E-Care - AXA Singapore

advertisement

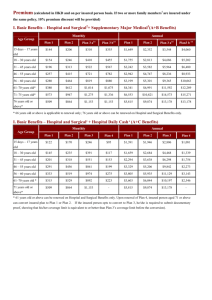

Employee Benefits E-Care AXA’s E-Care is the ideal employee benefits solution offering a wide selection of quality plans designed to fit your corporation needs and budget. Your employees are your organisation’s most important asset. Select E-Care today to provide them with the protection they deserve and the assurance that their well-being is your priority. Why E-Care? Small groups welcome You can start a policy with just 3 employees. Effective budgeting tool With fixed and age-banded premiums, E-Care provides you with predictable annual costs. This saves you time from re-negotiating with your insurer at each renewal. 24-Hour worldwide cover Your employees will receive 24/7 protection worldwide under all selected plans. Wide selection of supplementary covers 2 supplementary rider plans are available to complement to the Group Term Life plan. 5 supplementary rider plans are available to complement to the Group Hospital & Surgical plan. Key Features Easy Enrolment No hassle of completing Health Declaration Forms/Group Insurance Fact Find Form. All you need to do is submit a simple enrolment form and receive immediate coverage upon our approval 1. Immediate acceptance No medical examinations or additional underwriting requirements. Eligible persons can be covered immediately upon enrolment1. Discounted premium based on group size Bigger groups enjoy a bigger discount on premium2. Portfolio Underwriting Claims made under your E-Care policy will not affect your annual renewal premium. Premiums are priced based on the entire portfolio within E-Care. For Group Term Life and Group Critical Illness (Acceleration) Sum Insured applied for in excess of S$100,000 is subject to underwriting. For Group Critical Illness (Additional), the full Sum Insured applied for is subject to underwriting. 2 Group Hospital & Surgical plans. 1 Benefits at a glance Basic Plans Group Term Life • Lump sum payment upon death due to any cause • Lump sum payment upon total and permanent disability as a result of an accident or illness • Provides benefit upon diagnosis of a terminal illness • Provides extension of benefits for 12 months if an insured employee’s employment is terminated on medical grounds Group Hospital & Surgical • Provides reimbursement of eligible expenses incurred as a result of hospitalisation or if surgery has taken place • Wider coverage through lump sum benefit per disability • Covers outpatient kidney dialysis and cancer treatment • Coverage can be extended to dependants of employees Supplementary Plans Group Critical Illness (Rider to Group Term Life) • Provides benefit for 37 named critical illnesses • Available on an acceleration or additional basis Group Outpatient - General Practitioner (GP) Group Personal Accident (Rider to Group Term Life or Group Hospital & Surgical) • Provides benefit for loss of life, permanent disablement or dismemberment arising solely and directly from an accident (Rider to Group Hospital & Surgical) • Covers outpatient expenses incurred at any general practitioner clinic in Singapore (including polyclinics) and overseas • No need to pay out of pocket when visiting any of our panel clinics • Added protection with access to A&E departments at any hospital in Singapore • Coverage can be extended to dependants of employees Group Extended Major Medical Group Outpatient - Specialist (SP) (Rider to Group Hospital & Surgical) • Provides reimbursement of eligible expenses in excess of Group Hospital & Surgical benefits • Applicable to hospitalisation of more than 20 days or surgical procedure that pays a maximum benefit of at least 75% and above as shown in the Schedule of Surgical Fees • Coverage can be extended to dependants of employees (Rider to Group Hospital & Surgical) • Provides reimbursement of eligible expenses incurred at specialist clinics and diagnostic x-ray and laboratory tests referred by a general practitioner • Coverage can be extended to dependants of employees Group Dental (Rider to Group Hospital & Surgical) • Provides reimbursement of eligible dental expenses incurred at a dental