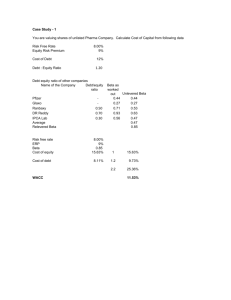

Financial Subject: WACC computation

advertisement

Financial Subject: WACC computation The Weighted Average Cost of Capital (WACC) is the return expected by all the stakeholders (shareholders and debt holders) who have provided funds to the company. This annual cost expressed as an interest rate represents the minimum return that needs to be generated by the company to meet its investors’ expectations. This note provides a detailed overview of the methodology used in practice to compute the WACC. To compute the WACC you have to calculate separately the financial return expected by the shareholders (K E ), also called the cost of equity, and the financial return expected by the providers of debt financing (K D ), the cost of debt, so as to compute a weighted average of the two expected returns according to their respective proportion in the capital structure of the company. The WACC is obtained by using the following formula: WACC = KE VE VD + K D (1 − T ) VE + VD VE + VD Where K E is the cost of equity, K D the cost of debt, V E the market value of equity, V D the market value of debt 1, and T is the corporate tax rate. To obtain the WACC, there are several steps that have to be followed in order to compute the different inputs for the WACC formula: • Estimate the cost of debt (K D ): The cost of debt is the minimum interest rate at which the company could raise new funds on the debt market. An easy way to estimate the average interest rate is to compute the ratio of the interest expenses to the company’s financial debt at the beginning of the period. However, this rate does not reflect the forthcoming debt refinancing cost for the company under its future capital structure. For this reason, the historical debt interest rate can hardly be considered as a good proxy for the cost of debt, especially if the current debt of the company is too old 2 and if the capital structure has changed or is expected to change in the future. In practice, the average current interest rate observed on recently 3 issued debt securities by comparable companies displaying a similar credit rating is often considered as a good proxy for the cost of debt. The cost of debt can also be easily calculated if the 1 We have to use the Net Debt which is calculated by subtracting the company’s cash and cash equivalents from the company’s debt 2 3 In this case, the debt market conditions are very likely to have changed Less than 3 months • • company has publicly traded debt securities, we can then use the yield on those bonds as our cost of debt. If this is not the case, another way of determining cost of debt is by the risk free rate, the default risk of the company and the tax advantage associated with debt. We have to estimate a default spread and add it to the risk free rate to find the cost of debt. If the firm has a credit rating, we can take the default spread corresponding to this rating, but if this is not the case, we have to estimate a synthetic rating ourselves and match it to the list. In the real world, estimating the bond rating is a complicated process and the issuance type should also be taken in to account. In our case, we simplifiy the process, by estimating the interest coverage ratio of the firm we can get an idea of its rating (the interest coverage ratio is calculated by dividing the EBIT with the Interest Expenses). Calculate the capital structure (or market gearing = V D /V E ): The capital structure is the mix of debt and equity used by the company to finance its operating activities. In the WACC formula, the capital structure has to be expressed in market value terms (not in accounting value terms). This means that the equity value used in the formula should be the market value of equity and not the paid in shareholders’ capital reported in the Balance Sheet. The debt value must be the market value of debt, net of cash and cash equivalents. The market value of debt is usually more difficult to obtain since very few firms have all their debt in the form of bonds trading in the market. Many firms have non-traded debt, such as bank loans, which is specified in book value terms. If the cost of debt is available, a simple way of finding the market value of a loan is to calculate the present value of the cash payments to the bank using cost of debt. Estimate the cost of equity (K E ): The cost of equity is the minimum required rate of return expected by the company’s shareholders. The most common model used to assess the cost of equity is the Capital Asset Pricing Model (CAPM) which states that the expected return on an asset relies on the current risk free rate and a risk premium which depends on the degree of correlation between the risk of the asset and the total risk of the market as measured by the variance of the returns. The CAPM formula is as follows: Ri = RF + βi ( RM − RF ) where R i is the expected return of the security or asset, R F is the risk free rate, β I is the equity beta of the company and R M is the expected return of the market portfolio. The term (R M -R f ) is called the Market Risk Premium. A common approach in finance when estimating a return is to start off with a risk free rate and then add a risk premium. The risk free rate reflects the time value of money and is usually determined by an asset that is defined to be risk free. For an asset to be risk free, its actual return must always be equal to its expected return and there must be no default risk. In practice, the government bonds of economically stable countries are used as an estimate because they approximate these conditions very closely. If, for example, we need the five year risk free rate, we use the yield of a five year government bond as a proxy. The currency of the risk free rate should be consistent with the currency of the cash flows to be discounted to avoid additional risk coming from foreign exchange fluctuations. The (R M -R f ) factor denotes the annual excess return on the market over the risk free rate. In other words, it estimates how much greater is the return expected on an equity investment in the stock market index compared to a fixed income investment in a risk free government bond. The equity risk premium is the excess return of a given stock when compared to the risk free rate, it is also known as the equity premium. However, the risk premiums can vary several percentage points depending on the method of calculation. The dominating technique for estimating the risk premium is to compute the annual excess returns on the stock market index over a longer time period and then take the arithmetic average of the premiums over the period. The best possible evaluation is reached when the standard deviation is minimized. A longer time period is usually necessary to achieve the standard deviation minimization. Depending on the time period used, the results can vary greatly. Using 100 years of data should provide a good estimation as long as the return that the investors expect has not changed over this period. If we believe that the excess returns demanded by the investors has changed over time, we could use the last 10 years for the estimation period. However, this means that the standard error might increase severely (it may be of the same magnitude as the risk premium itself). The risk premium can also change severely depending on which risk free security we use. Long term government bonds (10 years) are recommended. The equity beta, also referred to as the levered beta, can be estimated by taking a ratio of the the historical covariance between the daily share price return and the daily index return (used as a proxy for the whole market) and the variance of the daily market return. Cov( Ri , RM ) βi = Var ( RM ) For private companies, the calculation of the WACC raises additional technical problems as some required parameters such as the equity beta or the gearing cannot be observed on the market and are not available. A proxy for the equity beta can be estimated using the average of the betas observed on a sample of comparable listed companies. This approach requires making adjustments to take into account the sample heterogeneity in terms of capital structure because all the selected comparable listed companies (for comparison purposes with the non-listed firm) are unlikely to have the same capital structure. In this case, the unlevered beta, which reflects the riskiness of the company’s total assets, of each comparable company has to be calculated to exclude the impact of their capital structure on their equity beta. The unlevered beta is calculated using the Hamada formula: β unlevered = β equity 1 + (1 − T ) × VD VE The sample average of the unlevered betas can then be used as a proxy for the unlevered beta of the non-listed firm. A statistical test is useful to check wether the obtained unlevered beta lies within the required confidence interval, usually at least 90%. Finally, the estimated unlevered beta has to be relevered through the same formula using the target company’s capital structure to reach the sought after equity beta.