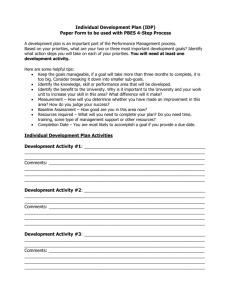

Individual Development Plan Employee Worksheets

advertisement

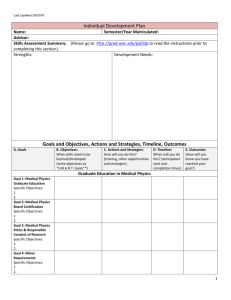

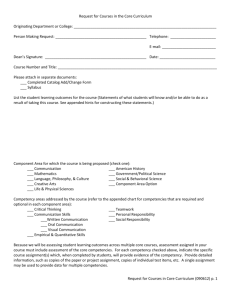

Individual Development Plan Identifying Goals and Strategies for Financial Professional Development Employee Worksheets Training Services Financial Competency Program Organizational Effectiveness For Employee Only Part 2 of 3 IDP Planning Worksheet Before starting this worksheet, the employee and manager will have agreed upon one to two Financial Core Competencies in which to develop the plan. Please list those in the box provided. This worksheet is designed for the employee to complete. It allows for personal reflection, goal setting, and identification of possible development activities to be included in the IDP. The completed form will be used when meeting with the manager to create the final IDP Agreement. In this meeting, specific action steps to develop the desired competencyrelated goals will be determined. Please block off about 60-minutes for this activity. The one or two financial competencies my IDP will focus around are: 1. __________________________ 2. __________________________ Optional – Personal SOAR Exercise Individual development planning is all about creating current and long-term goals for your job, and developing action steps towards accomplishing your plan. Before you know where you want to go, you need to look at your current state – what’s working, what needs attention, how can the department benefit from your learning? A Personal SOAR analysis (Strengths, Opportunities, Aspirations, Results) will help you in planning your IDP Goals. Strengths What are your greatest assets as they relate to the competencies you’ve identified? • What are you really good at? • What skills do other people recognize in you? • What do you do better than most people you work with? • What about yourself, are you most satisfied with? • What experiences do you have that others don’t? Opportunities What possibilities exist to further develop skills, knowledge or ability related to the competencies you’ve identified? • Is there a future team project that would allow you to learn new skills? • What certifications would help you move ahead? • Would courses such as business writing, curriculum development, graphic design, etc. will help you expand your current role and/or help you move within the department? • What development opportunities exist within your current job or daily routine? How can these activities supplement your current plan? How will you track your progress and report these to your manager? Aspirations What do you hope your professional future will look like in relation to enhancing the 1 to 2 competencies identified? • Do you want to write well? • Do you want to coach, teach or train? • Do you want to improve your leadership skills? • Do you want to get a Master’s degree? In what? Results How will you measure your development in the 1 to 2 competencies identified? Define what success means to you and determine what results you will need to attain your goals for success. office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 2 Personal SOAR Analysis Strengths Aspirations Opportunities You Results Based on your Personal SOAR Analysis, identify the professional goals you’d like to accomplish by this time next year. We recommend you have at least two and not more than four. This will allow you to experience focused results. Use the SMART approach to setting your goals. 1. 2. 3. 4. office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 3 Financial Competency: Identifications, Definitions, and Behavioral Anchors Functional / Technical Skills Definition Demonstrating ability to understand and use the financial systems of the University. Behavioral Anchors • • • Can correctly complete transactions in a timely manner. Is able to understand the majority of error messages and find the discrepancies and resolve them. Is able to process documents or complete transactions that fall outside of the ordinary. Analytical Thinking Definition The ability to break down problems into their component parts and consider or organize parts in a systematic way; the process of looking for underlying causes or thinking through the consequence of difference courses of action. Behavioral Anchors • • • • Use a step-by-step approach to break down financial problems or processes into their constituent parts. Identify cause and effect by identifying trends in incorrect transactions, why error messages are occurring, and what transaction to perform based on previous results. Analyze issues/concerns to arrive at an appropriate solution by looking at all available financial information and considering all possible solutions. Define significant parts and how they are related to the University’s financial policies and procedures. Critical Thinking Definition The ability to identify an issue, dilemma, or problem; explore and evaluate relevant information; and