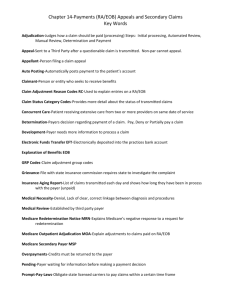

Accounts Receivable (A/R) Management

advertisement