Specific investment and negotiated transfer pricing in an

advertisement

DISCUSSION PAPER

SERIES IN

ECONOMICS AND

MANAGEMENT

Specific investment and negotiated transfer pricing

in an international transfer pricing model

Oliver M. Dürr & Robert F.

Göx

Discussion Paper No. 10-37

GERMAN ECONOMIC ASSOCIATION OF BUSINESS

ADMINISTRATION – GEABA

Specific investment and negotiated transfer pricing in an

international transfer pricing model∗

Oliver M. Dürr†

Robert F. Göx‡

June 2010

∗

We thank Tim Baldenius, Martin Wallmeier, and participants of the EIASM Workshop on Accounting

and Economics in Vienna for their valuable suggestions and comments.

†

Dr. Oliver Michael Dürr, University of Fribourg, Bd. de Pérolles 90, CH-1700 Fribourg (Switzerland),

Tel.: +41 26 300 8761, Fax +41 26 300 9659, email: olivermichael.duerr@unifr.ch.

‡

Prof.

Dr.

Robert F. Göx, Chair of Managerial Accounting, University of Fribourg, Bd.

de

Pérolles 90, CH-1700 Fribourg (Switzerland), Tel.: +41 26 300 8310/8311, Fax +41 26 300 9659, email:

robert.goex@unifr.ch, web: http://www.unifr.ch/controlling/

1

Abstract

We study the efficiency of the negotiated transfer pricing mechanism proposed by Edlin

and Reichelstein (1995) for solving a bilateral holdup problem in a multinational enterprise.

Our main finding is that the proposed renegotiation procedure will generally not provide

incentives for efficient renegotiations of the initial trade quantity if the same transfer price

is also used for minimizing the global tax bill. Moreover, given that efficient renegotiations

are expected to fail, the divisions will not make efficient investments in the first place.

Nevertheless, we demonstrate that Pareto improving renegotiations are still possible in many

cases but the first-best solution can generally not be attained. Finally, we demonstrate that

the conflict between the two functions of transfer pricing can be solved by the use of different

transfer prices for tax and managerial purposes. Since using a second set of books is costly,

the firm faces a cost-benefit trade-off that can only be solved in the context of a particular

decision problem.

2

1

Introduction

The ongoing globalization of the world economy has significantly increased internal trade

within multinational firms. According to a recent report of the Economist (2004) around 60%

of all global trade takes the form of internal transactions within multinational enterprises.

This trend has also increased global tax competition and the importance of international

tax management for multinational firms. Transfer prices are an important instrument for

managing the global tax liability of multinationals. According to a recent survey conducted

by Ernst & Young (2008) 90 % of the multinational enterprises found transfer pricing fairly

or very important and 39 % of corporate tax directors named transfer pricing as the most

important item on their agendas.

Despite the increased importance of international transfer pricing, the management accounting literature has focused on the managerial aspects of transfer pricing and largely

ignored the tax function of transfer pricing. Starting with Hirshleifer (1956), transfer pricing was primarily analyzed as an internal coordination mechanism enabling the management

of decentralized firms to achieve goal congruence between the firms’ headquarters and the

management of autonomous divisions.

The most important topic in the recent managerial transfer pricing literature was certainly the role of transfer prices in providing incentives for specific investments at the divisional level. In their seminal paper, Edlin and Reichelstein (1995) demonstrate that negotiated transfer pricing can be an efficient mechanism for solving a bilateral holdup problem in

a multidivisional firm and motivate the divisions to make efficient investment decisions. A

number of other papers have subsequently examined the investment incentives provided by

various forms of negotiated and cost-based transfer pricing mechanisms.1 However, except

1

See, for example, Baldenius et al. (1999), Baldenius (2000), Wielenberg (2000), Sahay (2003), or Pfeiffer

3

Johnson (2006) none of the papers has so far analyzed a bilateral hold-up problem in the

context of a multinational enterprise.

In this paper, we aim to close this gap in the literature by analyzing the usefulness of

the negotiated transfer pricing mechanism proposed by Edlin and Reichelstein (1995) for

solving a bilateral holdup problem in a multinational enterprise. The mechanism comprises

3 steps. First, the divisions negotiate a fixed-price contract specifying a transfer quantity

and a lump-sum transfer payment. Second, the divisions make specific investments under

uncertainty that increase the expected value of internal trade. Third, uncertainty resolves

and the divisions renegotiate the initial contract specifying a new transfer quantity and a

new transfer payment. Our main finding is that the proposed renegotiation procedure will

generally not provide incentives for efficient renegotiations of the initial trade quantity if

the same transfer price is also used for minimizing the global tax bill. Moreover, given that

efficient renegotiations are expected to fail, the divisions will not make efficient investments

in the first place.

Intuitively, the negotiated transfer pricing mechanism suffers from the fact that the divisions possess only one instrument for solving two problems. They can either adjust the lump

sum payment in order to minimize the global tax bill or they can adjust it to redistribute

the mutual gains from implementing a new contract. Both objectives can only be achieved

simultaneously when they are coincidentally solved by the same transfer price. Nonetheless,

we demonstrate that Pareto improving renegotiations are still possible in many cases. In

fact, if the intermediate input is transferred at the tax minimizing transfer prices and both

divisions benefit from an increase or a decrease of the transfer quantity, the operating profit

can be improved by adjusting the initial contract. However, since the efficient quantity will

only be achieved incidentally in this case, the divisions’ investment incentives are generally

distorted. We also show that the divisions can benefit from renegotiations if they cannot

et. al. (2008). Recent survey of the incomplete contracting literature are provided by Göx and Schiller

(2007) and Baldenius (2009).

