May 2010 - Ag

PUBLICATION OF

NATIONAL CROP

INSURANCE

SERVICES ®

VOL. 43, NO. 2

MAY 2010

CROP

INSURANCE

TODAY

TM

EVERY CAPP Exam

Proctored

The ‘Combo Policy’

ON THE TRACK AND

HEADED YOUR WAY

Rural Community Insurance Agency, Inc., D/B/A Rural Community Insurance Services. RCIS is an equal opportunity provider. © 2010 Rural Community Insurance Agency, Inc. All rights reserved.

TODAY

PRESIDENT’S MESSAGE

THANK YOU

“It Takes a Village”

Laurie Langstraat, Editor

TODAY IS PROVIDED AS A SERVICE OF

NATIONAL CROP INSURANCE SERVICES ®

TO EDUCATE READERS ABOUT THE RISK

MANAGEMENT TOOLS PRODUCERS USE

TO PROTECT THEMSELVES FROM

THE RISKS ASSOCIATED WITH

PRODUCTION AGRICULTURE.

TODAY is published quarterly–February, May,

August, and November by

National Crop Insurance Services

8900 Indian Creek Parkway, Suite 600

Overland Park, Kansas 66210

If you move, or if your address is incorrect, please send old address label clipped from recent issue along with your new or corrected address to

Laurie Langstraat, Editor, at the above address.

NCIS Website: http://www.ag-risk.org

NCIS ® EXECUTIVE COMMITTEE

Steve Harms, Chairman

Steve Rutledge, Vice Chairman

Ted Etheredge, Second Vice Chairman

NCIS ® MANAGEMENT

Robert W. Parkerson, President

Thomas P. Zacharias, Executive Vice President

P. John Owen, General Counsel

James M. Crist, Controller

Laurence M. Crane, Vice President

Dave Hall, Vice President

Frank F. Schnapp, Vice President

Creative Layout and Design by Graphic Arts of Topeka, Inc., Kansas

Winner of The Golden ARC Award

Printed on recycled paper.

As I was sitting at my desk reviewing the next set of documents being prepared to comment on the second

SRA draft, I heard a cheerful voice come into my office who said, “Good morning!” The voice belonged to

Laurie Langstraat who was there to inform me that that another addition of the TODAY magazine was getting ready to go to press. She then informed me she needed a president’s message ASAP! As she was telling me about this issue, my mind was racing through what topic or issue pertaining to the SRA negotiations I would write about. There seems to be a never-ending

Bob Parkerson, NCIS supply of material to discuss.

Should I write about the multiple effects of Appendix III and IV? Or should this space be used to focus on the most controversial economic terms of this second draft – the dramatic effects on the industry concerning underwriting gain/risk and A&O subsidy? As I started going through some two dozen documents and memorandums NCIS has put out in the past three to four weeks, I started to realize the amount of effort and time that it has taken to produce the 14-inches of paper stacked on my desk. There are a number of people who have contributed many hours to emphasize what this industry contributes to U.S. agriculture. As I continue to think about all of the time, money, and energy put forth on this effort, the phrase “it takes a village” comes to mind. (At this point I should acknowledge Mrs.

Clinton and her book. Hopefully I don’t owe any royalties for using the title!)

Therefore, I have made the decision to thank all of those who have helped in our efforts to explain what it takes to deliver one of the most successful public/private partnerships in the history of American agriculture.

First, I would like to say THANK YOU to all 18,000 employees in this industry. You have created a service and offer value to the U.S. farmers and ranchers that few will understand, but so many take advantage of when they walk into their local food markets.

Second, I am not sure I have the appropriate words to express the most valued work that

Dr. Keith Collins has brought to this effort. His inexhaustible energy and understanding of this program and the workings of USDA have been most helpful.

Next, I would like to thank the companies who make up the membership of NCIS.

They have not only contributed the dollars that this effort has taken so far, but have provided the employees, time, and resources to the five SRA workgroups who have set the direction of this negotiation. And to the Chairman, Co-Chairman and NCIS staff liaisons who have provided the leadership and time to pull together so many details to provide complete and meaningful responses to the draft SRAs… THANK YOU!

Another contributing factor to this process, under the direction of the NCIS Board of

Directors and on behalf of the entire crop insurance industry, we have undertaken a series of activities to help promote the positive message of crop insurance and to educate the media, congress, and general public about the importance of crop insurance in rural America.

Continued on page 16

CROP INSURANCE TODAY 1

VOL. 43, NO. 2

MAY 2010

CROP

INSURANCE

TODAY

TM

Table of Contents

7

18

1

“It Takes a Village”

4

The ‘Combo Policy’. . . on track and headed your way!

7

EVERY CAPP Exam Proctored

14

Effective Committees—Participation is Important

18

Introducing East R/S Committee

22

Crop Insurance—Protecting Michigan Agriculture

24

Breeding For High Oleic Acid Oils

28

Industry Embracing Social Media

29

Avtar Gill Awarded the Crop Insurance Industry

Outstanding Service Award and Gene Grimsley Receives

Industry Leadership Award

30

In Memory of James R. Dawson

32

NCIS Services Spotlight

34

2009 Loss Ratio By State

36

2010 MPCI Insurance Writers By State

24

Visit www.cropinsuranceinamerica.com

TODAY crop insurance

The ‘Combo Policy’

. . . on track and headed your way!

By Mike Sieben, NCIS

The Common Crop Insurance Policy, or as we like to call it the

‘Combo Policy,’ was released in Final Rule on March 30, 2010, and will be available for the 2011 crop year. The combo policy revises the Common Crop Insurance Regulations to combine the

Actual Production History (APH), Crop Revenue Coverage (CRC),

Revenue Assurance (RA), Income Protection (IP) and Indexed

Income Protection (IIP) into a single insurance plan. The intended effect of this action is to offer producers a choice of revenue protection or yield protection within one basic provision and the applicable crop provisions.

The Risk Management Agency (RMA) kept and combined the principle features in the five plans that producers bought most often. RMA also developed a single rating and pricing component so all insurance coverage is consistent in insurance protection and cost to producers.

“The Combo Policy creates one insurance plan that replaces five similar plans, which will greatly simplify the insurance process for agents and promote better understanding of the options available for producers” said USDA’s Risk Management

Agency Administrator William J. Murphy. “The Combo Policy will also reduce the amount of paper that the companies have to deal with since multiple, similar plans are rolled into one insurance plan.”

Crop provisions have been revised to provide either revenue protection or yield protection plans of insurance for barley, canola and rapeseed, corn, cotton, grain sorghum, rice, soybeans, sunflowers and wheat. Revenue protection provides protection against loss of revenue caused by price changes or low yields or a combination of both (for corn silage and rapeseed, protection is only provided for production losses). Yield protection provides protection for production losses only.

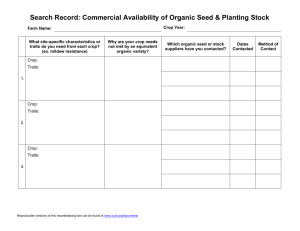

To understand what policy protection a carryover policyholder will have for the 2011 crop year as compared to 2010, please see the chart on page 5:

Carryover policyholders who insured their crops with a Crop

Revenue Coverage or Revenue Assurance policy in 2010 will automatically have Revenue Protection for 2011. Carryover policyholders who insured their crops under the Actual Production History plan will be automatically rolled to the Yield Protection plan for

2011. If a policyholder wants to make a change in coverage to a different plan, then he will need to see his agent prior to the sales closing date for the crops insured.

A projected price and a harvest price for the crops insured under the Combo Policy will be determined by using the

Commodity Exchange Price Provisions (CEPP). The projected price will be used to determine the premium, any replant payment or prevented planting payment for the Yield Protection policy and Revenue Protection policy. For Revenue Protection, the revenue protection guarantee will be determined by multiplying the production guarantee by the greater of the projected price or the harvest price (if the harvest price exclusion is in effect, the revenue protection guarantee will be determined by multiplying the production guarantee by the projected price). The harvest price will be used to value the production to count.

