85

Convergence markets:

Digital economy and structural change

August 4, 2011

Smartphones and triple play continue to erode sector

boundaries

Convergence being driven by omnipresence of internet. Over the past

few years the convergence of the information technology, telecommunications,

consumer electronics and media sectors has gathered pace. Given wider

availability of fast internet connections – both fixed-line and mobile solutions – it is

becoming increasingly convenient to call up online services on various webenabled end-user devices such as TVs, smartphones and tablet PCs.

Stiff competition across sector boundaries. Companies that originally

operated in discrete industries are now fiercely competing with one another for

market shares in areas such as broadband infrastructure and smartphones. In

addition, the market for end-user devices is marked by high innovation rates, with

a stable distribution of the market shares nowhere on the horizon.

Makers of standard consumer electronics products are losing market

share. Since smartphones are mutating into all-rounders and integrating, say,

MP3 players and digital cameras without any drop in quality, makers of standard

products are condemned to seeing their market shares dwindle. The ―losers‖ thus

need to rise to the challenge of finding strategic solutions, e.g. by scaling their

products towards the higher end of the line.

Impetus for mobile internet use and services. Going forward,

smartphones and tablets are set to become part of everyday life. For this reason,

consumers will expect companies to offer mobile solutions for online services, too.

Such services will have to appeal to users and deliver real value added if they are

to hold their own in the surge of new applications flooding the market. Apps may

generate income in the publishing sector, but they are not a panacea for the

latter‘s revenue problems.

Separation of content from physical media gathering pace. The rising

Author

Antje Stobbe

+49 69 910-31847

antje.stobbe@db.com

Editor

Stefan Heng

number of households with broadband, the convergence of internet and TV as well

as the growing use of appealing mobile end-user devices will boost on-demand

consumption of music, videos, news, games and books – at the expense of their

physical sale and rental.

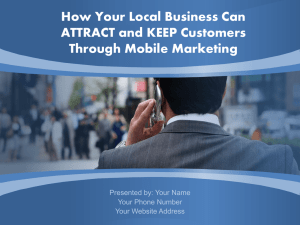

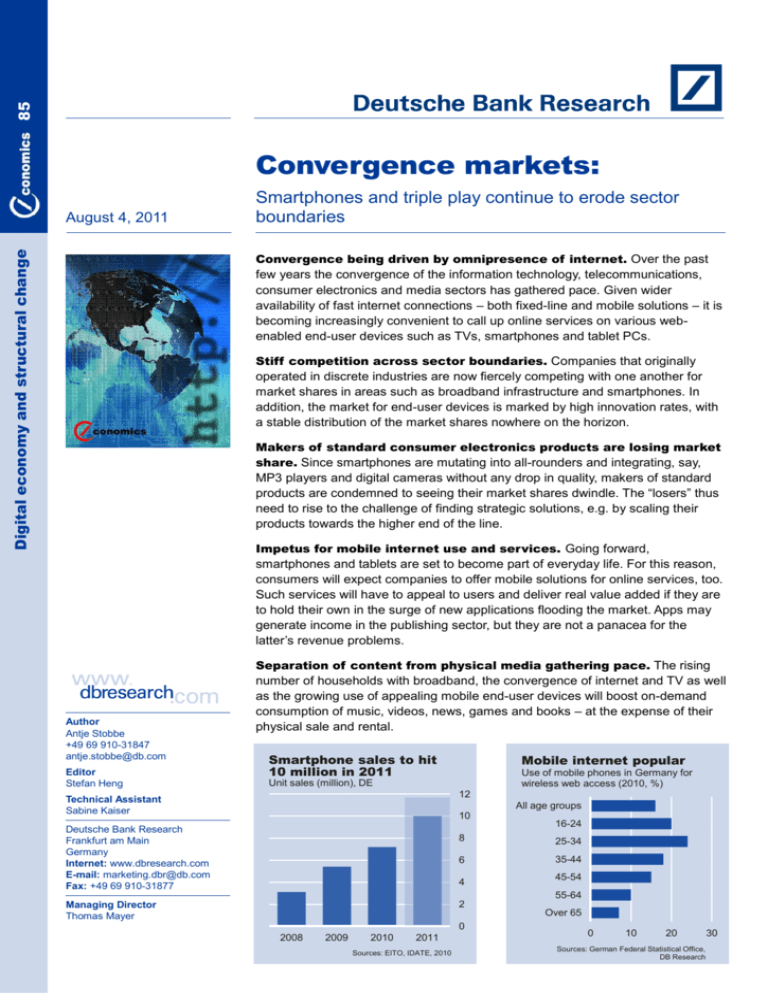

Smartphone sales to hit

10 million in 2011

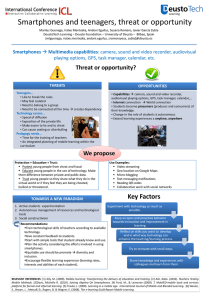

Mobile internet popular

Use of mobile phones in Germany for

wireless web access (2010, %)

Unit sales (million), DE

12

Technical Assistant

Sabine Kaiser

All age groups

10

Deutsche Bank Research

Frankfurt am Main

Germany

Internet: www.dbresearch.com

E-mail: marketing.dbr@db.com

Fax: +49 69 910-31877

16-24

8

25-34

6

35-44

4

45-54

55-64

2

Managing Director

Thomas Mayer

0

2008

2009

2010

2011

Sources: EITO, IDATE, 2010

Over 65

0

10

20

Sources: German Federal Statistical Office,

DB Research

30

85

20

In recent years, more efficient infrastructures and technological

innovations at the end-user level have triggered an appreciable

change in the way people use the internet. Mobile internet use via

smartphones and tablet PCs as well as access to the worldwide web

via TV will shape user habits substantially going forward. Today,

more and more end-user devices are internet-enabled: not only

mobile phones and TVs, but also game consoles, radios and MP3

players. Experts suggest that in the near future a network

connection – either wireless or fixed-line – may be standard

1

equipment on most consumer electronics devices. Networked

devices offer additional functionalities and services, enabling

consumers to use them in new situations: banking via mobile phone,

searching for products online while watching TV shows, or reading

newspapers and books on an iPad are only a few examples. This

gives companies new ways of reaching their clients: additional

services can supplement current services via existing channels (e.g.

submitting damage reports via an app) or tap new revenue models

(news apps), but also pose a threat to existing distribution channels.

This report analyses the current state of the technological change

and points to the implications for the consumer electronics,

information and communications technology (ICT) markets as well

as for service providers.

15

What is convergence?

