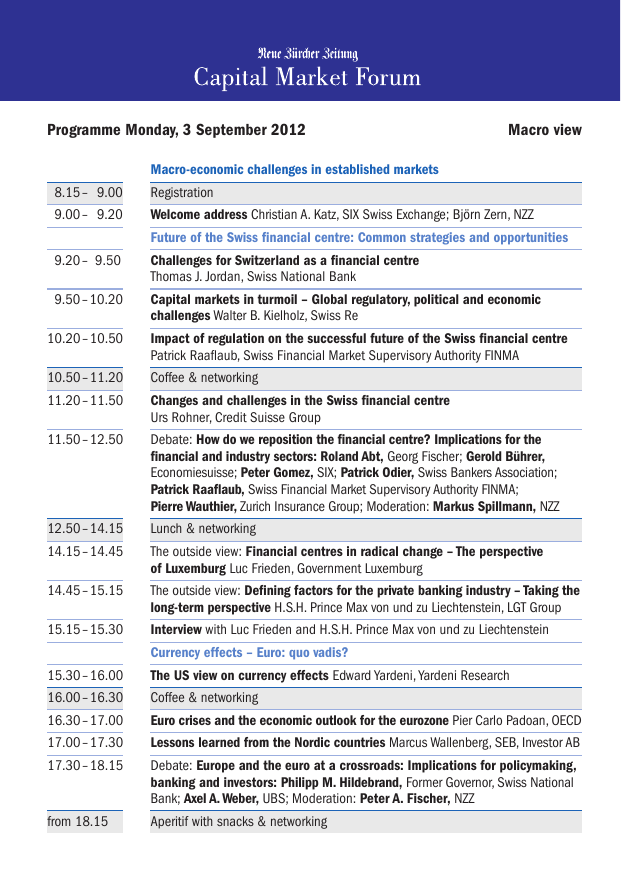

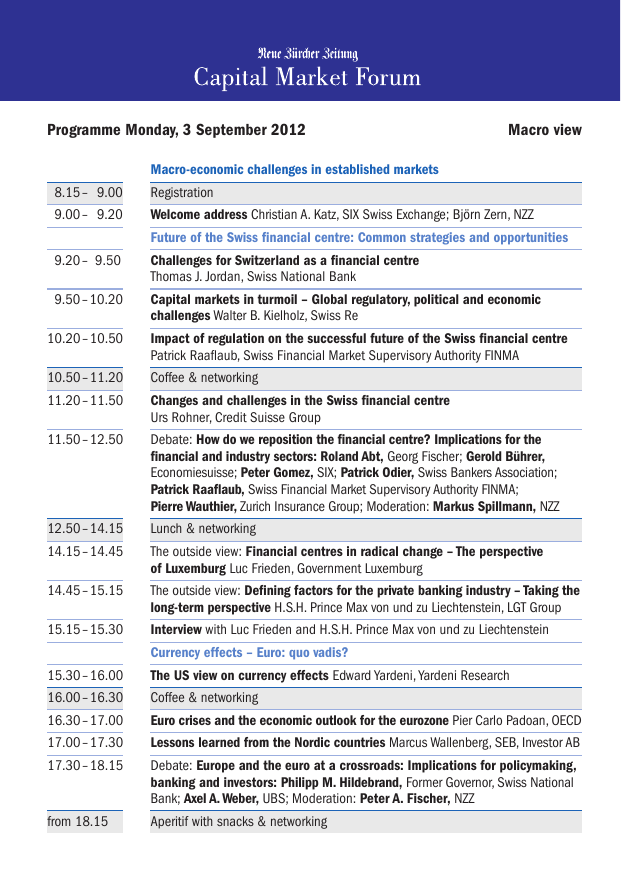

Programme Monday, 3 September 2012

Macro view

Macro-economic challenges in established markets

8.15 – 9.00

Registration

9.00 – 9.20

Welcome address Christian A. Katz, SIX Swiss Exchange; Björn Zern, NZZ

Future of the Swiss financial centre: Common strategies and opportunities

9.20 – 9.50

Challenges for Switzerland as a financial centre

Thomas J. Jordan, Swiss National Bank

9.50 – 10.20

Capital markets in turmoil – Global regulatory, political and economic

challenges Walter B. Kielholz, Swiss Re

10.20 – 10.50

Impact of regulation on the successful future of the Swiss financial centre

Patrick Raaflaub, Swiss Financial Market Supervisory Authority FINMA

10.50 – 11.20

Coffee & networking

11.20 – 11.50

Changes and challenges in the Swiss financial centre

Urs Rohner, Credit Suisse Group

11.50 – 12.50

ebate: How do we reposition the financial centre? Implications for the

D

financial and industry sectors: Roland Abt, Georg Fischer; Gerold Bührer,

Economiesuisse; Peter Gomez, SIX; Patrick Odier, Swiss Bankers Association;

Patrick Raaflaub, Swiss Financial Market Supervisory Authority FINMA;

Pierre Wauthier, Zurich Insurance Group; Moderation: Markus Spillmann, NZZ

12.50 – 14.15

Lunch & networking

14.15 – 14.45

T he outside view: Financial centres in radical change – The perspective

of Luxemburg Luc Frieden, Government Luxemburg

14.45 – 15.15

T he outside view: Defining factors for the private banking industry – Taking the

long-term perspective H.S.H. Prince Max von und zu Liechtenstein, LGT Group

