A Smarter Approach to the Alternative Minimum Tax Limitation

advertisement

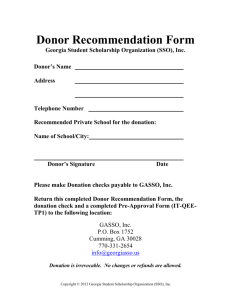

A Smarter Approach to the Alternative Minimum Tax Limitation A Case Study in Utilizing Investment Tax Credit Carrybacks Alternative Minimum Tax (AMT) is a feature of the Income Tax Act designed to ensure that all taxpayers remit a minimum amount of tax relative to income in any one year, even though they may have participated in tax incentive transactions such as Flow Through Share subscriptions which would otherwise reduce taxable income to nil. As a result, individuals who accumulate a large amount of tax preferential items may not be able to utilize them to the fullest extent in the year they were acquired since the individual may be subject to AMT. Consider a donor who wishes to substantially increase their annual pledge using PearTree’s Flow Through Donation service, but does not have sufficient income to make us of all of the tax benefits in the year of participation. Since Canadian/Québec Exploration Expenses can be carried forward indefinitely, and Mineral Exploration Investment Tax Credits (ITCs) carried forward 10 years, the donor could apply these tax incentives to the fullest extent in the current taxation year without incurring AMT, with the unused balances carried forward for use in future taxation years. However, the AMT approach is more nuanced in that a donor does not have to wait until future taxation years to realize the unused ITC benefits. By way of explanation, the Federal ITC (15% of the subscription amount net of any Provincial ITC entitlement) can be carried back up to three years to recoup income taxes previously paid. Provincial non‐refundable investment tax credits in each of British Columbia (20%) and Manitoba (30%) can also be carried back up to 3 years (note: the 5% Ontario ITC has no carry provision since it is refundable). The ITCs must first be applied to the fullest extent in the current taxation year to determine the amount available for carryback. The request for ITC carryback is submitted to tax authorities as part of the donor’s current year T1/TP1 income tax return. The financial analyses that follow illustrate how a donor can substantially increase their annual pledge while: i) utilizing carrybacks to accelerate unused ITC benefits; ii) redirecting tax payable to their choice charity; and iii) realizing tax savings relative to a straight cash donation. PLEASE NOTE: the case study is based on a hypothetical donor profile, and will not mirror individual donor tax circumstances. PearTree donors are sophisticated and successful in their business and their professions, and with that success often comes complex tax circumstances. All our clients have tax advisors who should be consulted prior to participation to determine if their tax circumstances limit or potentially enhance the benefits and costs set out in this case study. Please also note that the case study uses 2011 basic personal amounts and tax brackets, both of which will increase for the 2012 taxation year by an indexation factor. Donor Profile Single Individual Taxpayor 100% Employment Income ‐ $400,000 per annum Annual RRSP contribution of $22,950 Québec Individual Donor Donor Scenarios: 1) Cash donation of $25,000 in the current taxation year 2) PearTree donation of $50,000 in the current taxation year* * Note that in this instance, the donation receipt will be greater than $50,000 since the donor acquires flow through shares which are donated to and sold by the charity sufficient to net the charity the pledged amount plus sufficient funds to pay fees billed to the charity. Income Tax Summary Salary Income Scenario 1 Scenario 2 $400,000 $400,000 ‐ $135,265 ‐ $135,265 ‐ $135,265 B x 150% = C ‐ $202,897 D ‐ $119,000 A Flow Through Share Purchase Canadian Exploration Expenses (CEE) Available B CEE Used in Current Year Québec Exploration Expenses (QEE) Available QEE Used in Current Year Donations Claimed $25,000 $60,469 Federal Investment Tax Credit (ITC) Claimed in Current Year E ‐ $14,099 Federal ITC Carried Back to Recover Taxes Previously Paid F ‐ $6,191 Federal Income Tax Payable $75,390 $29,215 Provincial Income Tax Payable $78,116 $41,193 $153,506 $70,408 E + F = H ‐ $20,290 24.22% x H = I ‐ $4,914 Total Income Tax Payable in Current Year Federal ITC Income Inclusion in Following Year Income Tax Payable on ITC Inclusion in Following Year Total Income Tax Payable G G + I Federal/Provincial Alternative Minimum Tax (AMT) $153,506 NIL $75,322 NIL Cash Flow Summary Cash Donation ($25,000) Flow Through Share Purcahse ‐ ($135,265) Proceeds of Sale of Excess Shares ‐ Net of Transaction Fee ‐ $16,068 Federal ITC Carried Back to Recover Taxes Previously Paid ‐ $6,191 Total Income Tax Payable Tax Benefit of Excess QEE in Following Year Net Cash Out‐of‐Pocket Net Cash Position Donon