10

Over the past few years the markets for information technology,

telecommunications, consumer electronics and media have

increasingly grown together, and in many areas they have become

virtually inseparable. This holds for example in the area of

telephony, where 3.8 m Voice over IP (VoIP) connections (as of

2009) document this technology‘s emergence as a serious rival to

conventional telephone operations. This growing together of the

telecommunications, information technology, consumer electronics

and media sectors, which originally operated largely independently

of one another, is referred to as convergence. A certain amount of

differentiation is called for, however: convergence can take place at

different levels, i.e. at the level of the infrastructure, end-user

2

devices and/or services. We define convergence as a process of

qualitative change that connects two or more existing, previously

discrete markets. The driving force behind this phenomenon is

predominantly the refinement of one technology or the integration of

various technologies, enabling infrastructures, end-user devices or

services to acquire new functionality. Another important source of

market convergence is the change in product features resulting from

new technologies.

Germany remains DSL

territory

Million connections

30

25

5

0

01 02 03 04 05 06 07 08 09 10*

DSL

Wireless broadband access, FTTx, cable

modem, powerline, satellite etc.

* Estimate

Sources: German Federal Network Agency,

DB Research 2010

1

Buoyed by higher-performance infrastructure and

appealing end-user devices

One key prerequisite for convergence is the full digitisation of

networks and end-user devices. Digitisation of end-user devices is

already well on its way: in 2009 some 95% of the consumer

3

electronics products on the market were digital. Furthermore, the

expansion of broadband infrastructure plays a key role in the spread

1

2

3

2

See Schidlack, Michael, Klaus Böhm, Benjamin Libor and Gregor Schmidt (2010).

Die Zukunft der digitalen Consumer Electronics – 2010. BITKOM, p. 4.

For more on this subject and further details on definitions, see Stobbe, Antje and

Tobias Just (2006). IT, telecoms & New Media: The dawn of technological

convergence. Deutsche Bank Research. E-conomics 56. Frankfurt am Main.

See Schidlack, Michael, Klaus Böhm, Benjamin Libor and Gregor Schmidt (2010).

Die Zukunft der digitalen Consumer Electronics – 2010. BITKOM, p. 6.

August 4, 2011

Convergence markets: Smartphones and triple play continue to erode sector boundaries

of attractive services in both fixed-line and mobile internet solutions.

In Germany, close to 27 million households (approx. two-thirds of

the total) had broadband in 2010 (see chart 1), with nearly 90% of

them equipped with DSL technology. The second most important

technology is internet access via cable-TV modem (3 million

connections at the start of 2010). This segment is witnessing

unbroken strong growth. The share of fast fibre-optic connections (at

least 50 Mbit/s) totalled barely 1% of all households (approx.

255,000) at end-2010. More than half of the households are still

surfing at much lower transmission rates of some 6 Mbit/s at the

maximum (see chart 2). The sharp climb in the volume of data

transmitted (see chart 3), driven by data-intensive applications such

as video on demand (VoD), underscores the necessity of further

expanding the telecommunications infrastructure.

High-speed internet not yet

common

DSL connections by downstream bandwidth (%)

0.9

7.0

13.8

39.6

38.7

Over 50 Mbit/s

16 to 50 Mbit/s

6 to 16 Mbit/s

2 to 6 Mbit/s

To 2 Mbit/s

2

Source: DIALOG CONSULT/VATM, 2010

Demand for broadband

services growing

Volume of broadband traffic, bn gigabytes

3

2

1

0

01 02 03 04 05 06 07* 08* 09e

*Updated values

Source: German Federal Network Agency, 2010

3

Smartphone sales to hit

10 million in 2011

Unit sales (million), DE

12

10

8

Over the last two years, the mobile internet has gained much

greater acceptance, meaning that the momentum of convergence

has also gathered pace at the mobile level. The trigger was the

boom in smartphones, which represented the growth market of 2010

– at the expense of conventional mobile phones. The European

Information Technology Observatory (EITO) estimates that

smartphone sales were up by 33% on the previous year to 7.2

million units in Germany in 2010; in value terms, turnover totalled

EUR 1.6 bn (+23%). For 2011, EITO forecasts that sales will

4

surpass the 10 million unit threshold (see chart 4). On a

conservative estimate, probably about 20% of all Germans now own

5

a smartphone. Today, smartphones are the most important

convergent end-user device: ―users are seeking – and finding –

6

experiences that are intuitive, seamless, and fun.‖

In general, smartphones illustrate the advances being made on enduser devices: over the past few years they have become easier to

operate, smaller and more powerful. Besides, today they have better

displays and perform a larger range of functions. This is driven by

the trend towards miniaturisation, i.e. the steady reduction in the

size of components for technical equipment to boost not only

performance and speed, but also to reduce weight and energy

requirements, some examples being storage chips, GPS receivers

and batteries. However, there are limits to this development if it

restricts the functionality of the devices. Take, for example, the size

of keypads or displays. The new smartphones attempt to mitigate

this restriction by combining a larger display with a touchscreen and

improving operability, enabled not least by more intuitive user

navigation.

The high-performance end-user devices can increasingly build on

high-speed infrastructure, so users are able to enjoy the easy

operation of sophisticated mobile services. Various estimates say

that in H1 2010 about 70% of the locations offering mobile/wireless

network access were equipped with 3G technology (UMTS or

7

HSDPA). However, there are very substantial differences in the

4

6

4

5

2

0

2008

2009

2010

August 4, 2011

7

2011

Sources: EITO, IDATE, 2010

6

4

See BITKOM (2010). Smartphone-Absatz 2011 über der 10-Millionen-Marke.

Press release. November 10, 2010. This suggests that 1 in 3 new mobile phones

sold will be a smartphone. Unit sales of mobile phones are set to hit 28.4 million

(+6% yoy) in 2011.

The estimates of smartphone numbers in Germany vary quite considerably

depending on source and definition. They range from 40% to 60% for internetenabled mobile phones and from 20% to 40% for smartphones.

IDC Press Release, May 7, 2010.

For German statistics see http://www.hsdpa-umtsverfuegbarkeit.de/blog/2010/07/07/halbjahresbericht-2010-zur-umtsverfuegbarkeit-70-netzabdeckung-erreicht/. Accessed on May 26, 2011. Availability

3

85

Data volume increasing

exponentially

Wireless data volume, m gigabytes

70.0

70

60

50

40

33.5

30

20

11.5

2005

10

0.8

0.2

2006

3.5

0

2007 2008 2009e 2010e

Sources: German Federal Network Agency,

EITO, 2010

5

ICT & consumer electronics:

EUR 715 bn turnover in

Europe

Revenue breakdown, 2011

Consumer

electronics

8%

IT

44%

Telecommunications

48%

Source: EITO, 2010

6

German ICT market

returning to growth

EUR bn (left), % yoy (right)

160

140

120

100

1.4

0.7

2.0

80

60

-4.8

40

20

0

2008

2009

2010

5

4

3

2

1

0

-1

-2

-3

-4

-5

2011

Telecommunications

IT

Digital consumer electronics

% growth

Sources: BITKOM, EITO, PAC, IDATE, IDC, 2010

7

level of coverage depending on operator and region. So far, supply

has tended to be poorer in rural areas. But they are currently likely

th

to benefit from the rollout of 4 generation mobile infrastructure

(long-term evolution, LTE) to unserved areas, which various

providers say is to be completed by the end of 2011.

