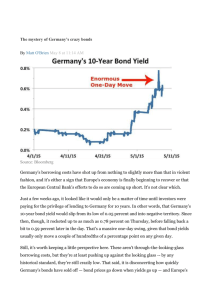

Macroeconomics and the Term Structure

advertisement