FATWA

IN ISLAMIC

FINANCE

/// // // ////// / / / / / / / / / / / / ////////////////////////// / / / / / / / / / / / / / / / / / / / / / /

A SNAPSHOT OF TAWARRUQ IN

CONTEMPORARY ISLAMIC FINANCE*

IBRAHEEM MUSA TIJANI**– The emergence of tawarruq in

modern Islamic financial institutions (IFIs) goes back to the year

1421 Heejra/2000 AD in the Kingdom of Saudi Arabia from the

Saudi British banks and later AlJazira Bank in 2002. It was later

practiced by banks in the Gulf region and other IFIs. Tawarruq,

also referred to as commodity murabahah or monetization, has

gain popularity in the IFIs; it has been widely used to structure

various financial products and liquidity management instruments,

such as attracting deposits, financing and structuring government and corporate sukuk. This is due to its ease of execution

and wide acceptability among IFIs and banks. However due to

the ever growing controversies and some disapproval of the

tawarruq concept, some IFIs have become reluctant to use this

structure. Although classical tawarruq is accepted by most Islamic scholars as a genuine Islamic contract, organized tawarruq

on the other hand have gained serious criticisms to the extent

that the OIC Fiqh academy in its 2009 resolution have deemed

it impermissible (haram), see appendix.

WHAT IS TAWARRUQ?

Tawarruq, linguistically, is derived from the term warq or wariq

or waraqa, which basically denotes minted silver (coin). This

word has no direct trace in the Arabic language, as mentioned

by Arab linguist. Tawarruq was used by early generations to

mean a request for silver coin (dirham). A great example of this

was the statement of Ali, Prophet Muhammad’s son in law and

the fourth Caliph, that: “I would not abandon hajj (pilgrimage)

even if I had to do it through tawarruq” (Aleshaikh, et al., 2011).

The term was also used in the Quran, Allah says “So, send one

of you with this waraq (silver coin) of yours to the town, and let

him find which food is purest and let him bring you provision

from it.” (Surah al-Kahf: 19)

As for the technical meaning, the OIC Fiqh Academy defines

tawarruq as: “a person (mustawriq) who buys a merchandise

at a deferred price, in order to sell it in cash at a lower price.

Usually, he sells the merchandise to a third party, with the aim

to obtain cash.” To add clarity to this meaning the Islamic Fiqh

Academy of Muslim World League defined tawarruq as: a

contract to purchase a commodity from a seller on terms of

spot delivery and deferred settlement and then the buyer sells

the same commodity to a third party other than the original

seller on terms of spot deliver and spot settlements. The

AAOIFI Shariah standard, summing this up, defined tawarruq

as: “the purchase of a commodity (i.e. subject matter of

Monthly Publication - September 2013 Edition

tawarruq) on deferred payment basis by way of either direct

sale or murabahah. The commodity is then sold for cash to a

party other than the original sellers.” The Fiqh Encyclopaedia

of Kuwait gave a concise definition of tawarruq as: “buying a

commodity with deferred payment and selling it to a person

other than the buyer for a lower price with immediate payment.”

TYPES OF TAWARRUQ

Al-Tawarruq al-Fardi (Tawarruq on an individual basis,

or better known as classical tawarruq):

The OIC Fiqh Academy defined it as: “the purchase of

a commodity possessed and owned by a seller on a deferred

payment basis, whereupon the buyer then resell the commodity

for cash to other than the original seller in

order to acquire cash (al-wariq).”

Al-Tawarruq al-Munazzam (Organized Tawarruq): The

OIC Fiqh Academy defined it as: “when a person (mustawriq)/

[mutawarriq] buys a merchandise from a local or international

market on deferred price basis. The financier arranges the sale

agreement either himself or through his agent. Simultaneously,

the mutawarriq and the financier execute the transactions,

usually at a lower spot price.”

