SCICOM Annual Report

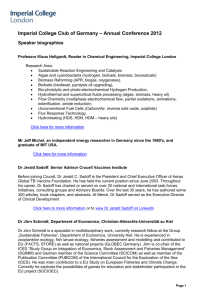

advertisement