4

agree to adjust the trade quantity at the tax minimizing transfer price. In these cases, there

is always a solution in which the two divisions can benefit from adjusting the transfer price

and the trade quantity, but this solution requires that both variables take inefficient values.

Finally, we demonstrate that the conflict between the two functions of transfer pricing can be

solved by the use of different transfer prices for tax and managerial purposes. Since the use

of two sets of books usually involves additional cost for additional resources, the firm faces

a trade-off between the benefits of a more flexible transfer pricing policy and the additional

cost associated with the use of two sets of books that can only be solved in the context of a

particular decision problem.

Our analysis contributes to the existing transfer pricing literature by exploring the limits

of the negotiated transfer pricing mechanism proposed by Edlin and Reichelstein (1995) in

the context of a multinational enterprise. So far, only Johnson (2006) has analyzed the

problem of providing divisional investment incentives in an international transfer pricing

model. Johnson’s model is not directly comparable to ours. She considers a model in which

two divisions can sequentially invest in an intangible asset and compares the effectiveness of

three transfer pricing methodologies for intangibles: A renegotiated royalty-based transfer

price, a non-negotiable royalty-based transfer price and purely negotiated transfer price. She

finds that a renegotiable royalty-based transfer price provides better investment incentives

than the other two methodologies and in some cases it even motivates first-best investments.

Johnson (2006) also discusses the possibility of decoupling the royalties for tax reporting

and internal purposes and find that decoupling the two transfer prices usually increases the

firm’s after tax profit.2

A number of other papers has analyzed the benefits of separate transfer prices for tax

reporting and managerial purposes. Baldenius et al. (2004) show that firms are better off

by using two sets of books if tax and managerial objectives are conflicting. In a related

paper, Hyde and Choe (2005) analyze the relation between tax and incentive transfer prices

2

See Baldenius (2006) for a detailed discussion of Johnson’s model.

5

and find that the optimal transfer prices with two sets of books are typically related to each

other although they serve different functions. Finally, Dürr and Göx (2011) show that using

one set of books can be an optimal strategy if firms compete in prices in industries with

a small number of competitors. The reason for this result is that the unique tax transfer

price can be used strategically vis-à-vis a competitor even if the internal transfer price is

unobservable. By using a tax transfer price above marginal cost, the firm can credibly signal

to its competitor that its division manager will adopt a less aggressive pricing strategy in

the final product market.

The remainder of our paper is organized as follows. In section two we present the model

and its main assumptions. We also derive the first-best solution of our model. Section three

analyzes the equilibrium strategies of the non-cooperative investment game between the

divisions of the decentralized firm. We first show that efficient renegotiations of the transfer

quantity and global tax minimization can generally not be achieved with the same transfer

pricing mechanism. We also discuss different forms of Pareto improving renegotiations and

show that efficient renegotiations and first-best investment can be achieved if the firm uses

two sets of books. Section four summarizes the main results.

2

Model setup

2.1

Firm organization, technology, and taxation

We consider a decentralized firm consisting of headquarters (HQ) and two divisions, (j =

S, B). Divison S (the ”seller”) produces an intermediate product and supplies it to division B

(the ”buyer”). The buyer processes the intermediate product and sells it in the final product

market. We assume that one unit of the intermediate product is required to produce one

final product unit and that there is no external market for the intermediate product.

The two divisions can make upfront specific investments Ij in order to increase the value

6

of internal trade. For making an investment, division Ij incurs a cost ω(Ij ), where the cost

function ω(Ij ) is twice differentiable and convex in Ij . The cost of the selling division is

given by the function C(q, θ, IS ), where q denotes the quantity of the intermediate product,

θ is a state variable that is unknown at the beginning of the planning horizon, and IS is

the amount of specific investment undertaken by the seller. Likewise, the revenue of the

buying division from selling the final product is defined as R(q, θ, IB ), where IB denotes the

buyer’s specific investment. We assume that the specific investment of the seller reduces her

marginal cost, whereas the specific investment of the buyer increases her marginal revenue.3

For example, the seller might invest in specialized production equipment or the training of

workers. Likewise, the buying division might invest in the training of sales personnel or

marketing activities.

As in Edlin and Reichelstein (1995), we assume that the firm employs a negotiated

transfer pricing mechanism for motivating the divisions to make efficient investment and

production decisions. The mechanism comprises four steps. At date one the two divisions

negotiate a fixed-price contract specifying a transfer quantity q and a lump-sum transfer

payment of T . At date two, the divisions make their investment decisions I ≡ (IS , IB ) and

at date three they learn the actual value of the state variable θ ∈ Θ,where Θ denotes the set

of possible states. At date four, the initial contract is renegotiated, and the parties agree on

an actual trade quantity qb and a monetary transfer Tb . The ratio between a given lump sum

payment T and a transfer quantity q, t = T /q, can be interpreted as a negotiated transfer

price. To rule out that the divisional investment problem can be solved by a complete ex

ante contract, we assume that HQ cannot observe θ and I and that both variables are not

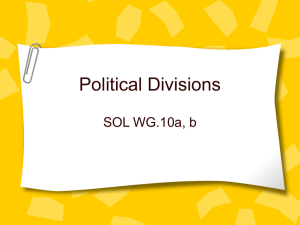

contractible. Figure 1 summarizes the sequence of events.