Company personnel have been invited to attend a meeting to learn the basics of how the ‘Combo Policy’ works on May 18 &

19, 2010, in Overland Park, KS. The meeting agenda includes; basic provision changes, crop provision changes, details on how the projected price and revenue price is computed, form changes, how information can be accessed, and how coverage is calculated. In turn, the company personnel will then train the crop insurance agents on the Combo Policy who will then be able to explain these changes to producers.

The goal of the ‘Combo Policy’ is to reduce the amount of information producers must read to determine the best risk management tool for their operation and to better meet the needs of the insured producers. Combo Policy is on the track and headed your way.

4 MAY 2010

2011 COMMON CROP INSURANCE POLICY CONVERSION CHART

2010 Policy

Crop Revenue Coverage (CRC)

Revenue Assurance (RA)

-with Fall Harvest Price Option

Revenue Assurance (RA)

-without Fall Harvest Price Option

Actual Production History (APH)

Income Protection (IP)/

Indexed Income Protection (IIP)

CAT Income Protection (IP)

Indexed Income Protection (IIP)

Converted for 2011 Crop Year

Revenue Protection

Revenue Protection

Revenue Protection with Harvest Price Exclusion

Yield Protection

Revenue Protection with Harvest Price Exclusion

Revenue Protection with Harvest Price Exclusion (50/100)

IMPORTANT DEFINITIONS

Revenue Protection —Insurance coverage that provides protection against production loss or price decline or increase or a combination of both.

Revenue Protection with Harvest Price Exclusion —Allows the producer to exclude the use of the harvest price in the determination of the revenue protection guarantee.

Yield Protection —Insurance coverage that only provides protection against a production loss for crops for which revenue protection is available but was not elected.

Commodity Exchange Price Provisions (CEPP) —A part of the policy that is used for all crops for which revenue protection is available, regardless of whether the producer elects revenue protection or yield protection for such crops. This document will include the information necessary to derive the projected price and the harvest price for the insured crop, as applicable.

Projected Price —A price determined in accordance with the Commodity Exchange Price Provisions and used for all crops for which revenue protection is available, regardless of whether the producer elects to obtain revenue protection or yield protection for such crops.

Harvest Price —A price determined in accordance with the Commodity Exchange Price Provisions and used to value production to count for revenue protection.

Revenue Protection Guarantee (per acre) —For revenue protection only, the production guarantee (per acre), times the greater of the projected price or the harvest price. If the harvest price exclusion option is elected, the production guarantee

(per acre) is only multiplied by the projected price.

Yield Protection Guarantee (per acre) —When yield protection is selected for a crop that has revenue protection available, the production guarantee times the projected price.

CROP INSURANCE TODAY 5

Your Mapping Needs — Answered by FMH

Farmers Mutual Hail has been protecting crops since 1893. Through these many years of service, one thing has always remained the same — our commitment to the needs of our agents and policyholders. This is why we are dedicated to providing the best crop insurance products and services. FMH answers your mapping needs by offering personalized satellite mapping books, pocket books, and wall maps that can be used to make informed crop insurance decisions. Put your trust in Farmers Mutual Hail, a proven leader in crop insurance since 1893. www.fmh.com

FMH is an equal opportunity provider.

© 2010 Farmers Mutual Hail Insurance Company of Iowa. All rights reserved.

TODAY crop insurance

EVERY CAPP Exam

Proctored

By Lisa Cain

If you tried taking your online Crop

Adjuster Proficiency Program (CAPP) exam(s) on or after February 1, 2010, then you already know that proctoring is now mandatory. This article will explain the process and requirements, to help you better understand proctoring.

For every CAPP web user, the splash page shown in Figure 1 will display upon logging into the CAPP web for the first time after February 1, 2010. This splash screen requires the user to review the mandatory proctoring information on the page and then attest to the fact that they have reviewed the information before they can complete their login. Notice the green “LOGIN PENDING” notification at the upper part of the page? This shows the user that their login has been suspended until they review the information on the page. Once the user has read the information, they will put a check in the box preceding the statement reading, “I have reviewed the above Mandatory

Proctoring statement” by clicking on the box. Their login will proceed when they click the “Log In” button at the bottom of the page.

What is proctoring?

In general, a proctored exam is very simply an exam that is overseen by an individual. For CAPP exams, it means that everyone completing a CAPP exam must be overseen by an approved CAPP Proctor.

This proctor will be documented within the

CAPP system (additional details below). An approved CAPP Proctor will sign into the

CAPP system immediately prior to the beginning of a CAPP exam and again, at the end of the exam, verifying that the

CAPP rules and regulations were followed

CROP INSURANCE TODAY 7

Figure 1: Mandatory proctoring began February 1, 2010.

during the exam and that the examinee was not left alone during the exam.

What does a proctor do?

There is more to being a proctor than just being present during a CAPP exam. An approved CAPP Proctor has several responsibilities; the first of which is the very most important…

1. A proctor must NEVER reveal his/her

Proctor Login ID and Password to anyone.

Ever .

Once approved as a proctor, the approved CAPP Proctor will be issued a

Proctor Login ID and Password. The approved CAPP Proctor will be required to enter these into the CAPP learning management system (LMS) prior to and after the examinee completes a CAPP exam. The Proctor Login

ID and Password are ONLY utilized by the approved CAPP Proctor and MUST

BE PROTECTED and kept from the sight of an examinee, even when entering them into the CAPP system.

Any proctor who reveals their Proctor

Login ID and Password will have their proctor designation revoked and their associated AIP(s) (Approved Insurance

Provider) notified. Disciplinary action will be left to the discretion of the

AIP(s).

Any completed CAPP exams not proctored according to the CAPP proctoring rules and regulations will be reset and that examinee’s CAPP card revoked. Any disciplinary action of the examinee will be left to the discretion of the associated AIP. If this examinee wishes to obtain the CAPP accreditation again, he/she must first have the appropriate Type-56 record on file with an AIP, and then will be required to retake all of the CAPP exams under the supervision of a CAPP Approved

Proctor assigned by the associated AIP.

2. An approved proctor must have access to appropriate facilities and computer systems needed to complete a CAPP exam.

8 MAY 2010

Examinees will contact a proctor to set up a time and place for taking a proctored CAPP exam. Access to computers and high-speed internet connectivity, as well as a setting that is conducive to taking an exam are a must for the exam site, even if that place is the examinee’s home or office. Prior to an exam, the approved CAPP Proctor will eliminate potential distractions and the examinee’s ability to communicate with others electronically. The proctor must assure that the examinee has turned off his/her cellular phone and any other electronic communication device.

During an exam, examinees may not access email by any means, nor may they access any web site other than the

CAPP web.

3. An approved proctor must have a working knowledge of computers.

Proctors may be required to assist those taking the CAPP exam. Assistance must never include help with technical crop insurance knowledge; however it may

Figure 2: The new approved CAPP Proctor Search tool on the CAPP web.

Figure 3: Proctor Search option added to the CAPP web.

include assistance with the technology required to take the CAPP exams.

Prior to taking the CAPP exams, examinees should have already set up their account and received their User ID and Password. Examinees should have already logged on to the CAPP web and practiced taking the exams by using the

Practice Exam in the CAPP LMS.

However, if someone has difficulties with the technological requirements needed for taking the CAPP exam, the approved CAPP Proctor may assist him/her to resolve the issue.

Technological assistance may include helping to navigate the internet or locate the CAPP exams; assisting with

CAPP exam navigational requirements as allowed within the CAPP Practice

Exam; or, helping the examinee with new or unfamiliar computer systems

CROP INSURANCE TODAY 9

Figure 4: On the NEW Proctor Search page in the CAPP web, choose what type of proctor you want to search for.

Figure 5: Using the "Select State" drop-down box to find an approved CAPP Proctor near you.

(i.e.

an unfamiliar laptop computer when the examinee is used to working on a PC). To assist the examinee, the proctor will need to have a working knowledge of web browsers, the CAPP web, and computers used to complete the exam.

