subsidies financed with distorting taxes

advertisement

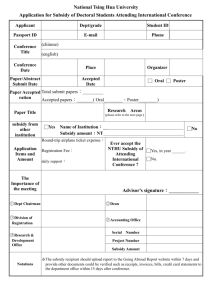

National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 SUBSIDIES FINANCED WITH DISTORTING TAXES EDGAR K. BROWNING* Abstract - Subsidizing the production of particular goods or services is frequently justified on the basis of positive externalities, but the conventional analysis neglects the welfare cost of the taxes that finance the subsidy. This paper shows how the familiar partial equilibrium analysis of a subsidy can be extended to take account of the marginal welfare cost of raising the necessary tax revenue. The focus is on identifying the marginal social cost (MSC) of using the subsidy to expand output which, in conjunction with the marginal social benefit (MS8) of the output, determines the (second-best) optimal subsidy. Three types of subsidies are analyzed and compared: excise subsidy, marginal excise subsidy, and in-kind transfer. An important part of government spending is devoted to the subsidization of the production (or consumption) of particular goods and services. Externalities are often cited as the justification for such subsidies, and the familiar textbook analysis illustrates how to determine the optimal Pigovian subsidy, where the subsidy per unit should equal the marginal external benefit (MEB) at the efficient level of output. This analysis is, however, incomplete, because it implicitly assumes there is no welfare cost associated with raising the tax revenue necessary to finance the subsidy. This is well known, but exactly how to incorpo*Texas A&M Unwerslty, College Station, TX 77843 12 1 rate the welfare cost of taxation into the traditional analysis has not been made clear tn the literature. A major purpose of this paper is to show how this extension can be accomplished within a simple partial equilibrium model. Closely related to this issue is the burgeoning recent literature on the marginal cost of public funds.’ This literature emphasizes how the welfare cost of taxation should be measured for purposes of evaluating the social cost of government spending. The relevant measure of social cost is called the marginal cost of funds (MCF) and equals the direct resource cost of taxation (the revenue raised) plus the marginal welfare cost of collecting the revenue. With MCF properly measured, the (second-best) optimal level of spending is where the marginal benefit of government spending equals MU. In principle, that solves the problem of determining efficient subsidies. In practice, however, it is not always clear how to measure the marginal benefit of government spending, especially when the expenditure takes the form of subsidization of particular goods and services, with or without externalities present. (In the MCF literature, the expenditure is always assumed to be on a pure public good, so the marginal benefit is simply taken to be the summed marginal rates of substitution between the public and private good.) This National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 paper basically extends the MCF literature by assuming that we know the magnitude of MCF and shows how to apply it to the analysis of different kinds of subsidies. others, a conclusion that follows directly from incorporating the welfare cost of taxation as part of the social cost of the polICY. The analysis in this paper is based on a partial (equilibrium model of the market that is being s#ubsidized. The magnitude of the marginal welfare cost of the taxation used to substclize this, market is assumed to be a constant and Independent of the type or size of subsidy used. Note that this does ignore the possible interdependencies between the subsidizecl market and the taxed sector of the economy. While I think this is often a reasonable assumption and certainly makes the analysis more accessible, its limitations must be acknowledged. Ng (1980) has investigated this issue within a general equilibrium framework, and the relatively limited conclusions derived serve to emphasize the necessity of making some sort of simplifying assumptions about the relevant interdependencies. Sandmo (1975) also analyzes a similar problem within an optlrnal commodity tax framework where it is assumed that all government expenditures and taxes are optimally determined rather than assuming (as I do) that there is ;ln unavoidable marginal welfare cost of taxation associated with financing a subsidy. These approaches lead to an emphasis on the various possible types of interdependencies between the taxed and subsidized sectors, whereas the approach adopted here allows us to focus on the implications IlDr particular subsidies in a given market. EXCISE SUBSIDY I begin with an analysis of an excise subsidy, the familiar Pigovian remedy for a market with external benefits. Then the analysis is extended to two other types of subsidies, a marginal excise subsidy and an in-kind transfer. In each case, I show how to idenltify the (second-best) optimal subsidy when the