clinic of your choice • Coverage can be extended to dependants of employees Group Term Life Group Term Life Benefits • Lump sum payment upon death due to any cause • Lump sum payment upon total and permanent disability as a result of an accident or illness Additional benefits a) Terminal illness benefit The sum insured shall be payable in one lump sum in advance if the insured member is diagnosed as suffering from terminal illness, from which death is highly probable within the next 12 months b) Extended benefits If the insured member’s employment is terminated on medical grounds, the insured member shall be covered for an extended period of 12 months from the date of termination of his employment Plan 1 Plan 2 Plan 3 Plan 4 Plan 5 Plan 6 500,000 300,000 200,000 150,000 100,000 50,000 80.00 40.00 Sum insured (S$) Age group (next birthday) 35 and below 36 - 40 500.00 300.00 200.00150.00 100.00 50.00 41 - 45 800.00 480.00 320.00240.00 160.00 80.00 46 - 50 1,150.00690.00 460.00345.00 230.00 115.00 51 - 55 2,000.00 1,200.00 800.00 600.00 400.00 200.00 56 - 60 3,500.00 2,100.00 1,400.00 1,050.00 700.00 350.00 61 - 65 5,500.00 3,300.00 2,200.00 1,650.00 1,100.00 550.00 Annual premium* per employee (S$) (GST exempt) 400.00 240.00 160.00 120.00 Main Exclusions For Sum Insured up to $100,000, all pre-existing conditions are excluded for the first 18 months of coverage. *Premium rates stated are for standard lives based in Singapore only. Supplementary Rider Group Critical Illness (Rider to Group Term Life) Benefits Lump sum payment upon diagnosis of any of the following 37 named critical illnesses (please refer to the policy contract for definitions of these illnesses). Flexibility This benefit can be selected on an acceleration or additional basis to suit your requirements. (a) Acceleration basis The sum insured shall be payable in advance from the Group Term Life Benefit if the insured member is diagnosed with any of the named critical illnesses. The balance of the Group Term Life Benefit will be payable upon subsequent death. (b) Additional basis The sum insured shall be payable if the insured member is diagnosed with any of the named critical illnesses. This is an additional benefit and does not affect the Group Term Life Benefit. List of Critical Illnesses 1. Major Cancers 2. Heart Attack of Specified Severity 3. Stroke 4. Coronary Artery By-pass Surgery 5. Kidney Failure 6. Aplastic Anaemia 7. End Stage Lung Disease 8. End Stage Liver Failure 9. Coma 10. Deafness (Loss of Hearing) 11. Heart Valve Surgery 12. Loss of Speech 13. Major Burns 14. Major Organ/Bone Marrow Transplantation 15. Multiple Sclerosis 16. Muscular Dystrophy 17. Parkinson’s Disease 18. Surgery to Aorta 19. Alzheimer’s Disease/Severe Dementia 20. Fulminant Hepatitis 21. Motor Neurone Disease 22. Primary Pulmonary Hypertension 23. HIV Due to Blood Transfusion and Occupationally Acquired HIV 24. Benign Brain Tumour 25. Viral Encephalitis 26. Bacterial Meningitis 27. Angioplasty & Other Invasive Treatment For Coronary Artery 28. Blindness (Loss of Sight) 29. Major Head Trauma 30. Paralysis (Loss of Use of Limbs) 31. Terminal Illness 32. Progressive Scleroderma 33. Apallic Syndrome 34. Systemic Lupus Erythematosus with Lupus Nephritis 35. Other Serious Coronary Artery Disease 36.Poliomyelitis 37. Loss of Independent Existence Supplementary Rider Group Critical Illness (Rider to Group Term Life) Acceleration Basis Sum insured (S$) Plan 1 Plan 2 Plan 3 Plan 4 Plan 5 Plan 6 250,000 150,000 100,000 75,000 50,000 25,000 Age group (next birthday) Annual premium* per employee (S$) (GST exempt) 35 and below250.00 150.00 100.0075.00 50.00 25.00 36 - 40 375.00 225.00 150.00112.50 75.00 37.50 41 - 45 625.00 375.00 250.00 187.50 125.00 62.50 46 - 50 1,100.00 660.00 440.00 330.00 220.00 110.00 51 - 55 1,662.50 997.50 665.00 498.75 332.50 166.25 56 - 60 2,500.00 1,500.00 1,000.00 750.00 500.00 250.00 61 - 65 4,000.00 2,400.00 1,600.00 1,200.00 800.00 400.00 Additional Basis Sum insured (S$) Plan 1 Plan 2 Plan 3 Plan 4 Plan 5 Plan 6 250,000 150,000 100,000 75,000 50,000 25,000 Age group (next birthday) Annual premium* per employee (S$) (GST