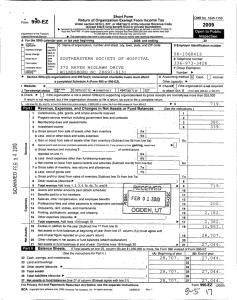

Return of Organization Exempt from Income Tax

advertisement

990

Form

OMB No 1545-0047

Return of Organization Exempt from Income Tax

2004-

Under section 501 (c), 527 , or 4947(a)(1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

ry

IInternalnReven a Service

A

For the 2004 calendar year. or tax year beainnina Jul

B

Check if applicable

C

use

pIIRSlabel

or prinik

pe.

ortype.

Address change

Name change

Initial return

specific

mstruc

tions

Final return

Amended return

1

.2004. and endna

Jun 30

Name of organization

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT,

Number and street (or P 0 box if mail is not delivered to street addr)

2005

D

Employer Identificati on Number

E

Telephone number

F

Accou a tin g

metho

INC.

74-1900345

Room/suite

POST OFFICE BOX 829

(409)

count

City, town or country

ZIP code + 4

State

BEAUMONT

❑ Application pending

Open to Public

Inspection

► The organization may have to use a copy ofthis return to satisfy state reporting requirements

TX

77704-0829

• Section 501 (cX3) organizations and4947(aX1) nonexempt

835-7118

11 Cash

X Accrual

Other (specify)

H andI are not applicable to section 527 organizations

charitable trusts must attach a completed Schedule A

H (a) Is this a group return for affiliates?

(Form 990 or 990-EZ).

❑ Yes

X❑ No

❑ Yes

❑ No

Y es

No

H (b) If 'Yes,' enter number of affiliates

G

Web site: O' WWW. CATHOL I CCHARI T I ES BMT . ORG

J

Organization type

H (C) Are all affiliates included'

(if 'No,' attach a list See instructions )

0.

(check only one)

501(c)

(inse rt no)

3 -4

❑ 4947 (a)(1) or

❑ 527

H (d) is this a separate return filed by an

K

Check here

If the organization ' s gross receipts are normally not more than

$25 , 000 The or g anization neednot file a return with the IRS , but if the or g anization

received a Form 990 Package in the mail, itshould file a return without financial data.

Some states require a complete return .

Gross receipts: Add lines 6b, 8b,9b, and 10b to line 12 11 7 , 8 7 4 , 181.

N= Revenue , Expenses, and Changes in Net Assets or Fund Balances (See Instructions)

Contributions, gifts, grants, and similar amounts received:

a Direct public support

b Indirect public support

c Government contributions (grants)

d 1athroughli1c)s(cash $

1, 340, 962.

noncash

1

5

6a

b

c

D idendR

fr

cur ies

G oss rents

L

er>

®cppn4sZ00ld

N

al Income or (loss) (su

t line 6b from line6a)

R

7

O er

E

v

8a Gr ss a

E

Z

E

x

pora

th

f„y�gme

u

tIV

cash

1d

2

3

)

4

5

investments

crib

X

1,040, 962.

300 000.

Program service revenue including government fees and:ontracts (from Part VII, line 93)

Membership dues and assessments

4

N

la

1b

1c

$

'

Group Exemption Number

► 0928

Check ► ❑ if the organization is not required

to attach Schedule B (Form 990, 990-EZ, or 990-PF)

L

2

3

0

I

M

O

1

W-

organization covered by a group rul in g

1, 340, 962.

6,293,682*

31,063.

6a

6b

6c

l

other

(A) Securities

entory

(B) Other

8a

b Less cost or other basis and sales expenses

8b

c Gain or (loss) (attach schedule)

8c

d Net gain or (loss) (combine line 8c, columns (A) and (B))

9 Special events and activities (attach schedule) If any amountis from gaming , check here

a Gross revenue (not Including

$

of contributions

reported online l a)

9a

b

c

10a

b

c

11

12

Less direct expenses other than fundraising expenses

Net income or (loss) from special events (subtract line 9b from line 9a)

Gross sales of inventory, less returns and allowances

Less cost of goods sold

Gross profit or (loss) from sales of inventory (attach schedule) (subtract line 10b from line l0a)

Other revenue (from Part VI, line 103)

Total revenue (add lines 1 d, 2, 3, 4, 5, 6c, 7, 8d, 9c, 1 Oc, and 11)

9b

13

Program services (from line 44, column (B))

8d

�❑

208, 474 .

9c

208, 474.

10c

11

12

7, 874, 181.

13

6,743,861.

10a

10b

14 Management and general (from line 44, column (C))

E 15 Fundraising (from line 44, column(D))

N

E 16 Payments to affiliates (attach schedule)

S 17 Total expenses (add lines 16 and 44, column (A))

A 18 Excess or (deficit) for theyear (subtract line 17 from line 12)

N 5 19 Net assets or furd balances at begiming of year (from line 73, column (A))

T T 20

Other changes in net assets or fund balances (attach explanation)

Net assets or furl balances at end of year (combine lines 18, 19, and 20)

S 21

BAA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions .

14

15

16

17

18

19

20

21

TEEA0101 01/07/05

244, 958.

23,272.

7,012,091.

862,090.

1, 80 7, 345.

2, 669, 435.