expenditure is financed with taxes that result in welfare costs. The analysis also shows that some types of subsidies are Intrinsically imore efficient than In what follows, I assume that the product to be subsidized is produced by a constant-cost competitive industry. Income effects on the demand for the product, either from changing the form of subsidy or from collecting the tax revenue, are assumed to be negligible. Much of the analysis does not depend on whether or not there are (jny external benefits associated with the subsidized market, but when externalities are assumed to be present, they are taken to be a function of total industry output. Obviously, there are important cases where this is not true-when external benefits flow from consumption and differ among individual consumers--but extending the analysis to these cases is straightforward.2 Tax revenue to finance any subsiclies is acquired through the use of taxes that produce excess burdens, or welfare costs. The marginal welfare cost, that is, the additional welfare cost associated with each dollar of revenue, is assumed to be constant and equal to W The assumption that W is constant and independent of the size of the subsidy will gelnerally be appropriate, becaL[se any given subsidy absorbs a small portion of total tax revenue and therefore does not significantly aifect the magnitude of marginal welfare cost (Browning, 1976). Marginal welfare cost is closely related to the concept of the m(arginal cost of funds; Indeed, the MCF is simply one plus W, or the direct cost of the revenue plus the indirect efficiency cost produced by increasing tax rates. However, much of the literature on MICF has emphasized that the proper measure of MCF (or W) depends on how the funds are spent (Wildasin, 1984). I22 National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 SUBSIDIESFINANCED WITH DISTORTINGTAXES This issue can be ignored here, since the focus is on subsidizing a particular product, and we can just assume that W is the appropriate measure for subsidization of this product. When there is a marginal welfare cost of financing an excise subsidy, the social cost of expanding output beyond the competitive level will exceed the private marginal cost of producing the extra output. The marginal social cost (MSC) of increasing output with a subsidy is the sum of the private marginal cost of producing the extra output and the welfare cost of the taxes that finance the subsidy required to stimulate the extra output. If W is zero, as implicitly assumed in the usual textbook analysis, MSC is simply the private marginal cost, as given by the supply curve. When W is positive, there is an additional social cost and MSC will be greater than private marginal cost. As we will see, MSC depends not just on W, but also on the type of subsidy and on the price elasticity of demand, which affects how much government spending is required to expand output. Intuitively, this is obvious: MSC for an excise subsidy will be smaller the more elastic the demand for the subsidized good, because this means that less tax revenue (and hence less welfare cost) is required to expand output by any given amount. The crucial step in the analysis is the determination of MSC for each subsidy. Once that is identified, the determination of the (second-best) efficient output simply involves equating MSC and the marginal social benefit (MSB) of the good, where the latter measure includes any external benefits that are related to output. Note that this approach differs from that in the literature on MCF. There, MCF is equated to the marginal benefit of government spending to determine efficient spending. Here, we equate the MSC of expanding output using a particular subsidy with the MSB of that output, with the efficient level of spending determined implic- itly by the efficient level of output. Carefully handled, these two approaches are equivalent, but when applied to subsidies in particular markets, I believe the approach adopted here is preferable. In part, this is because it just extends the conventional partial equilibrium analysis of a subsidy In a particular market and so focuses explicitly on the implications of incorporating the welfare cost of taxation. Now let us turn to the derivation of MSC for a per unit excise subsidy. In Figure 1, the competitive demand and supply curves are shown as D and 5, respectively, and competitive output is Q-,. Let the subsidy per unit be given by T and P be the price to consumers, equal to MC - T, where MC is marginal cost. The total budgetary cost of the subsidy, C, is TQ. The marginal budgetary cost per unit of output-how much total spending on the subsidy must rise to stimulate an extra unit of outputis given by q dC dT -=Qz+T dQ For a constant-cost industry, dT is equal to dP, so equation 1 can be rewritten as dC P --+T z-7 where r) is the price elasticity of demand, expressed as a positive number. Equation 2 gives the marginal budgetary cost associated with a change in output brought