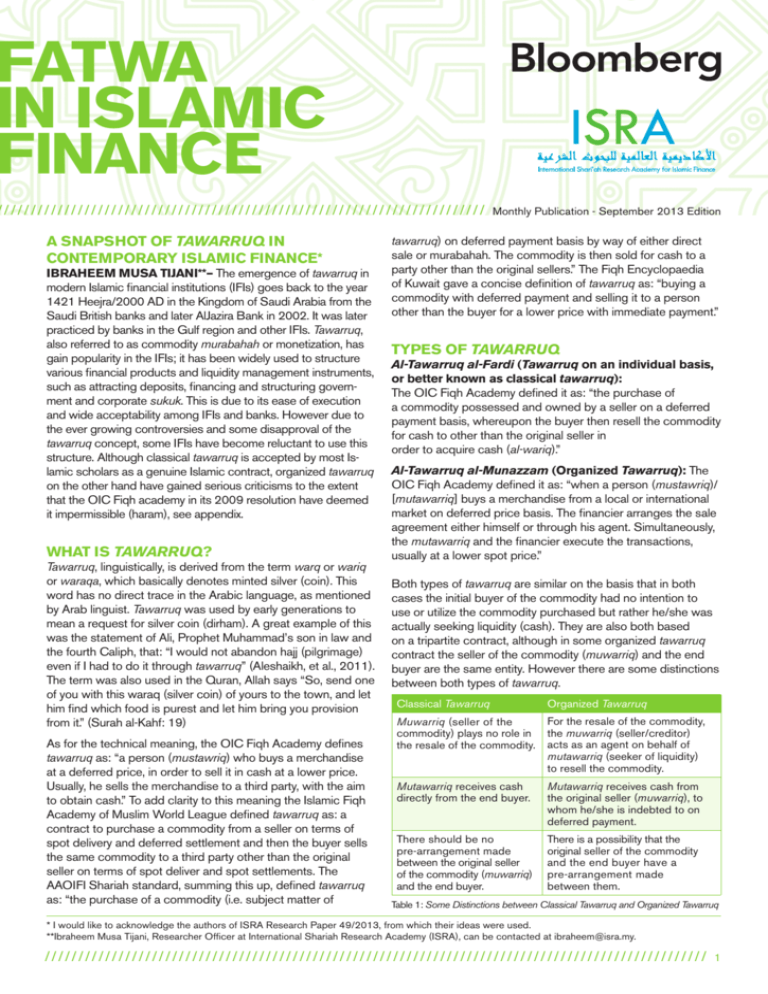

Both types of tawarruq are similar on the basis that in both

cases the initial buyer of the commodity had no intention to

use or utilize the commodity purchased but rather he/she was

actually seeking liquidity (cash). They are also both based

on a tripartite contract, although in some organized tawarruq

contract the seller of the commodity (muwarriq) and the end

buyer are the same entity. However there are some distinctions

between both types of tawarruq.

Classical Tawarruq

Organized Tawarruq

Muwarriq (seller of the

commodity) plays no role in

the resale of the commodity.

For the resale of the commodity,

the muwarriq (seller/creditor)

acts as an agent on behalf of

mutawarriq (seeker of liquidity)

to resell the commodity.

Mutawarriq receives cash

directly from the end buyer.

Mutawarriq receives cash from

the original seller (muwarriq), to

whom he/she is indebted to on

deferred payment.

There should be no

pre-arrangement made

between the original seller

of the commodity (muwarriq)

and the end buyer.

There is a possibility that the

original seller of the commodity

and the end buyer have a

pre-arrangement made

between them.

Table 1: Some Distinctions between Classical Tawarruq and Organized Tawarruq

* I would like to acknowledge the authors of ISRA Research Paper 49/2013, from which their ideas were used.

**Ibraheem Musa Tijani, Researcher Officer at International Shariah Research Academy (ISRA), can be contacted at ibraheem@isra.my.

////// / / / / / / / / / / / / ///////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

1

FATWA IN

ISLAMIC FINANCE

/// / // /////// / / / / / / / / / / / ////////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

Al-Tawarruq Al-Masrafi (Banking Tawarruq):

Banking tawarruq, although consider as a form of organized

tawarruq by Muslim jurist, is a process where the IFIs

formally organize the sale of a commodity (other than gold

or silver) between an international commodity market or

other market and mutawarriq, for a delayed payment on a

binding condition that may be stipulated in the contract or

the custom and norms guiding such a commodity. The IFIs, for

example, will represent the mutawarriq in selling it to another

buyer for cash, where upon the bank will deliver its payment

to the mutawarriq (Bouheraoua, 2009).

Reverse Tawarruq: it is similar to organized tawarruq,

but in this case, the mutawarriq (seeker of liquidity) is the

financial institution, and it acts as a client seeking liquidity.

PARTIES INVOLVE IN A

TAWARRUQ TRANSACTION

In a legitimate and bone fide tawarruq contract, i.e. tawarruq

fardi, there are three parties involve. There is the buyer

(mutawarriq); this is the party that is seeking liquidity, and

therefore advances his/ her request to an individual or a

financial institution, who plays the role of a seller or creditor

(muwarriq). The muwarriq thereby sells the commodity to

the mutawarriq on deferred payment basis. The mutawarriq,

having possession of the commodity, sells the commodity on

spot value to another party, i.e. the third party, other than the

muwarriq to obtain cash; which was the original intention of

the mutawarriq.

