Capital Market Review 2012

advertisement

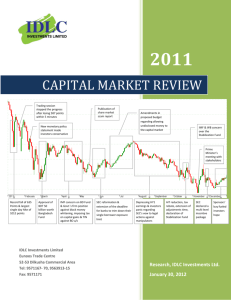

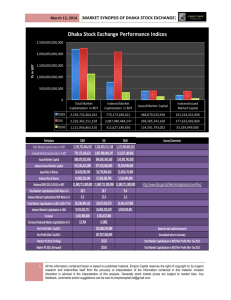

Research, IDLC Investments Ltd. 2012 CAPITAL MARKET REVIEW DGEN loses 19.75% Average Daily Turnover Falls by 36.86% Market Cap shrinks 8% 11.84 Bn Raised Through 14 IPOs Mid Cap Stocks Outperform Others Roadmap Announced for Capital Market IDLC Investments Limited Eunoos Trade Centre 52-53 Dilkusha Commercial Area Tel: 9571167- 70, 9563913-15 Fax: 9571171 Salim Afzal Shawon Research, IDLC Investments Ltd. January 07, 2013 Capital Market Review 2012 Bangladesh Capital Market 2012 - Rough Journey Continues Market Indicators: After 36.6% decline in 2011, 2012 passed as another depressive year for investors, with key index DGEN losing 19.75% over the year. Following two consecutive losing years, DGEN is now 52.69% below from its peak value of 8918.51 in December 05, 2010. Over 2012, the index lost 1038.29 points, closing at 4219.31 points. In the way between, DGEN bottomed on Feb 06 2012 at a 27-month low of 3616.24. Since there, it reversed and subsequently reached at 5502 points on Apr 17 2012, which was the highest in 2012. In addition to decline in index, plunge in turnover was also apparent in 2012. 2012 Average daily turnover stood at BDT 4159 mn, 36.86% less than 2011 figure of BDT 6587 mn. On Jul 08 2012, Turnover hit a 39 month low at BDT 1157 mn. Aided by a revived primary market, number of listed securities increased from 501 to 515 in 2012. However, despite the contribution from new listings, 2012 observed an 11% decline in equity portion of market capitalization, and 8% drop in aggregate market capitalization. 541 295 288 109 98 -50 -161 -365 -414 2010 2011 2012 244 235 238 - 4,010 1,561 1,001 -36% 16,514 6,587 4,159 -37% 70 72 91 26% Market Capitalization (USD Bn) Market Capitalization: Equity portion (USD Bn) 43.99 32.81 30.14 -8% 38.05 25.42 22.67 -11% DSE General Index (DGEN) 8,290 5,258 4,219 -20% DSI Index 6,878 4,384 3,577 -18% DSE 20 Total Number of Listed Securities 5,205 3,910 3,473 -11% 445 501 515 3% 218 232 242 4% Total Number of Mutual Funds Total Number of Corporate Bonds 31 37 41 11% 2 3 3 0% Total Newly Listed Securities Market Capitalization to GDP (Ratio) 21 14 14 0% 50.67 33.23 26.27 -21% Total Trading Days Total Turnover value (BDT Bn) Daily Average Turnover value (BDT mn) Average Volume (BDT mn) Total Number of Companies Change Source: IDLC Research Market Behaviour: Still Event-Driven and Volatile DGEN: Monthly Change in 2012 700 500 300 100 -100 -300 -500 -700 -900 -1100 -1300 DSE at a Glance -122 -283 -1104 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: IDLC Research While almost two years have passed since 2010 crash, market sentiment has not improved enough to expect a recovery. Confidence is still shaky, and any negative sign still sparks panic amid general investors. DSE thus continued to show event driven volatile movements in 2012. Average movement in DGEN was 588.02 points monthly for 2012. Meanwhile, true extent of volatility was observed in turnover during the year 2012. As sentiment went back and forth, market observed high movement in turnover, mostly negative. 2|Page Capital Market Review 2012 Market Depth: Shaky Confidence Yields Low Participation BDT mn Turnover 2012 10,000 As confidence has not restored fully in the bourse, investor participation saw a draught throughout the year 2012. Apart from April and September, turnover mostly hovered below BDT 4000 mn daily. As 2012 ended, turnover registered a 36.86% fall in average daily turnover, dropping from an average of BDT 6587 mn daily in 2011 to BDT 4159 mn daily in 2012. In addition, average daily turnover have also fallen below the level of 2009, on a historical basis. Over 2004-2012 horizon, daily turnover peaked in 2010, at BDT 16434 mn. Compared to the peak, daily turnover have fallen by 74.41% by 2012. 