Year-end Report

advertisement

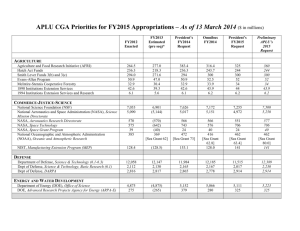

To Our Shareholders The 190th Period Year-end Report April 1, 2013 to March 31, 2014 CONTENTS Interview with President・・・・・・・・・・・・ ・・・❶ Topics・・・・・・・・・・・・・・・・・・・・・・・・・ ・・・❺ Product Profiles・・・・・・・・・・・・・・・・・・・ ・・❼ Consolidated Financial Results・・・・・・・・ ・・❾ Company Profile and Share Information・ ・・・ Securities Code: 2001 Annual Shareholders Meeting: Notice of Resolutions Shareholder Information (Back Cover) To Our Shareholders With the delivery of this “Year-end Report for the 190th Period” to you, I would like to express my thanks for your support. Nippon Flour Mills Co., Ltd. (NIPPN) announced, on May 14, 2014, its consolidated financial results for the fiscal year ended March 31, 2014 (FY2014). I will explain about the outcome in FY2014 as the last year of the two-year “Medium-term Business Plan” and future outlook of FY2015. Representative Director, President and COO Haruki Kotera ■ Interview with President FY2014 Business Climate and Future Outlook Aggressive Challenge for Sustainable Growth Looking back at FY2014, what do you think of the business environment? The Japanese economy progressed along a moderate recovery track as corporate earnings and the labor market showed signs of improvement. Regarding personal consumption, consumers remained budget-minded as far as daily necessities were concerned because of deep-seated anxiety about declining disposable incomes. As a result, the social and economic conditions around the NIPPN Group remained harsh generally. The food industry continued to operate in a challenging business environment amid rising costs, notably those of raw materials and electricity, owing to a weaker yen, and intensifying sales competition reflecting lackluster consumption, with little growth in gross demand because of the aging of Japanese society as people live longer and a low birth rate persists. With the objective of achieving sustainable growth by Q A responding flexibly to the challenging business environment, the Group has facilitated the structural reform efforts for group-wide optimization, for example, by placing greater emphasis on low-cost operations, carrying out selection and concentration of business operations, and reviewing the business portfolio. Q A How do you see the consolidated performance for FY2014? Both sales and income increased in FY2014 on a consolidated basis as net sales were ¥287,109 million, operating income was ¥10,808 million, ordinary income was 12,248 million and net income was ¥7,810 million. However, they are not satisfactory because the targets for net sales and operating income were not achieved. In the Flour Milling segment, in line with the increase of government sales prices of imported wheat by 9.7% on 1 We see a significant growth in the Food segment, especially in frozen foods. With regard to frozen foods, we launched the Oh’ my Premium “Vege-Full” Series, with the theme of making up for the deficiency of vegetable intake, as part of the Oh’ my Premium series of high-grade pasta dishes for home use, which celebrated the 10th anniversary since its launch. At the same time, we redesigned the existing products to enrich the line-up. Sales of the Oh’ my BIG series of large-portion pasta dishes and the snack series, such as the Pie Sheet, were brisk. Q A FY2014 Consolidated Financial Highlights FY2015 Full-Year Forecasts (April 1, 2013 to March 31, 2014) (April 1, 2014 to March 31, 2015) Net Sales ¥287.1 billion (Up 5.9% y-o-y) Operating Income ¥10.8 billion Ordinary Income ¥12.2 billion Net Income (Up 11.3% y-o-y) (Up 12.3% y-o-y) ¥7.8 billion (Up 11.4% y-o-y) Net Income per Share ¥47.23 Net Sales ¥300.0 billion Total Assets ¥226.8 billion Operating Income ¥10.0 billion Net Assets ¥121.6 billion Ordinary Income (Down 10.2% y-o-y) Net Assets per Share ¥715.84 Net Income (Down 12.9% y-o-y) 2 (Up 4.5% y-o-y) (Down 7.5% y-o-y) ¥11.0 billion ¥6.8 billion Interview with President tion divisions. The Flour Milling