Connect Chapter 1 Homework - MGMT-026

advertisement

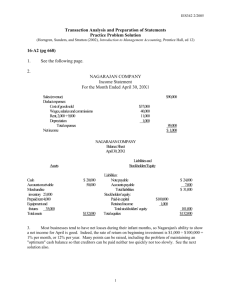

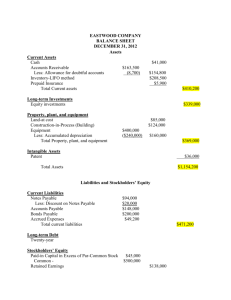

1. award: 10 out of 10.00 Accounting is an information and m easurem ent system that identifies, records, and communicates relevant, reliable, and comparable information about an organization's business activities. Select the aspect of accounting associated with this activity. Activities Aspects of accounting 1. Analyzing and interpreting reports. Communicating 2. Presenting financial information. Communicating 3. Maintaining a log of service costs. Recording 4. Measuring the costs of a product. Recording 5. Preparing financial statements. Communicating 6. Establishing revenues generated from a product. Identifying 7. Determining employee tasks behind a service. Identifying ./ ./ ./ ./ ./ ./ ./ 2• award: 10 out of 10.00 ··············· potrns ························································· ····················································································· Part A Identify the following users of accounting information as either an internal or an ext ernal user. Accounting information user External /Internal 1. Research and development director Internal 2. Human resources director Internal 3. Labor unions External ~Shareholders External 5. Internal Distribution managers ~Creditors External ~uction supervisors Internal 8. Internal Purchasing manager ./ ./ ./ ./ ./ ./ ./ ./ Part B Identify the following questions as most likely to be asked by an internal or external user. Questions •• External / Internal ~ Internal 1. What are reasonable payroll benefits and wages? 2. Should we make a frve-year loan to that business? External 3. What are the costs of our product's ingredients? Internal 4. Do income levels justify the current stock price? External 5. Should we spend more to further re search our product? Internal 6. Which firm reports the highest sales and income? External 7. What are the costs of our service to customers? Internal ./ ./ ./ ./ ./ ./ 3• a·ward: 10 out of 10.00 ·······················polrns- ································································································································································································· Identify the area of accounting that is most involved in each of the following responsibilities: Responsibilities 1. Area of accounting Internal auditing. Managerial accounting External auditing. Financial accounting 3. Cost accounting. Managerial accounting 4. Budgeting. Managerial accounting 5. Investigating violations of tax laws. Tax accounting 6. Planning transactions to minimize taxes. Tax accounting 7. Preparing external financial statements. Financial accounting 8. Reviewing reports for SEC compliance. Financial accounting 2. - - -- - ./I ./ ./ ./ ./ ./ ./ ./ 4. award: 10 out of 10.00 Match each of the numbered descriptions with the term or phrase it best reftects. Description 1. Principles that determine whether an action is right or wrong. --l--- Term or Phrase Ethics ./ 2. Accounting professionals who provide services to many clients. Public accountants ./ 3. A n accounting area that includes planning future transactions to minimize taxes paid. Tax accounting ./ A n examination of an organization's accounting system and records that adds credibility to financial statements. Audit ./ A mount a business earns after paying all expenses and costs associated wit h its sales and revenues. Net income ./ r4 ~: 5• award: 10 out of 10.00 ·························poiotS' ···················································································································································································································································································································· · Match each of the numbered descriptions with the principle or assumption it best reflects. Description 1. Usually created by a pronouncement from an authoritative body. 2. Principle or Assumption Specific accounting principle .,/ Financial statements reflect the assumption that the business continues operating. Going-concern assumption .,/ 3. Derived from long-use<! and generally accepted accounting practices. General accounting principle .I 4. Every business is accounted for separately from its owner or owners. Business entity assumption .,/ 5. Revenue is recorded only when the earnings process is complete. Revenue recognition principle .,/ 6. Information is based on actual costs incurred in transactions. Cost principle .,/ Matching principle .,/ Full disclosure principle .,/ -~I-- -+-- -~I-- 7. 