Hedge Fund Alert: News on Funds, Managers, and Investments

MAY 13, 2015

2 Deal to Buy Arrowgrass Stake Unravels

2 Warwick LPs Favor Less-Liquid Fund

2 Equity Pro Hits Marketing Trail

3 Prop Trader Seeks Outside Backers

3 Victory Park Backs Magnetar Alum

7 Consolidation Narrows Auditor Field

8 Funds Embracing Outside Directors

8 Ex-Ziff Brothers Tech Pro Preps Fund

9 AlphaParity Offers Downside Defense

11

THE GRAPEVINE

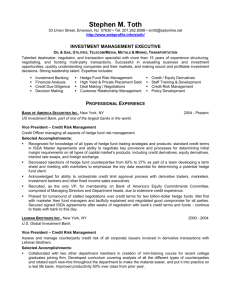

D.E. Shaw has picked up a portfolio manager. Brett Caughran arrived in the firm’s New York headquarters on May 4, with responsibility for running a book of healthcare-company stocks under long/ short equity head Edwin Jager. Caughran previously spent seven years at Maverick

Capital and one year at Greenhill & Co.

David Shaw leads D.E. Shaw, which had

$36 billion under management on April 1.

Carlson Capital has lost its sales chief.

Client-development head Daniel Hoinacki left the $9.3 billion multi-strategy shop in the past few weeks, after five years on board. He previously co-founded marketing firm Highlander Consulting and investment shop Alstra Capital, and also spent time at Moore Capital.

His exit from Carlson comes in the midst of a

See GRAPEVINE on Back Page

Dyal Eyes IPO for ‘Succession-Capital’ Fund

Neuberger Berman’s Dyal Capital unit, which buys stakes in fund-management firms, has hired investment bankers to pursue an initial public offering.

The thinking is that an IPO represents the best possible long-term exit strategy for investors in Dyal’s private equity funds, which currently hold 11 minority stakes in fund operators including Blue Harbour Group, Capital Fund Management, Capstone

Investment, Jana Partners, MKP Capital, Providence Equity Partners and Waterfall

Asset Management.

Dyal, led by Michael Rees, is working with two unidentified bankers who are described as well-known dealmakers in the asset-management field.

Rees and his team are borrowing a page from Affiliated Managers Group, which in 1997 held an IPO for a business that at the time held minority interests in 10 long-only investment firms. Today, AMG owns stakes in a total of 31 traditional and alternative asset managers with a combined $638 billion of assets. But Dyal’s effort represents the first serious attempt to hold a public offering for a portfolio of

See DYAL on Page 9

Cube Pulls Plug on Multi-Manager Vehicle

Cube Capital is shuttering its flagship fund of funds, a move that will leave the firm with a tenth of the assets it had at the start of the year.

In a letter to investors last week, the London firm said it had begun unwinding the 10-year-old Cube Global Multi-Strategy Fund, with the expectation of returning the bulk of client capital in July and August. The balance would be paid out later in the year pending a final audit.

The fund reported gross assets of $920 million in a recent SEC filing. It’s unclear how many underlying managers will be affected by the liquidation.

Cube, led by founding partners Francois Buclez and Alan Sipols, has just one other offering — a single-manager vehicle called Cube Global Opportunities Fund that had about $105 million at the start of the year. The letter didn’t address Cube’s plans for that fund, but the wind-down of the fund of funds will eliminate the firm’s

See CUBE on Page 5

UBS Deal Set to Shift Administrator Ranks

UBS appears to have an agreement to sell its fund-administration business to

MUFG, the latest in a series of deals that are shifting the balance of power in the sector.

The transaction would further lift the Japanese bank’s standing in a ranking of the top 20 fund administrators maintained by Hedge Fund Alert (see ranking on Page

4). MUFG debuted on the list last year as a result of its 2013 takeover of Butterfield

Fulcrum, and strengthened its position with the purchase of Meridian Fund Services in 2014. Assuming it retains all of UBS’ clients, MUFG would move up from 10th to eighth place in the league table, with a combined $179.3 billion of gross hedge fund assets under administration. The yet-to-be-announced acquisition was confirmed by industry sources at SkyBridge Capital’s “SALT Las Vegas” conference last week.

They expect negotiations to be finalized in a month or two.

UBS’ effort to shed its fund-services unit is the latest example of a big Wall

See RANKS on Page 5

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

Deal to Buy Arrowgrass Stake Unravels

Foundation Capital’s deal to buy Deutsche Bank’s stake in

Arrowgrass Capital has come undone.

Arrowgrass’ principals are now seeking to buy back the

17.5% stake Deutsche took when it backed the firm’s launch.

The London shop, which manages $4.8 billion, formed when a group of convertible-bond traders on Deutsche’s proprietarytrading desk spun off in 2008.

It’s unclear why the deal involving Foundation fell apart. The

Greenwich, Conn., firm, led by former Citigroup executive Dean

Barr, has spent more than five years trying to raise money to acquire stakes in well-established hedge fund firms. Arrowgrass would have been its first investment.

Last month, a spokesman for Barr told Hedge Fund Alert that he had delivered commitment letters both to Arrowgrass and

Deutsche for a deal in which Foundation would pay up to $200 million, depending on performance targets, for as much as

24.9% of Arrowgrass. That size of a stake would have required

Arrowgrass’ principals to further dilute their ownership, but a source said they never wanted to do that.

That could be one reason the Foundation deal unraveled.

But it’s also possible that Barr’s personal financial troubles spooked some of the parties. He faces a contempt-of-court order for failing to repay a defaulted personal loan from City

National Bank.

The Los Angeles bank also obtained court orders freezing a checking account of Barr’s and effectively garnishing any payments he is owed by Foundation. Barr owes City

National $185,000, plus interest.

Arrowgrass is a multi-strategy manager led by former

Deutsche trader Nicholas Niell.

The firm employs more than

100 staffers in London and New York.