Deposit

Commodity murabahah deposit facility

and placement

Financing

Personal financing, asset financing,

cash line facility, contract financing,

commodity murabahah financing,

education financing, revolving credit

facility, working capital financing, home

financing, project financing facilities

Liquidity

Management

and Debt

Restructuring

BNM Islamic accepted bills (IABs),

islamic private debt securities (IPDSs),

interbank commodity murabahah.

Government and

Corporate Sukuk

Financing

Sukuk ijarah, sukuk murabahah

Risk

Managemen

and Hedging Purposes

Ijarah rental swaps, Islamic crosscurrency swap, Islamic profit-rate swap

September, 2013 Edition

Modes of Classical Tawarruq

1. An individual in need of cash, however finds no one that

would lend it to him. Therefore he/she purchases a good

on credit to be paid on deferred basis and sells the good to

another person at spot price, hence obtaining cash.

2. An individual in need of cash and made a request to a

merchant. The merchant however has no cash to lend

but offers to sell him a commodity on deferred basis. The

buyer then sells the good in the market for cash value.

Some Modes of Organized Tawarruq:

1. At the request of the mutawarriq (individual seeking

liquidity), the bank purchases local or international

commodities for cash and sells them to the mutawarriq,

after which the bank, acting as an agent of the mutawarriq,

sells the commodity to a third party and the liquidity value

is credited to the mutawarriq’s account. In most cases

the commodities never move from their original place and

the third party is usually the original seller; in this case

the bank. This is the most popular method of organized

tawarruq in the banking application of tawarruq for

personal financing. An example of this mode can be

seen in figure 1 below.

2. Cash is deposited in foreign banks, which are then

delegated to purchase commodities in cash on the

international market. They then sell the commodities

[on behalf of the mutawarriq] to themselves with

payment delayed to a certain period at an increased price

commensurate with the interest rate. Those commodities

will then be resold in the international market in order to

restore the deposit to its liquidated form a second time.

The IFIs normally rely on this mode as a means to utilize

liquidity in their possession.

3. Leased Asset Sukuk: It consists of the sale of a certain

property/asset to the public at a fixed price, then leasing

the same property from them on the condition that they

will be resold to the first seller (the issuing entity) at the

original purchase price, either through deferred payment

or spot payment. The sukuk holder would profit from both

sales.

4. The client signs an initial pre-agreement with the bank

authorizing it to undertake tawarruq transaction on his/her

account whenever the balance reaches a certain amount,

whether on the credit card account or current account.

The procedure of tawarruq is conducted in order to

achieve a monetary increase from the Islamic bank to

his/her account’s deficit. (Bouheraoua, 2009)

Table 2: Some Common Islamic Finance Instruments Based on Tawarruq;

Source: Adapted from Islamic Financial System: Principles and

Operations (2012)

////// / / / / / / / / / / / / ///////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

2

FATWA IN

ISLAMIC FINANCE

/// / // /////// / / / / / / / / / / / ////////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

BROKER

2

7

5

BANK

ISLAM

6

4

3

CUSTOMER

2

1

BROKER

1

September, 2013 Edition

Step by Step Process Flow of the Tawarruq Structure

1 The customer applies

4 Under the Wakalah

financing product based

contract, customer

on Tawarruq concept

requests Bank to sell the

from the Bank. Bank

commodity in the market.

obtains Tawarruq

5 Acting as the appointed

transaction documents

sale agent for the

from the customer.

customer, Bank sells the

2 Bank will buy the

commodity to Broker 2.

commodity at London

6 Bank then credits the

Metal Exchange (LME)

Wariq (proceed) from the

through Broker 1.

sale of commodity to the

3 Under the Murabahah

customer’s account.

contract, Bank then sells

7 Finally, customer pays

the commodity to the

amount due to the

customer at Bank’

Bank (Principal + Profit)

Selling Price (Principle

by way of agreed

+ Profit) on deferred

installment method.

payment term.

Figure 1: Tawarruq Structure Diagram of Bank Islam

Source: Bank Islam (2009) (http://www.bankislam.com.my

Regarding

Commodities

(subject matter

of the sale)

The commodity is the subject matter that is purchased and resold, therefore it must meet all the Shariah requirement of

valuable items that can be sold and purchase. The major concern for most Islamic scholars about the use of commodities

in a tawarruq transaction is that in most cases the same commodities are sold and resold without ever leaving its place

of origin. Furthermore, that banks do not check or inspect the commodities, to ensure that these commodities are

Shari’ah compliant.

