comScore Presentation Title

advertisement

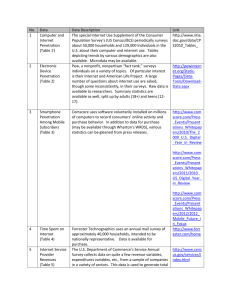

Canadian Mobile Landscape February 2013 Darrick Li, Account Manager © comScore, Inc. Proprietary. Analytics for a Digital World™ Audience Analytics Advertising Analytics Digital Business Analytics Mobile Operator Analytics comScore comScore comScore comScore Media Metrix® AdEffx™ Digital Analytix® Subscriber Analytix™ © comScore, Inc. Proprietary. V0113 2 The comScore Story © comScore, Inc. Proprietary. The Digital World is Complex © comScore, Inc. Proprietary. comScore Brings it Together PC/Mac © comScore, Inc. Proprietary. Tablet Gaming TV Smartphone V0113 5 comScore is a leading internet technology company that provides Analytics for a Digital World™ NASDAQ SCOR Clients 2,100+ Worldwide Employees 1,000+ Headquarters Reston, Virginia, USA Global Coverage Measurement from 172 Countries; 44 Markets Reported Local Presence 32 Locations in 23 Countries Big Data Over 1.5 Trillion Digital Interactions Captured Monthly © comScore, Inc. Proprietary. V0113 6 MobiLens Service © comScore, Inc. Proprietary. comScore MobiLens MobiLens provides the mobile industry with unparalleled clarity on mobile behaviors, demographics and key landscape features so users can build solid mobile strategy, back their direction with facts, and execute on those plans with confidence. © comScore, Inc. Proprietary. 8 A Comprehensive Market View Through Intelligent Online Surveys 360° View of the Mobile Consumer Technology Penetration and Effectiveness Content Merchandising Consumer Behavior MobiLens Data Sets Reporting monthly in Spain, Italy, Germany, France, UK, Japan, and US, quarterly in Canada Technical capabilities of every handset in market: >7,000 Monthly census of operator content portals: 2,000+ publishers, 15,000+ titles Intelligent online survey of 5,500 CA mobile phone owners per month. Market Sizing Quota Sampling is used, requiring that a precise number of consumer be selected each month by nested age and gender groups based on Census population proportions © comScore, Inc. Proprietary. 9 Mobile Landscape in Canada © comScore, Inc. Proprietary. Total Canadian Mobile Universe: 22,076,000 Operator Share Koodo Mobile 6% Other 13% Virgin Mobile 6% Fido Wireless 7% Bell Mobility 20% Original Equipment Manufacturer (OEM) Kyocera Communications 1% Sony 2% Rogers Wireless 25% HP 0% Motorola 4% HTC 4% Other 5% Samsung 28% Nokia 8% Telus Mobility 22% RIM 13% Not Smartphone 38% © comScore, Inc. Proprietary. Smartphone 62% LG 13% Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 Apple 22% 11 Demographics of Canadian mobile subscribers Mobile Audience by Gender % Mobile Audience by Age 18% 17% 18% 15% 13% 13% 7% 49% 51% 13-17 % Mobile Audience by Household Income 23% of smartphone owners is between the ages of 25-34. 18-24 25-34 35-44 45-54 55-64 65+ % Mobile Audience by Region 33% 20% 21% 17% British Columbia 14% 10% <$25k $25k to <$50k $50k to <$75k $75k to <$100k © comScore, Inc. Proprietary. Atlantic 7% Prairies 18% $100k+ Source: comScore, Inc., MobiLens, CA, Persons 13+, Sept 2012 Ontario 41% Quebec 20% 12 Smartphone penetration by market 62% of Canadians now own smartphones 67% 65% 62% % Smartphone Audience 55% 54% 54% 53% 29% Spain +14.7 pts United Kingdom Canada France +10.5 pts +16.9 pts +13.4 pts © comScore, Inc. Proprietary. Germany +15.2 pts United States Italy Japan +10.1 pts +8.1 pts +10.6 pts Source: comScore, Inc., MobiLens, JP, US, UK, ES, IT, DE, FR, CA,, Persons 13+, Dec 2011 – Dec 2012 13 BC saw the highest smartphone penetration compared to other regions Smartphone Penetration by Region December 2012 British Columbia 67% +16 pts since Dec 2011 Atlantic 57% Quebec 55% Prairies 64% +19 pts since Dec 2011 © comScore, Inc. Proprietary. Ontario 64% +16 pts since Dec 2011 +19 pts since Dec 2011 Source: comScore, Inc., MobiLens, CA, Persons: 13+, Dec 2011 & Dec 2012 +14 pts since Dec 2011 14 Android continues to increase market share in Canada Smartphone Platform Share December 2012 HP Symbian 0% Microsoft 2% 2% Smartphone Platform Share Other Smartphone 0% Microsoft -0.6 pts RIM Symbian -2.3 pts -12.1 pts Apple +3.7 pts HP -0.5 pts Google +12.0 pts Other Smartphone -0.3 pts Google 40% Apple 35% % Smartphone Audience 45% RIM 20% 40% 35% 30% 25% 20% 15% 10% 5% 0% Dec-11 © comScore, Inc. Proprietary. Mar-12 Jun-12 Note: Palm has been renamed as HP Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2011 – Dec 2012 Sep-12 Dec-12 15 Dual device ownership: The digital omnivore In December 2012, 38% of all Canadian mobile users also owned a connected device*, an increase of 11.5 pts over December 2011. 