8,934 8,027 8,000 6,000 4,000 5,605 4,206 4,035 4,091 3,187 3,013 2,769 1,968 1,932 2,144 2,000 Jan Feb Mar Apr May Jun Jul Month Avg 2012 Avg BDT mn 20,000 Aug Sep Oct Nov Dec 2011 Avg Avg Daily Turnover 2004-2012 16,434 15,000 10,000 5,000 6,642 6,046 264 251 303 1,362 2004 2005 2006 2007 4,206 2,818 2008 2009 2010 2011 2012 Source: IDLC Research Sector Performance: Sector Index 2011 Index 2012 Food & Allied 396.28 493.78 24.61% Telecom 107.13 129.90 21.25% Cement 134.28 141.54 5.41% Power 166.45 161.04 -3.25% Life Insurance 218.86 204.94 -6.36% IT 130.47 115.80 -11.24% Pharmaceuticals 142.03 125.59 -11.57% Tannery 174.99 149.99 -14.28% Textile 218.44 181.70 -16.82% NBFI 266.43 212.92 -20.08% Miscellaneous 188.40 149.77 -20.50% General Insurance 247.75 196.65 -20.63% 75.02 58.13 -22.52% Bank 192.49 142.98 -25.72% Engineering 274.04 195.63 -28.61% Services 145.54 86.34 -40.68% Jute 407.78 227.35 -44.25% Paper 320.47 154.42 -51.82% Ceramic %Change Since market was in backtrack, most of the sectors underperformed in 2012. In the Equity segment, only three Sectors posted positive return. Of the three positive movers, Food & Allied topped (24.61%), followed by Telecom (21.25%) and Cement (5.41%). Notably, movement of large cap scrips (BATBC, GP, Heidelberg) played a strong role in pushing the sectors upwards. In addition, newly listed BSCCL added significantly to telecom sector. Meanwhile, heavyweight bank sector lost 25.72% over 2012, followed by other financial sectors (NBFI -20.08%, Non-Life Insurance -20.63%). As financial sectors hold approximately 38% of total market capitalization, poor performance of financial sector acted as a prime catalyst behind DSE 2012 performance. In addition, Engineering and Textile lost 28.61% and 16.82% respectively. Amid other major sectors, Fuel & Power, Life Insurance and Pharmaceuticals beat DGEN despite having negative performance (-3.25%, -6.36% and -11.24% respectively). Source: IDLC Research 3|Page Capital Market Review 2012 Cap Wise Movement: Mid Caps Outperform Cap Wise Stock Movement 2012 Globally, small cap stocks are expected to outperform large and mid caps in a volatile market like ours. However, contrary to the common, large and mid caps have outperformed over small, Mini and Micro caps in DSE in the year 2012. On a YoY basis, Mid caps lost the least, 15.4%, while mini caps lost most, 25.9% over 2012. 20.00% 0.00% -20.00% -17% -15% Large Mid -40.00% -23% -26% -24% Small Mini Micro Source: IDLC Research Market Capitalization and Impact of IPOs Fuel & Power 11.34% 12.91% 1.57% Pharma 8.49% 8.09% -0.40% NBFI 9.15% 8.08% -1.08% Engineering 5.12% 4.14% -0.98% Cement 1.96% 4.10% 2.14% Textile 2.82% 3.54% 0.72% Food 2.76% 3.31% 0.55% Life Insurance 2.58% 2.87% 0.29% Non Life Insurance 2.97% 2.78% -0.19% Travel & Leisure 0.53% 2.66% 2.13% Mutual Fund 1.58% 2.21% 0.62% Miscellaneous 2.95% 1.66% -1.29% Ceramic 1.45% 1.22% -0.23% Tannery 0.69% 0.63% -0.06% Service 0.73% 0.48% -0.25% IT 0.21% 0.27% 0.06% Corporate Bond 0.36% 0.20% -0.16% Jute 0.04% 0.02% -0.02% Paper & Printing 0.04% 0.02% -0.02% Meanwhile, IPOs helped a number of sectors to increase their MCAP share in the market, notably Telecommunication (+3.03%), Travel & Leisure (+2.13%), and Fuel & Power (+1.57%). In addition, MCAP of Cement (+2.14%) saw improvement due to good performance of large cap HEIDELBERG. MCAP Addition by IPOs in 2012 (BDT Mn) Travel & Leisure Telecommunication Textile Mutual Funds Engineering Fuel & Power Life Insurance IT NBFI 37,153 17,325 15,817 8,221 5,411 2,136 1,965 1,847 1,751 40,000 3.03% 35,000 -6.45% 14.13% 30,000 26.67% 11.10% 25,000 33.12% Telecommunication 20,000 Bank Sector With most of the sectors posting negative returns, aggregate market capitalization shrank by 8%. However, effect of the shrinking was uneven across the sectors. The largest sector, Banks shrank by 6.45%, as the entire sector experienced significant erosion as expectations were pessimistic over Bank provisioning guidelines. 15,000 YoY Change 2012 10,000 Industry Cap 2012 5,000 Industry Cap 2011 - Sector MCAP as a % of Total MCAP Source: IDLC Research Source: IDLC Research Momentum in Primary Market: After 2010 Dec crash, primary market was very much depressed in 2011, as investor sentiment was unfavourable towards new issues in a distressed market. However, the situation turned in 2012, and the long depressed primary market seems to gain momentum. After staying low since 2010 Dec market crash, regulators finally shook off the go-slow stance towards new issues. As regulators started rolling on the issues, the primary market got a momentum. During 2012, 14 IPOs (10 equity stocks