An Exploration in the Theory of Optimum Income Taxation Author(s

advertisement

An Exploration in the Theory of Optimum Income Taxation

Author(s): J. A. Mirrlees

Source: The Review of Economic Studies, Vol. 38, No. 2, (Apr., 1971), pp. 175-208

Published by: The Review of Economic Studies Ltd.

Stable URL: http://www.jstor.org/stable/2296779

Accessed: 16/04/2008 12:38

Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at

http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless

you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you

may use content in the JSTOR archive only for your personal, non-commercial use.

Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at

http://www.jstor.org/action/showPublisher?publisherCode=resl.

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed

page of such transmission.

JSTOR is a not-for-profit organization founded in 1995 to build trusted digital archives for scholarship. We enable the

scholarly community to preserve their work and the materials they rely upon, and to build a common research platform that

promotes the discovery and use of these resources. For more information about JSTOR, please contact support@jstor.org.

http://www.jstor.org

An

Exploration in

Optimum

the

Income

Theory

of

2axa on12

J. A. MIRRLEES

Nuffield College, Oxford

1. INTRODUCTION

One would supposethat in any economicsystemwhereequalityis valued,progressive

income taxationwould be an importantinstrumentof policy. Even in a highly socialist

economy,whereall who workare employedby the State,the shadowpriceof highlyskilled

labourshouldsurelybe considerablygreaterthan the disposableincomeactuallyavailable

to the labourer. In WesternEuropeand America,tax rateson both high and low incomes

are widelyand lengthilydiscussed3:but thereis virtuallyno relevanteconomictheoryto

appealto, despitethe importanceof the tax.

Redistributiveprogressivetaxationis usuallyrelatedto a man'sincome(or, rather,his

estimatedincome). Onemightobtaininformationabout a man'sincome-earning

potential

from his apparentI.Q., the numberof his degrees,his address,age or colour: but the

natural,and one wouldsupposethe most reliable,indicatorof his income-earning

potential

is his income. As a result of using men's economic performanceas evidence of their

economicpotentialities,completeequalityof social marginalutilitiesof income ceases to

be desirable,for the tax systemthat would bring about that resultwould completelydiscourageunpleasantwork. The questionsthereforearisewhat principlesshouldgovernan

optimumincome tax; what such a tax schedulewould look like; and what degree of

inequalitywould remainonce it was established.

The problemseemsto be a ratherdifficultone evenin the simplestcases. In this paper,

I make the followingsimplifyingassumptions:

(1) Intertemporalproblemsare ignored. It is usual to levy income tax upon each

year'sincome,with only limitedpossibilitiesof transferringone year'sincometo another

for tax purposes. In an optimumsystem,one would no doubtwish to relatetax payments

to the whole life patternof income,4and to initialwealth; and in schedulingpaymentsone

would wish to pay attentionto imperfectpersonalcapitalmarketsand imperfectforesight.

The economydiscussedbelowis timeless. Thusthe effectsof taxationon savingareignored.

One mightperhapsregardthe theorypresentedas a theoryof " earnedincome" taxation

(i.e. non-propertyincome).

(2) Differencesin tastes, in familysize and composition,and in voluntarytransfers,

are ignored. These raise ratherdifferentkinds of problems,and it is naturalto assume

them away.

I

2

First versionreceivedAug. 1970;final versionreceivedOctober1970 (Eds.).

Work on this paperand its continuationwas begun duringa stimulatingand pleasurablevisit to the

Departmentof Economics,M.I.T. The influenceof PeterDiamond is particularlygreat, and his comments

have been very useful. Earlierversionswere presentedat the Cowles Foundation, to the Economic Study

Society, at the London School of Economics,and to CORE. I am gratefulto the membersof these seminars

and to A. B. Atkinson for valuablecomments. I am also greatlyindebtedto P. G. Hare and J. R. Broome

for the computations.

3 Discussions on (usually) orthodox lines, including many important points neglected in the present

paper, can be found in [7], [1], [5, Chapters5, 7, 8], and [6, Chapters11 and 12]. [2] is close in spirit to

what is attemptedhere.

4 Cf. [7, Chapter6].

175

176

REVIEWOF ECONOMICSTUDIES

(3) Individualsare supposedto determinethe quantityandkindof labourtheyprovide

by rationalcalculation,correspondingto the maximizationof a utilityfunction,and social

welfareis supposedto be a functionof individualutilitylevels. It is also supposedthat the

quantityof labour a man offers may be varied within wide limits without affectingthe

pricepaidfor it. Thefirstassumptionmaywell be seriouslyunrealistic,especiallyat higher

incomelevels,whereit does sometimesappearthat thereis consumptionsatiationand that

workis done for reasonsbarelyconnectedwith the incomeit providesto the " labourer".

(4) Migrationis supposedto be impossible. Sincethe threatof migrationis a major

influenceon the degreeof progressionin actualtax systems,at any rate outsidethe United

States,this is anotherassumptionone would rathernot make.'

(5) The State is supposedto have perfect informationabout the individualsin the

economy,their utilitiesand, consequently,their actions. In practice,this is certainlynot

the case for certainkinds of incomefrom self-employment,

in particularwork done for the

workerhimself and his family; and in some countries,the extent of uncertaintyabout

incomesis very great. Yet it seems doubtfulwhetherthe neglectof this uncertaintyis a

simplificationof much significance.

(6) Variousformalsimplificationsare madeto renderthe mathematicsmoremanageable: thereis supposedto be one kind of labour(in a specialsenseto be explainedbelow);

there is one consumergood; welfareis separablein terms of the differentindividualsof

the economy,and symmetric-i.e. it canbe expressedas the sumof the utilitiesof individuals

when the individualutilityfunction(the samefor all) is suitablychosen).

(7) The costs of administeringthe optimumtax scheduleare assumedto be negligible.

In sections 2-5, the more generalpropertiesof the optimumincome-taxschedule,

and the rules governingit, are discussed. The treatmentis not rigorous. Neverthelessa

readerwho wantsto avoid mathematicaldetailscan omit the last page or two of section3,

and will probablywant to glancethroughsection4 ratherrapidly. In section 6, I begin

the discussionof specialcases. The mathematicalargumentsin sections6-8 are frequently

complicated. If the readergoes straightto section9, wherenumericalresultsarepresented

and discussed,he should not find the omission of the previous sections any handicap.

He may, nevertheless,find it interestingto look at the resultsand conjecturespresentedat

the beginningof section7, and at the diagramsfor the two cases discussedin section8.

Rigorousproofs of the maintheoremswill be givenin a subsequentpaper,[4].

2. MODEL AND PROBLEM

Individualshave identical preferences. We shall suppose that consumptionand

workingtime enterthe individual'sutilityfunction. Whenconsumptionis x and the time

workedy, utilityis

u(x, y).

x andy both haveto be non-negative,andthereis an upperlimitto y, whichis takento be 1.

In fact, it is assumedthat: u is a strictlyconcave, continuouslydifferentiable,function

(strictly)increasingin x, (strictly)decreasingin y, definedfor x> 0 and 0 < y< 1. u tends

to - oo as x tends to 0 from above or y tends to 1 from below.

The usefulnessof a man's time, from the point of view of production,is assumedto

vary-from person to person. To each individualcorrespondsa numbern such that the

quantityof labourprovided,per unit of his time, is n. If he worksfor timey, he provides

a quantityof labourny. Thereis a knowndistributionof skills,measuredby the parameter

n, in the population. The numberof personswith labourparametern or less is F(n). It

1 The relationof optimumtax schedulesto propensitiesto migrateis discussedin anotherpaper under

preparation.

MIRRLEES

177

OPTIMUM INCOME TAXATION

will be assumedthat F is differentiable,so that there is a density function for ability,

is n an n-man.

f(n) = F'(n). Call an individualwhose ability-parameter

The consumptionchoice of an n-manis denotedby (xn,yn). Writezn = nyn for the

labourhe provides. Then the total labouravailablefor use in productionin the economy

is

Z=

. . .(1)

{ 00 z,,f(n)dn,

and the aggregatedemandfor consumergoods is

X

=

... (2)

xnf(n)dn.

0

In orderto avoid the possibilityof infinitelaboursupply,I assumethat

nf(n)dn< oo

S

.(3)

.

Eachindividualmakeshis choiceof (xn,yn)in the lightof his budgetconstraint. Using

an income tax, the governmentcan arrangethat a man who suppliesa quantityof labour

z can consume no more than c(z) after tax: the governmentcan choose the function c

arbitrarily. It makessenseto imposethe restrictionon the government'schoice of c, that

c be upper semi-continuous,for then all individualshave availableto them consumption

choicesthat maximizetheirutility,subjectto the budgetconstraint1:

... (4)

(xn,yn) maximizes u(x, y) subject to x ? c(ny).

Notice that (xn,yn) may not be uniquelydeterminedfor everyn.2 I write:

..

Un = u(Xn, Yn))

(5)

Proposition 1. There exists a numberno > 0 such that

Yn= O (n

yn>O

Proof.

_

no),

...(6)

(n>no).

If m<n, and ym>0, u[c(mym), ym]<u [c (n.

m)

m

<u.

