Property, plant, and equipment is defined as tangible assets that are

advertisement

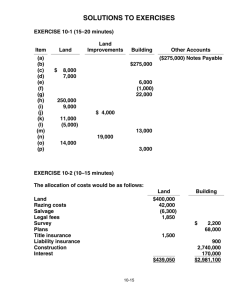

Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment ► Introduction: Property, plant, and equipment is defined as tangible assets that are held for use in production or supply of goods and services, for rentals to others, or for administrative purposes; they are expected to be used during more than one period. Nature of Property, plant, and equipment : ► Used in operations, and not for resale. ► Long-term in nature and usually depreciated, except land. ► Possess physical substance. Property, plant, and equipment Includes: Land, Land Improvements Building structures (offices, factories, warehouses), and Equipment (machinery, furniture, tools). ► The Value of Property, plant, and equipment : A) Value of Property plant and equipment at Acquisition date: Determined using (Historical Cost Principle): the cash or cash equivalent price of obtaining the asset and bringing it to the location and condition necessary for its intended use. B) Value of Property plant and equipment in subsequent periods: Determined using either the: 1- Cost Method (Historical Cost) 2- Fair value (revaluation) method. Acquisition Cost Property Plant and Equipment (PP&E): 1- Land Includes all costs to acquire land and Making it ready for use. Costs typically include: (1) purchase price; (2) Real estate Broker’s Commission (3) Closing costs, such as title, attorney’s fees, and recording fees; (4) assumption of any liens, mortgages, or encumbrances on the property; (5) additional land improvements that have an indefinite life. (Clearing, Cleaning, Filling, Grading) (6) Accrued (Delinquent) Property taxes. Intermediate Accounting 2:IFRS Page 1 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment 2- Land Improvement (Must depreciated) Includes all land improvements with limited lives (definite life) (1) Private driveways, (2) Walks, (3) Fences, and (4) Parking lots (5) Landscaping (6) Underground sprinklers Notes ► Land acquired and held for speculation is classified as an investment. ► Land held by a real estate concern for resale should be classified as inventory. 3- Building Purchased Purchase price Real estate Broker’s Commission Closing costs Improvements to the building (Before the use of the building) Constructed Contract Price Architects Fees Excavation Costs Building Permits Materials, Labor, Overhead ( Interest) Note: If a real estate (Land + Building) Purchased as Plant Site it must recorded as Land otherwise recorded as Land and Building 4- Equipment Include all costs incurred in acquiring the equipment and preparing it for use. Costs typically include: (1) purchase price, (2) freight and handling charges (3) insurance on the equipment while in transit, (4) cost of special foundations if required, (5) assembling and installation costs, and (6) costs of conducting trial runs. Intermediate Accounting 2:IFRS Page 2 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment E10-1 : The expenditures and receipts below are related to land, land improvements, and buildings acquired for use in a business enterprise. Determine how the following should be classified: No. 1 2 3 4 5 6 Items Money borrowed to pay building contractor Payment for construction from note proceeds Cost of land fill and clearing Delinquent real estate taxes on property assumed Premium on 6-month insurance policy during construction Refund of 1-month insurance premium because construction completed early 7 Architect’s fee on building 8 Cost of real estate purchased as a plant site (land €200,000 and building €50,000) 9 Commission fee paid to real estate agency 10 Installation of fences around property 11 Cost of razing and removing building 12 Proceeds from salvage of demolished building 13 Cost of parking lots and driveways 14 Cost of trees and shrubbery (permanent) N/P, B, L, L, B, -B, B, L, L, LI, L, -L, LI, L Intermediate Accounting 2:IFRS Page 3 of 16 Classification Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment Capitalization of Interest Capitalization considers three items: 1. Qualifying assets. تحديد األصول Two types of assets are qualified for interest Capitalization: ► Assets under construction for a company’s own use. ► Assets intended for sale or lease that are constructed or produced as discrete projects. أصول سوف يتم بيعها أو تأجيرها وتعتبر مشروعات مستقلة 2. Capitalization period. Begins when: 1. Expenditures for the asset have been made. 2. Activities for readying the asset are in progress . 3. Interest costs are being incurred. Ends when: The asset is substantially complete and ready for use 3. Amount to capitalize. Capitalize the lesser of: 1. Actual interest costs 2. Avoidable interest the amount of interest that could have been avoided if expenditures for the asset had not been made. .مقدار الفائدة التي كان يمكن تفاديها لو لم يتم اإلنفاق على األصل باستخدام القروض Exercise 2: Blue Corporation borrowed $200,000 at 12% interest from State Bank on Jan. 1, 2011, for specific purposes of constructing special-purpose equipment to be used in its operations. Construction on the equipment began on Jan. 1, 2011, and the following expenditures were made prior to the project’s completion on Dec. 31, 2011: Actual Expenditures Amount January 1, 2011 $ 100,000 April 30, 2011 150,000 November 1, 2011 300,000 December 31, 2011 100,000 Total expenditures $ 650,000 Other general debt existing on Jan. 1, 2011: 1. $500,000, 14%, 10-year bonds payable 2. $300,000, 10%, 5-year note payable Instructions: Determine the cost of Equipment , Prepare all required Journal entries. Intermediate Accounting 2:IFRS Page 4 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment Step 1 - Compute weighted-average accumulated expenditures. Weighted Average Actual Capitalization Accumulated Expenditures Period Expenditures $ 100,000 12/12 $ Apr. 30 150,000 8/12 100,000 Nov. 1 300,000 2/12 50,000 Dec. 31 100,000 0/12 - Date Jan. 1 $ 650,000 $ 100,000 250,000 Step 2 - Compute the Total Interest ( Actual Interest). Interest Rate 12% 14% 10% Debt Specific Debt General Debt $ 200,000 500,000 300,000 Actual Interest Actual Interest $ 24,000 70,000 30,000 124,000 Step 3 - Compute the weighted-average interest Rate on General Debt. WAIR = = = 12.5% Step 4 - Compute the Avoidable Interest. Accumulated Interest Rate Expenditure From Specific Debt $ 200,000 12.0% From General Debt 50,000 12.5% Avoidable Interest Avoidable Interest $ 24,000 6,250 30,250 Step 5 – Capitalize the lesser of Avoidable interest or Actual interest. Avoidable interest = $ 30,250 Actual interest = $124,000 Intermediate Accounting 2:IFRS Page 5 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment Step 6 – Capitalize the lesser of Avoidable interest or Act ual interest. Date 1 Accounts Dr. 650,000 Building Cash Interest Expenses Cash Building Interest expenses 2 3 Cr. 650,000 124,000 124,000 30,250 30,250 Ex. 10-158—Weighted-Average Accumulated Expenditures. On April 1, Paine Co. began construction of a small building. Payments of $120,000 were made monthly for four months beginning on April 1. The building was completed and ready for occupancy on August 1. For the purpose of determining the amount of interest cost to be capitalized, calculate the weighted-average accumulated expenditures on the building by completing the schedule below: Date Expenditures Expenditures Capitalization Period Weighted-Average Solution 10-158 Date Expenditures April 1 May 1 June 1 July 1 Expenditures Capitalization Period $120,000 120,000 120,000 120,000 4/12 3/12 2/12 1/12 Weighted-Average $ 40,000 30,000 20,000 10,000 $100,000 Ex. 10-159—Capitalization of interest. On March 1, Mocl Co. began construction of a small building. The following expenditures were incurred for construction: March 1 $ 75,000 May 1 180,000 July 1 100,000 April 1 June 1 $ 74,000 270,000 The building was completed and occupied on July 1. To help pay for construction $50,000 was borrowed on March 1 on a 12%, three-year note payable. The only other debt outstanding during the year was a $500,000, 10% note issued two years ago. Intermediate Accounting 2:IFRS Page 6 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment Instructions (a) Calculate the weighted-average accumulated expenditures. (b) Calculate avoidable interest. Solution 10-159 (a) Date Expenditures March 1 $ 75,000 April 1 74,000 May 1 180,000 June 1 270,000 July 1 100,000 (b)Weighted-Average Accum. Expend. $50,000 46,000 $96,000 Capitalization Weighted-Average Period Accum. Expend. 4/12 $25,000 3/12 18,500 2/12 30,000 1/12 22,500 0 0 $96,000 Rate .12 .10 Avoidable Interest $ 6,000 4,600 $10,600 :مالحظة هامة : شهور مثال ا9اذا كان المشروع ينتهي خالل سنة و ) تحسب السنة األولى بالطريقة العادية ( السابقة شهور ) فيجب وضع جميع9 ( أما السنة الثانية مصروفات السنة األولى باإلضافة الي الفوائد في أوالً قبل حساب21/9 السنة األولى ونضرب في . مصروفات التسعة شهور Intermediate Accounting 2:IFRS Page 7 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment ► Valuation of Property, plant, and equipment : Companies should record property, plant, and equipment: ► at the fair value of what they give up or ► at the fair value of the asset received, whichever is more clearly evident. Valuation Problems: 1. Cash Discounts — Whether taken or not — generally considered a reduction in the cost of the asset. Exercise: On January 1, 2013. ABC Purchased Equipment for $10,000, Terms 2/10, n30 and the payment was Paid on January 15, 2013. Date Accounts Dr. Cr. Jan 1, 2013 Equipment ($10,000 x 98%) 9,800 Accounts Payable 9,800 Jan 15, 2013 Accounts Payable 9,800 Cash Discount forfeited 200 Cash 10,000 2. Deferred-Payment Contracts — Assets, purchased through long term credit, are recorded at the present value of the consideration exchanged. Exercise: Sutter company purchases a specially built robot spray painter for its production line. The company issues a $100,000 five years, zero interest bearing note to Wrigley Robotics Inc. for the new equipment the prevailing market rate of interest for obligation of this nature is 10%, Sutter is to pay off the note in five $20,000 instalments, made at the end of each year. Sutter cannot readily determine the fair value of this specially built robot. Date Accounts Dr. Cr. Date of Equipment ($20,000 x 3.79079) 75,816 Purchase Note Payable 75,816 End of First Interest Expenses (75,816 x 10%) 7,582 Year Note Payable (Difference) 12,418 Cash 20,000 Intermediate Accounting 2:IFRS Page 8 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment 3. Lump-Sum Purchases — Allocate the total cost among the various assets on the basis of their fair market values. Exercise: On May 13, we purchased land and building for $200,000 cash , the appraised value of the building is $162,500 and the land is appraised at $87,500 . Prepare the journal entry to record this transaction ? Asset Building Land Total Date May 13 Apprised Value 162,500 87,500 250,000 % of value Purchase price Assigned cost 65% 200,000 130,000 35% 200,000 70,000 100% 200,000 وبعد عملية التوزيع يتم عمل قيد االقتناء Accounts Building Land Cash Dr. 130,000 70,000 Cr. 200,000 4. Issuance of Shares — The market value of the shares issued is a fair indication of the cost of the property acquired. Exercise I: On March 31, 2003 the Elcorn Company issued 10,000 shares of $10 Par Ordinary Shares in Exchange for land , with Fair market value of $120,000. Journal Entry: Date March 31 Accounts Land Share Capital – Ordinary Share Premium – Ordinary Intermediate Accounting 2:IFRS Page 9 of 16 Dr. 120,000 Cr. 100,000 20,000 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment 5. Government Grants المنح الحكومية Grants are assistance received from a government in the form of transfers of resources to a company in return for past or future compliance with certain conditions relating to the operating activities of the company. IFRS allows one of two ways: 1. Credit Deferred Grant Revenue for the subsidy االعانة الماليةand amortize the deferred grant revenue over the useful life of purchased asset. 