10 MAY 2010

4. The approved CAPP Proctor is required to verify that the examinee follows the rules for taking the CAPP exams.

The identity of the individual taking the CAPP exam must be verified by comparing the name in the upper right hand corner of the examinee’s screen

(after they have logged on to the CAPP web) with the examinee’s governmentissued photo I.D. (i.e. a valid driver’s license). In addition, the examinee may not receive help or assistance from or provide help or assistance to any other examinee during the exam.

CAPP EXAM

Figure 6: Click the "List Proctors" button to reveal the Approved Proctors listed for that state.

Figure 7: The CAPP Accreditation Center will list the approved CAPP Proctors in your area.

Call an approved CAPP Proctor to set up a time and place to complete the proctored CAPP exam(s).

Coaching by a proctor, another examinee, or anyone is strictly prohibited.

While the CAPP exams are openbook exams, the examinee can only use the CAPP Source Material as their open-book reference during the exam.

These materials, including the General

Insurance Terms, Concepts, and Federal

Regulations Governing the Federal

Crop Insurance Program Study Guide;

Multiple Peril Crop Insurance Common

Crop Policy Basic Provisions; and, the

MPCI Loss Adjustment Manual (LAM).

Either a hard-copy form or online electronic form of these materials may be used. Source material with any clarifying notes and markings made prior to the exam are acceptable for use during the exam. Personal notes or other materials are not allowed. Examinees are not allowed to copy exam questions by any means. In addition, any notes made during the exam should be made on a separate sheet of paper and not in the source material. These notes must be submitted to the approved CAPP

Proctor after completion of the exam and disposed of appropriately to ensure the integrity of the exam.

The approved CAPP Proctor must not leave the examinees alone during an exam.

5. The approved CAPP Proctor must understand and verify that he/she has adhered to the proctor guidelines and duties of being a CAPP proctor. The proctor will be asked to make such verification within the CAPP system immediately prior to the beginning of an exam and again after the examinee has finished completing the exam, but prior to the submission of the exam for grading. If the approved CAPP Proctor fails to adhere to the proctor guidelines and duties, or makes any false statements, omissions, or other misrepresentations on the Proctor Application, it may result in immediate revocation of the approved CAPP Proctor status without notice or appeal.

Who will proctor my exam?

Only those approved as a CAPP proctor can proctor a CAPP exam.

Individuals wishing to serve as a CAPP proctor must submit a completed application and must be approved before they can serve as an approved CAPP

Proctor. Anyone who is at least 18 years of age could qualify as a proctor if he/she is impartial, satisfies the conflict of interest requirements in the SRA, is willing to be available to examinees, and will ensure standard and fair test conditions; however, proctor applications are strictly scrutinized.

There are two kinds of proctors; an

AIP proctor and a public proctor.

CROP INSURANCE TODAY 11

Approved CAPP AIP Proctor

An approved CAPP AIP proctor is someone affiliated with an AIP who has agreed to make themselves available to proctor exams taken by others affiliated with that same AIP.

AIP proctors may choose to also serve as public proctors. Unlike public proctors,

AIP proctors have the option to be displayed or not displayed on the CAPP

Proctor Search web page (Figure 2). Once logged into the CAPP web, examinees may use the Proctor Search option to locate a proctor near their home or office.

To assure that proctor rules and regulations are followed closely, many AIPs require their company employees and those under contract with that company to be proctored only by their Approved AIP

Proctor(s). Often these AIPs choose not to list their proctors on the CAPP Proctor

Search page, requiring their employees and contracted personnel to contact their

AIP CAPP Administrator (or other designated personnel) to set up a time and place to take their CAPP exam(s).

Applications for AIP proctors may be obtained by contacting the AIP CAPP

To assure that proctor rules and regulations are followed closely, many AIPs require their company employees and those under contract with that company to be proctored only by their Approved AIP Proctor(s).

Administrator.

The AIP CAPP

Administrator has access to the CAPP

Proctor Application page on the CAPP web, from which the administrator can download an application. Most AIPs have already hand-selected and approved the company personnel that they want to serve as their AIP proctors. Applications are still required for these proctors.

Approved CAPP Public Proctor

An Approved Public Proctor is someone who has agreed to proctor examinees as they complete their CAPP exam(s), regardless of the examinees AIP affiliation.

12 MAY 2010

How do I find an

Approved CAPP

Proctor?

Contact your AIP administrator to find an approved CAPP proctor in your area.

NCIS has developed a search tool on the

AIP’s CAPP administrator’s web to help find an approved CAPP Proctor near your home or office. This search tool shows both Approved CAPP public and AIP proctors who have chosen to be displayed in the search tool. Many of the AIPs who have chosen not to list their approved AIP proctors on the Proctor Search page have also chosen to establish a company-wide schedule for administering proctored

CAPP exams.

If so, examinees must adhere to their AIP’s requirements.

Examinees who have not already been appointed a proctor by their AIP, can ask their AIP CAPP administrator for proctor contact information. The proctor search tool within the CAPP web can be utilized by the AIP administrator to find a proctor.

Follow the instruction below to utilize the proctor search tool.

• Once logged into the CAPP web, an

AIP CAPP administrator will see the

“Proctor Search” option at the left of the page. Click on this option to go to the Proctor Search page (Figure 3).

• On the Proctor Search page (Figure 4), click on the down arrow to reveal the drop-down box of options. Choose to see only the Approved CAPP Public

Proctors by clicking on “Public

Proctors” or select “All” to see both the

Approved CAPP Public Proctors and any associated Approved CAPP AIP

Proctors who have chosen to be listed.

The Approved CAPP AIP Proctors displayed will be the AIP(s) with which the examinee is associated and which

All Approved Public Proctors are listed on the CAPP Proctor Search web page.

Public proctors are approved by

National Crop Insurance Services (NCIS).

A public proctor may not proctor the exam of anyone with which he/she has a direct supervisory or familial relationship. Again, all proctors must comply with the conflict of interest requirements of the SRA.

supplied NCIS with the examinee’s

Type-56 record information.

If an examinee is currently associated with two companies, then that person will see the Approved CAPP AIP Proctors for both companies.

• After the proctor type is selected, another drop-down box will appear.

Click on the down arrow of this box to reveal the states where proctors are located (Figure 5). Click on the state in which you are located. Then, click on the

“List Proctors” button to reveal the

Approved Proctors in that state (Figure 6).

• The Approved Proctor(s) available in the state have supplied their contact information for the examinee to use.

Their Name, Company, Address, Phone

Number and Email are all supplied by the proctor during the Proctor

Application process.

The examinee uses the information provided to contact the proctor to set up a day, time and place to take their CAPP exam(s).

Notice that under the “Company” column (Figure 7), a code appears. In our example “PP” populates this column.

Roll the cursor over the top of the company code to reveal the company name. In this case, the code “PP” stands for public proctor.

Examinees who complete all three

CAPP exams with an approved CAPP proctor present will have the “Proctored” designation displayed on the front of their

CAPP card. If any of the three CAPP exams has not been proctored by an approved CAPP Proctor, then the

“Proctor” designation will not appear on the CAPP card.

If you successfully completed your

CAPP exams prior to February 1, 2010, without a proctor present, there is nothing in the current CAPP procedures that require you to retake the CAPP exams with an approved CAPP proctor present.

In summary, the NCIS Board of

Directors made the decisions to require proctoring in support of maintaining the integrity of the CAPP program. To aid adjusters through the process, the CAPP website is evolving to help adjusters by making proctoring as understandable and workable as possible. Stay tuned for further developments and improvements.

$

. ( ( 3 , 1 * , 7 6 , 0 3 / (

)UHH ($6<PDSSLQJ

1$8 &RXQWU\ VXSSRUWV SROLF\KROGHUV

ZLWK IUHH PDSSLQJ WRROV IRU &URS

,QVXUDQFH UHSRUWLQJ &RQWDFW XV WRGD\

DQG H[SHULHQFH MXVW KRZ

HDV\

PDSSLQJ

FDQ PDNH \RXU OLIH

)LHOGV

&RXQW\

$

7RZQVKLSV

6HFWLRQV

1 $ 8 0 3 & , ʈ : : : 1 $ 8 & 2 8 1 7 5 < & 2 0

1$8 &RXQWU\ ,QVXUDQFH &RPSDQ\ LV DQ (TXDO 2SSRUWXQLW\ 3URYLGHU 1$8 &RXQWU\ ,QVXUDQFH &RPSDQ\ $OO ULJKWV UHVHUYHG

TODAY crop insurance

Effective Committees

Participation is Important

During the two-day orientation session the chairman learned valuable information about how to make their committees operate more effectively.