Form 990 (2004)

1q

-Form

74-1900345

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

(20012

Statement of Functional Ex enses All organizations must complete column (A). Columns (B), (C), and (D) are

required for section 501(c)(3) and (44) organizations and section 4947 (a)(1) nonexempt charitable trusts but optional for others.

Do not include amounts reported on line

6b, 8b, 9b, 10b, or 16 of Part /

Grants and allocations (aft sch )

(cash

$

)

non-cash $

Specific assistance to individuals (aft sch)

Benefits paid to or for members (aft sch)

22

23

24

25

26

Pension plan contributions

27

28 Other employee benefits

29 Payroll taxes

Professional fundraising fees

Accounting fees

Legal fees

Supplies

30

31

32

33

34 Telephone

Postage and shipping

35

------------------b PROFESSIONAL SERVICES

------------------c INSURANCE

y' q

('4'a

%r�t 1 g

0.

0.

207 , 123.

173, 215.

33, 908.

69,415.

56,240.

13,175.

0.

0.

30

31

32

33

52,612.

8, 746.

35

26,417.

16,301.

40, 176.

6,086.

18,798.

16,050.

12,436.

2,660.

7, 619.

0.

34

251.

0.

9,279.

13,808.

6, 025 .

0.

0 .

18, 625.

932.

0.

0.

40

41

42

14,740.

6, 739.

3,047.

26, 753.

714 .

3, 047.

26, 753.

0 .

0.

0.

43a

43b

43c

5,826 .

48 ,733.

37,880.

2,987.

40,627.

28,347.

2,839.

8 106.

9,533.

0.

0.

0.

66,290.

28

29

37

Conferences , conventions, and meetings

Interest

Depreciation , depletion, etc (attach schedule )

Other expenses not covered above ( itemize):

a ADVERTISING

s"y

, ',+ 1

66,290.

23,536.

37

38

40

41

42

43

q

0.

756, 340.

36

39 Travel

�uV+ti

I ,�

(D) Fundraising

779, 876.

36 Occupancy

Equipment rental and maintenance

Printing and publications

(C) Management

and general

dti' +l�

q

22

23

24

25 Compensation of officers, directors , etc

26 Other salaries and wages

27

( B) Program

serv ices

( A) Total

Page 2

27 , 904.

38

39

0.

0.

------------------300.

5,458.

0.

dJANITORALSERVICES

43d

5 ,758.

------------------43e

9,076.

23,272.

eSee Other Expenses Stmt

5, 607, 931.

5, 575, 583.

44 Total functional expenses (add lines 22 - 43).

Organizations completing columns (B) - (D),

44

7 012, 091.

244, 958.

23,272.

carry these totals to lines 13 -15

6, 743, 861.

Joint Costs . Check Of] if you are following SOP 98-2.

Yes ® No

Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services?

If 'Yes,' enter (i) the aggregate amount of these joint costs

$

, (ii) the amount allocated to Program services

$

; and (iv) the amount allocated

$

; (iii) the amount allocated to Management and general

to Fundraising $

Accom

What is the organization's primary exempt purpose? ►

SOCIAL-SERVICES--CHARITY - _ _ _ _ _ _ _ _ _ _

All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number of

clients served, publications issued etc. Discuss achievements that are not measurable. (Section 501(c)(3) & (4) organizations and 4947(a)(1) nonexempt charitable trusts must also enter the amount of grants & allocations to others)

a IMMIGRANT-ASSISTANCE-PROVIDED-TO-LOW-INCOME-MEMBERS-OF

-----------------------------------THE COMMUNITY ON A NOMINAL TO NO FEE BASIS

-----------------------------------------------------------------------------------------(Grants and allocations $

0 . )

bCHILD CARE-DAY CARE SUBSIDY FOR HUNDREDS OF LOW-INCOME

-----------------------------------------------------FAMILIES.THE PROGRAM IS OPERATED UNDER CONTRACT WITH

--------------------------------------------------SOUTHEAST-TEXAS WORKFORCE-DEVELOPMENT BOARD _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

------------------------------(Grants and allocations $

0 . )

CCOUNSELING SERVICES- AVAILABLE TO ALL AGE GROUPS, WITH

----------------------------------------AN EMPHASIS ON MARRIAGE AND FAMILY THERAPY.

---------------------------------------------------------------------------------------------(Grants and allocations $

0. )

dPARISH SOCIAL MINISTRY- SEEKS TO EMPOWER PERSONS IN THE

----------------------------------------------------PARISH TO RESPOND TO COMMUNITY NEEDS THROUGH SERVICE

----------------------------------------------------AND ACTION.

-----------------------------------------------------(Grants and allocations $

0. )

(Grants and allocations $

e Other program services SEE. STATEMENT

0. )

f Total of Program Service Expenses (should equal line 44, column (B), Program services)

BAA

TEEA0102

01107/05

Program Se rv ice Expenses

(Required for 501(c)(� and

and

494(aa))(1)iusts,

optional for others )

144,869.

6, 239, 521.

54,682.

6,214.

208,575.

6,743,861.

Form 990 (2004)

'Form 990 (2004)

74-1900345

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

Page 3

Balance Sheets (See Instructions)

Note :

1, 053, 220. 45

45 Cash - non - interest - bearing

46

Savings and temporary cash investments

1,387,565.

46

47a Accounts receivable

47a

bLess• allowance for doubtfil accounts

47b

48a Pledges receivable

b Less : allowance for doubtful accounts

48a

48b

26,549.

