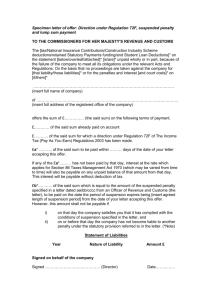

IRS penalties

advertisement

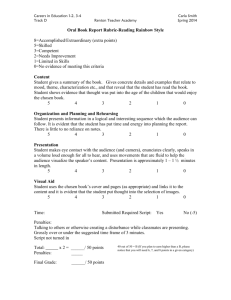

Recalculating Penalties and Interest Welcome to TaxMama’s Place Home of the 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 2 Table of Contents Meet Your Instructors Introduction to penalties and their purpose Dealing with Proposed Penalties Dealing with Assessed Penalties Penalties in detail Preparer Penalties Recomputing and Reducing penalties Career Reducing penalties Resources Evaluations and Thanks! 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 3 Who is Eva Rosenberg MBA, EA Eva Rosenberg, EA, Your TaxMama® has been teaching Enrolled Agents Exam review courses off and on since developing the program for UCLA Extension over 15 years ago. These days, she’s teaching her own course online at www.irsexams.com Eva has a BA in Accounting and an MBA in International business. Your TaxMama® is a TaxWatch columnist for Dow Jones' www.MartketWatch.com and author of the ever-popular book, Small Business Taxes Made Easy, published by McGraw-Hill – new edition – just released! As a speaker, TaxMama® is popular with both tax professionals and taxpayers. You can find her at www.TaxMama.com and subscribe to her free daily podcast at www.TaxQuips.com 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 4 Who is Tom Buck, CPA Tom Buck, CPA is a published author, tax coach, teacher And mentor. He has been a licensed CPA since 1971 and has been in private practice since 1982. Tom was chairman of the Nevada Society of CPAs Taxation Committee. Tom has been representing taxpayers and solving IRS problems ever since the landmark Casino employee cases in 1982. The approach Tom takes and that he would like to pass on to you is this: the “science” of the work is the law and how it should be applied. The “art” is being able to counter any and all IRS measures which are not supported by law. Does the IRS always follow the rules? Of course not, so part of the “art” is really in forcing the IRS to obey the law. Of course, having the tenacity of a bulldog is often the critical ingredient. In the final analysis, once you determine what the outcome should be, then you must be ready to take any detours necessary to get your client to the finish line. Tom is a willing and helpful teacher and looks forward to sharing his hard-gained knowledge. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 5 Who is Sonya Wilt, EA Sonya Wilt, BS in Management, EA and entrepreneur. A graduate of Upper Iowa University, Fayette, and former student of Eva Rosenberg’s Enrolled Agent Review Course, Sonya also has an extensive background in management and accounting, small business consulting, and employee training Sonya’s desire to stay on top of the changes in tax law is two-fold: 1) 2) To make sure her investments and entities are taking advantage of every legal tax deduction available with adequate documentation, and… 2) To provide our clients with accurate information so they may make solid decisions in both resolving current tax issues and legally protecting their future earnings. Sonya and her partner, Tom Buck, CPA aggressively represent clients before state and federal taxing authorities through audits, appeals and collections. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Introduction Purpose of Penalties – Per IRS 1. 2. 3. Penalties exist to encourage voluntary compliance by supporting the standards of behavior required by the Internal Revenue Code. For most taxpayers, voluntary compliance consists of preparing an accurate return, filing it timely, and paying any tax due. Efforts made to fulfill these obligations constitute compliant behavior. Most penalties apply to behavior that fails to meet any or all of these obligations. The following factors support the public conviction that the tax system is fair and the penalty is in proportion to the severity of the noncompliance. Penalties encourage voluntary compliance by: Defining standards of compliant behavior, Defining consequences for noncompliance, and Providing monetary sanctions against taxpayers who do not meet the standard. http://www.irs.gov/irm/part20/irm_20-001-001r.html#d0e406 © www.taxdebtanonymous.com 2011 Penalties Page 6 Penalties Penalties – Inevitable? Or Abatable? 