Barr launched Foundation in 2010 following stints at both

Citi and Deutsche, where he held senior roles in the banks’ alternative-investment units. In 2011, Barr reached a tentative agreement with Izzy Englander to buy a minority stake in his

Millennium Management, but the deal fell through after Foundation failed to raise the necessary capital.

Warwick LPs Favor Less-Liquid Fund

Warwick Capital is liquidating a distressed-debt fund due to heavy investor withdrawals.

The $340 million Warwick European Distressed & Special

Situations Credit Fund lost 5.3% last year. By the end of the first quarter, the manager had received redemption requests amounting to about 90% of the fund’s capital.

But limited partners representing about a third of the fund’s assets have expressed interest in rolling their investments into another vehicle the firm manages: Warwick European Credit

Opportunities Fund. The change of venue reflects increasing appetite among European debt investors for less-liquid positions offering a higher return potential.

The $242 million Credit Opportunities Fund is something of a hybrid between a hedge fund and a private equity vehicle,

Hedge Fund

ALERT

2 with a four-year lockup (versus quarterly redemptions for the liquidating distressed-debt fund). That allows the fund to target longer-term distressed plays with the aim of generating annual returns in the 15-20% range. The fund gained 2.3% in 2014.

Warwick, founded in 2010 by former Polygon executives Ian

Burgess and Alfredo Mattera, manages about $1 billion overall.

A third vehicle, the $446 million Warwick European Opportunities Fund, rose 8% last year. That fund has stopped accepting fresh capital.

Equity Pro Hits Marketing Trail

An equity manager is opening to outside backers for the first time.

Riposte Capital, led by former Credit Agricole executive

Khaled Beydoun, started trading in February 2013 with seed capital from business conglomerate Libra Group.

Later that year it developed the framework to collect third-party money for a fund called Riposte Global Opportunity Fund. But it only recently began seeking that capital.

The aim is to start trading the vehicle in July, with the goal of quickly raising $250 million and then closing the door to additional capital. Beydoun isn’t planning a broad marketing campaign, however, and instead is pursuing investors that the highly private Libra deems acceptable.

Riposte currently runs $50 million. It operates from a New

York office of London-based Libra, which owns a swath of businesses in industries including shipping, aircraft leasing, real estate, hotels and energy production — but doesn’t own any other hedge funds.

Riposte employs a long/short equity strategy, investing worldwide based on information gleaned from Libra’s business network and its own fundamental analysis. The firm aims to maintain a net exposure of 40% or less. It produced a return of about 15% in 2014, following a gain of about 40% in 2013.

Early investors in Riposte’s fund will be placed in a founders share class with fees equal to 1.5% of assets and 15% of profits. For later arrivals, those charges will rise to 2% and 18%.

Limited partners also will have the option to place up to 20% of their equity in illiquid co-investments in private businesses.

Beydoun holds a stake of at least 50% in Riposte. He worked until 2012 as chief executive for the North American arm of

Credit Agricole unit Cheuvreux, whose businesses included equity research, sales and trading. Credit Agricole sold Cheuvreux in 2013 to Kepler Capital, now known as Kepler Cheuvreux.

Also at Riposte are James Gildea, who worked on a hedge fund run by real estate investor Colony Capital until last year, and Tehmur Jabbar, a former Cheuvreux associate who has been on board since the firm’s start. This March, Riposte hired

Derek Webb as chief financial officer and chief operating officer.

He previously was chief financial officer at Black Capital and

Alson Capital.

Libra is owned by the Logothetis family. George Logothetis is chief executive.

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

Hedge Fund

ALERT

3

Prop Trader Seeks Outside Backers

Details are emerging about a planned fund launch by proprietary-trading firm Quad Capital.

The New York operation aims to raise $100 million for the vehicle, Quad Multi-Strategy Fund. It currently is finalizing marketing materials, which it plans to circulate to family offices, fund-of-funds operators and institutional investors.

The fund will employ a multi-strategy approach, initially distributing its capital among four traders separately following liquid catalyst-driven equity, long/short equity, energy-futures and merger-arbitrage strategies. Although Quad intends to stop marketing the vehicle upon reaching its equity target, it may seek additional capital later — and add traders at that point.

Quad’s broader prop-trading business encompasses 45 traders working with $60 million. For the fund, the firm is selecting employees who have been part of that group for about a year and allowing them to manage their allocations autonomously.

Part of the pitch is that because the new fund’s traders will run both proprietary and client capital, Quad’s interests will be aligned with those of its backers.

Limited partners will pay fees equal to 2% of assets and 20% of gains, less than they would for many multi-strategy vehicles with similar formats. Such entities often incur higher operational expenses than the typical hedge fund, leading to higher management charges.

Quad’s traders oversee smaller portfolios than they would at a bigger multi-strategy shop, and therefore should be more nimble. Those handling proprietary capital get to keep 45-50% of their gains, plus 30-35% of profits on any money they run for the commingled fund.

Leading the fund’s development is chief investment strategist Peter Borish, whose duties include recruiting Quad’s traders. Borish, a veteran commodities trader and entrepreneur, is best known for a stint as Paul Tudor Jones’ top lieutenant at

Tudor Investment.

Overseeing marketing is David Horowitz.

He arrived in

September following a run as chief operating officer at globalmacro shop Banyan Capital, whose assets grew from $40 million to $1 billion during his time on board.

Quad was founded in 2007 by former Spear Leads & Kellogg executives Rino Ciampi and John Guarino.

The firm also runs a 2-year-old arm called Quad Securities that deploys capital to four managers who are on track to launch their own businesses, along with a year-old incubator dubbed Quad Advisors that so far is working with two traders who get to tap the shop’s infrastructure while remaining independent. and plans to start a broad marketing campaign at the end of

May. He is telling prospective limited partners that he will use a fundamental approach to identify event-driven investments in debt and equity products, with a global-macro overlay.