1 , 599. 47c

26,549.

48c

49 Grants receivable

1, 289 , 010. 49

Receivables from officers , directors , trustees , and key

employees (attach schedule)

51 a

51 a Other notes & loans receivable (attach sch)

51 b

b Less : allowance for doubtfii accounts

52 Inventories for sale or use

A

s

E

(B)

End of year

(A)

Beginning of year

Where required, attached schedules and amounts u.thm the description

column should be for end - of-year amounts only

1,264,284.

50

s

50

53 Prepaid expenses and deferred charges

54 Investments - securities (attach schedule )

55a Investments - land, buildings , & eq ui pment : basis

b Less: accumulated depreciation

(attach schedule )

56 Investments - other (attach schedule)

57a Land, buildirgs , and equipment : basis

�fl Cost[] FMV

51 c

52

855.1 53

54

907.

55a

55b

55c

56

57a

1, 139, 097.

57b

126 , 418.

b Less accumulated depreciation

(attach schedule )

58

59

L-57 Stint

Other assets (describe ►

Total assets (add lines 45 through58) (must equal line 74)

2, 853, 899.

60 Accounts payable and accrued expenses

61 Grants payable

A

T

E

S

A

Ts

317,962.

)

73

74

599 081.

64b

238, 473.

184, 995.

1, 022, 549.

1, 294 225. 67

513, 120. 68

69

2, 209, 519.

459, 916.

X and complete lines 67

67 Unrestricted

68 Temporarily restricted

69 Permanently restricted

E

3, 691, 984.

164 220 . 65

1, 046, 554. 66

o Organizations that do not follow SFAS 117 , check here ►

and complete lives

F

70 through 74

70 Capital stock , trust principal , or current funds

N

D

71 Paid-in or capital surplus , or land,building , and equipment fund

B

A

72 Retained earnings , endowment, accumulated income , or other furds

L

A

N

1,012, 679.

62

63

64a

b Mortgages and other notes payable (attach schedule)

65 Other liab il ities (describe ► See Line 65 Stmt

66 Total liabilities (add lines 60 through65)

Organizations that follow SFAS 117, check here through 69 and lines 73 and 74

58

59

564, 372. 60

61

62 Deferred revenue

63 Loans from officers, directors, trustees , and key employees (attach schedule)

64a Tax - exempt bond liab il ities (attach schedule)

B

1

T

509, 215. 57c

)

Total net assets or fund balances (add lines 67 through 69 or lines 70 th rough

72; column (A) must equal line 19, column (B) must equal line 21)

Total liabilities and net assets/fund balances (add lines 66 and 73)

70

71

72

1, 807, 345.

2,853, 899.

73

74

2, 669, 435.

3, 691, 984.

Form 990 is available for public inspectionand, for some people, serves as the primary or sole source of information abouh particular

organization How tie public perceives an organization insuch cases may be determined by the uformation presentedon its return. Therefore,

please make sure the retun is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments

BAA

TEEA0103

01/07/05

'Form 990 (2004)

74- 1900345

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT , INC.

JIMMM List of Officers , Directors, Trustees, and Key Em

(A) Name and address

(B) Title and average hours

per week devoted

to position

SHERRY-DISHMAN

--------------------645 PEYTON DRIVE

---------------------BEAUMONT, TX 77706

TREASURER

LINDA DOMINO

----------------------

Page4

to ees (List each one even if not compensated , see instructions )

(D) Contributi ons to

(E) Expense

(C) Compensation

(if not paid,

employee benefit

account and oth er

and

deferred

allowances

enter -0-)

plans

compensation

AS

0.

0.

0.

AS

0.

0.

0.

AS

0.

0.

0.

As

0.

0.

0.

AS

0.

0.

0.

66,290.

0.

0.

890 BRANDYWINE

--------------------BEAUMONT, TX 77706

DIRECTOR

AMELIE COBB

---------------------2511 LONG AVENUE

---------------------BEAUMONT, TX 77702

DIRECTOR

DONNA HARRIS

---------------------735 THOMAS ROAD

---------------------BEAUMONT, TX 77706

DIRECTOR

RUSSELL J. _CHIMENO_

P.O. BOX 3948

---------------------BEAUMONT, TX 77704

DIRECTOR

----------------------

Statement- - - - ------------

See List of Officers, Etc.

75

Did any officer, director, trustee,or key employee receive aggregate compensation ofrnore

than $100,000 from your organization and all related organizations, of ihich more than

$10,000 was provided by the related organizations?

If 'Yes,' attach schedule - see instructions.

Yes

XQ No

Form 990 (2004)

BAA

TEEA0104

01/07/05

74-1900345

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

'Form 990 (2004)

Other Information (See instructions .)

Yes

Did the organization engage in any activity not previously reported to the IRS ? If 'Yes,'

attach a detailed descriptionof each activity

77 Were any changes made in he organizing or governing documents but not reported to the IRS?

If 'Yes,' attach a conformed copy ofthe changes.

78a Did the organization have unrelated business gross income of$1,000 or more during the year covered by this return?

b If 'Yes ,' has it filed a tax return on Form 990-T for th is year?