segment, which enjoyed the steady prices of wheat bran and other market-oriented products, made up for the decreased profit in the Food segment affected by the deflation and rising prices of various materials. As a result, operating income increased by ¥1,095 million while ordinary income and net income rose by ¥1,342 million and ¥801 million, respectively. average for the five key products in April 2013 and by 4.1% in October 2013, we revised the prices of wheat flour products for professional use in June and December, respectively. Sales grew as a result of increased domestic sales volume of wheat flour products for professional use, two sales price hikes, and steady sales prices of wheat bran as by-product. In the Food segment, our aggressive sales promotion activities including participation in various exhibitions and cookery workshops steadily increased the sales volume of pastas, pasta sauces and other related products, frozen pastas and delicatessen items, and consequently brought about segment-wide revenue growth. In the Other segment, a revenue increase was achieved as the net sales of the donut, pet care and engineering businesses grew from the corresponding period of the previous year. As a result, net sales increased by ¥16,040 million. In order to ensure profitability, we worked in a thorough cost reduction in all the business segments through a concerted effort in the production, sales and administra- Q A Let us know about the measures taken during FY2014. In the Flour Mill segment, a new grain silo and an expanded flour milling line (C Mill) of KobeKonan Mill became operational as part of our capacity in 2012. Now we are planning to increase our storage capacity of grain silos by 50% from the current level up to 300,000 tons in order to further enhance cost competitiveness. As part of this plan, we completed the construction of a new grain silo in Chiba Mill, whose construction was started in October 2012 to enhance the storage capacity of the mill by 25,000 tons. With the continued efforts to reinforce our silos in the large seaside flour mills and promote cost reduction, we will fulfill our responsibility for stable supply to customers by ensuring steadier demand and supply of raw wheat and flour. In addition, as part of the business portfolio review strategy for sustainable growth, two M&A deals are done to add new entities to our consolidated subsidiaries. In the Food segment, in September 2013, the Company acquired an equity stake in Nagano Tomato Co., Ltd., a manufacturer and a distributor of tomato-based food products in Nagano Prefecture, to pursue further diversification in the processed food field, which is among the Group’s key business fields. With regard to other businesses, the Group has started developing a donuts business in Kyushu, having included NIPPN Donuts Kyushu Co., Ltd. in the Group in October 2013. In this way, the Group is also working to reinforce the existing business. Moreover, in order to seize opportunities in growing business fields without suffering an opportunity loss, construction of a frozen food plant was completed in March 2014, which is located within the site of the Kuwana Plant of Fast Foods Nagoya Co., Ltd., the Group’s subsidiary producing and selling boxed lunches. Q A How do you expect the performance in FY2015 We will enhance our business foundation by following the single-year business foundation Kuwana Plant, Fast Foods Nagoya Co., Ltd. Grain silo Panoramic view of Chiba Mill 3 enhancement policy adhering to the basic measures in the past, rather than a medium-term business plan, in view of the uncertain business environment in FY2015. We expect as the performance in FY2015 ¥300,000 million in net sales, ¥10,000 million in operating income, ¥11,000 million in ordinary income, and ¥6,800 million in net income. The annual dividend is anticipated to be ¥12 per share. Changes in Consolidated Net Sales Flour Milling Segment (¥ billion) 120 91.8 96.0 100.1 FY2012 FY2013 FY2014 80 40 0 Finally, do you