of 0

advertisement

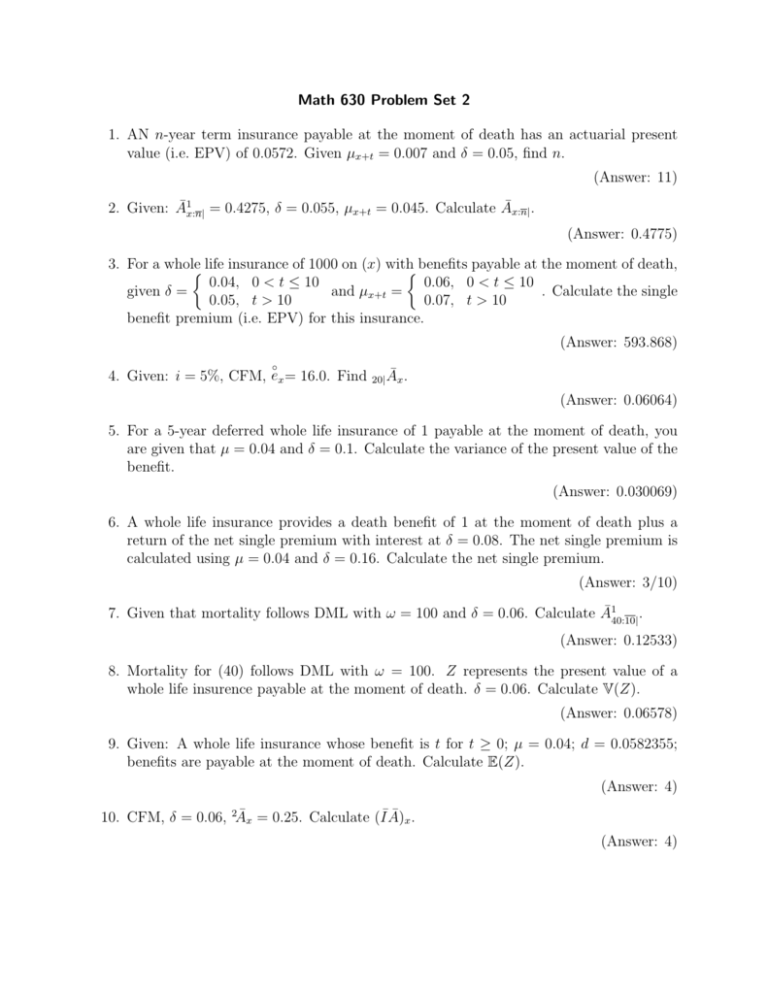

Math 630 Problem Set 2 1. AN n-year term insurance payable at the moment of death has an actuarial present value (i.e. EPV) of 0.0572. Given µx+t = 0.007 and δ = 0.05, find n. (Answer: 11) 2. Given: Ā1x:n| = 0.4275, δ = 0.055, µx+t = 0.045. Calculate Āx:n| . (Answer: 0.4775) 3. For a whole life insurance of 1000 on (x) withbenefits payable at the moment of death, 0.04, 0 < t ≤ 10 0.06, 0 < t ≤ 10 given δ = and µx+t = . Calculate the single 0.05, t > 10 0.07, t > 10 benefit premium (i.e. EPV) for this insurance. (Answer: 593.868) ◦ 4. Given: i = 5%, CFM, ex = 16.0. Find 20| Āx . (Answer: 0.06064) 5. For a 5-year deferred whole life insurance of 1 payable at the moment of death, you are given that µ = 0.04 and δ = 0.1. Calculate the variance of the present value of the benefit. (Answer: 0.030069) 6. A whole life insurance provides a death benefit of 1 at the moment of death plus a return of the net single premium with interest at δ = 0.08. The net single premium is calculated using µ = 0.04 and δ = 0.16. Calculate the net single premium. (Answer: 3/10) 7. Given that mortality follows DML with ω = 100 and δ = 0.06. Calculate Ā140:10| . (Answer: 0.12533) 8. Mortality for (40) follows DML with ω = 100. Z represents the present value of a whole life insurence payable at the moment of death. δ = 0.06. Calculate V(Z). (Answer: 0.06578) 9. Given: A whole life insurance whose benefit is t for t ≥ 0; µ = 0.04; d = 0.0582355; benefits are payable at the moment of death. Calculate E(Z). (Answer: 4) 10. CFM, δ = 0.06, 2Āx = 0.25. Calculate (I¯Ā)x . (Answer: 4) 11. The purchase price of a washing machine is 600. Company ABC provides a 10-year warranty. In the event of failure for t ≤ 0, ABC will pay 600(1 − 0.1t)at time t of failure. There is a constant force of failure of 0.02, δ = 0.08. Calculate the APV (i.e. EPV) of the warranty given it is paid for at the time of purchase. (Answer: 44.14533) 12. Given: µ = 0.05, δ = 0.06, Z is the prsent value random variable of a 5-year deferred whole life insurance of 1000 on (x) payable at the moment of death. Calculate the 90th percentile of Z. (Answer: 628.19) 13. Z is the present value for a whole life insurance of 1 on (x) payable at the moment of death. Given that µx+t = 0.01t and δ = 0.04, calculate the 80th percentile of Z. (Answer: 0.7655) 14. A maintenance contract on a hotel promises to replace burned out light bulbs at the end of each year for 3 years. The hotel has 10,000 light bulbs. The light bulbs are all new. If a replacement bulb burns out it will be replaced with a new bulb. Given that q0 = 0.1, q1 = 0.3, q2 = 0.5. Each light bulb costs 1. i = 0.05. Calculate the APV of this contract. (Answer: 6688.26) 15. Gary, age 30, is subject to µ = 0.12 and wants to buy a 3-year $1000 endowment insurance. δ = 