The design of an ABC system In theory and at DSB

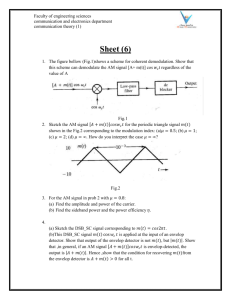

advertisement