have message for shareholders? In order to improve the profit structure, the Group will continue the capital expenditure and ensure that such investment will promptly become part of our capacity as well as entering fields with growth potential including overseas operations. We will fulfill our social responsibility to stakeholders and further seek sustainable growth by enhancing the corporate value through aggressive challenges to resolve the current difficult situation. Your further support will be greatly appreciated. Q A FY2011 Food Segment (¥ billion) 150 132.9 140.5 147.5 158.9 100 50 0 FY2011 FY2012 FY2013 FY2014 Other Segment (¥ billion) 30 27.3 27.8 27.4 28.0 FY2011 FY2012 FY2013 FY2014 20 10 Net Sales by Segment (FY2014) Flour Milling Segment Consolidated Net Sales ¥287.1 billion (10%) (¥ billion) 16 Processed Foods Food Segment Delicatessen Capital Expenditure ¥158.9 billion (55%) 8 4 * Figures are rounded down to the nearest billion yen. 0 4 Capital Expenditure Depreciation 13.3 11.7 12.2 6.7 7.2 7.8 8.0 FY2011 FY2012 FY2013 FY2014 12 Frozen Foods Other Segment ¥28.0 billion Capital Expenditure and Depreciation Ingredients ¥100.1 billion (35%) 0 7.1 Interview with President 100.7 Topics NIPPN is now an official sponsor of the national swimming, synchronized swimming and water polo teams We became an official sponsor of the national teams of swimming, synchronized swimming and water polo on April 1, 2014. Our activity started at the “90th National Swimming Championships” held in the Tokyo Tatsumi International Swimming Center. We will further promote the corporate brand as well as supporting the competitions as an official sponsor. Panel behind the interview platform Panel behind the starting blocks Announcement of Enhanced Shareholder Special Benefit Plan Period Ending Sep. 30 Our shareholder special benefit plan will be enhanced in and after FY2016. In addition to the traditional benefit for the period ending March 31, we will provide another benefit for the period ending September 30 to the domestic shareholders who have continuously held our shares for more than one year. * Note that the benefit for the period ending March 31 is not subject to the holding period requirement (as before). Target Domestic shareholders who have continuously held at least 1,000 shares for more than one year (Note) and are listed on the shareholder registry as of September 30. Content Assorted NIPPN products equivalent to ¥1,500. Time of Delivery Scheduled to be delivered around December every year. * The first one will be for the period ending September 30, 2015. * This is an image. Note: “Shareholder who has continuously held our shares for more than one year” means a shareholder who was listed on the shareholder registry on the record dates (September 30 and March 31) under the same shareholder number at least three times in a row. Please be advised that it will not be carried out for the period ending September 30, 2014 because the target is set as shareholders who have continuously held our shares for more than one year. 5 Kansai people, are you ready? Notice of “Cookery Workshops for Shareholders Osaka ” As our cookery workshops receive favorable comments every year, we decided to hold one in fall as well. A shareholder and up to one accompanying person may participate. Capacity: 30 participants Tuition: Free of charge How to apply for: Application deadline: Notice of winners: Contact point: Paste the triangular “token” on a postcard with the following information: (1) zip code; (2) mailing address; (3) name; (4) (daytime) phone number; (5) name of the accompanying person (who can be a non-shareholder) (if you wish to be accompanied) Send it to us at: “Cookery Workshop” Section, IR Office Nippon Flour Mills Co., Ltd. 27-5 Sendagaya 5-chome, Shibuya-ku, Tokyo 151-8537 Thursday, July 31, 2014, as indicated by the postmark on the postcard * If more than the set number applies, a lottery will be held to select participants. Postcard 151 8537 27-5 Sendagaya 