The volume of data transmitted via mobile phones has also jumped

8

in recent years (see chart 5). Cheaper tariffs and the increasing use

9

of flatrates for the mobile internet have played their part. The

popularity of mobile, internet-enabled end-user devices and complex

applications that require more bandwidth (e.g. games, videos) will

lead to a greater burden on network capacities in future. Therefore,

there will need to be further investment in network expansion over

the next few years in order to meet users‘ increasing demands for

high-speed transmission rates and problem-free service. According

to estimates from the industry trade association BITKOM, the

expansion of the mobile telephony network with LTE alone will

require investment totalling EUR 8-10 bn up to 2015.

ICT market has overcome the crisis

The convergence of the markets for IT, telecommunications,

consumer electronics and media paves the way for companies to

tap new customer markets. However, this also represents a threat to

established products, as numerous examples from the CD to the

DVD right through to print products show. Convergence gains its

significance not only from the size of the affected sectors, but also

from the – in some cases – rapid growth of individual segments

along with the related structural changes. These may quickly

devalue existing products and business models. Therefore,

companies struggling to retain market shares need to assume the

role of the innovation leader or at least be among the early

followers.

The IT, telecoms and consumer electronics sectors are

heavyweights in Europe. Combined, these sectors will probably

generate total revenues of roughly EUR 715 bn in 2011 (see chart

6). In Germany alone the figure is EUR 145 bn. Thus the sectors

taken together are just as large as the chemicals industry in

Germany. The German ICT market was also among the sectors that

had to cope with losses in the 2008/09 economic slump, but since

2010 it has returned to growth (see chart 7). In this respect, crisisrelated and fundamental structural effects have overlapped over the

past few years. However, the trend towards mobile, networked and

IP-based modes of living, working and communicating is emerging

clearly in the business development of vendors and service

providers:

— The IT hardware segment accounted for close to 30% of total

ICT revenues in 2010, and did not perform nearly as well as the

software and services segments over the past few years.

However, mobile computer devices are currently registering

strong growth; unit sales of notebooks, netbooks and tablet PCs

rose by 16% in 2010, to 9.5 million. Tablet PCs are particular

customer favourites: BITKOM estimates that about 450,000

8

9

4

increased by 3 percentage points over H2 2009. The evaluation is based on

160,000 locations in Germany equipped for mobile telephony.

This includes all mobile end-user devices, such as smartphones, laptops and

netbooks.

Tomorrow Focus Media has found that 58.5% of those surveyed already have a

flatrate for mobile internet use. See Tomorrow Focus Media (2011). Mobile Effects

– wie geht die mobile Reise in 2011 weiter?

August 4, 2011

Convergence markets: Smartphones and triple play continue to erode sector boundaries

tablets were sold in Germany last year. For 2011 the association

forecasts that unit sales will reach 1.5 million. Therefore, apart

from smartphones, tablet PCs will probably become the most

important driver of mobile internet use and of convergence for

end-user devices and services in this segment.

Data services march ahead

Share of non-voice revenues in wireless

turnover, DE, %

30

12.7

12.3

25

— In Germany‘s telecommunications market about 85% of revenue

20

is generated by network services, primarily telephony and data

services. In this context, mobile communication has gained

considerable significance in recent years: the share of revenue

generated by mobile telephony increased from 22% in 1998 to

10

about 40% in 2010. Furthermore, over the past five years data

services have claimed an ever larger share of mobile turnover.

More than half of non-voice revenue was generated by mobile

data services in 2010 (see chart 8). In fact, according to

estimates from VATM, the Association of Telecommunications

and Value-Added Service Providers, the data volume is likely to

have tripled in 2010 vis-à-vis 2009. Lower end-consumer prices

and the increasing spread of data flatrates are reasons for the

11

difference to revenue growth. In spite of the unfavourable price

development, data services revenues are probably going to

increase further for the telecommunications companies in future

and assume a key role in a market where revenues as a whole

are shrinking.

11.9

13.1

15

13.8

14.4

10

8.9

6.0

3.3

15.9

11.9 13.9

5

0

05

06

07

Data

08

09

MMS

10*

SMS

*Estimate

Source: DIALOG CONSULT/VATM, 2010

8

Consumer electronics:

Stable revenues

DE, EUR bn

14

12

10

8

6

4

2

0

2007

2008

2009

2010 2011e

Source: EITO, 2010

9

Prices falling

Retail sales of consumer electronics,

incl. VAT (% yoy)

0

— Consumer electronics revenues have been flat on average over

the past few years (see chart 9). Fundamentally, the sector has

to get to grips with the price deterioration dilemma (see chart 10).

Consumer willingness to pay for services is generally higher for

innovative products. However, short innovation and product life

cycles rapidly erode any pricing latitude. In recent years, the

digitisation of products and the integration of microprocessors

and storage chips have subjected the market to a high rate of

innovation and rapid changes. BITKOM estimates that over 80%

of the industry‘s turnover in 2009 was generated on products that

12

did not exist a mere 10 years ago. Innovative products such as

smartphones are repeatedly sweeping the market and devaluing

existing technologies and products (disruptive technology,

product substitution). Market shares can therefore change

sharply within a foreseeable period.

Moreover, there is evidence of so-called ―technology preservation

strategies‖ in the market: this means that vendors upgrade their

products along the lines of established performance criteria by

integrating new technologies. It is precisely the many product

areas with a high degree of household penetration, such as TVs,

where new generations of equipment are being rolled out that,

unlike the existing appliances, offer higher-grade technology and

extended functionalities (e.g. flat-screen TVs that support hybrid

TV). These devices enable the use of new, convergent services.

-2

-4

-6

-8

00

02

04

06

08

10

Source: German Federal Statistical Office

10

10

11

12

August 4, 2011

See Dialog Consult / VATM (2010). 12. gemeinsame TK-Marktanalyse 2010, p. 5.

See VATM (2010). VATM and Dialog Consult unveil report on telecommunications

market in 2010. Press release, October 7, 2010.

See Schidlack, Michael, Klaus Böhm, Benjamin Libor and Gregor Schmidt (2010).

Die Zukunft der digitalen Consumer Electronics – 2010. BITKOM, p. 6.

5

85

TVs and cameras claim largest market shares

TV and mobile phone have

greatest penetration

Revenues (% of total), 2009

Share found in private households,

DE, 2009 (%)

MP3 / MPEG4

player

4.0

TV (all types)

Digital set-top

boxes

Digital

4.0

recording

media

5.1

Mobile phone

CD player

PC

Digital camera

Car navigation

Game

systems

consoles

5.6

6.1

Desktop PC

Mobile PC

MP3 player

Navigation device

Other

13.7

TVs

47.9

Digital

cameras

13.7

Source: EITO, 2010

12

Flat-screen TV

Game console

Convergence markets – where do we stand today?