By Lynnette Dillon, NCIS

Participation from all companies in the

NCIS Regional/State Crop Insurance

Committees was one of the topics that surfaced at the recent regional/state committee chairman training held at NCIS in mid-

March. For the committees to be effective, participants from each company need to make a substantial contribution in terms of sharing their experience and skills.

Individuals (loss supervisors, territory managers, claim managers) with an understanding and working knowledge of crops throughout the different regions are important to the success of the industry’s 18 regional/state crop insurance committees.

All companies are strongly encouraged to actively participate in the states where they write business. In fact, the real strength of each individual committee comes from the committed participation of all members.

Committee members’ input and contributions identify issues that need to be addressed regarding Crop-Hail and MPCI programs, and if necessary, the committees propose recommendations for consideration by the respective NCIS standing committee(s) and the board of directors. The regional/state committees are organized to:

• Recommend coverage and language changes to the Crop-Hail and MPCI policy forms and endorsements;

• Recommend new or revised loss adjustment procedures and forms;

14 MAY 2010

• Promote communication and cooperation within the crop insurance industry;

• Provide a forum for the discussion of claims related issues in compliance with federal and state law, including antitrust laws; and,

• Promote and participate in risk management education activities.

To accomplish each of these objectives, every committee member and elected chairman play an important role in keeping the crop industry viable and effective.

While committee participation is important, training the elected committee chairman is of equal value. Each year, chairmen take part in training to ensure that committees understand their role, function properly, and are effective in accomplishing their responsibilities. The primary objective of the training session is to help the chairmen succeed by preparing them for their official responsibilities.

Throughout the two-day training, NCIS staff, most who also serve as committee liaisons, instruct on topics such as:

• NCIS organizational structure;

• Compliance with anti-trust laws;

• Operating in accordance with NCIS bylaws;

• Presentation of the NCIS Regional/State

Crop Insurance Committee Manual/

Guidelines;

The 2010 Regional/State Committee Chairmen (or vice chairmen) attending the training session included (left to right): Jeff Cameron, John Boomsma (SD vice chairman), Dorne Meyer, Sharon

Shock, Ted Cremers, Rick Turner, Willie Capers, Steve Short (CO/WY vice chairman), Rocky Blair,

Cindy Jackson, John McMartin, Steve Borba (CA/NV vice chairman), Midge Boettger, Terry

Hayes, and Eric Lippa.

2010 NCIS Regional/State

Committee Chairmen

California/Nevada – Joe Nunes, Great American Insurance Company

Colorado/Wyoming – Shawn Dalton, Rain and Hail LLC

East – Cindy Jackson, Great American Insurance Company

Gulf States – Willie Capers, ProAg Insurance

Illinois/Wisconsin – John McMartin, Rain and Hail LLC

Indiana/Ohio/Michigan – Sharon Shock, Great American Insurance Company

Iowa – Jeff Cameron, ProAg Insurance

Kansas/Oklahoma – Mike Legleiter, Rain and Hail LLC

Kentucky/Tennessee – Terry Hayes, Great American Insurance Company

Minnesota – Midge Boettger, Hudson Crop Insurance Services

Missouri – Al Taylor, Farmers Mutual Hail Ins. Co. of Iowa

Montana – Rick Turner, NAU Country Insurance

Nebraska – Ted Cremers, NAU Country Insurance

North Dakota – Dorne Meyer, Nodak Mutual

Northwest – Eric Lippa, ARMtech Insurance

South Dakota – Jason Mathis, Rain and Hail LLC

Southeast – Jeff Lanier, Rain and Hail LLC

Southwest – Rocky Blair, ProAg Insurance

CROP INSURANCE TODAY 15

This training also provides the chairmen opportunities to exchange information and ideas with peers, as well as develop a working relationship with their NCIS liaison. Returning chairmen can discuss first year challenges and achievements.

At the conclusion, each chairman walks away with a better understanding the role of the NCIS regional/state crop insurance committee and what is expected of him or her.

It is a personal and professional honor for each of these individuals to be elected as a chairman of one of these committees.

Job knowledge, integrity, and respect of one’s peers are just a few of the qualities that qualify an individual for this leadership role. However, the key to being a successful chairman, an active regional/state committee, a summer school, or wellattended annual meeting is participation .

Involvement on a regular basis from all committee members is vitally important.

Participating in the process such as providing input for recommendations at committee meetings, taking part in summer schools, or providing suggestions to a loss procedure, ensures continuous improvement of industry procedures.

“It Takes a Village”

Continued from President’s Message

The genesis of the campaign revolves around the Crop Insurance

Keeps America Growing website

(www.CropInsuranceInAmerica.org) .

The website contains all of the documents NCIS has submitted to RMA in response to the two SRA drafts as well as supporting documentation and reports that help support our position.

It also contains several recent producer testimonials addressing how the potential funding cuts would affect farmers across the U.S. Press releases, talking points and toolkits are also available on the website.

Every advertisement placed, every

Facebook posting (www.facebook

.com/crop insuranceinamerica) , and tweet on Twitter points people to the website for more information. The goal is to drive people to the website and provide them with accurate and up-to-date information about the industry.

Planning for many of these initiatives took place long before the SRA negotiation process began in

December of last year. The messages of the ads, letters and opinion/editorial pieces are fluid; they change as the issues change within the industry.

However, they are done to achieve the same outcome – to ensure the success of the public/private partnership.

Other trade associations working in the crop insurance industry have also worked many, many hours to achieve success during the negotiation process.

Working together as an industry – across association lines – has proven to be successful as we put together a unified stand to protect the integrity of this program.

There are too many people to thank individually in this short message. You know who you are, and you all deserve a pat on the back and a huge THANK

YOU from the entire industry for all that you have done and will continue to do in the future.

Errors and Omission Insurance

For Your Agency

Full lines of coverage including MPCI Crop Insurance

We will work diligently to offer you quotes with reputable companies at competitive prices

To obtain a quote for your agency call

1-800-769-6015

American Insurance Services, LLC.

Premium financing is available

We have over 35 years experience in all lines of insurance www.tomstanleyinsurance.com

16 MAY 2010

J

Experience makes the difference.

Season after season.

We’re leaders working together.

Our customers depend on our experience. That’s why, at

John Deere Risk Protection*, we select only the most experienced agents in a given area; talented professionals who know the land and the people. Then we give them the tools to make their customer relationships even stronger — with

RXU DJHQW FHUWL÷FDWLRQ SURJUDP GHDOHU QHWZRUNV WUDLQLQJ LQ precision farming technology and an expert support team.

That’s what sets our agents apart and keeps customers coming back season after season.

To see how you can become a select John Deere Risk Protection agent, call 1-866-404-9057.

*John Deere Risk Protection, Inc. (dba JDRP Crop Insurance Services in California) is the crop insurance Managing General Agent for The

Insurance Company of the State of Pennsylvania. Coverage may not be available in all jurisdictions and is subject to actual policy language.

John Deere Risk Protection and The Insurance Company of the State of Pennsylvania are equal opportunity providers.

CR0810523 Litho in U.S.A. (09-09) www.JohnDeereRiskProtection.com

TODAY crop insurance

Introducing

East R/S Committee

The 18 NCIS Regional/State Crop or MPCI loss adjustment procedures and forms; Insurance Committees are an integral part of the crop insurance industry. They are 3)`Advise NCIS on public acceptance of

By Dr. Laurence M. Crane, NCIS critical to the communication flow within the industry and are organized for the purpose of identifying issues that need attention and making recommendations to the

Board of Directors.