Pages

No

76

Was there a liquidation, dissolution, termination, or substantial contraction dung the

year ? If Yes,' attach a statement

79

76

77

X

X

78a

78b

X

79

X

80a Is the organization related (other thanby association with a statewideor nationwide organization ) through common

membership , governing bodies, trustees, oficers , etc, to any other exempt or nonexempt organization?

b If 'Yes,'enter the name of the organization

and check whether it is _11 exempt or- _11 nonexempt.

1 81 al

81 a Enter direct and indirect political expen ditures See line 81 instructions

0.

b Did the organization fil e Form 1120-POL for this year?

80a

j

X

8 bb

X

82 a Did the organization receive donated services or the use of materials, egwpmentpr facilities at no charge or at

substantially less than fair renbl value?

82a

X

b If 'Yes,' you may indicate the value ofthese items here . Do not include this amount as

revenue in Part I or as an expense in Part II (See instructions in Part III.)

1 82b 1

83a Did the organization comply with the public inspection requirements br returns and e)emption applications?

b Did the organization comply with the disclosure requirements relating to quidpro quo contributions7

84a Did the organization solicit any contributions or gifts th at were not tax deductible?

83a

83b

84a

b If 'Yes,' did the organization include oath every solicitation an express statement that such contnbufions or gifts were

not tax deductible?

85 501 (c)(4), (5), or (6) organ izations. a Were substantially all dues no ndeductible by members?

b Did the organization make only in-house lotbying expenditures of $2,000 or less?

84b

85a

85b

NA

NA

85g

NA

85 h

NA

X

X

X

If'Yes' was answered to either 85a or85b , do not complete 85c through85h below unless the organization received a

waiver for proxy tax owed for the prior year

c

d

e

f

g

Dues, assessments , and similar amounts from members

Section 162 (e) lobbying and politcal expenditures

Aggregate nondeductible amountof section 6033 (e)(1)(A) dues notices

Taxable amount of lobbying and political expenditures (line 85d less 85e)

Does the organization electto pay the section 6033 (e) tax on the amount on line 85f'

85c

85d

85e

85f

h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line85f to its reasonable estimate of

dues allocable to nondeductible lobbying and political expenditures for the following tax year?

86 501 (c)(7) organizations Enter- a Initiation fees and capital contribu ti ons included on

line 12

86a

86b

b Gross receipts , included online 12, for public use of club facilities

87a

87 501 (c)(12) organizations Enter a Gross income from members or shareholders

bGross income from other sources (Do not netamounts due or paid to other sources

against amounts due or received from them.)

87b

NA

NA

NA

NA

NA

NA

NA

NA

At any time during the year , did th e organization own a 50% or greater interest ina taxable corporation or partnership,

or an entity disregarded as separate from the organization uder Regulations sections 301 7701-2 and 301 7701-37

88

If 'Yes,' complete Part DC

89a 501 (c)(3) organizations. Enter Amount of tax imposed on the organization during the year under

NA

section 4911 ►

NA , section 4912

NA section 4955

88

b 501(c)(3) and 501(c)(4) organizations Did the organization engage in any section 4958 excess benefittransaction

during th e year or did it become aware of an excess benefit transaction from a prior year? If Yes,' attach a statement

explaining each transaction

89b

X

„

X

c Enter Amount of tax imposed on the organization managers or disqualified persons during the

year under sections 4912, 4955, and 4958

0.

Enter : Amount of tax on line 89c, above, reimbursed by theorganization

NONE

List the states with which a copy of this return is filed ►

------------------------------ -90b

Number of employees employed in the pay period that includes March 12, 2004 (See instructions.)

30

Telephone number ►

(4 0 9) 8 35-7118

The books are in care of ► DEAN TERREBONNE

-------------------------------------ZIP + 4 ► 77701

Located at ► 2780 EASTEX FREEWAY, BEAUMONT, TX

---------------------------------------------- -------1092 Section 4947(a)(1) nonexempt charitable trusts filing Form 990 in lleuof Form 1041 - Check here

►I 92

and enter the amount of tax-exempt interest received or accrued during thetax year

Form 990 (2004)

BAA

d

90a

b

91

F]

TEEA0105

01/07/05

74-1900345

Page 6

'Form 990 (2004) CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

Nffi� Analysis of Income-Producing Activities (See instructions)

Excluded by section 512 , 513, or 514

(E)

Unrelated business income

Note : Enter gross amounts unless

(A)

(C)

(D)

Related or exempt

(B)

otherwise indicated.

Exclusion code

Amount

function income

Business code

Amount

93 Program service revenue

31,155.

a CHILD CARE SERVICES

35,129.

b IMMIGRATION

15,327.

c SOCIAL SERVICES

d

e

f Medicare/Medicaid payments

g Fees & contracts from government agencies

94

6,212,071,

Membership dues and assessments

95 Interest on savings & tempora ry cash invmnts

96 Dividends & Inrest from securities

31,063.

Net rental income or ( loss) from real estate:

a debt-financed property

b not debt - financed property

98 Net rental income or ( loss) from pers prop

99 Other investment income

100 Gain or (loss) from sales of assets

other than inventory

97

101

Net income or (loss ) from special events

102

Gross profit or (loss) from sales of invento ry

1

208,474.

Other revenue: a

103

b

C

d

e

208,474.1

1111.

104 Subtotal (add columns ( B), (D), and (E))

105 Total (add line 104, columns (B), (D), and (E))

Note : Line 105 plus line 1 d, Part 1, should equal tie amount on line 12, Part

6,324,745.

