Opportunistic customer claiming during service recovery

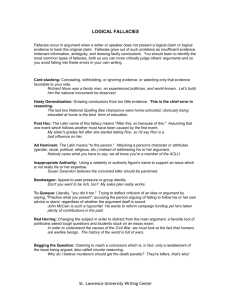

advertisement