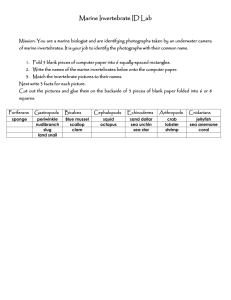

Marine Sector Profile April 2013

advertisement