He plans to maintain a net-long position but could go netshort at times, and is viewing his short bets as a source of profits rather than just hedging tools. On the long side, the plan is to focus on dislocations tied to announced and likely-to-beannounced corporate actions. On the short side, the focus is on so-called investigative trades, such as those involving companies with accounting irregularities and related-party transactions.

Victory Park owns a stake in Vitalogy, and is supplying middle- and back-office support to the operation. The Chicago fund manager was running $1.5 billion at yearend 2014, with a focus on corporate-lending and distressed-asset investing. It is led by founders Brendan Carroll, Richard Levy and Matthew Ray, all formerly of Magnetar.

Tunick joined Magnetar in 2013 as the manager of an opportunistic equity allocation within an event-driven fund. He left in 2014. Magnetar, led by Alec Litowitz in Chicago, had $12.5 billion under management at the start of this year.

Tunick earlier headed event-driven investments as a portfolio manager at Balyasny Asset Management and spent time at

Pentwater Capital.

He is looking for equity and credit-product analysts at Vitalogy.

“ I don’t think the regulatory landscape has ever been more complex.”

People who know Hedge Funds, know BDO.

Victory Park Backs Magnetar Alum

A former Magnetar Capital executive is starting a new fundmanagement shop with backing from Victory Park Capital.

Jonathan Tunick is calling his firm Vitalogy Capital. He is aiming for the third quarter to launch the Chicago operation’s

Vitalogy Opportunity Fund.

Tunick has spoken to a few potential anchor investors so far,

The Asset Management Practice at BDO

Today’s hedge funds face an array of challenges, from deferred compensation issues to heightened SEC scrutiny. BDO provides a range of assurance, tax, fi nancial advisory, and consulting services to guide clients through a wide range of businesses issues.

Accountants and Consultants www.bdo.com

© 2015 BDO USA, LLP. All rights reserved.

SMA 001491 Pub. Asset Mgmt-Hedge Funds Size 3.5 x 4.5 Issue tbd

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

Hedge Fund

ALERT

RANKINGS

Top Administrators of Hedge Funds

Based on SEC filings by hedge fund managers.

Administrator

1 Citco

2 State Street

3 SS&C GlobeOp

4 BNY Mellon

Contact

Maria Cantillon

Fred Jacobs

Michael McCabe

212-401-9601 jpeller@citco.com

44-203-395-7502 mcantillon@statestreet.com

646-213-7104 fjacobs@sscinc.com

6 Morgan Stanley

7 Citigroup

8 SEI

9 Hedgeserv

10 MUFG

11 Wells Fargo

12 J.P. Morgan

13 HSBC

Erik Forssman

Christopher Kundro

Dylan Curley

Kevin

732-667-1378 michael.mccabe@bnymellon.com

312-444-5655 mb147@ntrs.com

914-225-4906 erik.forssman@msfundservices.com

michael.sleightholme@citi.com

610-676-1270 jcipriano@seic.com

212-920-3522 kpicco@hedgeserv.com

44-203-195-0339 vdesai@mitsubishiufjfundservices.com

917-260-1530 christopher.e.kundro@wellsfargo.com

212-272-1794 dylan.j.curley@jpmorgan.com

212-525-7136 kevin.skorzewski@us.hsbc.com

14 Brown Brothers Harriman Christopher McChesney 617-772-1263 chris.mcchesney@bbh.com

15 U.S. Bank Michael Secondo 917-326-3923 michael.secondo@usbank.com

16 UBS

17 Credit Suisse David Nable

212-882-5896 john.sergides@ubs.com

212-538-3602 david.nable@credit-suisse.com

18 Harmonic Fund Services

19 Conifer Financial

Allen Bernardo

Jack McDonald

20 Stone Coast Fund Services Marc Keffer

OTHERS

Total: Administered Funds

Total: All Funds

345-949-0090 allen.bernardo@harmonic.ky

212-676-5500 jmcdonald@conifer.com

207-699-2680, ext. 4 mkeffer@stone-coast.com

Clients’ Gross Assets Under Management

1Q-15 % of

($Bil.) Total

1Q-14 % of ’14-’15

($Bil.) Total % Chg.

$1,095.2 19.6 $974.9 19.8 12.3

1,016.8 18.2

919.5 16.5

444.5 8.0

342.6 6.1 278.1 5.7 23.2

336.8 6.0

202.8 3.6 233.7 4.8 -13.2

131.8 2.4 116.7 2.4 12.9

117.9 2.1

116.4 2.1

109.4 2.0

88.1 1.6

87.5 1.6

73.7 1.3

65.5 1.2

62.9 1.1

59.3 1.1

56.0 1.0

47.8 0.9

30.9 0.6

879.9 17.9

838.3 17.1

400.1 8.1

282.4 5.7

96.1 2.0

85.8 1.7

61.8 1.3

56.3 1.1

51.3 1.0

53.6 1.1

6.8 0.1

20.0 0.4

15.6

9.7

11.1

19.3

78.1 1.6 51.0

94.1 1.9 23.8

13.9

2.8

83.4 1.7 4.8

19.3

16.4

53.0 1.1 18.8

15.7

4.5

602.1

54.9

311.1 5.6 308.7 6.3 0.8

5,576.4 100.0 4,912.1 100.0 13.5

5,642.7 5,188.6 8.8

4

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

Ranks

... From Page 1

Street bank seeking to exit a business known for small profit margins. Last August, Credit Suisse agreed to sell its fundadministration unit to BNP Paribas in a deal that is expected to close before June 30. The transaction would place BNP among the top 20 firms, given that Credit Suisse currently is ranked

17th.

Meanwhile, Citigroup continues to shop its Citi Fund Services unit four months after putting it on the block. Once it finds a buyer, only two major Wall Street banks will remain among the 10 biggest fund administrators: BNY Mellon, ranked fourth, and Morgan Stanley, in the sixth position. J.P. Morgan is number 12, and Goldman Sachs got out of the business three years ago via the sale of its administration unit to State Street.

Deutsche Bank, which placed 20th in the previous year’s ranking, disappeared from the league table this year, replaced by newcomer Stone Coast Fund Services.