15.15 – 15.30

Interview with Luc Frieden and H.S.H. Prince Max von und zu Liechtenstein

Currency effects – Euro: quo vadis?

15.30 – 16.00

The US view on currency effects Edward Yardeni, Yardeni Research

16.00 – 16.30

Coffee & networking

16.30 – 17.00

Euro crises and the economic outlook for the eurozone Pier Carlo Padoan, OECD

17.00 – 17.30Lessons learned from the Nordic countries Marcus Wallenberg, SEB, Investor AB

17.30 – 18.15

Debate: Europe and the euro at a crossroads: Implications for policymaking,

banking and investors: Philipp M. Hildebrand, Former Governor, Swiss National

Bank; Axel A. Weber, UBS; Moderation: Peter A. Fischer, NZZ

from 18.15

Aperitif with snacks & networking

Equity view & perspective

Small-cap presentations

10.20 – 10.50 Carlo Gavazzi Holding

10.50 – 11.20

Coffee & networking

Coffee & networking

11.20 – 11.50

Cosmo Pharmaceuticals

11.50 – 12.20 Schaffner Holding

12.20 – 12.50

Orell Füssli

Going & being public

Welcome (SIX Swiss Exchange)

IPO readiness Philipp Hofstetter, PwC

Going public the Swiss way Marco Estermann,

SIX Swiss Exchange

IPO process Patrick Treuer, Credit Suisse

Post-IPO Dieter Gericke, Homburger

12.50 – 14.15

Lunch & networking

14.15 – 14.45 Schmolz & Bickenbach

14.45 – 15.15 Mobimo Management

15.15 – 15.45 Starrag Group

16.00 – 16.30

Coffee & networking

16.30 – 17.00

Siegfried Holding

17.00 – 17.30 SHL Telemedicine

Programme modifications reserved

Workshops

Legal, Tax, Consulting

Lunch & networking

Bank lending and capital markets – both in

retreat?