43% of all smartphone owners owned a connected device in December. As smartphones, tablets, and other connected devices provide the means to connect outside of homes and workplaces, these devices are changing the way many consumers seek information, communicate, and engage online. Connected Device Ownership Penetration by Region % Mobile Audience Dec-11 Top 5 Connected Devices Dec-12 Apple iPad/iPad mini 39% 42% 30% 40% 27% 24% 31% 32% 27% 21% Kobo eReader/Touch/Glo/Mini +15.4 pts Prairies Ontario Quebec +11.3 pts +12.0 pts +10.1 pts © comScore, Inc. Proprietary. 7% iPod touch BlackBerry Playbook British Columbia 14% Atlantic +4.3 pts Amazon Kindle/ Kindle 2/ Kindle 3/ Kindle DX 6% 4% 3% % Mobile Audience Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2011 & Dec 2012 *Connected devices = devices used to access online content including tablets, mp3 players and ereaders. 16 NFC enabled phones continue to increase in the Canadian market Near-field communication (NFC) technology permits smartphones to receive radio communication by simply bringing them in close proximity. NFC technology can be used as an instant, contactless mobile payment along with a multitude of other uses, including advertising. Android-enabled phones currently lead with the largest number of NFC enabled devices in Canada (71%), while RIM’s phones represent 28% of NFC handsets. Ontario 12% Prairies 10% B.C. 13% Atlantic 12% Quebec 7% NFC Enabled Phones % Mobile Audience 12.0% 10.9% 10.0% 9.5% 8.0% 6.5% 6.0% 5.2% 4.0% 3.5% 2.0% 0.0% 1.6% 0.4% Jun-11 Sep-11 © comScore, Inc. Dec-11 Proprietary. Mar-12 Jun-12 Sep-12 Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 Source: comScore, Inc., MobiLens, CA, Persons 13+, Jun 2011 - Dec 2012 Dec-12 17 Mobile Media © comScore, Inc. Proprietary. 62% of all Canadian mobile phone owners consume mobile media Mobile Media = Used browser, application, native email, stream or download music and broadcast or on demand video (does not include SMS) Mobile Market Segments B.C. 70% Prairies 67% Just Voice 20% Ontario 64% SMS (and not mobile media) 18% Mobile Media 62% Quebec 52% Atlantic 58% © comScore, Inc. Proprietary. Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 19 More than half of all iPhone owners use apps native to device Browser and Application Usage Growth Dec-11 Used app native to device Dec-12 Apple 52% 57% % Mobile Audience 53% RIM 48% 46% 41% Microsoft 44% Google +11.7 pts 42% +12.3 pts Symbian 22% 0% Used Applications (except native games) Used Browser © comScore, Inc. Proprietary. 20% 40% % Smartphone Audience by Platform Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2011 & Dec 2012 Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 60% 20 What Content Appeals Most to Mobile Media Consumers? Mobile media users primarily use their phones to access various types of information, such as weather, maps and news. Top 10 Content Categories Weather 65% Search 61% Maps 46% News 43% Bank Accounts 35% Entertainment News 34% Movie Information 31% General Reference 30% Sports Information 29% Tech News 26% % Connected Media Audience © comScore, Inc. Proprietary. Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 21 Mobile Social Networking © comScore, Inc. Proprietary. Mobile social networking most popular in UK, Spain and North America Mobile Market Reach % December 2011 vs. December 2012 United Kingdom Canada 44% 41% + 4.7 pts + 9.7 pts France Germany 28% + 8.0 pts Italy United States 30% Spain 41% + 6.6 pts 32% 42% + 8.4 pts + 3.7 pts + 13.4 pts © comScore, Inc. Proprietary. Japan 17% - 3.0 pts Source: comScore, Inc., MobiLens, JP, US, EU5, CA, Persons 13+, Dec 2011 & Dec 2012 23 Social networking continues to rise on smartphones Mobile social networking on smartphones saw a 44% increase in the number of users between December 2011 and December 2012. More than half of smartphone social networkers access this almost every day, while 42% of feature phones access social networking almost daily. Frequency of Access Accessed Social Networking Site or Blog Not Smartphone % Accessed Social Networking Site or Blog in Month Smartphone 70% % Mobile Audience 60% 50% 40% 30% 20% 10% 16% 25% 30% 58% 42% Smartphone 0% Dec-11 Mar-12 Jun-12 Sep-12 © comScore, Inc. Proprietary. Dec-12 28% Not Smartphone Almost Every Day At least once each week Once to three times throughout the month Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2011 – Dec 2012 Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 24 Facebook remains #1 mobile social networking brand 62% of mobile social networkers access a social networking site or blog using an app, while 51% and 43% accessed this content by browser and by SMS. B.C. December 2012 Top 10 Social Networking Brands Brand % Reach** Instagram leads LinkedIn Prairies LinkedIn and Pinterest lead Google+ and Instagram Facebook 81% Twitter 29% YouTube 21% Google 14% LinkedIn 12% Instagram 10% Quebec Pinterest 10% YouTube leads Twitter Tumblr 6% Flickr 4% Atlantic Yahoo! 