0.09. Determine the net single premium for this insurance. (Answer: 787.61) 16. For a special 3-year term insurance on (x) you are given qx+k = 0.02(k + 1), k = 0, 1, 2. The following are death benefits payable at the end of year of death. k bk+1 0 300,000 1 350,000 2 400,000 i = 0.06. Calculate the EPV. (Answer: 36829.06) 17. Given: DML with k| qx = 1/75 for all x, δ = 0.05, Z is the present value of a whole life insurance of $1 payable at the end of the year of death issued to (x). Determine V(Z). (Answer: 0.06222) 18. For a 20-year pure endowment of 1 on (x), you are given 0.05E(Z) where Z is the present value. Calculate i. 20 px = 0.65 and V(Z) = (Answer: 0.102186) 19. Given: A40 = 0.3, A40:20| = 0.45, 20 p40 = 0.9, i = 0.04. Calculate A60 . (Answer: 0.634813) 20. Given: Ax+1 − Ax = 0.015, i = 0.06, qx = 0.05. Calculate Ax + Ax+1 . (Answer: 1.18318) 21. Given: 1000(IA)50 = 4996.75, 1000A150:1| = 5.58, 1000A51 = 249.05, i = 6%. Calculate 1000(IA)51 . (Answer: 5073.07) 22. Deaths are UDD over each year of age. i = 0.10, qx = 0.05, qx+1 = 0.08. Calculate Ā1x:2| (Answer: 0.113592) (4) (2) 23. Assuming UDD and Ax = 1.00248Ax , find i. (Answer: 0.02) 24. Problems from Chapter 5 of the text: Exercises 5.1–5.9. Solutions or Hints to Selected Problems µ µ = 0.4275 + n Ex δ+µ δ+µ = 0.4275 + 0.05 = 0.4775. 2. Āx:n| = Ā1x:n| + n Ex . However, Āx = Ā1x:n| + n Ex Āx+n ⇒ ⇒ 0.45 = 0.4275 + n Ex · 0.45 ⇒ n Ex = 0.05. So, Āx:n| 3. Āx = Ā1x:10| + v 10 10 px · Āx+10 . We have v 10 10 px = e−0.4 e−0.6 = e−1 = 0.3678794412, Z 10 Z 10 t 1 e−0.04t e−0.06t (0.06) dt = 0.3792723353 v t px µx+t dt = Āx:10| = 0 0 Āx+10 = µ 0.07 = = 0.5833333333 δ+µ 0.05 + 0.07 Therefore, Āx = 0.3792723353 + (0.3678794412) · (0.5833333333) = 0.593868676 ⇒ The EPV of 1000 is 1000Āx = 593.87. ◦ 4. Under CFM, ex = 1/µ ⇒ µ = 1/16. i = 5% ⇒ δ = ln(1.05). Z ∞ Z ∞ µ −20(δ+µ) t e−δt e−µt µ dt = · · · = v t px µx+t dt = e = 0.0606413904 20| Āx = δ+µ 20 20 6. Let E be the single net premium. The present value of the benefit is then Z = v Tx (1 + Ee0.08Tx ) = v Tx + Ee0.08Tx v Tx where v = e−0.16 ⇒ E = E(Z) = E(v Tx ) + EE(e0.08Tx v Tx ) = 4 4 E = 20 + 12 E ⇒ E = 3/10. 0.04 0.16+0.04 0.04 + E 0.08+0.04 ⇒ Note that E(e0.08Tx v Tx ) = E(e0.08Tx e−0.16Tx ) = E(e−0.08Tx ) is the EPV of a continuous 0.04 whole life insurance of 1 with µ = 0.04 and δ = 0.08, which is equal to 0.08+0.04 . 1 1 8. First, recall that for DML, t px µx+t = ω−x . So, t p40 µ40+t = 60 . Z 60 Z 60 1 1 1 t e−0.06t dt = v t p40 µ40+t dt = · (1 − e−0.06·60 ) = 0.270188 E(Z) = 60 60 0.06 0 0 Z 60 Z 60 1 2 2t E(Z ) = v t p40 µ40+t dt = e−0.12t dt = 0.138785 60 0 0 2 ⇒ V(Z) = 0.138785 − 0.270188 = 0.06578. 9. First v = 1 − d = 1 − 0.0582355 = 0.9417645 ⇒ δ = − ln v = 0.06 Z ∞ Z Z ∞ t −δt −µt ¯ E(Z) = I Ā x = tv t px µx+t dt = te e µ dt = 0.04 0 0 ∞ te−0.1t dt 0 Use integration by parts to finish. 