Financial Statement Analysis - the School of Economics and Finance

advertisement

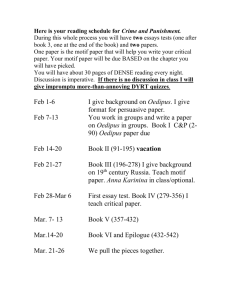

THE UNIVERSITY OF HONG KONG SCHOOL OF ECONOMICS AND FINANCE FINA1001: Financial Statement Analysis Second Semester 2010−2011 Instructor: Dr. Kam‐Ming WAN Teaching Assistant: Yan‐Wei YOU Phone number: 2219‐4180 Phone number: 2857‐8514 Office: 1111, K.K. Leung bldg. Office: 1026, K.K. Leung bldg. Office hours: Tue & Thu 2‐3pm Office hours: TBA Email: kmwan@econ.hku.hk Email : yanyou328@gmail.com Course Webpage: http://www.sef.hku.hk/~kmwan/fina1001/ Tutorial Webpage: http://www.sef.hku.hk/~fsa Class Time: Tue. 11:30a.m.‐12:25p.m. (MW T1) Thu. 10:30a.m.‐12:20p.m. (MW T1) Course Description This course is an introduction to financial statement analysis, aiming to provide you the basic skills and techniques to analyze financial statements for the purpose of valuation. You will learn basic accounting principles; how to evaluate financial statements; and perform rudimentary prospective and equity analyses. Students will acquire knowledge on how to recast and adjust financial statements to estimate of the intrinsic value of the firm. Last, students gain hand‐on experience on accessing basic information from Bloomberg. Course Objectives The goal of this course is to better equip students with the skills needed to perform financial restatement and interpret financial statements properly. Further, the subject aims to provide the prerequisite knowledge that will enable students to perform critical analysis on a firm performance. The course best suits the following students (but not limited to): • Those who aspire to be a financial analyst. • Those who aspire to pursue advanced study in financial economics/accounting. • Those who want to understand the inter‐disciplinary concepts among accounting, economics, and finance. 1 Course Intended Learning Outcomes (CILOs) By the end of the course, students should be able to: CILO01 Construct the basic skills needed to perform financial restatement and interpret financial statements properly. CILO02 Develop the prerequisite knowledge to perform critical analysis on a firm performance. CILO03 Comprehend knowledge on contemporaneous issues facing financial analysts. Alignment of program ILOs and course ILOs Program ILOs Course ILOs Acquisition and internalization of knowledge of economics & CILO01, CILO02, finance CILO03 Application and integration of knowledge CILO01, CILO02, CILO03 Developing global outlook CILO01, CILO02, CILO03 Mastering communication skills CILO02, CILO03 Inculcating leadership CILO02, CILO03 Course Prerequisite • Introduction to Accounting (BUSI1002) and • Intermediate Accounting I (BUSI0019) or Intermediate Accounting for Non‐accounting majors (BUSI0025) For those who are rusty on accounting concepts, you are strongly recommended to review materials taught in your Introduction to Accounting course. An excellent first‐year text is WHBC (see below). Knowledge on Corporate Finance (FINA1003) is essential for performing valuation analysis. Students are expected to be familiar with concepts of time value of money (e.g., present value, future value, PV of annuity, and amortization schedule), basic asset pricing models (e.g., CAPM), and cost of capital (e.g., Weighted Average Cost of Capital). The workload is demanding and students are expected to spend more than 10 hours per week on this course. Required Textbook Subramanyam and Wild (SW), Financial Statement Analysis, 10th International Edition, McGraw‐Hill/Irwin, New York, 2009. 