Conse-

quently, ym = 0 if yn = 0, since then Ym= 0 gives the utility unto n-man. Thus

has the desiredproperties.|

n

=

inf [n Iy?O]

Proposition 2. Any function3 of n, (xn, yn), that satisfies (4) for some upper semicontinuousfunction c also satisfies (4) for some non-decreasing,right-continuousfunction c'.

1

To say that c is upper semi-continuousmeans that

lim sup c(zi) = c(z) when lim zi = z.

i-~o

If

we can supposethat xi-x

of c,

un = sup {u(x, y) I x _ c(ny)}, and u(xi, yi)->un, xi _ c(nyj)

and yi->y (since {yi}and therefore{xi} is bounded). By the uppersemi-continuity

x ? limsup c(nyj) = c(ny);

and by the continuityof u, u(x, y) = lim u(xi, yi) = u,. Thereforethe supremumis attained.

2 In other words, we have a correspondence,

providinga set of utility maximizingchoices for n-men.

It arises when the consumptionfunction c coincideswith the indifferencecurve for part of its length. It is

convenient neverthelessto use the notation of the text, despite its suggestion that we are dealing with a

function.

3 It is easy to see that the result is true for a correspondencealso.

-178

REVIEWOF ECONOMICSTUDIES

If x' < c'(ny'), then, for any e>0, there exists

Proof. Define c'(z) = sup c(z').

z' < z

y Y

y'such that x - , ?c(ny'). Thus u(x - B,Yn) <un which implies, since u is a decreasu(x, yn)

u,. It follows that

ing function in y, that u(xn- 8, Yn)? Unn

Un Letting

n

(xn, yn) maximizes u subject to x < c'(ny).

c' is clearlya non-decreasingfunctionof z. To prove that it is right-continuous,take

a decreasingsequencezi-z. c'(zi) is a non-increasingsequence,and thereforetends to a

limit,whichis not less than c'(z). If it is equalto c'(z), thereis no moreto prove. Suppose

it is greater. Then for some i>0 each c'(z')>c'(z)+s.

Therefore,thereexists a sequence

(fi) such that 2' ? z' and c'(zi) > c(')> c'(z) +B. The second inequalityimplies that

zi>z. Thus z'-iz. Yet lim supc() > c(z), which contradictsupper semi-continuity.

Thus in fact, c is right-continuous.

11

This propositionsays that the marginaltax rate may as well be not greaterthan 100

per cent. We shall considerlaterwhetherit shouldbe positive.

The governmentchooses the functionc so as to maximizea welfarefunction

w

=

0

G(un)f(n)dn.

...

(7)

I use the functionG here,ratherthan writingunalone, becauseI shalllaterwant to devote

specialattentionto the case uXy= 0 (whenu can be writtenas the sumof a functiondepending only on x and a functiondependingonly on y). In maximizingwelfare,the government

is constrainedby productionpossibilities:it mustbe possibleto producethe consumption

demands,X, arisingfromits choiceof c, with labourinputno greaterthanZ. Theproduction constraintis written

X < H(Z).

... (8)

We have not yet fully specifiedthe possibilitiesavailableto the government,since, if

(xn,yn) is not uniquelydefined,it is not clearwhetherthe governmentor the consumeris

allowed to choose the particularutility-maximizingpoint. Perhapsit is reasonableto

supposethat the governmentcan choose, and that the necessityfor market-clearingwill

make its choices actual. But it will turn out that the issue is of no significancewhen we

make the followingassumption,as we shall:

(A) Ynis uniquelydefinedfor all n exceptfor a set of measure0.

Thus the class of functionsc from whichthe governmentchooses is furtherrestricted

by the requirementthat the functionlead to choices satisfying(A). It will appearin due

coursethat (A) is satisfiedfor all functionsc in the particularcases we shall be most concernedwith.

3. NECESSARYCONDITIONSFOR THE OPTIMUM

On the assumptionthat an optimumfor our problem exists, we shall now obtain

conditionsthat it must satisfy. The mathematicalargumentwill not be rigorous. To do

the analysisproperly,one must attend to a numberof rathertrickypoints. Since these

technicaldetails tend to obscurethe main lines of the argument,rigorousproofs will be

presentedseparately,in the continuationof this paper. The nature of these neglected

difficultieswill be discussedbrieflyin the next section.

The key to a reasonablyneat solutionof the problemis to find a convenientexpression

of the conditionthat each man maximizeshis utilitysubjectto the imposed" consumption

the derivativeof u[c(ny), y] with respect

function" c. If we supposethat c is differentiable,

to y mustbe zero. Denotingthe derivativeof u withrespectto its firstand secondarguments

by ul and u2, respectively,we have

ulnc'(ny)+u2

= 0.

OPTIMUM INCOME TAXATION

MIRRLEES

179

Recollect that unis the utility of n-man. Then a straightforwardcalculation,using the

first-ordercondition(9), yields

- u1yc'

dun

_

...(10)

n

dn

(Theexpressionson the rightare, of course,alternativeexpressionsfor thepartialderivative

of u with respectto n, evaluatedat the maximum. The case wheren entersu in a more

generalmannercan be analyzedby using this more generalequation. We shall returnto

this point later.)

Our problemis to maximizew subjectto the constraintof the productionfunction,

X < H(Z), the differentialequation(10), and the definitionun = u(xn,yn). Thosewho are

familiarwith the PontriyaginMaximumPrinciplewill see that this is a form of problem

fairly suitablefor treatmentby it. Shadowpricesp and w have to be introducedfor X

and Z. Then we would like to maximize

W-pX+wZ

= f[G(un)-pxn +wynn]f(n)dn

. . .(11)

subjectto (10). unis to be regardedas the state variable,yn (say) as the controlvariable,

while xn is determinedas a function of un and Ynfrom the equationUn= u(xn,yn). The

Hamiltonianis

M=

G[(un) - pxn + wynn]f(n) -4)nYnU2

n

whereOn is a functionof n satisfyingthe differentialequation

=~

dn

__

Du

fl+

-f[G(n)-

...(12)

Ynshouldthen be chosen so as to maximizeM:

= 0~

[wn+ pu2] f(n) + O9nRIY

....(13)

wherethe functionqi(u,y) is definedby

f(u, y) = -yu2(x, y),

u = u(x, y),

... (14)

and y is its partialderivativewith respectto y. (Notice, at the same time, that

fu- =

-YU12/ul.)

Equation(12) can now be integratedto obtain an expressionfor in; which, when

substitutedin (13), providesus with an equationto be satisfiedby the optimumwe seek.

Beforegoing on to use this equation,however,we shall deriveit in a differentway, by a

more explicituse of the methodsof the calculusof variations. The use of the Maximum

Principlehas a numberof seriousdisadvantages.It does not showus how to obtaincertain

importantsupplementaryconditionson the optimum. The analysisprovidesno hint as

to how it couldbe maderigorous. It does not provideanyinsightinto the kindof maximization that is going on. Whenwe have done a more explicitvariationalanalysis,we shall

be betterable to see wherethe logical holes are, and to understandwhy things come out

the way they do.

REVIEW OF ECONOMIC STUDIES

180

For this purpose, I prefer to write (10) in integrated form:

n

Un

~dm

YmU2(Xm, Y.)

-

m

o

+ u(c(O), 0),

5

= JY(U., Y.) -+ Uos...

m

o

using the notation ql introduced above, and denoting the utility allowed to a man who does

no work by u0. Suppose first that ql is independent of u (corresponding to the sepcial case

0). If we consider a variation from the optimum which changes the functions un

U12=

and Yn by " small " variations bun and bYn,we deduce from (15) that these variations must

be related by

dm

Jn

.. .(16)

fryYm m +L8oU

m

o

This variation will bring about changes in W, X, and Z. As before, introduce shadow

prices (in terms of welfare) for X and Z. Then the variation must leave (11) stationary:

bUn =

0

=

XJ[G(un)-Pxn +wYnn]f(n)dn

= {[G'(Un)un-P

(ubun

-u 2 6n

+ WbYn jf(n)dn,

... (17)

where the variation in x is calculated as follows:

bUn= 3u(xn, Y)

=

...(18)

UlbXn +u23yn

It remains to substitute (16) in (17), yielding,

Jp [

=

I:

{:

un)

y Ymdm

+ buo] + [wn+p

[G'(um)- -P]f(m)dm. Y + (wn+pp

82]

y

n}f(n)dn

)ff(n)} yndn

ffP](n)dn. buo.

+ f[G'(un)-

... (19)

The second equation is obtained by inverting the order of integration in the double integral.'

(19) is to be satisfied for all possible variations of the function yn, and the number u0.

Since u0 can be either increased or decreased at the optimum (if, as is to be expected in

general, some people will do no work at the optimum),

f

G'([u - P-j f(n)dn = 0

...(20)

at the optimum.

1 The double integralis

X G'(u)-P f(n)

mdn.

-

The region over which the integrationtakes place is definedby 0 ? m _ n. Thus, when the orderof integration is inverted,n ranges betweenm and oo for given m. The integralcan thereforebe written

77

[G'-Pl-]

f(n)dn. y8ym

which is seen to justify (19) on permutingthe symbols m and n.

