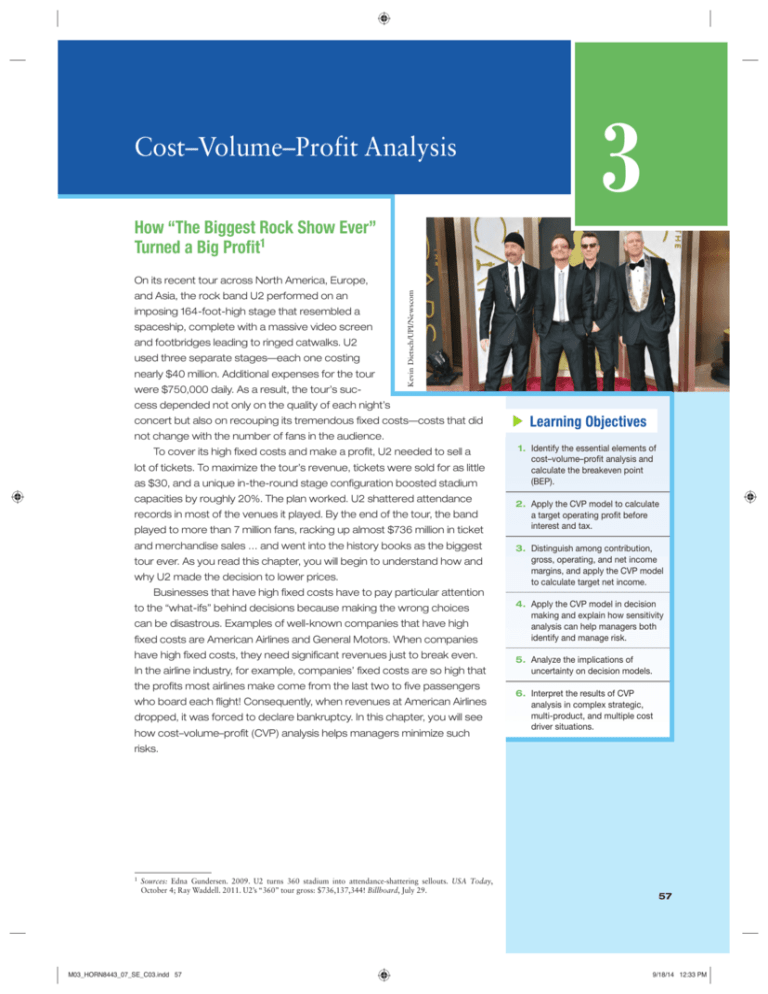

Cost–Volume–Profit Analysis

advertisement