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 7 Insignificant Penalties Page 8 Your billable time - $100 - $500 per hour or so Assessed negligence or preparer penalty of $250 IRC: 6694(a) Understatement of taxpayer's liability due to unrealistic position What should you do? © www.taxdebtanonymous.com 2011 Penalties Page 9 Some IRS Letters that include penalties A. B. C. D. E. F. G. H. I. J. K. L. 08/15/11 Form 886-A, Explanation of Items; Form 1273, Report of Estate Tax Examination Changes; Form 2504, Agreement to Assessment and Collection of Additional Tax and Acceptance of Overassessment. - NEVER SIGN THIS! Form 4549, Income Tax Examination Changes—for agreed cases for individuals and corporations; Form 4549–A, Income Tax Examination Changes—for unagreed and accepted agreed cases for individuals, corporations, taxable fiduciaries, and taxable small business corporations; Form 4605, Examination Changes—Partnerships, Fiduciaries, Small Business Corporations, and Domestic International Sales Corporations—used to report audit changes made to partnership, fiduciary, and small business corporation returns; Form 4605–A, Examination Changes—Partnerships, Fiduciaries, Small Business Corporations, and Domestic International Sales Corporations—for unagreed and excepted agreed cases for partnerships, fiduciaries, and small business corporations; Form 4665, Report Transmittal—never send the taxpayer or power of attorney copies of Form 4665; Form 4666, Summary of Employment Tax Examination. Form 4667, Examination Changes—Federal Unemployment Tax Form 4668, Employment Tax Examination changes Report and, Form 5385, Excise Tax Examination Changes. © www.taxdebtanonymous.com 2011 Penalties When Penalty is Proposed Page 10 Before the penalty is ever assessed, you have time to make it go away. Use it! Provide evidence to support reason for late filing Provide evidence to support taxpayer’s illness or incompetence causing delays Provide evidence to support reasons for taking that particular position Provide evidence why the data was in error at the time the return was prepared Beg or Whine ….tears? © www.taxdebtanonymous.com 2011 Penalties When Penalty is Assessed – to request abatement Page 11 Once a penalty as been assessed – Informal request Form 843 Claim for Refund and Request for Abatement Fast Track Mediation IRS Appeals Taxpayer Advocate Service Tax Court Petition Court of Claims or U.S. District Court (must pay taxes, penalties and interest, first) U.S. Court of Appeals U.S. Supreme Court 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Informal Request Page 12 Informal Claims for Refund Abatement may be submitted by taxpayers. Taxpayers who are not asking for a refund do not need to use Form 843, Claim for Refund and Request for Abatement, to receive consideration of the claim. Collection may process the informal claims that are submitted; however, if the taxpayer intends to file suit, the claim must be submitted on Form 843, Claim for Refund and Request for Abatement, along with the required payment. Collection is responsible for informing the taxpayer of this process. TaxMama Note: Without the rejection of the Form 843 claim, taxpayer cannot file for a refund in court. Appeals may receive Informal Claims for Refund Abatement from Collection. © www.taxdebtanonymous.com 2011 Penalties Penalty Relief Criteria Generally, relief from penalties falls into four separate categories: Reasonable Cause Statutory Exceptions Administrative Waivers Correction of Service Error © www.taxdebtanonymous.com 2011 Penalties Page 13 Penalty Relief – IRS Considerations • Reasonable Cause • Taxpayer’s Effort to Report the Proper Tax Liability (Good Faith) • Experience, Knowledge, Sophistication and Education of Taxpayer • Disasters – personal or public • Reliance on Advice • Reportable Transactions • Non-tax Matters • Advisor Independence • Adequate Disclosure © www.taxdebtanonymous.com 2011 Penalties Page 14 Reasonable Cause Page 15 Reasonable cause is based on all the facts and circumstances in each situation - taxpayer exercises ordinary business care and prudence in determining their tax obligations but nevertheless failed to comply with those obligations. What happened and when did it happen? During the period of time the taxpayer was non-compliant, what facts and circumstances prevented the taxpayer from filing a return, paying a tax, and/or otherwise