'

MIRRLEES

OPTIMUM INCOME TAXATION

181

If all variationsin yn werepossible-and this is a questionwe shall take up shortlywe could also claim that the expressionwithincurlybracketsought to be zero:

(wn+p

[I

l{:

=

)f(n)

n

ul

G'(um)]f(m)dm.

-

U1

n

...(21)

It should be noticed that this equation will only be valid for n > nO: it does not apply to

n for which yn = 0 (exceptno) because, there, not all variationsof the functionyn are

possible,sinceYncannotbe negative.

Finallywe know that the marginalproductof labourshould be equal to the shadow

wage:

pH'(Z) = w.

...(22)

These equations,(20) and (21), have been workedout underthe special assumption

that ql is independentof u. In the more generalcase, we have to replace(16) by

bun=

f

o

+ 5u0,

Tmnly6ymm

...(23)

where

Tmn=expf4(u

J

m

' .

. .

. (24)

(4

To show this, we can go back to the differentialequation(10). Applyingthe variation,

we obtainfrom it,

d bun = -1 /luUn +

ly6Yn-

dn

n

n

... (25)

This is a firstorderlinearequation,and can thereforebe solvedby the standardmethodto

give the solution(23).

Having replaced(16) by (23), we can now go throughthe rest of the calculationas

before. We find that (20) is generalizedinto

co

T

[G'(u.)-p/u1]T0nf(n)dn= 0;

... (26)

while (21) becomes

(wn+pu2fu1)f(n)

=

J[p/u1-

G'(um)]Tnmf(m)dm.

...

(27)

Notice that we have Tnmhere, although it was Tmnthat appeared in (23).

If theseequationsare correct,the two integralequations,(15) and (27) may be thought

of as determiningthe two functionsunandyn, giventhe threeparametersu0,w,andp. The

values of these parametersare fixed by the three equations(26), (22), and (8). We have

enoughrelationsto determinethe optimumtax schedule,since the functionc can be determined once we know unand yn.

4. NECESSARYCONDITIONS: A COMPLETESTATEMENT

The argumentused to derive these conditionsfor the optimumtax schedulehad a

numberof weak points. It is indeedunlikelythat the relationshipsderivedabove hold in

general. Among the weak points of the argument,notice that

(i) the existenceof the shadowpricesp and w was assumedwithoutproof;

(ii) the optimumtax schedule,and the resultingfunctionsxn,Yn,and unwereassumed

to be differentiable;

(iii) the applicationof the variationwas quite heuristic; and

(iv) no justificationwas providedfor assumingthat the functionYncould be varied

arbitrarily (for n >no).

M

182

REVIEWOF ECONOMICSTUDIES

I shall not commenton (i) and (iii), which,thoughimportant,are technicalmatters: they

can be justified. (ii) is not satisfiedin general: there was no reason to supposethat it

would be. When (ii) is not satisfied,the first-ordercondition, (9), for maximizationof

utility ceasesto be meaningful. Finally,(iv) is neverjustified. The functionyn is derived

from the impositionof the consumptionfunctionc, and we have no a prioriinformation

about it. We must expect that some conceivablefunctionsyn can never arise from the

impositionof a consumptionfunction. The class of possibley-functionsis no doubt quite

complicatedin certaincases. Fortunatelyit is possibleto specifythat class quitesimplyin

the realisticcases, and it is then possibleto use the variationalargumentrigorously.

Problem (ii) is dealt with in the rigorous analysis by dependingon equation (15)

insteadof the differentialfirst-ordercondition(9). It is a remarkablefact thatthis condition

holds if and only if the variousfunctionsarisefromutility-maximization

underan imposed

consumptionfunction,evenwhenthat functionis not differentiable.For proof, the reader

is referredto [4].

To deal with problem(iv), we have to restrictthe class of utilityfunctionsconsidered.

We assumethat

(B) V(x, y) = -yu2/u, is an increasingfunctionof y for each x>0 (and boundedin

0 < x < x, 0 < y < y for any < oo and y< 1).

It will be noticedthat this is an assumptionabout preferences,not just about the form of

the utility function used to representpreferences. The second part of the assumptionis

readilyacceptable. The first, and main part of the assumptionholds if and only if, for a

given level of consumptionx, a one per cent increasein the amountof work done requires

a largerincreasein consumptionto maintainthe sameutilitylevel,the greateris the amount

of work beingdone. It is equivalentto assumingthat (in the absenceof taxation)the consumer'sdemandfor goods is an increasingfunction of the real wage rate (at any given

non-wageincome.' Fewindividualsappearto havepreferencesviolating(B), andintuitively

it is ratherplausible. We shalllateruse the fact that (B) holds if preferencescan be representedby an additiveutility function. (It will be noticed that, as y-> 1, V-> + 00, so that

the assumptionmust hold for some rangesof y.) If the assumptiondoes not hold, the

theory of optimumtaxationis more complicated.

The point of the assumptionis indicatedin

Theorem 1. Under Assumption(B), zn = nyn maximizes utility for every n under some

consumptionfunction c if and only if

(i) zn is a non-decreasingfunction definedfor n >0;

(ii) 0 < zn<nfor all n>O.

1 This equivalenceis fairly obvious from an indifferencecurve diagram. For a formal proof thait(B)

impliesthat consumptionis an increasingfunctionof the wage rate,let w be the wage rate, and m non-labour

income (both measuredin terms of goods). (B) states that wy, regardedas a function of x and y, is an

increasingfunction of y. Write x and y as functions of w and m, putting x = x(w, m), y = y(w, m) and

x' = x(w', m), y' = y(w', m) where w'> w. I shall show that x'> x.

that x" = x(w", m") = x, and

y

To do this, choose w" and m" such

w

= y(w", m") = W y

Since x"-w'y" = m, (x', y') is preferredto (x",y"); and therefore

x'-x

> w"(y'-y")

e

L(wtytwty)

W

=

=

!! (w'y'-wy)

W

w' (X'-X),

since x'- wy' = m = x - wy. This implies, with our assumptionw'< w', that x'> x.

The conversepropositioncan be proved by reversingthe steps.

MIRRLEES

183

OPTIMUM INCOME TAXATION

For a rigorousproof of this theorem,the readeris referredto [4]. For a heuristicjustification,supposethat znis differentiable,and that c is twice differentiable.The first order

condition,(9), can be written

-

Oz

u(c(z), z/n) =

I [zc'(z)-V(c(z),

z

z/n)] = 0.

...(28)

Furthermore,we have the second-ordercondition, that the derivativeis non-increasing

at zn. Since it is zero there, this is also true when we drop the positivefactor ul/z. In

otherwords,

Oz

[ZC'(z) - V(c(z), z/n)]

_ 0, at z =

Zn.

... (29)

Now differentiate the equation znc'(zn)- V(c(zn)zn/n)= 0 with respect to n:

azc8-v]lz

Oz

= Zn

~dn

zn/n)z/n2.

V(c(zn),

. . .(30)

It follows from (29) and assumption(B) that

dzn >0

...(31)

dn

unlesszn = 0. In fact znis strictlyincreasingwhenn > nO and c is differentiable;a corner

in c causes zn to be constantfor a range of values of n. (An indifferencecurve diagram

makes this clear.) Condition(ii) of the theoremclearlyhas to be satisfiedby the utility

maximizing choice.

To prove that a suitableconsumptionfunctionexists for a given z-functionsatisfying

the two conditions,one definesc by the first-ordercondition(28). (30) then shows(nearly)

that the second-orderconditionfor a maximumis satisfied. This does not yet proveglobal

maximizationof utility,but that also is true.

It shouldbe noticedthat, as a corollaryof Theorem1, condition(A) holds whencondition (B) holds, for zn is shown to be non-decreasingeven if it is a correspondence. It

thereforetakesa singlevaluefor all but a countableset of valuesof n. Afortiori,condition

(A) is satisfiedin this case.

Theorem1 at once impliesthat zn and thereforealso xn are non-decreasingfunctions

when the optimumtax scheduleis imposed. Furthermore,it shows us quite straightforwardlywhat changesin the functionyn we are allowedto contemplatewhen applying

the variationalargumentthat allowablesmall changesshould make only a second-order

differenceto the maximand. The rigorousargumentis still complicated,in part because

one has to allowfor the possibilitythatznis constantoversomeintervals,and discontinuous

at somevaluesof n. Thefull statementof the result,whichis provedin [4],is as follows:

Theorem 2. If preferences satisfy assumption (B) and (un,x", yn) arise from optimum

income taxation, then

(i) zn = nyn is a non-decreasingfunction of n;

(ii) Un=

n

Uo-3 [YmU2(Xm,

ym)/m]dm

(n > 0);

...

(32)

(iii) at all points of increase of zn (i.e., where zn>zn, for all n'<n, or zn<zn for all

n'>n)

An

=

[w+u82I/nul]f(n)-

K

[

G-A

(u)

Tnmf(m)dm=0,

...