5-chome, Shibuya-ku, Tokyo “Cookery Workshop” Section, IR Office Nippon Flour Mills Co., Ltd. Winners will receive a participation ticket by Wednesday, September 10, 2014 There will be no announcement of winners prior to the delivery of the ticket. IR Office, Nippon Flour Mills Co., Ltd. at 03-3350-2356 (phone) (Weekdays 9:00 to 17:00) Notes (1) Zip code (2) Mailing address (3) Name (4) Phone number (5) Name of desired workshop To Works ke hop n 2014 Apron, hand towel, something to write with Coo ke ry Items participants need to bring: You will practice cooking, watch demonstrations and enjoy Course brief tastings with our products. details: • Bruschetta with basil and cheese • Pasta with spicy tomato sauce • Meat pie • Orange bavarois No need to fill in if you participate alone IR Venue: Osaka Gas Cooking School Yodoyabashi First floor, Osaka Gas Head Office Building, 4-1-2 Hirano-machi, Chuo-ku, Osaka-shi Three-minute walk from Yodoyabashi station of Midosuji Subway Line 20 13 . 4Q Thursday, October 16, 2014 10:00 to 13:00 (Doors open at 9:45) Topics Date & time: Paste this token • Paste one token per postcard. • Pay transportation cost to and from the venue. • No parking space available. (Use public transportation.) • Applications from non-shareholders will not be accepted. • Refrain from bringing children. • Online or telephone applications will not be accepted. • Note that we will take pictures at the venue on the day and use them on our website or “To Our Shareholders.” Request for Cooperation in Shareholder Questionnaire Survey am Co ok er 6 IR 6 e pl Q Ⓒ1976, 2014 SANRIO CO., LTD. APPROVAL NO.G550765 T y Wo 20 ok rks 13 e ho .4 n p2 01 4 We conducted a questionnaire survey for better communication to be gained by listening to our shareholders. The results of this survey will be used for our IR activities as well as for planning and production of the “To Our Shareholders” section in the future. You have a chance to be one of the 100 people to receive “Oh’my × Hello Kitty Original Strap.” (Reply deadline: August 31, 2014) Winners will receive the prize without prior announcement. Thank you for your cooperation. S Oh’my Japanese-style Pasta Lovers Series Superb taste created from Japanese ingredients. You can easily enjoy the authenti Lineup of NIPPN’s Japanese Tastes ! Washoku, traditional dietary cultures of the Japanese, is registered as an intangible cultural heritage of UNESCO. This has made people take a new look at Japanese tastes. NIPPN has a lot of products with which you can easily enjoy palatable tastes of Japan. There are a variety of products including not only tempura premixes as a basic item for washoku but also those which utilize traditional Japanese condiments and ingredients. Here let us introduce some of these products. “Tempura Premixes” Homemade delicious tempra “Retort Sauces” arehold Sh enefit er B The basic pasta dishes are arranged by Japanese ingredients. These are little luxurious past sauces made for Japanese-style pasta lovers. Bolognese with Coarsely Ground Meat and Lotus Root Soymilk-based Carbonara arehold Sh enefit er B Very rich sauce in flavor with Double miso-based coarsely ground meat and root vegetables simmered in a sauce with bonito broth and two types of miso (haccho miso and rice miso). Vongole with Clams and Bamboo Shoots Indicates a product delivered under the shareholder special benefit plan to the shareholders who have had 1,000 shares or more. arehold Sh enefit er B Mild sauce based on the flavor of soymilk and kombu with lots of mushrooms and bacon. This Japanese-style carbonara sauce is exquisite in richness and flavor of tahini. Tahiniflavored Soy Ginger with Chicken Soboro and Burdock Roots Oh’my DeliciousAs-Is Tempra Mix Tempra using this tempura mix is delectable on its own without tentsuyu tempra dip. A light scent of sesame oil and tasty saltiness enhance the flavor of vegetables and seafood. Savory clam sauce with white soy sauce and ginger, providing a sophisticated Japanese taste. The distinctive