Savings After‐Tax ($153,506) 24.00% x (C‐D) ‐ ‐ ($75,322) $20,135 J ($178,506) ($168,193) A + J $221,494 $231,807 $10,313 Ontario Individual Donor Donor Scenarios: 1) Cash donation of $25,000 in the current taxation year 2) PearTree donation of $50,000 in the current taxation year* * Note that in this instance, the donation receipt will be greater than $50,000 since the donor acquires flow through shares which are donated to and sold by the charity sufficient to net the charity the pledged amount plus sufficient funds to pay fees billed to the charity. Income Tax Summary Salary Income A Flow Through Share Purchase Donations Claimed Scenario 1 Scenario 2 $400,000 $400,000 ‐ $178,409 $25,000 $60,055 Federal Investment Tax Credit (ITC) Claimed in Current Year B ‐ $2,891 Federal ITC Carried Back to Recover Taxes Previously Paid C ‐ $22,532 Federal Income Tax Payable $90,288 $44,262 Provincial Income Tax Payable $54,013 $19,198 $144,300 $63,460 B + C = E ‐ $34,344 46.41% x E = F ‐ $15,939 $144,300 $79,399 Total Income Tax Payable in Current Year D ITC Income Inclusion in Following Year Income Tax Payable on ITC Inclusion in Following Year Total Income Tax Payable D + F Federal Alternative Minimum Tax (AMT) NIL NIL Cash Flow Summary Cash Donation ($25,000) Flow Through Share Purcahse ‐ ($178,409) Proceeds of Sale of Excess Shares ‐ Net of Transaction Fee ‐ $69,396 Federal ITC Carried Back to Recover Taxes Previously Paid ‐ $22,532 Total Income Tax Payable Net Cash Out‐of‐Pocket Net Cash Position Donon Savings After‐Tax ‐ ($144,300) ($79,399) G ($169,300) ($165,880) A + G $230,700 $234,120 $3,421 British Columbia Individual Donor Donor Scenarios: 1) Cash donation of $25,000 in the current taxation year 2) PearTree donation of $50,000 in the current taxation year* * Note that in this instance, the donation receipt will be greater than $50,000 since the donor acquires flow through shares which are donated to and sold by the charity sufficient to net the charity the pledged amount plus sufficient funds to pay fees billed to the charity. Income Tax Summary Salary Income A Flow Through Share Purchase Donations Claimed Scenario 1 Scenario 2 $400,000 $400,000 ‐ $158,978 $25,000 $60,562 Federal Investment Tax Credit (ITC) Claimed in Current Year B ‐ $8,095 Federal ITC Carried Back to Recover Taxes Previously Paid C ‐ $10,982 Provincial (ITC) Claimed in Current Year D ‐ $23,899 Provincial ITC Carried Back to Recover Taxes Previously Paid E ‐ $7,896 Federal Income Tax Payable $90,288 Provincial Income Tax Payable $44,316 Total Income Tax Payable in Current Year ITC Income Inclusion in Following Year Income Tax Payable on ITC Inclusion in Following Year Total Income Tax Payable F $41,915 ‐ $134,604 $41,915 B + C + D + E = G ‐ $50,873 43.70% x G = H ‐ $22,232 $134,604 $64,146 F + H Federal Alternative Minimum Tax (AMT) NIL NIL Cash Flow Summary Cash Donation ($25,000) Flow Through Share Purcahse ‐ ($158,978) Proceeds of Sale of Excess Shares ‐ Net of Transaction Fee ‐ $50,742 ‐ $18,879 Total ITC Carried Back to Recover Taxes Previously Paid C + E Total Income Tax Payable Net Cash Out‐of‐Pocket Net Cash Position Donon Savings After‐Tax ‐ ($134,604) ($64,146) I ($159,604) ($153,504) A + I $240,396 $246,496 $6,099 Manitoba Individual Donor Donor Scenarios: 1) Cash donation of $25,000 in the current taxation year 2) PearTree donation of $55,000 in the current taxation year* * Note that in this instance, the donation receipt will be greater than $55,000 since the donor acquires flow through shares which are donated to and sold by the charity sufficient to net the charity the pledged amount plus sufficient funds to pay fees billed to the charity. Income Tax Summary Salary Income A Flow Through Share Purchase Donations Claimed Scenario 1 Scenario 2 $400,000 $400,000 ‐ $145,086 $25,000 $66,516 Federal Investment Tax Credit (ITC) Claimed in Current Year B ‐ $11,919 Federal ITC Carried Back to Recover Taxes Previously Paid C ‐ $3,315 Provincial (ITC) Claimed in Current Year D ‐ $32,213 Provincial ITC Carried Back to Recover Taxes Previously Paid E ‐ $11,313 Federal Income Tax Payable $90,288 Provincial Income Tax Payable $56,644 Total Income Tax Payable in Current Year ITC Income Inclusion in Following Year Income Tax Payable on ITC Inclusion in Following Year Total Income Tax Payable F $37,650 ‐ $146,932 $37,650 B + C + D + E = G ‐ $58,760 46.40% x G = H ‐ $27,265 $146,932 $64,915 F + H Federal Alternative Minimum Tax (AMT) NIL NIL Cash Flow Summary Cash Donation ($25,000) Flow Through Share Purcahse ‐ ($145,086) Proceeds of Sale of Excess Shares ‐ Net of Transaction Fee ‐ $25,869 ‐ $14,628 Total ITC Carried Back to Recover Taxes Previously Paid C + E Total Income Tax Payable Net Cash Out‐of‐Pocket Net Cash Position Donon Savings After‐Tax ‐ ($146,932) ($64,915) I ($171,932) ($169,504) A + I $228,068 $230,496 $2,428