2% Pinterest leads Instagram and LinkedIn © comScore, Inc. Proprietary. Ontario LinkedIn leads Google+ *Note: Top Social Networking/Chat/Blog brands excluding Unknown or Other based on Dec 2012 data **Note: % Reach based upon mobile audience who accessed social networking site or blog in month Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2011 – Dec 2012 25 Mobile social networkers are primarily focused on reading posts Social Networking Activities Read posts from people known personally 81% Posted status update 61% Read posts from organizations/brands/events 58% Followed posted link to website 57% Posted photo 55% Read posts from public figures/celebrities 51% Posted link to website 36% Received coupon/offer/deal 33% Clicked on advertisement 29% % Accessed Social Networking Site or Blog in Month © comScore, Inc. Proprietary. Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 26 The mobile device is increasingly becoming the new social communication medium Social Media Activities 70% 64% % Mobile Audience 60% 50% 43% 41% 40% 29% 30% 21% 20% 16% 13% 10% 0% Took photos Sent photo taken to Accessed Social a phone or email Networking Site or address Blog © comScore, Inc. Proprietary. Recorded Video Accessed Personal Sent recorded Used Social photo or Video video to a phone or Networking Checksharing email address In Service Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 27 Mobile Commerce © comScore, Inc. Proprietary. Canadian mobile subscribers who accessed online retail in December 2012 increased 81% compared to December 2011 17% of all U.S. mobile users have accessed online retail on their phones, while 13% have accessed electronic payments. In Japan, 8% of mobile subscribers made purchases using the ‘Mobile Wallet’. The most popular location for using the mobile wallet is in a retail or convenience store setting (71%). Canada United States Europe Japan % Mobile Audience 17% 14% 13% 11% 10% 11% 11% 10% 10% 8% 6% 6% Electronic Payments © comScore, Inc. Online Retail Proprietary. Shopping Guides Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 Source: comScore, Inc., MobiLens, CA, US, EU5, JP, Persons 13+, Dec 2012 Source: comScore, Inc., MobiLens, Japan, Persons 13+, Dec 2012 29 Accessing Online Retail by Region Total Canada: 10% Accessed Online Retail 14% 12% 12% 12% 11% 10% 10% 8% 6% 5% 4% 2% 0% BC Prairies © comScore, Inc. Proprietary. Ontario Quebec Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 Atlantic 30 60% of mobile subscribers who access online retail purchased goods or services on their phone Top 10 Retail Brands Frequency of Accessing Online Retail 60% 29% 12% Almost Every At Least Once One to Three Day Each Week Times Throughout the Month © comScore, Inc. % Accessed online retail Brand % Reach* Amazon.com 61% BestBuy 34% Future Shop 29% Canadian Tire 24% Wal-Mart 20% Costco 15% eBay 13% Apple 12% Sears 12% Shoppers Drug Mart 10% Proprietary. % Accessed Online Retail in Month % Accessed Online Retail in Month 55% of mobile consumers who access online retail on their phones also own a connected device, the most popular being an iPad/iPad mini (26%). The second most popular connected device owned is a Kobo ereader (11%). 73% 24% 16% Accessed via Accessed via Accessed via App Browser SMS *Note: % Reach based upon mobile audience who accessed online retail in month Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 31 Mobile phones are becoming the new shopping tool Mobile phones are increasingly becoming a consumer’s shopping tool, allowing them to check product availability, compare prices and conduct research on the fly. In December, 33% of Canadian Smartphone users found a store location with their phone, while 23% made shopping lists and 22% researched product features. Select Mobile Shopping Activities % Smartphone Audience 33% 23% 22% 21% 18% 16% Made shopping Checked product Compared lists availability product prices © comScore, Inc. Proprietary. Found coupons or deals 14% Found store location Researched Purchased goods product features or services Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 32 Canadians are increasingly using their mobile device to purchase goods and services 