The committees exist primarily to:

1) Recommend coverage and language changes to the Crop-Hail and MPCI policy forms, applications, endorsements and miscellaneous forms;

2) Recommend new or revised Crop-Hail crop insurance programs offered through the companies;

4) Promote communication and cooperation within the industry, with the exception of pricing and agent commissions; and,

5) Promote and participate in risk management education activities.

There are many ways that committees carry out their important role, i.e. through monthly or weekly meetings, sponsoring

Adjusters grading apples

18 MAY 2010

Apple trees in New Jersey

Cindy Jackson, East Regional/State

Committee Chairman loss adjuster schools and field days, participating in industry-sponsored research projects on growing crops, speaking as the voice of the industry at grower meetings, etc. Each company doing business in the area comprised by the committee is highly encouraged to actively and fully participate in all committee activities. A committee is only as strong as its members.

This new series of articles that will appear in the next several issues of the

East R/S Committee Members

Cindy Jackson, Chairman,

Great American

Hunter Hall, Vice Chairman,

Rain and Hail

Benny Andrew, Rain and Hail

Dock Ayers, RCIS

Freddy Beach, ProAg

John Beach, RCIS

John Bednarik, AFBIS

Larry Burkhart, RCIS

Belinda Buzzerio, ARMtech Ins.

Ed Cerven, RCIS

Jason Crotts, ARMtech Ins.

Mike Day, RCIS

Allen Dickerson, Triangle Ins. Group

Charlie Fox, RCIS

Bill Fullerton, RCIS

Mara Garris, AFBIS

Charles Goode, Rain and Hail

Ross Hankins, John Deere

Billy Holt, RCIS

Heather Horne, RCIS

Neil Mason, RCIS

Graham Neville, Triangle Ins. Group

Brad Newsome, CGB Diversified

David Nice, NAU Country

Joel O’Neal, ADM Risk Management

Pam Parrish, Triangle Ins. Group

Walker Powell, ARMtech Ins.

Wayne Reaves, RCIS

Jeff Robertson, John Deere

Donnie Rogers, RCIS

Eric Shivar, CGB Diversified

Jerry Shoun, ADM Risk Management

Andy Stanley, ARMtech Ins.

Pam Strickland, Rain and Hail

Peery Sugg, CGB Diversified

Noel Sylvester, Heartland Crop

Judy Watts, RCIS

Gerry Wessing, Rain and Hail

Dwight Williams, AFBIS

Allen Yeatts, AFBIS

Terry Young, Great American

CROP INSURANCE TODAY 19

Win Cowgill,

Rutgers Cooperative Extension magazine will feature each of the 18 committees and their current chairman. It will highlight the activities of the committees and give you each chairman’s perspective on the positive things this committee is involved in. This first issue features the East

Regional/State Committee, chaired by

Cindy Jackson of Great American

Insurance Company. This is her second year as Chairman.

Celebrating her 20th year with Great

American, Cindy is a marketing representative for North Carolina, South Carolina,

Virginia and the eastern part of Tennessee.

“Our area [of the country] has had many

“It is very important to meet for the companies to know what each other is doing and to minimize possible problems.”

issues with tobacco losses,” said Jackson.

“The committee meetings were very important to find out things like who is buying poor quality [tobacco] or what tobacco company contracts create price issues.”

The Committee meets as often as possible considering the wide-spread area it covers . . . the 15 states from Maine to South

Carolina. Due to the geographical size of the East Committee, a regional sub-committee has been created to better facilitate the communication between the companies on local issues. It would be highly impractical for some individuals to attend the weekly meetings simply because of travel issues. Meeting as sub-committees, local issues can be addressed and forwarded to the full committee for attention and recommendation to NCIS.

“It is very important to meet for the companies to know what each other is doing and to minimize possible problems,” said Jackson. “Most of our meetings this year have dealt with problems with the new tobacco policy.”

The Committee sponsored an apple school in August 2009, in conjunction with the Rutgers Cooperative Extension and Rutgers Snyder Research and

Extension Farm.

“It was a great success,” Jackson said.

Adjusters spent the day learning a variety of things they need to know when adjusting apple losses including: what a well-maintained orchard should look like; how to identify insect- and disease-damaged apples’; USDA’s grading system; as well as the apple loss adjustment standards handbook and apple policy provisions.

The chairman’s role of the committee is extensive and time consuming, which comes in addition to their job responsibilities for their companies. It’s a job that comes with too little recognition and no additional pay, but it’s something the industry couldn’t do without.

“The most rewarding part of this job

[being chairman] is the knowledge that I’ve gained,” said Jackson.

Her time, energy and effort given to chairing the NCIS East Regional/State Crop

Insurance Committee is very much appreciated by NCIS and the entire industry.

Thanks for a job well done!

20 MAY 2010

22 MAY 2010

TODAY

crop insurance

Crop Insurance

Protecting

By Kelly Moyer, NCIS Intern

From blueberries to beef cattle,

Michigan’s agriculture industry is diverse.

Producing over 200 commodities commercially, Michigan is second only to California in agricultural diversity. Agriculture is a bright spot in a fumbling economy as the

USDA 2007 Census showed a growth of $2 billion in farm gate sales. Still slated as the second largest industry in the state, people are speculating that agriculture may now be the largest revenue generator since manufacturing has taken a dive. Agriculture and tourism are providing for the state of

Michigan during these difficult times.

Crop insurance is protecting Michigan agriculture and those who work in the industry to ensure it stays strong. According to the USDA’s Risk Management Agency,

3.9 million acres were insured at a value of

$1.5 billion through the Federal crop insurance program in 2009. With 25 different products insured, crop insurance is protecting Michigan’s agricultural diversity as well.

And those numbers don’t even include the large number of crops insured by crop-hail policies. According to Leo Pasch, Vice

President of Financial Services for

Greenstone Farm Credit, “There is a huge need for crop insurance for Michigan producers because of the volatility of changing markets and the weather.” He notes there

Michigan Agriculture

has been an increase in participation by farmers and an increased number of claims.

This means that the safety net of crop insurance is protecting more agriculturalists.

However, there is still room for growth in the crop insurance industry. The state’s agents and producers look forward to the development of more insurance products

– specifically a policy for tart cherries.

Michigan produces the most tart cherries in the country and would like to manage the risks that accompany growing the specialty crop.

and use it to market well into the future.”

From a lending standpoint, Leo explains, “If they have a good revenue product, it makes the lender more comfortable because it guarantees a minimum cash flow.”

The unseasonably wet spring and cool temperatures in 2009 slowed crop maturity throughout the state. When he wrapped up wheat harvest, Todd’s yields were high enough not to trigger a loss. But when wheat that started the year at $8.58 a bushel fell to

$2.35 at harvest time, he expected to receive an indemnity payment to make up the difference. He sees crop insurance as a way to secure his revenue – at a cost. The guaranteed revenue is worth that cost to Todd. “Just like I don’t want my house to burn down to collect homeowner’s insurance, I would just as soon never draw on my crop insurance.”

But this is one of those years Todd is thankful he purchased crop insurance.

ducer to analyze the production situation and help the producer decide whether to purchase insurance. A great amount of time is then spent gathering information for further analysis before writing a specific policy.

If the insured makes a claim, they contact their agent who alerts the insurance company that an adjuster needs to process a claim.

An agent then follows up with the producer.

Unlike car insurance, where the insured typically renews the policy without question and only contacts the agent when in an accident, crop insurance agents reanalyze the producer’s operation each year, custom fitting their insurance plan to the changing business. In other lines of insurance, the premium is due upfront. With crop insurance, the producer pays the premium at harvest time. In a bad year, the farmer’s indemnity payment will pay for the premium.

Revenue Insurance

Reduce Risks

Todd Green farms 1600 acres near

Hopkins, Michigan where he grows corn, soybeans and wheat. He has been farming in western Michigan for his “entire life.” He purchases revenue insurance to manage the risks that come with production agriculture.

When asked how long he had been purchasing crop insurance, Todd responded,

“Forever!” With the cost of equipment and other operational costs, Todd says, “I don’t see how you could not do it (buy crop insurance).”