6,533,219.

Relationship of Activities to the Accomplishment of Exempt Purposes (See instructions)

Line No .

Explain how each activity for which income is reported incolumn (E) of Part VII contributed importantly to the accomplishment

of th e organization ' s e)empt purposes (other than by providing finds for such purposes).

93aiFEES CHARGED FOR QUALIFYING CHILD CARE

93bIFEES CHARGED PARTICIPANTS BASED ON ABILITY TO PAY

Infnrmatinn Renardinn TaYahle Subsidiaries and Disrenarded Entities (See instructinns )i

N /A

(A)

(B)

(C)

(D)

(E)

Name, address, and EIN ofcorporation,

partnership, or disregarded entity

Percentage of

ownership interest

Nature of activities

Total

income

End-of-year

assets

00

Information Regarding Transfers Associated with Personal Benefit Contracts (See instructions)

a Did the organization , during the year, receive any funds, directly or indirectly, to pay premiums on a personal benefit contract?

b Did the organization, during the year, pay premiums, directly or I

Note : If 'Yes' to (b), file Form 8870 and Form 4720 (see instruction

Under penaltte

pequry, I care at I _ havepiennyp4.khrs return , mcludm

Please

Sign

Signattre of officer

Here

E�80�/NC

W

ype or print name and title

Paid

Preparer's

Use

Only

BAA

Prepares

signaturee

110-

ZI

U,01-

Ed ands, Tate & Fontenote

► 43

row Road Suite B

Beaumont

Firm's name (or

empoyed )n

and

P+ 4

A -

Yes

I X No

(Form 990 or 990-EZ)

Department of the Treasury

Internal Revenue Se rv ice

OMB No 1545-0047

Organization Exempt Under

Section 501(cx3)

SCHEDULE A

(Except Private Foundation) and Section 501(e), 501(f), 501(k),

501(n), or Section4947(aX1) Nonexempt Charitable Trust

Supplementary Information - (See separate instructions.)

MUST be completed by the above organizations and attached to their Form 990 or 990-EZ.

2004

Employer identification number

Name of the organization

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT,

174-1900345

INC.

Compensation of the Five Highest Paid Employees Other Than Officers , Directors , and Trustees

(See instructions. List each one If there are none, enter 'None.')

(a) Name and address of each

employee paid more

than $50,000

(b) Title and average

hours per week

devoted to position

(c) Compensation

(d) Contributions

to employee benefit

plans and deferred

compensation

(e) Expense

account and other

allowances

NONE

-------------------------

Total number of other employees paid

over $50,000

NonesINEMEREMM

Compensation of the Five Highest Paid Independent Contractors for Professional Se rvices

(See instructions List each one (whether individuals or firms) If here are none, enter 'None )

(a) Name and address of each Independent contractor paid more than $50,000

(b) Type of service

I (c) Compensation

NONE

-----------------------------------------

Total number of others receiving over

10-1

$50,000 for professional services

None

BAA For Paperwork ReductionAct Notice, see the Instructions for Form 990 and Form 990-EZ.

TEEA0401

07/22/04

Schedule A (Form 990 or 990-EZ) 2004

Sched le A (Form 990 or 990-EZ) 2004

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC. 74-1900345

Page

Yes

Statements About Activities (See instructions)

No

During the year, has the organization attemptedto influence national, state, or local legislation, includingany attempt

1

to influence public opinion on a legislative matter or referendun7 If Yes,' enter the total expenses paid

0. $

or incurred in conrection with the lobbying activities

(Must equal amounts on line 38, Part VI-A, or line i of Part VI-B.)

0.

Organizations that made an electionunder section 501 (h) by filing Form 5768 must complete Part V-A Other

organizations checking 'Yes' must complete Part VI-B AND attach a statement giving a detailed cl;scription of the

lobbying activities.

During the year, has the organization, either directly or indirectly, engagedn any of the following acts with any

substantial contribubrs, trustees, directors, officers, creators, key employees, or members of their families, or with any

taxable organization wifi which any such person is affiliated as an officer, director, trustee, majority owner, or pincipal

beneficiary? (If the answer to any question is 'Yes,' attach a detailed statementexplaining the transactions

2

a Sale, exchange, or leasing of property?

lox

b Lending of money or other extension of credit?

2bJ

X

c Furnishing of goods, services, or facilities?

2cl

X

d Payment of compensation (or payment or reimbursement ofexpenses if more than $1,000)?

2dJ

X

e Transfer of any part of its income or assets?

2e

X

3a

3b

X

X

4a

4b

X

X

3a Do you make grants br scholarships, fellowships, student loans, et? (If Yes,' attach an

explanation of how you determine that recipients qualify to receive payments)

b Do you have a section 403(b) annuiV plan for your employees?

4a Did you maintain any separate account for participating donors where donors have the right b provide advice

on the use or distnbulon of funds?

b Do you provide credit counseling,debt management, credit repair, or debtne otiation services?

Reason for Non-Private Foundation Status (See instructions)

The organization is not a private foundation because it is (Please check only ONE applicable box )

A church , convention of churches , or association of churches . Section 170(b)(1)(A)(i)

5

A school. Section 170(b)(1)(A)( ii) (Also complete Part V.)