The ranking, based on assets under administration for SECregistered fund operators, continues to be led by Citco, which administers $1.1 trillion of gross fund assets, for a 19.6% market share. Rounding out the top five are State Street (with an

18.2% share), SS&C GlobeOp (16.5%), BNY Mellon (8%) and

Northern Trust (6.1%).

Hedge Fund Alert’s Manager Database extracts assets under administration from regulatory filings fund operators submit to the SEC. In those filings, managers disclose the names of administrators and other service providers for each of their vehicles. The database encompasses SEC-registered investment advisors, as well as so-called exempt managers with assets typically above $25 million. As a result, it understates the size of administrators that cater mainly to smaller fund operators.

Several factors help explain why big investment banks are losing their appetite for the fund-servicing business. Many were drawn to the sector in the first place because they saw an opportunity to sell higher-margin prime-brokerage services to their administration clients. But that strategy hasn’t always worked out, and now banks are under increasing pressure to trim or eliminate less-profitable units.

“There is so much more examination in the banks, which leads to thoughts of giving up business strategies that aren’t core,” said an industry source.

Consider that Citi entered the arena only five years ago via its

$1.5 billion purchase of Bisys.

In January, the bank moved that unit into its Citi Holdings subsidiary, which houses troubled assets and non-core businesses. Citi, Credit Suisse, Deutsche and J.P. Morgan have made no progress toward eroding the market share of the top five firms, which together control twothirds of the market.

But if no longer a priority for many big banks, the fundadministration business remains an attractive opportunity for others. In March, for example, the Carlyle Group agreed to buy a majority stake in Conifer Financial, ranked 19th among administrators.

And one Wall Street bank that remains committed to its

Hedge Fund

ALERT

5 fund-servicing unit is Morgan Stanley, with $336.8 billion of gross fund assets under administration and a 6% share of the market. Sources said Morgan Stanley invested in technology early on, increasing the efficiency of its business and contributing to better profit margins.

Cube

... From Page 1 main source of fee revenue.

Although the fund of funds has generated a solid 8% annualized return, Buclez and Sipols decided to pull the plug in the face of waning demand for smaller multi-manager vehicles. “Even with our proven hybrid structure, we find it increasingly difficult to compete with the larger brand names for the mandates we need to grow our assets under management,” the letter said.

In recent months, limited partners have withdrawn some

$400 million from Cube Global Multi-Strategy Fund, according to a May 5 article in Pensions & Investments.

Cube’s single-manager hedge fund takes equity, debt and derivative positions in companies based on macroeconomic trends, regulatory changes, natural disasters and law-enforcement actions — as opposed to announced corporate events. It has generated a 15% annualized return over six years.

The firm previously ran a real estate-investment vehicle that spun off in 2013 as a separate entity called Quadrum.

That business is led by Oleg Pavlov, who was a founding partner of Cube.

AlphaSense – The New

“Google” for Analysts

Find what you need in seconds:

3 Search across all company docs

3 See results on ONE screen

3 Highlight and annotate content

3 Find what others miss

No need to search docs one at a time.

Free, 2-Week Trial: www.alpha-sense.com/hfa

AlphaSense is a registered service mark of AlphaSense, Inc. | www.alpha-sense.com

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

Hedge Fund

ALERT

RANKINGS

Top Auditors of Hedge Funds

Based on SEC filings by hedge fund managers.

Auditor

1 Ernst & Young

Contact

Michael Serota

3 KPMG

4 Deloitte

5 McGladrey

6 EisnerAmper

7 BDO

Al Fichera

10 Elliott Davis

11 Arthur Bell

12 CohnReznick

13 Anchin Block

14 WithumSmith & Brown

15 Marcum

16 Kaufman Rossin

17 Citrin Cooperman

Karl Jordan

Corey McLaughlin

Jeffrey Rosenthal

Anthony Tuths

Robert Kaufman

Mark O’Connell

17 Cohen Fund Audit Services Brett Eichenberger

19 Weaver

20 Demetrius Berkower

OTHERS

TOTAL

Maurice Berkower

212-773-0378 michael.serota@ey.com

646-471-3070

Number of Hedge Fund Clients

% of

1Q-15 Total

% of ’14-’15

1Q-14 Total Chg.

2,713 24.0

2,473 21.8

2,300 20.3

2,589 23.3

2,372 21.4

124

101

1,066 9.6 1,234 michael.s.greenstein@us.pwc.com

617-988-1059 afichera@kpmg.com

212-436-4630 josfisher@deloitte.com

312-634-3354 john.hague@mcgladrey.com

1,358 12.0 1,351 12.2

484 4.3

331 2.9 christian.bekmessian@eisneramper.com

212-885-8037 242 2.1 kmcgowan@bdo.com

485 4.4

329 3.0

236 2.1

7

-1

2

6

11 212-624-5258 michael.patanella@us.gt.com

303-515-5300 ryurglich@spicerjeffries.com

231 2.0

120 1.1

423-756-7100 karl.jordan@elliottdavis.com

66 0.6

410-771-0001 57 0.5 corey.mclaughlin@arthurbellcpas.com

646-254-7412 53 0.5

220 2.0

96 0.9

51 0.5

48 0.4

55 0.5

24

15

9

-2 jay.levy@cohnreznick.com

212-840-3456 jeffrey.rosenthal@anchin.com

212-829-3203 atuths@withum.com

631-414-4230 beth.wiener@marcumllp.com

305-857-6730 rkaufman@kaufmanrossin.com

212-607-1000 moconnell@citrincooperman.com

216-649-1704 beichenberger@cohenfund.com

832-320-3249 kevin.sanford@weaver.com

732-510-1523 mb@demetriusberkowerllc.com

46 0.4

44 0.4

41 0.4

31 0.3

29 0.3

49 0.4

22 0.2

38 0.3

34 0.3

16 0.1

-3

22

3

-3

13

29 0.3

27 0.2

24 0.2

28 0.3

5

-1

22 0.2

623 5.5

11,320 100.0

18 0.2 4

1,967 17.7 -1,344

11,094 100.0 226

6

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

Consolidation Narrows Auditor Field

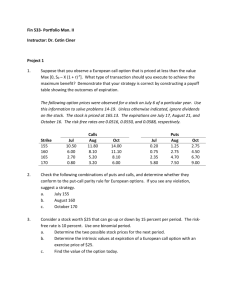

KPMG’s purchase of Rothstein Kass last year means the top three hedge fund-auditing firms now account for a whopping two-thirds of the market.

