the

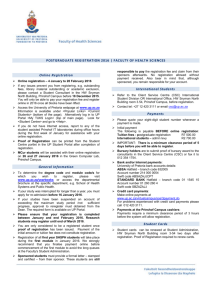

VOICE of

+

Commerce

2016 MediaKit

Payments

2016 MEDIA KIT

ABOUT

Paybefore is the leading media brand for the

payments and retail industries. With in-depth

news and analysis, Paybefore offers an

industry-insider perspective into the world of

prepaid, payments technology, commerce

and loyalty.

We deliver Paybefore e-newsletters to your

in-box, so you can catch late-breaking

news on the CFPB, the latest M&A deal and

in-depth analysis from payments experts.

All of our e-newsletter articles as well as

Pay Magazine—our digital flipbook—are

available on Paybefore.com. If you need

detailed information or background history,

our Website is your research library, open

24/7. In the new Pay Studio channel, you’ll

find spotlights on companies and people,

research and analysis, videos, Webinars,

bespoke surveys, white papers and more.

New in

2

You’ll also find Events, a place to post Jobs,

and even partners on Pay Connect.

016!

Paybefore also recognizes the best in

prepaid, payments technology, and retail

& loyalty with its yearly Pay Awards and

Pay Awards Europe.

Paybefore is a part of the Knowledge &

Networking division of Informa plc (INF:LSE),

one of the world’s leading business

intelligence, academic publishing, knowledge

and events businesses, creating unique

content and connectivity for customers

worldwide.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

2

36% - Executive

22% - Client-Foc

2016 MEDIA KIT

14,700

Rate Base

Readership Breakdown:

Industry Function: (create graph)

28% - Program Manager

18% - Acquirer / Processor

11% - Retailers, Brands, Consumer Service Companies

30% - Financial Institutions

13% - Service Providers

41,500

11,600

by Industry

Implementation

7% - Finance

4% - Other

Avg. Monthly Page Views

Avg. Monthly Unique Visitors

Readership

Sales, Marketing

17% - Product

AUDIENCE

14% - Operation

28% - Program Managers

In 2016, Paybefore became

Job Function: (create graph)

available without a subscription,

36% - Executive (C-Level, EVP, SVP, President)

allowing free and unlimited

13%

- Service

Providers

22%

- Client-Focused (Business Development,18% - Acquirers/Processors

access to all Paybefore content

on our Website, including our

Sales, Marketing, Client Relations)

digital Pay Magazine—without

dership Breakdown:

17% - Product

an annual

fee orgraph)

a log-in. In

ustry Function:

(create

14% - Operations (Legal, Risk, Compliance,

addition,

readers can sign up

- Program

Manager

- Acquirer

/ Processor

to receive

all of our free digital

Implementation,

- Retailers,

Brands, by

Consumer

newsletters

email. Service Companies

11% - Retailers, Brands,

- Financial Institutions

- ServiceOpen

Providers

access means deeper

SEO and higher readership,

giving our sponsors and

advertisers bigger impact and

greater visibility.

To increase our readership, we

will be distributing print copies

of Pay Magazine at paymentsrelated events such as All

Payments Expo, Money2020,

NBPCA’s Power of Prepaid and

Shoptalk.

7% - Finance

4% - Other

30% - Financial Institutions

Consumer Service Companies

by Job Function

4% - Other

36% - Executive

(C-Level, EVP, SVP, President)

7% - Finance

14% - Operations

(Legal, Risk,

Compliance,

Implementation)

22% - Client-Focused (Business

17% - Product

Development, Sales, Marketing,

Client Relations)

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

3

2016 MEDIA KIT

MEDIA PROPERTIES

Pay Magazine: Features in-depth articles, industry views, executive and company profiles, analysis and

expert commentary. Sections include Companies & People, Pay World, Digital Money, Finance & Strategy,

Government Watch and Vertical Opportunities. Available as a digital flipbook online. Printed twice a year for

distribution at payments-related events.

Pay Connect: B2B Web directory of companies participating in prepaid, payments technology and

commerce, as well as the businesses that support them. Database available online.

Pay Awards Magazine: Features our Pay Awards and Pay Awards Europe Best-in-Category and Industry

Achievement winners. Available as a digital flipbook online.