6

7

A hospital or a cooperative hospital service organization. Section 170(b)(1)(A)(iii)

8

A Federal , state, or local government or governmental unt. Section 170(b)(1)(A)(v)

A medical research organization operated in con j unctiorwith a hospital. Section 170(b)(1)(A)(iii) Enter the hospital ' s name, city,

9

10

and state

--------------------------------------------------------An organization operated br the benefit of a college or university ownedor operated by a governmental unit Section 170(b)(1)(A)(rv)

(Also complete the Support Schedule in Part IV-A.)

11 a

An organization that normally receives a substantial part of its supportfrom a governmental unitor from the general public

Section 170(b)(1)(A)(vi) (Also complete the Support Schedule in Part IV-A )

11 b

A community trust. Section 170(b)(1)(A)(vi) (Also complete theSupport Schedule in Part IV-A.)

12

13

X❑ An organization that normally receives (1) more than 33-1/3% of its support from contributions, membership fees, and gross receipts

from activities related to its charitable, etc, unctions - subject to certain exceptions, and (2) no more than 33-1/3% of its support

from gross investment income and inrelated business taxable income (less section 511 tax) from businesses acquired by the

organization after June30, 1975 See section 509(a)(2) (Also complete theSupport Schedule in Part IV-A )

An organization that isnot controlled by any disqualified persons (other thanfoundation managers) and supports organizations

described in (1) lines 5 through 12 above, or(2) section 501(c)(4), (5), or (6), if they meet the test ofsection 509(a)(2). (See

section 509(a)(3) )

Provide the following information about the supported organizations (See instructions )

(a) Name(s) of supported organization(s)

(b) Line number

from above

14 n An organization organized and operatedto test for public safety. Section 509(a)(4) (See instructions.)

Schedule A (Form 990 or Form 990-EZ) 2004

TEEA0402 07/27/04

BAA

74-1900345

Schedule A (Form 990 or 990-EZ) 2004

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

Support Schedule (Complete only if you checked a box on line 10, 11, or 12) Use cash method of accounting.

Note : You may use the worksheetin the instructions for converting from the accrual to the cash method of accountirg

Calendar year (or fiscal year

beginning in )

15 Gifts, grants, and contributions

Page 3

(a)

2003

(b)

2002

(c)

2001

(d)

2000

(e)

Total

461, 059.

818, 377.

599, 543.

365, 820.

2, 244, 799.

6, 826, 253.

6, 300, 163.

7, 339, 505.

7,484, 109.

27, 950, 030.

16 570.

16,950.

19,287.

32,002.

84,809.

7, 303, 882.

477, 629.

73,039.

7, 135, 490.

835, 327.

71,355.

7, 958, 335.

618, 830.

79,583.

7,881, 931.

397, 822.

78,819.

30 279, 638.

2,329,608.

received. (Do not include

16

17

18

19

20

21

unusual grants. See line 28.)

Membership fees received

Gross receipts from admissions,

merchandise sold or services performed,

or furnishing of facilities in any activity

that is related to the organization's

charitable, etc, purpose

Gross income from interest, dividends,

amounts received from payments on

securities loans (section 512(a)(5)),

rents, royalties, and unrelated business

taxable income (less section 511 taxes)

from businesses acquired by the organization after June 30, 1975

Net income from unrelated business

activities not included in line 18

Tax revenues levied for the

organization's benefit and

either paid b it or expended

on its behalf

The value of services or

facilities furnished to the

organization by a governmental

unit without charge. Do not

include the value of services or

facilities generally furnished to

the public without charge

22

Other income. Attach a

schedule Do not include

gain or (loss) from sale of

capital assets

23 Total of lines 15 through 22

24 Line 23 minus line 17

25 Enterl%ofline23

26a

Organizations described on lines 10 or 11 :

a Enter 2% of amount in column (e), line 24

b Prepare a list for your records to show the name of and amount contributed by each person (other than a governmental unit or publicly

supported organization) whose total gifts for 2000 through 2003 exceeded the amount shown in line 26a. Do not file this list with your

260

return . Enter the total of all these excess amounts

c Total support for section 509(a)(1) test. Enter line 24, column (e)

01 26c

18

19

d Add: Amounts from column (e) for lines:

22

26b

11 26 d

01 26e

e Public support (line 26c minus line 26d total)

26f

%

f Public support percentage (line 26e (numerator) dividedby line 26c (denominator))

27 Organizations described on line 12:

a For amounts included in lines 15, 16, and 17 that were received from a 'disqualified parson,' prepare a list for your records to show the

name of, and total amounts received in each year from, each 'disqualified person. Do not file this list with your return . Enter the sum of

such amounts for each year

(2003)

0. (2000)0_

0. (2002)

0. (2001)

26

bFor any amount included in line 17 that was received from each person (other than'disqualified persons'), prepare a list for your records to

show the name of, and amount received for each year, that was more than thelarger of (1) the amount on line 25 for the year or (2)

$5,000 (Include in the list organizations described in lines 5 trough 11, as well as individuals ) Do not file this list with your return. After

computing the difference between the amount received and the larger amount described in(1) or (2), enter the sum of these differences

(the excess amounts) for each year

(2003)

0. (2000)

0.

0. (2002)

0. (2001)

15

16

c Add. Amounts from column (e) for lines.

2,244,799.

27c

27, 950, 030. 20

21

30, 194, 829.

17

27d

and line 27b total

0.

0.

d Add. Line 27a total

0.

