modelling the impact of these scenarios, we assumed that alcohol excise duty increases are passed on to consumers to differing degrees, with off-trade beer duty increases seeing relatively little pass-through to consumers, and on-trade beer duty increases being passed through by more than 100%. For on-trade and off-trade beer pass-through rates, we adopted estimates broadly in line with those made by Oxford Economics and PricewaterhouseCoopers . Econometric analysis by these companies suggests a higher pass-through rate for on-trade beer than off-trade beer, and we have incorporated this into our central projections. 7 We have assumed pass-through rates of 100% for spirits, wine and cider. While there will be deviations, both up and down, amongst sellers of these products in practice, we have no evidence to suggest that, in the aggregate, pass-through rates for these other beverages are likely to deviate significantly from this norm. The full set of pass-through rates are detailed in Table 1 below. Table 1: Pass-through rates for duty and VAT rises, by type of alcoholic beverage Type of alcoholic beverage Assumed pass-through rate 7 Beer (on) 170% Beer (off) 100% Spirits 100% Wine 100% Cider 100% See Oxford Economic Forecasting (2004), “Modelling the Beer Market” and PwC (October 2009), “Analysis of the impact of excise taxation on the brewing sector”. © Centre for Economics and Business Research 29 Modelling the above scenarios also required assumptions about elasticities of demand for alcohol products. In the analysis which follows, we use recent HM Revenue & Customs (HMRC) estimates for alcoholic beverage elasticities of demand.8 Table 2 below provides an overview of the own-price and cross-price elasticities estimated by HMRC. Table 2: HMRC elasticities of demand Source: HM Revenue and Customs Assumptions about inflation and household income growth also need to be made, as these feed through into duty escalator calculations and also have implications for alcoholic beverage demand going forward. Cebr’s November 2014 inflation and income forecasts are used in the analysis which follows and the forecasts are outlined in Table 3 below. Office for Budget Responsibility (OBR) December 2014 forecasts are also shown in Table 3, for reference. 8 Source: HM Revenue and Customs (December 2010), “Econometric Analysis of Alcohol Consumption in the UK”, London. © Centre for Economics and Business Research 30 Table 3: Inflation and earnings forecasts, Cebr and OBR Cebr OBR Annual % change Household nominal disposable incomes RPI (September) Household nominal disposable incomes RPI (September) 2015 4.3% 1.7% 3.3% 2.1% 2016 3.9% 3.6% 3.7% 2.9% 2017 4.0% 3.4% 4.0% 3.4% 2018 3.8% 3.1% 4.4% 3.6% 2019 3.8% 3.1% 4.4% 3.6% Source: Cebr, Office for Budget Responsibility © Centre for Economics and Business Research