Paybefore.com: Updated almost daily, our searchable Website includes the most recent Paybefore news and

features plus all Paybefore coverage since our launch in 2007. It’s an invaluable research resource for industry

professionals. Departments include Headline News, Top Stories, Mobile & Emerging Payments, Pay Studio,

Retail, Op-Ed, Government Watch, On the Move, Jobs, Events, videos and polls.

Pay News: Provides in-depth news and analysis beyond the headlines, from an industry-insider perspective.

Includes profiles of innovative companies and people transforming payments; product launches and partnerships; rules, regulations, litigation and security issues affecting payments and retail perspectives; and the latest

research data to guide your strategy. E-newsletter emailed 3 times a week.

Pay Gov: Coverage of the legal, legislative and regulatory landscape with analysis and insights specific to the

industry. Departments include Washington Watch, Viewpoint, State Update, In the Courthouse, International

News and Dates & Deadlines. E-newsletter emailed 20 times a year.

Pay Op-Ed: Industry thought leaders share what they see shaping the world of payments. E-newsletter

emailed 20 times a year.

Pay Week: Weekly summary of the top headlines and leading news stories in the U.S. and around the world,

including government issues, deals & launches and an industry calendar. E-newsletter emailed every Friday.

volume 8 • fall 2015

volume 8 • fall 2015

companies & people

Industry Views: Let’s Get Physical

paybefor e awards

europe

Why do plastic cards matter in a mobile world?

The fact is there’s nothing inconvenient about plastic

and until there is ubiquitous acceptance for other form

factors, it will remain quite relevant. Just like cash and

checks, the ratio of plastic transactions relative to other

forms may diminish over time but won’t go away for

many years to come.

Acceptance. While the latest mobile and contactless technologies are exciting for some Gen Xers

and those of us in the industry, cardholders

continue to rely on the

ability to make a purchase

at their local hardware store

or to withdraw cash at their

local bank’s ATM. Our customers enjoy prepaid because

of their confidence in the

product and the simplicity

of its use. Part of that confidence factor is dependent

on reliable acceptance, regardless of the type of merchant. Ironically, cardholder adoption of mobile and

contactless payments may well be dependent on the

continued peace of mind associated with the plastic

in their wallet.

Plastic cards defined mobility

before cellular phones were

invented. They allowed consumers to carry around their

“lender” or “bank” in their

pockets, no longer being

limited to shopping only at

merchants where they could

open a tab or withdrawing cash

from the bank during normal

banking hours in advance of making a purchase.

In the 60 years since plastic cards were introduced,

consumers around the world have enjoyed the

—Trent Sorbe,

president, central payments division, Central Bank of Kansas City

However, merchants across

the country are adding mobile

payments at the POS but

until acceptance is ubiquitous, plastic will continue

to be necessary.

—Joan M. Herman,

senior vice president, Sunrise Banks

—Daniel Spier,

managing director, IDT Financial Services Ltd.

—Kevin Phalen,

head of global card and comprehensive payables,

Bank of America Merrill Lynch

rele“Plastic cards will remain as some

manueven

t may seem as if card

vant for many years

the push

facturers would view

new payment and transas a threat to of the

compete

for mobile payments

action technologies

It’s true that

strucposition in this highly

their business models.

was up only for a

Vrancart,

growth

Al

unit

says

card

global

tured market,”

to the

and founder

1 percent in 2014, according nal

ICMA industry adviser

Internatio

applicatlatest data from the

emeritus. “Most mobile card

Association

n

Card Manufacturers

ions require a companio

you look at

backup,” he

(ICMA). However, when

as an alternative or

period,

es

same

the

preferenc

for

dollar growth

says. “Demographic

largely

lists and

sales were up 5.6 percent, chip

suggest that traditiona support

to

because of more expensive

boomers will continue

to drive

millennials will

cards, which continue

plastic cards while

32 percent

accept the various new

global growth. Nearly

readily

which

r

chip,

a

remembe

of all cards now have

technologies. Also,

of the

not have

represents 84.9 percent cards.

that everyone does

ured

value of all manufact

a smartphone.”