8. - A company records the expenses incurred to generate the revenues reported. A company reports details behind financial statements that would impact users' decisions. --'---- -~-- 6. award: 10 out of 10.00 A-G contain separate situations, identify each as being a sole proprietorship, partnership or corporation. Description Business organization a. Ownership of Zander Company is divided into 1,000 shares of stock. Corporation ./ b. Wallingford is owned by Trent Malone, who is personally liable for the company's debts. Sole proprietorship ./ c. Micah Douglas and Nathan Logan own Financial Services, a financial services provider. Neither Doug~as nor Logan has personal responsibility for the debts of Financial Services. Riley and Kay own Speedy Packages, a courier service . Both are personally liable for the debts of the business. Corporation ./ Partnership ./ ./ ./ ./ d. e. IBC Services does not have separate legal existence apart from the one person who owns it. Sole proprietorship f. Physio Products does not pay income taxes and has one owner. Sole proprietorship t----l- g=-1 AJ pays its own income taxes and has two owners. Corporation 7. award: 10 out of 10.00 a. Office Store has assets equal to $1 23,000 and liabilities equal to $47 ,000 at year-end. What is the total equity for Office Store at year-end? Assets $ 8 Liabilities = 123,000 $ Equity + 47,000 + $ 76,000./ award: 10 out of • 10.00 ········· points ·········································· · · b. At the beginning of the year, Addison Company's assets are $300,000 and its equity is $100,000. Du ring the year, assets increase $80,000 and liabilities increase $50,000. What is the equity at the end of the year? Assets Beginning $ Change Ending 9 $ Liabilities 300,000 = 80,000 = 380,000./ = $ 200,000~ Equi + + $ 100,000 50,000 $ + 250,000./ + 30,000./ $ 130,000~ award: 10 out of • 10.00 ·······················points ··························································································································································································································································· c. At the beginning of the year, Quaker Company's liabilities equal $70,000. During the year, assets increase by $60,000, and at y ear-end assets eCJiual $190,000. Liabilities decrease $5,000 during the year. What are the beginning and ending amounts of equity? Assets ~Beginning $ ~Change 1 Ending i$ 130,000./ = J $ 60,000 = I 190,000 $ = Liabilities Eu + 70,000 + (5,000) + 65,000~ + $ 60,000./ 65,000./ $ 125,000./ award: 10 10 out of • 10.00 ················poirns···· Determine the missing amount from each of the separate sit uations given below. Assets 65,000./ = 100,000 = ~ (a) J.$ rr (c) $ 154,000 = Liabilities $ 20,000 $ 34,000 + $ 114,000./ + $ + $ + $ Equity 45,000 66,000./ 40,000 11. award: 10 out of 10.00 Select a transaction that affects the accounting equation as follows: Affect Decreases an asset and decreases equity. Business incurs an expense paid in cash lncreases an asset and increases a liability. Business purchases equipment on credit 1----f- b. c. ,__ __ e. ,__ __ f. g. __ d. Transaction Decreases a liability and increases a liability. Business signs a note payable to extend the due dat e on an account payable Decreases an asset and decreases a liability. Business pays an account payable with cash Increases an asset and decreases an asset. Business purchases office supplies for cash Increases a liability and decreases equity. Business incurs an expense that is not yet paid Increases an asset and increases equity. ,__ Owner(s) invests cash in the business -~== 12. award: 10 out of 10.00 Lena Holden began a professional practice on June 1 and plans to prepar.e financial state ments at the end of each month. During June, Holden (the owner) completed these transactions: Owner invested $60,000 cash in the company along with equipment that had a S1 5,000 market value. The company paid $1 ,500 cash for rent of office space for the month . The company purchased $10,000 of additional equipment on credit (payment due within 30 days). The company completed work for a client and immediately collected the $2,500 cash earned . The company completed work for a client and sent a bill for $8,000 to be receiv ed within 