If a producer has a loss of production or of revenue due to a drop in market prices, revenue insurance covers these losses. Crop insurance allows Todd to manage the highs and lows of the commodity market. He explains, “Crop insurance is a tool that I like better than the future’s markets.” Leo Pausch says, “This

(an indemnity payment) is paid in a timely manner to allow producers to manage their cash flow, compared to a disaster payment that they may not receive for up to two years later. With crop insurance, producers know what protection they have

Crop Insurance –

A Whole Different Animal

…Almost

While Todd might view his crop insurance policy like a car and homeowner’s policy, agents do not. For starters, the agent selling the policy must have more training and a knowledge of agriculture. But the biggest difference lies in the amount of time spent on a crop insurance policy compared to the others. Leo Pausch, Vice President of

Financial Services for Greenstone Farm

Credit, offers an agent’s perspective says,

“Crop insurance is much different from other types of insurance. You are spending much more time with the producer.”

Service is the name of the game in crop insurance, seeing as all government sponsored policies are the same. To make a crop insurance sale, agents meet with the pro-

Crop Insurance Keeping

Current and Future

Farmers Around

“When producers have insurance, they sleep better, knowing they have protection,” says Leo. He sees crop insurance keeping farmers out working their fields in several ways. By decreasing stress, farmers who purchase insurance tend to be physically healthier. This also takes a load off of family relationships that are often business partnerships as well. Promoting the next generation of farmers is another positive effect of crop insurance. “If a farm family has a couple of bad years in a row, the attitude toward the child is, “Don’t and do this (farming)” Crop insurance makes production agriculture a financially feasible career for young people to enter. It prevents a terrible year of debt and despair from ripping farms and more importantly, families apart.

CROP INSURANCE TODAY 23

TODAY crop insurance

Breeding for

High Oleic Acid Oils

industry is paying attention.

Editor’s Note: The article below is ment of new soybean types – not all Oleic fatty acids are found in nature in reprinted with permission from the July associated with the types and amounts avocados, macadamia nuts, almonds, and olive oil. They’re a key ingredient in the 2009 issue of CSA News Magazine. In of oils, but that seems to be one of the the last 10-15 years, there has been a areas with a major impact on crop

Mediterranean diet, and now high-oleic tremendous development of a new insurance. The shift away from “comoilseeds are becoming big business. Oleic fatty acids are found in certain varieties of

“class” of oils seeds by plant breeders to modity beans” to “identity preserved” meet certain market requirements for types of markets means more detail canola, soybeans, sunflowers, and safprocessors, and ultimately the consumneeds to be known as to the types of flower. High-oleic peanuts are also becoming an interesting oilseed source.

ing public.

beans being grown, yields, markets,

The development of these new oilseeds and other information not previously

The shift to “healthier” fats got underhas resulted in some changes with gathered. We felt reprinting the article way in the late 1960s when the USDA Food

Pyramid started talking about the differrespect to crop insurance due to the difbelow would be beneficial to give our ferent marketing channels and qualities readers an idea of where many of the ence between saturated and unsaturated that these seeds have. There have been markets for these crops are heading in fats. Interest in avoiding trans fats increased as scientists became aware of the different new policies associated with the developthe future and why the crop insurance ways that fats are utilized by the body. By the early 2000s, food manufacturers were starting to be pressured into switching to healthier fats. The real bellwether was the

2005 Dietary Guidelines for Americans , which included—for the first time—recommendations that U.S. consumers keep their intake of trans fatty acids as low as possible. States began to ban trans fats, or at least make noise about banning them, and food labels were required to show the concentration of trans fats. As fat producers started looking around in earnest for another way to produce fats with the necessary stability but without hydrogenation, plant breeders started looking at changing the lipid ratios in oilseeds.

Oleic acid is a monounsaturated fatty acid, structurally defined as an omega-9 fatty acid, and is considered one of the healthier sources of fat in the diet. In its pure form, oleic acid is cis-9-octadecenoic acid. The natural form of 9-octadecenoic acid (oleic acid) found in olive oil has a “V” shape due to the cis configuration at position 9. It is a monosaturated fatty acid, des-

24 MAY 2010

ignated as C18:1.

High-oleic acid oilseeds benefit the grower because there is usually a bonus for growing the oilseed, and they may be grown on contract, so the vagaries of price at harvest are taken out of the equation. The reason for the benefit to consumers is that high-oleic oils are usually not hydrogenated (hydrogenation produces trans fats), as they are more stable than other oils.

of oilseeds to similar levels was a goal set by companies who were interested in gaining market share.

However, it is important to note that

U.S. domestic producers were not the only ones in the “healthy” game. World olive oil production almost doubled between

1990–1991 and 2006–2007, with further increases being expected in future years as new lands come into bearing. Research developments in recent years have promoted the initiation of olive-breeding programs in the main olive-producing countries. In

Spain, an olive-breeding program aimed at developing new cultivars for olive oil production was initiated in 1991 in Córdoba by performing crosses between the cultivars Arbequina, Frantoio, and Picual.

Besides agronomic characteristics such as earliness of bearing and oil content, other

How High is

‘High’-Oleic Acid?

Higher-oleic acid concentrations also benefit consumers by reducing levels of blood LDL (low-density lipoproteins)— also known as the “bad” cholesterol. It’s commonly used as a replacement for animal fat sources that are high in saturated fat. As a replacement for other saturated fats, it can lower total cholesterol levels and raise levels of HDL (high-density lipoproteins)—the “good” cholesterol— while lowering LDL levels.

During the 1980s, the current knowledge was just being sorted out, and multiple oilseeds were appearing on the grocery shelves. Safflower, sunflower, canola, corn, and soy oils were vying for popularity, and the terms saturated, monounsaturated, and polyunsaturated were entering the public lexicon. The trans-fat controversy was still on the horizon, but the concern was clear in the medical field and technical service labs of many fat and oil producers and marketers.

The original “healthy” oil used in foods was probably olive oil, with its roughly 76 percent monounsaturated fatty acids, mainly oleic acid. Certain specialty nut oils such as cashew, almond, and walnut contain increased oleic acid. Macadamia nut oil is described as containing about 80 percent monounsaturated fatty acids, mostly oleic acid. Cashew nut oil contains about

57 percent oleic acid, and almond oil ranges between 64 and 80 percent oleic acid, depending on the variety. Because these nut oils are expensive, attention has been drawn to methods of increasing the oleic acid content of more common oilseeds. Increasing the oleic acid content

characteristics, including fatty acid composition, are also taken into account in the evaluation process.

So high-oleic acid now means oleic fatty acids that are in the general area of olive oil—high 70s or 80 percent oleic acid.

The race is on, with breeders using various methods— natural selection, mutant breeding, gene silencing, and gene insertion—on sunflower, corn, canola, peanuts, and soybean. The competition is between grains and between high-oleic cultivars and “regular” grains. All of the variations that determine risk and reward are not totally clear but are becoming more transparent with time.

Timeline of New

High-Oleic Seed

Development

Safflower

California High-Oleic Safflower Oil has been commercially available for more than

30 years. Oleic acid is about 77 percent of the total oil. The oxidative stability of the total oil is about 40 AOM (Active Oxygen

Method) hours, without added antioxidants, which means that this oil is very stable against development of off flavors.

According to the Alternative Field Crops

Manual published by the University of

Wisconsin and the University of Minnesota, safflower production is not recommended for areas with more than 15 inches (or 38 cm) of annual precipitation or growing seasons with fewer than 120 frostfree days and less than 2,200 growing degree days.

Temperatures as low as

20°F (–6.6°C) are tolerated by plants while in the rosette stage, but safflower is very sensitive to frost injury after stem elongation until crop maturity. This crop does best in areas with warm temperatures and sunny, dry conditions during the flowering and seed-filling periods. Yields are lower under humid or rainy conditions since seed set is reduced and the occurrence of leaf spot and head rot diseases increases. Consequently, this crop is adapted to semiarid regions.

