For: Market

Insights

Professionals

Build Market Insights’ Efficiency

And Influence

by richard evensen, February 1, 2013

key TakeaWays

digital disruption Changes The Requirements For Market insights

professionals

In the digital (Internet) world, things move much faster. Market insights

professionals need to be more proactive and push more relevant insights to

stakeholders in a timely manner.

To improve agility, Market insights Needs To evolve The insights

supply Chain

Market insights professionals need to have a deeper understanding of business

needs and supplier capabilities as well as manage more of the insights supply chain

effectively to optimize the value-add of their insights.

Market insights professionals Need To Change how They Work if

They Want To survive

Market insights professionals need to provide deeper insights more quickly, more

proactive and predictive analyses, as well as more influential and actionable

deliverables to meet the needs of their stakeholders.

Forrester research, Inc., 60 acorn Park Drive, Cambridge, Ma 02140 usa

tel: +1 617.613.6000 | Fax: +1 617.613.5000 | www.forrester.com

For Market Insights Professionals

February 1, 2013

Build Market Insights’ Efficiency And Influence

Processes: The Market Insights Optimization Playbook

by Richard Evensen

with Reineke Reitsma, Ryan Morrill, and Douglas Roberge

Why Read This Report

Digital disruption has created an environment in which customer and competitive change are happening at

much faster rates, leading stakeholders to increase their demands for more innovative, agile, and deep insights.

This, in turn, is forcing market insights to evolve and significantly change how it works. At a high level, market

insights must become more proactive, predictive, and agile; work more effectively with too little (incomplete)

or too much (big) data; greatly improve the integration of data and insights; impress stakeholders with

deliverables; and influence change to maximize the ROI of insights. In this report, Forrester drills down into

how market insights must change. We’ll describe what an evolved market insights information supply chain

looks like and show you what process changes need to happen at each of three key phases in the insights value

chain — insights capture, insights analysis, and insights delivery and activation — to allow market insights to

become more efficient and influential in the age of digital disruption.

Table Of Contents

Notes & Resources

2 Digital Disruption Changes Everything For

Market Insights

In developing this report, Forrester drew on

a wealth of analyst experience, insight, and

research through a review of existing best

practices, interviews, analyst advisory, and

inquiry discussions with market insights

professionals and stakeholders.

2 The Market Insights Information Supply

Chain Must Evolve

5 Market Insights Needs To Optimize Its

Insights Fulfillment

Insights Capture Must Be More Focused And

Holistic

Insights Analysis Must Be More Proactive And

Innovative

Insights Delivery And Activation Must Be More

Engaged And Influential

Related Research Documents

The Marketing Of Market Insights: How To

Build Internal Relationships And Influence

February 22, 2012

Market Insights Must Add Value And Evolve

March 14, 2011

Recommendations

12 Focus Market Insights In The Right Direction

Notes & Resources

© 2013, Forrester Research, Inc. All rights reserved. Unauthorized reproduction is strictly prohibited. Information is based on best available

resources. Opinions reflect judgment at the time and are subject to change. Forrester®, Technographics®, Forrester Wave, RoleView, TechRadar,

and Total Economic Impact are trademarks of Forrester Research, Inc. All other trademarks are the property of their respective companies. To

purchase reprints of this document, please email clientsupport@forrester.com. For additional information, go to www.forrester.com.

For Market Insights Professionals

2

Build Market Insights’ Efficiency And Influence

digital disruption changes everything for market insights

In 2011, Forrester wrote that: “Digital disruption is unlike any other disruptive force you’ve read

about . . . When it’s your turn, digital disruption will happen so fast and with such a completely

devastating effect that it will feel like it was led by a global conspiracy, a junta of disruptors who

shared secrets, pooled their digital resources, and plotted their overthrow of the establishment.”1

As the primary department in the company focused on capturing external insights about customers,

competitors, and the market, market insights has responsibility for maintaining a “disruption radar.”

This means that market insights professionals need to learn to:

■ Identify disruptions early or before they happen. Market insights professionals need to know

what to look for, be on the alert for potential triggers of change, and have a lot more eyes and

ears helping them, as disruptions can come from the market, competitors, the ecosystem, and

even their customers.

■ Proactively alert stakeholders to potential disruptions and their impact. Market researchers

like to deal with “what is” rather than “what if ”; they want to have enough data on hand to

make statistically valid statements.2 Unfortunately, because of the swiftness of disruptions,

companies no longer always have the time to get all the data before they make decisions. To

ensure resiliency in the face of disruption, market insights professionals must maintain a rich

knowledge base and know where to get quick access to needed insights.