about by changing the subsidy per unit; it is how much taxes must be increased to finance the incremental subsidy that increases output by a unit. This is not itself a social cost; as with any subsidy, it is only a transfer. However, if there is a positive marginal welfare cost associated National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 FIGURE 1. Marginal Soci.4 Cost Excise Subsidy MC with ralislng the tax revenue to finance this budgetary cost, therie will be a social cost Ihat results from the marginal budgetary outlay: it will be given by (P/q t T)W. This expression gives the added welfare cost produced by financing the marglnal budgetary cost with distortionary taxation. rhat is part of the MSC associated wtth changing output. The other part is, of course, the MC of tne resources used to produce more of thcl product. Thus, the IMSC of changing output with a per unit excise subsidy is given by MSC == MC +- p t T IN. i 77 ) T’o Interpret equation 3, let us initially assume that the demand curve IS of constant unit elasticity In that case, equation 3 simplifies to MC(‘I + PI/), since P -t- T = MC. For example, if W equals 0.25, then MSC IS simply 1.25 times the private marginal cost o-f producing the output, and this magnitude is independent of the level of output (In excess of the competitive output). The MSC curve for a unit elastic demand curve (not for the linear demand curve shown) is shown as MSC, in Figure -____--- 1. Note that It originates at the competltive output, since we are concerned with the cost of expanding output beyond that level. The intuitlon behind MSC, is easy to explain. Whl?n demand is unit elastlic, direct consumer outlays are constant relgardless of the size of the subsidy and they are equal to the resource cost of the first Qa units. Therefore, the marginal budgetary cost necer,sary to expand output is exactly equal to the resource cost of producing the increment in output. In other words, to expand output by one unit, the budgetary cost must increase by exactly MC when demand io unit elastic. Financing that budgetary cost entails a welfare cost of (MC)W, so the marginal social cclst is higher than marginal private cost by the proportion (1 + W). When dernand is of constant elasticity not equal to one, MSC is not a constant but depends on the size of the subsidy per unit, as shown In equation 3. For example, if the price elasticity is 0.5, the additional welfare cost component of marginal social cost--the (P/T + T)W term in equation 3--for the first unit of output in excess of Q. is exactly twice as large as for the unit elastic case (since, in equation 3, T is equal 124 I National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 SUBSIDIESFINANCED WITH DISTORTINGTAXES to zero and P is equal to MC for the first unit). The MSC curve when elasticity is 0.5 is shown as MSC 5 in Figure 1. It is negatively sloped and approaches MSC, as price approaches zero. Its negative slope arises because the additional budgetary cost of successive units falls when demand is inelastic. When elasticity is greater than unity, the MSC curve begins with a value lower than MSC, and rises with output, approaching MSC, from below as price approaches zero.3 MSCz is the MSC curve when demand is of constant elasticity equal to two. The important implication of this analysis, of course, is that the MSC of expanding output with a per unit excise subsidy depends strongly on the price elasticity of demand for the product. (When demand is not unit elastic, it also depends on the size of the subsidy.) It is (socially) more costly to increase output of a good in inelastic demand, because the budgetary cost will be higher and therefore the additionat welfare cost due to the taxes that finance the outlay will be larger. Now let us turn to the determination of the (second-best) optimal subsidy and output when the competitive output is not efficient. Assume that there are external benefits associated with the output of good X. The MSB of good X is then P + MEB, where P is the marginal private benefit given by the demand curve and MEB is the marginal external benefit. Efficiency then requires that output be expanded to the point where MSB equals MSC, so the condition for efficient output is II P+MEB=MC+ This is illustrated in Figure 2. Marginal social cost is shown by MSC, drawn to refleet the assumption of a unit elastic demand curve (although the demand curve is 125 drawn as linear for simplicity). Marginal social benefit is shown by the MSB curve, the vertical sum of the private demand curve D and the MEB curve (not shown separately). The efficient output when a per unit excise subsidy is used to expand output is given by the intersection of the MSB and MSC curves at output Q,, and the subsidy per unit is equal to GH. The welfare gain is shown by area ALE. Area BEFG is the additional welfare cost produced by the tax that finances the excise subsidy. By contrast, if the tax used to finance the excise subsidy produces no marginal