[please insert Figure 1 about here]

3

More formally, we require that ∂ 2 C(q, θ, IS )/∂q∂IS < 0 and ∂ 2 R(q, θ, IB )/∂q∂IB > 0. See Edlin and

Reichelstein (1995) for an equivalent assumption.

7

The above assumptions are equivalent to the model setup proposed in Edlin and Reichelstein (1995). The novel element of our study is that we allow for potential differences in the

taxation of divisional income. We assume that the firm’s HQ and the selling division are

located in the home country and the buying division is located in a foreign country. The

marginal tax rate in the home country equals τ and the marginal tax rate in the foreign

country equals τ + δ. The differences in marginal tax rates equals δ. To keep the model as

general as possible we do not restrict the sign of δ. If δ is positive, there is a domestic tax

advantage. If δ is negative, the foreign country offers a tax advantage. Since marginal tax

rates in both countries are reasonably restricted to the interval between zero and one, δ can

take values from the interval [−τ ; 1 − τ ].

The existence of international tax differences places additional demands on the firm’s

transfer pricing policy. In fact, if δ > 0 (δ < 0), the firm has an incentive to tax the largest

(smallest) possible part of its world income in the home country. Accordingly, the firm has

an incentive to set a high transfer price in case of a domestic tax advantage and a low transfer

price in case of a foreign tax advantage. In line with the majority of the international transfer

pricing literature and for making our results comparable to those of Edlin and Reichelstein

(1995), we assume for most of the analysis that the firm uses the same transfer price for

tax and managerial purposes. In section 3.4 we also consider the case where the firm uses

different transfer prices for tax and managerial purposes assuming that carrying two sets of

books incurs additional fixed cost of F for the firm.

Tax authorities usually require firms to report the unit transfer price in conformity with

the arm’s length principle. This principle demands that transfer prices are set within an

acceptable range of prices that could be found for similar transactions between independent

parties under comparable circumstances (OECD 2001). This broad definition leaves firms

with substantial leeway in determining their transfer prices because in most cases comparable

transactions are not easily identified. In what follows, we capture the arm’s length constraint

by an interval of admissible transfer prices that is accepted by the tax authorities in both

8

countries. We assume that the negotiated transfer price t must take values from the interval

[s, s], where s (s) denotes the lowest (highest) acceptable unit transfer price from the tax

authorities’ perspective. Since the arm’s length constraint is defined on the basis of a per

unit transfer price, there exists a large set of transfer payments T and transfer quantities

q that are acceptable for tax authorities. Moreover, in order to negotiate a tax conform

transfer price, the divisions can either adjust the transfer quantity, the lump-sum payment

or both variables. This additional degree of flexibility provided by negotiated transfer pricing

should make it easier to satisfy the arm’s length constraints than with any other transfer

pricing method that allows for price adjustments only.

2.2

Benchmark case: Centralized investment and transfer pricing

Before we analyze the decentralized solution of the model presented in section 2.1, we briefly

present the first best solution. The analysis starts with the optimal transfer pricing and

production decisions at date 4. For a given value of the state variable θ and investments

undertaken at stage 2, the operating profit after taxes is given by

M (q, t, θ, I) = α · [R(q, θ, IB ) − C(q, θ, IS )] + δ · [t · q − C(q, θ, IS )],

(1)

where α = 1 − τ − δ, and t is the transfer price set by HQ. The expression in (1) comprises

the difference between revenue and cost after taxes evaluated at the foreign tax rate and

a tax term capturing the impact of the firm’s transfer pricing policy on its global tax bill.

This second term equals zero if the tax rates in both countries are identical (δ = 0), or if the

value of internal transactions equals total cost. Maximizing the contribution margin with

respect to t yields δ · q. For a given production quantity, the sign of this expression depends

on the sign of δ, so that the optimal transfer price can be characterized as follows:

⎧

⎪

⎨

t∗ = ⎪

⎩

s f or δ > 0

s f or δ < 0

9

.

(2)

The optimal transfer pricing policy in (2) is solely determined by tax considerations. In

case of a domestic tax advantage, the firm sets the highest possible transfer price in order

to tax the largest possible part of its global income in the home country. In case of a foreign

tax advantage, the firm sets the lowest acceptable transfer price in order to tax the largest

possible part of its global income in the foreign country. For a given transfer price, the

optimal volume of internal trade is found by maximizing the operating profit in (1) with

respect to q. The resulting optimality condition,

Ã

!

Ã

∂M (q, t, θ, I)

∂R(q, θ, IB ) ∂C(q, θ, IS )

∂C(q, θ, IS )

=α·

−

+δ· t−

∂q

∂q

∂q

∂q

!

= 0,

(3)

shows that the existence of international tax differences usually affects the optimal quantity

decision at date 4. In fact, if we reasonably assume that transfer prices satisfying the arm’s

length constraint must at least equal marginal cost, so that s ≥ ∂C(q, θ, IS )/∂q, the optimal

production quantity of a multinational enterprise is strictly higher (weakly lower) than the

production quantity of a domestic firm if there is a domestic (foreign) tax advantage. Let

q ∗ (θ, I, t) denote the efficient quantity and let M(θ, I) ≡ M(q∗ (θ, I, t∗ ), t∗ , θ, I). At date 2,

the firm maximizes the expected profit after taxes and investment costs,

Γ (I) = Eθ [M(θ, I)] − (1 − τ ) · ω(IS ) − α · ω(IB ),

(4)

with respect to IS and IB . The optimal solutions satisfy

−Eθ

"

#

∂C(q ∗ , θ, IS )

∂ω(IS )

=

∂IS

∂IS

and Eθ

"

#

∂R(q∗ , θ, IB )

∂ω(IB )

=

.