exempt) 35 and below 300.00 180.00 120.00 90.00 60.00 30.00 36 - 40 550.00 330.00 220.00 165.00 110.00 55.00 41 - 45 875.00 525.00 350.00 262.50 175.00 87.50 46 - 50 1,275.00 765.00 510.00 382.50 255.00 127.50 51 - 55 2,000.00 1,200.00 800.00 600.00 400.00 200.00 56 - 60 3,025.00 1,815.00 1,210.00 907.50 605.00 302.50 61 - 65 4,875.00 2,925.00 1,950.00 1,462.50 975.00 487.50 Main Exclusions • Pre-existing medical conditions • Attempted suicide or self-inflicted injuries • Under the influence of narcotics or drugs *Premium rates stated are for standard lives based in Singapore only. Supplementary Rider Group Personal Accident (Rider to Group Term Life or Group Hospital & Surgical) Benefits • Lump sum payment upon loss of life, permanent disablement or dismemberment arising solely and directly from an accident as per benefits schedule below Benefit Schedule Accidental Death Permanent Total Disability Loss of or the permanent total loss of use of two limbs Loss of or the permanent total loss of one limb Permanent total loss of both eyes Permanent total loss of one eye Loss of or the permanent total loss of use of one limb and loss of sight of one eye Loss of speech and hearing Permanent and incurable insanity Permanent total loss of hearing in: • both ears • one ear Loss of speech Permanent total loss of the lens of one eye Loss of or the permanent total loss of four fingers and thumb of: • right hand • left hand Loss of or the permanent total loss of four fingers of: • right hand • left hand Loss of or the permanent total loss of use of one thumb: • both right phalanges • one right phalanx • both left phalanges • one left phalanx Loss of or the permanent total loss of use of fingers of: • three right phalanges • two right phalanges • one right phalanx • three left phalanges • two left phalanges • one left phalanx Fractured leg or patella with established non-union Shortening of leg by at least 5cm Third degree burns covering at least 25% of the body surface Loss of or the permanent total loss of use of toes: • all-one-foot • great toe-two phalanges • great toe-one phalanx • other than great toe, each toe Percent of Sum Insured % 100 150 150 125 150 100 150 150 100 75 25 50 50 70 50 40 30 30 15 20 10 10 7.5 5 7.5 5 2 10 7.5 100 15 5 3 1 Supplementary Rider Group Personal Accident (Rider to Group Term Life or Group Hospital & Surgical) Sum Insured Plan 1 Plan 2 Plan 3 Plan 4 Plan 5 Plan 6 500,000300,000 200,000150,000100,000 50,000 Occupation Class Annual premium* per employee (S$) (inclusive of GST) Class 1 240.75 144.45 96.30 72.23 48.15 24.08 Class 2 321.00 192.60 128.40 96.30 64.20 32.10 Class 3 428.00 256.80 171.20 128.40 85.60 42.80 Coverage up to age 65 Classification of Risk Occupation Class 1 Clerical, administrative or other similar non-hazardous occupations Occupation Class 2 Occupations where some degree of risk is involved e.g. supervision of manual workers, totally administrative job in an industrial environment Occupation Class 3 Occupations involving regular light to medium manual work but no substantial hazard which may increase the risk of sickness or accident Main Exclusions • Suicide, attempted suicide or self-inflicted injuries • War (declared or undeclared), invasion, act of foreign enemies, hostilities, civil war, rebellion, revolution, insurrection, military or usurped power • Participation in racing on wheels • Participation in a riot or civil commotion, violation or attempted violation of law, or resistance to lawful arrest or imprisonment • Air travel, other than as a fare paying passenger on a licensed commercial aircraft *Premium rates stated are for standard lives based in Singapore only. Group Hospital & Surgical Group Hospital & Surgical Benefits • Provides reimbursement of eligible expenses incurred as a result of hospitalisation or if surgery has taken place • Provides reimbursement of eligible expenses incurred for outpatient kidney dialysis and cancer treatment • Choice of Private hospital or Government/Restructured hospital plans depending on budget Benefit Schedule (S$) Plan 1 Policy Limit Plan 2 Plan 3 250,000 Per Annum Plan 4 Plan 5 Plan 6 Maximum Per Disability