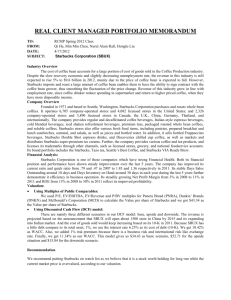

Form 10-K/A Starbucks Corporation - Corporate-ir

advertisement