Investor presentation

advertisement

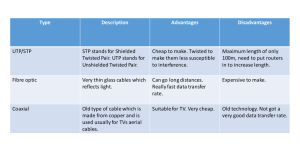

wireless living .... Q2 2013 Investor Presentation Svenn-Tore Larsen, CEO Robert Giori, CFO July 12, 2013 1 2 Strong order inflows reflect increasing demand Lower shipments to PC accessories and ASIC segments in Q2 2013 Order volumes pick up (82% Q-over-Q growth), based on improving demand • Revenue of MUSD 28.8 • Order inflows of MUSD 42.5 • Operating profit (EBIT) of MUSD 2.8 • Cash flow from operations of MUSD -6.8 Business Outlook: Revenue expected to accelerate during 2H 2013, as many new products containing Bluetooth Smart solutions are launched • Demand for PC accessories is expected to stabilize • Sales of Bluetooth Smart solutions are expected to generate increasing revenue during the remainder of the year. – Bluetooth Smart solutions grow to 12% of revenue in Q2 2013 (1% in Q2 2012) – Customer demand for Nordic’s development kits continues to grow rapidly, signaling high product design activity. Many new products are to be launched in 2H 2013. – Addressable market for Bluetooth Smart will further expand as new devices (including Android smartphones) implement Bluetooth 4.0. wireless living .... FINANCIAL HIGHLIGHTS Robert Giori, CFO 4 Q2 2013 Financial Highlights (MUSD) MUSD Financial objectives Q2 2013 Q2 2012 Comments Revenue 28.8 38.7 Lower sales to PC accessory and ASIC segments Order Inflow 42.5 21.7 Strong order inflows reflects improving demand Gross Margin % 48% 52% Operating Profit (EBIT) 2.8 9.4 Higher production costs relative to revenue on new product launches EBIT Margin % 10% 24% Net Profit after tax 2.0 6.5 Free Cash Flow -12.7 4.5 Cash Balance 18.8 24.2 Accounts Receivable 29.2 32.5 Inventory 19.3 18.8 Growth Profitability Cash Flow Negative cash flow as company prepares for increased sales from 2H 2013. Drives investments in production equipment, higher working capital requirements. 5 Group Revenues • Q2 2013 Revenue of MUSD 28.8 (26% decline from prior year) – Slower shipments to PC accessories and ASIC segments – Sales of Bluetooth Smart solutions grow to 12% of revenue (from 1% in prior year) Segment revenue by quarter, 2011 – Q2 2013 (MUSD) 45 40 35 Sharp YOY decline in PC accessories and ASIC business segments in Q2 2013 30 25 20 Other wireless segments grow by 19% from prior year 15 10 5 0 Q1/11 Q2/11 Q3/11 Q4/11 Q1/12 PC accessories Other Sensor networks Mobile devices ASIC / Consulting Home electronics devices Q2/12 Q3/12 Q4/12 Q1/13 Q2/13 6 Segment performance – Q2 2013 PC Accessories Wireless mouse, keyboard, presentation tools Mobile devices Sports / medical monitors, mobile accessories, wireless payments Q2 Revenue: MUSD 18.6 (MUSD 27.3) Q2 Revenue: MUSD 4.3 (MUSD 4.5) • Weaker PC market has impacted sales of accessories. • Growth in Bluetooth Smart mobile accessories offsets decline in older sports monitors ASICs (application specific IC’s) Wide sector span Q2 Revenue: MUSD 1.7 (MUSD 4.1) • Supporting existing customers only, not a focus area for growth. Sales fluctuates based on few designs. Home electronics devices TV / media remotes, audio streaming, game controls, toys Other Sensor networks Industrial automation, building sensors, RFID systems, automotive Consulting services Custom electronics design Q2 Revenue: MUSD 1.3 (MUSD 1.3) Q2 Revenue: MUSD 2.8 (MUSD 1.3) • Sales driven by wireless toys, with new design activity underway • Growth driven by new RFID product designs • Project services for existing ASIC customers * Reflects Q2 2013 revenue (Q2 2012 in parenthesis) Q2 Revenue: MUSD 0.1 (MUSD 0.2) 7 Order inflow / order backlog • Order inflow of MUSD 42.5 in Q2 2013 (96% growth from prior year) • Order backlog of MUSD 35.5 at quarter-end – Higher order inflow and backlog reflects increased demand within traditional market segments and new product designs within Bluetooth Smart Order Inflow and Backlog 2011 – Q2 2013 (MUSD) 50 40 Order inflows grow to highest levels in two years 30 20 Strong order backlog entering Q3 10 0 Q1/11 Q2/11 Order Inflow Backlog Q3/11 Q4/11 Q1/12 Q2/12 Q3/12 Q4/12 Q1/13 Q2/13 8 Gross Margin • Gross