■ Guide stakeholders in making insights-based decisions, rather than gut-based ones.

Traditionally, market researchers delivered the data and were done, often leaving a gap between

“what is,” “what it means,” and “what should we do.” To ensure the actionability of insights —

and gain proof points of insights’ value — market insights teams need to partner with their

stakeholders to ensure that their insights are acted upon and not just put in the recycling bin.

The market insights information supply chain must evolve

It’s important for market insights professionals to realize that they are the fulfillment stage in a larger

information supply chain. As with any other supply chain optimization process, this means that

market insights professionals need to (see Figure 1):

■ Improve their visibility into demand flow. Instead of waiting for research requests, market

insights teams need to engage stakeholders proactively to identify key business and stakeholder

goals, then identify and guide the relevant research and insights that will support these goals.

This requires improving stakeholder relationships and influence.3 The benefit is that greater

visibility into demand also means an improved ability to align budget, resources, research supply,

and plans with business needs.

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

3

Build Market Insights’ Efficiency And Influence

■ Improve their control over supply flow. Crucial to market insights’ ability to become a more

agile, innovative, and high-value partner is its ability to improve its own supply chain.4 This

requires beefing up the availability of and access to insights as well as partnering more with

suppliers to help push relevant insights into the organization and gain the lead time required to

proactively capture the needed data and insights.

■ Improve their fulfillment time and quality. Market insights needs to own the information

supply chain — from ordering to implementation. In research terms, this includes the capture,

analysis, and delivery of insights — as well as their activation. The latter point is crucial, as

insights have no value if stakeholders don’t act on them.5

■ Improve their visibility into the use and impact of their insights. Automobile manufacturers

don’t just sell their cars and walk away. They track how well their cars are performing to ensure

continual improvements in product design, supplier choice, and processing as well as to gain

feedback for marketing purposes. Market insights is no different in that it must track the impact

of its insights to know what performed well in order to identify where it should focus its portfolio

and efforts as well as to gain proof points to use when marketing the value of market insights.

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

4

Build Market Insights’ Efficiency And Influence

Figure 1 Evolution Requires Better Visibility Into And Control Of The Insights Supply Chain

Start

Business

goals

Strategy

assessment

Stakeholder

goals

Strategy

impact

Demand flow

Stakeholders

Stakeholder

info. needs

Research

needs

Insights

availability

Knowledge

and profiles

Insights fulfillment

Insights Insights Insights

capture analytics delivery

Insights fulfillment

Strategy

integration

Strategy

creation

Postmortems

Gap

analysis

Supply flow

Suppliers

Data and

insights

Enrichment

plan

Sources

Insights’

needs

Start

85641

© 2013, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

February 1, 2013

For Market Insights Professionals

5

Build Market Insights’ Efficiency And Influence

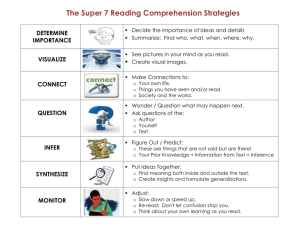

Market Insights Needs To Optimize its Insights Fulfillment

In the past, if you ordered a product, it could take many months to get from its point of creation

to its final sales destination. Fast-forward to 2013 and we now expect two-day delivery or we’ll go

elsewhere. The takeaway here is not about delivery time but about realizing the massive changes that

had to happen at each step in the product fulfillment (supply) chain to make this possible.

Market insights professionals looking to optimize the delivery of their insights must optimize their

fulfillment. More precisely, this means that (see Figure 2):

■ Insights capture needs to become more holistic and focused. Monolithic data feeds are no

longer enough. Market insights needs to tap inputs across its entire ecosystem and get needed

information sooner.6 Inputs — including quantitative and qualitative data, as well as refined

insights — will need to be as automated as possible, properly organized, integrated, and easily

accessible to ensure agility and efficiency.

■ Insights analysis needs to be more proactive and innovative. Market insights professionals

no longer have the time to swim in the data and see what they find. To optimize this step in the

information supply chain requires improved data science — and art: hypothesis-based research

and analysis, better quantitative and predictive models, and the ability to see patterns in the data

and information that others don’t.

■ Insights delivery and activation needs to be more engaged and influential. Insights have

no value unless they are acted upon. This needs to become market insights’ mantra. To ensure

insights activation, market insights professionals need to improve their understanding of, and

influence with, key stakeholders. This means becoming more engaged with stakeholders in their

strategic decision-making and following insights from delivery to implementation and impact.