Government/ Type of Hospital Private Private Restructured Room & Board (standard) 1 Bed 1 Bed 2 Bed 4 Bed ICU/CCU/HDU (per disability) As Charged 10,000 10,000 10,000 Hospital Miscellaneous Services As Charged Surgical Fees (Subject to Surgical Table for Private Hospital)^ Anesthetist Fees - 25% of Surgical Benefit payable In-Hospital Physician’s Fees As Charged 1 Bed 10,000 4 Bed 10,000 25,00020,00015,00025,000 15,000 As Charged As Charged Ambulance Services As Charged Pre-Hospitalisation/Surgery Specialist’s Consultation (Up to 90 days before hospitalisation/surgery) As Charged Pre-Hospitalisation/Surgery Diagnostic Services (Up to 90 days before surgery) As Charged Post-Hospitalisation/Surgery Treatment (Up to 90 days) As Charged 2,000 1,500 1,000 2,000 1,000 3,000 1,000 1,000 1,000 1,000 1,000 As Charged 2,000 1,500 1,000 2,000 1,000 Emergency Outpatient Dental Treatment (due to accident) 5,000 2,000 1,500 1,000 2,000 1,000 Surgical Implants 5,000 2,000 1,500 1,000 2,000 1,000 Accidental Miscarriage/Abortion due to Medical Reason/Ectopic Pregnancy Emergency Outpatient Treatment (due to accident only) Out-patient Kidney Dialysis (Max per year) 75,000 20,000 15,000 10,000 20,000 10,000 Out-patient Cancer Treatment (Max per year) 75,000 20,000 15,000 10,000 20,000 10,000 5,000 5,000 5,000 5,000 5,000 5,000 Special Grant Daily Recovery Benefit (after 7 days of hospitalisation, up to 30 days) Dread Disease Recuperation Benefit (Multiple Sclerosis, Heart Attack, Cancer & Stroke) + 150 10,000 Parent Accommodation (up to 60 days per year for child below age 12) As Charged Home Nursing (up to 26 weeks) As Charged Emergency Medical Evacuation/ Repatriation* Repatriation of Mortal Remains or Local Burial* Unlimited Unlimited * The above benefits are not subject to annual policy limits ^ Plan 1 is not subjected to Surgical Table + Dread Disease Recuperation Benefit is subject to a waiting period of 90 days Not Applicable Group Hospital & Surgical Group Hospital & Surgical Plan 1 Plan 2 Plan 3 Plan 4 Plan 5 Plan 6 Annual premium* per employee / dependant (S$) (inclusive of GST) Age Group (next birthday) Group Size (3 – 4 Employees) 0 - 30 31 - 40 41 - 45 46 - 50 51 - 55 56 - 60 61 - 65 66 - 70 ** 71 - 75 ** 76 - 80 ** 610.39 718.10 771.96 1,077.15 1,328.49 1,651.63 2,154.30 2,872.40 3,949.55 5,170.32 432.20 508.48 546.61 762.71 940.68 1,169.49 1,525.43 2,033.90 2,796.61 3,661.02 378.29 445.05 478.43 667.58 823.34 1,023.62 1,335.15 1,780.20 2,447.78 3,204.36 221.13 260.15 279.66 390.23 481.28 598.35 780.45 1,040.60 1,430.83 1,873.08 320.73 377.33 405.62 565.99 698.05 867.85 1,131.98 1,509.30 2,075.29 2,716.74 180.01 211.78 227.66 317.66 391.78 487.08 635.33 847.10 1,164.76 1,524.78 567.80 668.00 718.10 1,002.00 1,235.80 1,536.40 2,004.00 2,672.00 3,674.00 4,809.60 402.05 473.00 508.48 709.50 875.05 1,087.90 1,419.00 1,892.00 2,601.50 3,405.60 351.90 414.00 445.05 621.00 765.90 952.20 1,242.00 1,656.00 2,277.00 2,980.80 205.70 242.00 260.15 363.00 447.70 556.60 726.00 968.00 1,331.00 1,742.40 298.35 351.00 377.33 526.50 649.35 807.30 1,053.00 1,404.00 1,930.50 2,527.20 167.45 197.00 211.78 295.50 364.45 453.10 591.00 788.00 1,083.50 1,418.40 525.22 617.90 664.24 926.85 1,143.12 1,421.17 1,853.70 2,471.60 3,398.45 4,448.88 371.90 437.53 470.34 656.29 809.42 1,006.31 1,312.58 1,750.10 2,406.39 3,150.18 325.51 382.95 411.67 574.43 708.46 880.79 1,148.85 1,531.80 2,106.23 2,757.24 190.27 223.85 240.64 335.78 414.12 514.86 671.55 895.40 1,231.18 1,611.72 275.97 324.68 349.03 487.01 600.65 746.75 974.03 1,298.70 1,785.71 2,337.66 154.89 182.23 195.89 273.34 337.12 419.12 546.68 728.90 1,002.24 1,312.02 Group Size (5 – 9 Employees ) 0 - 30 31 - 40 41 - 45 46 - 50 51 - 55 56 - 60 61 - 65 66 - 70 ** 71 - 75 ** 76 - 80 ** Group Size (10 Employees and above ) 0 - 30 31 - 40 41 - 45 46 - 50 51 - 55 56 - 60 61 - 65 66 - 70 ** 71 - 75 ** 76 - 80 ** *Premium rates stated are for standard lives based in Singapore only. ** For renewal only. The last entry age is at 65. Supplementary Rider Group Extended Major Medical (Rider to Group Hospital & Surgical) Benefits • Inpatient limits by per disability • Applicable to