Macroeconomics and the Term Structure

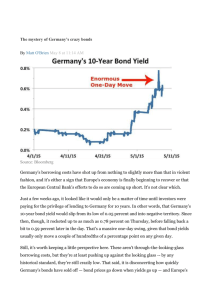

advertisement