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

6

Build Market Insights’ Efficiency And Influence

Figure 2 Evolved Market Insights Teams Have An Enriched Insights Fulfillment Chain

Stakeholder and

business empowerment

Insights delivery and

activation

Insights analysis

Insights capture

Stakeholder and

business understanding

Engaged and

influential

Proactive and

innovative

Holistic and

focused

85641

Source: Forrester Research, Inc.

Insights Capture Must Be More Focused And Holistic

There is a tendency among some market researchers to “boil the ocean” — i.e., to try to capture

all possible data and then see what nuggets of insight they can find. Just like (literally) boiling an

ocean, this is very labor-intensive and time-consuming — and it’s impossible for market insights

professionals who are already overworked.

Forrester believes that market insights professionals need to change how they look for and capture

insights. By adopting a step-by-step, focused process, market insights professionals can become more

efficient and effective at capturing truly high-value/high-impact insights. To do this (see Figure 3):

■ Start with what stakeholders want, not what you have. Because many market researchers are

reactive and working under extreme time pressure as a result, there is a tendency to give

stakeholders whatever data/insights are on hand rather than what they really want. This can both

overload and underwhelm stakeholders, giving them the impression that market insights is a

low-value information supplier rather than a high-value insights partner. For Intuit, aligning the

research portfolio to stakeholder initiatives was one of the first priorities in empowering the team.

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

7

Build Market Insights’ Efficiency And Influence

■ Don’t over-engineer things. Swinging too far in the other direction and doing a full-blown

project for every stakeholder request is also problematic. First, it greatly reduces time-toinsights; second, it reduces budget and resource availability, potentially unnecessarily. Instead,

assess on-hand and easily available information by tapping business partners, industry

organizations, and analyst firms, and see if these insights are sufficient for stakeholders. Market

insights professionals at BlackBerry and CSC run stakeholder queries by a variety of analysts

and then synthesize the results, often saving stakeholders months of waiting and the insights

team many precious hours of effort.

■ Prioritize net-new insights requirements. Not all insights have the same value to the

business or to stakeholders. Prior to investing your precious budget and time in a project,

talk to stakeholders about the intended use of the insights.7 For which workflows or strategy

developments are they needed? Which metrics could be affected — and by how much? Then, do

a projected ROI analysis to determine how important these insights are.8

■ Hypothesize what is really needed. Often, market insights professionals will send out requests

for proposals (RFPs) that ask for tons of data and insights when they are simply trying to

determine whether competitor X is doing Y. The result is a much more costly and timeconsuming project than necessary. Instead, focus on what you’re trying to prove or disprove,

identify the key types of data and insights that would help you do this, and then focus on how

best to capture this information.9

■ Align insights with optimal information sources. Many sources are available to market

insights professionals.10 At this stage, align the types of insights that you are looking for with the

optimal sources of these insights — where optimal is defined in terms of the cost and time to

obtain insights and the quality and depth that the sources typically provide. Avoid the tendency

to get multiple bids, which wastes your time and undermines your relationship with the vendors

that don’t win your business; focus instead on the partners that can best meet your needs.

■ Assess and make requests until you get what you need. There are enough cases of market

insights teams being frustrated with outside vendors to reiterate the warning: Buyer beware!

If you use an outside vendor to obtain targeted insights, don’t be hands-off. To ensure optimal

results, one market insights professional had the vendor provide “insights to date” at 25%, 50%,

and 75% of project completion. It’s your responsibility to ensure that you get the insights you

need, so push for regular updates and adjust criteria as needed to optimize the final deliverables.

■ Cross-check results against other information sources. Prior to taking a firm stand that

the insights you have are accurate, test them against other relevant sources of data, especially

customer feedback, competitive intelligence, transactional data, social media insights, and

even web analytics. Several market insights analysts have faced the challenge recently of social

media analytics not backing up survey data, and Forrester has heard of several situations where

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

8

Build Market Insights’ Efficiency And Influence

survey data (what customers said they did) didn’t line up with behavioral data (what actually

happened). Not being aware of — and solving for — the differences among sources can make

you vulnerable and lose credibility if these other sources refute your findings. By contrast,

integrating these other sources gives you a more holistic view of your topic, which can greatly

enrich your insights.11

■ Ensure stakeholders understand your insights. Don’t just hand off electronic insights

deliverables. Instead, have a conversation with the insights analytics team member(s) or

stakeholders to make sure they fully understand the insights you’re providing. If the news

is going to be bad, do as Sonja Mathews, vice president of market research and competitive

intelligence at USAA, does and give the stakeholders affected a pre-read rather than surprising

them in a larger meeting.

