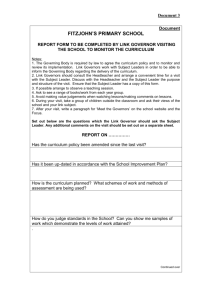

Summary Proceedings - Documents & Reports

advertisement