welfare cost, the efficient output would be Qz and the subsidy per unit would be CJ. (Note that when W is zero, equation 4 simplifies to MEB = MC - P = T: the subsidy per unit is equal to the MEB, the familiar conclusion from externality theory.) The welfare gain is shown by area ABC. The use of a distorting tax to finance the excise subsidy therefore reduces the achievable welfare gain from area ABC to area AFE, a reduction of area EFCB. It should also be noted that the efficient level of government spending is always smaller with a greater marginal welfare cost of taxation (implying that MSC is larger). This is because the efficient output is always smaller when MSC is larger, implying T is smaller; therefore expenditures, the product of T and output, will be smaller.4 It is obvious from Figure 2 that, if MSC is sufficiently large, it will be inefficient to use any excise subsidy despite the presence of positive MEBs. The necessary condition for an excise subsidy to produce a welfare gain is that the MSB evaluated at Q0 must exceed MSC evaluated at QO. Recalling that T = 0 and MC = P at Q,, the necessary condition can be expressed as II MEB W \ -, 77 National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 FIGURE 2. Optrr~~~l Exctse Subsidy \Nhen ldemanld is unit elastic at I&, this simply says that MEB must be a larger proportion of the market price than W (which is already expressed (3s a fraction). If MEB is 25 percent of market price, marginal welfare cost i’s 30 percent, and demand is unit elastic, then efficiency calls for not subsidizing this proditict with an excise subsidy. When demand is inelastic, MEB must be larger to justify a subsidy, and they must be smaller if demand is elastic. put some quantitative perspective on these conclustons and also to provide a ba!;IS for comparison with the different types of subsidies considered subsequently, it will be helpful to develop a simple numerical example. Assume that demand is unit elastic and select units so that the competitive price and quantity are 1 and 100, respeci:ively: Q = lOOF’. Assume further that IMEBs are always half as large as marginal Iprivate benefits (so the MEB curve is also [unit elastic): IQ = 5O(MEB)-‘. Then marginal social benefits are given by -r0 l\/lSB = 150Q-‘. The welfare gain, G, from expanding iput with a subsidy is, then given by out- Q G= I (MSB - MSC‘IdQ. QO When financed with a tax that has a zero marginal welfare cost, the MSC IS one and the efficient output is 150 (from setting equation 6 equal to one and solving). The welfare g;-lin from the optimal subsidy IS •91 Q G = I (I ;OQ-’ = ITO In Q - -- l)dQ Q 1::: := 10.82. The welfare gain is therefore just under 11 percent of total outlays on the product. Since government outlays are $50, the welfare g,-tin is equal to just under 22 percent of total spending. Now suppose that W is equal to 0.25 (which is, I believe, a fairly conservative figure based on the estimates available in the literature) so that MSC is 1.25. The efficient output when financed with this tax is 120, so the welfare gain is given by I National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 SUBSIDIESFINANCED WITH DISTORTINGTAXES ary cost of the subsidy is equal to T(Q Q”), so the marginal budgetary cost of changing output is given by 120 G= I (ISOQ-' - 1.25)dQ 100 = 150 In Q - I .25Q 1;:: = 2.35. The welfare gain in this case is only 2.35 percent of total outlays on the product, less than one-fourth as large as achievable when a nondistorting tax is used to finance the subsidy. It is apparent from this example (as it is from inspection of Figure 2) that the welfare gains possible from using an excise subsidy are substantially reduced when a distorting tax is used to finance the subsidy. We will return to this example later below to show how the situation differs for different types of subsidies. MARGINAL EXCISE SUBSIDY A marginal excise subsidy is a subsidy that lowers the price to consumers only for units in excess of some exempted level of consumption. For example, consumers might have to pay the full market price (MC) for the first 10 units purchased, and then additional units would be available at the subsidized price, MC - T. Such a subsidy is not easy to administer since it must be provided directly to consumers and resale of the product must be prevented, but when feasible, this type of subsidy offers significant efficiency advantages over an excise subsidy that applies to all units consumed. Figure 3 illustrates a marginal excise subsidy. The term Q* is the level of exempted consumption; this is the sum of the exempted levels of all the consumers (the level can vary from consumer to consumer). A subsidy of T per unit applies to consumption in excess of Q*, so the price of additional units is P and total purchases are Q. Now consider the MSC of expanding output with this type of subsidy. Total budgetIL, dC dT -=Qz+T-Q*% dT dQ which simplifies to Equation I I gives the marginal budgetary cost of increasing output