I

and beyond

The outlook for 2015

global dolis for continued robust

card unit

lar growth and modest

n predicts.

growth, the associatio

20

with sophIdentification cards

such

paybefore.com

isticated security features,

y, are

as biometrics technolog

Plastic and the

secure

preferred to access

with mobile

systems compared

potential

applications that have consecurity issues, Vrancart

card martinues. And, in the gift

cards—with

ket, physical plastic

are not

myriad design options—

cards

losing ground to e-gift grow.

cards

even as virtual gift

impact

that

want

ers

“Consum

a

or ‘wow factor’ of having card

e gift

packaged decorativ

occasion,”

in hand for that special

Vrancart maintains.

you’ll find

In this special section,

became the

out about how cards

sidebar at

go-to form factor (see

several card

right) and hear from

how they’re

manufacturers about

an increasingly

staying relevant in

21

mobile world.

Future: the evolutio

n oF Payments’

cards first appear,

Proprietary charge

by

issued in the 1920s

including paper cards

bill customers

oil companies that

each month or quarter.

in full for purchases

Form Factors

Innovation Meets

early

1900s

usage to other major

Diners Club expands

abroad.

cities in the U.S. and

1950

credit cards appear

The first general purpose

ca

establishes BankAmeri

when Bank of America

card

franchises the BankAmeri

Service Corp. and

time,

Visa). At the same

brand (later named

the InterBank Card

several banks establish

a

MasterCard, creating

Association, later named

credit nationally.

rival brand providing

debit system emerges,

The nationwide U.S.

re.

and ATM infrastructu

built on credit card

1955

1966

1978

1984

gift

develops a prepaid

Blockbuster Video

, which goes

card in lieu of gift certificates and 1996.

in 1995

on display nationally

Other retailers follow.

payment app developSmartphone mobile

form

network operators

ment begins. Mobile

Softcard).

Isis (which later becomes

the development

Apple Pay launches;

with payment

of wearable technology

accelerate.

features begins to

1994

2010

2014

Old WOrld

O

enthe first travel and

Diners Club issues

City.

cards in New York

tertainment charge

1958

ss Association

Association

Security continues to be the main reason for resistance

to mobile payments. This is primarily because many

consumers fail to see the multiple benefits that mobile

payments bring, such as ease,

access and convenience.

This resistance to change

has resulted in continued heavy

use of credit and debit cards.

There’s no doubt that mobile payments are experiencing exponential growth; however, I do

not believe mobile payments and plastic cards

are mutually exclusive. I see

the mobile wallet and the

plastic card working harmoniously, with consumers

utilizing both for different

transactions. It’s also worth

considering that as with any

new technology, it will take

time to educate consumers

on the use and applications

of mobile payments. I don’t envisage there being

a complete eradication of plastic cards anytime

in the near future.

While there’s no doubt that mobile applications are

taking off as a future channel for payments, they are

a way off from universal acceptance. Plastic will still

rule as long as it remains the easiest and only form

of electronic payment that can be used anywhere,

anytime, by anyone.

aside

g all the attention—

Mobile may be gettin

is firm.

c’s place in payments

from EMV—but plasti

—Brad Hanson,

president of MetaBank and Meta Payment Systems

simplicity of cards, and ubiquity with which they’re

accepted. Plastic cards also are available to unbanked consumers, who receive cards funded with

benefits payments.

Card Manufacturer

SOURCE: International

International Card Manufacturer

g

Excellence. SOURCE:

g Excellence.

For the same reason cash

still matters: People use it, it’s

accepted anywhere and it’s

often more convenient, especially for small transactions.

Plastic is definitely still more

ubiquitous and convenient than

mobile apps. Besides, there’s

not really anything mobile about

the wallets and payment apps

on your phone. They use NFC

technology, not mobile technology to transact a payment. Therefore, why does mobile

even matter when you could just use your Fitbit, watch

or other wearable instead of pulling out your phone?

1988

n May 19, in Marbella,

Spain, Paybefore celebrated

2015 Paybefore Awards

its

Europe winners, revealing

in-category honorees and

bestresults of People’s Choice

voting. The presentatio

n closed

Expo Europe, where industry the second day of All Payments

stakeholders gathered

the future of payments.

to discuss

)

issues the first (cardboard

American Express

later,

purchases. A year

charge card for T&E

T&E

issues the first plastic

American Express

“Green Card.”

“We’re proud to celebrate

the companies and programs

forefront of payments and

at the

innovation, who continue

ways to solve problems

to

and create value for consumersfind new

businesses,” said Loraine

and

DeBonis, Paybefore editor-in-ch

and chair of the judging

ief,

panel. “Our best-in-cate

gory winners

represent veteran providers

as well as newer market

from Italy, Germany, U.K.,

entrants

U.S. and the UAE.”

