2014 Individual Income Tax Instructions (Rev. 9-14)

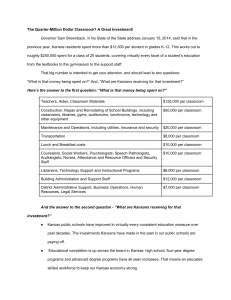

advertisement