As a result of the acquisition, KPMG more than doubled the number of clients in its hedge fund practice to 2,300, good for a 20.3% market share and third place in Hedge Fund Alert’s annual auditors ranking (see ranking on Page 6).

Ernst & Young retained its first-place standing with 2,713 clients, up 124 from a year earlier, and a 24% share of the market.

No. 2 PricewaterhouseCoopers added 101 clients for a total of

2,473 and a 21.8% share.

Together, E&Y, PwC and KPMG command 66.1% of the hedge fund market, compared to the 56.9% that the top three firms controlled prior to the KPMG-Rothstein Kass deal, according to the newsletter’s Manager Database.

The database sifts regulatory filings by more than 3,000 hedge fund operators doing business in the U.S. Managers are required to update their filings annually, and most do so in the first quarter.

The effects of consolidation also were evident further down the league table. Elliott Davis, a regional accounting firm that was absent from the top-20 list a year ago, now appears in 10th place by virtue of its Jan. 1 merger with Decosimo (ranked 12th last

Hedge Fund

ALERT

7 year). The combined firm counts 66 fund clients, good for a 0.6% market share. Its business is concentrated in the Southeast.

And WithumSmith & Brown cracked the top 20 via its March

15 acquisition of Boston-based Walsh Jastrem, which ranked

18th last year. The combined firm, which also has offices in

Colorado, Florida, New Jersey, New York, Philadelphia and the

Cayman Islands, is in 14th place with 44 fund clients.

WithumSmith’s financial-services practice has more than tripled in size in the past two years, said practice head Anthony

Tuths.

On the hedge fund side, it picked up a handful of clients that bolted from Rothstein Kass following the KPMG deal.

“We’re all moving upstream together,” Tuths said.

Among the blue-chip clients KPMG gained via its purchase of Rothstein Kass are Brigade Capital, Coatue Management,

Field Street Capital, Metacapital Management

Management.

and Visium Asset

KPMG also has been turning up with increasing frequency as the auditor for fund launches tracked by Hedge

Fund Alert — a sign that its market share could increase further still.

The Manager Database contains the names of 203 auditing firms, though the top 20 account for 94.5% of the market.

Because it only captures SEC-registered managers and socalled exempt advisors — with assets typically above $25 million — the database understates the size of auditing practices catering to smaller fund shops.

Tomorrow’s opportunities.

Family Of f ice & Private Wealth

Management Forum

July 20-22, 2015 / Hyatt Regency Newport, Newport, RI

31

Hedge Fund Alert, the weekly newsletter that delivers the early intelligence you need to anticipate money-making openings in the fund-management arena.

Start your free trial at HFAlert.com

or call 201-659-1700

The Family Office/Private Wealth Management Forum is Opal's premier conference and the preeminent event in North America for high net worth individuals and family offices from around the world. Come and join us for three days of engaging discussions on the latest investment trends and soft issues with some of the most well established and senior Family offices,

Private investors, money managers, and private wealth service providers from around the globe.

Sponsorship and Exhibiting Opportunities are Available

If you are interested in attending, sponsoring, speaking or exhibiting at this event, please call 212-532-9898 or email info@opalgroup.net

Register

To register, visit us online at www.opalgroup.net or email us at marketing@opalgroup.net

ref code: FOPWA1504

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

Funds Embracing Outside Directors

An annual study of fund-governance practices suggests managers increasingly are committed to installing independent directors on the boards of their Cayman Islands-domiciled vehicles.

The study, by Sound Fund Advisors, found eight out of 10

Cayman funds now employ at least one “external” director who is unaffiliated with the fund manager, compared to less than seven out of 10 in 2011. And among funds with at least two independent directors, 53% maintain “split boards,” where the outside directors are unaffiliated with each other. In 2012, just

39% had split boards.

Managers of offshore funds have long relied on a cottage industry of professional-director firms to supply independent members for their boards, said Sound Fund founder Jonathan

Morgan. Historically, fund operators have found it easier to hire two professional directors from the same shop.

But Morgan contends that fund managers defeat the purpose of a split board — to ensure independent oversight — by hiring more than one director from the same outfit. “Effectively, this reduces the two external directors to something akin to one external director,” Morgan wrote in the study, “Fund Governance Trends: 2014 Industry Data and Recommended Best

Practices.”

Sound Fund itself is a professional-director firm. But unlike most of its Cayman Islands-based peers, the Darien, Conn., firm works with a relatively small number of clients at a time.

It currently has contracts with 11 management firms running a total of 16 offshore funds. Among the larger professionaldirector firms, it’s common to see directors sitting on dozens of fund boards.

Sound Fund’s fourth-annual study was based on SEC filings by managers of 2,525 Cayman-domiciled funds. Morgan began distributing the report last month to a small circle of current and prospective clients, as well as operational-due-diligence specialists who work for large institutional investors.

Morgan said the professional-director system has its roots in the 1990s, when U.S. hedge fund managers began establishing offshore versions of their funds for tax-exempt investors.

Because most offshore funds are structured as corporations, rather than as limited partnerships, they are required to maintain boards of directors.

Originally, fund administrators agreed to furnish independent board members for a nominal fee. But after the collapse of Enron led to a renewed push for better governance, the administrators became concerned about liability issues and stopped supplying professional directors. Filling the void were a handful of Cayman-based businesses including law firms and professional-director shops that formed specifically to meet the new demand.