margin of 48 % in Q2 2013 – Decline in gross margin from prior year as new products are launched with higher production costs relative to revenues – PC accessories market shifting to lower cost category Gross Margin % of revenue 2011 – Q2 2013 60% 50% 30% New product releases lead to fall in Gross Margin from prior year 20% Gross Margin stable from Q4 / 2012 40% 10% 0% Q1/11 Q2/11 Q3/11 Q4/11 Q1/12 Q2/12 Q3/12 Q4/12 Q1/13 Q1/13 9 Operating Profit • Operating profit (EBIT) in Q2 2013 of MUSD 2.8 – EBIT decline driven by lower revenue and gross margin – Operating expenses remain stable during period Operating Profit by quarter 2011 – Q2 2013 (MUSD) 10 8 6 4 2 0 Q1/11 Q2/11 Q3/11 Q4/11 Q1/12 Q2/12 Q3/12 Q4/12 Q1/13 Q2/13 10 Q2 2013 Financial summary Rapid growth in order inflows, as demand accelerates and new designs are launched Revenue growth • Group revenue of MUSD 28.8 (MUSD 38.7) – Decline in PC accessories and ASIC segments – 19% growth across other business segments, with increasing demand for Bluetooth Smart solutions • Order inflow of MUSD 42.5 (MUSD 21.7) – Reflects accelerating market demand – Order backlog of MUSD 35.5 Profitability Cash Flow • EBIT of MUSD 2.8 (MUSD 9.4) – Lower revenue and GM% drive decline in EBIT • Free Cash Flow of MUSD - 12.7 (MUSD 4.5) – Capital expenditures and working capital increase as company prepares for production and sales of new products – Large payment of 2012 income taxes (final) wireless living .... BUSINESS OUTLOOK Svenn-Tore Larsen, CEO 12 Revenue expected to accelerate in 2H 2013 Business expected to return to growth from 2H 2013, as many new product designs containing Nordic’s Bluetooth Smart solutions are released • Revenue from PC accessories market is expected to stabilize in 2H 2013 • New customer designs with Nordic’s Bluetooth Smart solutions are expected to drive revenue improvement in 2H 2013 – Growing customer interest in developing Bluetooth Smart applications, especially within smartphone accessories («app-cessories») and other sensor networks («the internet of things») – Customer demand for Nordic’s development kits continues to grow rapidly, signaling high product design activity. Many new products due to be launched in 2H 2013. – Excellent customer feedback on Nordic’s wireless solutions confirms competitive advantages in Bluetooth Smart market – Support for Bluetooth Smart within Android smartphones will further expand market • Strong growth rates expected at the end of the year, continuing into 2014 13 Bluetooth Smart market is rapidly expanding Installed base of Bluetooth 4.0 (Smart Ready) devices is now growing rapidly, driving increased demand for Bluetooth Smart accessories Specification of Bluetooth 4.0 Adoption of BT 4.0 “BT Smart Ready” in hub devices Sale of “BT Smart” wireless accessories July 2010 Started in 2H 2011 Started in 2H 2012 • Bluetooth SIG releases final specification of Bluetooth 4.0, with low energy technology • Major consumer electronics categories implement “host” version of BT 4.0 (incl. PC’s, Mobile devices, Home Media centers) • Release and sale of battery powered sensors / peripherals to connect with BT 4.0 hub devices (incl. remote controls, etc.) • “Bluetooth Smart Ready” label indicates ability of hub device to connect with low power peripherals • “Bluetooth Smart” label indicates ability of battery powered peripherals to connect with BT 4.0 hub 14 Major operating systems support Bluetooth Smart By 2015, sales of Bluetooth 4.0 (Smart Ready) devices is expected to reach 2.2 billion*. Support for Bluetooth Smart accessories is progressing across PC’s, tablets, smartphones. Apple • First to support for Bluetooth Smart accessories across its major product lines (smartphones, tablets, PC’s) • Dominant market position in tablets (over 80% market share) • Smartphone customers (approx. 