∂IB

∂IB

(5)

That is, the efficient investment levels equate the marginal investment costs with the marginal cost reduction and revenue increase resulting from the respective investment outlay.

Unlike the quantity decision, the optimal investment decision is not directly affected by

tax considerations, so that the decision rule determining the efficient investment levels is

equivalent to the domestic transfer pricing model in Edlin and Reichelstein (1995).4

4

Evidently, the expected marginal cost savings and revenue increase in (5) depend on the expected

quantity determined at stage 4, so that they also affect the investment decision, but this effect works

indirectly and does not affect the structure of the optimal investment decision.

10

3

Decentralized investment and pricing decisions

3.1

Investment efficiency and tax minimization as conflicting objectives

To analyze the usefulness of negotiated transfer pricing in the context of a multinational

enterprise, we first employ the same renegotiation procedure as Edlin and Reichelstein (1995).

As explained in section 2.1, this procedure entails that the two divisions initially agree on

a fixed-price contract specifying a transfer quantity q and a lump-sum transfer payment of

T . After undertaking specific investments and after learning the actual value of the state

variable θ, the initial contract is renegotiated and a new trade quantity qb and a new monetary

transfer Tb are specified.

The renegotiation procedure itself is cooperative in the sense that the division managers

jointly maximize the operating profit at date 4 and distribute the resulting surplus over the

profit resulting from the execution of the initial contract according to a γ-surplus sharing

rule. The allocation rule reflects the parties’ bargaining power and allocates a share γ of the

renegotiation surplus to the seller and a share 1 − γ to the buyer. The renegotiation surplus

is defined as the difference between the maximum operating profit and the profit resulting

from the initial quantity q and the initial transfer price t = T /q

SP = M (θ, I) − M (q, t, θ, I) .

(6)

In order to achieve a mutually beneficial and acceptable renegotiation of the initial contract,

the adjusted lump-sum payment Tb must satisfy the following conditions:

b θ, IS )) = (1 − τ ) · (T − C(q, θ, IS )) + γ · SP

(1 − τ ) · (Tb − C(q,

b θ, IB ) − Tb ) = α · (R(q, θ, IB ) − T ) + (1 − γ) · SP,

α · (R(q,

(7)

(8)

where efficient production requires that qb = q ∗ . The conditions assure that for both divisions

the operating profit under the adjusted contract terms equals the payoff resulting from the

11

original contract plus the division’s share of the renegotiation surplus. It can be seen from

the seller’s participation constraint in (7) that a higher bargaining power of the seller (γ)

is economically equivalent to a higher transfer payment Tb from the buyer to the seller.

Moreover, as Edlin and Reichelstein (1995) show, it is always possible to find a transfer

payment Tb satisfying conditions (8) and (7) as long as transfers are unrestricted.

However, for the multinational enterprise, efficiency does not only require that the divi-

sions agree on the optimal production quantity for a given transfer payment, but also that

the resulting unit transfer price minimizes the companies global tax bill. That is, efficiency

requires that the divisions agree on a new contract specifying a quantity qb = q ∗ (θ, I, t∗ ) and

a tax minimizing transfer payment Tb = T ∗ ≡ t∗ ·q ∗ (θ, I, t∗ ). The following proposition shows

that both objectives can generally not be achieved simultaneously.

Proposition 1: Negotiated transfer pricing is generally insufficient for implementing an

efficient renegotiation of operating profits in the presence of international tax differences.

Proof: see appendix.

The proof of proposition 1 shows that an efficient renegotiation of the initial contract

usually fails because one of the two divisions will be better off if the initial contract is

executed. The reason is that global tax minimization restricts the adjusted transfer payment

Tb under the new contract and thereby makes efficient renegotiation impossible. In fact,

optimal transfer pricing requires that Tb = T ∗ . Since all other variables in the divisions’

participation constraints (7) and (8) are fixed, there exists only one particular distribution

of bargaining powers satisfying equations (7) and (8). This bargaining power equals:

γ ∗ = (1 − τ ) · [T ∗ − C(q ∗ , θ, IS ) − (T − C(q, θ, IS ))]/SP.

(9)

While it cannot be excluded that the distribution of bargaining power between the two divisions actually happens to equal (9), an efficient renegotiation is excluded for all bargaining

powers γ 6= γ ∗ . Intuitively, the firm suffers from the fact that the divisions possess only one

instrument for solving two problems. The divisions can either use Tb to minimize the global

12

tax bill or to redistribute the mutual gains from implementing a new contract. Both problems

can only be solved simultaneously when the distribution of contract gains and losses implied

by the optimal tax transfer T ∗ happens to coincide with the adjusted transfer payment Tb

that solves equations (7) and (8). In addition, we can make the following observation:

Corollary 1: Negotiated transfer pricing is generally insufficient for implementing first

best investment decisions in the presence of international tax differences. Proof: If γ 6= γ ∗ ,

efficient renegotiations fail and q = q. Efficient investments require that q = q ∗ (θ, I, t∗ ) from

(5); a contradiction.