2. Credit the Granted assets (Reduce the cost of equipment) for the subsidy and depreciate this amount over the five-year period. Example 1: Grant for Lab Equipment. AG Company received a €500,000 subsidy from the government to purchase lab equipment on January 2, 2011. The lab equipment cost is €2,000,000, it has a useful life of five years, and is depreciated on the straight-line basis. Date Jan 2 Dec 31 Deferred Revenue Accounts Dr. Cash 500 Deferred Grant Rev Equipment 2,000 Cash Deferred Grant Rev 100 Grant Revenue Depreciation Exp. 400 Accumulated Dep. Cr. Reduce Cost Accounts Dr. Cr. 500 2,000 Equipment Cash 1,500 1,500 100 Depreciation Exp. 400 Accumulated Dep. 300 300 Statement of Financial Position Statement of Financial Position At Dec 31, 2011 At Dec 31, 2011 Non Current Assets Non Current Assets Equipment 2,000 Equipment 1,500 (-) Accumulated Dep. 400 (-) Accumulated Dep. 300 1,600 1,200 Non Current Liability Deferred Grant Rev. Current Liability Deferred Grant Rev. Income Statement Income Statement For the year ended Dec 31, 2011 For the year ended Dec 31, 2011 Grant Revenue 100 Depreciation Exp. (400) Depreciation Exp. (300) (=) Net Income Effect (300) (=) Net Income Effect (300) Intermediate Accounting 2:IFRS Page 10 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment 6. Contributions التبرع باألصول When a company contributes a non-monetary asset, it should record the amount of the donation as an expense at the fair value of the donated asset. Illustration: Kline Industries donates land to the City of San Paulo for a city park. The land cost $80,000 and has a fair value of $110,000. Kline Industries records this donation as follows. Date Accounts Contribution Expense Land Gain on Disposal of Land Dr. 110,000 Cr. 80,000 30,000 ► Costs Subsequent to Acquisition Recognize costs subsequent to acquisition as an asset when the costs can be measured reliably and it is probable that the company will obtain future economic benefits. Future economic benefit would include increases in 1. useful life, 2. quantity of product produced, and 3. quality of product produced. Intermediate Accounting 2:IFRS Page 11 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment ► Disposition of PP&E A company may retire plant assets voluntarily or dispose of them by: abandonment ( Retirement , Discarded, Scraped ) الترك Involuntary Conversion التحويل االجباري sale, exchange, Note: Depreciation must be taken up to the date of disposition 1. Abandonment of Assets (Voluntary). Exercise: Matterhorn Company retires its delivery equipment, which cost $44,000 and had accumulated depreciation of $39,000, No residual Value is received. Date Accounts [1] Accumulated Depreciation [3] Loss on Disposal [2] Delivery Equipment Dr. 39,000 5,000 Cr. 44,000 2. Involuntary Conversion o Sometimes an asset’s service is terminated through some type of involuntary conversion such as fire, flood, theft, or condemnation. o Companies report the difference between the amount recovered (e.g., from a condemnation award or insurance recovery), if any, and the asset’s book value as a gain or loss. o They treat these gains or losses like any other type of disposition. Exercise: Matterhorn Company Involuntary retire its delivery equipment due to fire damage, the equipment cost $44,000 and had accumulated depreciation of $39,000, Matterhorn receive $6,000 cash from insurance company. Date [1] [3] [4] [2] Accounts Accumulated Depreciation Cash Gain on Disposal Delivery Equipment Intermediate Accounting 2:IFRS Page 12 of 16 Dr. 39,000 6,000 