The 2015 Paybefore Awards

Europe judging panel included

DeBonis; Brian Dunne,

managing director, SVM

Europe,

president, IMA Europe;

Peter Howitt, founder, Ramparts, and

and secretary, Gibraltar

e-Money Association; David

director, Polymath Consulting;

Parker,

and former Paybefore CEO

Marilyn Bochicchio.

is issued to business

The first debit card

Bank of Seattle,

owners by First National

against a check.

providing a guarantee

providers are established

The first PIN-debit

signature debit launches.

;

paves the way to mobile

2000

2011

2015

photo: Loraine DeBonis

for Card Manufacturin

Awards for Card Manufacturin

the ICMA

Élan Awards

in the

ICMA Élan

winners in

and winners

finalists and

are finalists

images are

Card images

Card

y

finance & strateg

Paybefore also announced

results of People’s Choice

which ran from April 21-May

voting,

18. More than 3,000 votes

cast for People’s Choice.

were

Congratulations to Epipoli,

home this honor, and all

which took

our winners.

Smartphone adoption

payments via browsers.

Starbucks launches

Google Wallet launches;

app nationwide after

its mobile payments

piloting at Target stores.

The Apple Watch

Google absorbs Softcard.

capabilities; Samsung

launches with payment

MCX’s CurrentC mobile

Pay, Android Pay and

pilots.

roll out or launch via

payments services

Worldwide

Reserve, MasterCard

sources: Federal

paybefore.com

87

4

86

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

4

2016 MEDIA KIT

PRINT & ONLINE RATES

Pay Magazine

Frequency: 2 Issues/Year

Covers

Gatefold (Front Cover)..................................... Price dependent upon insert/production charges

Inside Front..................................................... $30,000/issue

Outside Back................................................... $25,000/issue

Inside Back...................................................... $20,000/issue

Interior

Gatefold.......................................................... Price dependent upon insert/production charges

Two-Page Spread............................................ $10,000/issue

Full-Page......................................................... $5,000/issue

Half-Page (Horizontal)...................................... $3,000/issue

Inserts

Paybefore offers the option to polybag various units within any given issue, pending publisher

approval, and when meeting printer specifications. Additional units available on request.

Pay Magazine is distributed at major payments conferences worldwide in addition to being

available as a digital flipbook online.

Pay Awards Magazine

Frequency: 1 Issue/Year

Covers

Inside Front..................................................... $30,000/issue

Outside Back................................................... $25,000/issue

Inside Back...................................................... $20,000/issue

Interior

Two-Page Spread............................................ $10,000/issue

Full-Page......................................................... $5,000/issue

Half-Page (Horizontal)...................................... $3,000/issue

Pay Awards Magazine is available as a digital flipbook online.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

5

2016 MEDIA KIT

PRINT & ONLINE CREATIVE UNITS

New in

Full-Page Ad

Full Bleed

8.25” w x 10.875” h

add .25” on all sides

No Bleed

7.125” w x 9.375” h

2016!

Full-Page Spread

Page Trim Size

16.5” w x 10.875” h

Allow for .25” bleed on all sides.

Bleeds: 17˝ w by 11.375˝ h

(crop marks outside of bleed area)

No Bleed max area: 16˝ w x 10.375˝ h

.875 (7/8)“ gutter margin

Half-Page Ad

(Horizontal)

No Bleed

7.125” w x 4.6875” h

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

6

2016 MEDIA KIT

RATES – ONLINE

Paybefore.com

PLACEMENTS

PRICE

Department Sponsorship................... available as a feature of

significant sponsorship

Leaderboard*.....................................$20,000/year

Medium Rectangle**...........................$20,000/year

Vertical*..............................................$15,000/year

Anchor*..............................................$5,000/year

Horizontal***.......................................$1,000/month

* Rotating on homepage and ROS.

** Rotating on homepage and non-sponsored department pages.

*** Rotating on homepage only.

Pay Connect (Online)

Lead Sponsorship of a Category........$20,000/year

Leaderboard*.................................... $20,000/year

Medium Rectangle**.......................... $20,000/year

Vertical*............................................. $15,000/year

Anchor*............................................. $5,000/year

Premier Company Listing................... $1,500/year

* Rotating on homepage and ROS.