hospitalisation of more than 20 days or surgical procedure that pays a maximum benefit of at least 75% and above as shown in the Schedule of Surgical Fees Benefit Schedule (S$) Maximum Limit per disability Plan 1 Plan 2 Plan 3 Plan 4 Plan 5 Plan 6 100,000 100,000 80,000 50,000 100,000 50,000 Government/ Type of Hospital PrivatePrivatePrivate Private Restructured Room & Board (standard) Surgical Implants Co-insurance Government/ Restructured 1 Bed 1 Bed 2 Bed 4 Bed 1 Bed 4 Bed 10,000 10,000 8,000 5,000 10,000 5,000 NILNILNIL NIL NIL NIL Plan 1 Plan 2 Plan 3 Plan 4 Plan 5 Plan 6 Annual premium* per employee / dependant (S$) (inclusive of GST) Age Group (next birthday) 0 - 30 39.10 29.75 24.65 20.40 26.35 17.00 31 - 40 46.00 35.00 29.00 24.00 31.00 20.00 41 - 45 49.45 37.63 31.18 25.80 33.33 21.50 46 - 50 69.00 52.50 43.50 36.00 46.50 30.00 51 - 55 85.10 64.75 53.65 44.40 57.35 37.00 56 - 60 105.80 80.50 66.70 55.20 71.30 46.00 61 - 65 138.00 105.00 87.00 72.00 93.00 60.00 66 - 70 184.00 140.00 116.00 96.00 124.00 80.00 71 - 75 253.00 192.50 159.50 132.00 170.50 110.00 76 - 80 331.20 252.00 208.80 172.80 223.20 144.00 *Premium rates stated are for standard lives based in Singapore only. Supplementary Rider Group Outpatient - General Practitioner (GP) (Rider to Group Hospital & Surgical) Benefits • Covers eligible expenses incurred at a general practitioner clinic, polyclinic or A&E department of any hospital in Singapore Per Visit Limits (S$) Panel Clinics Polyclinic X-Ray and Laboratory Care (referred by Panel clinic or polyclinic) Non-Panel Clinics A&E Departments Overseas Outpatient Treatment Number of visits per year per insured Co-payment per claim (applicable to all benefits)^^ Plan 1 As charged As charged As charged As charged As charged As charged 35 35 100 100 35 35 Unlimited Unlimited NIL$10 Annual Premium* (S$) Plan 1 (inclusive of GST) Per employee / dependant Plan 2 310.00 *Premium rates stated are for standard lives based in Singapore only. ^^All employees and eligible dependants will have to take up the same plan (either with or without co-payment). Plan 2 250.00 Supplementary Rider Group Outpatient - Specialist (SP)*** (Rider to Group Hospital & Surgical) Benefits • Provides reimbursement of eligible expenses incurred in specialist clinics and diagnostic, x-ray and laboratory tests referred by a general practitioner Annual Limits (S$) Plan 1 Plan 2 Outpatient Specialist Consultation 1,500 800 Outpatient Diagnostic, X-Ray & Laboratory Test 1,500 800 500 500 Physiotherapy (referred by SP) Annual Premium* (S$) Plan 1 (inclusive of GST) Per employee / dependant 230.00 *Premium rates stated are for standard lives based in Singapore only. ***Group Outpatient – Specialist (SP) must be purchased with Group Outpatient – General Practitioner (GP). Plan 2 150.00 Supplementary Rider Group Dental (Rider to Group Hospital & Surgical) Benefits • Provides reimbursement of eligible dental expenses incurred Benefit Schedule (S$) Overall Annual Limit Plan 1 Plan 2 1,200 800 As Charged up to Annual Limit As Charged up to Annual Limit Consultation Medication (including administration of Local Anaesthesia) X-Rays i) Periapical Film ii) Bite-Wing iii) Occulusal Film iv) Orthopantomugraph Prophylaxis i) Scaling/Polishing ii) Fluoride application Amalgam Restorations - fillings Per Surface Tooth-Coloured Restorations - fillings Per Surface Extractions (inclusive of Local Anaesthesia) i) Anterior Tooth ii) Posterior Tooth Oral Surgery (inclusive of Local Anaesthesia) i) Surgical Root Removal (Per Tooth) ii) Surgical Removal of Wisdom Tooth Pulp/Root Canal Treatment i) Pulp Capping ii) Root Canal Treatment (inclusive of temporary fillings) - One Canal - Two Canals Periodontal Treatment Root Planning (Per Tooth) Miscellaneous Treatment i) Sedative Dressings ii) Retention pins - restoration of tooth Crowning - due to accident only Bridges - due to accident only Co-insurance 20%20% Annual Premium* (S$) Plan 1 (inclusive of GST) Per employee / dependant 188.00 Plan 2 155.00 Exclusions The coverage provided does not apply to charges for:(a) Orthodontic treatment and temporary dentures. (b) Treatment consisting