20% market share) are leading consumers of accessories and app content Microsoft • Windows 8 operating system supports Bluetooth Smart accessories • Windows is dominant platform within PC market (over 90% market share), with customer base transitioning to Windows 8 • Growing market share within tablets, with focus on office applications (target users for wireless mouse / keyboard) Google Android • Android is dominant platform in smartphone market (over 70% market share), and has growing market share in tablets • Google has announced that Android support for Bluetooth Smart accessories will be available in the coming months • Android support will be major market driver for Bluetooth Smart accessories * Source: IMS Research (now part of IHS), October 2012 15 Nordic’s sales of Bluetooth Smart are taking off • Bluetooth Smart represented over 12% of Nordic’s revenue in Q2 2013, up from 1% in the previous year – Revenue growth from Bluetooth Smart expected to accelerate in 2H 2013, as many new products are launched featuring Nordic’s solutions Nordic % of revenue from Bluetooth Smart (2012 – Q2 2013) 15% 10% 5% 0% Q1/12 Q2/12 Q3/12 Q4/12 Q1/13 Q2/13 16 Dramatic growth in demand for development kits Growing interest in developing Bluetooth Smart applications is driving record demand for Nordic’s development kits Unit sales of development kits – Driven by new nRF51 product for Bluetooth Smart applications 5823 6000 • 3127 developer kits distributed in 1H 2013, a 50% increase from 1H 2012 – Design activity is positive leading indicator of new product releases 4000 3415 3127 2812 • Nordic’s Bluetooth Smart solutions receive 24% excellent feedback from design teams – Industry leading technical specifications and ease of development 2000 0 2010 First Half Second Half 2011 2012 1H 2013 – Many new products due to be released in 2H 2013, particularly within smartphone accessories 17 News from Apple WWDC Strong support for Bluetooth Smart devices at Apple developers conference • Bluetooth Smart / robotics application takes center stage at Apple CEO’s keynote address – Anki demonstrates how smartphone can interact wirelessly with intelligent robotics systems via Bluetooth Smart – Shows opportunities for developers to create innovative new wireless applications • Apple iOS 7 greatly expands support for Bluetooth Smart – HID profile (wireless keyboard, etc.) – Apple Notification Center Services (e.g., smartphone alerts to nearby devices) – Preservation and Restoration Service (hold connection without opening app) – Core technology within AirDrop (file sharing) 18 New application: Indoor location with Bluetooth Smart Nordic partners with Korean Indoor GPS specialists DIO Interactive Co. Ltd. to develop Bluetooth Smart based indoor location systems • Nordic Bluetooth Smart wireless solution will be positioned every 15 – 30 sq. meters in indoor environment to connect location beacon with smartphones • Provides indoor navigation support and targeted information / advertising • Both companies are members of In Location alliance with Samsung, Nokia, LG, Sony, etc. 19 Strong competitive position in a high growth market Nordic’s competitive advantages Market forces Growth of wireless technology Growth of sensor networks Eliminate wires between devices Ultra-low power wireless pioneer and market leader • Clear market leader - over 800M IC’s sold • Key contributor to BT low energy standard • Board member of Bluetooth from 2011 • Bluetooth Chairman from 2012 Best-in-class technology platforms Adoption of Bluetooth Smart Greatly expands the market opportunity Enables connection to phones, etc. New wireless applications New controllers, “App-cessories”, “Internet of things” • High performance connectivity • Lowest power consumption • SoC’s, protocol stacks, application software and reference designs Key account relations • Leader in major segments • Strong entry position in new segments • Application / market knowhow Competitive cost structure • High volumes on product platforms 20 For more information on Nordic Sign up for a Nordic MyPage account on our website www.nordicsemi.com Provides latest company and investor news directly to your Email address • Wireless Quarterly magazine – learn more about Nordic’s products and markets • Direct links to Nordic content on YouTube, Facebook, LinkedIn, Twitter • Press releases • Stock exchange notices