** Rotating on homepage and non-sponsored category pages.

Pay Connect

Lead Sponsorship of a Category

Category Sponsorship offers extensive online exposure, maximizing

your association with a specific vertical market or value chain position.

•Recognition as Category Sponsor on homepage,

category page, and individual listing page in that category.

•Medium rectangle banner fixed on your specific category page.

•Medium rectangle banner on homepage and all non-sponsored

Premier Listing

• 175-word business description

in up to four categories.

• Full-color company logo

category pages.

• Social media links

•Premier listing.

• Priority placements in each

category (premier listing run

before standard listings).

• Linking Paybefore editorial

mentions of your company to your online Pay Connect listing.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

7

2016 MEDIA KIT

CREATIVE UNITS - ONLINE

Paybefore.com Pay Connect

Leaderboard (600 x 74)

Leaderboard (600 x 74)

Department Sponsorship

Medium Rectangle

(300 x 250)

Category Sponsorship

Vertical (120 x 240)

Medium Rectangle

(300 x 250)

Horizontal (630 x 90)

Vertical (120 x 240)

Anchor (600 x 74)

Anchor (600 x 74)

Paybefore.com Departments

Pay Connect Categories

Pay News

Top Stories

Mobile & Emerging Payments

Pay Studio

Retail

Op-Ed

Government Watch

On the Move

Jobs

Events

Featured Video

Pay Poll

Value Chain Categories

• Card Manufacturing & Fulfillment

• Customer Care

• Hardware/Software & Terminal Suppliers

• Issuers

• Knowledge Providers

• Mobile Payments/Bill Pay Providers

• Networks

• Processors

• Program Managers

• Retail Distribution/Load Providers

• Risk Management & Security Firms

Introducing Pay Studio

In 2016, we launched Pay Studio on Paybefore.

com. You’ll find spotlights on companies and people,

research and analysis, videos, Webinars, bespoke

surveys, white papers and more. Check this channel

as it continues to grow.

Vertical Categories

• Benefits & Payroll

• Business to Business (B2B)

• Consumer-Funded Products

• Gift

• Reward, Incentive, Loyalty

• White Label

Stay tuned for more enhancements to Pay Connect.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

8

2016 MEDIA KIT

RATES – DIGITAL

Pay News (E-newsletter)

PLACEMENTS

PRICE

Sponsorship...........................Available as a feature of significant sponsorship

Leaderboard.......................... $3,500/week*..........3x per week

Rectangle.............................. $3,500/week*..........3x per week

Vertical.................................. $900/week*.............3x per week

Anchor.................................. $2,000/week*..........3x per week

Text Ad.................................. $500/week*.............3x per week

*Consecutive 2-week minimum insert required.

On weeks when we do not publish Pay Gov or Pay Op-Ed, we publish a fourth issue of Pay News.

Pay Op-Ed (E-newsletter)

Sponsorship..........................Available as a feature of significant sponsorship

Leaderboard..........................$7,500/insert*..........20x per year

Top Vertical............................$6,000/insert*..........20x per year

Vertical..................................$2,500/insert*..........20x per year

Anchor..................................$2,000/insert*..........20x per year

*3-insert minimum

Pay Week (E-newsletter)

Sponsorship..........................Available as a feature of significant sponsorship

Leaderboard..........................$7,500/insert*.......... 1x per week

Top Vertical............................$6,000/insert*.......... 1x per week

Vertical..................................$2,500/insert*.......... 1x per week

Anchor..................................$2,000/insert*.......... 1x per week

*3-insert minimum

Pay Gov (E-newsletter)

Sponsorship..........................Available as a feature of significant sponsorship

Leaderboard..........................$7,500/insert............20x per year

Rectangle..............................$7,500/insert............20x per year

Vertical..................................$2,500/insert*..........20x per year

Anchor..................................$2,000/insert*..........20x per year

*3-insert minimum

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

9

2016 MEDIA KIT

CREATIVE UNITS - DIGITAL

Pay News/Pay Gov

Pay Op-Ed/Pay Week

Sponsor

Sponsor

Leaderboard (600 x 74)

Rectangle (240 x 200)

Leaderboard (600 x 74)

Vertical (120 x 240)

Vertical (120 x 240)

Anchor (600 x 74)

Anchor (600 x 74)

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

10

2016 MEDIA KIT

MULTIMEDIA OPPORTUNITIES

More Brand-Building

Pay Awards & Pay Awards Europe:

Enter your partners or your own company

and get international recognition for

winning in a rigorous and highly

competitive juried competition.

