New Hampshire - Nuclear Electric Insurance Limited

advertisement

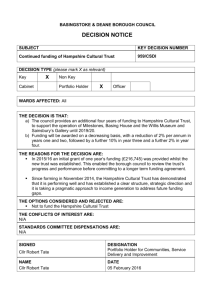

December 2006 THIS STATE LAW SURVEY IS BEING PROVIDED TO INSUREDS OF NUCLEAR ELECTRIC INSURANCE LIMITED FOR INFORMATIONAL USE ONLY AND NOT AS LEGAL ADVICE, OR AS AN OPINION OF LAW. IT IS SIMPLY AN INDICATION OF WHAT GENERAL RESEARCH SUGGESTS IS THE RELEVANT LAW. NO PARTY SHOULD RELY ON THE FOLLOWING INFORMATION IN MAKING DECISIONS AS TO LEGAL ISSUES. NEW HAMPSHIRE Page Insurance Authorization Status .............................................................................................. 1 Contract Enforceability by Unauthorized Insurers ................................................................ 1 Enforceability of Arbitration Provisions................................................................................ 2 Enforceability of Choice of Law Provisions.......................................................................... 2 Enforceability of Choice of Forum Provisions ...................................................................... 3 Cancellation of an Insurance Contract .................................................................................. 3 Waiver of Statutory Rights .................................................................................................... 3 Insurance Authorization Status In New Hampshire, a foreign or alien insurance company shall not “do insurance business” within New Hampshire unless it has obtained a license from the Insurance Commissioner. N.H. REV. STAT. ANN. § 405:1. The unauthorized insurance provisions do not apply to any insurance company issuing contracts of insurance to industrial insureds, and any contract of insurance issued to any one or more industrial insureds are exempt from the definition of “doing an insurance business.” N.H. REV. STAT. ANN. § 406-B:16, VI. An “industrial insured” is: (1) An insured who procures the insurance of any risk or risks other than life and annuity contracts by use of the services of a full time employee acting as an insurance manager or buyer or the services of a regularly and continuously retained qualified insurance consultant; and (2) An insured whose aggregate annual premiums for insurance on all risks total at least $15,000; and (3) An insured having at least 25 full time employees. N.H. REV. STAT. ANN. § 406B:16, VI. All “industrial insureds” must pay to the commissioner of insurance before March 1 of the succeeding the calendar year in which the insurance was so effectuated, continued, or renewed a premium receipts tax of 3 percent of the gross premiums charged for such insurance. Id. The unauthorized insurance provisions also do not apply to “[t]ransactions involving contracts of insurance independently procured through negotiations occurring entirely outside of [New Hampshire] which are reported and on which premium tax is paid in accordance with RSA 406-B:17.” 1 N.H. REV. STAT. ANN. § 406-B:16, IV. Contract Enforceability by Unauthorized Insurers Contracts of insurance that are entered into by an unauthorized insurer are valid insurance contracts. N.H. REV. STAT. ANN. § 406-B:8, II (“the failure of any insurer transacting insurance business in this state to obtain a certificate of authority shall not impair the validity of any act or contract of such insurer and shall not prevent such insurer from defending any action at law or suit in equity in any court”). However, before an unauthorized insurer may defend any action, the unauthorized insurer December 2006 THIS STATE LAW SURVEY IS BEING PROVIDED TO INSUREDS OF NUCLEAR ELECTRIC INSURANCE LIMITED FOR INFORMATIONAL USE ONLY AND NOT AS LEGAL ADVICE, OR AS AN OPINION OF LAW. IT IS SIMPLY AN INDICATION OF WHAT GENERAL RESEARCH SUGGESTS IS THE RELEVANT LAW. NO PARTY SHOULD RELY ON THE FOLLOWING INFORMATION IN MAKING DECISIONS AS TO LEGAL ISSUES. must satisfy a pre-answer security requirement by filing a bond sufficient to secure payment of any final judgment or obtaining a certificate of authority. N.H. REV. STAT. ANN. § 406-B:6, I. As set forth above in the “Insurance Authorization Status” section, however, an out-of-state insurer that issues policies to industrial insureds, or which issues policies that are independently procured through negotiations occurring entirely outside of New Hampshire is not required to procure a license. 1 decision). See, e.g., Aetna Life & Cas. Co. v. Martin, 134 N.H. 90, 93, 588 A.2d 813, 81415 (1991) (applying arbitration provisions of uninsured motorist coverage section of automobile policy and commenting that “the jurisdiction of arbitrators over the parties and the subject matter depends entirely upon the voluntary agreement of the parties”). Enforceability of Choice of Law Provisions New Hampshire has no statutory provision which would prevent the enforcement of a valid choice of law provision in commercial insurance contracts, nor have the New Hampshire courts directly addressed the issue in the context of commercial insurance policies. The New Hampshire Supreme Court, in the context of uninsured motorist claims under automobile insurance policies, has held that New Hampshire will apply the Restatement (Second) of Conflicts of Laws approach to determine which state’s law will govern the interpretation of an insurance contract. Glowski v. Allstate Ins. Co., 134 N.H. 196, 198, 589 A.2d 593, 595 (1991); Cecere v. Aetna Ins. Co. 145 N.H. 660, 766 A.2d 696 (N.H. 2001). In each of these cases the courts have held that the Restatement’s “most significant relationship” test will be applied only “in the absence of an express choice of law by the parties.” Stevens v. Merchants Mut. Ins. Co., 135 N.H. 26, 28, 599 A.2d 490, 491 (1991). In Cecere, the New Hampshire Supreme Court, in citing Glowski, provided that this general rule articulates “the fundamental contract policy of giving effect to the intention of the parties and their reasonable justified expectations.” 