capital market review - IDLC Finance Limited

advertisement

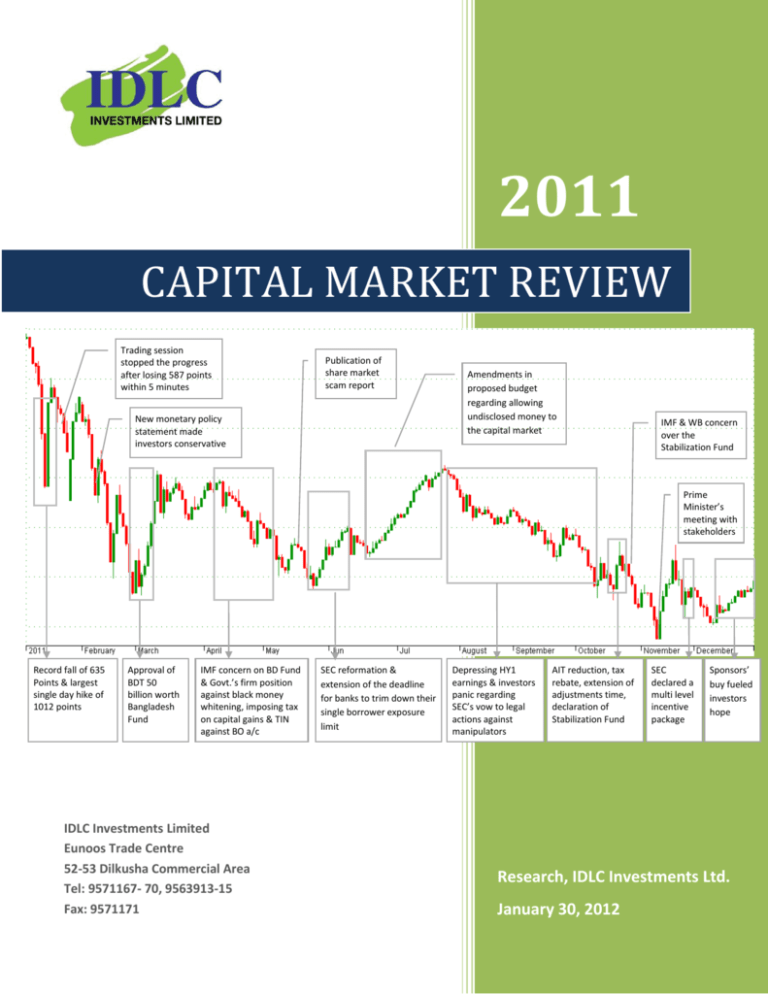

Research, IDLC Investments Ltd. 2011 CAPITAL MARKET REVIEW Trading session stopped the progress after losing 587 points within 5 minutes Publication of share market scam report New monetary policy statement made investors conservative Amendments in proposed budget regarding allowing undisclosed money to the capital market IMF & WB concern over the Stabilization Fund Prime Minister’s meeting with stakeholders Record fall of 635 Points & largest single day hike of 1012 points Approval of BDT 50 billion worth Bangladesh Fund IMF concern on BD Fund & Govt.’s firm position against black money whitening, imposing tax on capital gains & TIN against BO a/c IDLC Investments Limited Eunoos Trade Centre 52-53 Dilkusha Commercial Area Tel: 9571167- 70, 9563913-15 Fax: 9571171 SEC reformation & extension of the deadline for banks to trim down their single borrower exposure limit Depressing HY1 earnings & investors panic regarding SEC’s vow to legal actions against manipulators AIT reduction, tax rebate, extension of adjustments time, declaration of Stabilization Fund SEC declared a multi level incentive package Sponsors’ buy fueled investors hope Research, IDLC Investments Ltd. January 30, 2012 Research, IDLC Investments Ltd. Bangladesh capital market flipped in FY11 after a steep rise in FY10. Against 83% return in 2010, DSE General Index lost 36.6% in Bangladesh Capital Market in FY11- a changing landscape 2011. DGEN loss was severe but more disastrous upshot of BD capital market of FY11 was “Loss of Confidence” among investors. Bangladesh capital market flipped in FY11 after a steep rise in FY10. Against 83% return in 2010, DSE General Index lost 36.6% in 2011. DGEN loss was severe but more disastrous upshot of BD capital market of FY11 was “Loss of Confidence” among investors. The bubble created during FY10 without any major correction, finally burst on December 19, FY10 while DGEN witnessed the steepest till date single day fall of 552 points or 6.7% to 7,654 since FY09. The down slope of the index continued till January 10, 2011, with frequent record sets and breaks. Market observed record fall of 635 points & largest single day hike of 1012 points in two consecutive days. To stabilize the market, SEC took several initiatives like increasing the margin loan ratio and allowing netting facilities to nonmarginable shares. But free fall of all indices continued and market outlook appeared grim with fear when on February 28, 2011, DGEN closed at 5203, a new low, with paltry turnover of BDT 4894 million. Though news of imminent formation of open-end mutual fund for BDT 50.0 billion to be sponsored by state-owned institutions aimed at stabilizing the capital market, helped to prevent further fall, the momentum did not last long. Govt’s pre-budget firm position on not allowing money whitening through the capital market, probability of imposing tax on capital gains and submission of TIN certificate against BO account fueled the steep fall of DGEN. Completion of long awaited SEC reformation and news on extension of the deadline for banks to trim down their single borrower exposure limit to December, 2011 from August, 2011 had set some affirmative futuristic inhalation in late May. Amendments in the proposed budget, especially regarding allowing undisclosed money to the capital market and other potential positive changes stimulated to continue a positive trend in June also. DSE at a glance 2010 2011 Change 243 4,009,913 235 1,560,912 -61% 16,434 6,642 -60% 818 41.25 849 30.77 4% -25% 35.68 23.84 -33% 8,290 6,878 5,205 445 218 5,258 4,384 3,910 501 232 -37% -36% -25% 56 14 31 37 6 Total Number of Corporate Bonds 2 3 Total Newly Listed Securities 21 8 Market Capitalisation to GDP (Ratio) 50.67 33.23 Source : DSE Monthly