Comes with instant brand building and extensive Paybefore

editorial coverage.

Email Campaigns:

Deliver your dedicated messages

through Paybefore

email distribution.

Reprints:

Put the power

of Paybefore to

work for you by

ordering reprints

to post on your

Website or distribute to clients and

prospects as collateral.

Govern

ment

watch

October 2015 | Volume 9 | Issue XVI I | www.paybefore.com

In Viewpoints, prepaid and emerging payment professionals share their

perspectives on the industry. Paybefore endeavors to present many

points of view to offer readers new insights and information. The opinions

expressed in Viewpoints are not necessarily those of Paybefore.

Contrasting Payments Innovation in Europe and the U.S.

By Monica Monaco, TrustEUAffairs, and Eric Grover, Intrepid Ventures

A

merica has led Europe in payments

innovation. Europe has led in

payments regulation.

There are significant differences in

payments innovation in Europe and the

U.S., influenced by policymakers’ views

of their roles and the regulatory, tax and

competitive climates. These differences

affect the cost, quality and choice of

payment products Europeans and

Americans enjoy and, therefore, ought to

be of profound interest to retailers and

consumers. Payment providers, too,

should be keenly interested in an environment conducive to competition and

creating and enhancing services across

the value chain.

Innovation at a Glance

Payments competition in the U.S. is

greater than in Europe. Specifically, retail

payment network competition in the U.S.

is fierce and increasing. American

Express, Discover, FIS’s NYCE, Fiserv’s

Accel, First Data’s STAR, JCB, MasterCard, PayPal, Visa and increasingly

China UnionPay compete. In stark

contrast, until 2009, Europe’s third-largest card network, France’s CartesBancaires, enjoyed a domestic monopoly.

Until 2011, the Netherlands had a

monopoly debit payment scheme.

Why the disparity? If you look at the

Monica Monaco

snapshot on the next page, you can see

details about payments innovations

during the last 65 years. More often than

not, these innovations were made in

America. And that trend largely continues as new mobile wallet providers

compete to shift consumer behavior. At

the same time, bitcoin investments in the

U.S. dwarf those in Europe, suggesting

that emerging payments are more likely

to thrive in the U.S. market. While there

are many factors at play, the regulatory

environment is a major force in shaping

the two market realities.

the same regulatory principles apply

regardless of the technology used.

As Nobel Laureate James Buchanan

says in his Public Choice Theory, regulators seek to maximize their power and

utility. Technology neutrality is a banner

under which European regulators

inevitably will extend their authority to

new markets and technologies, before or

absent evidence of market failures

meriting intervention. When has an EC

regulator ever argued his enlightened

direction wouldn’t improve the market or

produce more “European” results? In this

sense, technology neutrality can encourage over-regulation of emerging markets.

Consequent regulatory uncertainty and

risk can cause businesses to defer or

reduce investment, as the 2011 “OECD

Council Recommendation on Principles

for Internet Policy Making” explains.

Although there is investment activity in

payments in Europe, it would be much

he

greater if the regulatory burden weren’tregulatory waters

been choppy

have

so great.

for

Social Media:

Reach our online community

through Paybefore’s

private LinkedIn

Group (nearly

2,000 members) and

more than

4,100 Twitter

followers.

Navigatin

g

Regula the

toRy Wa

Technology Neutrality

Leads to Broader Regs

To understand the European regulatory

environment and how it has and will

continue to affect the payments industry,

it’s helpful to look at how European

regulators view themselves. Often, it

seems they believe that regulation should

precede market solutions. For example,

technology neutrality is one of the key

principles of the European regulatory

framework for electronic communications. The concept appears in the proposed EU Data Protection Regulation

and the proposed EU Directive on

Network and Information Security (the

NIS Directive), both of which likely will

be adopted in 2015 or 2016. In a nutshell,

The five

regulator biggest

y

that could issues

the preindustry

make severalpaid

and,

for roug

Regulators

‘Know Best’the air, major issues still with

her seas.

up in

European regulators’

interest in newit may be

Based in Brussels for the past 13 years,

Monica Monaco created TrustEUAffairs in

September 2013 to advise clients on relevant EU

legislative initiatives. Monica focuses on payment systems and new payments solutions, such

as mobile payments and contactless. She was

senior manager for EU relations and regulatory

affairs in the legal department of Visa Europe for

more than 10 years. Monica can be reached at 104

monacom@trusteuaffairs.com.