by a unit, and multiplying this by marginal welfare cost gives the part of MSC associated with the financing of the subsidy. Adding this to the direct resource cost of additional output gives MSC: u MSC=MC+[;(I-$)+T]W Equation 12 shows that, for given values of 77 and W, the MSC of a marginal excise subsidy is lower than that of an excise subsidy, and it will be lower the higher the exempted level of consumption as a fraction of total consumption (Q*/Q) is. This is not surpnsing since a marginal excise subsidy involves a smaller total (and marginal) budgetary outlay to stimulate additional consumption and therefore a smaller added welfare cost from the financing of the subsidy. Figure 3 shows the MSC curves for three different levels of exempted consumption (with demand assumed to be unit elastic in all cases). MSC is the relationship when the exempted level is zero; this is simply the curve for the per unit excise subsidy from the previous section. MSC* is the relationship when the exempted consump- National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 FlGURE 3. Marginal Social Cost: Marglnal Excise Subsidy !ion is half the competittve level of Qo. It begins at exactly half the level of MSC and rises with output. Finally, MSCo IS drawn for a marginal excise subsidy when the exempted level is exactly Q,,; note that MSC begins at MC in this case. ,4s in the case of an excise subsidy, we can give the necessary condition for there to exist a margrnal excise subsidy that will rmprove welfare by evaluating the MET3 and IMSC at the competitive output level. The result is: IMEB W .->. P 11 I\Aarginal external benefits do not have to be as large to justify a marginal excise sublsidy as to justify an excise subsidy (comIpare equations 13 and 5). Of course, this is (obvious from the relative positions of the MSC curves This analysis makes it clear that there are Iefficiency advantages to the use of a mar(ginal excise subsidy rather than an excise <subsidy, and .these advantages are greater the larger the exempted level of consump- tion is. To suggest the yuantitatrve magnitudes that may be Involved, let us extend the numerical example from the iiast section. The same assumptions regarding demand, supply, MEB, rnarginal welfare cost, and demand elasticity will be used; the only difference is in tlhe type of subsidy used. Let us assume t:hat the exempted level of consumption of the marginal excise subsidy is 50, exactly half the competitive level of output, 100. Inserting this and the other assumed values into equati,on 12, we find that MSC is equal to 1.25-1 250Q2. (Evaluating this at the competitive output, we see that MSC of the first unit is 1 .I 25 compared to 1.25 for an excise subsidy applying to all units.) Equating MSC and MSB (equation 6), we find that the optimal output for the marginal (excise subsidy (conditional on Q* equal to 50) is 127.8. Thus, the welfare gain from the use of this subsidy is 1273 G= r J100 (150Q-' - 1.25 + 125OQ-*)dQ = 150 In Q - 1.2512 -- 1250 Q-' I;;;" IL8 = 4.76. I National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 SUBSIDIESFINANCED WITH DISTORTINGTAXES This welfare gain is more than twice as large as that possible with an excise subsidy (2.35) but still is less than half as large as that achievable if nondistorting taxes can be used to finance the subsidy (10.82). Applying the same procedure for a marginal excise subsidy that exempts the competitive output (Q* = 100)5, a larger exemption than is likely to be practical, we can calculate that the optimal output is 134.8 and the welfare gain from the optimal subsidy is 7.74. These examples suggest that there are substantial welfare advantages to the use of marginal excise subsidies when distorting taxes are used to finance the outlays. IN-KIND TRANSFER There are a variety of in-kind transfers that can be used to subsidize consumption of a good, and the type I will examine in this section is the unpriced voucher. With this subsidy, consumers receive a voucher which can be used only to purchase a specified product. The voucher is denominated in dollars so that, if the face value is Y dollars, Y/MC units of consumption can be purchased with the voucher. (The food stamp program is an example of this type of in-kind transfer.) Resale of the product is not permitted. One characteristic of this type of subsidy is that it will not increase consumption of the good beyond the competitive level until the face value of the voucher exceeds total outlays of consumers at the competitive equilibrium. For example, if a consumer is given a voucher worth $100 and his or her unsubsidized outlay on the product is $150, private purchases will fall to $50 and total consumption will be unaffected. At least this is true if we maintain the assumption of zero income effects on demand. That assumption is a reasonable approximation if the consumers are also the taxpayers. However, in many instances where there is substantial redistribution to 129 all or a subset of consumers (as