Summary of Significant Accounting Policies

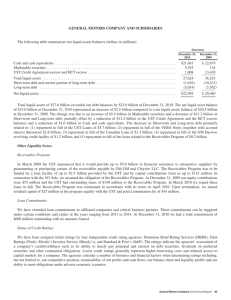

advertisement