Sunflower

Historically, moisture and temperature during flowering time had significant impacts on the absolute levels of linoleic fatty acid (polyunsaturates) and oleic fatty acids (monounsaturates), and therefore on their ratios. Sunflower seed grown in cooler climates yielded generally higher linoleic acid contents while seed produced under warmer conditions saw higher oleic acid contents. In a very general sense, the inverse relationship results in a one percent increase in oleic acid approximating a simultaneous one percent decrease in linoleic acid and vice versa, depending on the climate. The other fatty acids see only limited changes. According to Oilseeds

International, Ltd., a Californiabased organization that has developed expertise in specialty oilseeds, the origin of the higholeic acid gene in most breeding programs dates back to the early 1970s with an openpollinated release, known as “Pervenets,” from the Soviet Union.

In 1995, members of the National

Sunflower Association made the commitment to change the fatty acid structure of sunflower oil to meet the future needs of the food industry. The needs were identified as “oil that had a pleasing taste, stability without needing partial hydrogenation, and low saturated fat levels.” Sunflower had the natural genetic characteristics to make this change. The National Sunflower

Association initiative was supported by

USDA plant breeders, the industry, and sunflower growers. NuSun sunflower oil became a reality. Initial testing of the new sunflower type began in 1996.

In 1998, commercial volumes were available.

In

2003, NuSun varieties were

55 percent of total oilseed acres planted with future growth expected. In 2005, it is estimated that 70 percent of the sunflower oilseed acres were NuSun.

In 2005,

Mycogen Seeds introduced two new higholeic sunflower hybrids, defined as having a minimum of 80 percent oleic acid. The patent on med-high oleic sunflower oil and seed has expired, and more companies showed interest in this type. As with all sunflowers, high-oleic hybrids have been developed through conventional breeding methods.

Peanuts

The first high-oleic peanut variety released was SunOleic 95R, which originated from a cross with a University of Florida high-oleic breeding line (F435) and a component line of Sunrunner. SunOleic 97R was released in 1997 with improved characteristics over 95R. By 2002, high-oleic peanuts had grown to 150,000 acres.

Several new disease-resistant higholeic peanut cultivars became available in 2003.

An identity-preserved program, as used in seed certification, helps to maintain the quality assurance and assists manufacturers in the purity of the high-oleic trait. The

University of Florida has three patents on the high-oleic oil chemistry in peanuts, all issued in the early 2000s. The early higholeic peanuts were raised in west Texas to avoid the tomato spotted wilt virus. Later varieties were less susceptible to the virus.

The SVO Division of Lubrizol Corporation and Hershey Foods, Inc. co-developed another source of high-oleic peanuts in the

1990s. Dow AgroSciences continues to market this source of high-oleic peanuts, and Hershey and other confection peanut users use them in their candy confections as the high-oleic peanuts greatly extend the shelf life of products.

Dow

AgroSciences/Mycogen Seeds has had the dominant market = share in Texas peanut production since 2000 with their high-oleic

Flavor Runner 458 variety (Fig. 1).

Canola

Canola oil is produced from the crushed seeds of canola plants, which are grown in the United States, Canada, and many other parts of the world. Canola is a trademarked

cultivar of the rapeseed plant with lowerucic acid content that was first bred in

Canada in the 1970s. They christened it canola, a contraction of “Canadian ola,” with “ola” being derived from oleum, the

Latin word for oil. It is distinct from rapeseed in its chemical and nutritional composition. Just over 40 percent of the canola seed is oil, making it one of the highest oilcontaining crops in the world. Canola oil is high in unsaturated fats (93 percent), primarily monounsaturated fats such as oleic and linolenic fatty acids. This composition helps reduce the risk of coronary heart disease by lowering total blood and LDL cholesterol, according to Guy H. Johnson,

Ph.D., who wrote the qualified health claim petition on behalf of the United

States Canola Association.

“There is ample scientific evidence to demonstrate these benefits from the unsaturated fats in canola oil,” Johnson says.

“By using it in place of other common edible oils, consumers can increase their compliance with the latest dietary recommendations.”

A new type of canola with a modified fatty acid profile for high-oleic and lowlinolenic oil was introduced in the mid-

1990s. This novel canola provides high oxidative stability oil for frying and does not require hydrogenation, allowing food companies to reduce the amount of trans fat in the foods they produce, creating a healthier option for today’s consumers.

Dow AgroSciences has a proprietary position in North America on canola with increased high-oleic acid and low-linolenic acid content.

One of the company’s newest higholeic varieties is called

“Nex845 CL.” Nex845 CL, which is adapted for use in mid- and long-season zones, also boasts very low levels of linolenic acid

(less than three percent), which further increase the stability and functionality of this high-oleic oil.

“Mycogen Seeds is very excited to offer this new canola variety,” says John

Kalthoff, marketing specialist for Mycogen

Seeds. “This product offers growers additional high-yield options to complement their production program.”

In June, Cargill introduced a new, higher-oleic oil canola with lower saturated fats.

“This new technology will enable

Cargill to expand our offerings into the

‘next generation’ of low saturate oils,” says

Jenny Verner, president of Cargill Specialty

Canola Oils. “We want Cargill to be the company that food manufacturers and foodservice operators call first when they are developing nutritious products for their consumers.”

The new oilseed is expected to deliver similar functionality, mouth feel, and fry and shelf life stability as its current higholeic canola oils, with the added nutritional benefits that help customers meet their saturated fat goals.

Soybeans

In 2006, DuPont (Pioneer) submitted the necessary information for approval of the high-oleic trait in soybeans. With its processing partner, Bunge NA, the firm is set to commercialize its high-oleic soy with

2009 plantings. The high-oleic version follows low-linolenic soy. At the Pioneer media day held in February this year, Steve

Butzen, agronomy information manager, and Steve Schnebly, research coordinator, pointed out that the oleic content negates the need for hydrogenating the oil for shelf life to prevent the formation of the rancid, soapy flavor that used to be the effect of nonhydrogenated oil. This high-oleic oil is produced by silencing a gene in the endogenous fatty acid pathway of soybean seed.

“This is a significant step for DuPont and for food companies looking for further improved oils,” says Dean Oestreich,

Pioneer president. “These regulatory submissions keep us on track for commercialization of products beginning in 2009 and allow us to build on the success we’ve had developing products to meet consumer demand for healthier foods.”

How Will All These

Crops Shake Out?

Which crop will rule the grocery shelves? Canola, right now, looks like a winner. According to David Dzisiak, commercial leader for oils at Dow

AgroSciences, it’s now the second largest vegetable oil crop consumed in the U.S., is easily produced, and hits the oleic mark at about the mid-70 percent level combined with less than three percent linolenic.

“The high-oleic trait doesn’t apply a drag to crop yield, whereas newly introduced high-oleic crops typically incur about 10 to 15 percent less grain per acre than the conventional crop,” Dzisiak says.

High-oleic sunflower has an important place too. Dzisiak notes that there is a market need for all of these oilseeds. Most of these crops are planted under contract with an oilseed processor, who supplies the end-use customer specifications.

Which oil is better?

High-oleic acid oilseeds produce an oil with more stability than even low-linolenic oils, providing more functionality in food systems. They eliminate the need for transesterification

(hydrogenation) of oils, making them healthier for consumers. And, as more states and cities ban trans fats, these oils will become even more popular.

Why should farmers grow these crops?

Is there an improvement in price? If there is currently a price premium for these specialty oils, it will disappear as these crops reach a level of production similar to conventional crops. However, they should be easier to market and sell when overall pro-

CROP INSURANCE TODAY 27

TODAY crop insurance

INDUSTRY

Embracing Social Media

By Deanna Parker, NCIS

Social media marketing is a process in which you can promote your website or business through social media networks. The more popular social networking sites, such as

Facebook, Twitter, LinkedIn, YouTube, and

Blogs are being used in both the agricultural realm and society as a whole. This method of marketing allows you to promote your site or business using social media channels to bring to your website a large audience, generate a high volume of primary and secondary traffic, provide and receive instant feedback, and the ability to gather important information regarding what your visitors are saying about the message you are relaying or a product you are promoting. Precise statistics can be obtained from a variety of sites giving you the ability to track how many visitors your site is attracting, how many return visitors your site is receiving, and comments on your site’s content. Taking advantage of this low cost/high return marketing method and intertwining your social networking sites together can prove to be very beneficial in getting your message out. Statistics show that the social media is one of the fastest growing ways to promote your business or site. If you are not out there taking advantage of this powerful resource, chances are, your competitor is. Many anti-agricultural groups and organizations have a strong presence and are very active in social media thus, making it important that our industry also has a strong presence in social media in order to get the other side of the story out.

