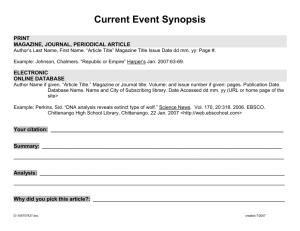

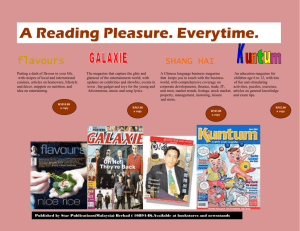

The Loyalty Challenge: How Consumer Magazine

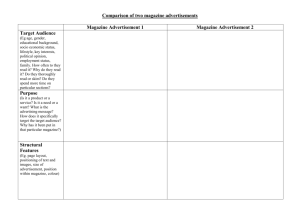

advertisement