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

9

Build Market Insights’ Efficiency And Influence

Figure 3 How To Efficiently Capture And Process High-Value Insights

Insights capture process flow

Assess

Focus on stakeholder

needs versus

available insights.

Determine if on-hand

and easily available

insights are sufficient.

insight needs.

Hypothesize and

identify triggers to

focus on in research

requests.

Capture

Identify optimal

providers and

partner with

key source(s).

Assess insights and

request changes

until needs are met.

Optimize

Cross-check insights

against other sources.

Deliver insights to

analytics team

and/or stakeholders.

Focus Prioritize any net-new

85641

© 2013, Forrester Research, Inc. Reproduction Prohibited

Source: Forrester Research, Inc.

February 1, 2013

For Market Insights Professionals

10

Build Market Insights’ Efficiency And Influence

Insights Analysis Must Be More Proactive And Innovative

For market insights professionals to meet the needs of the business and key stakeholders in the

age of disruption, they must move beyond only explaining the past: where the company was

(benchmark reports), why something happened (deep-dive reports), and how satisfied customers

were (CSAT reports). Instead, the focus has to move increasingly toward forward-looking research:

where the company should go, what offerings it should develop, and how it can improve its

competitive advantage and meet future customer needs.

To do this, though, requires a major shift in mindset for market insights professionals and a

change in how they typically do insights analysis (see Figure 4). Forrester believes that the winning

companies (and winning market insights organizations) will be those that:

■ Have a deep understanding of their customers, competitors, and broader ecosystem. It’s

no longer enough to track what competitors did, how customers felt, and what happened in

the ecosystem. To maintain customer alignment and competitive advantage, market insights

professionals need to understand what competitors could do based on a deep understanding

of their assets, talent, capabilities, structures, processes, and cultures and what customers are

likely to do based on a deep understanding of their values, beliefs, needs, and behaviors. Further,

companies need to track potential changes across the ecosystem: the types of companies that

could move in from adjacent markets or that could use technology to become a competitive

threat or collaborator.12

■ Use insights to evaluate possible outcomes (scenarios). Instead of explaining the past, market

insights professionals need to be able to foresee possible futures. This is about analyzing

available data and insights, brainstorming with the best minds in the company and industry,

and identifying disruptive business models, potential hot offerings, and strategies before a

competitor does. Look at changes in technology and consumer preferences and do what-if

exercises to develop logical scenarios based on a deep understanding of the market. This may

not seem very innovative, but it ultimately provides the fuel for innovation!

■ Build proactive “sense and respond” mechanisms to be ready for change. Companies no longer

have the time to start the clock once competitors have announced their change or customers have

told you they’re leaving. Whatever the disruption and driver of customer change — a new product,

new competitor, new pricing model, or new way of accessing offerings (e.g., via an app) — market

insights professionals need to be ready to guide the company’s response strategies with insightsbased, not gut-based, options. This ability to “sense” sooner helps ensure that the company can

“respond” quicker.13

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

11

Build Market Insights’ Efficiency And Influence

Figure 4 Proactive Analytics Requires Improved Sourcing, Profiles, Hypotheses, And Focus

Step 1

Rich sourcing (360˚ information — external and internal)

Comprehensive profiles

Step 2

(market/ecosystem/competitive/customer )

Profile 1

Scenario 2

Profile 2

Step 3

Scenario 1

Scenario 3

Step 4

Triggers

(a, b, c, etc.)

Step 5

Information

needs

Step 6

Target

suppliers

Step 7

Monitor and adjust above as needed.

Scenario 1

Scenario 2

Scenario 3

Make sure to differentiate

by offering, industry,

country, and customer

segment (as applicable).

Source: Forrester Research, Inc.

85641

Insights Delivery And Activation Must Be More Engaged And Influential

To evolve to a more powerful and influential position and ensure that strategic decisions are

insights-based rather than gut-based, market insights professionals must step far outside their

comfort zone and treat their insights like a product or service offering.

“When we focused on providing data and not insights, we were asking our internal clients

to connect the dots on their own, and that kept research limited to more of an analytics

function than an insights function.” (Beth Schneider, director of corporate customer market

insights, Intuit)

This means that you must:

■ Engage more deeply with stakeholders. Stephane Gayraud, senior director of market

intelligence and social media at Corel, notes that he works “to ensure good collaboration

between [my] team members and stakeholders.” He’s learned that “influence is individual.” By

making sure that individual relationships are positive, Stephane is able to build a network of

influence across the organization.