(33)

184

REVIEW OF ECONOMIC STUDIES

wheresuperscripts" (n) ", etc. indicatethat the function is evaluatedat n-man

(etc.)'sutility-maximizing

choice,and

(n) + ynU(n)U(n)/U(n)

= -u(-n)

~

m-

). dm'

-

exp

...(34)

=

(iv) If n e [nl, n2], where z is constant on [nl, n2], and [nl,

n2]

Ymyu12(xm',Ym')/U(Xm,

of constancyfor z,

rn

{Amdm

ni

2,

rn2

is a maximal interval

];*(35)

Of,JAmdm < 0;

...(36)

n

(v) If z is discontinuous

at n, Ynis definedto be lim ym,Xn is definedby

m*n-

(9n, Y7n)= Un = U(Xn,Yn),

andui1,etc., denoteu1 evaluatedat n,,5n,whileu1, etc., denoteevaluationat x",yn,

- ,nln) w+ U2/nul

(Wyn-xnln) - (w57n

YnU2

,YnU2

-

w + ii2/ni1

y

(37

jy

If qlyis a non-decreasing

functionof y for constantu, znis continuous

for all n.

(vi)

{G

[-)iG'(um)]

o

(vii) X=

w

T0mf(m)dm= 0,

...(38)

_ui

H(Z),

...(39)

H'(Z).

...(40)

It will be noticedthat in this statementw is the commodityshadowwage rate (wlpin the

earliernotation),whileA (i/p in the previousnotation)is the inverseof the marginalsocial

utility of commodities(nationalincome). The second part of (v) should be particularly

noted, sincewe are quite likelyto be willingto assumethat y is a non-decreasingfunction

of y, and it is a great advantagenot to have to worryabout possiblediscontinuitiesin Zn.

It does not seempossible,unfortunately,to delimita class of casesin whichone can be sure

that [0, no] will be the only intervalof constancyfor z. It shouldbe mentionedthat, when

4fyis not non-decreasing,and the equations(37) may possibly apply, the conditionsof

Theorem1 may definemore than one candidatefor optimality,and then only directcomparisonof the welfaregeneratedby the alternativepaths so definedwill solve the problem.

5. INTERPRETATION

If n is not in an intervalof constancyfor z, and c(.) is thereforea differentiable

function

at zn,the first-ordercondition(9) applies. It can be written

.. .(41)

-u2/nu1 = c'(z).

If we denotethe marginaltax rate, dd[wz

-

c(z)], by 0, we have

=

w+u2/nul

d(wz)

wO= d [wz-c(z)]

dz

= A-

a

Tnmf(m)dm,

...(42)

MIRRLEES

OPTIMUMINCOME TAXATION

185

by (33). (42)suggeststhe considerationsthatshouldinfluencethe magnitudeof the marginal

tax rate. First,it can tell us somethingaboutthe sign of 0: we alreadyknowthat 0 will not

be greaterthan 1, but we werenot previouslyableto say anythingaboutits sign. Of course,

we expectthat it will not usuallybe negative. Using (42) and the conditionsin Theorem1,

we can establishthis rigorously.

Note firstthat 1- AG'u1is a non-decreasingfunctionof n, sincexnis a non-decreasing

functionof n, and a G = G'u1a decreasingfunctionof x. If 1-AG'u1werealwayspositive

Ox

or alwaysnegative,Equation(38) could not be satisfied. Therefore

00 l

f

(1-AG'u1)Tn,f(m)dm

Jn ul

is increasingin n for n less than some n, and decreasingfor n> n; but in any case positive

for n >n. (Here we use the propertiesu1>0, Tmn>O.) Since the integralis zero when

n = 0, it is non-negativefor all n. Consequentlythe marginaltax rate is non-negativeat

all points of increaseof z. If n is not a point of increaseof z, c is not differentiableat Zn.

It is easily seen that, if [n1, n2] is a maximalintervalof constancyof z, - u2/nu1 is equal

to the left derivativeof c at n1, and the right derivativeat n2. Thus both the " right" and

"left" marginaltax ratesare non-negativein this case. Summarizing:

Proposition 3V1 If assumption(B) is satisfied, wz- c(z) (the " tax function ") is a nondecreasingfunction for all z that actually occur (and may therefore be taken to be a nondecreasingfunction for all z).

Havingestablishedthat the integralin Equation(42) is non-negativefor all n, we can

see that the marginaltax ratewill be greaterif therearerelativelyfew n-menthanotherwise;

or if the utility-valueof work, -yuy, is more sensitiveto work done (utilitybeing held

constant); or if n is closer to ni,the value of n at which 1 = AG'u1(and the integralis

thereforea maximum). Iff is a single-peakeddistribution,the firstconsiderationsuggests

that marginaltax rates should be greatestfor the richest and the poorest; but the last

considerationtells the otherway.

In any case, it is importantto note than no, the largestn for whichyn = 0, may be

quite large: if the numberwho do not work in the optimumregimeis large,the marginal

tax rate may not be high at zero income. Explicitly,we can rewriteEquation(38) in the

form

[U1(X~,

0) -i'G'(uo)] F(no)+

A[--lG']

Tnomf(m)dm= 0

...(43)

which,when combinedwith Equation(33) (for n = no) gives

w+

u2(Xo,

nOlxO

?)

)

= t;e (uo, 0) F('no)[AG'(uo) - 1I]

0O(O

ul(xo,

... (44)

?)-

Unfortunately,one cannot get much informationfrom these " local" conditions,at least

for smalln. For any detail,and in particularfor numericalresults,one must examinethe

whole system of equations. It is easierto do that for particularexamplesof the general

problem,and that is what we shall do in succeedingsections. It may be noted, however,

that Equation(44) does provideus with someinformationabout no and x0. For example,

it is clearthat no can be zero only if F/nf tends to 0 as n tends to 0; indeed,since the left

hand side of Equation (44) is bounded, no = 0 only if x0 = 0, and therefore 1/u1 = 0.

It follows that no = 0 only if F/(n2f) is boundedas n-*0, whichmeansthat F tendsto zero

faster than exp (- 1/n). This excludesthe cases usually consideredby economists. We

1 The analysis and result can be generalizedto the utility function u(x, z, n) where the parametern

can indicate-variationsin tastes as well as skill. The extension is fairly routine and will not be discussed

here.

186

REVIEWOF ECONOMICSTUDIES

mayconcludeat this stagethatit will be optimal,in the mostinterestingcases,to encourage

some of the populationto be idle.

A numberof conclusionshave been obtained,but they are fairlyweak: the marginal

tax ratelies betweenzero and one; in a largeclassof cases,consumptionand laboursupply

vary continuouslywith the skill of the individual; therewill usuallybe a group of people

who oughtto workonly if theyenjoyit. The mainfeatureof the resultsis thatthe optimum

tax scheduledependsupon the distributionof skillswithinthe population,and the labourconsumptionpreferencesof the population,in sucha complicatedway thatit is not possible

to say in generalwhethermarginaltax ratesshouldbe higherfor high-income,low-income,

or intermediate-income

groups. The two integralequationsthat characterisethe optimum

tax scheduleare, however,of a reasonablymanageableform. One expectsto be able to

calculatethe schedulein particularcases withoutgreat difficulty. In the next sectionsof

the paper,we shall show how this can be done in certainspecialcases, and obtainfurther

propertiesof the optimumtax in these cases.

6. ADDITIVE UTILITY

An interestingcase ariseswhen, for all x and y,

Ul2 =

0.

...

(45)

Thus ul dependsonly on x, and u2 only on y.

Proposition4. If assumption(45) is satisfied,V(x,y) is an increasingfunction of y,

boundedfor smallx andy.

Proof. V = -yu2(y)/u1(x),and V2 = (-u2-yu22)/u1>0.

Corollary. Underassumption(45), Theorem1 applies.

Boundednessis obvious.11

In particularwe know,from statement(v) of that Theoremthat yn is continuousprovided that fryis non-decreasing. In the presentcase, this conditionis equivalentto the

requirementthat

-yu2(y) is convex.

...(46)

Thereis no reasonwhy this assumptionshouldhold in general,but it is easilycheckedfor

any particularcase. We shall now restrictattentionto cases for which(46) holds.'

If we restrictattentionalso to caseswherez is strictlyincreasingwhenn >no, the optimum situationwill be a solutionof the equations

W+

8

nu,

Un

=

Uo-J

= VI,

n2fi(n)

)

YmU2

o

(

n

Ul

-AG')f(m)dm,

... (47)

...(48)

d.

m

We shall furtherassumethatf is continuouslydifferentiable. Since xn,yn are continuous

in this case, it follows that unand

+ _!2 -)liy are differentiablefunctionsof n. Write

nu,.

w+

v=-

U2

nu,

4iy

...(49)

1 In [4] a theoremis provedwhich states that the conditions of Theorem2 are in fact sufficient(as well

as necessary)for an optimum in the special case now being considered.

MIRRLEES

OPTIMUM INCOME TAXATION

187

u and v are continuouslydifferentiablefunctionsof x and y. Since au >0, au <0, and,

Ox

ay

as can easilybe seen, eV <0 eV <0, the Jacobiana(u, v) is alwaysnegative. Consequently

Ox

ay

o(x,

y)

x and y can be expressedas continuouslydifferentiable

functionsof u and v, and are therefore themselvesdifferentiablefunctionsof n.