texture of bamboo shoots is enjoyable. Shredded nori enhances a smell of ocean. White soy sauce used 7 Minced chicken simmered Whole soybean soy in ginger-flavored sauce sauce used with bonito stock and whole soybean soy sauce. The flavor of ginger and soy sauce evokes nostalgia and stimulates your appetite. “Okonomiyaki Premixes” ic Japanese taste. “Dressing Sauces” You can enjoy an authentic pasta dish by just dressing your cooked pasta with a light and fresh flavored sauce suitable for the spring and summer time. Okonomiyaki premixes with distinctive flavors. Oh’my Seasoned Okonomiyaki Premix Bonito and Kombu Flavor Oh’my Seasoned Okonomiyaki Premix Shrimp and Scallop Flavor Rich flavor of bonito and kombu. The solid aroma of bonito enhances the flavors of ingredients. Okonomiyaki premix flavored with slightly sweet shrimp and scallop. The savory smell of shrimp enhances the flavors of ingredients. Yuzu Soy Sauce Product Profiles Frozen Food Palatable soy-based sauce providing refreshing flavor of yuzu. Dried green onions are included to add color. Yuzu peel used Yuzu Soy Sauce Domestically- Lightly seasoned sauce with grown kombu ume (Japanese apricot) and used shiso (Japanese basil) accompanied by crispy rice crackers for topping. Oh’my Premium Shrimp and Clams with Savory Salt Lightly salted spaghetti with shrimp and clams. Mild “seaweed salt” is used. Oh’my Premium Cod Roe & Squid Cod roe that pops in your mouth is used. Toasted sesame seeds adding a nutty flavor and scallion are generously included for topping. This is a popular product owing to its savory bonito and kombu broth. 8 Oh’my Oozy Chicken and Egg Bowl A bowl of rice topped with chicken and eggs, featuring the sweetness of tender chicken and onions simmered in a chicken and bonito-based broth. With koikuchi soy sauce produced by Yagisawa Shoten in Iwate Oh’ my Premium Vege-Full Japanese-style Soy Sauce with Okura and Eggplant Okura, eggplant and spinach going well with a Japanese-style pasta dish are lavishly included for toppings. A mild garlic-flavored soy-based sauce stimulates your appetite. ●For more information, visit website: http://www.e-nippn.com/FR/ Consolidated Financial Results ● Total Assets/Net Assets 250,000 ● Net Sales Total Assets Net Assets (¥ million) 200,000 179,181 202,904 194,365 300,000 226,803 214,528 (¥ million) 261,586 252,139 FY2010 FY2011 250,000 269,094 271,069 FY2012 FY2013 287,109 200,000 150,000 97,979 100,000 113,263 104,450 100,016 121,636 150,000 100,000 50,000 50,000 0 FY2010 FY2011 FY2012 FY2013 0 FY2014 ● Equity Ratio ● Operating Income (%) 14,000 (¥ million) 12,802 12,000 55 53.9 50 FY2014 52.2 51.9 50.4 50.3 12,248 10,827 10,000 10,210 10,906 8,000 6,000 4,000 45 2,000 0 FY2010 FY2011 FY2012 Cash Flows from Operating Activities ● Cash Flows 19,797 10,000 15,952 15,487 9,279 0 (10,000) (6,673) (15,000) FY2010 FY2011 8,000 6,143 FY2011 FY2012 FY2013 FY2014 Net Income Net Income per Share (11,371) (11,412) FY2012 (13,055) FY2013 (13,349) FY2014 9 (¥) 47.23 42.37 36.06 6,026 47.23 37.46 7,892 6,000 2,138 41 (3,297) FY2010 (¥ million) 10,000 19,198 5,000 (5,000) 0 ● Net Income/ Net Income per Share Cash Flows from Investing Activities 23,094 20,000 15,000 FY2014 Free Cash Flows (¥ million) 25,000 FY2013 6,235 50 40 7,008 7,810 30 4,000 20 2,000 10 0 FY2010 FY2011 FY2012 FY2013 FY2014 0 (As of March 31, 2014) (As of June 27, 2014) Company Overview Directors and Executive Officers Company Name: Nippon Flour Mills Co., Ltd. Head Office: 27-5 Sendagaya 5-chome, Shibuya-ku, Tokyo Established: December 1896 Capital: ¥ 12.24 billion Number of Employees: 995 [non-consolidated basis] Major Businesses: Manufacturing and marketing of wheat flour and secondary processed foods, including premixes, pastas and frozen foods, deli (packaged lunch), pet food products, health care products, biotechnology business, etc. Locations: Head office (Tokyo), two administration divisions, eight branches, eight plants, central laboratory and processing laboratory Matsuya