10% of mobile subscribers purchased goods or services using their mobile device in December 2012. The most popular goods or services purchased are clothing/accessories, tickets and consumer electronics/household appliances. % Purchased Goods or Services in Month Frequency of Purchase Type of Goods Purchased 36% Clothing or accessories 29% Tickets 59% 24% 24% Consumer electronics / household appliances Books (not ebooks) 19% 16% 15% 13% Daily deals or discount coupons Meals for delivery or pickup Gift certificates 30% Personal care / hygiene products 8% 7% 7% 6% 6% 6% 5% 3% Groceries Flowers Airplane tickets 10% Auto / Auto parts Hotel accommodations Sports/Fitness equipment Almost Every Day At Least Once Each Week One to Three Times Throughout the Month Furniture Car rental or ground transportation 0% 10% 20% 30% 40% % Purchased Goods or Services in Month © comScore, Inc. Proprietary. Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 33 Smartphone users are beginning to “showroom” with their phones while in a retail store setting Mobile Activities Performed in Retail Store 30% Smartphone users are 52% more likely to have found a store location while in a retail store. % Smartphone Audience 26% Took picture of a product 18% 10% 10% 10% 8% 6% 6% 2% Texted or Sent picture Found store called of product to location friends/family family/friends about a product © comScore, Inc. Proprietary. Compared product prices Scanned a product barcode Researched product features Checked product availability Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 Found coupons or deals Purchased goods or services (online) 34 Mobile Deal-a-Day Sites on the Rise As Deal-a-Day sites continue to gain momentum online, they’re also increasing in popularity on mobile – 8% of all mobile subscribers used a Deal-a-Day in December 2012. 16% of mobile consumers who purchased a daily deal or discount coupon spent between $201 - $300, while 14% spent between $51 and $100. Brand % Reach* 48% 28% 24% Almost Every At Least Once One to Three Day Each Week Times Throughout the Month © comScore, Inc. Method of Accessing Deal-a-Day Top 10 Deal-a-Day Brands Groupon 61% WagJag 21% LivingSocial 19% Dealfind 17% TeamBuy 14% Kijiji 13% Red Flag Deals 10% Tuango 6% Buytopia 4% Jaunt 4% Proprietary. % Used Deal-A-Day in Month % Used Deal-a-Day in Month Frequency of Accessing Deal-a-Day 52% 39% 22% Accessed via Accessed via Accessed via App Browser SMS *Note: % Reach based upon mobile audience who accessed deal-a-day in month Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 35 Mobile Advertising © comScore, Inc. Proprietary. QR Code usage in Canada In December 2012, 9% of Canadian mobile phone owners scanned a QR/bar code with their device. The primary source of QR codes scanned are printed magazines or newspapers (46%), while poster or flyer or kiosk saw a 7.0 pt increase between December 2011 and December 2012. The most common location when scanning QR codes is in a retail store (58%), followed by at home (51%) and grocery stores (25%). % Scanned QR/Bar Code in Month Dec-11 47% 46% Dec-12 43% 39% 34% 27% 27% 24% 12% 13% 12% 12% 7% 6% Printed Poster or flyer or Website on PC magazine or kiosk newspaper © comScore, Inc. Proprietary. Product packaging Business card or brochure Storefront Note: Excluding Other and Unknown sources Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2012 Source: comScore, Inc., MobiLens, CA, Persons 13+, Dec 2011 & Dec 2012 TV 37 What information are mobile phone owners scanning QR codes for? The primary reason for scanning QR Codes is product information (73%), followed by event information (29%) and coupon or offer (28%). 87% of mobile users who scanned a QR Code from a printed magazine or newspaper did so for the purpose of obtaining product information – an increase of 2.9 pts over December 2011. % Scanned QR/Bar Code in Month Product information Event information Charity/cause information 87% 85% Coupon or offer 84% Application download 82% 81% 75% 65% 33% 35% 30% 19% 18% 12% 42% 42% 38% 7% Poster or flyer or Website on PC kiosk © comScore, Inc. Proprietary. 40% 21% 12% 8% 42% 41% 35% 20% 13% Printed magazine or newspaper 55% 52% 50% 46% Product packaging 12% Business card or brochure 10% 13% Storefront Note: Excluding Other and Unknown sources Source: comScore, Inc., MobiLens, Canada, Persons 13+, Dec 2012 Source: comScore, Inc., MobiLens, Canada, Persons 13+, Dec 2011 & Dec 2012 20% 17% TV 38 Thank You www.comscore.com Darrick Li, Account Manager dli@comscore.com www.facebook.com/comscoreinc @comScore 416.646.9979 © comScore, Inc. Proprietary.