Corollary 1 shows that the failure of efficient renegotiations naturally implies that the

divisions do not have the right incentives to make the first-best investment decisions at

stage two because they anticipate that renegotiations will fail in almost all cases except for

a bargaining power distribution of γ = γ ∗ . However, the fact that efficient renegotiations

are generally impossible does not imply that negotiated transfer pricing does not permit the

divisions to improve their situation as compared to the original contract. In what follows,

we explore the conditions for Pareto improving renegotiations between the two divisions.

3.2

Quantity adjustment with optimal tax transfer price

An efficient renegotiation procedure requires that the divisions set the tax minimizing transfer amount T ∗ and the efficient quantity q ∗ (θ, I, t∗ ). In principle, an adjustment of both

decision variables can lead to a Pareto improving contract adjustment. In what follows we

first analyze the case where the divisions agree to apply the tax minimizing transfer price

b That is, the transfer

and restrict renegotiations to an adjustment of the transfer quantity q.

b where the optimal unit transfer price t∗ is given in (2). This

payment equals Tb = t∗ · q,

situation is economically equivalent to a situation where the firm commits to the use of a

particular unit transfer price vis-à-vis tax authorities. For any given production quantity q,

it would be rational for the firm to set the initial transfer payment equal to T = t∗ · q in

order to minimize the expected tax bill.

13

Given the tax minimizing transfer pricing policy, the two divisions can only renegotiate

the quantity at date 4, but not the transfer price. The divisions realize the following profits

for a given transfer quantity q, state θ and divisional investments IS and IB :

MS (q, t∗ , θ, IS ) = (1 − τ ) · (t∗ · q − C(q, θ, IS ))

(10)

MB (q, t∗ , θ, IB ) = α · (R(q, θ, IB ) − t∗ · q).

(11)

For the selling division a renegotiation of the quantity is favorable if

¯

∂MS (q, t∗ , θ, IS ) ¯¯

∂C(q, θ, IS )

∗

¯

=

t

−

6= 0.

¯

∂q

∂q

q=q

(12)

That is, the marginal cost evaluated at the initial quantity q must be different from the tax

minimizing transfer price t∗ . Whenever the optimal transfer price is higher than marginal

cost, the selling division has an incentive to agree on a transfer quantity qb > q, and if

marginal cost is higher than t∗ , the seller will accept to reduce the transfer quantity. Likewise,

the buying division benefits from adjusting the initially negotiated quantity if its marginal

revenues at date 4 are different from the transfer price

¯

∂R(q, θ, IB )

∂MB (q, t∗ , θ, IB ) ¯¯

¯

− t∗ 6= 0.

=

¯

∂q

∂q

q=q

(13)

As for the supplying division the buying division will benefit from an increase (decrease)

of the original transfer quantity if marginal revenues evaluated at the initial quantity q are

higher (lower) than the tax minimizing transfer price t∗ . However, mutually beneficial renegotiations can only take place if the two conditions in (12) and (13) are satisfied and have

the same sign. In fact, whenever both conditions are positive (negative), the divisions will

agree on an upward (downward) adjustment of the initial transfer quantity during renegotiations. Since the only degree of freedom for adjustments is the transfer quantity, the divisions’

bargaining power play no role in determining the lump sum transfer payment which is obb If

tained as the product of the tax minimizing transfer price t∗ and the adjusted quantity q.

renegotiations take place, division j realizes the following surplus as compared to the initial

contract

b t∗ , θ, Ij ) − Mj (q, t∗ , θ, Ij ) .

SPj = Mj (q,

14

(14)

This surplus is positive, whenever renegotiations are successful. In addition, we can make

the following observation:

Corollary 2: If t = t∗ and renegotiations are beneficial for both divisions but restricted to

the set of quantities {q S , qB } that maximize divisional profits, the divisions will generally not

agree on the efficient transfer quantity q∗ . Proof: Given t = t∗ the divisions would find it

optimal to adjust their quantities so that

∂R(q B , θ, IB )

∂C(q S , θ, IS )

= t∗ and

= t∗ ,

∂q

∂q

(15)

where q B denotes the optimal quantity from the buyer’s perspective and qS denotes the

optimal quantity from the seller’s perspective. As in general q B 6= q S , the efficient quantity

q ∗ is only achieved coincidentally and if the following condition holds

∂C(q S , θ, IS )

∂R(q B , θ, IB )

=

.

∂q

∂q

(16)

More generally, the divisions are free to agree on any quantity q + ex post that increases

the profit of both divisions. Since qB can be smaller or larger than qS , the potential set of

renegotiation quantities q+ is given by the closed interval q + ∈ [min {q S , qB }, max {qS , q B }].

In particular, any quantity q+ from this interval satisfying the condition

R(q+ , θ, IB ) − R(q, θ, IB ) > (q+ − q) · t∗ > C(q+ , θ, IS ) − C(q, θ, IS )

(17)

increases the profit of both divisions. This condition requires that the revenue difference

realized by division B is larger than the incremental transfer payment which, in turn, must

exceed the cost difference incurred by division S. As there are a large number of renegotiation

quantities satisfying condition (17), it cannot be excluded that the divisions agree on the

efficient quantity q + = q ∗ .

However, even if the divisions renegotiate the quantity efficiently for some states, efficient

investment is generally excluded. Let H ⊂ Θ be the set of states for which the divisions

renegotiate and H be its complement. Then, the ex ante expected profits of divisions S and

15

B at date 2 are equal to

ΓS = E θ|θ∈H [MS (q, t∗ , θ, IS )] + E θ|θ∈H [MS (q + , t∗ , θ, IS )] − (1 − τ ) · ω (IS )

(18)

ΓB = E θ|θ∈H [MB (q, t∗ , θ, IB )] + E θ|θ∈H [MB (q+ , t∗ , θ, IB ] − α · ω (IB ) .