We can now write Equations(47) and (48) as differentialequations:

dv

n

du

1

nf

f

Vm_ v (2+

I

dn

2G'

_

n2ul

Y2

dn

... (50)

n2

...(51)

n

which, as we havejust shown,can be thoughtof as equationsin u and v. The particular

solution we seek, and the particularvalue of A,,are definedby the boundaryconditions,

Equations(39), (40),

Vno=

2f(n)

...(52)

UAG'(un))]

whichis the form (38) takes here,and

vnn f(n)-0

....(53)

(n- oo),,

which is apparent from Equation (47). Provided that zn is strictly increasing for n

>

no,

a

solutionthat satisfiesall those conditionswill, by Theorem2 of [4],providethe optimum.

Equations (39) and (40), the production function and the marginal productivity

equation,may be ignoredin the calculations. Correspondingto the particularvalues of

w and 2 usedin the calculation,one obtainsvaluesfor Xand Z. Thuswe knowthe optimum

tax schedulewhen the marginalproductis w and the averageproductis X/Z. In this way

one could obtaina rangeof tax schedulescorrespondingto differentaverageproductsand

marginalproducts-which is what one wants. Of course, it is desirableto choose 2 so

that the averageproductwill be relatedto the marginalproduct,w, in a reasonableway.

This shouldnot presentany greatdifficulty.

To determinethe sign of

dv

dn

_

(22 _

nu,

_

\)

dy

I dn

nu,

1(

dy

dn

y

(u22 _

n nu,

Yn+ ndy we calculate,from Equation(49),

dn

=

dn

_Vly

y+

u2u11 dx

nu2 dn

u2

n2ul

u2

-

+

n2ul

U2UI1)

3

nu

dz

dn

dy

u2211

_

nu3 dn

_Y

n

U2U11

nu3

y

v(

nu,

du

dn

-

*(54)

22

n2ul

substitutingfrom (51). Therefore,using (50)

Lu22 _vr* +u2u11 dz = YU22 _yy

-nu,

nu, _ dn

nu,

=-yl(2~+n

+ U2 -

nu

+YL//

)+

+

)

+ fn2t(

V+G$

+

n

... (55)

REVIEWOF ECONOMICSTUDIES

188

We may thereforecheckthe assumptiondz > 0 by examiningthe solutionto see whether

dn

+ YYY

(2+ -

2

-

-G'> 0.

...(56)

Equation(56) is equivalentto dz >0 becausethe expressionin squarebracketsin Equation

dn

(55) is negative,termby term.

In computation,one can proceedas follows:[1] A value of

|u

A

is chosen. To get the right order of magnitude,one can calculate

{

G'fdn (cf. (38))for someparticularfeasible,and aprioriplausible,

'fdn/

allocationof consumptionand labour.

[2] A trial value of no> 0 is chosen. (It shouldbe bornein mind that the inequality

vno > 0 may, with (52), restrictthe rangeof possibleno.)

[3] Bearingin mind that yno= 0, the values of vnoand uno are obtainedfrom (49)

and (52).

[4] The solution of equations(50) and (51) is calculatedfor increasingn until either

(56) fails to be satisfied,or it becomesapparentthat (53) will not be satisfied(see

[6] below).

[5] If (56) fails to be satisfied,zn is kept constant,un(and v")being calculatedfrom

(49) until (56) is satisfiedagain, when zn is allowed to increaseand the solution

pursuedas in [4].

[6] The attemptedsolutionshouldbe stoppedif unor xn beginsto decrease,or vn or

Ynfall to zero, or xn, yn cannot be calculated(e.g. becauseunexceedsthe upper

bound of u, if there is one). Other stopping rules can be given for particular

examples,dependingon the structureof the solutionsof the equations.

[7] A rangeof trialvaluesof no mustbe usedto findthe one that most nearlyprovides

a solution satisfying (53). Efficientrules for iteration might be obtained in

particularcases.

7. FEATURES OF SOLUTIONS

Solutionsmay,for all I know,be verydiversein theircharacteristics;but examination

of the equationssuggestsa numberof comments. First we note that v"will always lie

between 0 and

1

,

since

qy(O),

1+

0

<

U2

nu

l+

U2

nu, <

...(57)

We are thereforeled to expectthat v tendsto a limit as n->oo. (It mightcycle for certain

forms off, of a kind one would perhapsbe unlikelyto use.) y is also bounded,by 0 and

1, and is thereforelikelyto tend to a limit. Oneis thenled to certainconjecturesaboutthe

limits,which ought to hold for sufficientlyregularf and u.

MIRRLEES

OPTIMUM INCOME TAXATION

189

Let

- +y+2<oo.

...(58)

b00

nfdn < oo, y > 0: otherwisen2f is increasingfor large n, thereforebounded

(Since

0

below.) Further,suppose

aex

u,

..>(59)

)*

as x-+ oo. Thenthereappearto be threecases; in each of which one expectsthe following

resultsto hold.

(i) u<1. Asn -+oo,

and

Yn-+1

v .-.+.(61)

0.

..

.(60)

The marginaltax rate,

0-+ 1.

...(62)

(ii) u = 1. As n-+oo,

Yn Y~

wherey is defined(uniquely)by

and

.(63)

**

YU2(Y)= -a,

Vn-[-(1 + )u2(j))-YU22(0)]1.

. . .(64)

...(65)

Furthermore,

0-> 1j+

...(66)

v

...(67)

where

YU22(Y)

UY)

(iii) 1u> 1. As n-+oo,

*.*(68)

and

v-[-(1

+y)u2(0)]1.

...(69)

1

...(70)

1+y

(It may be noted that, in a naturalsense,(66) holds for all cases.)

Beforeindicatingthe reasonsfor these conjectures,a few words of interpretationmay

be in place. On the whole, the distributionof incomefrom employmentappearsto be of

Paretianform at the upper tail1: Equation(58) holds with y between 1 and 2, roughly

speaking. It is not improbable,however,that marginalproductivityper workingyear is

distributeddifferentlyfromactualincomes: the lognormaldistributionis the mostplausible

simpledistribution. For this, y = oo, and

nf _ logn

f

for largen;

(a2

a2

is the varianceof the distributionof logarithmof incomes).

1 See the generalassessmentby Lydall [3].

...(71)

REVIEWOF ECONOMICSTUDIES

190

The realismof alternativeassumptionsabout utility may be assessedby calculating

the responseof the consumerto a linearbudgetconstraint,x = wy+a. It is easy to see

that utility-maximization

requires(sinceul2 0)

u1(x)

1

x=wy+a.

=-,

U2(y)

W

... (72)

If u1 = cxx, we have to solve

caw = -(a+wWY)4U2(Y).

(If aw < &-au2(0), y

=

O.)

...(73)

Clearlythe solutionhas the followingproperties:

y-+ I as w- oo if < 1,.

y-+Oas w-*oo if j> 1.J

(Cf. (61) and (68).) Also

x-a+w

aw

(y<1),

13(5

(

)t

These asymptoticpropertiessuggestthat the case yu 1 is particularlyinteresting.

Whenp = 1, since, by (73)

a = - --yax

w

U2

-Yu2-+c

as w-*oo;

i.e.

.

. . (76)

Y- ,

wherey is definedby (64). (Cf. (63).) If in addition,

u2(y) = -(-y)A

(3>0),

.. .(77)

we have

90(1 y)

=

y(1-9)

=

a,

v.

The choiceof a maybe influencedby consideringthaty = 0 whenwla < 1/a. It is interesting to note that, if

ac=2, 3 = 1, y =2,

v=2,

y=2/3,

and, if our conjecturesare correct,

0-+60 per cent.

Thiscaseis perhapsnot completelyunrealistic;but it shouldbe remembered

thatthe homogeneousformfor u meansthat the decisionnot to workdependsonly on the ratio of earned

to unearnedincome,whichis not a veryrealisticassumption.

It will be noticed that, in this case, the asymptoticmarginaltax rate is very sensitive

to the value of ,u(in the neighbourhoodof 1).

The reasonsfor the conjecturesEquations(60)-(70)(in fact, I can providea proof of

(iii) and will do so below)are as follows. One expectsthat, as n-* oo,the relevantsolution

of the differentialequationswill tend towardsa singularityof the equations: not only will

y and v tend to limits,but n dy and n dvwill tend to zero. Denote the postulatedlimit of

dn

dn

y,, by y. Considerfirstthe case ul = oax-(4u< 1).

MIRRLEES

OPTIMUM INCOME TAXATION

191

In this case utilityis unbounded. I shall show that y = 1. If not, u2 and ify tend to

finitelimits,and, from (51), we have

nu dx

Therefore,since u1 dx= o

dn

dy\ -

_u(y+n

[

1 x -Ja

x

X1

U2(-

...(78)

dn I1- y

-

=-9u2(y

log n[1+o(1)].

...(79)

I

This impliesthat

nu1 = 0[n(log n)f 1i]

...(80)

o00.

..(81)

Therefore

1

('x

n2f(n)J

[i

--A jf(m)dm=

1>0,

IF

1+

[1 + 2]

...(82)

which is readilyseen to be inconsistentwith (80) if the distributionis either Paretianor

lognormal.