0

25

50

75

100

Source: Destatis

11

Companies come from different

sectors

In converging markets it is difficult to demarcate sectors. Today, a

smartphone is a telephone, music and video player as well as a

navigation device all in one, besides offering internet access.

Converging markets are often served concomitantly by established

companies from several concerned sectors with differing roots. The

biggest providers in the European smartphone market now come

from the sectors for IT end-user devices, telecoms end-user devices

and IT services. Moreover, convergence markets are marked by the

fact that knowledge leads are rapidly eroded and competition is very

intense. The makers of end-user devices and service providers are

much more exposed to this trend than the infrastructure providers,

since sunk costs in infrastructure act as barriers to market entry.

Over the past five years since we published our first report on

13

convergence markets there has been progress in the convergence

process at all levels (infrastructure, end-user devices and services)

– albeit at differing paces.

Convergence market of triple play: Slowly making inroads

Triple play: Major investment

required

Triple play, i.e. the provision of television, telephone and internet

services across a common infrastructure based on IP protocol, is

slowly making advances in Germany. As the development of the

past five years shows, this requires heavy investment in

infrastructure and cooperative ventures. The telephone companies

and cable operators in particular compete head-on in this field.

The cable operators have created the technical prerequisites over

the past few years to enable them to offer triple play functionality. To

do so they have invested huge sums in the upgrading of the cableTV network in order to digitise the network and set up reverse

channel capability. At present, 24 million households are equipped

for this service. The number of contracts signed is much smaller,

though: in early 2011 a total of 3 million households used the cableTV network for internet access; a similar number used it for

14

telephone calls. Despite the currently still limited customer base,

the cable operators are a major challenger for Deutsche Telekom

AG (DTAG) nonetheless since they have recorded high newcustomer growth in the broadband internet segment. According to

13

14

6

See Stobbe, Antje and Tobias Just (2006). IT, telecoms & New Media: The dawn of

technological convergence. Deutsche Bank Research. E-conomics 56. Frankfurt

am Main.

See ANGA (2011). Das deutsche Breibandkabel. Infrastruktur der Zukunft.

August 4, 2011

Convergence markets: Smartphones and triple play continue to erode sector boundaries

ANGA, the Association of German Cable Operators, these

companies claimed nearly 40% of the market for new customers in

2010. As offered by the cable network providers, triple play is

frequently not only more appealing to customers on price, but is also

associated with relatively low technical hurdles. Besides, the

consumers hardly have to change their media consumption patterns

at all.

Moving images popular on

the internet

Video downloads, at least occasionally,

DE, 2010 (%)

Video (total)

Video portals

Time-shift TV

Live TV on the

internet

0

25

50

All age groups

75

100

14-19

Source: ARD/ZDF-Onlinestudie, 2010

13

Nonetheless, the cable operators are also being confronted with

new competitors in their traditional market, television. Offers such as

web TV (see chart 14), VoD and the growing use of video platforms

such as YouTube and MyVideo (see chart 13) are bringing about a

fundamental change in the market situation and are likely to further

reduce the effective range of conventional TV programming going

forward. Even if the users do not forgo a cable connection, there is

―in-house competition‖ for the most attractive content offers. Users

are increasingly watching TV content directly on the internet and

15

thus circumventing all ―real‖ TV infrastructure. TV and video offers

via mobile phone are set to join the fray, further intensifying the

battle for users‘ attention. For this reason, the cable operators intend

to establish innovative (digital) TV services in future, too. These

include, for example, home entertainment such as VoD or interactive

TV.

Convergence of internet and television

IPTV

Closed network (Ecosystem)

Web TV

Open internet

Hybrid TV

TV

Internet

Platform

Platform

Platform

Consumer

Consumer

Consumer

Content received and sent via

broadband connection

End-user device: PC

TV programme and additional

services transmitted via broadband

End-user device: TV

= Access to content

= Reception of content

Broadband internet and TV are

combined

End-user device: TV

Source: Deloitte, 2010

14

In developing these offers, the cable operators are also attempting

to position themselves for the increasing competition with telecoms

providers in the video segment. Several telecoms providers have

upgraded their product and now provide linear TV programming via

closed internet platforms (referred to as IPTV, see chart 14). In

addition they are offering VoD, an archive of shows from selected

broadcasters and further additional services such as time-shift TV.

IPTV, whose market debut was about five years ago (Alice TV was

launched in May 2006), is only slowly gathering pace in the German

15

August 4, 2011

See von Wichert-Nick, Dorothea (2010). Wirtschaftsfaktor Kabel. Solon

Management Consulting, p. 26.

7

85

IPTV slowly making inroads

IPTV households (million), DE

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2008 2009 2010 2011 2012 2013

Source: PwC, 2010

15

market, though. It is estimated that there were roughly 1 ½ million

subscribers to IPTV at the end of 2010. One reason for the rather

sluggish start is an issue of requisite infrastructure: the customer

requires a fast internet connection in order to use IPTV in high

16

quality or high-definition (HD) mode. In 2010, only 8% of all

households had connections with a data transfer rate of more than

16 Mbit/s in the first place. Market forecasters are optimistic about

the further take-up of IPTV. PwC, for instance, expects there to be

17

2.5 million IPTV households in 2013 (see chart 15). What this boils

down to, however, is that IPTV is still gaining market share at a

much slower pace than cable operators‘ triple play offers.

Cable operators and telecoms providers have fleshed out their

product in various areas and are now offering customers similar

packages of services. In a largely fragmented market, competition is

generally fought on price and content. As media consumption

becomes more geared towards on-demand selection, independent

of linear TV programming (trend towards non-linear media

consumption), and the importance of video platforms increases, the

providers will find themselves facing further competitors in the

content segment.

Convergence market of VoIP: Greater acceptance

VoIP providers gaining market shares

So far, triple play has only been made available by a few providers

and it has spread rather slowly. By contrast, internet telephony

(voice over IP, VoIP) already enjoys much greater acceptance. VoIP

is based on the principle of speech being converted into data

packets for transport across an IP network. In 2009, the providers of

the 38.9 million telephone connections in Germany made VoIP

available to roughly 10% (3.8 million) of them via unbundled DSL.

Virtually all of these connections are offered by DTAG‘s

18

competitors. There are also another 3 million connections via the

cable-TV network that are used for voice telephony. Furthermore,

special providers of VoIP, such as Skype, are continuing to slice into

the market shares of the market leader, e.g. in the area of longdistance calls abroad. The company says that 12% of all calls

19

abroad are now made via Skype. Going forward, the specialised

provider is poised to challenge the telephone companies for ―voice‖

business not only in the fixed-line but also in the mobile segment.