(19)

From the expressions in (18) and (19) the two divisions maximize a weighted average of the

operating profit evaluated at the initial quantity and at the renegotiated quantity minus the

investment cost after taxes. Maximizing the expected profit at t = 2 with respect to the

divisional investments yields the following first-order conditions:

"

#

"

#

∂ω(IS )

∂C(q, θ, IS )

∂C(q+ , θ, IS )

−E θ|θ∈H

− E θ|θ∈H

=

∂IS

∂IS

∂IS

"

#

"

#

+

∂R(q, θ, IB )

∂R(q , θ, IB )

∂ω (IB )

E θ|θ∈H

+ E θ|θ∈H

=

.

∂IB

∂IB

∂IB

(20)

(21)

Comparing these conditions with the conditions for efficient investment in (5) shows that

the divisions will generally not invest efficiently because for all states θ ∈ H, no renegotia-

tions take place and q+ is generally not equal to q ∗ . Nonetheless, the divisions’ investment

comes closer to the first-best solution the larger the set of states H for which the divisions

renegotiate the quantity and chose q+ = q ∗ .

3.3

Simultaneous adjustment of quantity and transfer price

If the conditions in (12) and (13) have the opposite sign, renegotiations of the transfer quantity at the tax minimizing transfer price will fail because one of the divisions prefers to

increase the quantity while the other division prefers to decrease it. Under these circumstances, it may be beneficial for both divisions to adjust the transfer price and the transfer

quantity in order to find a Pareto improving contract adjustment. For example, suppose

that

∂R(q, θ, IB )

∂C(q, θ, IS )

>

> t∗

∂q

∂q

(22)

so that the buying division would benefit from increasing the trade quantity at the tax

minimizing transfer price, whereas the selling division would like to reduce the quantity

16

because the transfer price is lower than marginal cost. If the divisions agree to deviate

from the tax minimizing transfer prices, set a transfer price t◦ > t∗ that falls between

marginal revenues and marginal cost and increase the quantity to q◦ > q, both divisions

can realize a higher profit albeit the global tax bill of the firm is no longer minimized. An

adjustment of transfer price and quantity might also be Pareto improving if in the former

case the renegotiated quantity q + is below the efficient quantity q ∗ . If renegotiations take

place, division j realizes the following surplus as compared to the initial contract

SPj = Mj (q◦ , t◦ , θ, Ij ) − Mj (q, t∗ , θ, Ij ) .

(23)

Since the divisions can adjust the quantity and the price, there exists a large set of feasible

contracts that increase the profit of both divisions. The final contract is determined by the

division’s bargaining power. The set of mutually acceptable transfer payments T ◦ = t◦ · q◦

can be obtained by solving the divisions’ participation constraints in (7) and (8) for T ◦ ,

yielding

SP ◦

,

(24)

1−τ

where SP ◦ = M(q◦ , t◦ , θ, I)−M(q, t∗ , θ, I) is the joint renegotiation surplus of both divisions.

T ◦ = t∗ · q + C (q ◦ , θ, IS ) − C (q, θ, IS ) + γ ·

The optimal transfer quantity is found by maximizing SP ◦ with respect to q◦ and subject to

(24). This quantity is generally inefficient because t◦ 6= t∗ and thus q◦ (θ, I, t◦ ) 6= q∗ (θ, I, t∗ ).

Given the optimal renegotiation procedure the ex ante expected profits of divisions S and

B at date 2 become

ΓS = Eθ [MS (q, t∗ , θ, IS ) + γ · SP ◦ ] − (1 − τ ) · ω (IS )

(25)

ΓB = Eθ [MB (q, t∗ , θ, IB ) + (1 − γ) · SP ◦ ] − α · ω (IB ) .

(26)

From the expressions in (25) and (26) the two divisions maximize the status quo profit

plus the divisions’ share of the renegotiation surplus minus investment cost after taxes.

Maximizing the expected profit of division B with respect to IB yields the following firstorder condition:

γ · Eθ

"

#

"

#

∂R(q, θ, IB )

∂R(q ◦ , θ, IB )

∂ω(IB )

+ (1 − γ) · Eθ

=

∂IB

∂IB

∂IB

17

(27)

Comparing this condition with the condition for efficient investment in (5) shows that division

B will generally not invest efficiently because it does not produce the efficient quantity q∗ .

A similar observation can be made for the selling division. We can make the following

observation.

Corollary 3: If the divisions renegotiate the transfer price and the quantity, division j

will generally not invest efficiently even if it was the residual claimant. Proof: Assume that

the buying division is the residual claimant of its own investment return (γ = 0). Comparing

the resulting first order condition from (27) with the condition for efficient investment in (5)

shows that investment is only efficient if by coincidence q ◦ = q ∗ . A similar argument can be

made for division S.

Overall, the results of this sections 3.2 and 3.3 show that Pareto improving renegotiations

are generally possible but the first-best solution is typically not achieved when the negotiated

transfer price is expected to provide efficient investment incentives and to minimize taxes at

the same time.

3.4

Separate transfer prices for tax and managerial purposes

As a potential alternative to the use of a single transfer price for tax and managerial purposes,

the firm might use separate transfer prices for tax reporting and for providing investment

incentives. Baldenius et al. (2004) have shown that decoupling tax and managerial objectives

is generally beneficial because it helps to avoid potential conflicts between the two objectives.