complying with the law? How did the facts and circumstances result in the taxpayer not complying? How did the taxpayer handle the remainder of their affairs during this time? Once the facts and circumstances changed, what attempt did the taxpayer make to comply? Reasonable cause does not exist if, after the facts and circumstances that explain the taxpayer’s noncompliant behavior cease to exist, the taxpayer fails to comply with the tax obligation within a reasonable period of time. © www.taxdebtanonymous.com 2011 Penalties Special Circumstances, Disasters – Personal or Public • Death, illness, Disability – provide dates and circumstances Alcoholism and substance abuse Mental illness or dementia Physical abuse or intimidation • • • • Personal fires, floods, destruction of records Presidentially declared disaster areas Military service Incarceration © www.taxdebtanonymous.com 2011 Penalties Page 16 Other Explanations Unable to Obtain records Held by ex-spouse or partner Employer filed BK • Mistake – a pure and simple, honest-togoodness error Error by taxpayer Error by preparer Error by Computer Error by third party © www.taxdebtanonymous.com 2011 Penalties Page 17 Statutory Exceptions – Statute of Limitations Page 18 Statute of Limitations on Assessments • 3 years after the tax return is filed • 6 years after filing, for substantial understatement 25% of gross income Gross estate or gross gifts Excise tax • Indefinitely for false or fraudulent returns -IRC section 6501(c)(1) © www.taxdebtanonymous.com 2011 Penalties Statutory Exceptions – Exceptions in the Code © www.taxdebtanonymous.com 2011 Penalties Page 19 Statutory Interest Abatement Page 20 IRC section 6205 provides for an interest-free adjustment when an employer underreported and underpaid certain employment taxes if specific conditions are met by the employer to report the error and pay the tax due. However, IRC section 6205 and related Treasury Regulations are silent in regard to penalties. Consequently, IRS extended an Administrative Waiver to certain penalties. See IRM 20.1.1.3.3.2, Administrative Waivers. Effective Jan. 1, 2009, Treas. Reg. 31.6205–1 and Treas. Reg. 31.6302–1 have been amended for qualified interest-free adjustments. When all conditions have been met for an employer to qualify for an interest-free adjustment, "the amount timely paid will be deemed to have been timely deposited by the employer. " In other words, "tax deemed to have been timely deposited " is not subject to the Failure to Deposit (FTD), Failure to Pay (FTP), and Failure to File (FTF) penalties. See IRM 21.7.2.5, Adjusted Employer's Federal Tax Return or Claim for Refund, IRM 20.1.2, Failure to File/Failure to Pay Penalties, and IRM 20.1.4, Failure to Deposit Penalty, for required procedures and additional information. We’re going to talk more about this a little later today © www.taxdebtanonymous.com 2011 Penalties Administrative Waivers 1. 2. 3. Page 21 The IRS may formally interpret or clarify a provision to provide administrative relief from a penalty that would otherwise be assessed. An administrative waiver may be addressed in either a Policy Statement, News Release, or other formal communication stating that the policy of the IRS is to provide relief from a penalty under specific conditions. An administrative waiver may be necessary when there is a delay by the IRS in: Printing or mailing of forms, Publishing guidance (e.g. writing of Regulations), or Other conditions. An example of an administrative waiver is Notice 93–22, 1993-1 C.B. 305. This allowed individuals who requested an automatic four-month extension of time to file an income tax return, an extension of time without remitting the unpaid amount of any tax properly estimated to be due. See Treas. Reg. 1.6081–4. Real-life example – when partnership extensions were changed from 4 months to 3months. IRS didn’t highlight the change in What’s New or make any special announcements. I didn’t notice it and filed about 20 partnerships (each with 10-40 partners) late. Penatlies would have run into 10s of thousands of dollars! I would have had to pay them!!! © www.taxdebtanonymous.com 2011 Penalties IRS Penalties in Detail Page 22 IRS penalties, as set out in the Internal Revenue Code, are imposed to "enhance voluntary compliance." There are over one hundred-forty separate IRS penalty provisions. Common IRS civil law penalties include the penalty for filing a fraudulent return, the accuracy related penalties, the penalty for failure to timely file a return, the penalty for failure to timely pay a tax, and the frivolous return penalties. In addition, there are a variety of preparer penalties. We’ll go into them in more depth in a minute. Let’s start with at taxpayer penalties – and how to abate them. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties File and Pay Page 23 §Sec. 6651(a)(1) Failure to file a return - 5% of the unpaid balance for each month or part of a month the return is late, maximum 25%. More than 60 days late – The minimum is the lesser of $100 or the tax due §Sec. 6651(a)(2) - Failure to pay tax - The penalty for failure to timely pay a tax is set out in IRC Section 6651(a)(2) & (3). This penalty is equal to 0.5% per month, up to 25% of the amount shown as due on a return. §Sec. 6651(f) - Fraudulent failure to file a tax return - 15% of tax balance per month, maximum 75% 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Certain Information Returns Page 24 § 6652 – a) Failure to file 1099-Int or 1099-PATR for amounts under $10 penalty is $1 per report, up to $1,000 - (1) section 6042 (a)(2) (relating to payments of dividends aggregating less than $10), or (2) section 6044 (a)(2) (relating to payments of patronage dividends aggregating less than $10). b) Failure to report tips - In the case of failure by an employee to report to his employer on the date and in the manner prescribed therefore any amount of tips required to be so reported by section 6053 (a) which are wages (as defined in section 3121 (a)) or which are compensation (as defined in section 3231 (e)), unless it is shown that such failure is due to reasonable cause and not due to willful neglect, there shall be paid by the employee, in addition to the tax imposed by section 3101 or section 3201 (as the case may be) with respect to the amount of tips which he so failed to report, an amount equal to 50 percent of such tax. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Exempt Orgs Page 25 § 6652 (c) - Returns by exempt organizations and by certain trusts (1) Annual returns under section 6033(a)(1) or 6012(a)(6) (A) Penalty on organization In the case of - (i) a failure to file a return required under section 6033(a)(1) (relating to returns by exempt organizations) or section 6012(a)(6) (relating to returns by political organizations) on the date and in the manner prescribed therefore (determined with regard to any extension of time for filing), or (ii) a failure to include any of the information required to be shown on a return filed under section 6033(a)(1) or section 6012(a)(6) or to show the correct information, there shall be paid by the exempt organization $20 for each day during which such failure continues. The maximum penalty under this subparagraph on failures with respect to any 1 return shall not exceed the lesser of $10,000 or 5 percent of the gross receipts of the organization for the year. In the case of an organization having gross receipts exceeding $1,000,000 for any year, with respect to the return required under section 6033(a)(1) or section 6012(a)(6) for such year, the first sentence of this subparagraph shall be applied by substituting ''$100'' for ''$20'' and, in lieu of applying the second sentence of this subparagraph, the maximum penalty under this subparagraph shall not exceed $50,000. Managers penalties? - http://www.taxalmanac.org/index.php /Internal_Revenue_Code:Sec._6652._Failure_to_file_certain_information_returns,_registratio 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Accuracy Page 26 § 6662 - Accuracy related penalty The accuracy-related penalty is set out in IRC Section 6662. This penalty is 20% of the amount of the portion of the understatement of tax attributable to the conduct being penalized. Accuracy penalties include the "negligence or disregard of rules or regulations" penalty, the "substantial understatement of income tax" penalty, the penalty for "substantial valuation misstatement," the penalty for "substantial overstatement of pension liabilities," and the penalty for substantial valuation misstatement in connection with gift tax or estate tax. They Can be assessed due to: (1) Negligence or disregard of rules or regulations. (2) Any substantial valuation misstatement (3) Substantial understatement of tax -- More than the greater of 10% of actual amount due or $5000 Certain substantial valuation misstatements may cause a doubling of the penalty rate to 40%. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Fraud and Frivolity Page 27 § 6651 (f) - The Fraudulent Failure to File Penalty includes penalties of 15% per month up to 75%. § 6663 - The Fraudulent Return Penalty is set out in IRC Section 6663. This penalty is "75% of the portion of the underpayment [of tax] which is attributable to fraud." The fraudulent failure to file return penalty is set out in IRC Section 6651(f). This penalty also has a maximum 75% rate. § 6673 – Frivolous Tax Court action - Maximum $25,000 if position is groundless, intentional delay, frivolous or failed to follow administrative remedies § 6702 The frivolous return penalty is set out in IRC Section 6702. This penalty imposes a $5,000 fine for filing a frivolous income tax return. The penalty applies to an individual who files a return of tax on behalf of a tax shelter. http://www.taxalmanac.org/index.php/Internal_Revenue_Code:Sec._6702._Frivolous_tax_submissions 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Trust fund penalty § 6662 – Trust Fund Penalty (also known as the 100% Penalty) This penalty may be assessed against any and all “responsible” parties. IRS procedure for Trust Fund Penalty Cases http://www.irs.gov/irm/part8/irm_08-025-002.html 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 28 Willfulness Page 29 These are recent penalties. IRS finally got the authority to do something about those people who’ve been thumbing their noses against IRS. What does ‘willful’ mean? § 7201 – Willful attempt to evade or defeat any tax – Felony - up to $100,000 fine or 5 years in prison or both. $500,000 for corp. § 7202 – Willful failure to collect or pay over tax Felony - up to $250,000 and/or 5 years in prison ($500,000 for corporations) § 7203 – Willful failure to pay tax or file a tax return or supply information Misdemeanor - up to $100,000 fine or one year in prison or both. ($200,000 for corp.) § 7206(1) - Perjury and fraud -- knowingly filing or helping in filing false return Felony - up to $250,000 fine or 3 years in prison or both. ($500,000 for corp.) Note: this penalty also applies to any person who aids or abets. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Willfulness, continued Page 30 § 6662 – Attempts to Interfere with administration of IRS laws - This law has to do with attempts to intimidate or impede any agents acting in an official capacity. Felony – up to 3 years in prison or fine up to $250,000 or both ($500,000 for corps) Title 18 USC § 371 – Conspiracy to commit offense to or defraud the United States This law refers specifically to a conspiracy between two or more people. If there is such a conspiracy then if one or more of the conspirators commits such an act, they can all be held guilty. Felony – each conspirator – up to 5 years in prison or a fine up to $250,000, or both ($500,000 for corps) 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Summary of Preparer Penalties 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 31 Summary of Preparer Penalties © www.taxdebtanonymous.com 2011 Penalties Page 32 Assessed Penalties and Interest Page 33 Once IRS assesses penalties, some penalties are computed based on a number of months of noncompliance, or tardiness. Then, the interest is computed on the taxes and penalty balances each month. IRS doesn’t always get their computations right. How can you check IRS’s computations? Is it worthwhile to check IRS’s computations? 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Worthwhile checking? Page 34 ABSOLUTELY! Getting the right penalty balance, in the right month, will reduce all the related interest. Correcting penalty assessments for high-volume business clients, or clients with high taxes and penalties – can result in a saving of thousands of dollars. Some penalties have statutory reductions, where the right timing can save hundreds of thousands of dollars. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties How Can you Check IRS’s Calculations? Page 35 You can set up a spreadsheet with the interest rates for each period built in and build the computation yourself. Manually enter each penalty, on each date Interest rates change each quarter How many hours will that take? Or you can use well-tested tools to do all that for you? And still charge your clients for your expertise, not the time. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties TimeValue Software TimeValue Software - www.TimeValue.com One of the oldest (perhaps the original) tools. IRS uses their tools extensively Includes corporation and (most) state computations Just plug in your client’s numbers – and let the software do all the computations. Get 20% discount on TaxInterest Software Get over 50% on Payroll Bundle – PayrollPenalty and Tax941 Tell them TaxMama sent you – or use the flyers in your Resources 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 36 TimeValue TaxInterest Includes quarterly updates – be sure to install before any new computations. • Enter dates – current, due date, date filed • Select penalties that were assessed (check boxes) • Enter changes and dates – like amendments, and suspensions of time • Compute 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 37 Suspend Interest in TimeValue Page 38 Suspend Interest The Suspend interest event stops the running of interest until you enter a Resume interest event. The suspension applies to all interest computations. Interest can be suspended for a number of reasons. For example, if a waiver of restrictions on the assessment of a deficiency has been filed and if notice and demand by the IRS is not made within 30 days, interest is suspended from that point until notice and demand is made. §6601(c). http://www.irs.gov/irb/2005-28_IRB/ar15.html 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Suspend or Abate Interest Rules Page 39 IRM 20.2.7 explains the application of interest rules on accounts where interest was: Excessive, barred by statute, erroneously or illegally assessed [ IRC 6404(a)]; Attributed to certain unreasonable errors or unreasonable delays by the IRS [ IRC 6404(e)(1)]; Assessed on an erroneous refund [ IRC 6404(e)(2) ]; Due on an additional liability that was not identified by the IRS in a timely manner [ IRC 6404(g)]; Disregarded for a period of time due to a taxpayer's participation in a combat zone [ IRC 7508]; Disregarded for a taxpayer qualifying for Military Deferment [Title 50 Appendix section 570 USC]; and Due on an account for a taxpayer located in a declared disaster area [ IRC 7508A]. http://www.irs.gov/irm/part20/irm_20-002-007r.html © www.taxdebtanonymous.com 2011 Penalties Evaluate the Effect of Exam Concessions – Before you agree Page 40 Facts Roger Santiago and the IRS agreed that a $1,000 credit taken in 2006 should have been taken in 2007. Santiago wants to know the amount due as of July 1, 2008. In addition, he wants his Interest and Penalty Detail Report to read “06 Exam Adjustment” instead of “Tax” and “06 Credit Allowed” instead of “Payment.” Solution The interest due as of July 1, 2008, is $80.88. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Payment Allocation and Correction Page 41 For a variety of reasons, taxpayers may wish to specifically designate the application of payments. For example, the interest amount may be deductible or the payment might be used to satisfy a liability that is running interest at a higher rate than another item. The IRS spells out its position with respect to allocation of payments in Rev. Proc. 8458, and Treas. Reg. §301-6621-2T. If the taxpayer makes no designation, the payment is applied first to tax, then motivated tax, then penalties, and finally to interest. The IRS default payment allocation rules may not be binding on the taxpayer who makes timely designation as to how payments should be applied. See, for example, Perkins v. Commissioner, 92 T.C. 749 (1989), in which the court overruled Rev. Proc. 84-58 and allowed the taxpayer to allocate an entire payment to interest. You may want to correct the application of payments – or locate payments made by your client that were not applied to the correct year – especially including Garnishments and levies ES payments that did not specify a year. Amended returns with additional refunds 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Payroll Tax Penalties When it comes to payroll, you can barely turn around without being hit with a penalty. Late payment penalties are harsh – and so is the penalty for paying with the 940 or 941, instead of EFTPS. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Page 42 TimeValue PayrollPenalty Page 43 T h e IR S u s e s o n ly o n e m e th o d t o c a lc u la te t h e p e n a lt ie s fo r fa ilu r e -to -d e p o s it. H o w e v e r , R e v e n u e P r o c e d u r e s 9 9 -1 0 a n d 2 0 0 1 -5 8 a llo w u s e o f o th e r c a lc u la tio n m e th o d s th a t a r e fa r m o r e b e n e fic ia l to th e ta x p a y e r . P a y r o llP e n a lt y fa ilu r e -to -d e p o s it p e n a lty -a b a te m e n t s o f tw a r e u s e s u p to 2 5 0 a lte r n a tiv e m e th o d s o f a llo c a tin g th e d e p o s its to g iv e y o u th e lo w e s t p o s s ib le p e n a lty f o r 9 4 0 , 9 4 1 , 9 4 3 , a n d 9 4 5 fa ilu r e -to -d e p o s it p e n a ltie s . These Rev Procs allow you to re-allocate payments to avoid or reduce the immediate late payment penalties (1-16 days), and leave those older penalties intact where it’s too late to apply payments. By re-allocating payments, you not only reduce the 10% - 15% penalties, you also reduce the related interest. Companies with large payrolls are very susceptible to such penalties. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Career Reducing Payroll Penalties Page 44 You can make an entire career out of getting these penalties reduced. How? IRS allows tax practitioners to collect a contingency fee for representation. Imagine walking into a multi-million dollar corporation and making them this offer: If I can reduce your payroll tax penalties and interest, will you pay me 20% (or more) of any savings I bring you? Pay me nothing if I don’t succeed. (Don’t tell them HOW you did it – just do the work on your laptop in a conference room or empty office. Simply log into https://www.payrollpenalty.com ) Not only will you get the fee – you will get an ongoing client, too! 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Career Reducing Penalties Page 45 Think about yourself – and why you’re here. You’ve lacked confidence about getting penalties and interest reduced. You didn’t know how to research getting penalties and interest reduced. You didn’t know who to ask when it comes to getting penalties and interest reduced. And you didn’t want to look ignorant. Wouldn’t you have given anything to have someone do it for you? Don’t you think other tax pros would jump at the chance to turn over those problems to you? © www.taxdebtanonymous.com 2011 Penalties Summary Page 46 Remember, “Penalties exist to encourage voluntary compliance by supporting the standards of behavior required by the Internal Revenue Code.” If you can convince IRS that your client has erred, but once, and has learned from his/her error – you may be able to abate all penalties. If not, either fight them or reduce the impact by checking IRS’ calculations. In fact, you can build an entire career around abating penalties. 08/15/11 © www.taxdebtanonymous.com 2011 Penalties Resources Page 47 2011 IRS Processing Codes and Information http://www.irs.gov/pub/irs-utl /document6209_redacted.pdf IRS procedure for Trust Fund Penalty Cases http://www.irs.gov/irm/part8/irm _08-025-002.html IRS Penalty Handbook - http://www.irs.gov/irm/part20/irm_20-001-001r.html IRS Penalty Relief http://www.irs.gov/irm/part20/irm_20-001-005.html#d0e969 Form 843 Claim for Refund and Request for Abatement http://www.irs .g ov/pub/irs -pdf/f843.pdf Fast-Track Mediation http://www.irs.gov/individuals/article/0,,id=96779,00.html IRS Publication 3605 – Fast Track Mediation (FTM) http://www.irs.gov/pub/irs-pdf /p3605.pdf IRS Form 14017 – Request for FTM http://www.irs.gov/pub/irs-pdf/f14017.pdf IRS Appeals - http://www.irs.gov/individuals/article/0,,id=98180,00.html Taxpayer Advocate Service http://www.irs.gov/advocate/ 08/15/11 © www.taxdebtanonymous.com 2011 Penalties CPE Link Page 48 Thanks for coming. Remember to give CPE Link your evaluations. Drop by to sign up for other TaxMama classes – http://www.cpelink.com/teamtaxmama The next class in the series is – Representing Your Client at a 1040 Audit – Office or Field Series are available as Self-Study or Resources: • The Tax Practice Series - Taxpayer representation – Collections, Offers In Compromise, other payment alternatives • TaxMama’s Courses 08/15/11 © www.taxdebtanonymous.com 2011 Penalties