27e

30, 194, 829.

e Public support (line 27c total minus line 27d total)

27f

30,279,638.

ElIJIMIJIM

f Total support for section509(a)(2) test: Enter amount from line 23, column (e)

27

99.72 %

g Public support percentage (line 27e (numerator) dividedby line 27f (denominator))

0.28 %

01 27h

h Investment income percentage (line 18 , column (e) (numerator) divided by line 27f (denominator))

Unusual Grants: For an organization described in line 10, 11, or 12 that received any unusual grants during 2000 through2003, prepare a

list for your records to show, fir each year, the name ofthe contributor, the date and amount of the grant, and a brief description of the

nature of the grant Do not file this list with your return . Do not include these grants in line 15.

Schedule A (Form 990 or 990-EZ) 2004

TEEA0403 07/23/04

BAA

28

A (Form 990 or 990-EZ) 2004 CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

74-1900345

Page 4

Private School Questionnaire (See instructions.)

(To be completed ONLY by schools that checked the box on line 6 in Part IV)

N/A

No

29

Does the organization have a racially nondiscriminatory policy toward students by statemenli its charter, bylaws,

other governing instrument, or in a resolution of its governing body?

30

Does the organization irclude a statement of its racially nondiscriminatory policy toward students in all its brochures,

catalogues, and other writbn communications with the public dealing with student admissions, programs,

and scholarships?

31

Has the organization piblicized its racially nondiscriminatory policy through newspaper or broadcast media during

the period of solicitation for students, or during the registration period if it has no solicitation program, in a way that

makes the policy known to all parts of the general community it serves?

If 'Yes,' please describe, if 'No,' please explain (If you need more space, attach a separate statement.)

32

--------------------------------------------------------Does the organization maintainthe followinga Records indicating the racial composition of be student body, faculty, and administrative staff?

b Records documenting that scholarships and other financial assistance are awarded on a racially

nondiscriminatory basis?

c Copies of all catalogues, brochures, announiements, and other written communications to the public dealing

with student admissions, programs, and scholarships?

d Copies of all material used by he organization or on its behalf to solicit contributions?

If you answered 'No'to any of the above, please expain. (If you need more space, attach a separate statement )

----------------------------------------------------------------------------------------------------------------Does the organization discriminate by race in any way wih respect to

33

a Students' rights or privileges?

b Admissions policies?

c Employment of faculty or administrative staff?

d Scholarships or other financial assistance?

e Educational policies?

f Use of facilities?

g Athletic programs?

h Other extracurricular activities?

If you answered 'Yes' to any of the above, please expain (If you need more space, attach a separate statement )

34a Does the organization receive any firancial aid or assistance from a governmental agency?

b Has the organization 's rightto such aid ever been revoked or suspended?

If you answered 'Yes' to either 34a or b, please explain using an attached statement.

35

BAA

Does the organization certify hat it has complied with be ap p licable requirements of

sections 4.01 through 4 05 of Rev Proc 75-50 , 1975-2 C.B. 587 , covering racial

nondiscrimination ? If'No,' attach an explanation

TEEA0404

07/23/04

orm yvu or

45

Lobbying nontaxable

amount

46

Lobbying ceiling amount

(150% of line 45(e))

47

Total lobbying

48

Grassroots nontaxable amount

49

Grassroots ceiling amount

(150% of line 48(e))

50

Grassroots lobbying

Lobbying Activity by Nonelectin g Public Charities

(For reporting only by organizations that did not complete Part Vl-A) (See instructions)

During the year, did the organization atbmpt to influence national, state or local legislation, including any

attempt to influence public opinion on a legislative matter or referendum, through the use of

N/A

Yes

No

Amount

Volunteers

Paid staff or management (Include compensation in expenses reported on lines c through h.)

Media advertisements

Mailings to members, legislators, or the pubic

Publications, or published or broadcast statements

Grants to other organizations for lobbying purposes

Direct contact with legislators, their staffs, government officials, or a legislative body

Rallies, demonstrations, seminars, conventions, speeches, lectures, or any other means

Total lobbying expenditures (add lines c through h.)

If 'Yes' to any of the above, also attach a statement givinga detailed description of the lobbying activities

Schedule A (Form 990 or 990-EZ) 2004

BAA

a

b

c

d

e

f

g

h

i

TEEA0405

07/23/04

Sched le A (Form 990 or 990-EZ) 2004

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

74-1900345

Page 6

Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations (See instructions)

51

Did the reporting organization directly or indirectly engage many of the following with any other organization described in section501(C)

of the Code (other than section 501 (c)(3) organizations) or in section 527, relating to political organizations?

Yes

a Transfers from the reporting organization to a nonchantable exempt organization of:

(i)Cash

51 a

a ii

(ii)Other assets

b Other transactions:

b (i)

(i)Sales or exchanges of assets with a norcharitable exempt organization

(ii)Purchases of assets from a noncharitable exemptorganization

b ( i)

(iii)Rental of facilities, equipment, or other assets

b (Iii)

(iv)Reimbursement arrangements

b (iv)

b (v)

(v)Loans or loan guarantees

b (vi)

(vi)Performance of services or membership or fundraising solicitations

C

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees

d If the answer b any of the above is Yes,' complete the following schedule. Column (b) should always show the fair market value of

the goods, other assets, or services given by the repo rtm rganization. If the organization received less than fair market value in

any transaction or sharing arrangement, show incolumn d) the value of the goods, other assets, or services received.