Nonetheless, it seems very likely that a second set of books requires additional resources for

satisfying the increased demands faced by the firm’s accounting department. Apart from

additional administrative consequences it has also been hypothesized that the use of different

transfer prices for tax and managerial purposes increases the likelihood of a tax audit.5 In

both cases, the use of two sets of books is associated with additional cost. Let F be the

5

See e.g. Kant (1988), Smith (2002a) and Smith (2002b).

18

incremental cost of a second set of books, then the potential benefits of using two separate

transfer prices must be higher than these additional cost to justify their use.

In what follows, we assume that the firm uses a unit transfer price denoted s for tax

reporting and a negotiated transfer price for managerial purposes. It should be evident,

that the optimal policy entails a tax transfer price equal to s = t∗ in order to minimize the

global tax bill of the firm, where the optimal transfer prices t∗ is defined in (2). Given this

transfer price, the divisions will renegotiate the initial contract at date 4. Since the adjusted

transfer payment is no longer restricted by tax considerations, we can make the following

observation:

Proposition 2: With two set of books negotiated transfer pricing is sufficient for implementing an efficient renegotiation of operating profits in the presence of international tax

differences. Proof: Since Tb can take any value, the divisions can maximize the renegotiation

surplus and find a side payment that satisfies the participation constraints (7) and (8).

From proposition 2, operating decisions will always be efficient with two sets of books.

That is, the firm sets a tax transfer price s = t∗ and the divisions agree to exchange the

efficient quantity q ∗ (θ, I, t∗ ). Accordingly, the ex ante expected profits of divisions S and B

at date 2 become

ΓS = Eθ [MS (q, t∗ , θ, IS ) + γ · SP ] − (1 − τ ) · ω (IS )

(28)

ΓB = Eθ [MB (q, t∗ , θ, IB ) + (1 − γ) · SP ] − α · ω (IB ) .

(29)

From the expressions in (28) and (29), the two divisions maximize the expected sum of the

status quo profit plus the share of renegotiation surplus minus the investment cost after

taxes. The first order conditions become:

"

#

"

#

∂C(q, θ, IS )

∂C(q ∗ , θ, IS )

∂ω(IS )

−(1 − γ) · Eθ

− γ · Eθ

=

∂IS

∂IS

∂IS

"

#

"

#

∂R(q, θ, IB )

∂R(q ∗ , θ, IB )

∂ω(IB )

+ (1 − γ) · Eθ

=

.

γ · Eθ

∂IB

∂IB

∂IB

19

(30)

(31)

The first order conditions in (30) and (30) are generally different from the first order conditions of HQ in (5). However, as shown by Edlin and Reichelstein (1995), the two conditions

coincide, if the cost and revenue functions satisfy certain separability conditions and the

ex-ante quantity equals the expected from renegotiations q = Eθ [q ∗ ].6

We conclude that the efficiency result derived by Edlin and Reichelstein (1995) generally

prevails in the context of a multinational enterprise if it uses two sets of books. Otherwise

efficient renegotiations for all states are generally impossible and the first-best investment

solution cannot be implemented. However, since carrying two sets of books is associated

with an incremental cost of F , this result does not imply that the net benefit form using

two sets of books is positive. The higher the efficiency loss induced by the use of a single set

of transfer prices for tax and managerial purposes and the lower the incremental cost of a

second set of books, the more likely is it that the firm prefers to use different transfer prices

for tax and managerial purposes

4

Summary

A significant part of the recent managerial transfer pricing literature studies the role of

transfer prices in providing incentives for specific investments at the divisional level. Most

notably, Edlin and Reichelstein (1995) demonstrate that negotiated transfer pricing can be

an efficient mechanism for solving a bilateral holdup problem in a multidivisional firm and

motivate the divisions to make efficient investment decisions. We contribute to the transfer

pricing literature by analyzing the usefulness of negotiated transfer pricing for solving a

bilateral holdup problem in multinational enterprises.

6

In fact, Edlin and Reichelstein (1995) show that (30) and (30) are equivalent with (5) if the revenue

and cost functions take the following forms R(q, θ, IB ) = R1 (IB ) · q + R2 (q, θ) + R3 (θ, IB ) and C(q, θ, IS ) =

C1 (IS ) · q + C2 (q, θ) + C3 (θ, IS ), respectively and the initial quantity equals the expected optimal quantity

q = Eθ [q ∗ ]

20

Our main finding is that the proposed renegotiation procedure will generally not provide

incentives for efficient renegotiations of the initial trade quantity if the same transfer price is

also used for minimizing the global tax bill. Moreover, given that efficient renegotiations are

expected to fail, the divisions will not make efficient investments in the first place. Intuitively,

the negotiated transfer pricing mechanism suffers from the fact that the divisions possess

only one instrument for solving two problems. They can either adjust the lump sum payment

in order to minimize the global tax bill or they can adjust it to redistribute the mutual gains

from implementing a new contract. Both problems can only be solved simultaneously when

they are coincidentally solved by the same transfer price.

