0 - Gruppo BPER

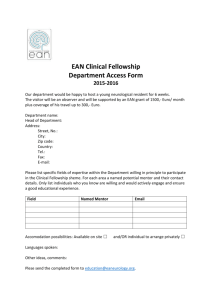

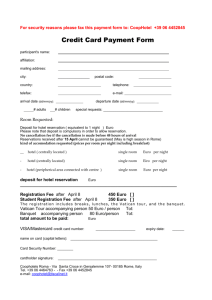

advertisement