in the case of the food stamp program), ignoring income effects would be unwarranted. I will consrder first the case of zero income effects and then examine how the analysis differs when income effects are taken into account. Thus, with zero income effects, thts in-kind transfer increases consumption only when the government finances the entire consumption of the product6 Total cost of the in-kind transfer is (MC)Q, where Q is the subsidized quantity and MC is constant and equal to price since I continue to assume constant-cost conditions. Marginal budgetary cost, dC/dQ, is undefined up to the point where government is financing exactly Q. units; thereafter, it is equal to MC, and the social cost associated with financing the marginal unit is equal to (MC)W. Thus, MSC is given by MSC = MC(l + W). Note that MSC is constant; it does not depend on output or the demand elasticity. Figure 4 illustrates the analysis for an inkind transfer. Assume the subsidy leads to consumption of Q units. Total budgetary cost IS then equal to (MC)Q, and the associated total welfare cost of the taxes that finance this outlay is equal to W times (MC)Q. This is shown in the graph as the sum of the shaded rectangular area (the welfare cost of the tax necessary to finance the Q. units that would be consumed in the absence of the subsidy) plus the rectangular area ACFE (the welfare cost of the tax necessary to finance the expansion in consumption from Q0 to Q). In effect, there is a fixed cost with an in-kind transfer, as shown by the shaded area, because the first Q, that are subsidized do not result in any increase in total consumption. After that cost is incurred, the MSC of expanding output beyond Q. is shown by MSC, as given by equation 15. National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 In-Kind Transfer FIGURE 4. Marginal Social i ./ MC/ I 1 I_- The welfare effect of an in-kind transfer that expands consumption from Q, to Q (where Q is greater than QJ is now the sum of two terms. The first is the welfare cost of subsidizing the first Q. units of consumption, given by W(MC)Q,. The second telrm is the welfare effect of expanding output from Q0 to Q, given by the difference between MSC and MSB summed over thlese units. In terms of the graph, the net gain (or loss) from the subsidy is shown by area ABC minus the shaded area. In general, the welfare gain (positive or negative) is given by -0 cc;= - W(MC:Q, + I (MSB - MSC)dQ ~Qo It is clear that MEB must be quite large for an in-kind transfer to be capable of producing a welfare gain. For example, using the azumptions of the earlier numerical example (with unit elasticity and marginal external benefit equal to half the consumer’s marginal valuation), if the in-kind transfer is used to finance consumption at the level where MSC and MSB are equal, there vvill be canet loss of 22.65. (The tri- _-----Qo Q angle ABC- equals 2 .35, and the shaded rectangle equals 25 in this case.) It IS straightforward to determine how large MEB must be for the in-kind transfer to produce a welfare gain in the context of the earlier numerical example Varying MEB as a fraction of marginal private beneflts alter the MSB given by equation 6; for example, if MEB is equal to marginal pnvate benefit, MSB will equal 2OOQ-‘. Equating MSB and MSC (equation 15) allows us to determine Q, and equation 16 can be used to solve for the welfare gain. Following this procedure, I find that MEB must be greater than 1.12 times as large as marginal private benefit before there can be a positive welfare gain from the use of this type of in-kind transfer. Of course, the required level of MEB is lower if marginal welfare cost is lower than the 0.25 value assumed. Now let us turn to the case where income effects are important, as would be the case when the consumers do not pay the taxes that finance the in-kind transfer. Let Q, be the level of consumption where the constraint prohibiting resale becomes binding. Then the in-kind transfer is equivalent to a lump sum transfer and will expand 130 I National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 SUBSIDIESFINANCED WITH DISTORTINGTAXES consumption through its income effect up to the point where consumption equals Q,. The marginal budgetary cost of expanding output over this range is then MC/M, where M is the marginal propensity to spend on good X out of income. (For example, if MC equals $1 and M equals 0.25, the government would have to spend $4 to increase consumption by one unit.) The social cost associated with financing the marginal unit is thus equal to (MC)W/M, and marginal social cost is given by Equation 17 gives MSC up to the point where the subsidy totally displaces private purchases, Le., up to consumption of Q,. Thereafter, each dollar of additional spending on the in-kind transfer will increase consumption by $1. Thus, MSC for output in excess of Q, is given by equation 15. Figure 5 illustrates this case. Marginal social cost is shown by the solid MSC curve, which is discontinuous