Until recently, the boards of most offshore funds were controlled by internal directors — that is, those who worked for or were otherwise affiliated with the fund manager. But the most recent data show that external directors now constitute a majority on 54% of boards, up from 43% in 2011.

Hedge Fund

ALERT

8

Before establishing Sound Fund in 2011, Morgan was head of hedge fund research and manager selection for fund-offunds operations run by Barclays, Julius Baer and UBP Asset

Management.

MKP Offers CMBS Follow-Up

MKP Capital is replicating a vehicle that invests in commercial-mortgage bonds and loans.

The New York firm said in a letter to investors last month that it plans to close on an initial round of capital for the new

MKP CRE Fund 2 on June 1, with a final close on Nov. 1. However, a source said the dates could be pushed back. MKP didn’t tell investors how much it hopes to raise.

The effort comes after MKP wrapped up capital-raising efforts for MKP CRE Fund 1 on Feb. 1 with $75 million.

The MKP CRE funds invest in the subordinate portions of commercial mortgage issues. MKP’s bullishness on the sector is based on positive outlooks for property values and the economy in general, along with a healthy financing pipeline and changes to the regulatory landscape.

Steven Gordon is the portfolio manager for both vehicles.

MKP is seeking an experienced marketing professional whose duties would include distributing the new offering.

MKP Capital manages $8.5 billion, spread across a series of global-macro funds and a lineup of credit-product vehicles whose investments include collateralized loan obligations and residential and commercial mortgage paper.

Ex-Ziff Brothers Tech Pro Preps Fund

A computer scientist who invests in technology stocks is getting ready to start a hedge fund.

Ankur Luthra, whose resume includes work at Balyasny

Asset Management, Crosslink Capital ments, began setting up

and Ziff Brothers Invest-

Finchwood Capital last month. He is joined at the San Francisco firm by two analysts, Sagar Gupta and Brendan Nemeth , both of whom had worked with Luthra in

Balyasny’s San Francisco office until earlier this year.

Luthra plans to launch a long-biased fund that invests in the stocks of technology companies. In meetings with prospective backers, he is highlighting fundamental-research skills he honed during a five-year stint at Ziff Brothers. He’s also touting the planned fund as a rare example of a tech-focused offering managed by a computer scientist.

Gupta joined Luthra at Balyasny in January 2014, having previously worked at Kohlberg Kravis Roberts.

Nemeth arrived at Balyasny last July from Firestorm Capital.

Finchwood is offering a founders share class that will charge a 1.5% management fee and 15% performance fee. Investors who arrive later on presumably would pay fees closer to the traditional 2-and-20. The firm has begun searching for a chief financial officer.

Before working at Ziff Brothers, Luthra was a vice president at growth-equity shop Summit Partners and a program manager at Microsoft.

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

AlphaParity Offers Downside Defense

AlphaParity is about to launch a vehicle designed to profit when equities turn bearish.

The New York global-macro shop aims to begin trading its

AlphaParity Negative Correlation Fund in the next month or so with $50 million to $100 million. An undisclosed foundation has signed on as the vehicle’s anchor investor, locking up its capital for two years.

Despite its name, the entity won’t be 100% negatively correlated to stocks. Instead, it aims to offer downside protection while still making money in bull markets by trading a mix of highly liquid instruments including futures and currencies.

To that end, AlphaParity founders Steve Gross and Joshua

Smith are positioning the offering as part of a new generation of vehicles designed to hedge against declines both in stocks and in portfolios of other hedge funds. Investors often have addressed that need by placing capital in short-biased hedge funds, trend-following managed futures funds or tail-risk funds — but increasingly view those products as drags on performance due to losses suffered during the past few years’ stock market run-up.

Behind AlphaParity’s strategy is a focus on so-called risk premia — that is, the difference between the projected return on a security or portfolio and that of a risk-free investment. As hedge fund strategies get more sophisticated, managers believe they are becoming more capable of isolating and managing risk.

AlphaParity is pitching its new fund as a complement to its flagship AlphaParity Global Premia Fund. That $573 million vehicle, formerly known as AlphaParity All Weather Fund, takes more of an absolute-return approach in which it aims for zero correlation to stocks and hedge funds while employing some elements of the negative-correlation strategy. It has produced annualized returns of 13% since its March 2013 inception.

Gross and Smith worked at Tudor Investment from 2010 to

2012. They are joined by president Jeff Silverman, most recently of Perella Weinberg.

Silverman earlier was a recruiter at Tudor, where he hired Gross and Smith.

Dyal

... From Page 1 ownership stakes in alternative-investment firms.

Neuberger Berman declined to comment.

Dyal is considering a couple of different approaches to a share sale. Under one scenario, it first would seek to sell a pre-

IPO stake in its business to one or two deep-pocketed backers

— most likely a large family office or sovereign wealth fund. In that case, Dyal would aim to close the transaction by the end of this year.

Or it could proceed directly to an IPO, in which case it would create a holding company whose initial assets would encompass the positions now held by Dyal’s first fund, Dyal Capital

Partners 1. That vehicle held a final close in September 2012

Hedge Fund

ALERT

9 with $1.3 billion and is now almost fully invested.

Over time, the public company would acquire the assets of

Dyal’s other vehicles. Dyal Capital Partners 2, which raised $2.1 billion last year, has made one investment so far, a stake in Jana.

And the firm recently began marketing Dyal Capital Partners

3 with the aim of raising $2.5 billion to $3 billion to acquire stakes in private equity firms. That effort has netted about $850 million so far, including $550 million from Alaska Permanent

Fund, which has earmarked another $500 million for co-investments.

A successful IPO would cement Dyal’s reputation as the dominant player in the “succession-capital” arena, where investors seek to capitalize on a demographic shift in which senior principals of mature fund-management firms are looking to monetize their ownership stakes ahead of retirement. A prime example is Bridgewater Associates founder Ray Dalio, who has been gradually loosening his hold on the Westport, Conn., firm by selling small stakes to institutional investors including

Ontario Municipal Employees and Texas Teachers.