We must thereforeexpect that y = 1. Supposenow that 1+ 2, the marginaltax

flu

rate, tends to a limit t < 1. Then

dx

dn

_

U2

(y

nu,

dy\

dn

...(83)

+nI->1+1,1

and consequently

X

...(84)

n

This impliesthat

-=

U1

(1- )0n'1 + o(1)],

-

...(85)

OC

from whichwe can deducethe behaviourof

I

{

oo. In the Paretiancase,f-

n-2-y,

as n->

U(I-

)f(m)dm

...(86)

it is easily seen that

...(87)

I--(2+y-u)-1>O.

Since 1-I =

limn-v

u2

. u2

J-,

and y

nu,

1_ d logfu2

tends to -oo as y-*1 (if it tends

dy

u2

to a limit at all), we musthave U2 -+O,whichis inconsistentwith the assumption < 1. In

nu,

the lognormalcase, one obtains

1-l = lim

u2 constant

u2

If 'y

u2

nu1

log

n

1 tendedto a finitelimit, since

log n

log I u2 # log(1-l) +log (nu,) #(1-ji) log n,

Y

...(88)

192

REVIEWOF ECONOMICSTUDIES

1

d log U2

u I would tend to a finite limit as y-+1; which is clearly impossible.

log I U21 dy

_

Thus in the lognormalcase too, we expect that t = 1. This explainsthe conjecturesin

the case u< 1.

If,u=

1,

dx

ocd(log x) = nu,

=

dn

d(log n)

yn(

dy

*dy(89)

dn

which thereforecannot tend to oo, since in that case uj1 =

finiteM, so that

21

f

1

>nM

n eventuallyfor any

f(m)dmbecomesunboundedas n- oo.

< 1 and

We can expect,therefore,that y-

logx

...(90)

Y-yU2(y).

log n

It is easily seen that the only plausiblevalue of y is that for whichlog x/log n- 1, i.e.

Then if 1+

U2

nu1

... (91)

-a.

YU2(Y) =

-4, we shall have

nocx

--1

-+

-U2(Y)

U-,

1-t

and

VIy

f( m)Pfdm-+

n2f(n) Ju

(I)'r

-U2(Y)

Y)

Y'

whichsuggeststhat

t=frt) G') -U2(Y)

Y

...(92)

(1 - t)(1+ v)/y,

in the notation(57). This is equivalentto (56). In particular,we expectthat I = 0 in the

lognormalcase.

When u> 1, the utility functionis boundedabove, and a more generaland rigorous

treatmentis easy. un is an increasingfunction,and beingnow boundedtendsto a finiteii.

We shall write

u(x,y) = x(x)+p(y).

...(93)

Since x is an increasingfunction,X(x)also tends to a finite limit j. Thus p(y) tends to a

limit, and so does y. The limit of y must be zero, since otherwise(32) implies u-+co,

whichis now impossible.

Now

=

qy

nu,

ip

nul

... (94)

-+

-U2(0)

OPTIMUM INCOME TAXATION

MIRRLEES

in this case (since

-,

being <

,

nu,

193

is bounded . Therefore Equation (50) becomes

U2

n

dv1

dn(Y+1+o(1))v+

+o(l)

~~~~U2(0)

...(95)

in the Paretiancase. From (95) one deduces,by the usual methodof solvinga first-order

lineardifferentialequation,that

1

_ U2(0)(Y

...(96)

+ 1)

from which it follows at once that the marginaltax rate tends to (y+ 1)-. It is easily

checkedthat in the lognormalcase the marginaltax rate tends to zero.

In the next section,a particularcase is examinedin detail, and providesconfirmation

for some of our conjectures.

8. AN EXAMPLE

CaseI. Let us, by way of illustration,analyzethe followingcase:

u = oclog x+]og(1-y)

G(u)= f(n)

1.

(lPog

= 1exp

n+1)2

(log

[

J

2

L

(The last assumesa lognormaldistributionof skills: the averageof n is 0_= O607...).

We put w = 1. With these assumptions,Equations(50) and (51) become V

dv

dn

logn

n

du

dn

y

n(l-y)'

x

A

n2

n2

where

x

1-

V= 01+

/V/

nu,

],*=

- y)

-y)2

1/cc(l

n(

=

(1

Y)(

1y

x

e

and

eu= x (1-y).

For simplicity,we considerthe case ,B= 0 first,and put

1-y,

s=

t

=

log n.

The equations become, since u = a log (an) + a log

s-

+ log s,

dv = v t+ 1 -s+2e-t,

ds

= [1-a_

dt

-(1

1

(1 + a)s](s2-v)+ocs(vt+2e-t)

+a)s2-(1-a)v

In the case of 9 = 0, we define G = u.

...(98)

(99)

REVIEWOF ECONOMICSTUDIES

194

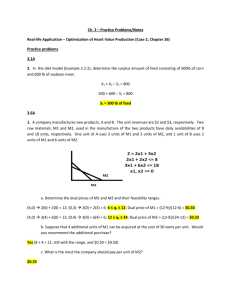

Solutionsof these equationsare depictedin Fig. 1. We now establishtheirproperties.

We rememberthat, in the optimumsolution,0< v<s2 (for the marginaltax rate, v/s2, is

between0 and 1). Using this fact, we can deducefrom the firstequationthat

v-+O (to so).

Supposethat, for some t, vt > 1. Then

d- v

dt

>vt+V

v-s2

s

>vt-1_O,0

'I

v~~~~~~~~~~~~~~~~

2-t~~

1

5

FIGuVR 1

since v>0, and s < 1. Therefore v is increasing at an increasingrate, contradicting

v<s2 < 1. Thisshows that, in fact,

0<v< l/t.

...(100)

The two equationstogetherimply that

I1-(1 +oc)s I-a2

d '-a _

...(101)

s a (S -V),

[S 'a(S2 V)] s

dt

as one may see if one multipliesthe firstby as, and the secondby [(1 +oc)s2-(1- cx)v],and

subtracts. Write

-

r =sa(s2_v).

... (102)

MIRRLEES

OPTIMUM INCOME TAXATION

195

so that

dr

1-(1 +ex)s r

_

dt

When s <

,

...(103)

s

r increases; when s>

,

r decreases. For this reason s cannot tend to a

limit otherthan l/( +oc): we shall show more, that s-?1/(1 +oc). (Cf. Fig. 1.)

Since v-+0, given s>0, thereexists to such that 0<v,<e for all t _ to. Then

1+a

s

If

rt>(l+o)-

a

a -

1-a

cs a

1+a

<r<s

rS

...(104)

(t_ to).

, the right hand inequality implies that

1

St>-~~.

l+oc

Thereforer is decreasing. If

1++a

rt<(l

+oa)-

... (105)

1-a

max[l, (1 + oc) ccJ.

a -e

. ..(106)

we obtain from the left hand inequality(104),

St a <(1+x)-

a

-e{max[1,

(l+

O)~

a } <(1O)-

]-St

... (107)

a

if, either oc? 1 (in which case {...} ? 0 since s _ 1), or a> I and st>

.

Thus, in

fact

St <1+cx

and, by (98), rt is increasing. Combiningthese two results,we deducethat

...(108)

l+cc

a

-+<(l+o()

whichin turnimplies,since v>0, that

St-1+

. ...(109)

1+c

Our demonstrationthat v and s tend to limits 0 and

,

respectively,confirmsthe

conjecturesfor the specialcase. It is readilycheckedthatexactlythe sameargumentsapply

to the case /3>0. As we have noted previously,the marginaltax rate is v/s2. Thus, as

t ->oo

o0-.

... (1 10)

It is a strikingresult; but we shouldnote at once that 0 is a poor approximationto V/S2

even for larget. This becomesapparentwhenwe demonstratethat vt-* 1

I1+o

>s > 0 for an unboundedset of values of t.

Suppose the contrary,that vtIf Vt>

1+e

+ s, and t is large enough to imply that st<

dv > ...

1

1+

(Ili)

REVIEW OF ECONOMICSTUDIES

196

Thus vt continuesgreaterthan 1 +6, and - > is for all largert: but this impliesthat

dt

1+0e

v-* c, which we have alreadyshown to be false. If on the otherhand vt<

l+cx

and

-?,

t is greaterthan 2 and is largeenoughto imply

vt<

4

A

2tet

+

<

4

1

Stx

-

~~~~1+0e

then

d-(vt) = v + t(Vt-S) + Vt + Ate-t

s

dt

-8

I__

1+

< 1+

2

+

+

1

This impliesthat vt becomesnegative,which is impossible. Therefore vt-

I

for

<6

all largeenought:

Vt-*

I

.

(113)

I+o

Thus

o=

2_

v/s=...

14)

=..(1

t

Only 1 per cent of our populationhave t > 1P7(one in a thousandhave t > 2*4).

Since one mightwant to have acas low as 1, the above approximationis clearlyratherbad

even at t = 2., 2 How bad will becomeapparentin the next section.

CaseII. It is also of interestto examinethe case of a skill-distribution

with Paretian

tail:

nf'

f

... (115)

y+2,y>?

The equationsfor the optimumbecome(with,B= 0),

dv_

dt

-

vy(t)+

v

-s++

...(116)

et,

dtt

ds =[I1-oec-(I

+ O)S](S2-v) + os(vy(t)+ et)..(17

dt

(I + Oe)S2 Oe-)V

1 In this example, r2= 1: that is, the standarddeviationof log n is 1. This is done merely for convenience in manipulations. A preciselysimilartheory holds for a generallognormaldistribution.