at an output of Q,. (Ignore the downward sloping dashed FIGURE 5. Comparison of Subsidies MC curve for the moment.) Note that, because of the discontinuity, it is possible for there to be two (local) optima in this case. It should also be noted that as M goes to zero, this case converges to the earlier case of no income effects. It should also be pointed out that this analysis of an in-kind transfer can be extended to apply to public production and free distribution, as with public schools. At least if public production takes place at the same resource cost as private production, the financing cost of any given output in excess of Q0 will be the same as for the inkind transfer. If public production is more inefficient than private production, as a large number of studies have suggested,7 then this can be incorporated into the analysis as an upward shift in the MSC curve(s) in Figures 4 and 5. RANKING OF SUBSIDIES This analysis suggests that the three types of subsidies can be ranked according to their social costs of expanding output. It suffices to compare the social cost of achieving any given output in excess of the competitive level for the various subsidies. The comparison of an excise subsidy and a National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 marginal excise subsidy is simple. We have shown that tl’le MSC of a marginal excise subsidy IS lower at every level of output than that of <anexcise subsidy-compare equations 3 and 12 Thus, on efficiency grounds, a mlarginai excise subsrdy is preferable to an #excise subsidy. The comparison of an in-kind transfer with an excise subsidy is more difficult, but it can be shown that the excise subsidy is more efficient than the in-kind transfer. First, consider the case when demand is unit elastic. Then the marginal social cost of an excise subsidy is MC(l -t VV); see equatilon 3 and the discussion immediately following. Note that this is the same as MSC for the ill-kind transfer for output in excess of Q, (or Q0 with zero income effects). However, since MSC of the in-kind transfer exceeds this value for previous units, the total social cost of expanding output to any level is larger for the In-kind transfer. Since the MSC of an excise subsidy when dernand is of greater than unit elasticity is uniformly less than when dernand is unit elastic, this shows that the excise subsidy is more efficient than the inkind transfer in this case also. When demand IS inelastic, the comparison is slightly more involved. In this c.ase, the MSC of an excise subsidy is greater than MC(l + W), and declines as output expands. Such a case IS illustrated in Figure 5 by the downward sloping dashed curve. To see th’at the total social cost of achieving any level of output is still always less for the excise subsidy than for the in-kind transfer, consider first the case when output falls between Q. and Q,. The MSC of the first unit of output in excess of Q. for the excise subsidy is MC t (MC)W/q, from setting 7-equal to 0 in equation 3. For the in-kind transfer, MSC is MC + (MC)Vi/lM. Thus, if M is less than r~, the MSC curve for the tilxcise subsidy begins at a lower value than the MSC curve for the in-kind transfer (as they are drawn in Figure 5) That this must always be the case follows from the Slutsky equation in elasticity form, because M equals the budget share times the income elasticity (recalling that I am treating price elasticities as positrve numbers). Finally, since MSC for the excise subsidy is downward sloping, the MSC for ,311units between Q. and Q, is lower for the excise subsidy. Therefore, the total social cost of achieving any output between Q. and Q, is lower for an excise subsidy, regardless of how low the price elasticity of demand IIS. If the subsidized output is greater than Q,, at first gl,jnce it might appear to be possible for the advantage to go to the in-kind transfer because its MSC is lower than that of the excise subsidy over this range, as illustrated In Figure 5. That this is not the case is easily seen, however. Over this range of output, government ou tlays on the in -kind transfer are equal to the total resource cost of output, since private purchases have been displaced. By contrast, consumers are still paying part o-f this resource cost when an excise subsidy is used (as long as the demand price is positive). Therefore, the tax revenue required for an excise subsidy to achieve any output in this range is smaller than for an in-kind transfer, and, from this it follows that the total social cost of achieving any output in this range is smaller for ti’le excise subsidy The conclusion to be drawn from this analysis is, therefore, that the social cost of achieving any level elf output is lower for a marginal excise subsidy than for an excise subsidy and lower for an excise subsidy than for on In-kind transfer. (It should be recalled, however, that I have restricted attention tCJ a particular type of in-kind transfer; for an in-kind transfer of the priced voucher