30 days. The company purchased additional eq uipment for $6,000 cash. The company paid an assistant $3,000 cash as wages for the month. The company collected S5.000 cash as a partial payment for the amount owed by the client in transaction e. i. The company paid $10,000 cash to settle the liability created in transaction c. j. Owner withdrew $1,000 cash from the company for personal use. a. b. c. d. e. f. g. h. Required : Enter the impact of each transaction on individual items of the accounting equation. (Enter dec reases to account balances with a minus sign.) lbLiabilities Assets Cash + a. 60,000J + b. (1,500)J + Bal. 58,500 + c. 0 58,500 + Bal. d. Bal. e. Bal. f. Bal. g. Bal. h. Accounts Receivable '$ $ t + 0 61,000 -- - - -a ;] r 1 - - 8,000J ] + 8,0000 I ++ 1· 0 5,000J j + - _..__L 8, * 0 + 8,000 + (5,000)./ + [ 51.000 . 3,00~ 1$ 31,000 _J_ 0 31.00H - + 31,000 I = '$ ~ + _+_~_ + : $ 75,000 0 ./1-_ 75,ooo l 0 - + oI- 0 + 0 - ---~--t ~ ~ jl Expenses ' 1,500J I 1.50~ ~ o -+ -.--~ o-1--- +1 --1, 500 ---; ~ 0 + 2.~ - 0 ---~----~ 75,oo~ ~ '-1---~--~-_:_~__!_:~-~-~J~'--~-1.___1_.5_0~--;I I 75,00~ I~ I -1- -_ 75,000 0 10,000 + + 0 75,000 0 + 0 10,000 + 75.00~ I ~ o ' + - 0 * + $ Revenue + 75.00~ -1--~-1-- + W. 1 1 10,000 p O,OOO)J +-I-+- + - - = 0 II Holden, With drawals Holden, Capital QT+ = = I 31,000 -1-= I I 0 I = _,__ 31,000 -1-= 3,000 _J_ _+_ 0 + I. ( 10.000)J~ ----,-----~ 47,000 + Bal. I : j. (1,000)J + 46,ooo I + 3,ooo I -:;--i $ Bal. Bal. + 1~0~ _1 _+ I 25,000 = 6,000./1 = (6,000)J t + +--.:- 25,000 II ~ i --+-1- 10,00~ _+__,,_____~ + + 55,000 (3,000)J 1 + 52,000 + =~ = = = = = = 15,00~Ji = 15,000 o 10,000J 10,000J 25,000 - - ! - - - - ! - - - 10,000 0 0 -1---+-- 2, 500J I + 61 ,000 + Accounts Payable Equipment + Equity + l I + a o + + + : ~ -j-:- _ I- 10,50~ I$ I + 1,50~ I 1_J -_ IT 10,50~ I ~ 1o.5oo 0 I l'--___:<---+--10.50~ 15.ao~ 15,000 -%f: J I ++ + ·1 10.50~ I 10,500 I- $ 1.500 3,oooJ 4,~ 4.~ 4,5~ 4,500 I 13 • award: 10 out of 10.00 ········· poims-· The following table shows the effects of five transac ti ons (a through e) on the assets, liabilities, and equity of Trista's Boutique. Match the given transaction with its probable description. = Assets Accounts + Receivable + $ 21,000 + $ 0 + Cash a. e. $ 3,000 - 4,000 + b. c. d. Office Supplies + Accounts + l and = Payable + $ 19,000 = $ 0 4,000 + + 1,000 + Equity Trista , + Capital + Revenues + $ 43,000 + $ 0 + 1,900 - 1,000 + 1,900 - 1,900 - 1,000 1,900 $ 17 900 + Transaction 1,000 Liabilities $ 0 + $ 4,000 + $ 23,000 = $ 0 Description a. Purchased land for cash b. Purchased office supplies on credit c. Billed a client for services provided d. Paid the account payable created in transaction b e. Collected cash for the billing in transaction c ./ ./ ./ ./ ./ + $ 43,000 + $ 1,900 14 • award: 10 out of 10.00 ················points ····························································· · On Oc tober 1, Keisha King organized Real Answers, a new consulting firm; on October 3, the owner contributed $84 ,000 cash. On October 31 , the company's records show the following items and amounts. Cash Accounts receivable Office supplies Land Office equipment Accounts payable Owner investments $1 1,360 14,000 3,250 46 ,000 18,000 8,500 84,000 Cash with drawals bv owner Consulting fees earned Rent expense Salaries expense Telephone expense Miscellan eous expenses $ 2,000 14,000 3,550 7,000 760 580 Using the above information prepare an October income statement for the business. REAL ANSWERS Income Statement ./ For Month Ended October .31 .I Revenues Consulting fees earned ./ $ -=1_ 14,000./ 0 0 Total revenues $ 14,000 ./ Expenses Miscellaneous expenses Rent expense Telephone expense Salaries expense Total expenses Net income ./ ./ ./ ./ --i ./ (580)./ (3,550)./ (760)./ (7,000)./ 0 0 (1 1,890) $ "Red t -:xt ind c.at-:s no respcns.= Wa$ exoect-:d in a cell or a fc!TT'u!a· based calcu ation pornts deducted. 