IT77 - TaxTim

advertisement

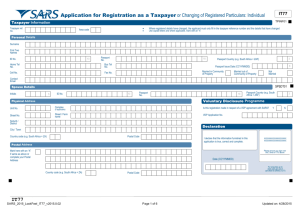

Application for registration as a Taxpayer or Changing of Registered Particulars: Individual IT77 TPINF01 Information Taxpayer ref. no. Where registered details have changed, the applicant must only fill in the taxpayer reference number and the details that have changed Area code Use capital letters and where applicable, mark with an “X” Details Surname Initials First Two Names Date of Birth (CCYYMMDD) Passport Country (e.g. South Africa = ZAF) Passport No. ID No. Home Tel No. Bus Tel No. Cell No. Fax No. Passport issue date (CCYYMMDD) Married in Community of Property Married out of Community of Property Not Married Contact Email Details Initials ID No. Passport Country (e.g. South Africa = ZAF) Passport No. Programme Address Unit No. Complex Is this registration made in respect of a VDP agreement with SARS? Street No. Street / Farm name VDP Application No. (if applicable) Y N Suburb / District by Taxpayer / Representative Taxpayer City / Town Country code (e.g. South Africa = ZA) Postal Code I declare that the information furnished in this application is true, correct and complete. XXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXX Address Please ensure you sign over the 2 lines of “X”s above Mark here with an “X” if same as above or complete your Postal Address Date (CCYYMMDD) Country code (e.g. South Africa = ZA) For enquiries go to www.sars.gov.za or call 0800 00 SARS (7277) Postal Code IT77 Version: v2012.0.5 Page 1 of 5 Updated on: 1/23/2013 TPDIF01 Practitioner Details (if applicable) Surname / Registered name Registration No. Initials (if applicable) Tel No. Contact Email EMPIF01 Details Name Address PAYE ref no. Unit No. Complex Bus tel no. Street No. Street / Farm name Fax no. (if applicable) Suburb / District City / Town Country code (e.g. South Africa = ZA) Postal Code Address Mark here with an “X” if same as above or complete your Postal Address Country code (e.g. South Africa = ZA) Postal Code IT77 Version: v2012.0.5 Page 2 of 5 Updated on: 1/23/2013 Details IDINF01 R State the estimated taxable income per annum of Income Date From Date To (Rands only) State main source of income a) Salary / Wages b) Bonus / Gratuity c) Commission d) Pension e) Other: Specify Total MPDIF01 Details (Only in case of partnership) One Taxpayer ref no. Surname ID No. Initials Passport Country (e.g. South Africa = ZAF) Passport No. Two Taxpayer ref no. Surname ID No. Initials Passport Country (e.g. South Africa = ZAF) Passport No. Three Taxpayer ref no. Surname Initials ID No. Passport No. Passport Country (e.g. South Africa = ZAF) IT77 Version: v2012.0.5 Page 3 of 5 Updated on: 1/23/2013 Details EDINF01 of Estate Date (CCYYMMDD) for Insolvent Estates First meeting CCYYMMDD Insolvent Second meeting (CCYYMMDD) Special meeting (CCYYMMDD) Deceased Other: Specify Taxpayer Details Surname Initials First two names Taxpayer ref. no. Date of Birth (CCYYMMDD) ID No. Passport No. Passport Country (e.g. South Africa = ZAF) Home tel no. Bus tel no. Passport issue date (CCYYMMDD) Cell no. Fax no. Date of Appointment (CCYYMMDD) Email Address Address Numbers Unit No. Complex Tel No. Street No. Street / Farm name Cell No. (if applicable) Suburb / District Fax No. City / Town Country code (e.g. South Africa = ZA) Postal Code of Representative Mark here with an “X” if same as above or complete your Postal Address Executor Country code (e.g. South Africa = ZA) Trustee Postal Code IT77 Version: v2012.0.5 Page 4 of 5 Updated on: 1/23/2013 RQINF01 Required for Registration / Change of Registered Particulars The following information is required in order for SARS to process your application. Your application may be rejected where the required information has not been submitted. Application Form This IT77 form must be completed In full and signed by the taxpayer or the representative taxpayer. Proof of identity A certified legible copy of the taxpayer’s identity document or passport or driving licence must be submitted. Bank Account Detail Changes The changes of bank account detail can only be done via the following channels: • SARS eFiling • SARS Branch (in person) • When submitting an ITR12 For bank account detail changes done at the SARS Branch, the following documents must be provided: • Original identity document / passport / driving licence • A temporary identity document / passport and an affidavit to justify the absence of the identity document / passport • Original bank statement with the bank stamp that confirms the account holder's name, account number, account type, and branch code • Original proof of residential address, e.g municipal account / utility bill not more than three months old reflecting your name and residential address • In the absence of proof of residential address in your name, the Confirmation of Entity Residential Address (CRA01) must be completed. The CRA01 can be obtained at a SARS Branch or downloaded from the SARS website (www.sars.gov.za) FOINF01 Use Only Initial year of liability Sub-Category Code Normal Emigrant Short term imprisonment Parliamentarian Visiting artist Overseas Effective Date (CCYYMMDD) Study / University IT77 Version: v2012.0.5 Page 5 of 5 Updated on: 1/23/2013