It can be shown, by continuing the methods of the text, that vt-

l

I

-t

while s =

I

+0 (

The fact that the optimum path is tangential to the vertical at (s, v) = (11 , O)implies that s<

for large t, since otherwiser would be decreasing,and that, as can be seen from the diagram,is inconsistent

Thus we have the situationportrayedin Fig. 1.

with dv ??

2

The case /> 0 can be treatedin a preciselysimilarway, to obtain the same qualitativeresults.

MIRRLEES

OPTIMUM INCOME TAXATION

197

and, exactlyas before,one has the equation

dr _1-(1+ao)s

dt

s

where r = s

(

(S2-v).

(118)

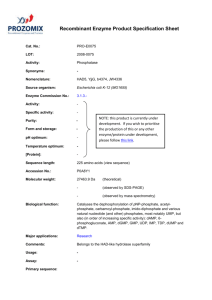

The situation is portrayed in Fig. 2. The broken curves have

equations

s

a(s _v) ri i

2,2 3) v= s

...(119)

V~~~~~~~

v

1/

/ //

S2~~~~~~~~~~~~S

~ ~ ~~~~~

vs +1

FIGuRE 2

with 0 < r1< r2< r3. It will be noted that such a curve,with equation

v= s2-rs

ac(r constant),

...(120)

alwayscuts from below the curve

dVI

v2=

= sv - rs3+ p_

constant)

(p

r cntant),>

...

...(121)

(120)

that passesthroughthe samepoint. This follows from the calculation,

ds

dN1

N

_

ds

dv2

_

ds \ys+

d vs3 ~rs

>0.

...(122)

198

REVIEW OF ECONOMIC STUDIES

This remark will prove very useful; but first we want to establish that, for large t,

the sign of dt is nearly the same as the sign of v_-YS

dt

vs +1

Let e' be a positive number, and let t1 be so large that Ivy(t)+Ae-t - vy I>6' when

t ? t1. Since s = 1 at to = log no, s< 1 at t only if s = 1 for some previous t1;

1+o

1+o

if (for the given t) t1 is the greatest such, we have from Equation (118)

rt> t =(1

-a)-

a(nf

+

2-Vtl

t St

|

{(1+a)2

1+oc dt

since as t- oo, 0>

d-

dt

5

...(123)

=A/\>0,

implies

-t

Vt<

s2

+

o(1)

VSt + 1

< S2_

... (124)

yS t3+o(1).

Therefore st is positively bounded below, say

st > A'>0.

... (125)

Hence, when_t _ t1,

dt

= vy(t)+ v

s

-s+Ae-t

>,

... (126)

if

2s'

s2

S+ +

ys+

... (127)

11

y

Similarly, we can show that

dv<,

dt

... (128)

if

v<

s

YS+1

Now write ?= 8'/( + 1).

2

Y+

...(129)

1

It is clear that, if, for some t

v s-I +s

YSl

and s >

=1+aoc

t,

MIRRLEES

199

OPTIMUM INCOME TAXATION

then dv >0 and also dr <0. Therefore,by the propertiesof the two sets of curves(cf.

dt

dt

Fig. 3), v

s2_is increasing. Thusfor all subsequentt,~~~~~~~~dv

>e', and v-?oo. Sucha path

dt

Ys+1

cannot be optimum. Consequentlyon the optimumpath, if t _ tl,

1 or v?

either s<

l+oc

S2

ys+1

+C.

...(130)

-?.

...(131)

Similarly, for t > tl,

either s> 1 or v> s

1+oc

-ys+1

X~~~~~~

+

pi

/~~

FIGuRE 3

Suppose that at t1, s> 1

(An exactly similar argumentapplies if s<

1*)

Then r is decreasing,and continuesto do so until

2(

) N

r =r' =(1+Soc)~ aE ( 1+oe)2

1 (1+oe+y) +6,.

(Cf. Fig. 4.) Once s <

Only then can s becomeless than 1

1+x ~

~

~~+

Thereforeat no time is

r<r" = (1+Oc)

1,

r increasesagain.

a G +a)2(1 +a

Nor can we have r>r' at any later time. Thus we have found t2 such that, when t > t2,

LMPQ in Fig. 4, which containsX, and can be

(st, v) lies in the curvilinearparallelogram

made as small as we pleaseby suitablechoice of 6'. Thereforeas t-+oo,

1+o

(t

oc)(l+oc+y)32)

REVIEWOF ECONOMICSTUDIES

200

The optimumpath is indicatedby XZ in Fig. 2. On it, the marginaltax rate,

v2

.(133)