integrate the results into the development of a resolution. Behavioral Anchors • • • • Identify and clarify the issue by reviewing available information. Evaluate evidence for value, validity, and accuracy based on information found. Interpret policy by reviewing it to see if and when it applies. Resolve issues and discrepancies by determining the causes of problems, developing a plan to address the problem, and then implementing the plan. Problem Solving / Decision Making Definition Active search for a solution or answer to a question or matter involving doubt, uncertainty, or difficulty utilizing the processes of research, analysis and critical thinking. Behavioral Anchors • • • • • Ability to define the issue and identify the information requirements. Determine a range of possible sources for collecting data/information (e.g., co-worker, manager, FSS Helpline, the University’s policy and procedure, training materials, outside sources). Gather and analyze information and generate options using research and University policy. Choose the best alternative by reviewing the options that have been identified and selecting the appropriate one. Resolve issues and discrepancies by determining the causes of problems, developing a plan to address the problem, and then implementing the plan. Financial Competency: Identifications, Definitions, and Behavioral Anchors Communication Definition The transferring of thoughts, opinions, or knowledge related to financial information and the expression of ideas, orally or in written form, to individuals or groups. office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 4 Behavioral Anchors • • • • Listen actively by demonstrating one or more of the following: Paraphrase: Restate in their own words what they believe has been communicated. Mirror: Reflect back the message using the speaker’s exact words. Clarify: Make sure the message has been understood. “Lets me make sure I understand what you’ve said. It sounds to me like.…” Encourage: Use body language and verbal cues to encourage the speaker to continue or expand. “Tell me a bit more about what you are thinking.” Be intentionally silent: Use silence to allow time for messages to sink in, strong emotions to dissipate or a speaker to gather his or her thoughts. Communicate purposefully and in a timely way to ensure that financial activities are completed when necessary. Ask clear and well thought-out questions by planning the questions and possible follow up questions. Identify communication styles, individual interests, abilities, and knowledge levels to communicate with a diverse audience. Express facts and ideas in writing in a succinct and organized manner. • • • • • • Time Management Definition The development of processes and tools that increase efficiency and productivity and ensure accomplishment of specific objectives. Behavioral Anchors • Develops or uses systems to organize and keep track of information (e.g., "to-do" lists, appointment calendars, follow-up file systems). Sets priorities with an appropriate sense of what is most important and plans with an appropriate and realistic sense of the time demand involved. Keeps track of activities completed and yet to do, to accomplish stated objectives. • • Understands the University Context Definition Knows, understands, and can interpret University policies and how they relate to financial transactions and to the financial system at the University. Understands the University environments and processes that impact the user of the financial system. Behavioral Anchors • • • Adheres to University policy. Understands why adherence to policy is important and can communicate that to others. Understands the full context of a process, including inputs and outputs and ramifications of not following the process. office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 5 Financial Competency: Identifications, Definitions, and Behavioral Anchors Integrity Definition Undertakes tasks with an attitude of uncompromising ethics and honesty at all times, both professionally and personally with the intent of the rules and core values of the organization. Behavioral Anchors • • • • • Follows through on commitments. Only makes promises that can be kept. Takes care of the needs of the unit. Willing to accept responsibility or authority. Follows the University of Minnesota’s Code of Conduct Regent’s Policy. Accuracy / Attention to Detail Definition Thoroughness in accomplishing a task through concern for all the areas involved, no matter how small. Monitors and checks work or information and plans and organizes time and resources efficiently. Behavioral Anchors • • • • • Double checks the accuracy of information to provide accurate and consistent work. Provides information on a timely basis and in a usable form to others who need to act on it. Carefully monitors the details and quality of own and others’ work. Expresses concern that things be done right, thoroughly, or precisely. Completes all work according