Flour Mills Co., Ltd. OHMY Co., Ltd. NIPPN Frozen Foods Co., Ltd. NF Frozen Co., Ltd. NAGANO TOMATO Co., Ltd. NIPPN Donut Co., Ltd. NIPPN SHOJI Co., Ltd. OK Food Industry Co., Ltd. Nippon Rich Co., Ltd. Fast Foods Co., Ltd. NPF Japan Co., Ltd. NIPPN ENGINEERING Co., Ltd. Hiroshi Sawada Managing Director: Masaki Miyamoto Haruki Kotera Managing Director: Seiji Kanai Managing Director: Tatsuo Amano Executive Officer: Keysuke Nishiwaki Managing Director: Masayuki Kondo Executive Officer: Hirofumi Hamada Managing Director: Mitsuo Somezawa Executive Officer: Mitsuhiko Takeuchi Managing Director: Hirokazu Shimizu Executive Officer: Hideo Kondo Managing Director: Takafumi Kiyoto Executive Officer: Shizuo Yamaguchi Managing Director: Hiroyuki Matsui Executive Officer: Noboru Sekine Managing Director: Yoshiaki Murakami Executive Officer: Tsuneo Fukuzawa Director (Outside Director): Director (Outside Director): Executive Corporate Auditor (full time): Executive Corporate Auditor (full time): Corporate Auditor (Outside Corporate Auditor): Corporate Auditor (Outside Corporate Auditor): Morimasa Akashi Executive Officer: Katsuhiko Fujii Yoshio Kumakura Executive Officer: Kazumasa Miyata Kyoichi Sumiya Executive Officer: Toshibumi Horiuchi Katsutaro Nishihara Executive Officer: Toshiya Maezuru Akio Okuyama Executive Officer: Hiroyuki Jin Naotaka Kawamata (As of March 31, 2014) (As of March 31, 2014) Distribution of Shares Shares ● Number of Authorized Shares ● Number of Outstanding Shares ● Number of Shareholders ● Major Shareholders Name Nippon Flour Mills Clients Shareholding Association The Master Trust Bank of Japan, Ltd. (trust account) Mitsui Life insurance Co., Ltd. MITSUI & CO., LTD. Mitsui Sumitomo Insurance Co., Ltd. Japan Trustee Services Bank, Ltd. (trust account) DUSKIN CO., LTD. Itochu Corporation Sumitomo Mitsui Banking Corporation The Norinchukin Bank ■ Distribution by shareholder type 696,590,000 shares 170,148,018 shares 18,466 Financial institutions 33.3% Number of Shareshares held holding (thousand shares) ratio (%) 8,643 7,508 6,994 6,698 6,009 5,422 5,020 4,500 4,493 4,121 Individual investors 25.8% Treasury stocks 2.5% Companies in Japan 24.3% Non-Japanese investors 13.2% 5.2 4.5 4.2 4.0 3.6 3.2 3.0 2.7 2.7 2.4 ■ Distribution by shareholder size 1 million shares or more 58.8% Less than 1,000 shares 0.1% 100,000 shares or more 17.8% 10,000 shares or more 8.7% Note: The calculation of the shareholding ratios excludes 4,418,000 treasury shares. 10 Securities firms 0.9% More than 1,000 shares or more 14.6% Consolidated Financial Results / Company Profile and Share Information Major Group Companies Representative Director, Chairman and CEO: Representative Director, President and COO: The 190th Annual Shareholders Meeting: Notice of Resolutions We are pleased to inform you that the following matters were reported and resolved at our 190th Annual Shareholders Meeting held on June 27, 2014. Matters reported 1. Business report, consolidated financial statements, and audit reports on the consolidated financial statements by the accounting auditor and the board of corporate auditors for the 190th period (April 1, 2013 through March 31, 2014). 2. Non-consolidated financial statements for the 190th period (April 1, 2013 through March 31, 2014). The details of the above items were reported. Matters resolved Proposal 1: Appropriation of retained earnings This matter was approved and adopted as originally proposed, and the year-end dividend was determined to be ¥6 per share. Proposal 2: Election of seven directors This matter was approved and adopted as originally proposed. Seven individuals, of which five (Haruki Kotera, Mitsuo Somezawa, Hirokazu Shimizu, Takafumi Kiyoto and Morimasa Akashi) were reelected and two (Yoshiaki Murakami and Yoshio Kumakura) were newly elected, have assumed the post. Proposal 3: Election of two corporate auditors This matter was approved and adopted as originally proposed. Two individuals, of which one (Akio Okuyama) was reelected