Nevertheless, we demonstrate that Pareto improving renegotiations are still possible in

many cases. In fact, if the intermediate input is transferred at the tax minimizing transfer

price and both divisions benefit from an increase or a decrease of the transfer quantity,

the profit can be increased as compared to the initial contract but the quantity will only be

efficient by coincidence. This result stems from the fact, that the optimal quantities from the

perspective of the two divisions are generally different. As the efficient quantity is generally

not achieved, the divisions’ investment incentives are also distorted. We also show that the

divisions can benefit from renegotiations if they have the possibility to adjust both, the trade

quantity and the transfer price. In these cases, there is always a solution in which the two

divisions can benefit from an adjustment of the original contract, but this solution generally

requires that both variables take inefficient values. Finally, we demonstrate that the conflict

between the two functions of transfer pricing can be solved by the use of different transfer

prices for tax and managerial purposes. Since the use of two sets of books usually involves

additional cost for additional resources, the firm faces a trade-off between the benefits of

a more flexible transfer pricing policy and the additional cost associated with the use of

two sets of books. This trade-off can only be solved in the context of a particular decision

problem.

21

Appendix

Proof of Proposition 1: For an initial contract (T , q), the efficient quantity qb =

q ∗ (θ, I, t∗ ) and the tax minimizing transfer payment Tb = T ∗ ≡ t∗ · q∗ (θ, I, t∗ ), the seller

accepts the new contract if the following condition is met:

(1 − τ ) · (∆T − ∆C) ≥ γ · SP

(32)

where ∆T = T ∗ −T , and ∆C = C(q∗ , θ, IS )−C(q, θ, IS ) are the changes in lump sum transfers

and cost induced by the new contract. From the definition in (6) we can rewrite the renegotiation surplus as SP = α · ∆R − (1 − τ ) · ∆C + δ · ∆T, where ∆R = R (q∗ , θ, IB ) − R (q, θ, IB )

is the change in revenues caused by the adoption of the new contract. Substituting this

expression into the buyer’s participation constraint in (8) and rearranging terms indicates

that the buyer will only accept the new contract if the following condition is met

(1 − τ ) · (∆T − ∆C) ≤ γ · SP,

(33)

a contradiction to (32). We conclude that efficient renegotiations will typically fail unless

the distribution of bargaining powers happens to satisfy (32) and (33) with equality.

22

References

Baldenius, T. (2000). Intrafirm trade, bargaining power and specific investments. Review

of Accounting Studies, 5, 27—56.

Baldenius, T. (2006). Discussion of ”Divisional performance measurement and transfer

pricing for intangible assets”. Review of Accounting Studies, 11, 367-376

Baldenius, T. (2009). Internal pricing. Foundations and Trends in Accounting, 3(4), 223313.

Baldenius, T., Melumad, N., and Reichelstein, S. (2004). Integrating managerial and tax

objectives in transfer pricing. Accounting Review, 79, 591—615.

Baldenius, T., Reichelstein, S., and Sahay, S. (1999). Negotiated versus cost-based transfer

pricing. Review of Accounting Studies, 4, 67—91.

Dürr, O.M. and Göx, R.F. (2011). Strategic incentives for keeping one set of books in

international transfer pricing. forthcoming in Journal of Economics & Management

Strategy, Vol. 20.

Economist, 2004, ”A Taxing Battle, No.6, 65-66.

Edlin, A. S. and Reichelstein, S. (1995). Specific investment under negotiated transfer

pricing: An efficiency result. Accounting Review, 70(2), 275—291.

Ernst & Young, 2008. ”Precision under Pressure: Global transfer pricing survey 2007-2008,”

URL: http://www.ey.com/2005-2006 Publication/2005-2006 vwLUAssets/2005-2006

Tax Precision under pressure/2005-2006 $FILE/2005-2006 Tax TPSurvey 2007.pdf.

Göx, R. F. and Schiller U. (2007). An Economic Perspective on Transfer Pricing, in: C.

S. Chapman, A. G. Hopwood, & M. D. Shields (Eds.). Handbook of Management

Accounting Research (Vol.2). Oxford: Elsevier, 673-693.

23

Hirshleifer, J. (1956). On the economics of transfer pricing. Journal of Business, 29,

172-184.

Hyde, C.E. and Choe,C. (2005). Keeping two sets of books: The relationship between

tax and incentive transfer prices. Journal of Economics & Management Strategy, 14,

165-186.

Johnson, Nicole Bastian. (2006). Divisional performance measurement and transfer pricing

for intangible assets. Review of Accounting Studies, 11, 339-365

Kant, C. 1988, ”Endogenous transfer pricing and the effects of uncertain regulation,” Journal of International Economics, 24, 147-157.

OECD (2001). Transfer Pricing Guidelines for Multinational Enterprises and Tax Adninistration. Paris.

Pfeiffer, T., Lengsfeld, S., Schiller, U. & Wagner, J. (2008). Cost Based Transfer Pricing.

Working paper. University of Vienna. Available via SSRN. http://ssrn.com/

abstract=1024112.

Sahay, S. (2003). Transfer pricing based on actual costs. Journal of Management Accounting Research, 15, 177—192.

Smith, M. J. (2002a). ”Ex ante and ex post discretion over arms length transfer prices,”

Accounting Review, 77, 161-184.

Smith, M. J. (2002b). ”Tax and incentive trade-offs in multinational transfer pricing,”

Journal of Accounting, Auditing, and Finance, 17, 209—236.

Wielenberg, S. (2000). Negotiated transfer pricing, specific investment, and optimal capacity choice. Review of Accounting Studies, 5, 197—216.

24

Figure 1: Time line of events

t=1

q and T

negotiated

t=2

t=3

t=4

Investments

IS and IB

state

realized

qˆ and Tˆ

25

renegotiated