to procedures and standards. Optional Competencies Service Definition Demonstration of a strong commitment to providing internal and external customers with timely, quality, and courteous financial service. Behavioral Anchors • • • • • Identify customer needs by inquiring about their concerns, desires, and/or problems. Consider all possible actions to take based on the University’s policies and procedures. Decide on the best course of action by considering the customers needs/desires and what can be done to meet these needs. Take the best course of action and verify if the action meets needs/desires. Respond to customer needs in an approachable, responsive and timely manner. Influence / Negotiation Definition Encouraging or persuading others of a course of action for the terms of a financial transaction or agreement with the ability to explore positions and alternatives to reach outcomes that gain acceptance of all parties. Behavioral Anchors • • • • • Identify the financial issue. Listen actively to other ideas and presents own ideas for a balance of perspectives. Develop additional ideas with others. Decide solutions to agree upon with others. Verify the solution/agreement with others. office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 6 Identify Development Opportunities The next few pages are designed to help the employee identify potential development opportunities for the IDP. Once the potential activities have been designated, the employee will meet with the manager to create the action steps to achieve the desired goal. Some negotiations may take place, as all development activities within the unit/department must be approached strategically by the manager. For example, any necessary funding, time off, etc., must be approved by the manager. Please note each goal must correspond with one (or more) of the Financial Core Competencies. You can review the list, definitions, and standard behavioral anchors on the previous pages (4-6). Goal: Strategies to Enhance Financial Competency: Examples include: On-the-job training activities, mentoring, job-shadowing, courses through OE, Regents Scholarship courses, coaching, self-development. There may be multiple activities to achieve a single goal. Core Competencies: Functional/Technical Skills Analytical Thinking Critical Thinking Problem Solving/ Decision Making Communication Time Management Integrity Accuracy/Attention to Detail Understands U Context Optional Competencies: Influence/Negotiation Service Optional - Supervisors: Staff Management Strategic Planning Action Steps: office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 Timeline for Completion: 7 Goal: Strategies to Enhance Financial Competency: Examples include: On-the-job training activities, mentoring, job-shadowing, courses through OE, Regents Scholarship courses, coaching, self-development. There may be multiple activities to achieve a single goal. Core Competencies: Functional/Technical Skills Analytical Thinking Critical Thinking Problem Solving/ Decision Making Communication Time Management Integrity Accuracy/Attention to Detail Understands U Context Optional Competencies: Influence/Negotiation Service Optional - Supervisors: Staff Management Strategic Planning Action Steps: office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 Timeline for Completion: 8 Goal: Strategies to Enhance Financial Competency: Examples include: On-the-job training activities, mentoring, job-shadowing, courses through OE, Regents Scholarship courses, coaching, self-development. There may be multiple activities to achieve a single goal. Core Competencies: Functional/Technical Skills Analytical Thinking Critical Thinking Problem Solving/ Decision Making Communication Time Management Integrity Accuracy/Attention to Detail Understands U Context Optional Competencies: Influence/Negotiation Service Optional - Supervisors: Staff Management Strategic Planning Action Steps: office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 Timeline for Completion: 9 Goal: Strategies to Enhance Financial Competency: Examples include: On-the-job training activities, mentoring, job-shadowing, courses through OE, Regents Scholarship courses, coaching, self-development. There may be multiple activities to achieve a single goal. Core Competencies: Functional/Technical Skills Analytical Thinking Critical Thinking Problem Solving/ Decision Making Communication Time Management Integrity Accuracy/Attention to Detail Understands U Context Optional Competencies: Influence/Negotiation Service Optional - Supervisors: Staff Management Strategic Planning Action Steps: Timeline for Completion: Once the IDP Employee Worksheets have been completed a meeting between the employee and manager will need to occur. At this meeting, the final IDP Agreement will be created based on how the personal competency goals complement the needs of the department. office:OE:trn-srv:Competency_Program:Core_Level 1:IDP:IDP Finance - Employee Worksheets_2009.doc 2009 10