Summary of the Facts Galaxy Sports Inc. (Galaxy) has three

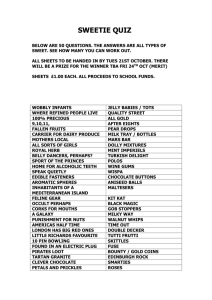

advertisement

Summary of the Facts Galaxy Sports Inc. (Galaxy) has three reporting units, Fitness Equipment, Golf Equipment, Hockey Equipment. In December 2009, Galaxy contracted Big Time LLC (Big Time) to perform an annual ASC 350, Intangibles - Goodwill and Other, for each of their reporting units. In late January 2010, Big Time determined that for each of Galaxyʼs reporting units the fair value of goodwill exceeded its book value, meaning there was no need for impairment. In each of Galaxyʼs first three quarters of 2010 they reported earnings lower than expected and common share prices fell. Galaxy cited reduced customer spending and competition from sports equipment manufactured in China. At year-end 2010, Galaxy determined to carry over the fair value determinations provided by Big Time in 2009 for both the Fitness Equipment and Hockey Equipment reporting units. Also, Galaxy decided for the Golf Equipment reporting unit to update Big Timeʼs fair value analysis using the same growth rate and discount rate as the previous year. Question 1: Should management have performed an interim goodwill impairment test as of September 30, 2010? Response: Yes, Galaxyʼs management should have performed an interim goodwill impairment test as of September 30, 2010 . According to ASC 350-2035-30, “Goodwill of a reporting unit shall be tested for impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount,” and cites “unanticipated competition” as one such circumstance. Galaxy states that one of the reasons for its earnings being below expectations is that the slowing economy is causing them to see an increase in competition from sports equipment manufactured in China. This fits the guidelines, provided by ASC 350-20-35-30, to require testing for impairment between annual tests. When trying to determine fair value, ASC 350-20-35-22 states that, “Quoted market prices in active markets are the best evidence of fair value.” In this respect, Galaxyʼs common share price has fallen from $56.75 as of December 31, 2009 to $31.50 as of September 30, 2010. This is almost a 50% decrease which would reasonably cause one to believe that fair value has decreased, possibly below book value, since Big Timeʼs 2009 determinations. Question 2: Assume no interim test is required. Was management justified in carrying forward the prior-year goodwill impairment test for the Fitness Equipment and Hockey Equipment reporting units? Response: Yes, management was justified in carrying forward the prior-year goodwill impairment test for the Fitness Equipment and Hockey Equipment reporting units. According to ASC 350-20-35-29, the determination of a fair value may be carried over to the next year if it meets three criteria. The first criteria is that the reporting unitʼs assets and liabilities have not changed significantly since the last determination. According to Galaxy, “assets and liabilities of the Fitness Equipment and Hockey Equipment reporting units had not significantly changed.” This satisfies the first criteria. The second criteria is that the most recent determination of fair value was substantially greater than the book value. According to Galaxy, “The most recent fair value determinations for both reporting units resulted in an amount that exceeded the carrying amounts by substantial margins.” This satisfies the second criteria. The final criteria is that based on analysis of events and circumstances nothing has changed that would reasonably cause fair value to fall below book value. According to Galaxy, “on the basis of its analysis, there have been no significant events or circumstances that would cause the fair value to fall below book value for both reporting units.” This satisfies the third criteria. Since all three criteria of ASC 350-20-35-29 have been met, Galaxy management was justified in carrying forward the fair values for both its Fitness Equipment and Hockey Equipment reporting units.