and the other one (Naotaka Kawamata) was newly elected, have assumed the office. Proposal 4: Election of one substitute corporate auditor This matter was approved and adopted as originally proposed. Yuriko Sagara was elected as the substitute corporate auditor. Proposal 5: Proposal 6: Payment of retirement benefits to retiring directors and retiring corporate auditor as well as retirement benefits discontinuation payment to directors and corporate auditors This matter was approved and adopted as originally proposed. It was decided that the Company would pay retirement benefits to two retiring directors (Tsunetaka Honda and Masaaki Tamura) and one retiring corporate auditor (Yoshio Kumakura) in accordance with its certain standards. As approved and adopted, the specific amounts, time and manner of payment and others are left up to the board of directors with respect to the directors or to mutual consultation among corporate auditors with respect to the corporate auditor. Meanwhile, with the elimination of the retirement benefits system for officers, it was decided that the Company would make a retirement benefits discontinuation payment to the incumbent directors and incumbent corporate auditors in accordance with its certain standards. As approved and adopted, the specific amounts, manner of payment and others are left up to the board of directors with respect to the directors or to mutual consultation among corporate auditors with respect to the corporate auditor, and such payment will be made when they retire. Determination of the amount and details of the stock-based compensation stock option for directors This matter was approved and adopted as originally proposed. The allocation of equity warrants as stock options of up to ¥120 million per year and the details of such equity warrants as stock options were determined. Shareholder Information Fiscal Year: April 1 to March 31 General Meeting of Shareholders: June Record Date: March 31 for the General Meeting of Shareholders and Year-end Dividend September 30 for the Interim Dividend Administrator of Shareholder Registry (Manager of Special Account): Sumitomo Mitsui Trust Bank, Limited. 4-1 Marunouchi 1-chome, Chiyoda-ku, Tokyo Procedural matters relating to shares The shares recorded in accounts at securities companies and recorded in special accounts are handled by different agents. Please contact the following for any inquiry regarding various procedures related to shares: Shares recorded in the general account (account at a securities company) Procedures / Inquiries Request for purchase of odd lot shares or sale of additional shares Change of name, address, etc Specification of dividend receipt method Contact Securities company at which you have an account Inquiries regarding delivery and return of mail Transfer Agent Inquiries regarding dividends after payment period Sumitomo Mitsui Trust Bank, Limited. Phone: 0120-782-031 General inquiries regarding the administration (toll free in Japan) of shares NIPPON FLOUR MILLS CO., LTD. 27-5 Sendagaya 5-chome, Shibuya-ku, Tokyo 151-8537 Phone: 03-3350-2311 (General) Website: http://e-nippn.com/ Mailing Address: Transfer Agent, Sumitomo Mitsui Trust Bank, Limited. 8-4 Izumi 2-chome, Suginami-ku, Tokyo 168-0063 (Telephone Contact): 0120-782-031 (toll free in Japan) Handling Offices: Head office and all domestic branch offices of Sumitomo Mitsui Trust Bank, Limited. Website: http://www.smtb.jp/personal/agency/index.html Shares recorded in the special account (account at a trust bank) Procedures / Inquiries Contact Request for purchase of odd lot shares or sale of additional shares Change of name, address, etc Transfer Agent Specification of dividend receipt method Sumitomo Mitsui Trust Bank, Limited. Application for transfer from special account Phone: 0120-782-031 to general account (toll free in Japan) Inquiries regarding delivery and return of mail Inquiries regarding dividends after payment period General inquiries regarding the administration of shares