Regarding

Possession

and Delivery

The inherent nature of a sale contract is that ownership of the asset/commodity must be transfered from the seller

to the buyer. Therefore, it is essential that the buyer accepts the commodity, and granted unrestricted access to

the commodity. However in the case of organized tawarruq, the senario is that the commodities are most often not

intended to be delivered to the customer. In some cases, the documents are embedded with clauses that state,

whether explicitly or implicity, that the customer has no right to take delivery.

Regarding

AAOIFI have stated in its Standard No. 30, Article 4/5 that: “The commodity (object of tawarruq) must be sold to a party

Pre-arrangment other than the one from whom it was purchased on a deferred-payment basis (third party), so as to avoid inah, which is

strictly prohibited. Moreover, the commodity should not return back to the seller by virtue of prior agreement or collusion

between the two parties, or according to tradition.” This standard clearly and explicitly shows that pre-arrangement between

financial institutions in tawarruq contract are contrary to the Shariah principles. This criterion is to ensure that the commodity is

physically transferred from the original seller to the purchasing party, after which is then resold to the end party, other than

the original seller, to avoid inah as mentioned above.

Regarding

Agency

AAOIFI in its Parameters on Tawarruq transaction, article 4/7 to 4/10 (2010) states the following requirements:

4/7 The client should not delegate the institution or its agent to sell on his behalf a commodity that he purchased from

the same institution and similarly, the institution should not accept such a delegation.

4/8 The institution should not arrange a proxy of a third party to sell the commodity on behalf of the client that

purchased it from the institution.

4/9 The client should not sell the commodity except by himself or through an agent other than the institution, and

should duly observe the other regulations.

4/10 The institution should provide the client with the information that he or his appointed agent may need in order to

sell the commodity.

There is no doubt that organized tawarruq, as it has been practiced in some IFIs, is in contradiction to these parameters.

Table 3: Tawarruq Shariah issues in bank’s Application of Organized Tawarruq

////// / / / / / / / / / / / / ///////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

3

FATWA IN

ISLAMIC FINANCE

/// / // /////// / / / / / / / / / / / ////////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

CONCLUSION

Although the OIC Fiqh Academy in its 2009 resolution

deemed organized tawarruq as impermissible, contemporary

banks still persist in the usage of this structure for deposit and

personal financing. This might also be seen on the basis that

AAOIFI in its Shariah Standard 30 (2010) permits tawarruq

provided that it’s according to the guidelines and parameters;

however as showed above, the current application of tawarruq

in IFIs do not comply with all these parameters (see appendix

for the full list of the parameters). Considering that tawarruq

is a means for customers to attain cash and for banks for

fulfil their liquidity needs, then it’s far fetch that the IFIs would

move away from this structure anytime soon. The banning of

the OIC Fiqh Academy of tawarruq was to encourage the

Islamic banking and financial institutions to adopt a better

investment and financing technique that will help enhance the

socio-economic objective of the Shariah (maqasid Shariah),

and to encourage them to provide qard hasan (benevolent

loans) instead of relying on tawarruq. There have been many

proposals for the industry to move away from these types

of debt-based structure toward equity participation and

asset-based financing. On the positive side, some IFIs have

become reluctant to use tawarruq after the resolution of the

Fiqh Academy and have chosen some other alternatives such

wakalah al-istismar (investment agency), sukuk al-ijara and

sukuk al-istismar.

APPENDIX

OIC Fiqh Academy Ruled Organized Tawarruq Impermissible

in 2009*

Resolution 179 (19/5) in relation to

Tawarruq: its meaning and types (classical applications

and organized Tawarruq) The International Council of Fiqh

Academy, which is an initiative of the Organization of Islamic

Conferences (OIC), in its 19th session which was held in

Sharjah, United Arab Emirates, from 1 - 5 of Jamadil Ula

1430 AH, corresponding to 26 – 30 April 2009, decided

on the following:

September, 2013 Edition

Having reviewed the research papers that were presented

to the Council regarding the topic of Tawarruq, its meaning

and its type (classical applications and organized Tawarruq), a resolution was passed. Furthermore, after listening

to the discussions that revolved about the applications of

Tawarruq, the resolutions were presented at the International

Council of Fiqh Academy, under auspices of the Muslim

World League in Makkah.

The following were the resolutions:

First: definition of both classical and organized Tawarruq.

Second: It is not permissible to execute both Tawarruq

(organised and reversed) because simultaneous transactions occurs between the financier and the mustawriq,

whether it is done explicitly or implicitly or based on common

practice, in exchange for a financial obligation. This is

considered a deception, i.e., in order to get the additional

quick cash from the contract. Hence, the transaction is

considered as containing the element of riba.