Cr. 1,000 44,000 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment 3. Sale of Plant Assets BE10-15: Ottawa Corporation owns machinery that cost $20,000 when purchased on July 1, 2007. Depreciation has been recorded at a rate of $2,400 per year, resulting in a balance in accumulated depreciation of $8,400 at December 31, 2010. The machinery is sold on September 1, 2011, for $10,500. Prepare journal entries to a) update depreciation for 2011 and b) record the sale. 4. Exchange of Non-Monetary assets We have two situations 1- The transaction has commercial substance (when) a- If the company expect a change in future cash flows as a result of the exchange b- If the two parties’ economic positions change, the transaction has commercial substance. 2- The transaction has No commercial substance. The transaction has commercial substance: (any Gain or loss should be recognized) 1- book value (old) = Cost – Accumulated Depreciation 2- Gain or loss = FMV (old) – BV (old) 3- Cost of new = FMV (old) + Cash paid (Or) – Cash Received (List Price – Trade in allowance) 3- Journal Entry FMV = Fair Market Value Intermediate Accounting 2:IFRS Page 13 of 16 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment The transaction has No commercial substance: (only loss should be recognized) 1- Book value (old) = Cost – Acc/Dep 2- Gain or loss = FMV (old) – BV(old) 3- Cost of new = FMV (old) + Cash paid (Or) – Cash Received - Gain (List Price – Trade in allowance) 3- Journal Entry Exercise: Information Processing, Inc. trades its used machine for a new model at Jerrod Business Solutions Inc. The exchange has commercial substance. The used machine has a book value of $8,000 (original cost $12,000 less $4,000 accumulated depreciation) and a fair value of $9,000. The new model lists for $16,000. Jerrod gives Information Processing a trade-in allowance of $9,000 for the used machine. Instructions: 1. By How much will Information Processing computes the cost of the new asset. 2. Prepare the required journal entry. 3. Repeat requirements (1) and (2) assuming the transaction has no commercial substance. Solution: 1. The cost of new assets computed as follows: 1- book value (old) = $12,000 - $4,000 = $ 8,000 2- Gain or loss = $ 9,000 - $8,000 = $ 1,000 Gain 3- Cost of new = $ 9,000 + ($16,000 - $9,000) = $16,000 2. Journal Entry Date Description Equipment (New) Accumulated Depreciation Cash Equipment (old) Gain on disposal of equipment Intermediate Accounting 2:IFRS Page 14 of 16 Dr. 16,000 4,000 Cr. 7,000 12,000 1,000 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment 3. Assuming No Commercial Substance. The cost of new assets computed as follows: 1- book value (old) = $12,000 - $4,000 = $ 8,000 2- Gain or loss = $ 9,000 - $8,000 = $ 1,000 3- Cost of new = $ 9,000 + ($16,000 - $9,000) - $1,000 = $15,000 The Journal entry is as follows: Date Description Equipment (New) Accumulated Depreciation Cash Equipment (old) Dr. 12,000 4,000 Cr. 7,000 12,000 E10-19: Santana Company exchanged equipment used in its manufacturing operations plus $2,000 in cash for similar equipment used in the operations of Delaware Company. The following information pertains to the exchange. Santana $28,000 Delaware $28,000 Accumulated Depreciation 19,000 10,000 Fair value of equipment 13,500 15,500 Equipment (cost) Cash given up 2,000 Instructions: Prepare the journal entries to record the exchange on the books of both companies. Solution: Calculation of the cost of new assets Book Value Gain or Loss Cost of New Santa 28,000 – 19,000 = $9,000 13,500 – 9,000 = $4,500 13,500 + 2,000 = 15,500 Intermediate Accounting 2:IFRS Page 15 of 16 Delaware 28,000 – 10,000 = $18,00 15,500 – 18,000 = $(2,500) 15,500 – 2,000 = $13,500 Ehab Abdou 97672930 Ch 10 : Acquisition, Valuation and Disposition of Property, Plant, and Equipment Santa Delaware: Intermediate Accounting 2:IFRS Page 16 of 16 Ehab Abdou 97672930