'

~~~~~..

l +a+Y

s2 1+ocy

whichconfirmsour conjecturein this specialcase.' 2

It shouldbe noted that we have not shown,in eitherof these cases, that s diminishes

(nor even that z = ny = et(1 - s) increases)all along the path: the possibilitythat z is

constantfor somerangeof n, in the optimumregime,remainsin both the exampleswe have

discussed. Calculationof specificcases is requiredto settlethis issue. Suchcalculationis

not difficultwith the informationabout the solutionthat we now have.

/

/

sZ

/

/

//

~~/

/

X~~

-M+T

w~~~~~~~~~~~~~~

Ls

FIGu1

4

9. A NUMERICAL ILLUSTRATION

The computationswhose results are presentedin the tables below were carriedout

for the first case examined above, with oc= 1, but with a more realisticvalue for c2.

Computationshave also beencarriedout for the case U2 = 1, andtheseprovidean interesting contrastto the mainset of calculations. In all cases,we take w = 1; and for computationalconvenience,the averageof log n is -1. Thismeansthatthe averagemarginalproduct

of a full day'swork is ef272, but it amountsonlyto a choice of unitsfor the consumption

good. The results show, for particularvalues of the averageproduct of labour, X/Z,

what is the optimumtax schedule,and what is the distributionof consumptionand labour

in the population.

1 The case 3>0 can be treatedin a preciselysimilarway, to obtain the same qualitativeresults.

2

It is possible to calculate optimum tax schedulesexplicitlyfor a uniform (rectangular)distribution

of skills; but since that distributionis of no great interest in the presentcontext, the analysis is omitted.

OPTIMUMINCOME TAXATION

MIRRLEES

201

For purposesof comparison,one naturallywants to know what would have been the

optimum position if it had been possible to use lump-sumtaxation (or, equivalently,

directionof labour). Let us considerthis first for the case ,B= 0. We shall assume a

linearproductionfunction

...(134)

X=Z+a

(whichone thinksof as applyingonly overa certainrangeof valuesof Z, includingall those

that are to be considered). In the full optimum,we maximize

[log x + log (1- y)] f(n)dn

T

subject to

.(135)

..

fxf(n)dn = fnyf(n)dn +a.

It is clearthat x will be the samefor everyone:

...(136)

x = x?,

and that yn must maximize

...(137)

log (1-y)+Jny/x0,

for otherwisewe could improvemattersby changingyn(for a set of n of positive measure,

of course)and changingthe constantx correspondingly.Maximizationof (137)yields

where the notation

[...]+

.. .(138)

[1-x?/n]+,

y=

means max (0,

...).

It is worthnoticingthat in the full optimum,only men for whomn > xo actuallywork,

and an interestingcuriositythat, with the particularwelfarefunction specifiedin (135),

utilitywill be less for morehighlyskilledindividuals. This is, as we have seen, impossible

underthe income-tax. The value of xo is determinedby the productionconstraint:

(n-xo)f(n)dn+a,

x?

...(139)

xo

where,for convenience,we havetaken

f(n)dn = 1. In the case of the speciallognormal

distributionused here,it can be shownthat this equationreducesto

...(140)

a.

2x0- x?F(x) - e-ff2 [-F(e

2X0)]=

Solution of this equationgives the consumptionlevel in the full optimum,and also the

skill-levelbelow which no work is requiredof a man, namelythat at which a full day's

labourwould providea wage equal to the consumptionlevel.

Whenf,>0, a similartheoryholds. In that case, x>xo for men with n>xo, but it is

still the case that such men are made to have a lower utility level than their less skilled

neighbours. The equationcorrespondingto (140)is a little more complicatedand will not

be reproduced. For n> xo, consumptionand labourare

Xn = (x0)(1+P)/(1+2P)n/(l+2P)

Yn=

..2.(141)

-(X01n)(1

In the tables, certainfeaturesof the optimalregimeunderincometaxationare given,

along with xo for the full optimumfor the samelinearproductionfunction. In TablesI-X,

the lognormaldistributionhas parametersa = 0 39. This figureis derivedfrom Lydall's

figuresfor the distributionof incomefrom employmentfor variouscountries([3], p. 153).

It is intendedto representa realisticdistributionof skills within the population. In each

202

REVIEW OF ECONOMIC STUDIES

TABLE I

(Case 1)

0-39, mean n = 0 40, XIZ = 0 93.

ot= 1, =0, c

Full optimum for X

Z-0-013:

xO = 0419, F(xO) = 0-045.

Partialoptimum (income-tax): xo = 0-03, no = 0-04, F(no) = 0-000.

F(n)

x

y

0

010

050

0 90

0.99

0-03

010

0-16

025

0-38

0

0-42

045

048

0-49

Population average

0417

x(l -y)

0 03

005

0-08

0-13

0419

z

full

optimum

x

0

009

0 17

0-29

0 45

0419

019

0 19

0419

0419

0418

0419

TABLE II

Same case as TableL

z

x

0

005

0.10

0-20

0 30

040

050

0 03

0*07

0*10

0418

0-26

0*34

043

o=1,

=,

Average

tax rate

per cent

-34

-5

9

13

14

15

Marginal

tax rate

per cent

23

26

24

21

19

18

16

TABLE HI

(Case 2)

cr = 039, mean n = 0 40, X/Z= 140.

Full optimum for X = Z+0-017:

xO = 0-21, F(xO) = 0-075.

Partialoptimum(income-tax): xo = 005, no = 0-06, F(no) = 0-000.

F(n)

x

y

x(l -y)

z

Full

optimum

x

0

0410

0 50

0 90

0 99

0*05

0411

0-17

0-27

0 40

0

0-36

0*42

0-45

0-47

0.05

0 07

0.10

0-15

0-21

0

0-08

0415

0-28

043

0-21

0-21

0-21

0-21

021

Population average

0418

0417

0-21

TABLE IV

Same case as TableIII.

z

0

005

040

1013

0-20

0 30

040

0 50

x

005

0'09

0*21

0-29

0*37

0-46

Average

tax rate

per cent

-80

-30

-5

3

6

8

Marginal

tax rate

per cent

21

20

19

17

16

15

MIRRLEES

203

OPTIMUM INCOME TAXATION

TABLE V

(Case 3)

= 1, P - 1, o = 0 39, mean n = 0 40, X/Z = 1V20.

Full optimum for X = Z+0-030: xO = 0 16, F(xO) = 0 016.

Partialoptimum(income-tax): xo- 007, no = 009, F(no) = 0000.

F(n)

x

0

0 10

0 50

0 90

0.99

0*07

0*12

0-17

0-26

0*39

Populationaverage

0 18

x(l -y)

y

z

Full

optimum

x

0

0-28

037

043

0*46

0-07

0*08

0*11

015

0-21

0

0-07

0-14

0-26

0-42

0416

0-18

0-21

0 25

0 29

0 15

0 21

TABLE VI

Same case as Table V.

z

Average

tax rate

per cent

x

0-07

0 11

0414

022

0-29

0 37

0A45

0

0 05

0'10

0-20

0*30

0 40

0 50

-113

-42

-8

2

7

10

Marginal

tax rate

per cent

23

28

27

25

23

21

19

TABLE VII

(Case 4)

= 1, ,3 = 1, o = 0 39, mean n = 0 40, X/Z= 0-98.

Full optimumfor X = Z-0 003: xO= 0414,F(xO)= 0 007.

Partial optimum (income-tax): xO = 0 05, no = 0-07, F(no) = 0 000.

F(n)

x

0

0410

0 50

0 90

0.99

0-05

0410

0415

0*24

0*37

Populationaverage

0416

y

0

0 33

0-41

0*46

0*48

x(l -y)

z

x

005

0 07

0 09

0*13

0.19

0

0-08

0415

0-28

0 44

0-14

0417

0-20

0-23

0 26

0417

0419

TABLE VIII

Same case as Table VII.

z

x

0

0 05

010

020

0 30

0 40

0 50

005

0 08

012

019

0-26

0 34

0-41

Full

optimum

Average

tax rate

per cent

-66

-34

7

13

16

17

Marginal

tax rate

per cent

30

34

32

28

25

22

20

204

REVIEW OF ECONOMIC STUDIES

TABLE IX

(Case 5)

039, mean n = 0 40, X/Z = 0-88.

o=

, ,B= 1, o =

Full optimum for X = Z-0-021;

xO = 0-13, F(xO) = 0 004.

Partialoptimum(income-tax): xo = 004, no = 0 06, F(no) = 0 000.

x

F(n)

0

0 10

0 50

0 90

0.99

004

0 09

0O14

0O23

0O36

Population average

0415

y

0

0O36

043

0-48

0 50

x(1 -y)

004

0-06

0-08

0O12

0418

z

Full

optimum

x

0

0-08

0-16

0-29

0 45

0-13

0-15

0-18

0-22

0-25

0417

0.19

TABLE X

Same case as TableIX.

Average

z

x

0

005

010

0-20

0 30

0 40

0 50

004

007

0.10

0-17

0-24

0-31

0 39

tax rate

per cent

per cent

-43

-3

15

20

22

21

TABLE Xl

(Case 6)

1, mean n = 0-61, XIZ

= 1,o =

oc= 1,

Full optimum for X = Z-0-013:

Marginal

tax rate

35

39

36

31

27

24

21

0 93.

xO = 0-25, F(xO) = 0 35.

Partialoptimum (income-tax): xO= 0410,no = 0-20, F(no) = 0-27.

F(n)

x

y

0

0*10

0 50

0 90

0.99

0*10

0*10

0-14

0-32

0*90

0

0

0*15

0-41

0*49

Populationaverage

0418

x(l -y)

0*10

0*10

0.11

0.19

0*46

z

Full

optimum

x

0

0

0-06

0 54

1-84

0-25

0-25

0-28

0 44

0-62

0-20

0-32

TABLE XII

Same case as TableXI.

z

x

0

0 10

0-25

050

1P00

1P50

2-00

3 00

0.10

0415

0-20

030

0-52

0 73

0*97

1P47

Average

tax rate

per cent

-50

20

40

48

51

51

51

Marginal

tax rate

per cent

50

58

60

59

57

54

52

49

MIRRLEES

OPTIMUM INCOME TAXATION

205

.4

.3

s 1-4-

*cXs

1

I0

*2

.4

3

FIGURE

5

z

5

Optimum

Consumnptio

Function

.3 i Distribution of

4

Consumption

after Tax

.2

CaSe 5:

X

1c=,

;nea

mean

Distributionof Income

k/;///,;;;t -efore Tax

/7<SX/B/

10

I=,6-.39,

X/Z=_____.88,

-

/

//777rr-.

12

.3

FIGuRE

.4

6

.5

z

t7.40,

206

REVIEW OF ECONOMIC STUDIES

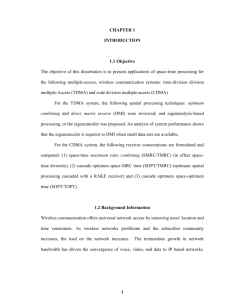

case, x0, no, and the values of x, y and x(I -y) (which measures utility) at the 10 per cent,

50 per cent, 90 per cent and 99 per cent points of the skill-distribution are given. In separate

tables, the average and marginal tax rates are given for a representative range of values of

z. Graphs of the optimal consumption schedule (x = c(z)) are given in Figs. 1 and 2.

In Fig. 2, the distributions of xn and zn are displayed in case 5.

It will be noticed at once that, under the optimum regime, practically the whole

population chooses to work in each of these cases: this contrasts, in some cases, with the

full optimum, where sometimes a substantial proportion of the population is allowed to be

idle. In most cases, a significant number work for less than a third of the time. It is also

somewhat surprising that tax rates are so low. This means, in effect, that the income tax

x

1*5

.5

Case 6:

?

.5

1

FIGURE

*5

c=I

2

z

7

is not as effective a weapon for redistributingincome, under the assumptions we have made,

as one might have expected. It is not surprising that tax rates are higher when,B = 1.

When objectives are more egalitarian, more output is sacrificed for the sake of the poorer

groups. Nevertheless, the difference between the optimum when only an income tax is

available, and the full optimum, is rather large.

The examples have been chosen for X/Z fairly large: this corresponds to economies

in which the requirements of government expenditure are largely met from the profits of

public production, or taxation of private profits and commodity transactions. Tax rates

are, as one might expect, fairly sensitive to changes in X/Z (i.e. to the production possibilities

in the economy, and the extent to which income taxation is used to finance government

expenditure as well as for " redistribution "). Tax rates are mildly sensitive to the choice

of,f. (When c = 4i,the main features are unchanged).

Perhaps the most striking feature of the results is the closeness to linearity of the tax

schedules. Since a linear tax schedule, which may be regarded as a proportional income

tax in association with a poll subsidy, is particularly easy to administer, it cannot be said

that the neglect of administrative costs in the analysis is of any importance, except that

MIRRLEES

OPTIMUM INCOME TAXATION

207

considerations of administration might well lead an optimizing government to choose a

perfectly linear tax schedule. The optimum tax schedule is certainly not exactly linear,

however, and we have not explored the welfare loss that would arise from restriction to

linear schedules: nevertheless, one may conjecture that the loss would be quite small.

It is interesting, though, that in the cases for which we have calculated optimum schedules,

the maximum marginal tax rate occurs at a rather low income level, and falls steadily

thereafter.

This conclusion would not necessarily hold if the distribution of skills in the population

had a substantially greater variance. The sixth case presented has a = 1. So great a

dispersion of known labouring ability does not seem to be at all realistic at present, but it

is just conceivable if a great deal more were known to employers about the abilities of

individual members of the population. The optimum is in almost all respects very different.