The recommendation is as follows:

To ensure that islamic banking and financial institutions

adopt investment and financing techniques that are

Shari’ah-compliant in all its activities, they should avoid all

dubious and prohibited financial techniques, in order to

conform to Shari’ah rules and so that the techniques will

ensure the actualization of the Shari’ah objectives (maqasid

Shari’ah). Furthermore, it will also ensure that the progress

and actualization of the socioeconomic objectives of the

Muslim world. If the current situation is not rectified, the

Muslim world would continue to face serious challenges and

economic imbalances that will never end. To encourage the

financial institutions to provide Qard Hasan (benevolent

loans) to needy customers in order to discourage them from

relying on Tawarruq instead of Qard Hasan. Again these

institutions are encouraged to set up special Qard Hasan Fund.

*OIC Resolution translated by Riaz Ansari, Researcher at the International Shari’ah Research Academy for Islamic Finance (ISRA), Kuala Lumpur,

Malaysia.

////// / / / / / / / / / / / / ///////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

4

FATWA IN

ISLAMIC FINANCE

/// / // /////// / / / / / / / / / / / ////////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

AAOIFI’s Shari’ah Parameters in the Application

of Tawarruq

The Accounting and Auditing Organization for Islamic

Financial Institutions (AAOIFI) in its Shari’ah Standards

No. 30 outlines several parameters to ensure the genuine

application of tawarrruq. Some salient conditions are

as follows:

4/1 T

he requirements of the contract for purchasing

the commodity on a deferred basis should be

completely fulfilled.

4/2 T

he commodity sold should be well identified so as

to become distinct from the other assets of the seller.

4/3 If the commodity is not made available at the time of

signing the contract, the client should be given a full

description or a sample that indicates the quantity of

the commodity and the place of the storage.

4/4 T

he commodity should be actually or impliedly

received by the buyer and there remains no

further condition or procedure for receiving it.

4/5 T

he commodity should be sold to a party other than

the one from whom it was purchased on deferred

payment basis so as to avoid inah.

4/6 T

he contract for purchasing a commodity on a

deferred payment basis and the contract for selling

it for a spot price should be linked together in such

a way that the client loses his right to receive the

commodity. Such a linkage between the two contracts

is prohibited whether it is stipulated in the documents

or regarded as a normal tradition or incorporated in

the procedures.

September, 2013 Edition

4/8 The institution should not arrange a proxy of a third

party to sell the commodity on behalf of the client that

purchased it from the institution.

4/9 The client should not sell the commodity except by

himself or through an agent other than the institution,

and should duly observe the other regulations.

4/10 The institution should provide the client with the

information that he or his appointed agent may

need in order to sell the commodity.

5/1 M

onetisation is not a mode of investment or financing. It

has only been permitted when there is a need for it and

subject to specific terms and conditions. Therefore, the

institutions should not use monetisation as a means of

mobilising liquidity for their operations, instead, it should

exert effort for fund mobilisation through other modes

such as mudarabah, investment proxy, sukuk, investment

funds, and the like. The institution should resort to

monetisation only when it faces the danger of a liquidity

shortage that could interrupt the flow of its operations

and cause losses for its clients.

5/2 The institutions should avoid the use of proxy in selling

the monetisation commodity, even if the proxy is to be

arranged with a third party. In other words, institutions

should use their own personnel for selling the

monetisation commodity, though using brokers for

this purpose is permissible.

Source: AAOIFI Shari’ah Standards for Islamic Financial Institutions (2010).

For more information, please mail nimap@bloomberg.net.

4/7 The

client should not delegate the institution or

its agent to sell on his behalf a commodity that he

purchased from the same institution and similarly,

the institution should not accept such a delegation.

If, however, the regulations do not permit the client

to sell the commodity except through the same institution,

he may delegate the institution to do so after he might

have actually or impliedly received the commodity.

Disclaimer: The views expressed in this bulletin does not necessarily reflect those of International Shariah Research Academy for Islamic Finance (ISRA) and Bloomberg

or its editors. Bloomberg and International Shariah Research Academy for Islamic Finance (ISRA) are not liable for errors or any consequences arising from the use of

information contained in this bulletin. No information or opinion expressed herein constitutes a solicitation of the purchase or sale of securities or commodities.

////// / / / / / / / / / / / / ///////////////////////// / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / / /

5

©2013 Bloomberg Finance L.P. All rights reserved. 55300422 0913