Flatrates continuing to make inroads

The significance of the conventional telephone connection is likely to

take a hit also from the growing use of flatrates for mobile voice

telephony. Roughly 50% of total voice minutes in Q1 2009 were

already billed on a flatrate basis. This is likely to reduce the

importance of home-zone tariffs, too. Some experts expect that the

higher performance capability of mobile networks following the

expansion of LTE will result in households doing away completely

with their fixed-line connection and subsequently phoning or

20

accessing the internet solely via the mobile network. What argues

16

17

18

19

20

8

HDTV is currently offered from a downstream rate of 16 Mbit/s; standard TV quality

is available starting at 6 Mbit/s.

See PwC (2010). German entertainment and media outlook: 2010-2014, p. 64. In

fact, Detecon even expects 5 million IPTV customers by this juncture. See

Detecon Consulting (2009). Mehr als 5 Millionen IPTV-Kunden in 2013. Press

release. February 25. 2009.

See German Federal Network Agency (2010). Annual Report 2009.

See ―Skype-Chef: ‗Deutsche Netzbetreiber behindern das mobile Internet.‘‖

February 26, 2010. FAZ-Blogs, Netzökonom. http://fazcommunity.faz.net/blogs/netzkonom/archive/2010/02/26/netzbetreiber-duerfenihren-kunden-nicht-vorschreiben-wofuer-sie-ihr-handy-nutzen.aspx. Accessed on

26.5.2011.

See PwC (2010). German entertainment and media outlook: 2010-2014, p. 34.

August 4, 2011

Convergence markets: Smartphones and triple play continue to erode sector boundaries

against this, though, is that in densely populated areas, for instance,

the data transfer rate declines at peak times, thus reducing the

appeal of mobile surfing. Moreover, fixed-line telephony is probably

going to retain its standing in the household as a product bundled

together with TV reception.

End-user devices as convergence driver: Hybrid TV

Internet enters the living room

The topic of hybrid TV focuses on the marriage of internet and

television, too. In this case, the convergence drive is being initiated

by manufacturers of end-user devices. Makers of TVs in particular

are intent on distinguishing their products from those of the

competition by offering internet capability in connection with content.

Hybrid TV is the term used to describe the combination of television

and set-top box which, apart from receiving TV fare, also pipes the

internet into the living room. The reverse channel capability of hybrid

TV paves the way for interactive offers, e.g. in the areas of

21

communication/product information, e-commerce and advertising ,

thus enabling the provider to tap new sources of revenue.

Hybrid TV driven by the

manufacturers

The functionality of hybrid TV will gradually be established in the

market by equipment suppliers when consumers need to replace

their TVs. According to a survey conducted by GfK, a market

research company, about 1.2 m web-enabled TVs were sold

between the March 2009 market launch and mid-2010. They

22

account for over one-third of revenues in the flat-screen segment.

However, the households that have already purchased a flat-screen

TV over the past few years will also need to be won over to hybrid

TV. This is nearly half of all German households, no less. They

would have to buy a (further) set-top box if they wished to use hybrid

TV.

TV suited for presentation of other

content

For the media consumer the new offer is most certainly of interest

since it allows the integration of TV and internet services. Television

is well established in the household. It can easily be used for further

applications from the internet, such as video downloads or games.

At the same time it is also suitable for online infotainment, such as

news or sport, as well as for personal multimedia content. According

to a BITKOM survey, nearly 50% of those approached said they

would be keen on their television offering additional options, such as

downloading films from the internet or surfing. In the 14-29 age

23

group the share totalled no less than 94%.

With this offer, the makers of hybrid TVs change their business

model: they become portal providers and thus extend their value

chain. This builds them a lasting relationship with the end-customer,

and also makes them service providers. For product makers,

offering content is a step into unknown territory. They are faced with

the challenge of having to collaborate with a large number of content

providers and aggregators to be able to create an attractive offer for

users at an early stage. This is likely to be a major purchase

criterion for the end-user device.

21

22

23

August 4, 2011

Products seen on TV programmes may be viewed and ordered. If the ―red button‖

symbol appears on the TV screen, the viewer is able to call up a URL that leads to

a website with the respective information.

See BITKOM (2010). Hybrid-TV wird zum Senkrechtstarter. Press release, July 29,

2010. http://www.bitkom.org/de/themen/54918_64709.aspx.

However, it is interesting to note that many consumers are apparently not aware of

the additional functionality of the TV and do not use it. A BITKOM survey in mid2010 found that only 4% of the respondents said they owned a TV with hybrid

functionality; 25% of them, no less, said they planned to purchase such a TV. See

BITKOM (2010). Survey on consumer electronics, p. 13.

See BITKOM (2010). Survey on consumer electronics, p. 11.

9

85

Apps – the new hype

Apps (from ―applications‖) are small user

programs for smartphones and tablet PCs.

Content-wise, they range from media

offerings, games, tools and augmented-reality

simulations right through to healthcare

applications – there is a long list of possible

examples and it continues to show dynamic

growth. The spread of apps has gathered

pace with the market launch of the various

generations of iPhone. The Apple app store

has established itself as the market leader for

now: the 10 bn downloads and 300,000 apps

thresholds were reached in only 2 ½ years.

One caveat bears noting, however: a small

number of apps are used heavily, but there is

also a notable long tail, i.e. a sizeable number

of seldom used apps. Apart from Apple, other

app stores have also set up shop, e.g. those

of Android and Microsoft.

The advance of apps is not entirely

uncontroversial, however. For one thing, the

ecosystems of the app stores have come

under fire because they contradict the

philosophy of the open internet and with their

specific programming requirements raise

costs for providers. For another thing, apps

will probably face competition from free offers

that are to be found on the mobile internet.

Current empirical analyses show that, even on

the iPhone, browser use still accounts for a

large share of total time on the mobile

internet. One-third of all users say they use no

apps whatsoever; nearly half spend 50% of

their time with apps at most.*

* See Tomorrow Focus Media (2011). Mobile Effects – wie

geht die mobile Reise in 2011 weiter? p. 16.

Quality makes a difference

"Which functions on your mobile do you

not use because you consider the [...]

quality of a different device to be superior?"

(%)

Digital camera

40

E-mail

35

MP3 player

33

Internet

30

Videos

25

GPS

20

0

10

20

30

Source: Deloitte, 2010

40

16

For the online content providers of, say, videos, games or news,

hybrid TV is a chance to gain direct access to living rooms and thus

increase their reach. Ideally, this boosts their attractiveness for

advertisers and their revenue potential. So far, though, no mature

revenue models have taken root. For broadcasters, hybrid TV

represents both an opportunity and a risk. On the one hand, the TV

is upgraded as a means to access the media world. Going forward,

the media consumer will be able to tap directly into offers from

media providers and the internet that are complementary to TV. This

will give conventional television a shot in the arm. But, on the other

hand, there will also be increased competition for the available

online content that the media consumer will put together as desired.