T

before

several

we see

months

payment solutions remainsHelping

keen. The

calmer waters.

to keep

European Central Bank’s NBPCA,

Euro Retail

an even

keel is the

and the

Payments Board, for example,

looking

captain

able iscrew

of

at person-to-person and proximity

presiden is Brad Fauss, a very

NBPCA

t

mobile payments. But private

took sector and CEO. He

time

recently

what the with Paybefore

teRs

35,000

commen

ts

deadline

and the by the March

expected

final rule

in early

is

2016.

The CFPB

is proposin

other mandate

g, among

s, that

compan

ies provide prepaid

long-for

shortm

sumers’ disclosures, limitand

losses when

constolen

to discuss

cards

or

Eric Grover is principal at Intrepidtop

Ventures, aassociation

five issues

sees

resolve lost, investigate are

errors

corporate development and strategy

consultancy

and

facing the as the

and

their

10 business generally

industry

within

advising issuers, networks and processors, andpotentia

firms l ramificat

days

provisio

ions.

nal credit or provide

investing in and serving businesses across the payamount

until the for the disputed

ments value chain. He was the first to make the case

complet

investiga

CFPB

e,

for demutualizing MasterCard and Visa. Eric

may be

tion is

free accessprovide convenie

Rulema

reached at Eric.Grover@IntrepidVentures.com.

nt and

king

to account

The

Eric Grover

CFPB

prepaid announced its

NPRM on

accounts

The bureau

on Nov.

13, 2014.

received

more than

©2015 Paybefore. All rights reserved. Forwarding or reproduction of any kind is strictly forbidden without the prior consent of Paybefore. This publication is intended for

general information purposes only and should not be construed as legal advice. Readers are urged not to act upon the information without first consulting an attorney.

3

and adhere

to credit information,

tections

if any type card prooffered

of credit

in

prepaid connection with is

account,

draft. The

including a

NPRM applies overto almost

Custom

Publishing:

Put Paybefore

editors to work

for you by helping

you develop articles

to promote your business.

Viewpoints: Share your

thought leadership on

what’s shaping the

world of payments.

Must meet Paybefore

editorial standards, i.e.,

no marketing pieces. Published in

Pay Op-Ed or Pay Gov.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

11

2016 MEDIA KIT

PRINT + ONLINE AD CLOSE ADVERTISING DEADLINES

AD MATERIALS DUE COVER DATE

Pay Magazine (spring).............. Jan. 11..............Jan. 15............... March

Pay Awards Magazine............. June 13.............June 17.............. August*

Pay Magazine (fall)................... Aug. 22.............Aug. 26.............. October

*Will be updated in the winter with Pay Awards Europe winners.

Coming in Pay Magazine this Spring

Issue Theme: Convergence of Payments

& Commerce

Special Section: Security Challenges for

Mobile Payments

Note: Earlier publication date for All

Payments Expo distribution.

DIGITAL

All ad materials due two weeks prior to publication date.

Pay News: Ads run on a two-week insertion cycle.

ONLINE/DIGITAL BANNERS

Pay Week: E-newsletter emailed every Friday.

PAY OP-ED PAY GOV

ISSUE

ISSUE

PUBLICATION DATES

Issue 1.............. Jan. 14

Issue 2 ............. Jan. 28

Issue 3.............. Feb. 18

Issue 4.............. March 3

Issue 5.............. March 17

Issue 6.............. April 7

Issue 7.............. April 21

Issue 8.............. May 5

Issue 9.............. May 19

Issue 10............ June 2

Issue 11............ June 16

Issue 12............ July 7

Issue 13............ July 21

Issue 14............ Aug. 4

Issue 15............ Aug. 18

Issue 16............ Sept. 1

Issue 17............ Sept. 22

Issue 18............ Oct. 6

Issue 19............ Nov. 3

Issue 20............ Dec. 8

PUBLICATION DATES

Issue 1.............. Jan. 20

Issue 2.............. Feb. 3

Issue 3.............. Feb. 24

Issue 4.............. March 9

Issue 5.............. March 30

Issue 6.............. April 13

Issue 7.............. May 11

Issue 8.............. May 25

Issue 9.............. June 8

Issue 10............ June 22

Issue 11............ July 13

Issue 12............ July 27

Issue 13............ Aug. 10

Issue 14............ Aug. 24

Issue 15............ Sept. 14

Issue 16............ Sept. 28

Issue 17............ Oct. 13

Issue 18............ Nov. 9

Issue 19............ Nov. 30

Issue 20............ Dec. 14

Paybefore encourages sponsors to change

their banner ads frequently to present timely

information, keep messages fresh and coordinated with other branding/advertising. You

may change your banner ads as frequently

as you like.