766 A.2d at 98 (citations omitted). Enforceability of Arbitration Provisions The New Hampshire arbitration code favors arbitration. N.H. REV. STAT. ANN. § 542:1 (a provision in any written contract to settle by arbitration a controversy thereafter arising out of such contract, or an agreement in writing to submit to arbitration any controversy existing at the time of the agreement to submit, shall be valid, irrevocable and enforceable, save upon such grounds as exist at law or in equity for the revocation of any contract). While New Hampshire courts have not addressed the issue, arbitration provisions in commercial insurance contracts should be enforced. New Hampshire courts accept the basic tenet that “the purpose of arbitration is to obtain a speedy and inexpensive resolution of a dispute before the arbitrators of the parties’ choice, thereby foregoing the ordinary process of the law.” Demers Nursing Home, Inc. v. R.C. Foss & Son, Inc., 122 N.H. 757, 761, 449 A.2d 1231, 1233 (1982) (enforcing arbitration provision in construction contract and focusing on the intent of the parties when reaching this -2- December 2006 THIS STATE LAW SURVEY IS BEING PROVIDED TO INSUREDS OF NUCLEAR ELECTRIC INSURANCE LIMITED FOR INFORMATIONAL USE ONLY AND NOT AS LEGAL ADVICE, OR AS AN OPINION OF LAW. IT IS SIMPLY AN INDICATION OF WHAT GENERAL RESEARCH SUGGESTS IS THE RELEVANT LAW. NO PARTY SHOULD RELY ON THE FOLLOWING INFORMATION IN MAKING DECISIONS AS TO LEGAL ISSUES. Enforceability Provisions of Choice of V. It would for some other reason be unfair or unreasonable to enforce the agreement. Forum Under New Hampshire law, choice of forum provisions are enforceable “if the contract bears any significant relationship to that jurisdiction.” Hobin v. Coldwell Banker Residential Affiliates, Inc., 744 A.2d 1134, 1137 (N.H. 2000) (upholding a forum selection clause in a franchise agreement) (citation omitted). New Hampshire has enacted the “Uniform Model Choice of Forum Act” as Chapter 508-A of the New Hampshire Statutes Annotated. Under this Act, N.H. REV. STAT. ANN. § 508-A:3. See Ford Const. Co. v. TWG Const. Co., Inc., 2004 WL 585629 (N.H. Super. Slip Op. 2/10/04) (Case brought in New Hampshire dismissed due to contract clause identifying a New York county as forum). Cancellation of an Insurance Contract Chapter 417-B of the New Hampshire insurance code governs “Cancellation, Refusal to Write, Refusal to Renew Certain Property and Liability Insurance.” N.H. REV. STAT. ANN. § 417-B:1 et seq. This chapter does not apply to insurance policies that are “primarily insuring risks arising from the conduct of a commercial or industrial enterprise.” N.H. REV. STAT. ANN. § 417B:1, III. Moreover, the substantive provisions of the chapter only apply to insurers who are “authorized to issue policies of insurance in the state of New Hampshire.” N.H. REV. STAT. ANN. § 417-B:8. Accordingly, policies issued by an unauthorized insurer to industrial insureds or which are independently procured with respect to a commercial enterprise are not subject to the notice and cancellation provisions set forth in Chapter 417-B. “if the parties have agreed in writing that an action on a controversy shall be brought only in another state and it is brought in a court of this state, the court will dismiss or stay the action . . . unless: I. The court is required by statute to entertain the action; II. The plaintiff cannot secure effective relief in another state. . . . III. The other state would be substantially less convenient place for the trial . . . IV. The agreement as to the place of the action was obtained by misrepresentation, duress, the abuse of economic power, or other unconscionable means; or Waiver of Statutory Rights The New Hampshire courts have not considered the question of statutory waiver in the context of civil proceedings. -3- December 2006 THIS STATE LAW SURVEY IS BEING PROVIDED TO INSUREDS OF NUCLEAR ELECTRIC INSURANCE LIMITED FOR INFORMATIONAL USE ONLY AND NOT AS LEGAL ADVICE, OR AS AN OPINION OF LAW. IT IS SIMPLY AN INDICATION OF WHAT GENERAL RESEARCH SUGGESTS IS THE RELEVANT LAW. NO PARTY SHOULD RELY ON THE FOLLOWING INFORMATION IN MAKING DECISIONS AS TO LEGAL ISSUES. ENDNOTES 1 In light of the exemptions in § 406-B:16, an insurer that issues policies to an industrial insured is not subject to the pre-answer security provision. According to the statute, transactions involving industrial insureds are exempt from the unauthorized insurance provisions of Chapter 406B. N.H. REV. STAT. ANN. § 406-B:16. The pre-answer security requirement in § 406-B:6 would appear to be an unauthorized provision under Chapter 406B. -4-