of cosmetic or plastic surgery or for beautification not necessitated by Injury Illness. *Premium rates stated are for standard lives based in Singapore only. Underwriting Guidelines Period of Insurance • Duration of coverage is for 12 months, renewable annually. Persons eligible • Permanent full-time employees from age 16 years to 65 years old and who is a Resident of Singapore • The employee’s legal spouse from age 16 years to 65 years old and who is a Resident of Singapore • The employee’s legal child from 15 days to 25 years old and a Resident of Singapore. The child must be unmarried, unemployed and not a full-time national serviceman Resident of Singapore shall mean Singapore Citizens and Permanent Residents (holders of re-entry permits) as well as holders of employment passes, work permits, students’ passes or dependant’s passes. Participation guide • Dependants are not eligible for Group Term Life, Group Critical Illness and Group Personal Accident • Dependant plan shall be the same as Employee plan for Group Hospital & Surgical and its supplementary riders • Employee plan for Group Extended Major Medical shall be same as Group Hospital & Surgical plan selected Selection guide • Group Personal Accident is a supplementary rider to either Group Term Life or Group Hospital & Surgical • Group Outpatient – Specialist (SP) must be purchased with Group Outpatient – General Practitioner (GP) Pro-ration Factor In the event that the Insured Person is admitted to a higher ward and/or hospital type than what he/she is entitled to under the Policy, we will pay 60% of the eligible expenses payable, subject to the maximum limits set out in the Insurance Schedule. Premium • Premium rates are quoted in Singapore Dollar and subject to change without prior notice • Prevailing GST applies to all plans except Group Term Life and Group Critical Illness • Premium rate is based on the individual Person Eligible’s age next birthday Application Documents • Enrolment form • Business Profile report from the Accounting & Corporate Regulatory Authority (ACRA) OR copy of Certificate of Incorporation/ Registration AND list of persons with executive authority within the company • List of names, identification numbers and specimen signatures of authorized persons to sign on the enrolment form • Health Declaration Form for: i. Group Term Life/Group Critical Illness (Acceleration) sum insured applied for in excess of S$100,000 ii. Group Critical Illness (Additional) application Underwriters • Policies with Group Term Life plans selected are underwritten by AXA Life Insurance Singapore Private Limited • Policies with only Group Hospital & Surgical plans and its supplementary riders, without Group Term Life or Group Personal Accident plans, are underwritten by AXA Insurance Singapore Private Limited (This page is intentionally left blank) Important Information This is not a contract of insurance. The standard terms and conditions of this plan are provided in the policy contract. A product summary is available and may be obtained from AXA Life Insurance Singapore Pte Ltd and the participating distributors’ offices. You should read the product summary before deciding whether to purchase the policy. The above is for your information only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You may wish to seek advice from a financial adviser before making a commitment to purchase the product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you. Underwritten by: AXA Life Insurance Singapore Private Limited Company Reg No. 199903512M 8 Shenton Way #27-02 AXA Tower Singapore 068811 AXA Customer Centre #B1-01 Tel: 1800-880 4888 Fax: 6880 5501 AC/GTL Broc/July 2015 The insurance policy featured in this brochure is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you should you buy the policy. For more information on the types of benefits that are covered under the Policy Owners’ Protection Scheme as well as the limits of coverage, where applicable, please visit the AXA website at www.axa.com.sg or visit the LIA or SDIC websites (www.lia.org.sg or www.sdic.org.sg) for a copy of the SDIC Guide on PPF Scheme (Life Insurance).