Developing a Successful Investment Program

advertisement

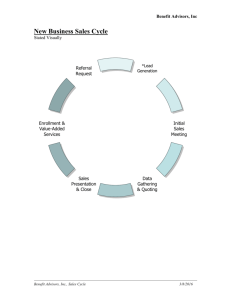

Developing a Successful Investment Program: Branch, Book and Marketing Once a financial institution (FI) has completed the transition of its financial services investment program to a new broker dealer (B/D), the most important goal for most programs is to grow the revenue. There are several steps to take to ensure the successful implementation of your investment program and the success of the financial advisors hired to provide guidance and customer service to clients. CFS and SPF provide a step-by-step process that will help any program – both start up and existing – to achieve their growth goals. Establish personal outreach and strong communications with program managers Most financial advisors in a financial institution work in either dual-employee, managed, or hybrid-managed programs. In a dual program, there is typically a dedicated program manager, usually employed by the financial institution. In managed or hybrid programs, the program manager is usually employed by the broker dealer and may have several programs to manage. There is typically also a regional program development manager that oversees the program managers at multiple programs. It is important for advisors and FI management to establish good communication channels and rapport with regional program development managers early in the process; they can be some of your strongest supporters. Both program managers and regional program development managers have the same goal – to remove any hurdles, help with integration, provide marketing support and provide access to additional resources needed to enhance the program’s success. They also clearly understand the chain of command and organizational structure of the bank or credit union in which the advisors are working so they can help streamline communications. Additional resources and specialists in the B/D back office can help with specific needs such as small business investment planning, insurance and trading, and program managers are often the conduit to these resources. Take advantage of program marketing support Program marketing support should be available from the B/D to help programs plan and build an annual marketing calendar and seasonal and/or life stage investment program strategies. Tactics offered may include branch referral training, client-facing workshops, marketing promotions, advertising concepts and public relations efforts. CFS and SPF offer this type of support through an easy access program development center portal that provides streamlined shortcuts to building successful marketing programs, tips, and examples of successful campaigns that have worked for other non-competing financial institutions. Conduct personalized program assessments After a minimum of six months of activity, and typically more likely done at one year, a production study becomes a beneficial exercise. In a production study, the B/D takes a threetiered approach – a detailed assessment of “branch, book, and marketing” to engage executive management, program managers and advisors in the same quest. Production studies from CFS and SPF go beyond the typical age-based and AUM breakdown of your business. A regional program development manager works closely with the program manager to look at a wide range of productivity metrics in order to better understand the “state of the business”– what’s working and what isn’t. We: Provide you with specific analytics, monthly benchmark data and direction needed to increase your annual business by at least 25% in a year Show how to engage all levels of your financial institution staff in discussions to improve awareness, credibility and integration Clearly define which marketing efforts are having the best effect Help advisors improve the quality and quantity of both branch and client/member referrals Present these findings to executive management at the FI to gain buy-in to program modifications and potential opportunities Target the right demographics to improve results: The Top 20% As you are heading into year two, you will want to refresh your marketing plan once you have completed the assessment and know what’s working. It is critical to identify ways to segment your advisors’ books of business to target the right audiences with most opportunity. It’s typical to find that the top 20% of clients will account for the majority of the revenue generated in your programs. Even though advisors may not realize it at first, segmentation of the book (and offloading of the lower half to two-thirds of it) actually improves the quality of communication and deepens relationships with the retained client base, prompting AUM increases and better referrals. When faced with a smaller client load, advisors will engage a deeper consultative approach that builds the relationship with the client and may lead to more wallet share being brought into the investment portfolio or the financial institution. It also allows another advisor to build better relationships with the offloaded “B” list of clients, growing them to top 20% list status. We recommend that advisors work with the program managers to do the following: Set goals for growth with the executive management of the financial institution Develop a new and improved, more targeted marketing plan Implement new processes that create efficiencies Plan key measurements – make a six-month commitment to hitting milestones Coach, measure, and monitor for continued success Sales training and coaching is critical in developing a successful investment program. When advisors take a more proactive, consultative and holistic approach, they will do a better job for financial services clients, build trust and bring more assets into the institution. However, if they have been used to simply being reactive to walk up traffic in the branches, or if they had such a large book of business that they’ve not had time to really meet with the clients, then they may require consistent coaching to change their processes and recognize the value of longer-term, deeper relationships. Education is key. Bring in additional sales training from the outside when it will enhance the advisors’ knowledge base and assist the customers. Sales training from external product partners can educate advisors well on the value of certain products and identify the types of clients for whom these products are most appropriate. Utilize subject matter specialists from the B/D to add products to each individual’s portfolio – many investors may need life, disability or long-term care insurance but if the financial advisor is unfamiliar with these products, he/she will be uncomfortable in presenting these products to clients. If they need additional support, the specialist is there to work with them and with the client. Don’t forget education for the client, too. Your B/D can help you develop workshops that will provide an educational foundation for the clients. Increase workshop outreach to clients on topics that are appropriate for each life stage. Focus on follow-up; teach advisors to always complete the loop. Once they have educated the consumer, it is important to make the call after the workshop and find out if they understood everything and if they have an interest in any products they learned about. Repeat the process At the end of year two, it’s important to again assess branch, book and marketing activity. Do you see a consistency in certain components? What’s working best? Are observations the same as last year? If not, what has changed? Look at advisors’ GDC activity, changes in structure and resources Look at new accounts opened within the top 20% list – data mining conducted on only the top 20% Adjust the plan as needed to increase growth for the following year By working closely with your broker-dealer, taking advantage of all the resources that they make available, and assessing your program on a regular basis, you will grow your revenue, establish solid relationships with your clients, and build an investment program that works for the longterm.