Dyal and the few other players in the field, including Blackstone and Goldman Sachs, typically buy stakes of about 20% in established fund operators, which entitles them to share in the managers’ fee revenues. Blackstone and Goldman, too, have given consideration to holding initial public offerings for their succession-capital vehicles.

Under Dyal’s plan, Rees and his staff of about a dozen would continue to manage the assets in Dyal’s funds. In that capacity, they would continue to help raise capital for portfolio firms and advise underlying managers on product development and other issues. The 11 firms backed by Dyal run a total of about

$110 billion.

Dyal’s debut fund has performed well. Since inking its first deal in 2011, Dyal Capital Partners 1 has generated an internal rate of return of about 20%. Fee revenue from underlying managers is distributed to limited partners quarterly, and annual payments have amounted to 18-23% of invested capital.

Rees began investing in fund-management firms long before the financial crisis, when Neuberger Berman was the asset-management arm of Lehman Brothers.

Prior to Lehman’s collapse, Rees and Andy Komaroff, now Neuberger’s chief operating officer, deployed some $2 billion of proprietary capital to purchase stakes in hedge fund operators including D.E. Shaw,

GLG Partners and Ospraie Fund Management.

Last month,

Lehman’s bankruptcy estate sold the D.E. Shaw stake to Hillspire, the family office of Google chairman Eric Schmidt.

Got a Message for the Hedge Fund Community?

Your advertisement in Hedge Fund Alert will get the word out to hundreds of professionals who actively manage funds, invest in them and provide services to the alternative-investment community. For more information, contact Mary Romano at

201-234-3968 or mromano@hspnews.com. Or go to

HFAlert.com and click on “Advertise.”

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

5 Marine View Plaza, Suite 400

Hoboken NJ 07030-5795

201-659-1700

FAX: 201-659-4141

Dear Subscriber:

A number of Hedge Fund Alert readers, who are concerned about violating copyright law, have been asking about the terms of our licenses.

Here’s how they work: For an annual fee, a company can designate a specific number of employees to receive the newsletter by email each week. Each member of the license group also receives a username and password for free access to Hedge Fund Alert’s archives and the

Manager Database at HFAlert.com.

From our standpoint, there’s nothing wrong with occasionally copying a page or two from our newsletter to pass along to an associate. In addition, we are happy to authorize a subscriber to reproduce — at no extra charge — any of our articles or tables for a presentation. And if a subscriber is preparing for a conference or some other type of meeting, we’re glad to provide free copies of the newsletter for attendees.

What’s unacceptable is the routine reproduction or electronic forwarding of our newsletters, or links to our newsletters, for use by people who aren’t covered by your license. This is a blatant, actionable violation of our copyright. We routinely monitor usage of the publication by employing tracking technology.

Feel free to call me at 201-234-3960 if you’d like information about the multi-user license that would best suit your company.

Sincerely,

Andrew Albert

Publisher

May 13, 2015

Hedge Fund

ALERT

11

Fund

Omni Secured Lending Fund 2

Domicile: Cayman Islands

Portfolio managers,

Management company Strategy

Steve Clark

Omni Partners,

London

44-203-540-1600

Direct lending

Service providers

Law firms: Berwin Leighton (UK),

Maples & Calder (Cayman

Islands), DLA Piper (U.S.)

Auditor: Deloitte

Administrator: Wells Fargo

Quad Multi-Strategy Fund

Domicile: U.S.

See Page 5

Peter Borish

Quad Capital,

New York

561-721-4804

Multi-strategy Prime brokers: Bank of America,

Wells Fargo

Law firm: Schulte Roth

Auditor: WithumSmith & Brown

Administrator: Wells Fargo

To view all past Latest Launches entries, subscribers can click on the Databases tab at HFAlert.com

Launch

April 7

Equity at

Launch

(Mil.)

$45

April

The 6th Annual

Private Investment

Funds Tax Master

Class

The industry’s most complete and informative tax event for BOTH private equity funds & hedge funds

June 15-16, 2015 New York, NY

As tax rates continue to escalate out of control it’s imperative to ensure that your fund has the best possible tax plan in place. Whether you’re from a private equity fund, a hedge fund or you provide tax services to either one, you simply can’t afford to miss the private investment fund industry’s

BIGGEST and most complete tax conference!

MENTION FMP112 FOR 15% DISCOUNT

To Register: Call 800-280-8440 or visit us at www.frallc.com

Reference HFA10 for 10% discount!

(DUO\&RQÀUPHG6SHDNHUV,QFOXGH

George Mussali,

Chief Investment Officer,

PANAGORA

Anthony Foley,

Head Product Strategist (USA),

WINTON CAPITAL

Andrew Ross,

Associate Director,

PAAMCO

Ed Rzeszowski,

Managing Director,

BLACKROCK

Suzan Rose,

Chief Compliance Officer,

MARSHALL WACE

Darren Feld,

Vice President,

MESIROW ADVANCED

STRATEGIES

Gregory Schneiderman,

Portfolio Manager

AURORA INVESTMENT

MANAGEMENT

Spencer Edge,

Principal, Senior Vice

President,

TIEDEMANN

WEALTH

MANAGEMENT

)RUVSRQVRUVKLSRSSRUWXQLWLHVFRQWDFW

5REHUW%DVVDWUEDVV#LPQRUJRU

ZZZLPQRUJDOSKDZHVW

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

May 13, 2015

THE GRAPEVINE

... From Page 1 capital-raising push for three energyfocused funds. Elizabeth Ewing handles investor relations at the Dallas firm.

Abrams Capital general counsel Bill

Wall will leave the Boston equity shop at the end of June. Wall’s next move is unknown. He joined Abrams in 2006 from Andover Capital, where he was a partner. He previously worked at

Fidelity Investments and Ropes & Gray.

Abrams, led by David Abrams, was managing $7.1 billion on Jan. 1. The firm is seeking a replacement.