and 4 Mutual Fund) got 4|Page Capital Market Review 2012 listed at DSE, adding a total of BDT 91.63 Bn to market capital. Out of the 10 Equity stocks, ENVOYTEX was the largest in terms of public issue size, while UNIQUEHRL was largest in terms of MCAP addition to the market. As part of the package announced in late November 2011, Bangladesh Securities and Exchange Commission (BSEC) put a 20% quota in most of these IPOs for affected investors, which acted as a driver to boost up sentiment. The buoyancy put some liquidity pressure on secondary market as well. Having multiple IPO subscriptions during the same month often channelled some liquidity from secondary market. IPOs in 2012 Sl. No. Name of Issue Listing Date Trading Date Public Issue BDT mn MCAP BDT mn 1 AB Bank 1st Mutual Fund (ABB1STMF) 11-Jan-12 NLI First Mutual Fund (NLI1STMF) 6-Feb-12 29-Jan-12 27-Feb-12 1,500 2 458 1,560 421 3 First Bangladesh Fixed Income Fund (FBFIF) 22-Feb-12 19-Mar-12 5,000 5,050 4 GSP Finance Company (Bangladesh) Limited (GSPFINANCE) 27-Mar-12 9-Apr-12 500 1,751 5 Padma Islami Life Insurance Limited (PADMALIFE) 8-Apr-12 18-Apr-12 120 1,965 6 GPH Ispat Limited (GPHISPAT) 8-Apr-12 19-Apr-12 600 5,411 7 NCCBL Mutual Fund-1 (NCCBLMF1) 10-May-12 24-May-12 1,000 1,190 8 GBB Power Limited (GBBPOWER) 20-May-12 13-Jun-12 205 2,136 17,325 Bangladesh Submarine Cable Company Limited (BSCCL) 29-May-12 10 Saiham Cotton Mills Limited (SAIHAMCOT) 29-May-12 14-Jun-12 24-Jun-12 310 475 3,828 11 Unique Hotel & Resorts Limited (UNIQUEHRL) 14-Jun-12 2-Jul-12 260 37,153 12 Aamra Technologies Limited (AAMRATECH) 14-Jun-12 4-Jul-12 216 1,847 13 Generation Next Fashions Limited (GENNEXT ) 15-Nov-12 5-Dec-12 300 4,837 Envoy Textiles Limited (ENVOYTEX) 3-Dec-12 9-Dec-12 900 7,153 11,843 91,626 9 14 Total Source: IDLC Research Regulatory Overhauls and Market Developments While 2012 seems another poor year from return perspective, it does incorporate significant regulatory changes and progresses. The bourse saw some significant structural changes, including the following: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Implementing Mandatory shareholding requirement from BSEC by corporate directors Development of draft guidelines on Research and Investment Advisor services Amending Margin Loan Rules Progress in Omnibus account closeout Developing BSEC Roadmap for capital market Initiation of demutualization process for the Exchange Implementing New MSA-Plus Software for Trading Amendment in the Mutual Fund Rules Inaugurating Surveillance system by BSEC Progress in introducing new Indices for DSE While immediate impact was not significant for most of these events, we do expect mid and long term impact of these changes in market development. Post a crash, such developments are of prima essential for restoring market confidence, and 2012 proved more as a year of development than another depressing year. 5|Page Capital Market Review 2012 Disclaimer: This Document has been prepared and issued by IDLC Investments Limited on the basis of the public information available in the market, internally developed data and other sources believed to be reliable. Whilst all reasonable care has been taken to ensure that the facts & information stated in the Document are accurate as on the date mentioned herein. Neither IDLC Investments Limited nor any of its director, shareholder, member of the management or employee represents or warrants expressly or impliedly that the information or data of the sources used in the Document are genuine, accurate, complete, authentic and correct. Moreover none of the director, shareholder, member of the management or employee in any way be responsible about the genuineness, accuracy, completeness, authenticity and correctness of the contents of the sources that are publicly available to prepare the Document. It does not solicit any action based on the materials contained herein and should not be construed as an offer or solicitation to buy sell or subscribe to any security. If any person takes any action relying on this Document, shall be responsible solely by himself/herself/themselves for the consequences thereof and any claim or demand for such consequences shall be rejected by IDLC Investments Limited or by any court of law. 6|Page