Review & Research, IDLC Investments Ltd. 1 -34% Total Trading Days Total Turnover value (BDT mn) Daily Average Turnover value (BDT mn) Average Volume (bn) Market Capitalisation (USD bn) Market Capitalization: Equity portion (USD bn) DSE General Index (DGEN) DSI Index DSE 20 Total Number of Listed Securities Total Number of Companies Total Number of Mutual Funds Significant Corporate Activities in FY11 13 new scrips made their debut. Keya Cosmetics and Keya Detergent merged in May. BEXTEX and BEXIMCO amalgamated in July. Indian High court passed judgment in Lafarge’s favor in August. Bangladesh fund had been launched on October 11. Uniform Face value was implemented on December 04. Source : Research, IDLC Investments Ltd. Free Float Index change 2-Jan-11 29-Dec-11 Change Large Cap 98.34 59.44 -39.55% Mid Cap 98.93 58.52 -40.85% Small Cap 99.28 58.69 -40.88% Mini Cap 99.78 64.58 -35.28% Micro Cap 99.24 73.56 -25.87% Source : Research, IDLC Investments Ltd. The depressed mode of market took place in late July again and continued throughout September, as investors panicked from SEC’s vow to legal actions against suspected investors. Investor pessimism, a weakening financial system, liquidity shortage all pushed toward the fall. Following investor activism on the street, regulatory bodies took certain measures to stabilize the market, of which relaxation of adjustment timeline for single borrower exposure of merchant 2|Page Research, IDLC Investments Ltd. bankers (from Dec 2011 to Dec 2012) was mentionable. Several stakeholders of capital market also took active steps to improve market. Especially, move taken by Bangladesh Association of Publicly Listed Companies (BAPLC) to mitigate the margin loan crisis, draw investors’ attraction. Following meeting with NBR, merchant banks, brokerage houses and other stakeholders, several stimulatory announcements were made. Among these include income tax rebate on stock market investment, lower taxes on mutual funds and halving of taxes on brokerage commission. Banks agreed to infuse funds into the drying stock market, and Bangladesh Association of Bankers (BAB) announced formation of Market Stabilization Fund. However, the market seemed a bit unsure as to the success of proposed steps and as no immediate impact was seen, investor confidence eroded further. Negative observation from World Bank and IMF only made the erosion faster. Regional markets Country (index) Bangladesh (DGEN) India (BSE 30) Taiwan ( Taiwan Weighted) HongKong (Hang Seng) Singapore (Straits Times) Thailand (SET) Malaysia (KLSE Composite) Pakistan (Karachi 100) Srilanka (CSE All Share Index) Source : DSE Monthly Review 3|Page YTD % change in Index Dec, 2010 PE Dec, 2011 PE -36.6% -34.7% -24.0% -19.2% -17.2% -4.5% -4.0% -10.4% - 30.94 23.89 15.00 20.00 16.00 15.00 18.00 9.00 24.69 13.62 17.61 13.00 10.00 11.00 10.00 15.00 8.00 15.82 Sector Index YTY change Dec-10 Dec-11 Change NBFIs 5885.48 Ceramics 1119.87 Textiles 3246.12 General Insurance 4246.70 Services & Real Estate 2998.20 Mutual Funds 1361.28 Miscellaneous 2376.07 Paper & Printing 3661.98 IT 2229.18 Engineering 4405.13 Banks 2765.52 Telecommunication 3422.97 Life Insurance 3143.99 Jute 5252.50 Fuel & Power 1869.32 Pharmaceuticals 1671.45 Cement 1897.61 Tannery 1976.05 Food & Allied 4167.84 Source : Research, IDLC Investments Ltd. 2415.55 577.96 1728.17 2370.45 1736.51 796.62 1432.09 2244.61 1384.98 2771.07 1804.64 2276.87 2105.63 3628.16 1298.98 1184.00 1356.49 1611.21 3489.72 -59% -48% -47% -44% -42% -41% -40% -39% -38% -37% -35% -33% -33% -31% -31% -29% -29% -18% -16% Research, IDLC Investments Ltd. On November 14, market saw DGEN breaking the psychological support level of 5000, reaching 4877. Panic spread further among already frustrated investors and the effort to leave out before its too late only made the market plunge at an accelerated