2 Reference Books J.R. Williams, S.F. Haka, M.S. Bettner, J.V. Carcello (WHBC), Financial Accounting, 13th edition, 2008, McGraw‐Hill International Edition. White, Sondhi, and Fried (WSF), The Analysis and Use of Financial Statements, 3rd edition, 2003 Book for fun The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel by Benjamin Graham, Jason Zweig, and Warren Buffet Assessment Your grade will be allocated based on your performance on examinations, group case project, homework assignments, and participation. The weights are given below: Final Examination 25% Midterm 1 15% Midterm 2 20% Group Case Project 25% Homework Assignments 9% Participation 6% Total 100% Exams (60%) Students are required to take two midterms (Feb. 10 & Mar. 24) and one final exam (to be announced). All exams are closed‐book exams. Grades will be curved based on the weighted average scores. Request for re‐grading must be in written form. I will re‐grade the entire exam upon receiving your written re‐grading request. I expect that all exams will be done in complete observance of the University’s Honor Code. No make‐up examination will be given. Group Case Project (25%) The objective of the group project is to give students an opportunity to apply their financial statement knowledge to analyze a global contemporary issue related to key accounting principles. These issues might involve earnings quality, uniform accounting standards, impact of granting employee stock options, analyst forecasts and stock market reaction. Each group must produce a term paper (of approximately 3,000 words) by the end of the semester, a case presentation (in MS‐PowerPoint), and an in‐class presentation. Each group is responsible to give an in‐class presentation on a pre‐specified date. A Q&A session will follow immediately after the in‐class presentation. In determining a group’s overall grade, 3 comments and inputs from your peers will be considered. Details will be given during the lecture. Homework Assignments (9%) Three homework assignments will be given and each counts 3%. No late assignments will be accepted. Participation (6%) Attending tutorials and designated Bloomberg training sessions can enhance your participation scores. In addition, providing high‐quality inputs/answers in lectures and tutorials and valuable suggestions to improve the quality of teaching will be counted toward your class participation scores. You are required to read the assigned readings prior to each lecture. Teaching and Learning Activities (TLA) TLA1 Lecture Instructor will give lectures on major concepts and issues. TLA2 tutorial discussion Students are expected to engage in discussion during lecture and tutorial meetings. Most in‐ depth learning takes place when students actively engage themselves in discussions thought presenting and sharing their ideas TLA3 Consultation Both instructor and teaching assistant hold weekly consultation hours to answer students’ questions. Alignment Among Course Intended Learning Outcome, Teaching and Learning Activities and Assessment Tasks: Learning Teaching and learning activity Assessment Task Outcome (TLA) CILO01 TLA1, TLA2, TLA3 Homework, tutorial participation, group project, Mid‐term Test, Exam CILO02 TLA1, TLA2, TLA3 Homework, tutorial participation, group project, Mid‐term Test, Exam CILO03 TLA1,TLA2, TLA3 Attendance, Assignment, group project, Mid‐ Term Test, Final Exam 4 Standards of Assessment Grade Grade Definition A+, A. A‐ High distinction 80%‐100% B+, B, B‐ Distinction 70%‐79% C+, C, C‐ Credit pass 60%‐69% Description Strong evidence of superb ability to fulfill the intended learning outcomes of the course at all levels of learning: describe, apply, evaluate, and synthesis. Strong evidence of the ability to fulfill the intended learning outcomes of the course at all levels of learning: describe, apply, evaluate, and synthesis. Evidence of adequate ability to fulfill the intended learning outcomes of the course at low levels of learning such as describe and apply but not at high levels of learning such as evaluate and synthesis Evidence of basic familiarity with the subject. D Pass 50%‐59% F Fail Little evidence of basic familiarity with the subject. <50% Academic and Class Conduct • Plagiarism and copying of copyright materials are serious offences and may lead to disciplinary actions. You should read the chapters on and “Plagiarism” and “Copyright” in the Undergraduate/Postgraduate Handbook for details. You are strongly advised to read the booklet entitled “What is Plagiarism?” which was distributed to you upon your admission into the University, a copy of which can be found at www.hku.hk/plagiarism. A booklet entitled “Plagiarism and How to Avoid it” is also available from the Main Library. • The use of any electronic device, including computers, mobile phones and games is strictly prohibited. • Attendance is mandatory. If you miss a class or a tutorial, you will be responsible for the materials covered that day. • I strongly discourage entering/leaving the classroom during the class because it distracts other students. My experience tells me that missing classes on a regular basis will put you in a disadvantageous position because not all class materials are covered in the textbook. • I expect you to seek help from teaching assistant and me in a timely way if you do not understand the course content and analysis. It would be hard to try to understand everything a few days before the exams. • To comply with the sanitation policy, eating is prohibited in the classroom. 5 Course Schedule for FINA1001: Financial Statement Analysis Teaching Chapters Topics Due Dates Weeks Week 1 Ch1 Overview of Financial Statement Jan 11&13 Analysis Week 2 Ch2 Financial Reporting and Analysis Jan 18&20 Week 3 Ch6 Analyzing Operating Activities Jan 25&27 Week 4 Ch6 ‐Earnings Quality Feb 1: HW#1 Feb 1 ‐Employee Stock Options (by 5pm) Lunar Chinese New Year Holiday (Feb 2‐8) Week 4 Midterm 1 Feb 10 Week 5 Ch7 Cash Flows Analysis Feb 15&17 Week 6 Ch3 Analyzing Financing Activities Feb 22&24 Reading Week (Feb 28 ‐ Mar 5) Week 7 Ch4 Analyzing Investing Activities Mar 8&10 Week 8 Ch4 Analyzing Investing Activities Mar 17: HW#2 Mar 15&17 (by 5pm) Week 9 Ch5 Analyzing Investing Activities: Mar 22 Intercorporate Investments Week 9 Midterm 2 Mar 24 Week 10 Ch5 Analyzing Investing Activities: Mar 29&31 Intercorporate Investments Week 11 Ching Ming Festival Holiday Apr 5 Week 11 Ch8 Return on Invested Capital and Apr 7 Profitability Analysis Week 12 Ch9&11 ‐Prospective Analysis Apr 12&14 ‐Equity Analysis and Valuation Week 13 ‐Project Presentation Apr 21: HW#3 Apr 19&21 (by 5pm) 6 Reference Articles Financial Reporting and Analysis Graham, J.R., C.R. Harvey, S. Rajgopal, 2005, “The Economic implications of corporate financial reporting,” Journal of Accounting and Economics 40, 3‐73. Analyzing Operating Activities Carson C. Block, 2010, “RINO International Corp,” Muddy Waters. Securities and Exchange Commission 2010, Accounting and auditing enforcement Release No. 3221 on “SEC vs. MOORE STEPHENS WURTH FRAZER & TORBET LLP and K. DEAN YAMAGATA, CPA” Earnings Quality Healy, P.M. and J.M. Wahlen, 1999, “A review of the earnings management literature and its implications for standard setting,” Accounting Horizons 13, 365‐383. Dechow, P., Skinner, D., 2000, “Earnings management: Reconciling the views of accounting academics, practitioners, and regulators,” Accounting Horizons 14, 232‐250. Employee Stock Options Damodaran, Aswath, 2005, “Employee Stock Options (ESOPs) and Restricted Stock: Valuation Effects and Consequences.” NYU working paper. Guthrie Katherine, Jan Sokolowsky, and Kam‐Ming Wan, 2010, “CEO Compensation and Board Structure Revisited,” forthcoming at the Journal of Finance. Kam‐Ming Wan, 2009, “Can Boards with a Majority of Independent Directors Lower CEO Pay?,” Working Paper. Analyzing Financing Activities Lemmon, Mike, Yung‐Yu Ma, and Elizabeth Tashjian, 2009, “Survival of the fittest? Financial and economic distress and restructuring outcomes in Chapter 11”, Working Paper. Return on Invested Capital and Profitability Analysis Damodaran, Aswath, 2007, “Return on Capital (ROC), Return on Invested Capital (ROIC) and Return on Equity (ROE): Measurement and Implications,” NYU Working Paper. 7 University of Hong Kong Financial Statement Analysis Second Semester 2010‐2011 School of Economics and Finance FINA1001 Dr. Kam‐Ming Wan Individual Sign­up Sheet Nationality: University attended Year of Study: Name: Email: Major: Relevant Courses Taken before FINA1001: Accounting: Finance: Stat. and Math.: Personal Description: (write a short description on why you take this course and what do you expect to benefit from this course?) Work and Summer Intern Experience: Picture: [Please affix a RECENT photo here] 8