10. First, 2Āx = µ 2δ+µ I¯Ā x = ⇒ 0.25 = µ 0.12+µ ⇒ µ = 0.04. Z Z ∞ ∞ t −0.06t −0.04t tv t px µx+t dt = te e 0.04 dt = 0, 04 Z 0 0 ∞ te−0.1t dt 0 (Same as the previous problem.) 11. The is a 10-year term insurance with a variable warranty (i.e. benefit) payment of bt = 600(1 − 0.1t) at time t. The APV is Z 10 Z 10 t 600(1 − 0.1t)e−0.08t e−0.02t 0.02 dt bt v t p0 µ0+t dt = E(Z) = 0 0 13. First note that t px = e− Rt 0 µx+s ds 2 = e−0.005t The present value is Z = v Tx = e−0.04Tx . Let z0 = e−0.04t0 be the 80th percentile. Using a graph of z = e−0.04t , we have 2 0.8 = P (Z ≤ z0 ) = P (Tx ≥ t0 ) = t0 px = e−0.005t0 . Solving the above equation for t0 , we get t0 = 6.68047. So, the 80th percentile is z0 = e−0.04t0 = 0.7655. 14. Consider one bulb first. The possible replacement scenarios (outcomes) are listed in the following chart, where each “—” is the duration of a year and a dot means that a replacement occurs at that time. Scenario PV of the Cost — — — 0 — — —· v3 — —· — v2 —· — — v 2 — —· —· v + v3 —· —· — v + v2 —· — —· v + v3 —· —· —· v + v2 + v3 Probability p0 p1 p2 = 0.315 p0 p1 q2 = 0.315 p0 q1 p0 = 0.243 q0 p0 p1 = 0.063 p0 q1 q0 = 0.027 q0 q0 p0 = 0.009 q0 p0 q1 = 0.027 q0 q0 q0 = 0.001 The average (mean) cost for one bulb is the sum of the products of the present value and its probability. Therefore, for 10000 bulbs the value is 10000 0.315v 3 + 0.243v 2 + · · · + 0.027(v + v 3 ) + 0.001(v + v 2 + v 3 ) = = 1000v + 2800v 2 + 3700v 3 = 6688.262607 Another solution is to use a chart to keep track of the replacements according to the given mortality rates (probabilities). : p2 6300 XXXX p1* z q2 X X 3150 : p0 j 2700 XX H XXX q z X 2430 9000 H HH q1 HH p0 3150 0 270 : p1 XXX q XXX z 630 p0 : XXX q XXX z 90 10000 @ @ q@ 0 p0 @ @ R @ * 900 1 1000 H HH q0 HH j H 100 0 0 1 2 270 10 3 The numbers in red are the numbers of bulbs replaced at that times. The present value is then 1000v + (2700 + 100)v 2 + (3150 + 270 + 270 + 10)v 3 = 6688.262607 15. First, A130:3| = vq30 + v 2 1| q30 + v 3 2| q30 , and 3 E30 = v 3 3 p30 . Then A30:3| = A130:3| + 3 E30 . The answer is 1000A30:3| . 1 17. First note that k| qx = k px · qx+k = ω−x = −0.05 life time. Also note that v = e . E(Z) = 74 X k=0 v k+1 k| qx = 1 75 ⇒ ω − x = 75, the maximal remaining 1 (v + v 2 + · · · + v 75 ) = 0.25394 75 2 E(Z ) = 74 X v 2(k+1) k| qx = k=0 1 2 (v + v 4 + · · · + v 150 ) = 0.126708 75 ⇒ V(Z) = 0.126708 − 0.253942 = 0.06222. 19. Use A40 = A140:20| + v 20 20 p40 A60 = (A40:20| − v 20 20 p40 ) + v 20 20 p40 A60 21. First, A150:1| = vq50 ⇒ q50 = A150:1| (1 + i) ⇒ p50 = 1 − q50 . Then use (IA)50 = A50 + vp50 (IA)51 = (A150:1| + vp50 A51 ) + vp50 (IA)51 22. Ā1x:2| = δi A1x:2| where A1x:2| = vqx + v 2 1| qx = vqx + v 2 px qx+1 . (4) 23. Ax = i(2) (2) A i(4) x ⇒ i(2) i(4) = 1.00248 ⇒ √ 2( 1+i−1) √ 4( 4 1+i−1 = 1.00248 ⇒ √ 4 1+i+1 2 = 1.00248 ⇒ i