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

12

Build Market Insights’ Efficiency And Influence

■ Sell your skills as a strategic advisor. The reality is that market insights won’t be able to have

a voice in how its insights are used unless it is able to translate them into strategic options. To

do this requires getting a seat at the strategic decision-making table. Beth Schneider at Intuit

notes that, “It’s not a God-given right to sit at the table, but when researchers can talk about the

strategic implications of their research, they are much more likely to get that seat.”

■ Engage higher in the company value-chain. Many market insights professionals are concerned

about engaging directly with executives, often out of fear of saying the wrong thing. Beth

Schneider and the Intuit team faced this challenge and decided to make a huge shift in their

business model to move up the value chain.14 “One of the changes was upping the conversation

to senior folks and to start talking about their initiatives and strategic direction versus (just

taking) tactical requests.” This focus on “much more strategic and forward-thinking research”

required investing more time with stakeholders in the various business units and at the

corporate level, but the payoff was huge: Stakeholders now see Beth and her team as much more

valuable partners.

■ Identify and measure your value-add. By staying engaged with stakeholders and asking simple

questions, market insights professionals gain visibility into the use and value-add of their

insights. Try to understand what business initiatives your insights are used for; what metrics

and KPIs stakeholders are looking to improve as part of this; and then, after a few quarters,

ask how much of a change stakeholders realized in these metrics and how much that affected

the company’s top and bottom line. By following the path to monetization, market insights

professionals can gain proof points of their value-add and identify ways to optimize their

portfolio and effort.15

■ Market your value and successes. It’s not enough to simply deliver great research and insights.

You need to generate some news around it. Options include brown-bag lunches, going after

innovation awards, and sharing success stories broadly in the company. The team at Intuit even

sends very short post-project emails to all employees. This high-value spam is well received and

has helped Intuit’s market insights organization gain “a lot of advocates for research.”

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

13

Build Market Insights’ Efficiency And Influence

R e c o m m e n d at i o n s

Focus market insights in the right direction

Market insights leaders looking to go from providing back-office and backward-looking research

to empowering the company through proactive and innovative insights have a multiyear

transformation journey ahead of them. Make sure you’re heading in the right direction initially by:

■ Understanding where your stakeholders are heading. A business knows its customers,

their needs, where they’re heading, and what enables their success. You need to become

customer-obsessed — i.e., obsessed with your stakeholders: Understand as much as you can

about them and make sure to align research plans and deliverables to their needs. For Beth

Schneider at Intuit, the first step was getting everyone on the same page, connecting with

the business units, and aligning to stakeholder initiatives.16

■ Committing to a 10% per year increase in forward-looking research. Stan Stanunathan,

vice president, marketing strategy and insights for The Coca-Cola Company, has been

battling to move away from backward-looking research toward more proactive futurelooking research. It takes time, but even getting to 10% forward-looking research in year 1

can help market insights reposition itself internally as a strategic advisor rather than a data/

research provider.

■ Partnering with forward-looking research firms. When it comes to thinking outside the

box, you need to get outside the box. Market insights professionals at BlackBerry, CSC, and

other firms work closely with forward-looking industry analysts to interpret market and

competitive changes, as well as to identify possible future states. Plug your team into this

knowledge network and you’ll build your idea/innovation pipeline as well as gain a deeper

understanding of present market dynamics and their underlying drivers.

Endnotes

For a deeper understanding of what digital disruption is all about and why it is a game changer for all

industries, see the October 27, 2011, “The Disruptor’s Handbook” report.

1

2

Businesses face pressure from increased competition in a flat world and are also dealing with financial crises,

the exponential growth of technological changes, Internet-enabled customer power, and other economic,

technological, and social challenges. To survive in this new economic environment, businesses need fast,

high-value, deep, and actionable insights across the breadth of the business — all while finding ways to

increase productivity and cut costs. The mandate for market insights is to evolve into a more capable

and valuable organization that can meet the needs of the business. In this report, Forrester describes the

landscape of market insights’ evolution — from being pure market researchers to providing insights that

drive business value — and how market insights professionals are evolving from cost centers to high-value

business enablers and, ultimately, business drivers. See the October 5, 2012, “Evolve From Research To

Insights” report.