Content providers will need to hold their own in the face of

intensifying competition, and offer users appealing content and

formats.

End-user devices as convergence driver: Smartphones

Like in the hybrid TV segment, end-user devices are the primary

drivers of the convergence process in the mobile internet sphere,

too. This is already obvious today with smartphones. With tablets, by

contrast, the PC makers are only just starting to ring the changes.

One thing is clear: ―The [mobile] phone market is fast becoming

24

synonymous with the smartphone market.‖ Nonetheless, the

market is still far from being in a state of stable equilibrium. The

introduction of the latest generations of iPhone has boosted the

smartphone market onto a steep trajectory. However, rival makers

are hot on the heels of the market leader, so there is bound to be a

further shifting of market shares in future. One thing that the growing

popularity of smartphones is radically changing thanks to

substitution relationships is the landscape for end-user devices.

Another is a quantum leap in terms of services.

The increasing diffusion of smartphones comes at the expense of

other end-user devices from the consumer electronics and

conventional telecommunications segments. Progress on the

integration of various technologies in one single end-user device

and improved handling concepts enable functions from a range of

devices to be integrated into the smartphone – with the quality

criterion for everyday use largely satisfactory. These include, for

example, the PDA, MP3 player, digital camera, digital camcorder

and mobile sat-nav unit. Stand-alone products that allow simple

integration with no loss of quality are showing corresponding

declines in unit sales.

— This is patently obvious taking the examples of the MP3 and the

MPEG4 player. Since turnover of these devices fell by about 11%

yoy in both 2008 and 2009, EITO estimates that the decline

probably even exceeded 20% in 2010.

— Unit sales of navigation devices pointed south in the last two

years (-15% yoy in 2010). In combination with persistent,

profound price erosion, revenues declined by a double-digit

percentage over the past few years. Owing to the trend towards

all-in-one devices, this segment is also likely to remain under

pressure. Some of the new smartphones can also be used as a

car navigation device given added software and a proper holder.

— With digital cameras, by contrast, the effect is not clear. While

sales revenues were down by 8% yoy in both 2008 and 2009,

24

10

See Fogg, Ian (2010). Mobile World Congress 2010. Smartphones are the new

phones. Forrester Research Inc.

August 4, 2011

Convergence markets: Smartphones and triple play continue to erode sector boundaries

25

there was a slight upturn of just over 1% in 2010. This is

probably due to the interplay of several developments. On the

one hand, many consumers are satisfied with the quality of

smartphone cameras. This hurts prices and unit sales in the

market segment for products of comparable quality. On the other

hand, there is a trend towards higher-quality products for

customers with more exclusive tastes (see chart 16). This is the

route camera makers are taking in efforts to at least partly offset

substitution effects in the lower market segment.

Growth market: Mobile

games

Market volume, EUR m

90

80

70

60

50

40

30

20

10

0

2005 2007 2009 2011 2013

30

25

20

15

10

5

0

Expenditure, EUR m (left)

% yoy (right)

Source: PwC, 2010

17

Mobile internet popular

Use of mobile phones in Germany for

wireless web access (2010, %)

All age groups

16-24

25-34

35-44

Landing new services

45-54

55-64

Over 65

0

10

20

30

Sources: German Federal Statistical Office,

DB Research

18

Searches, communication

and news top the list

Top ten of the offers/content regularly

used by men on smartphone

Search engines

67

E-mails/chat

59

Weather report

59

News

57

Reference material

47

Entertainment

38

Navigation, LBS

40

Social networks

33

Online shopping/

banking

33

Apps for hobbies

20

40

The increasing spread of smartphones and tablet PCs fosters

mobile internet use and the emergence of new services. 16% of

internet users in Germany surfed on a wireless basis in 2010 – and

there is a steep trend to the upside (see chart 18). Today, however,

smartphone owners still mainly use familiar applications from the

fixed internet. Besides using search engines some 60% of the men

surveyed say their primary focus is on communicating by e-mail and

calling up news or weather services (see chart 19).

However, small application programs referred to as ―apps‖ (see box,

p. 10), which are activated by an icon on the smartphone user

menu, have recently also rapidly attained popularity – particularly

with the younger generation (see chart 20). They are regarded as

drivers of convergence. All the hype today about ―smart‖ end-user

devices and the apps that can be run on them can only hint at the

new possibilities they could theoretically open, e.g. in the

entertainment segment or targeted information about so-called

location-based services (LBS). In particular, there is going to be a

rapid change in the ways many companies gain access to their

customers. At present, though, the companies are still at the

experimental stage, for apps and the high-performance mobile

internet are still too new on the market for a stable pattern of

customer usage to have become established.

Various trends are emerging. First, the companies bearing the brunt

of the digitisation process are hoping to find a new way to access

customers via mobile end-user devices who are willing and able to

pay for the new services. Second, the increasing spread of highperformance end-user devices will probably intensify the structural

29

0

60

Source: DTAG, 2010

August 4, 2011

The trend towards product upscaling will also materialise in other

branches of the economy, e.g. in the case of mobile game consoles.

For the foreseeable future, mobile games will account for the

smallest share of revenues in the video games segment; however,

with average growth of close to 20% over the next few years they

are said to have the greatest upside potential (see chart 17). Higher

bandwidths in connection with high-performance end-user devices

and a growing supply of gaming content will continue to boost their

appeal. Tablets will give the market an additional fillip due to their

larger displays. This is likely to weigh on mobile games consoles.

However, there will be further justification for their existence given

more complex games. This example also goes to show that, at least

in areas where quality differences play a big part, there will not be a

trend towards all-in-one devices, but rather towards different devices

that meet consumer demands in more varied ways. Nevertheless,

the currently rapid pace of innovation will result in a steady shifting

of market shares in the consumer electronics segment.

80

19

25

Source: gfu, BVT, GfK, Consumer Electronics Market Index Germany (CEMIX),

Jan-Dec 2010.

11

85

As always: Young people

take the lead

Use of apps, DE (%)

100%

23

80%

48

29

60%

21

40%

30

20%

24

17

7

0%

14-29 years

30-49 years

I've never heard of it

I only know it by name

I've heard of it, I am familiar with it

I already use it

20

Source: TNS Emnid Digitalbarometer, 2010

Majority do not want to

spend money on news apps

Question: How much would you spend

per month for a news app at the maximum?

(%)

Absolutely nothing

69

< EUR 1

3

EUR 1 - 2

9

EUR 2 - 3

9

EUR 3 - 4

3

EUR 4 - 5

1

> EUR 5

6

0

20

40

60

80

Basis: All respondents who use the news apps on an

iPhone

Source: IFAK, 2010

21

Video on demand: Business

booming

Revenue from digital downloads, DE,

EUR m

350

300

250

200

150

100

50

0

2008

2010

Buy

2012

2014

Rental

Source: PwC, 2010

22

change in certain sectors towards digital products. Tablets will

become established as a popular device for viewing films and

games. Third, companies are currently experimenting on how they

can better reach their customers – regardless of whether they use

apps or a browser.