National Crop Insurance Services, on behalf of the Industry, is moving forward with its social media marketing efforts. In

July, 2009 we made our presence known on

Facebook by creating a page entitled Crop

Insurance Keeps America Growing. Our mission is to gain support for America’s crop insurance industry through education and providing increased awareness. Currently there are 310 fans of our page with our numbers growing weekly. As our numbers grow, so does our content. Our campaign began by directing our fans to NCIS’s Crop Insurance

Keeps America Growing website to watch and read video and text testimonials from real farmers who rely on federal crop insurance programs. Links to current agricultural related news events, and weather maps that report various weather conditions across the country were also posted. In our recent efforts to promote page interaction and fan support, we have provided our fans with the ability to upload their own videos and pictures to share their stories, direct access to our favorite pages, which includes links to members of Congress to see their stories, and fans now have an opportunity to show their support by placing our widgets and badges on their own pages.

NCIS is excited about the new opportunities to promote our industry through Facebook. You can also find us tweeting on Twitter

(www.twitter.com/UScropinsurance), sharing and discovering what is happening in the agricultural industry in real time.

Social media marketing is based around online conversations, not controlled by the organization. Creating buzz or newsworthy events, videos, tweets, or blog entries encourages user participation and dialogue allowing the fans to promote the message or the product themselves. Fans share news with friends who then will share with their friends. Your primary traffic is generated through visitors who come directly from social media websites. Secondary traffic is referral traffic from websites which link to and send you visitors after they come across your content. It replicates a message through user to user contact, rather than the traditional method of purchasing an ad or promoting a press release.

Whether you post a comment, write a blog post, or upload a video, fans will take it from there providing instant feedback. This instant feedback can be highly effective. If you do something great, your fans like what they see and they will spread the message. If they are not happy with your content, they will be sure to voice their opinion, allowing a company the ability to quickly revise or withdraw their campaign. Measuring your marketing results is important and can easily be done using a variety of methods, including mentions on blogs and in media, comments on content, and click-throughs to your site.

There are many tools available from sites such as Google Trends, Twitter search,

Google Analytics, BackType, and Compete.

The numbers are there; social media networks are now reporting over 500 million users. The popular networking sites that are being used are reporting staggering growth statistics. Facebook, founded in

February, 2004, reported that by December,

2004 they had reached nearly 1 million active users. The most current data, reported in February, 2010, shows that number has reached nearly 400 million active users.

According to ReadWriteWeb, a web technology blog, Twitter saw a 347 percent increase in total audience over the last year.

This growth is consistent with all of the popular social media networks. With these kinds of statics, and the massive amounts of users, clearly one can see the potential for how many times a group or advertiser can get its message or product in front of potential supporters.

The social networking platform has endless opportunities. Internet as we know it today is one of the biggest platforms for interaction and knowledge sharing.

Although social media marketing takes time, it is well worth the effort. This new and growing opportunity will draw potential supporters and consumers to your website increasing message awareness and product support. We invite you to visit our

Facebook page to see how social media marketing is working for our industry at: www.facebook.com/cropinsuranceinamerica.

28 MAY 2010

TODAY crop insurance

Avtar Gill

Awarded Outstanding

Service Award

Avtar Gill, Gill Insurance, Caruthers,

Calif., is the recipient of the Crop Insurance

Industry Outstanding Service Award in recognition for outstanding service and outreach to small, limited resource, and socially disadvantaged farmers. Steve Harms,

Chairman of the National Crop Insurance

Services (NCIS) Board of Directors, and

Robert Parkerson, President of NCIS, presented the award at the 2010 Crop

Insurance Industry Annual Convention.

Avtar Gill moved from India to the

United States in 1980. In 1982 he began his crop insurance career with an agency located in Fresno, California. In 1988 Avtar purchased the entire book of business from this agency, moved his office to Caruthers,

California where he formed Gill Insurance.

Avtar services each policy in person by scheduling a date and time to meet with his insureds throughout the Southern Tejon area to Northern Redding. He is best known by his colleagues and clients for his extensive knowledge in multiple-peril crop insurance as well as various aspects of the farming industry.

Avtar is an active member of

Congressman George Radonovich’s Ag

Committee to discuss crucial water and agriculture related issues in the Central Valley.

He has also accepted invitations by Senator

Barbara Boxer, Congressman Jim Costa and

Presenting the award to Avtar Gill (center) was

(left) Robert Parkerson, President of National

Crop Insurance Services (NCIS), and, Steve

Harms (right), Rain and Hail Insurance L.L.C. and

Chairman of the NCIS Board of Directors.

Congressman Devin Nunes to address issues local farmers face today. Avtar is an advocate for the crop insurance, calling

Congressman and Senators stressing the urgency of continuing to protect farmers against nature’s disasters.

As well as Gill Insurance, Avtar and his family also own a large farming operation and three retail businesses in Caruthers.

Gene Grimsley

Receives Industry

Leadership Award

Gene Grimsley, Agro National Insurance,

Council Bluffs, Iowa, was presented with the

Crop Insurance Industry Leadership Award at the 2010 Crop Insurance Industry Annual

Convention. This award is given to individuals who are directly involved in the crop insurance industry and who consistently serve the industry by providing outstanding leadership.

Gene has been an instrumental part of the crop insurance industry since 1972 and has helped promote and educate the merits of agricultural risk management through the utilization of crop insurance to countless agents and farmers across the

United States.

After 37 years in the business and thousands of miles on the road, it is safe to say that Gene has developed a knowledge base of experience about crop insurance that few people can equal. One of the great things about Gene is that he not only understands this business, he possesses a unique ability to share and transfer that knowledge on to others.

Gene started his career with the Federal

Crop Insurance Corporation and moved to the private industry in 1984. He has been involved with most every phase and position of the business including claims, sales, processing and management. Gene has always been willing to offer assistance and support to individuals, as well as committee work during his career. He has been involved in numerous committees over the years, and is currently the Chairman of the

NCIS Public Relations Committee.

Committee work is often times consuming

(left to right) Robert Parkerson, President,

National Crop Insurance Services; Gene

Grimsley, Agro National Insurance; and, Steve

Harms, Rain and Hail L.L.C. and Chairman of the NCIS Board of Directors.

and may go unrecognized by many. We also know that committee work has been the lifeblood of our industry. Without the commitment of individuals like Gene and their countless hours of involvement to make this a better program, it would most certainly be worse off.

Gene grew up in Harlan, Iowa, and currently lives in Council Bluffs with his wife, Shelly. He enjoys activities with his family and anything related to Iowa

Hawkeye sports.

CROP INSURANCE TODAY 29

TODAY crop insurance

In Memory

about Jim. “One of my earliest memories of Jim Dawson was him sitting with the summer staff and stuffing envelopes with us. He

James R. Dawson

The crop insurance industry lost one of its patriarchs when, at the age of 84, Jim Dawson, passed away in late February surrounded by loving family and friends.

James Roen Dawson, the son of Charles and Helen Dawson, was born October 30, 1925, in Fargo, North Dakota. After graduating from Fargo Central High School, Jim proudly served in the

United States Army. Following his discharge in 1946, he returned to Fargo where he completed his education, graduating from North

Dakota Agricultural College (NDSU). On June 23, 1949, Jim married Barbara Ann Nelson of Washburn, ND. They made their home and raised four daughters in Fargo.

In 1946, Jim and his brother, Bob, became partners in the family business, Dawson Insurance Agency. During the 1950s and ‘60s,

Jim and Bob worked with their father to build the insurance agency and expand the crop insurance division. In 1969, Dawson