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

For Market Insights Professionals

14

Build Market Insights’ Efficiency And Influence

For guidance on how to build out influence and stakeholder relationships more effectively, see the February

22, 2012, “The Marketing Of Market Insights: How To Build Internal Relationships And Influence” report.

3

For details on how to optimally build out market insights’ sourcing and insights supply chain, see the

January 18, 2013, “Holistically Optimize Market Insights Capabilities” report.

4

For more details on how to follow insights to impact and identify the value of insights, see the May 17, 2011,

“Monetizing Market Insights” report.

5

For details on different sources of insights, see the January 18, 2013, “Holistically Optimize Market Insights

Capabilities” report.

6

For guidance on building out prioritization processes and templates, see the February 10, 2010, “The

Marketing Of Market Research: Prioritization Of Work” report.

7

For details on how to do an ROI analysis, as well as guidance on the types of metrics to ask stakeholders

about to help you get the data needed to do these analyses, see the June 15, 2011, “Achieving ROI-Aligned

Research And High Value” report.

8

Forrester provides guidance on performing hypothesis generation and trigger (i.e., key types of data and

insights) identification. This approach, however, is relevant not only for competitive intelligence but also for

any other type of projects. See the October 6, 2011, “How To Build Out A Proactive Competitive Market

Intelligence (CMI) Program” report.

9

For a deeper understanding of optimal sourcing strategies and targets — including company employees

(insourced), business partners and industry organizations (nearsourced), and a variety of analyst firms, data

providers, and consultants (outsourced) — see the January 18, 2013, “Holistically Optimize Market Insights

Capabilities” report

10

Forrester provides some great lessons from cross-analyzing survey against behavioral data. See the May 31,

2012, “Combining Survey Research And Behavioral Tracking Creates Deeper Insights” report.

11

To gain a better understanding of what’s needed to compete in the decade of disruption (and how your

company can be disrupted), see the August 4, 2011, “Innovating The Adjacent Possible” report.

12

Another key aspect of maintaining competitive advantage is being sufficiently customer-obsessed to

recognize when a competitive change makes it more aligned to customer needs. For a more in-depth

discussion of how being customer-obsessed is an important piece in a proactive competitive market

intelligence approach, see the June 6, 2011, “A Market Insights Professional’s Introduction To Competitive

Strategy In The Age Of The Customer” report.

13

For more specifics on how market research firms can move up the value chain and become more

empowered market insights departments, see the March 14, 2011, “Market Insights Must Add Value And

Evolve” report.

14

For a deeper discussion of insights’ path to monetization, see the May 17, 2011, “Monetizing Market

Insights” report.

15

For more details on how Intuit was able to make this step, see the February 22, 2012, “The Marketing Of

Market Insights: How To Build Internal Relationships And Influence” report.

16

© 2013, Forrester Research, Inc. Reproduction Prohibited

February 1, 2013

About Forrester

Global marketing and strategy leaders turn to Forrester to help

them make the tough decisions necessary to capitalize on shifts

in marketing, technology, and consumer behavior. We ensure your

success by providing:

Data-driven insight to understand the impact of changing

consumer behavior.

n

Forward-looking research and analysis to guide your decisions.

n

Objective advice on tools and technologies to connect you with

customers.

n

Best practices for marketing and cross-channel strategy.

n

for more information

To find out how Forrester Research can help you be successful every day, please

contact the office nearest you, or visit us at www.forrester.com. For a complete list

of worldwide locations, visit www.forrester.com/about.

Client support

For information on hard-copy or electronic reprints, please contact Client Support

at +1 866.367.7378, +1 617.613.5730, or clientsupport@forrester.com. We offer

quantity discounts and special pricing for academic and nonprofit institutions.

Forrester Focuses On

Market Insights Professionals

Working with innovative vendors and research methods, you operate

as a strategic business advisor, providing data-driven insights on

global trends and market opportunities, and helping to prioritize where

the business should focus. Forrester’s subject-matter expertise and

deep understanding of your role will help you create forward-thinking

strategies; weigh opportunity against risk; justify decisions; and

optimize your individual, team, and corporate performance.

«

Maya Irving, client persona representing Market Insights Professionals

Forrester Research, Inc. (Nasdaq: FORR) is an independent research company that provides pragmatic and forward-thinking advice to

global leaders in business and technology. Forrester works with professionals in 17 key roles at major companies providing proprietary

research, customer insight, consulting, events, and peer-to-peer executive programs. For more than 29 years, Forrester has been making

IT, marketing, and technology industry leaders successful every day. For more information, visit www.forrester.com.85641