(Please note: Pay News, Pay Op-Ed and

Pay Week have a two-consecutive-week,

same-ad requirement.)

Creative for banner changes is due two

weeks before your requested change date.

Please send new ad creative with run dates and instructions to robin@paybefore.com

and CC mmiddleton@iirusa.com.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

12

2016 MEDIA KIT

AD SPECIFICATIONS

PAY MAGAZINE AND PAY AWARDS MAGAZINE

• Press quality PDF created with 300-DPI, high-resolution

images.

• Trim size: 8.25 x 10.875”.

Digital file requirements:

• NO application files will be accepted.

• PDF files must be hi-res, print-ready PDF-X1a.

• EPS files must be 100% size. Please embed all images

and convert all fonts to outlines.

• TIFF files must be 100% size. Flatten all layers.

• All images used must be 300-DPI and CMYK color profile. • Do NOT include printer’s marks (crop marks, registration

marks, etc.) in the bleed of your file submission.

All printer marks should be offset from the trim by .375”. If

these marks are included in the bleed of the file, there is a

chance these marks will be printed in the final product.

Art/Photos and Logos

• EPS, TIFF or JPG file format.

• CMYK with 300-dpi, 175 line screen or greater.

• Make sure to outline all fonts and flatten layers.

• No compression.

two-page spread (bleed)

17 x 11.375”

two-page spread (no bleed)

16 x 10.375”

full page (bleed)

8.25 x 10.875”

full page (no bleed)

7.125 x 9.375”

half-page horizontal

7.125 x 4.6875”

Ad size (width x height); measurements in inches.

ONLINE/DIGITAL

We do not accept animated files for email banner ads since

many email programs, such as Microsoft Outlook, do not

render the images correctly.

Web Banner Ads

Accepted Banner Formats:

• Static PNG, GIF or JPG

• Animated GIF

• All files must be 35K or less.

We do not accept Flash files.

One-pixel border: Paybefore highly recommends inserting

a one-pixel border around ads that have a white background to distinguish it from white background areas of our

Website.

E-Newsletter Banner Ads

Accepted Banner Formats:

• Static PNG, GIF or JPG

• All files must be 35K or less.

ONLINE/DIGITAL

Click-thru URL and Tracking: Paybefore will not schedule

any campaigns with inactive click-thru URLs or 1x1 tracking

pixels. Include the click-thru URL for each ad campaign.

Paybefore.com

Pay Connect

Pay News & Pay Gov

Pay Op-Ed & Pay Week

leaderboard

600 x 74

600 x 74

600 x 74

600 x 74

medium rectangle

300 x 250

300 x 250

240 x 200

n/a

vertical

120 x 240

120 x 240

120 x 240

120 x 240

anchor

600 x 74

600 x 74

600 x 74

600 x 74

horizontal

630 x 90

n/a

n/a

n/a

Pay News also offers a text ad. Up to 200 characters total (including spaces). Website link at the bottom of text not included in character limit.

Ad size (width x height); measurements in pixels.

Please send new ad creative with run dates and instructions to robin@paybefore.com

and CC mmiddleton@iirusa.com.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

13

2016 MEDIA KIT

OUR SPONSORS

PREPAY

SOLUTIONS

TM

Paybefore, 708 Third Ave., 4th fl., New York, NY 10017 USA

Paybefore™, Paybefore.com™, Pay Gov™, Pay News™, Pay Op-Ed™, Pay Week™, Pay Magazine™, Pay Connect™,

Pay Awards Magazine™, Pay Awards® and Pay Awards® Europe are the property of Paybefore.

All other product and service names may be trademarks of their respective companies.

©2016. All rights reserved. Copyrighted material.

For more information, contact Sales Director Matt Middleton at +1 646.616.7604 or mmiddleton@iirusa.com

© 2016 Paybefore. All rights reserved.

14