— For publishers, the apps are a glimmer of hope in the battle to

make money on the content they produce, which so far they have

posted on the internet largely for free. They hope that customers

will be prepared to pay for news if they can get the latest update

at any time. However, the media groups are currently running up

against their limits since the production of applications is costly

and the app stores of the various providers have to be served

separately. Accordingly, not all (local) editions can be transported

to the various end-user devices. Besides, the users of mobile

devices also show only limited willingness to pay for service:

according to a survey conducted by the IFAK Institute, a German

economic research institute, only 30% of the respondents with an

iPhone were prepared to pay for news apps; nonetheless, 20%

would pay EUR 1-3 (see chart 21). So providers will have to

intensify their efforts to overcome the internet‘s widespread

―freebie culture‖ in the mobile context. But whether the media

groups will be able to tap a real additional source of revenue on

this basis is up in the air. 70% of the respondents stated that they

no longer used print media at all, or more seldom than before the

26

news app was installed.

— A rising number of households with broadband, the convergence

of internet and TV as well as the growing use of appealing mobile

end-user devices such as tablet PCs will boost on-demand

consumption of content (e.g. videos, music, games and books).

PwC estimates that revenues from video on demand, i.e. the

rental and sale of digital copies, are likely to rise to about EUR

300 m by 2014 (see chart 22). On the losing side in particular will

be the conventional businesses that physically sell and rent out

films on DVD (video outlets) as well as online rental businesses.

The rapid proliferation of smartphones and tablets is likely to

accelerate the trend towards a separation of content from

physical media, as in other content categories such as books and

games.

— Furthermore, numerous providers are offering customer loyalty

programmes or services via mobile devices. These include

services such as price comparisons, manufacturer information,

projections of furniture in living areas or virtual tours in hotels.

Moreover, apps are being deployed for marketing purposes or for

mobile-based direct selling. In this context, a further interesting

area is the provision of location-based services. For example,

retailers want to guide customers to their branches with the aid of

location-based services. LBS also give rise to new product offers:

travel guides may be tailored for mobile end-user devices and

linked with LBS so that tourists can call up local travel

information on such devices. In any event, a key factor for the

success of mobile services is that companies clearly define what

additional benefit is generated by the new offer (mobile use

case).

26

12

See IFAK Institut (2010) News-App-Analyzer 2010.

August 4, 2011

Convergence markets: Smartphones and triple play continue to erode sector boundaries

Apps still not a stable source of

earnings

It is virtually impossible today to assess the full extent of the

economic implications linked with the increased use of mobile

applications. As things stand today, most apps do not represent a

stable, additional source of revenue. For one thing, BITKOM

surveys found that in 2010 about 90% of the apps downloaded in

27

Germany were free of charge. The remaining 10% generated the

providers sales revenue of EUR 357 m (+88% yoy). For another

thing, uncertainty remains as to the appropriate way to price the new

service. Apps that cost money will probably become a component of

revenue portfolios in future, but perhaps at the expense of revenues

28

from other (conventional) offers.

Customers will come to expect

mobile offers

However, mobile offers may result in the medium term in the cost

efficiency of certain services and processes being increased, e.g. if

damage reports are recorded on mobile end-user devices. Besides,

sales of certain physical products and non-mobile services may

decline further if good alternatives can be offered in a mobile

context. The spectrum ranges from video rentals to travel guides

right through to game consoles. Initially, innovative companies in the

mobile services segment are likely to be able to seize advantages

over their competitors. Similar to the fixed-line online offers that for

most companies are a ―must‖ today, apps and mobile internet

access are also likely to become the new standard within a short

time. So companies will have to rise to the challenge of developing

online offers that are optimised to fit the respective access channel.

Companies face major uncertainty operating in rapidly

growing markets

Multi-technology strategies very

costly

Companies operating in converging markets face high levels of

uncertainty. In the case of many innovative products it takes time for

a dominant design to emerge. Standards are also often missing;

these still have to be developed by committees. In such a phase it

may initially make sense for companies to pursue multi-technology

strategies. However, these involve considerable expense. Multitechnology strategies are also necessary for companies

collaborating with other companies that have established their own

so-called ―ecosystems‖. The apps segment shows that service

providers develop different solutions for the respective app stores

owing to a lack of compatibility. From the standpoint of service

providers this exercise is linked with high costs and today‘s still

uncertain revenue prospects.

A further key phenomenon in convergence markets is cooperation.

In some cases, cooperative ventures cover numerous market

players and straddle traditional sector boundaries. Companies

concentrate on the parts of the value chain that dovetail with their

core competences. They collaborate so they can offer a

sophisticated product whose in-house production or development

would be prohibitively costly. Often, these cooperative ventures are

set up for only a limited period. Alternatively, some companies may

pursue acquisitions to supplement their existing expertise on a

permanent basis. Cooperative ventures can be found in the area of

hybrid TV, for instance, where inter alia content providers and

27

28

August 4, 2011

BITKOM (2011). Zahl der App-Downloads explodiert. Press information. Berlin,

February 14, 2011.

For more (in German) on revenue problems and consolidation trends in the

publishing sector see Heng, Stefan, Eric Heymann and Marion Müller (2010).

Verlage im Umbruch: Digitalisierung mischt Karten neu. Deutsche Bank Research.

Aktuelle Themen 496.

13

85

aggregators, platform operators and TV makers join forces. These

ventures result in what are known as ―value creation networks‖.

Which factors influence

convergence?

Benefit for

provider

Standards

Convergence

Benefit for

users

Obstacles to

integration (memory

capacity, power

supply, battery

performance,

complexity)

Challenges for providers and consumers alike

Environment

(Peer strategies, regulation, financing,

infrastructure etc.)

Source: DB Research, 2006

23

HbbTV – a standard for hybrid TV

HbbTV stands for ―hybrid broadcast

broadband TV‖ and is a standard for hybrid

TV which was adopted by the European

Telecommunications Standards Institute

(ETSI) in June 2010 (www.hbbtv.org). HbbTV

evolved from a pan-European initiative and is

supported by numerous companies from

various sectors, e.g. equipment

manufacturers, satellite operators, TV

broadcasters and software houses.

Hybrid broadcast broadband TV is an open

standard enabling consumption services to be

configured via the controls of a TV. The

interoperable standard allows various enduser devices to be operated in this way. The

international HbbTV consortium aims to

maintain and foster the ongoing development

of the standards.

Consumers are spoilt for choice

14

The objective of numerous cooperation strategies is to expand

supply via the addition of content or services. This enables the

provider to offer customers a package deal. Content is refinanced

either via advertising and/or by directly charging for articles or

applications. In any event, the development of an offering with a

broad reach is the prerequisite for boosting their attractiveness for

advertisers. Therefore, it is key that providers rapidly expand their

market shares in developing markets. The competition for new

custom even intensifies when ecosystems trigger lock-in effects on

the customer side, i.e. the customers show little willingness to

change provider once they have opted for a given provider.