Participants in the debate:

Roland Abt, Georg Fischer; Stefan Frischknecht,

Schroder Investment Management; Marco Illy,

Credit Suisse; Christian A. Katz, SIX Swiss

Exchange; Hélène Weber-Dubi, Orior

Moderation: Stephan Klapproth, 10vor10 – SRF

pportunities for asset managers in

O

Switzerland

Christian Soguel, Ernst & Young

Olaf Toepfer, Roland Berger Strategy Consultants

Convertible bonds

Marc Klingelfuss, Dominik Meyer, Tolga Yildirim

Bank Vontobel

Programme Tuesday, 4 September 2012

Macro view

Impact of emerging markets and demographic changes on capital markets

8.15 – 9.00Registration

9.00 – 9.30

Megatrends

Giles Keating, Credit Suisse

Emerging consumer / Soft commodities

9.30 – 10.00

Navigating in the age of structural reform: The role of consumers

Olin Liu, China International Capital Corporation (CICC)

10.00 – 10.30

The power of the Asian consumer

Jean-Claude Biver, Hublot

10.30 – 11.00

Coffee & networking

11.00 – 11.30

11.30 – 11.40

11.40 – 12.00

12.00 – 12.15

The impact of growing emerging markets on logistics

Reinhard Lange, Kuehne + Nagel International

The current situation in Africa

Markus M. Haefliger, NZZ

Sub-Saharan Africa – The tipping point

Aly-Khan Satchu, East African Financial Portal Rich Group

Markus M. Haefliger interviews Aly-Khan Satchu

12.15 – 13.30

Lunch & networking

13.30 – 14.00Hard and soft commodities – Will these asset classes protect you against

inflation? Thorsten Polleit, Degussa Goldhandel

14.00 – 14.30

Soft commodities markets – Drivers, impacts and challenges for big players

Margarita Louis-Dreyfus, Louis Dreyfus Group

14.30 – 15.00

Sustainable cocoa – From belief to business

Andreas Jacobs, Jacobs Holding, Barry Callebaut

15.00 – 15.30

Coffee & networking

Demographic changes / Aging societies

15.30 – 16.00

The global impact of demographic change Laurence J. Kotlikoff, Boston University

16.00 – 16.30

Increasing longevity and the coming paradigm shift for investing

Quintin Price, BlackRock

16.30 – 17.00

Aging of the European population and its effects on financial markets

Bruno Pfister, Swiss Life Group

17.00 – 17.15

Conclusion

17.15End

Equity view & perspective

The financial industry in transition

9.30 – 10.00Investment strategy in a challenging global environment

David Blumer, Swiss Re

Workshops

Investment strategies & ideas

From a balance sheet recession to

financial repression

Asoka Wöhrmann, DWS Investments

10.00 – 10.30

A new era for private banking

Zeno Staub, Vontobel Group

The big short fantasy

Jonathan Wilmot, Credit Suisse

10.30 – 11.00

Coffee & networking

Coffee & networking

11.00 – 11.30The future of the US wealth

management market

Stephen N. Potter, Northern Trust

Global Investments

Why the Asian consumer matters

Kevin Lyne-Smith, Credit Suisse

11.30 – 12.15

Debate: The financial industry in transition D. Blumer, Z. Staub, St. Potter

Moderation H. Baumann, AIC-SFA

12.15 – 13.30

Lunch & networking

Lunch & networking

Expansion into new markets

Growth of population & aging societies

13.30 – 14.00What old Europe can learn

from China

Michael Buscher, OC Oerlikon

The case for high income equities

Quintin Price, BlackRock

14.00 – 14.30Autoneum – Mastering noise and

heat in automotives

Urs Leinhäuser, Autoneum

Infrastructure investing in Europe

– an attractive albeit not risk-free

investment opportunity Serge-Alexandre

Lauper, Swiss Re Asset Management

14.30 – 15.00 Capturing growth through market

diversification

Thomas Bucher, Gategroup

lobal demographics: How do they

G

affect GDP growth, asset prices and

fiscal sustainability?

Amlan Roy, Credit Suisse

15.00 – 15.30

Coffee & networking

Coffee & networking

We thank our partners for supporting the NZZ Capital Market Forum

Co-Initiator

Local Host

Premium Partners

Practice Partners

Sponsors

Attendant Experts

Media Partners

Event Suppliers

DWS – Europe’s No.1

for global

dividend strategies.¹

Dividend-paying stocks are in the spotlight once again.