(a)

(b)

(c)

(d)

Line no

Amount involved

Name of rlonchantable exempt organization

Description of transfers, transactions, and sharing arrangements

52a Is the organization directly or indirectly affiliated wi6 , or related b, one or more tax-exempt organizations

described in section 501 (c) of theCode (other than section 501 (c)(3)) or in section 527'

► F] Yes X

No

X

X

X

X

X

X

X

X

X

No

Schedule A (Form 990 or 990-EZ) 2004

BAA

TEEAD406

11/29/04

IF

74 -1900345

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

Form 990, Page 2 , Part II, Line 43

Other Expenses Stmt

(A)

Total

Other expenses not

covered above ( itemize ):

(B)

Program

se rv ices

(C)

Management

and general

(D)

Fundraising

15,521.

4,778.

0.

2,070.

5, 551, 016.

1,585.

0.

485.

0.

0.

FUNDRAISING

23,272.

0.

0.

23,272.

MISCELLANEOUS EXPENSES

11,274.

7,461.

3,813.

0.

5, 607, 931.

5, 575, 583.

9,076.

23,272.

UTILITIES

CHILDCARE SUBCONTRACTORS

20,299.

5, 551, 016.

DUES

Total

Form 990 , Page 3 , Part IV , Lines 57a & 57b

Land , Buildings and Equipment Statement

(a)

Cost/Other

Basis

BUILDING

EQUIPMENT

Total

(b)

Accumulated

Depreciation

(c)

Book Value

985,097.

154,000.

22,775.

103,643.

962,322.

50,357.

1,139,097.

126,418.

1,012,679.

Form 990, Page 3, Part IV, Line 65

Other Liabilities Statement

Beginning

of Year

Line 65 - Other Liabilities :

ACCRUED LIABILITIES

DUE TO FUNDING AGENCIES:

TWC

Total

End of

Year

92,220.

72,000.

112,995.

72,000.

164, 220.

184, 995.

Form 990, Page 4, Part V

List of Officers, Etc. Statement

(A)

Name and address

FRAN LANDRY

8580 BRAEBURN

BEAUMONT, TX 77707

DONALD J MALONEY

2405 ASHLEY

BEAUMONT, TX 77702

(B)

Title and

average hours per

week devoted

to position

VICE PRESIDENT

AS NEEDED

DIRECTOR

AS NEEDED

(E)

Expense

account

and other

allowances

(C)

Compensation

(if not paid,

enter -0-)

(D)

Contributions

to employee

benefit plans

and deferred

compensation

0

0

0.

0.

0.

74- 1900345

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC

Continued

Form 990 , Page 4 , Part V

List of Officers , Etc. Statement

(A)

Name and address

RAMON L RODRIGUEZ, JR

5945 WOODWAY DRIVE

BEAUMONT, TX 77707

CAROLE MATTINGLY

2495 LOUISIANA AVE.

BEAUMONT, TX 77702

DEAN TERREBONNE

1410 NORTH STREET

BEAUMONT, TX 77701

2

(B)

Title and

average hours per

week devoted

to position

(C)

Compensation

(if not paid,

enter -0-)

(D)

Contributions

to employee

benefit plans

and deferred

compensation

(E)

Expense

account

and other

allowances

DIRECTOR

AS NEEDED

0.

0.

0.

DIRECTOR

AS NEEDED

0.

0.

0.

66,290.

0.

0.

PRESIDENT

AS NEEDED

0.

0.

0.

DIRECTOR

AS NEEDED

0.

0.

0.

DIRECTOR

AS NEEDED

0.

0.

0.

SECRETARY

AS NEEDED

0.

0.

0.

CAMILLE MOUTON

1215 LONGFELLOW #28

BEAUMONT, TX 77706

DIRECTOR

AS NEEDED

0.

0.

0.

MARK J KABALA

990 GOODHUE ROAD

BEAUMONT, TX 77706

DIRECTOR

AS NEEDED

0.

0.

0.

66,290.

0.

0.

KEVIN J. ROY

4925 BELLECHASE DR

BEAUMONT, TX 77706

DR. STEVEN SOCHER

17 OAKLEIGH

BEAUMONT, TX 77706

REV. TOM PHELAN

4300 MEEKS DRIVE

ORANGE, TX 77632

JACKIE SIMIEN

6 WINCHESTER COVE

BEAUMONT, TX 77706

EXECUTIVE DIRECTOR

40

HRS

Total

CATHOLIC CHARITIES OF THE DIOCESE OF BEAUMONT, INC.

74-1900345

Supporting Statement of:

Form 990 p 2/Other

Program Service

Exp

Description

Amount

HOSPITALITY CENTER-PROVIDES A CLEAN, SAFE AND

DIGNIFIED ENVIRONMENT TO PARTAKE IN A DAILY MEAL

TO THE ELDERLY ON FIXED INCOMES, TEMPORARILY

NEEDY, WORKING POOR, DISABLED AND HOMELESS

ELIJAH'S PLACE-PROVIDES ONGOING GRIEF SUPPPORT

SERVICES TO CHILDREN, AGES 5 TO 18, WHO HAVE

EXPERIENCED THE DEATH OF A PARENT OR SIBLING

Total

147,887.

60, 688.

208,575.

3