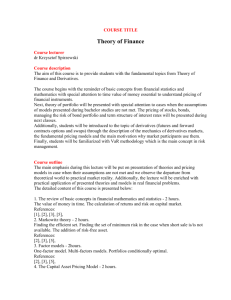

Bibliography

advertisement