That’s because dividends act as a downside buffer and

have constituted over half of total equity returns in the

past 20 years. DWS Invest Top Dividend★★★★★ is actively

managed with a focus on businesses that not only demonstrate above-average dividend yields, but also have a

history of attractive dividend growth and prudent payout

ratios. DWS Invest Top Dividend – from Europe’s No. 1

for global dividend strategies.

DWS Invest Top Dividend: quartile ranking

Period

Quartile

1 year

1

3 years

1

5 years

1

Source: Morningstar. Status: End of June 2012.

Based on the established DWS Top Dividend★★★★★, this

successful concept is also available as a mirror fund in

DWS Invest SICAV and since October 2011 has been

available in currency-hedged share classes in Swiss francs.

» DWS Invest Top Dividend CH2H (P) (ISIN LU0616864012)

» DWS Invest Top Dividend CH4H (P) (ISIN LU0616864285)

» www.DWS.ch

The funds indicated in this advert are funds under German and Luxembourg law that are licensed for public

distribution in Switzerland. Prospective investors in this fund can obtain the sales prospectus, the

management regulations or the articles of association, the key investor information document (KIID), as

well as the latest annual and semi-annual reports free of charge from the representative in Switzerland,

DWS Switzerland LLC., Prime Tower, Hardstrasse 201, 8005 Zurich, or from the paying agent, Deutsche

Bank (Suisse) S.A. in Geneva, and its branches in Zurich and Lugano. ¹Source: Morningstar Inc.; the largest

asset manager of income and dividend strategies in terms of assets under management in the category

(OE) Global Large Cap Value, Equity, status 06/12. Past performance is not a reliable indicator of future

returns. © (2012) Morningstar Inc. Status: June 2012. All rights reserved.

Effiziente

Lösungen für Ihr Unternehmen zu finden ist unser

Anspruch. Kapitalerhöhungen, Börsengänge, M&A

und Anleihenemissionen – dafür und für vieles

mehr entwickelt unser Corporate Finance Team

innovative Konzepte. Mit Talent und Tempo bei

der Umsetzung. Entschlossen, die Besten zu

sein. Und das auch für Ihr Unternehmen

zu beweisen – insbesondere für

Small & Mid Caps.

AEVIS HOLDING SA

ZUG ESTATES HOLDING LTD

PLANCAL HOLDING AG

GENOLIER SWISS MEDICAL

NETWORK SA

MOBIMO HOLDING AG

Capital Increase to

acquire Swiss Healthcare

Properties

Initial Public Offering

Spin-off

Sale to

Trimble Navigation Ltd.

Capital Increase

Rights Offering

Capital Increase

Rights Offering

CHF 140m

CHF 660m

July 2012

July 2012

Purchase

price not disclosed

CHF 17m

CHF 197m

Financial Advisor &

Listing Agent

Sole Lead Manager &

Financial Advisor

December 2011

December 2011

November 2011

Financial Advisor

Lead Manager

Joint Lead Manager

TORNOS HOLDING AG

HARBOURVEST

STARRAGHECKERT

HOLDING AG

SCHMOLZ + BICKENBACH AG

3M (SCHWEIZ) AG

Capital Increase

Public Tender Offer by

HarbourVest for Absolute

Private Equity AG

Capital Increase

Rights Offering

Capital Increase

Rights Offering

Public Tender Offer for

Winterthur Technologie AG

CHF 4m

USD 752m

CHF 65m

CHF 131m

CHF 364m

May 2011

April 2011

April 2011

April 2011

March 2011

Listing Agent

Advisor & Offer Manager

Lead Manager

Lead Manager

Offer Manager

Weitere Informationen

finden Sie unter

www.vontobel.com/

corporate-finance

oder rufen Sie uns an unter

Tel. +41 (0)58 283 77 66