1 2,110./ 1s incorrect: no 15 • award: 10 out of 10.00 ································potrns-·· On Oc tober 1, Keisha King organized Real Answ ers, a new consulting firm; on October 3, the owner contributed $84,000 cash. On October 3 1, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Land Office equipment Accounts payable Ow ner investments Cash withdrawals by owner Consulting fees earned Rent expense Salaries expense Telephone expense Miscellaneous expenses $1 1,360 14,000 3,250 46,000 18,000 8,500 84,000 $ 2,000 14,000 3,550 7,000 760 580 Using the above information prepare an October statement of owner's eq uity for Real Answers. REAL ANSWERS Statement of Owner's Equity ./ For Month Ended October 31 King, Capital, Oct. 1 ./ $ Add: Net income ./ ./ Add: Owner's investment 0 2,110./ 84,000./ 86,110 Less: Withdrawals by owner ./ (2.000)./ King, Capital, Oct. 31 ./ $ 84,110./ 16. award: 10 out of 10.00 ················pi'.1trrnr·· On Oc tober 1, Keisha King organized Real Answ ers, a new consulting firm; on October 3, the owner contributed $84 ,000 cash. On October 31 , the company 's records show the following items and amounts. Cash Accounts receivable Office supplies Land Office equipment Accounts payable Owner investments $1 1,360 14,000 3,250 46 ,000 18,000 8,500 84,000 Cash withdrawals by owner Consulting fees earned Rent expense Salaries expense Telephone expense Miscellaneous expenses $ 2,000 14,000 3,550 7,000 760 580 Using the above information prepare an October 3 1 balance sheet for Real Answers. REAL ANSWERS Balance Sheet ./ ./ As of October 31 ./ Assets Liabilities Cash ./ $ 11,360./ Accounts payable Land ./ ./ ./ ./ 46,000./ Accounts receivable Office equipment Office supplies T Total assets ./ $ ./ $ T ./ 14,000./ Tota.I liabilities 18,000./ 0 92,610 Total liabilities and equity 0 8,500 ./ Equity 3,250./ King , Capital 8,500./ ./ - - 84,110./ ./ $ 92,610 0 17. award: 10 out of 10.00 ·· · · · ····· · poirns-· On Oc tober 1, Keisha King organized Real Answ ers , a new consulting firm ; on October 3, the owner invested $84,000 of assets. On October 31 , the company's records show the following items and amounts. Cash Accounts receivab le Office supplies Land Office equipment Accounts payable Owner investm ents $1 1,360 14,000 3,250 46,000 18,000 8,500 84,000 $ 2,000 14,000 3,550 7,000 760 580 Cash withdrawals by owner Consulting fees earned Rent expense Salaries expense Telephone expense Miscellaneous expenses Also assume the following: a. The owner's initial investment consists of $38,000 cash and $46,000 in land. b. The company's $ 18,000 equipment purchase is paid in cash. c. The accounts payable balance of $8,500 consists of the $3,250 office supplies purchase and $5,250 in employee salaries yet to be paid. d . The company's rent, telephone, and miscellaneous expenses are paid in cash. e. No cash has been collec ted on the $14,000 consulting fees earned. Using the above information prepare an October 31 statement of cash flows for Real Answers. (Cash outflows shou ld be ind icated by a minus s ign .) REAL ANSWERS Statement of Cash Flows For Month Ended October 31 Cash flows from operating activities Cash received from customers $ T 0 Cash paid for rent ./ (3,550)./ Cash paid for telephone expenses ./ (760)./ Cash paid for miscellaneous expenses ./ (580)./ Cash paid to employees .; _ _ _(_ 1.1_50_1.1 ---+I _ .;1 '$ Net cash used by operating activities j_".'._ (6,640) Cash flows from investing activities Purchase of office equipment ./ ( 18,000)./ Net cash used by investing activities ./.-~ ] (18.000) Cash flows from financing activities Investments by owner Witl1drawals by owner ./ ./ Net cash provided by financing activities ./ Net increase in cash ./ Cash balance, October 1 Cash balance, October 31 38,000./ (2.000)./ ~~~~~~~-+ 1 36,000 11,360./ 0./ 11,360 I *Red taxt ind cat.es no resp<0nse \Vas ex?ect.s-d 1n a cell or a fom-ula· based caku ation 1s incorrect: no poin:s d.:d.1ae-:I. award: 18. 10 out of 10.00 Swiss Group reports net income of $40,000 for 2013. At the beginning of 2013, Swiss Group had $200,000 in assets. By the end of 20 13, assets had grown to $300,000. What is Swiss Group's 2013 return on assets? Return on assets Choose Numerator: Net income $ ---- Choose Denominator: ./ I Average total assets 40,000./ I $ <---I1 Return on assets ./I = 250,000./ = j Return on assets 16% - 19. award: 10 out of 10.00 · · · · · · · -ii-otrns- ··· Match each description with its section from statement of cash flows. Description Statement of cash flow 1. Cash paid for advertising Cash flows from operating activity 2. Cash paid for wages Cash flows from operating activity 3. Cash withdrawal by owner Cash flows from financing activity 4. Cash purchase of equipment Cash flows from investing activity 5. Cash paid for rent Cash flows from operating activity 6. Cash paid on an account payable (for :supplies) Cash flows from operating activity ~ investment by owner Cash flows from financing activity 8. Cash flows from operating activity Cash received from clients ./ ./ ./ ./ ./ ./ ./ ./