Convergence is influenced by a complex set of factors (see chart

23). These include the potential benefits for users, sustainable

business models and the overcoming of technical obstacles to

integration. The interoperability and standardisation factors, in

particular, play a significant role in the progress of convergence.

This holds, for example, if as in the case of hybrid TV a new

standard has to be established in order to establish the supply (see

box). Furthermore, there is ongoing work in committees, as for

example in the Digital Living Network Alliance (DLNA), in which

makers of computers, mobile phones and consumer electronics

collaborate at international level in order to ensure the

interoperability of consumer electronics products from various

manufacturers.

There are huge challenges to be faced in the area of

standardisation. Even though users currently accept ecosystems

when these are offered by innovation leaders, consumer demands

for open systems are likely to become louder in the medium term.

This will probably also be driven by changes in the demands/tastes

of consumers who would like to access familiar content, such as

videos, photos or media content, via the growing number of different

(mobile and fixed-line) devices. For one thing, this will require open

industry standards for content formats and interoperable hardware

interfaces. For another, the providers of media content are

challenged to make available both content and apps that are tailored

to various end-user devices and respective use scenarios. This is

crucial not only for user acceptance and users‘ willingness to pay for

services, but also in terms of attractiveness from the viewpoint of

advertisers. Finally, cloud-based solutions are likely to become more

popular as a way of storing data, as these enable users to access

music, videos or documents in the cloud from different end-user

devices.

In this context, consumers face the challenge of having to learn their

way around an increasingly complex market. Complexity is driven

here by a great variety of products, equipment and services that

operate in differing ways, large numbers of product innovations and

the networking of devices and their applications. For example,

before smartphones can be operated it is first necessary to register

them on the internet and set up the payment method. In such a

market it is of key significance for the providers that they clearly

identify the value added in the product or service they offer. If they

have a poor service mindset or no uniform standards – which curbs

the use of the product – people may be reluctant to pay for them as

a result.

August 4, 2011

Convergence markets: Smartphones and triple play continue to erode sector boundaries

Outlook

Networked services are the future

Over the past few years there has been an increasing degree of

convergence between the information technology,

telecommunications, consumer electronics and media industries.

This convergence is being driven by the omnipresence of the

internet. Given the increasing availability of fast internet connections

– both fixed-line and mobile solutions – it is becoming increasingly

convenient to call up networked services on various web-enabled

end-user devices such as TVs, smartphones and tablet PCs.

Market shares will be reshuffled

The competition between market participants has intensified at all

levels. Thus, there is now competition between established rivals

that originally operated in different sectors and are now thrashing it

out with one another in a battle for market share, e.g. in the area of

broadband infrastructure or smartphones. In addition, the market for

end-user devices is typified by high innovation rates, with a stable

distribution of the market shares still nowhere on the horizon. This

applies not only to the market for smartphones or tablets itself.

Since the small handheld devices are mutating more and more into

all-rounders and integrating, say, MP3 players and digital cameras

without any drop in quality, makers of these standard products are

condemned to seeing their market shares dwindle. The ―losers‖ thus

need to rise to the challenge of finding strategic solutions by, for

example, upscaling their offers towards higher product quality or

sophistication. But the result could instead be a market shakeout.

Extension of value chain to include

services

The service aspect is playing an increasingly important role in the

strategies pursued by the suppliers of end-user devices and

infrastructure. Companies are seeking to gain an edge over their

competitors by extending their product offers. This holds, for

example, for triple play from a single telecommunications company

and for cable operators with a focus on TV, video (in various forms)

and the internet or for hybrid TV, which is being pushed by TV

makers. New services are also in focus in the case of smartphones

and tablet PCs: vendors are offering app stores in tandem with the

end-user device.

Create value added for customers

The rapid proliferation of smartphones and tablets, which will

probably have become a part of everyday life over the next few

years, are going to give mobile internet use and the related services

market a sizeable boost. In future, consumers are going to expect

these in addition to the fixed-line internet offers. The service

providers face the major challenge of having to hold their own in the

surge of new applications flooding the market. They have to deliver

real value added for the user and create appealing entertainment

offers in order to raise customer willingness to pay for content.

Furthermore, they will have to plan the provision of their offer via

various channels (TV, fixed-line and mobile internet) even better,

especially since consumers‘ media use is likely to be further

fragmented by the increasing number of end-user devices. Mobile

services can generate additional income, for example, in the

publishing sector – but they are surely no panacea for the sector‘s

revenue ills.

Separation of content from physical

media gathering pace

Moreover, several segments – such as travel guides – will probably

experience new competition from mobile applications. All in all, the

separation of content from physical media is poised to gather pace.

Given a rising number of households with higher bandwidth, the

convergence of the internet and television as well as the diffusion of

smartphones and tablets, on-demand consumption of music, videos,

games, news and books will continue to spread. This will weigh on

August 4, 2011

15

85

physical sales and rental businesses. Thus, structural change in the

services segment will be given additional impetus.

Antje Stobbe (+49 69 910-31847, antje.stobbe@db.com)

© Copyright 2011. Deutsche Bank AG, DB Research, D-60262 Frankfurt am Main, Germany. All rights reserved. When quoting please cite ―Deutsche Bank

Research‖.

The above information does not constitute the provision of investment, legal or tax advice. Any views expressed reflect the current views of the author, which do

not necessarily correspond to the opinions of Deutsche Bank AG or its affiliates. Opinions expressed may change without notice. Opinions expressed may differ

from views set out in other documents, including research, published by Deutsche Bank. The above information is provided for informational purposes only and

without any obligation, whether contractual or otherwise. No warranty or representation is made as to the correctness, completeness and accuracy of the

information given or the assessments made.

In Germany this information is approved and/or communicated by Deutsche Bank AG Frankfurt, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht.

In the United Kingdom this information is approved and/or communicated by Deutsche Bank AG London, a member of the London Stock Exchange regulated by

the Financial Services Authority for the conduct of investment business in the UK. This information is distributed in Hong Kong by Deutsche Bank AG, Hong

Kong Branch, in Korea by Deutsche Securities Korea Co. and in Singapore by Deutsche Bank AG, Singapore Branch. In Japan this information is approved

and/or distributed by Deutsche Securities Limited, Tokyo Branch. In Australia, retail clients should obtain a copy of a Product Disclosure Statement (PDS)

relating to any financial product referred to in this report and consider the PDS before making any decision about whether to acquire the product.

Printed by: HST Offsetdruck Schadt & Tetzlaff GbR, Dieburg

ISSN Print: 1619-3245 / Internet ISSN: 1619-3253 / E-Mail: ISSN 1619-4756

16

August 4, 2011