Typhon Access head Jon Stein now has sole ownership of the Chicago separateaccount firm. Typhon Access, which funnels money to commodity traders, had launched last year with Stein and multi-manager shop Typhon Capital sharing control. On May 11, Typhon

Capital sold its interest in the business to Monandock Partners, the holding company where Stein’s stake resides.

With the move, Typhon Capital head

Hedge Fund

ALERT

James Koutoulas relinquished his duties as co-chief executive of Typhon Access and stopped playing a day-to-day role in its operations.

Two staffers parted ways with Senator

Investment in recent weeks. Managing director Alan Goldfarb left the New York fund operator to join an undisclosed family office. He previously handled distressed-debt investments at Carlyle

Group.

Meanwhile, analyst Lawrence

Krovlev

Capital.

jumped to Citadel unit Surveyor

Senator has $9.1 billion under management, mainly in distressed-debt and value- and event-driven equity investments.

Marketing specialist Merrill Chester has signed on as a vice president at

Brigade Capital, the fixed-income shop led by Don Morgan.

Chester arrived this month from the capital-introduction desk at Goldman Sachs, where she was employed since 2008. New York-based

Brigade manages $12 billion of regulatory assets.

In-house recruiter Michael Martinolich resigned on April 24 from Bridgewater

12

Associates, the $150 billion investment shop led by Ray Dalio.

His destination: the recruiting desk at Geller & Co., a multi-family office in New York. He started May 11. Martinolich had joined

Bridgewater in October from the New

York office of Toronto placement firm

Caldwell Partners.

John Thaler’s disclosure this week that he was converting his JAT Capital into a family office came as a surprise both to the Greenwich, Conn., equity shop’s investors and its staff. Indeed, it was only last week that JAT marketer

Augie Sculla was courting backers at

SkyBridge Capital’s “SALT Las Vegas” conference. What’s more, JAT appeared to be rebounding from an 11.3% loss in 2014 with a 4.9% gain during the first quarter. That included a 9% rise in

March, the firm’s third-best month ever.

Thaler’s decision came amid modest investor redemptions that left his shop with $1.7 billion under management, down from $2.1 billion as of Jan. 1. His move is reminiscent of one made by former employer Chris Shumway, who suddenly recast his Shumway Capital as a family office in 2011.

TO SUBSCRIBE

YES!

Sign me up for a one-year subscription to Hedge Fund Alert at a cost of $4,097. I understand I can cancel at any time and receive a full refund for the unused portion of my 46-issue license.

DELIVERY (check one): q Email.

q Mail.

PAYMENT (check one): q Check enclosed, payable to Hedge Fund Alert.

q Bill me. q American Express. q Mastercard. q Visa.

Account #:

Exp. date:

Name:

Company:

Address:

City/ST/Zip:

Phone:

E-mail:

MAIL TO: Hedge Fund Alert

5 Marine View Plaza #400

Hoboken NJ 07030-5795

Signature: www.HFAlert.com

FAX: 201-659-4141

CALL: 201-659-1700

HEDGE FUND ALERT

Telephone: 201-659-1700

www.HFAlert.com

Fax: 201-659-4141 Email: info@hspnews.com

Howard Kapiloff Managing Editor

Mike Frassinelli Senior Writer

James Prado Roberts Senior Writer

201-234-3976 hkapiloff@hspnews.com

201-234-3964

201-234-3982 mike@hspnews.com

james@hspnews.com

Andrew Albert Publisher

Daniel Cowles General Manager 201-234-3963 dcowles@hspnews.com

Thomas J. Ferris Editor 201-234-3972 tferris@hspnews.com

T.J. Foderaro

Dan Murphy

Ben Lebowitz

Deputy Editor

Deputy Editor

Deputy Editor

201-234-3960 andy@hspnews.com

201-234-3979 tjfoderaro@hspnews.com

201-234-3961 blebowitz@hspnews.com

201-234-3975 dmurphy@hspnews.com

Michelle Lebowitz Operations Director 201-234-3977 mlebowitz@hspnews.com

Evan Grauer Database Director 201-234-3987 egrauer@hspnews.com

Mary E. Romano Advertising Director 201-234-3968 mromano@hspnews.com

Josh Albert Advertising Manager 201-234-3999 josh@hspnews.com

Joy Renee Selnick Layout Editor 201-234-3962 jselnick@hspnews.com

Barbara Eannace Marketing Director 201-234-3981 barbara@hspnews.com

JoAnn Tassie Customer Service 201-659-1700 jtassie@hspnews.com

Hedge Fund Alert (ISSN: 1530-7832), Copyright 2015, is published weekly by Harrison Scott

Publications Inc., 5 Marine View Plaza, Suite 400, Hoboken, NJ 07030-5795. It is a violation of federal law to photocopy or distribute any part of this publication (either inside or outside your company) without first obtaining permission from Hedge Fund Alert. We routinely monitor forwarding of the publication by employing email-tracking technology.

Subscription rate: $4,097 per year. Information on multi-user license options is available upon request.

To start your subscription, return to the e-mail we sent with this issue and click on the “subscribe now” link.

Or call 201-659-1700. You can also complete the Order Form on the last page of this newsletter and fax it to 201-659-4141.

SUBSCRIPTION ORDER FORM

R YES! Sign me up for a one-year (46-week) subscription to Hedge Fund Alert and bill me at the special charter rate of $3,897 — a savings of $200. I can cancel at any time and receive a full refund for all undelivered issues.

DELIVERY (check one): q E-mail q Mail

PAYMENT (check one): q Bill me q AmEx

Account #: q

Exp. date:

Mastercard

Signature:

Name on card:

DELIVERY ADDRESS:

Name:

Company:

Address: q

BILLING ADDRESS (if different):

Name:

Company:

Address:

Visa

City/State/Zip:

Country:

Phone:

E-mail:

City/State/Zip:

Country:

Phone:

E-mail:

Fax this order form to: 201-659-4141.

05/13/15