variety, the ranklng can be National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 SUBSIDIESFINANCED WITH DISTORTINGTAXES Conclusions 3 In the case of linear demand, additional The major goal of this paper has been to show how the marginal welfare cost of taxation can be incorporated into the analysis of some familiar types of subsidies. In developing the analysis, I have ignored a number of factors that could be relevant in evaluating actual policies. For example, the informational requirements necessary to determine the efficient subsidy and the administrative and compliance cost of the subsidy have not been taken into account. Apart from these omissions, it should also be emphasized that the attention has been on efficiency considerations. Subsidies are also often intended to redistribute income, and if this goal is important, some of the conclusions of this paper could be changed. In general, we have found that subsidies are more efficient when they involve lower levels of spending to achieve desired output levels (thereby minimizing the welfare cost from raising the tax revenue)*. But lower spending means smaller direct benefits to the consumers of the product, so the most efficient subsidies are also often the ones that redistribute the smallest amounts to the consumers. demand output ‘n equation 3 The MSC curve will then be up- ward slop’ng, because the demand elast’c’ty at higher rates of output will be lower (see equat’on 4 Equat’on 4 can be rewritten VT) The left-hand ENDNOTES 3) in the form that shows the marg’nal benef’ts from government the marginal cost of funds spending must equal (1 + w) = (P + q(MEB)]/(P + s’de IS the marginal cost of funds, and the right--hand s’de IS the marg’nal benef’t from government spending-when excise subsidy the spend’ng takes the form of an In th’s formulat’on, from government spending the marginal benef’ts ~111 differ w’th the type of sub- s’dy used I prefer the formulat’on ‘n the text, because ‘t srmply extends a familiar graph’cal analys’s of external benefits 5 Marg’nal social cost ‘n th’s case IS given by 1 252500Q-2 ’ I am assumrng that the vouchers are distributed among consumers such that the marg’nal values (demand prices, or marginal rates of subst’tut’on) rema’n equal Otherwise. one consumer It would be poss’ble to subs’d’ze only thereby total consumpt’on) sumers of all consumers and increase h’s or her consumpt’on Alternatively, without subs’d’z’ng (and other con- tt can be assumed that all consumers have ‘dent’cal demands and rece’ve vouchers of the same value 7 Mueller (1989, pp 261 -66) surveys some 50 stud’es that have compared the prov’son of s’m’lar services by publ’c and pnvate firms He concludes “The evidence that publ’c prov’s’on of a servtce reduces the eff’c’ency of Its prov’s’on seems overwhelm’ng Obviously, further work needs to be done to apply this approach to actual policies, but this paper does suggest that the marginal welfare cost of taxation has important implications for the evaluation of subsidies. Not only is the appropriate size of a subsidy sensitive to the marginal welfare cost, but different subsidies differ as to their capacity to produce welfare gains. the MSC of the f’rst un’t of is given by us’ng the potnt elast’c’ty of ” (p 266) ’ This also suggests that regulat’ons vate spending should be cons’dered requ’nng mandated as alternat’ves pr’- to sub- sidles, since this avo’ds the use of tax revenue altogether In this regard, see Flowers (1991) REFERENCES Browning, Edgar K. “The Marg’nal Cost of Publ’c Funds ” Journal of Pohtd Economy 84 (Apr’l, 1976) Flowers, R. “The Pol’t’cal Economy of Mandated Marilyn Spend’ng ” Working 283-98 Paper, Munc’e, IN Ball State Un’vers’ty, 1991 I would like to thank Timothy Gronberg, Slemrod, and two anonymous Ph’l’p Trostel, Joel referees for helpful com- Fullerton, Don. “Reconc’l’ng ’ See Fullerton (1991) and the references g’ven there’n 81 (March, 1991). 302-08 ’ Pogue and Sgontz (1989) analyze the symmetrical Mueller, where external costs vary among ‘nd’v’duals the s’tuat’on when the government excise tax to all persons even though ‘cal prescnpt’on IS to apply d’fferent Recent Est’mates of the Mar- ginal Welfare Cost of Taxation ” Amencan ments on an earlrer version. case They focus on Dennis Economic Review C. Pub/~ Chorce II Cambridge Cambndge University Press, 1989 must apply the same the first-best theorettax rates to different Ng, Yew-Kwang.“Opt’mal Correct’ve Economic Review 70 (September, persons 133 Taxes or Subs’d’es when Revenue Ra’s’ng Imposes an Excess Burden ” Amencan 1980) 744-51 National Tax Journal Vol. 46, no. 2, (June, 1993), pp. 121-34 Pogue, Thomas F. and LG. Sgontz.“Taxlng clal Costs. The Ca>e of Alcohol ” kmeran 79 (March, 1989) Ijandmo, Agnar. ” Swedah /ouma/ “Optimal Wildasin, laxatlon In the Presence of Ex- of fconom/cs 21 (March, 1975) David E. “On Pubk Oood ProvIsIon with Dlstor- tionary Taxailon ” Econom/c Inqu~y 22 (April, 43 235 -43 iernalltles 86-98 to Control SoEconom,c Rewew 1984). 227--