pace. The depressed state of the market and investors protest led the govt. to act on the issue. Following up prime minister’s emergency meeting and finance ministry’s meeting, finally SEC declared a multi level incentive package on November 23, which consisted of short term, midterm and long term steps to stabilize the market. Among the proposals, some of the major ones were requiring sponsors to hold at least 30% stake, allowing Banks some flexibility in capital market investment, opening up sell side research and investment advisory service. Reaction was mixed among investors, as investors were still uncertain as to the proper implementation of the proposed steps. Sector wise PE Bank Financial Institutions Mutual Funds Engineering Food & Allied Fuel & Power Jute Textile Pharmaceuticals Paper & Printing Service & Real estate Cement IT Tannery Ceramic Insurance Tele Travel & Leisure Miscellaneous Market P/E Source : DSE Monthly Review PE (Dec 10) PE (Dec 11) 25.24 47.27 17.53 50.1 27.3 21.57 55.66 52.44 34.12 126.93 43.93 33.44 64.91 20.66 106.86 64.64 20.35 65.45 19.54 29.16 10.50 12.15 6.24 26.4 16.41 13.95 32.64 22.66 22.52 42.23 25.82 21.6 38.93 15.6 30.2 20.37 20.62 23.07 8.02 13.68 All shares with uniform face value of BDT 10 had been started trading on December 04. In the very last week of 2011, market showed a positive trend, primarily for the Sponsor’s buy. On December 29, the last trading session of the year 2011, DGEN ended at 5257.6. While the steep escalation of DGEN could not be justified by underlying fundamentals, restrictive monetary policy to curb rising inflation and to arrest depreciation of local currency was also instrumental behind acute fall of DGEN from December, 2010. Eroding confidence due to lack of consistency in the policy measures and bleak economic outlook accentuated the fall. Name of IPOs/RPOs : FY 2011 Name of the IPOs/RPOs Public Issue (BDT mn) MJL Bangladesh Limited 4,600 M. I. Cement Factory Limited 3,348 Bangladesh Shipping Corporation (RPO) 3,137 LR Global Bangladesh Mutual Fund One 1,500 Barakatullah Electro Dynamics Limited 1,200 EBL NRB Mutual Fund 750 Zahintex Industries Limited 500 Southeast Bank 1st Mutual Fund 500 MBL 1st Mutual Fund 500 AIBL 1st Islamic Mutual Fund Subordinated 25% Convertible Bonds of BRAC Bank Limited (RPO) Rangpur Dairy & Food Products Limited 500 Reliance Insurance Mutual Fund 275 Salvo Chemical industry Limited 260 Deshbandhu Polymer Limited Total issue size 300 294 160 17,824 Source : Research, IDLC Investments Ltd. Disclaimer: This Document has been prepared and issued by IDLC Investments Limited on the basis of the public information available in the market, internally developed data and other sources believed to be reliable. Whilst all reasonable care has been taken to ensure that the facts & information stated in the Document are accurate as on the date mentioned herein. Neither IDLC Investments Limited nor any of its director, shareholder, member of the management or employee represents or warrants expressly or impliedly that the information or data of the sources used in the Document are genuine, accurate, complete, authentic and correct. Moreover none of the director, shareholder, member of the management or employee in any way be responsible about the genuineness, accuracy, completeness, authenticity and correctness of the contents of the sources that are publicly available to prepare the Document. It does not solicit any action based on the materials contained herein and should not be construed as an offer or solicitation to buy sell or subscribe to any security. If any person takes any action relying on this Document, shall be responsible solely by himself/herself/themselves for the consequences thereof and any claim or demand for such consequences shall be rejected by IDLC Investments Limited or by any court of law. 4|Page